Global Direct Thermal Printing Film Market Size, Share, Growth Analysis By Material Type (Polypropylene (PP), Polyethylene (PE), Others), By Material Thickness (Up to 50 microns, 51 to 75 microns, 76 to 100 microns, Above 100 microns), By Product Type (Labels, Tags, Others), By End Use (Food & Beverages, Healthcare, Electronics, Cosmetics & Personal Care, Homecare, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167980

- Number of Pages: 352

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

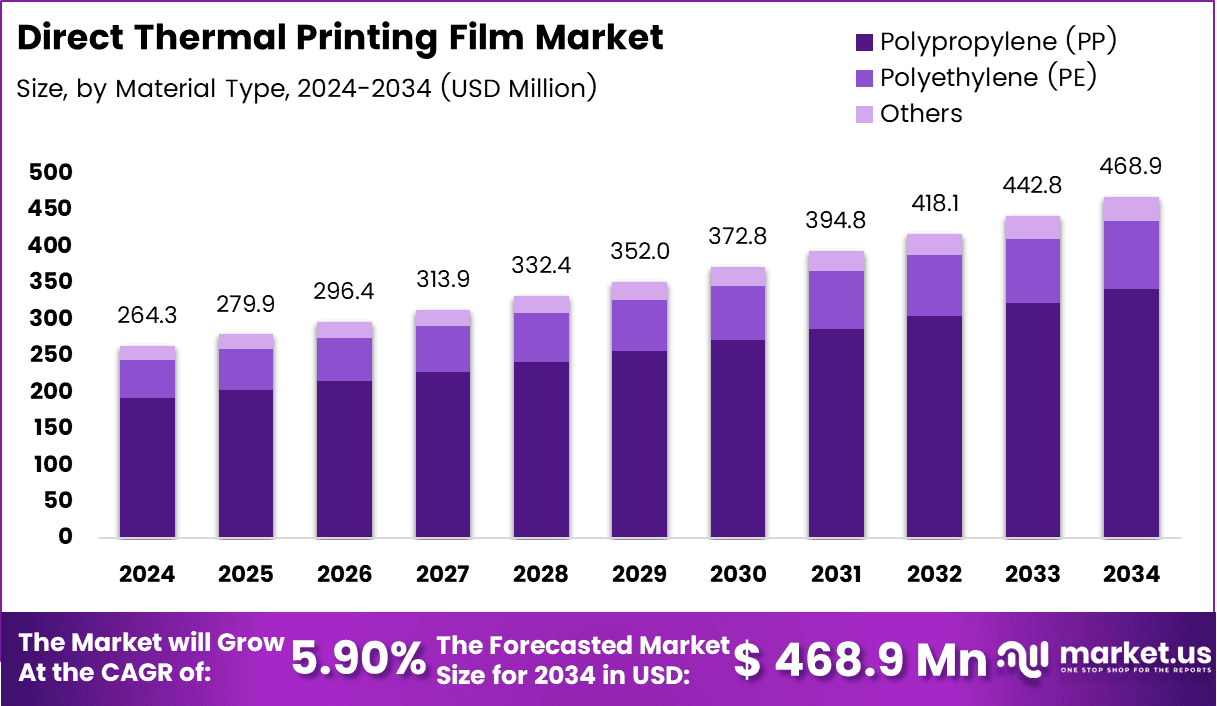

The Global Direct Thermal Printing Film Market size is expected to be worth around USD 468.9 million by 2034, from USD 264.3 million in 2024, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034.

The Direct Thermal Printing Film Market represents a fast-adopting segment within modern labeling, barcode media, and variable data printing ecosystems. It enables inkless printing, reduces consumable costs, and simplifies supply chains for retail, logistics, food packaging, and healthcare applications. This segment continues expanding as industries shift toward leaner printing operations.

Growing e-commerce volumes further stimulate demand as companies seek durable shipping labels and lightweight packaging films. Additionally, rising automation in warehouse management accelerates the integration of thermal printing workflows. The market benefits from rapid digitization, which increases the need for scannable IDs, QR codes, and retail shelf labels that support high-contrast printing.

Moreover, expanding opportunities emerge as sustainability directives encourage the use of recyclable and BPA-free thermal coating technologies. Government pressure to reduce hazardous printing inks pushes organizations toward thermal alternatives. Businesses increasingly prefer direct thermal solutions because they eliminate ribbons and inks, lowering long-term maintenance requirements and improving operational efficiency.

