Global Digital Servo Press Market Size, Share, Growth Analysis By Capacity (Upto 100 kN, 100-200 kN, Above 200 kN), By Application (Automotive & Auto Components, Electrical & Electronics, Aerospace & Defense, Medical Devices & Equipment, Consumer Appliances & Power Tools, Metalworking & General Industrial, Others), By Frame Type (Straight-Side / H-Frame, C-Frame, Post/4-Post Frame, Benchtop / Table-Top Presses, Custom / In-line Frames), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 175167

- Number of Pages: 313

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

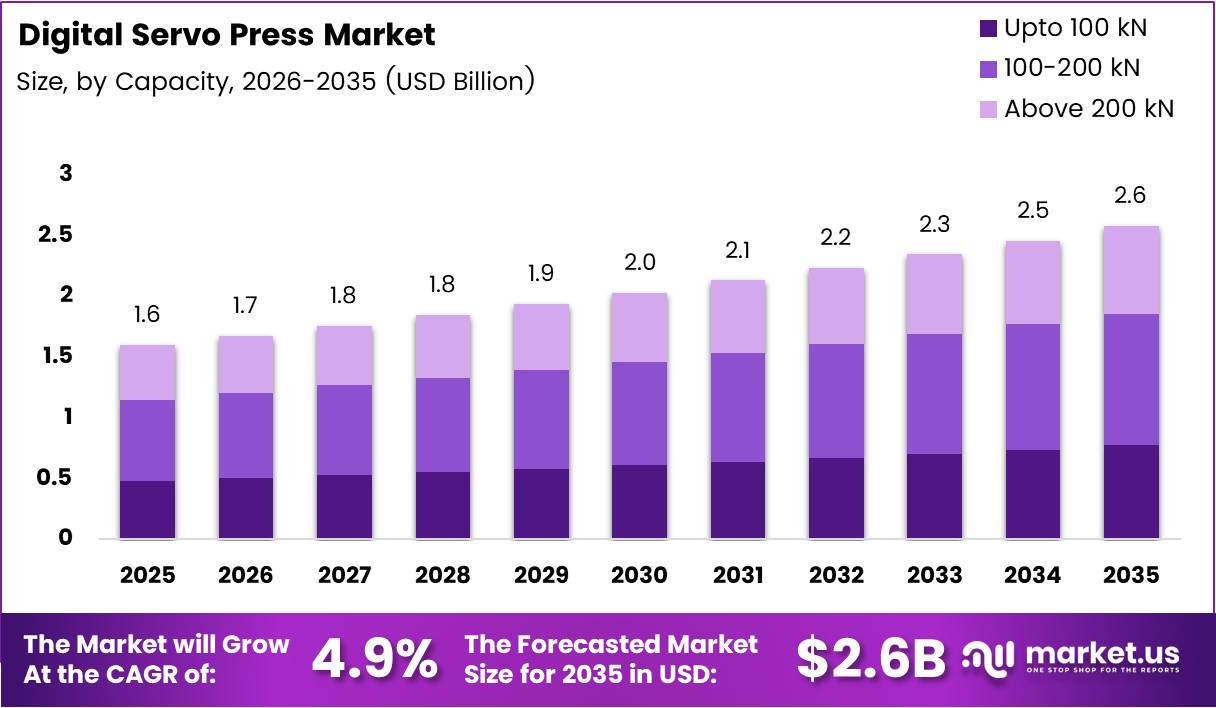

Global Digital Servo Press Market size is expected to be worth around USD 2.6 Billion by 2035 from USD 1.6 Billion in 2025, growing at a CAGR of 4.9% during the forecast period 2026 to 2035.

Digital servo presses represent advanced forming and assembly equipment that use electric servo motors to deliver precise force and position control. These systems replace traditional mechanical and hydraulic presses in applications requiring high accuracy, repeatability, and programmable stroke profiles. Moreover, they enable manufacturers to achieve tighter tolerances while reducing energy consumption and maintenance requirements.

