Global Digital Railway Market By Component (Solution (Remote Monitoring, Route Optimization and Scheduling, Analytics, Network Management, Predictive Maintenance, Security, Others), Service (Professional Services, Managed Services)), By Application (Rail Operations Management, Passenger Information System, Asset Management, Other Applications), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 174576

- Number of Pages: 240

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Key Statistics

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- Component Analysis

- Application Analysis

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

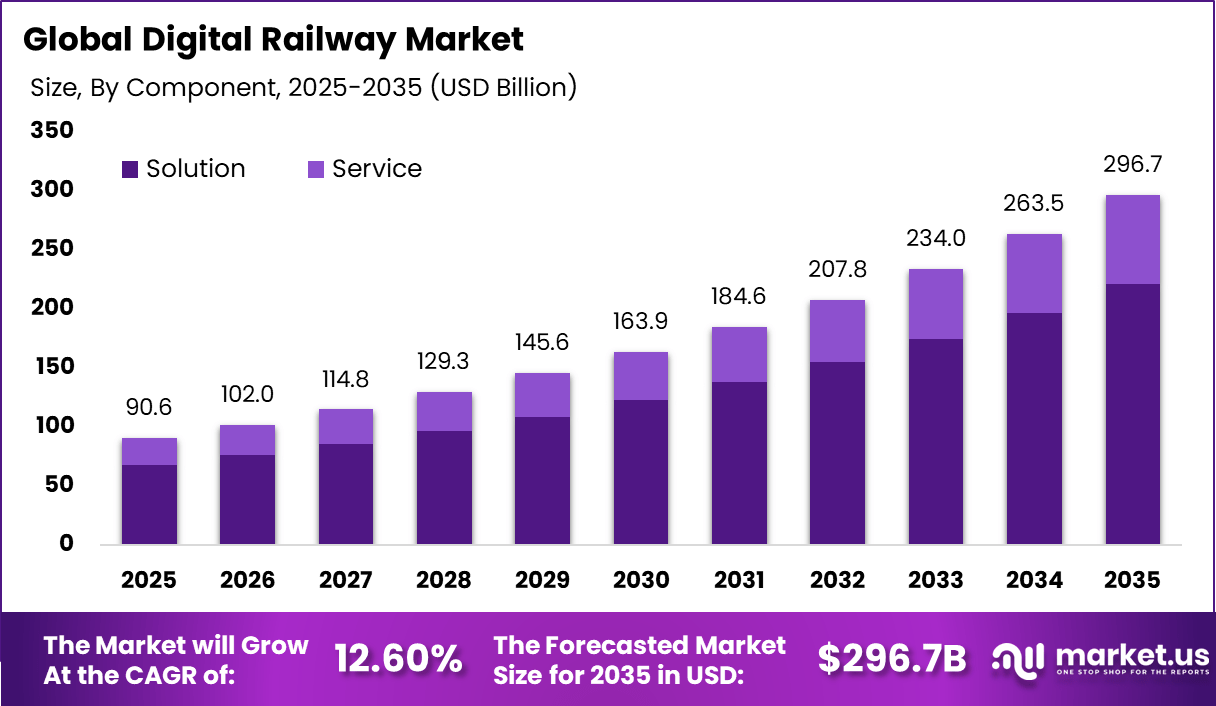

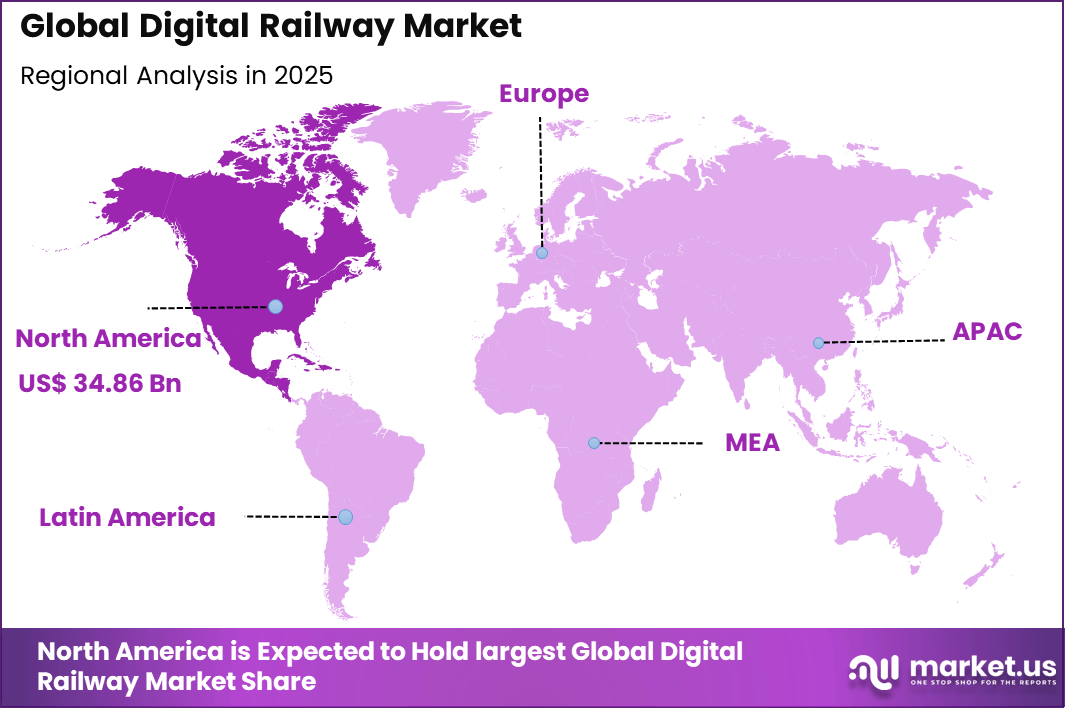

The Global Digital Railway Market generated USD 90.6 billion in 2025 and is predicted to register growth from USD 102 billion in 2026 to about USD 296.7 billion by 2035, recording a CAGR of 12.60% throughout the forecast span. In 2025, North America held a dominan market position, capturing more than a 38.5% share, holding USD 34.86 Billion revenue.

The digital railway market refers to the use of digital technologies to plan, operate, monitor, and maintain railway systems. These technologies include data analytics, automation, communication systems, and digital control platforms. Digital railways improve train operations, infrastructure management, and passenger services. Adoption is seen across passenger rail, freight rail, metro systems, and high-speed networks. These solutions support safer and more efficient railway operations.

One major driving factor of the digital railway market is the increasing demand for rail safety and reliability. Rail operators aim to reduce accidents and service interruptions. Digital monitoring systems detect faults and risks early. Automated signaling improves operational control. Safety priorities strongly drive adoption. Another key driver is rising passenger expectations for punctual and efficient transport.

Demand for digital railway solutions is influenced by expansion of urban rail and metro systems. Growing urban populations increase pressure on public transport. Rail operators require efficient tools to manage higher traffic volumes. Digital platforms support capacity optimization. Urban mobility needs strengthen demand.

Investment opportunities in the digital railway market exist in smart signaling and traffic management solutions. These systems support capacity expansion without new track construction. Improved utilization attracts infrastructure investment. Scalable solutions gain interest. Modernization projects create demand. Another opportunity lies in passenger experience and information systems. Digital platforms provide real-time updates and service information.

Top Market Takeaways

- By component, solutions account for 74.7% of the digital railway market, reflecting strong demand for software and platforms that optimize signaling, scheduling, asset monitoring, and passenger information.