Regulatory investments in food safety, pharmaceutical traceability, and cold-chain monitoring also strengthen market growth. Policies enforcing serialization and temperature-sensitive labeling boost the adoption of thermal printing films that maintain clarity across handling cycles. These developments support market penetration in consumer packaged goods, transportation, and healthcare sectors seeking resilient labeling materials.

In addition, the segment gains momentum as manufacturers innovate abrasion-resistant, heat-stable, and moisture-tolerant films suitable for high-speed label printers. New thermal coatings enhance print retention, enabling clearer variable data printing for compliance labels. These advancements attract industries requiring long-lasting markings under varied environmental conditions.

According to technical specifications from leading industry sources, direct thermal printing films produce dark, sharp images with an optical density of 1.9–2.0, ensuring high-readability barcodes for logistics and retail scanning. Furthermore, standard DTP films withstand temperatures ranging from –20°C to 70°C, supporting cold-chain labeling and moderate-heat packaging processes without print degradation.

Consequently, these performance characteristics reinforce the market’s value proposition across retail labeling, asset tracking, perishables management, and supply-chain automation. The combination of durability, regulatory alignment, and ink-free operation positions the Direct Thermal Printing Film Market for sustained expansion over the coming years.

Key Takeaways

- The Global Direct Thermal Printing Film Market reached USD 264.3 million in 2024 and is projected to hit USD 468.9 million by 2034.

- Polypropylene (PP) dominated the market by material type with a 72.9% share.

- The 76 to 100 microns segment led material thickness with a 44.4% market share.

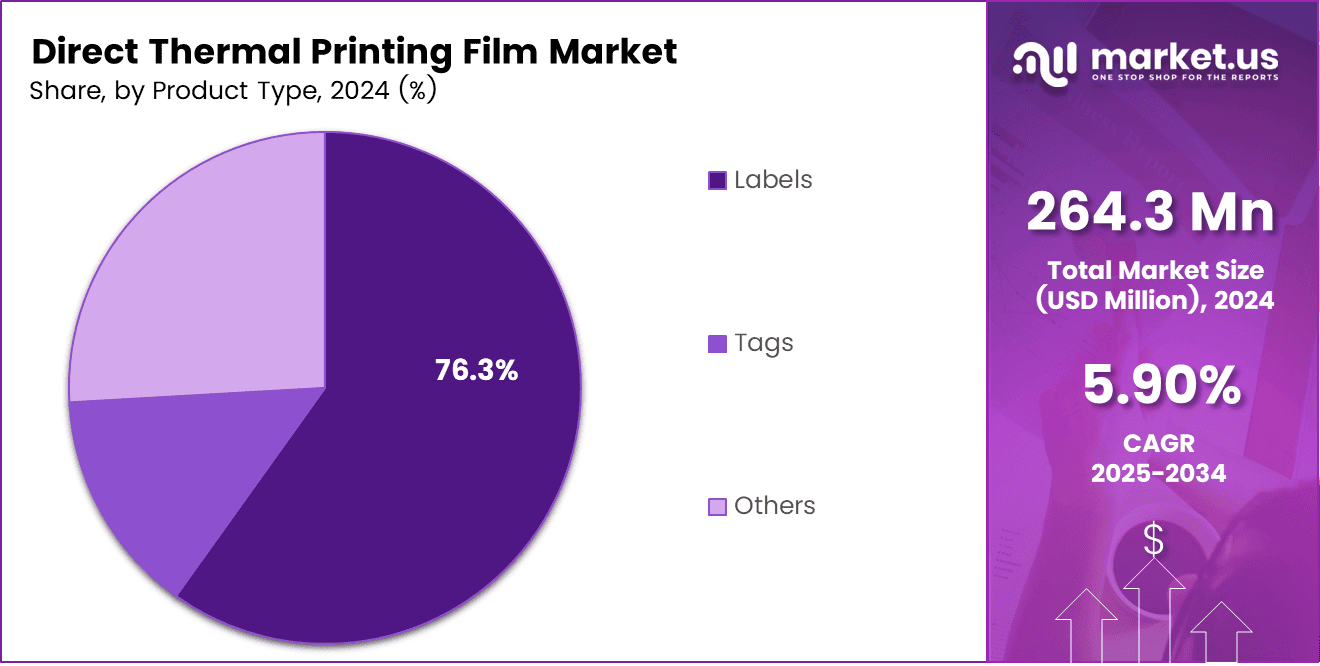

- Labels remained the top product type, accounting for 76.3% of total demand.