The market experiences robust growth driven by rising automation in automotive, electronics, and medical device manufacturing. Industries increasingly demand precision pressing solutions that integrate seamlessly with Industry 4.0 infrastructure. Consequently, manufacturers are transitioning from conventional press technologies to digitally controlled servo systems that offer superior process monitoring and quality assurance capabilities.

Automotive electrification and component miniaturization create significant expansion opportunities for digital servo press adoption. Battery assembly, powertrain manufacturing, and lightweight material forming require controlled force application that servo technology delivers effectively. Additionally, medical device production demands contamination-free, repeatable assembly processes that electric servo presses provide without hydraulic fluids.

Government initiatives promoting industrial automation and energy efficiency further accelerate market development. Manufacturing policies in developed economies encourage equipment modernization to enhance productivity and reduce carbon footprints. Therefore, regulatory support for sustainable manufacturing practices drives investment in energy-efficient servo press systems across multiple industrial sectors.

The technology offers substantial operational advantages including real-time force feedback, programmable motion profiles, and digital connectivity for process optimization. Manufacturers achieve faster cycle times, reduced scrap rates, and lower total cost of ownership compared to traditional press technologies. However, high initial capital requirements and technical complexity present adoption barriers for small and medium enterprises.

According to International Federation of Robotics, 4,281,585 industrial robots were operating in factories worldwide in 2023, representing a 10% year-over-year increase. Furthermore, new industrial robot installations in 2023 were distributed as 70% in Asia, 17% in Europe, and 10% in the Americas, highlighting the geographic concentration of advanced manufacturing automation.

Digital servo press systems integrate seamlessly with robotic assembly lines, enabling synchronized operations and enhanced production flexibility. The convergence of robotics, artificial intelligence, and electric press technology creates intelligent manufacturing ecosystems. Ultimately, this technological integration positions digital servo presses as essential equipment for next-generation smart factories pursuing operational excellence.

Key Takeaways

- Global Digital Servo Press Market projected to reach USD 2.6 Billion by 2035 from USD 1.6 Billion in 2025 at 4.9% CAGR

- Automotive & Auto Components segment dominates application category with 45.1% market share in 2025