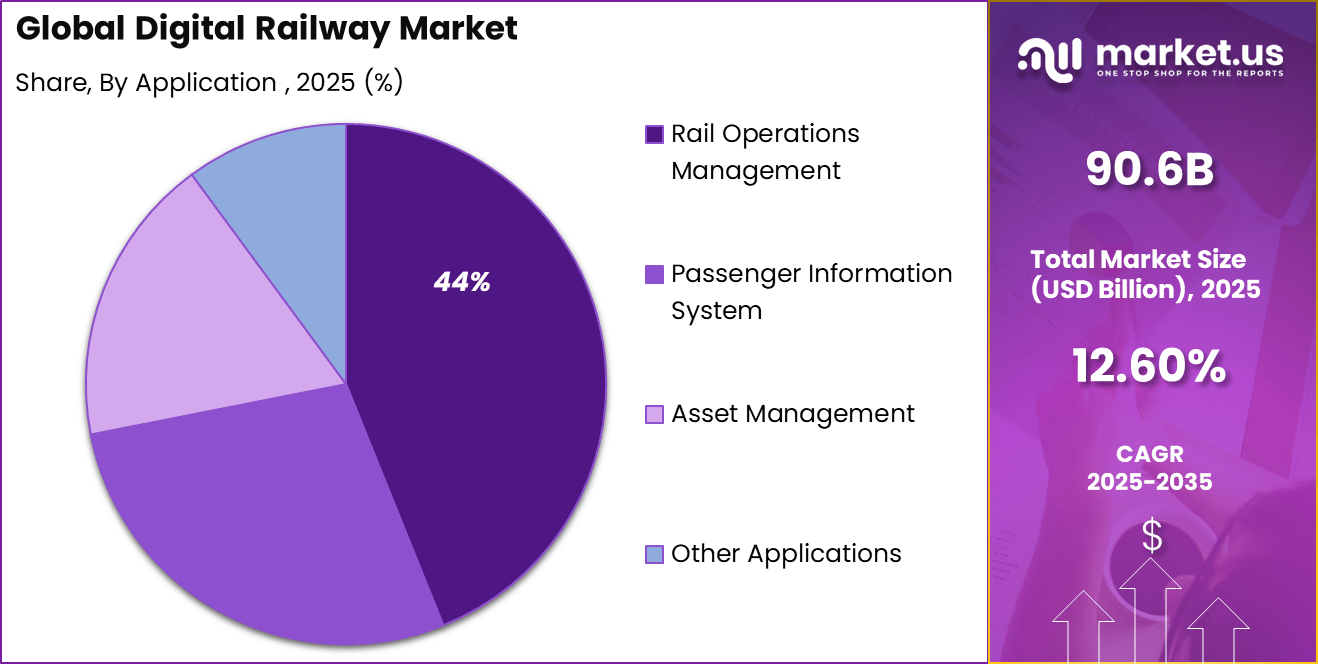

- By application, rail operations management holds 43.9%, driven by needs such as real-time traffic control, predictive maintenance, and improved network capacity utilization.