- Food & Beverages emerged as the leading end-use sector with a 49.8% contribution.

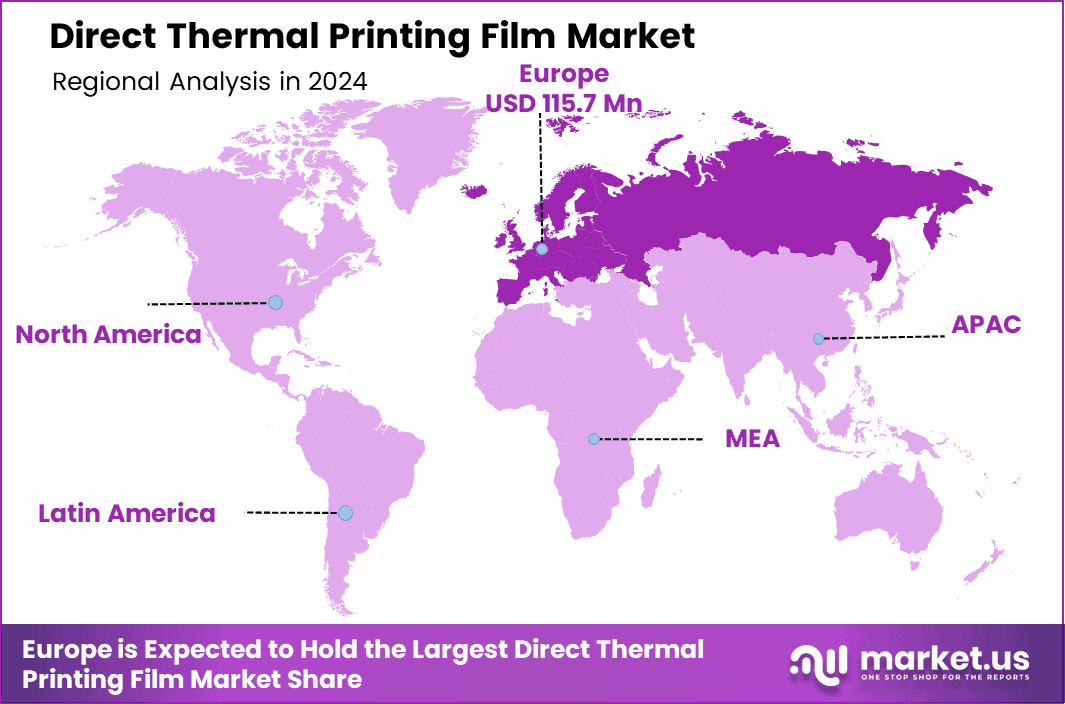

- Europe dominated the regional market with a 43.8% share valued at USD 115.7 million.

By Material Type Analysis

Polypropylene (PP) dominates with 72.9% due to its durability and strong thermal response suitability.

In 2024, Polypropylene (PP) held a dominant market position in the By Material Type Analysis segment of the Direct Thermal Printing Film Market, with a 72.9% share. This material supports strong print clarity and long-term stability, making it preferred for high-volume labeling and variable data printing applications across multiple packaging formats.

Polyethylene (PE) expanded steadily as converters used it for flexible packaging formats requiring lightweight and adaptable print surfaces. The segment advanced as manufacturers sought cost-effective films that supported smooth transport and storage. Its resilience and compatibility with thermal coatings enabled broader adoption across retail labeling environments.

Others gained traction as industry players explored film blends tailored for niche applications. This category was developed through custom formulations designed for specialty labels, cold-chain stock, and short-run industrial printing. These alternatives addressed requirements where standard PP or PE structures lacked technical suitability, especially in variable humidity and temperature cycles.

The segment evolved through manufacturers enhancing coating uniformity and print sensitivity. Innovations in material combinations strengthened performance across applications requiring durable marking and traceability. This diversification continued improving substrate flexibility, helping end-users meet printing precision standards while supporting long-term product identification across regulated and non-regulated markets.

By Material Thickness Analysis

76 to 100 microns dominate with 44.4% due to its balance of strength and print efficiency.

In 2024, 76 to 100 microns held a dominant market position in the By Material Thickness Analysis segment of the Direct Thermal Printing Film Market, with a 44.4% share. This thickness offered durability and crisp image resolution, strengthening adoption across logistics, inventory labeling, and packaged goods requiring robust handling and clarity.

Up to 50 microns advanced through increasing use in lightweight labeling formats. This thin-gauge category supported high-speed printing and mass-volume applications where cost optimization remained essential. Its compatibility with short-term labels made it suitable for fast-moving consumer goods and variable information printing across seasonal product flows.