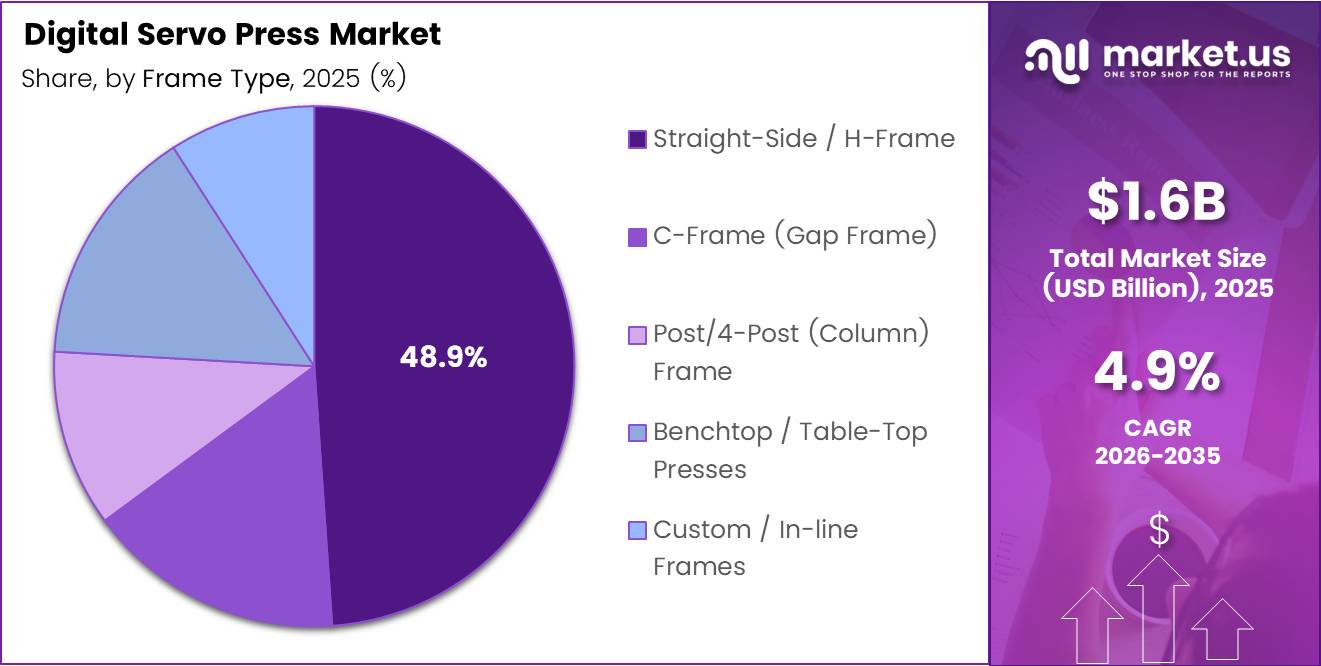

- Straight-Side / H-Frame configuration leads frame type segment capturing 48.9% market share

- 100-200 kN capacity range holds 37.9% share in capacity-based segmentation

- Asia Pacific region dominates with 43.20% market share valued at USD 0.6 Billion

- Energy efficiency advantages drive adoption with 10-20% energy consumption versus conventional systems

Capacity Analysis

100-200 kN dominates with 37.9% due to versatile application range across automotive and electronics assembly operations.

In 2025, 100-200 kN held a dominant market position in the By Capacity segment of Digital Servo Press Market, with a 37.9% share. This capacity range offers optimal force delivery for medium-duty stamping, forming, and assembly operations common in automotive component manufacturing and electronics production. Moreover, these systems balance power output with equipment footprint, making them suitable for diverse industrial applications requiring moderate force application.

Upto 100 kN systems serve precision assembly and electronics manufacturing applications where lower force requirements prevail. These compact presses deliver exceptional position accuracy for miniaturized component assembly in medical devices, consumer electronics, and small mechanical assemblies. Additionally, their smaller footprint and lower power consumption make them ideal for laboratory environments and research facilities focused on material testing and prototype development.

Above 200 kN capacity presses address heavy-duty metalworking, aerospace component forming, and large automotive structural part production. These high-force systems enable manufacturers to form thick materials and perform deep drawing operations with precise control. Consequently, industries requiring substantial forming forces while maintaining tight tolerances increasingly adopt these robust servo press solutions for critical manufacturing processes.

Application Analysis

Automotive & Auto Components dominates with 45.1% due to extensive precision assembly requirements in vehicle manufacturing operations.

In 2025, Automotive & Auto Components held a dominant market position in the By Application segment of Digital Servo Press Market, with a 45.1% share. Vehicle manufacturers require precise pressing operations for body panels, powertrain components, battery assemblies, and structural reinforcements. Furthermore, the shift toward electric vehicles intensifies demand for controlled force application in battery pack assembly and lightweight material forming operations.

Electrical & Electronics applications encompass connector assembly, PCB component insertion, and housing fabrication requiring micrometer-level precision. Digital servo presses deliver repeatable force profiles essential for preventing component damage while ensuring electrical contact integrity. Moreover, miniaturization trends in consumer electronics and telecommunications equipment drive adoption of programmable pressing systems capable of handling delicate components.

Aerospace & Defense manufacturing demands exceptional quality standards and traceability for critical structural components and assemblies. Servo press technology enables force signature analysis and digital documentation of every pressing operation for regulatory compliance. Additionally, composite material processing and precision riveting operations benefit from the programmable motion profiles and real-time monitoring capabilities that digital servo systems provide.

Medical Devices & Equipment production requires contamination-free, validated assembly processes with complete process documentation and quality assurance. Electric servo presses eliminate hydraulic fluid contamination risks while providing the precise force control necessary for catheter assembly, implantable device manufacturing, and diagnostic equipment production. Consequently, medical device manufacturers increasingly specify servo press technology to meet stringent regulatory requirements and ensure patient safety.

Frame Type Analysis

Straight-Side / H-Frame dominates with 48.9% due to superior rigidity and force distribution for high-precision applications.

In 2025, Straight-Side / H-Frame held a dominant market position in the By Frame Type segment of Digital Servo Press Market, with a 48.9% share. This configuration provides excellent parallelism between upper and lower platens, minimizing angular deflection during pressing operations. Moreover, the robust four-column design distributes forces evenly across the work area, ensuring consistent results for large-format stamping and forming applications.

C-Frame presses offer superior accessibility with three-sided part loading capability ideal for manual operations and vision system integration. The open-front design facilitates operator access and automated part feeding from multiple angles. Additionally, these compact units occupy less floor space while maintaining adequate rigidity for light to medium-duty pressing applications common in electronics assembly and small component manufacturing.

Post/4-Post Frame configurations provide economical solutions for applications requiring vertical pressing force without the cost premium of straight-side construction. These systems deliver adequate force distribution for general assembly tasks and moderate-precision forming operations. Furthermore, their modular design enables easier installation and reconfiguration to accommodate changing production requirements in flexible manufacturing environments.

Benchtop / Table-Top Presses serve laboratory, prototyping, and low-volume production applications requiring compact footprint and portability. These systems enable research facilities and small-scale manufacturers to access servo press technology without significant capital investment. Consequently, educational institutions and product development teams increasingly utilize benchtop servo presses for material testing, proof-of-concept validation, and small-batch specialized production runs.

Key Market Segments

By Capacity

- Upto 100 kN

- 100-200 kN

- Above 200 kN

By Application

- Automotive & Auto Components

- Electrical & Electronics (incl. Motors)

- Aerospace & Defense

- Medical Devices & Equipment

- Consumer Appliances & Power Tools

- Metalworking & General Industrial

- Others

By Frame Type

- Straight-Side / H-Frame

- C-Frame (Gap Frame)

- Post/4-Post (Column) Frame

- Benchtop / Table-Top Presses

- Custom / In-line Frames

Drivers

Precision Manufacturing Demand and Industry 4.0 Integration Drive Digital Servo Press Adoption

Manufacturing industries increasingly require precise force and position control for complex assembly operations across automotive, electronics, and medical sectors. Digital servo presses deliver programmable stroke profiles and real-time quality monitoring essential for modern production requirements. Moreover, these systems integrate seamlessly with manufacturing execution systems and enterprise resource planning platforms, enabling comprehensive process documentation and traceability throughout production cycles.

According to U.S. Census Bureau, manufacturers spent USD 12.96 billion on robotic equipment in 2022, representing 1.1% of total equipment capital expenditure. This investment demonstrates growing commitment to advanced automation technologies including digital servo press systems. Additionally, the rising adoption of collaborative manufacturing ecosystems requires equipment capable of communicating process parameters and performance metrics across interconnected production networks.

Energy efficiency considerations drive manufacturers to replace aging hydraulic press systems with electric servo alternatives that significantly reduce operating costs. Digital servo technology eliminates continuous hydraulic pump operation, consuming power only during actual pressing cycles. Consequently, facilities achieve substantial reductions in electricity consumption while simultaneously decreasing maintenance requirements associated with hydraulic fluid management, filtration systems, and potential environmental contamination risks.

Restraints

High Capital Investment Requirements and Technical Complexity Limit Market Penetration

Digital servo press systems require substantially higher initial capital investment compared to conventional mechanical and hydraulic press alternatives. Small and medium enterprises operating with limited capital budgets face significant barriers when considering equipment upgrades. Moreover, the total cost of ownership analysis must account for specialized installation requirements, facility modifications, and potential production downtime during system integration and commissioning phases.

Technical complexity of servo press programming and operation demands skilled workforce capable of configuring motion profiles and interpreting force-displacement data. Many manufacturing facilities lack personnel with adequate training in advanced servo control systems and industrial automation protocols. Additionally, the shortage of qualified technicians familiar with servo press maintenance and troubleshooting creates operational risks and potential extended downtime when equipment issues arise.

Limited awareness of digital servo press capabilities and advantages persists among traditional manufacturers accustomed to conventional press technologies. Decision-makers require education regarding energy savings, quality improvements, and long-term operational benefits to justify premium equipment investments. Therefore, market penetration remains constrained in regions and industry segments where traditional manufacturing practices dominate and resistance to technological change slows adoption of advanced pressing systems.