The 51 to 75 microns category progressed steadily as industries demanded balanced strength with improved print responsiveness. Its medium-range profile supported consistent performance in retail and warehouse environments. This segment benefited from improved coating technologies that enhanced contrast and optical density in demanding thermal workflows.

Above 100 microns grew gradually as users sought premium-grade materials for heavy-duty labeling. These thicker films served industrial environments where abrasion resistance and long-term readability were critical. They found utility in asset tracking, equipment labeling, and applications requiring sustained print visibility under frequent physical interaction.

By Product Type Analysis

Labels dominate with 76.3% due to wide-scale adoption in logistics, retail, and packaged goods.

In 2024, Labels held a dominant market position in the By Product Type Analysis segment of the Direct Thermal Printing Film Market, with a 76.3% share. The segment grew as businesses relied heavily on barcodes, shipping labels, and item identification formats requiring accurate thermal imaging and durable print surfaces.

Tags advanced through rising usage in apparel, warehousing, and long-duration identification requirements. This category benefited from demand for tear-resistant formats that supported crisp thermal printing. Retailers and industrial users employed these structures for batch tracking, price marking, and shelf-ready identification, requiring reliable scanning accuracy.

Others progressed gradually as organizations adopted specialized print media for equipment labeling, compliance marking, and high-temperature applications. These products expanded through customized coatings and film constructions targeting niche use cases where standard labels or tags did not meet specific operational or environmental conditions.

The segment evolved through improved print performance, faster imaging capability, and adoption of eco-conscious film alternatives. These innovations enhanced print density and resistance to abrasion, enabling consistent readability. This transition supported industries prioritizing reliable data capture while improving workflow efficiency and operational traceability.

By End Use Analysis

Food & Beverages dominate with 49.8% due to stringent identification, coding, and traceability needs.

In 2024, Food & Beverages held a dominant market position in the By End Use Analysis segment of the Direct Thermal Printing Film Market, with a 49.8% share. The segment strengthened as brands used thermal films for expiry dates, batch codes, and packaging identification essential for regulated distribution and safety compliance.

Healthcare expanded with the rising use of specimen labeling, patient identification, and pharmaceutical packaging. Direct thermal films supported high-clarity printing for barcodes and variable data essential for medical workflows. The segment advanced as hospitals and diagnostic centers prioritized precision and error reduction in labeling processes.

Electronics progressed steadily, driven by component tracing, warranty labels, and anti-tampering identification. Precision printing helped manufacturers manage complex inventories, ensuring readability throughout production cycles. The segment benefited from demand for durable thermal films capable of withstanding variable temperature and handling conditions.

Cosmetics & Personal Care, Homecare, and Others advanced through the need for clear branding and SKU-level tracking. These segments adopted thermal films for shelf labels, logistics identification, and packaging variations. Their expansion reflected increasing consumer product diversification and the push for consistent labeling accuracy across retail channels.

Key Market Segments

By Material Type

- Polypropylene (PP)

- Polyethylene (PE)

- Others

By Material Thickness

- Up to 50 microns

- 51 to 75 microns

- 76 to 100 microns

- Above 100 microns

By Product Type

- Labels

- Tags

- Others

By End Use

- Food & Beverages

- Healthcare

- Electronics

- Cosmetics & Personal Care

- Homecare

- Others

Drivers

Rising Adoption of Linerless Labels in Retail and Logistics Drives Market Growth

The Direct Thermal Printing Film Market is experiencing steady growth as more retailers adopt linerless labels to simplify day-to-day operations. These labels reduce material waste and allow faster labeling, helping companies manage high product turnover. This shift strengthens demand for thermal films designed for continuous printing efficiency.

Automated checkout and POS systems across supermarkets further support market expansion. As retailers upgrade to modern scanning and billing systems, the need for sharp, instant print outputs increases. Thermal printing films become preferred because they offer consistent quality, especially for barcodes and pricing labels used in quick-scan environments.

There is also growing interest in cost-efficient variable data printing solutions. Companies want to print batch codes, timestamps, and tracking information without expensive printing processes. Direct thermal printing films help lower operational costs, making them suitable for fast-moving distribution chains seeking affordability with accuracy.

Pharmaceutical serialization requirements are another key driver. Drug manufacturers must comply with strict labeling regulations, which require high-clarity and durable thermal labels. The growing need for compliant packaging strengthens demand for thermal films that support traceability and safety in regulated markets.