Growth Factors

Electric Vehicle Production and Component Miniaturization Create Significant Expansion Opportunities

According to International Energy Agency, Europe produced approximately 2.5 million electric vehicles in 2023, while the United States produced about 1.2 million EVs. Battery pack assembly and powertrain component manufacturing require precise force-controlled joining operations that digital servo presses deliver effectively. Furthermore, lightweight material forming for vehicle weight reduction demands programmable pressing capabilities that enable manufacturers to process advanced high-strength steels and aluminum alloys with consistent quality.

Medical device miniaturization and electronics integration drive demand for ultra-precise assembly equipment capable of handling delicate components without damage. According to MDPI journal research, servo presses consume only 10-20% of the energy required by conventional press machines in metal forming operations. This substantial energy advantage combined with contamination-free operation makes servo technology ideal for cleanroom manufacturing environments required for medical device and semiconductor assembly applications.

Aging mechanical and hydraulic press infrastructure across manufacturing facilities worldwide presents substantial retrofit and replacement opportunities. Many existing press systems approach end-of-life status while lacking digital connectivity and process monitoring capabilities required for modern quality management systems. Consequently, manufacturers increasingly evaluate digital servo press upgrades to maintain competitive positioning and meet evolving customer quality expectations in dynamic market conditions.

Emerging Trends

Digital Integration and Sustainable Manufacturing Practices Reshape Press Technology Landscape

Integration of IoT sensors and digital twin technology enables predictive maintenance capabilities that minimize unplanned downtime and optimize equipment lifecycle management. Manufacturers deploy connected servo press systems that continuously monitor performance parameters and transmit operational data for cloud-based analytics. Moreover, artificial intelligence algorithms analyze historical force signatures to predict component wear and recommend preventive maintenance activities before equipment failures occur.

According to Controls Drives Automation, electric joining and pressing systems can reduce energy use by up to 77% versus hydraulic and up to 90% versus pneumatic systems in industrial assembly. This dramatic energy efficiency advantage drives increasing preference for all-electric press systems aligned with corporate sustainability goals. Additionally, elimination of hydraulic fluids removes environmental contamination risks and reduces waste disposal costs while supporting manufacturing facilities pursuing zero-emission production objectives.

Compact, modular servo press designs address floor-space constraints in existing manufacturing facilities while enabling flexible production line reconfiguration. Manufacturers increasingly demand application-specific customization for unique force-displacement profiles optimized for particular assembly operations. Consequently, press suppliers develop specialized control software and mechanical configurations tailored to individual customer requirements, creating differentiated solutions that enhance manufacturing process efficiency and product quality outcomes.

Regional Analysis

Asia Pacific Dominates the Digital Servo Press Market with a Market Share of 43.20%, Valued at USD 0.6 Billion

Asia Pacific commands the largest regional market share driven by extensive automotive production, electronics manufacturing, and industrial automation investments across China, Japan, South Korea, and India. The region’s dominance reflects concentrated manufacturing activity and aggressive adoption of Industry 4.0 technologies by leading industrial nations. Moreover, government initiatives promoting smart manufacturing and digital transformation accelerate servo press deployment across diverse industrial sectors throughout the Asia Pacific region.

North America Digital Servo Press Market Trends

North America demonstrates strong market growth supported by automotive industry modernization, aerospace manufacturing requirements, and medical device production expansion. United States manufacturers invest heavily in advanced automation to address labor shortages and maintain global competitiveness. Additionally, stringent quality standards in aerospace and medical sectors drive adoption of precise servo press technology capable of meeting regulatory documentation and traceability requirements.

Europe Digital Servo Press Market Trends

Europe exhibits robust demand driven by automotive electrification, precision engineering traditions, and environmental regulations promoting energy-efficient manufacturing equipment. German, Italian, and French manufacturers lead regional adoption with established expertise in automotive and industrial machinery production. Furthermore, European sustainability initiatives and carbon reduction targets encourage replacement of hydraulic systems with electric servo alternatives throughout the manufacturing sector.