Restraints

Limited Heat Resistance of Thermal Films Restrains Market Expansion

The market faces challenges due to the limited heat resistance of thermal printing films, especially in harsh or high-temperature environments. When exposed to extreme heat, print quality often deteriorates, leading to faded barcodes or unreadable information. This restricts their use in industries where products are stored or transported under variable temperature conditions.

Another restraint relates to restricted color printing capabilities. Direct thermal films primarily support monochrome output, which limits their application in branding-heavy industries that require vivid, multi-color packaging labels. As digital and ink-based printing technologies evolve, some manufacturers lean toward alternatives with better graphic possibilities.

These limitations also affect long-term archiving needs. Documents or labels requiring multi-year durability may shift to alternative printing technologies with better longevity. This creates competition and moderates demand among users who prioritize lifespan and visual quality over cost-efficiency.

Additionally, industries with strict visual quality standards sometimes avoid thermal films due to print darkening over time. This challenge makes adoption slower among sectors with specialized packaging expectations. As a result, despite being cost-effective, thermal films face boundaries that restrict their wider industrial reach.

Growth Factors

Integration of Eco-Friendly Thermal Coatings Creates Strong Market Opportunities

The emergence of BPA-free and environmentally friendly thermal coatings is creating promising opportunities in the Direct Thermal Printing Film Market. Many companies are now shifting toward safer chemical formulations that meet global sustainability guidelines. This trend encourages manufacturers to innovate and expand product lines with greener solutions.

Smart packaging is becoming an attractive growth avenue. Scannable thermal labels allow brands to embed digital interactions, including QR codes, batch information, and authenticity checks. As industries digitalize packaging workflows, thermal films gain importance for enabling data-rich communication between brands and consumers.

E-commerce growth also supports strong demand. Fulfillment centers process millions of parcels daily and require rapid, reliable label printing. Direct thermal films enable faster throughput without the need for ink or ribbons, helping warehouses maintain operational speed and cost efficiency.

These opportunities are further strengthened by global efforts toward material reduction and traceability. Businesses value thermal films because they combine simplicity with precision, making them ideal for fast labeling applications. As sustainability and digital adoption rise together, the market is positioned to gain from new investment and product development.

Emerging Trends

Growing Preference for Sustainable and Recyclable Thermal Film Solutions Influences Market Trends

Sustainability trends are shaping the direction of the Direct Thermal Printing Film Market. Companies are increasingly selecting recyclable film substrates to meet environmental commitments and reduce landfill waste. This shift encourages continuous material innovation and supports the development of greener thermal printing options.

RFID-enabled thermal labels are emerging as another major trend. Logistics companies use RFID technology to improve asset tracking, enhance supply-chain visibility, and automate inventory movement. Integrating RFID with direct thermal printing offers faster operational accuracy, making it a preferred combination for large distribution networks.

Businesses also adopt thermal films designed for low-energy printing systems. These setups help companies reduce operational costs and support energy-efficient workflows, which align with global sustainability initiatives. This trend encourages greater interest in modern thermal printing solutions.

The market is also influenced by growing demand for traceability and product authentication. Thermal films support clear and scannable codes, which are vital in organized retail, pharmaceuticals, and food packaging. As supply-chain transparency becomes essential, the trend toward high-performance thermal substrates continues to strengthen.

Regional Analysis

Europe Dominates the Direct Thermal Printing Film Market with a Market Share of 43.8%, Valued at USD 115.7 Million

Europe held a strong leadership position in the Direct Thermal Printing Film Market, capturing a 43.8% share and generating USD 115.7 million in revenue due to its advanced retail automation and regulatory focus on sustainable labeling. The region benefited from widespread adoption of linerless labels, driven by food retail, logistics, and pharma distribution networks. Additionally, strong investments in automated POS technologies and compliance-focused packaging accelerated the regional demand.

North America Direct Thermal Printing Film Market Trends

North America remained a mature and technologically driven market, supported by high adoption of automated checkout systems across large retail chains. Increasing demand for variable data printing in logistics, alongside growing e-commerce shipments, boosted film consumption. Strong innovation across labeling technologies and expansions in pharmaceutical serialization further supported the region’s steady growth trajectory.

Asia Pacific Direct Thermal Printing Film Market Trends

Asia Pacific emerged as the fastest-expanding regional market, fueled by rapid industrialization and rising retail digitization across China, Japan, and Southeast Asian economies. High-volume manufacturing and expanding cold-chain logistics significantly accelerated the need for robust thermal labeling formats. Moreover, growing preference for cost-efficient barcode labeling in FMCG and pharma strengthened regional adoption.

Middle East & Africa Direct Thermal Printing Film Market Trends

The Middle East & Africa market showed measurable growth, supported by expanding retail modernization and logistics infrastructure upgrades in GCC economies. Demand increased in applications such as food distribution, consumer goods tracking, and warehouse automation. Rising digital commerce activity and government-led logistics reforms also enhanced market penetration.

Latin America Direct Thermal Printing Film Market Trends

Latin America exhibited stable growth driven by increased automation across supermarkets, warehousing hubs, and manufacturing units. Countries such as Brazil and Mexico showed rising adoption of thermal barcode labeling systems to improve supply-chain accuracy. Additionally, modernization of POS workflows and improved logistics networks contributed to expanding film usage.

United States Direct Thermal Printing Film Market Trends

The United States represented a high-value market characterized by advanced retail technologies, extensive e-commerce operations, and strong pharmaceutical packaging standards. Expansion of high-volume distribution centers and widespread integration of automated checkout terminals supported sustained demand. Adoption of cost-efficient labeling formats strengthened as companies optimized operational costs and improved labeling efficiency.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Direct Thermal Printing Film Market Company Insights

In 2024, the global Direct Thermal Printing Film Market showed steady expansion, driven by retail automation, logistics optimization, and the shift toward linerless label adoption. UPM Raflatac strengthened its position through sustainable thermal film solutions, focusing on recyclable and high-performance materials that aligned with rising regulatory pressures. The company’s emphasis on eco-efficient labeling formats supported its growing adoption across retail and distribution networks.

Ricoh Company, Ltd. contributed to market competitiveness by advancing thermal coating technologies that improved image stability and print density. The firm’s continued enhancement of heat-resistant film formulations allowed customers to adopt more reliable labeling systems across demanding logistics workflows and high-volume retail operations.

Diversified Labeling Solutions, Inc. leveraged its strong customization capabilities to meet demand for variable-data, on-demand labeling in e-commerce and warehousing. Its flexible production model supported rapid turnaround times, allowing brands to optimize SKU-level traceability and streamline distribution processes in high-velocity environments.

Stylerite Label Corporation added value to the market through niche manufacturing expertise focused on durable thermal printable substrates for industrial and food distribution chains. Its solutions helped users maintain labeling accuracy across temperature-sensitive and high-friction material-handling settings.

Beyond these key players, the broader ecosystem—including companies such as Avery Dennison Corporation, 3M Company, Mondi Group, Lintec Corporation, and Cosmo Films Ltd.—continued shaping innovation in print quality, sustainability, and material efficiency. Collectively, these advancements reinforced the market’s transition toward cost-effective, compliant, and environmentally aligned thermal printing films, supporting long-term industry growth across global retail and logistics sectors.

Top Key Players in the Market

- UPM Raflatac

- Ricoh Company, Ltd.

- Diversified Labeling Solutions, Inc.

- Stylerite Label Corporation

- Avery Dennison Corporation

- 3M Company

- Mondi Group

- Lintec Corporation

- Cosmo Films Ltd.

Recent Developments

- In Oct 2024, ORAFOL acquired a stake in Belgian speciality film manufacturer Group M.A.M., strengthening its capabilities in advanced functional and protection films. The investment supports ORAFOL’s plan to begin producing climate protection films at its Oranienburg facility from 2025, expanding sustainable product offerings.

Report Scope

Report Features Description Market Value (2024) USD 264.3 million Forecast Revenue (2034) USD 468.9 million CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Polypropylene (PP), Polyethylene (PE), Others), By Material Thickness (Up to 50 microns, 51 to 75 microns, 76 to 100 microns, Above 100 microns), By Product Type (Labels, Tags, Others), By End Use (Food & Beverages, Healthcare, Electronics, Cosmetics & Personal Care, Homecare, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape UPM Raflatac, Ricoh Company, Ltd., Diversified Labeling Solutions, Inc., Stylerite Label Corporation, Avery Dennison Corporation, 3M Company, Mondi Group, Lintec Corporation, Cosmo Films Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Direct Thermal Printing Film MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Direct Thermal Printing Film MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- UPM Raflatac

- Ricoh Company, Ltd.

- Diversified Labeling Solutions, Inc.

- Stylerite Label Corporation

- Avery Dennison Corporation

- 3M Company

- Mondi Group

- Lintec Corporation

- Cosmo Films Ltd.