Latin America Digital Servo Press Market Trends

Latin America shows emerging adoption patterns focused on automotive component manufacturing and consumer appliance production in Brazil and Mexico. Regional manufacturers gradually modernize production facilities to meet export market quality requirements and improve operational efficiency. However, economic constraints and limited technical infrastructure slow widespread servo press adoption compared to more industrialized regions globally.

Middle East & Africa Digital Servo Press Market Trends

Middle East and Africa represent developing markets with growing interest in manufacturing diversification and industrial automation initiatives. Regional governments invest in domestic manufacturing capabilities to reduce import dependence and create employment opportunities. Consequently, new industrial facilities increasingly specify modern servo press technology rather than conventional equipment as part of greenfield manufacturing development projects.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Yokogawa Electric Corp maintains significant presence in industrial automation and control systems with comprehensive servo press integration capabilities for process industries. The company leverages extensive sensor technology expertise and digital control platforms to deliver integrated pressing solutions with advanced monitoring features.

Honeywell International Inc. provides industrial automation solutions and control technologies applicable to servo press systems requiring sophisticated process management and quality assurance capabilities. The company’s broad industrial portfolio enables integrated manufacturing solutions combining press control with enterprise-level data analytics and operational intelligence platforms.

Siemens AG offers comprehensive industrial automation and digitalization solutions including servo drive systems and motion control technologies essential for advanced press applications. The company’s integrated engineering tools and digital twin capabilities enable manufacturers to optimize pressing processes through simulation and virtual commissioning before physical implementation.

ABB Ltd. delivers industrial robotics, motion control, and electrification solutions that complement and integrate with servo press installations across manufacturing industries. The company’s expertise in electric drive technology and industrial automation enables sophisticated press control implementations with precise force and position management capabilities.

Key players

- Yokogawa Electric Corp

- Omega Engineering Inc.

- McCrometer, Inc.

- Endress+Hauser AG

- Honeywell International Inc.

- Badger Meter, Inc.

- Krohne Messtechnik GmbH

- Emerson Electric Co.

- Siemens AG

- ABB Ltd.

- Toshiba Corporation

Recent Developments

- June 2024 – Bosch Rexroth launched the Smart Function Kit Pressing with integrated force-control software for servo press and joining applications. This solution enables controlled force profiling and easier commissioning processes, reducing implementation time and enhancing operational flexibility for manufacturers requiring precise assembly control across diverse industrial applications.

- December 2024 – Schuler announced a partnership with CEER Manufacturing Complex to install its first fully automatic press shop tailored for smart manufacturing in the MENA automotive sector. This strategic collaboration demonstrates expanding servo press adoption in emerging automotive manufacturing markets and highlights growing regional investment in advanced production technologies.

- September 2024 – Schuler delivered an 800-ton Triton servo press system to Austrian manufacturer Fulterer, featuring digital applications and advanced servo control capabilities. This high-capacity installation showcases the technology’s scalability for heavy-duty metalworking operations while providing comprehensive digital integration for Industry 4.0 manufacturing environments.

Report Scope

Report Features Description Market Value (2025) USD 1.6 Billion Forecast Revenue (2035) USD 2.6 Billion CAGR (2026-2035) 4.9% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Capacity (Upto 100 kN, 100-200 kN, Above 200 kN), By Application (Automotive & Auto Components, Electrical & Electronics, Aerospace & Defense, Medical Devices & Equipment, Consumer Appliances & Power Tools, Metalworking & General Industrial, Others), By Frame Type (Straight-Side / H-Frame, C-Frame, Post/4-Post Frame, Benchtop / Table-Top Presses, Custom / In-line Frames) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Yokogawa Electric Corp, Omega Engineering Inc., McCrometer, Inc., Endress+Hauser AG, Honeywell International Inc., Badger Meter, Inc., Krohne Messtechnik GmbH, Emerson Electric Co., Siemens AG, ABB Ltd., Toshiba Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Yokogawa Electric Corp

- Omega Engineering Inc.

- McCrometer, Inc.

- Endress+Hauser AG

- Honeywell International Inc.

- Badger Meter, Inc.

- Krohne Messtechnik GmbH

- Emerson Electric Co.

- Siemens AG

- ABB Ltd.

- Toshiba Corporation