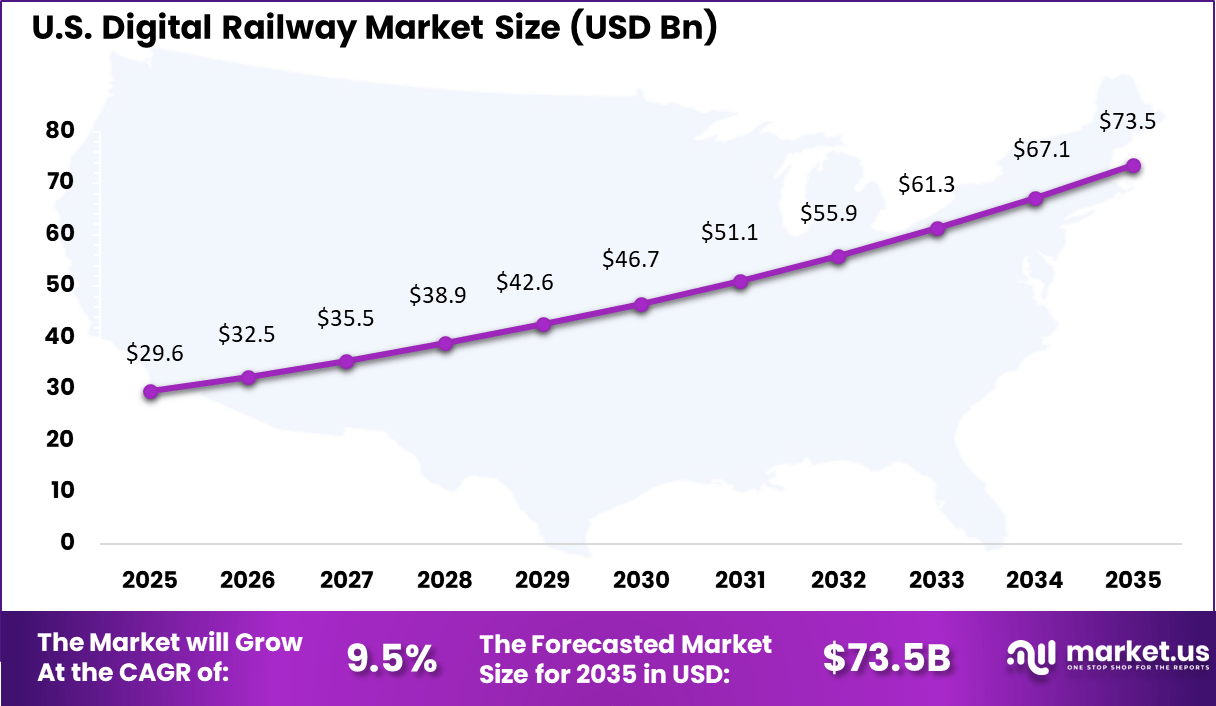

- North America represents 38.5% of the global market, with the US valued at USD 29.64 billion and growing at a CAGR of 9.5%, supported by investments in rail digitization and smart infrastructure upgrades.

Key Statistics

Key Performance Statistics and Technology Trends

- Ticketing capacity was scaled from 1,000 to 25,000 tickets per minute, reflecting major gains in digital transaction handling efficiency.

- Further system optimization targets 250,000 tickets per minute, indicating readiness for peak demand and large-scale passenger volumes.

- More than 6,500 locomotives were enabled with real-time tracking, improving operational visibility and schedule accuracy.

- Optical fiber connectivity expanded to about 67,233 route kilometers, strengthening digital backbone and data transmission reliability.

- Free public Wi-Fi services were deployed across 6,117 stations, enhancing passenger digital access and engagement.

- Coach guidance systems became operational at 1,064 stations, supporting smoother passenger movement and platform management.

Emerging Technologies and Operational Impact

- Digital twin adoption has delivered up to 25% reduction in unplanned downtime by enabling predictive maintenance and simulation-led planning.

- Cybersecurity strategies are shifting toward Zero Trust models to protect cloud-based and 5G-enabled rail operations.

- Digital acceleration control systems have demonstrated 18% improvement in energy efficiency, supporting cost reduction and sustainability goals.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Expansion of smart transportation Digitization of rail signaling and control ~3.4% North America, Europe Short Term Urbanization and passenger growth Need for efficient and safe rail operations ~3.0% Global Short Term Government infrastructure investments Public funding for rail modernization ~2.7% North America, Asia Pacific Mid Term Adoption of predictive maintenance Reduced downtime and asset failures ~2.1% Global Mid Term Focus on operational efficiency Data driven scheduling and energy optimization ~1.4% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline High capital expenditure Cost intensive digital infrastructure ~3.8% Emerging Markets Short Term Cybersecurity threats Vulnerability of connected rail systems ~3.2% North America, Europe Short Term Integration complexity Legacy railway system compatibility ~2.6% Global Mid Term Regulatory approval delays Safety and compliance certifications ~2.1% Global Mid Term Skilled workforce shortages Limited digital rail expertise ~1.6% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact High upfront investment Budget constraints for rail operators ~4.1% Emerging Markets Short to Mid Term Long project timelines Multi-year rail modernization cycles ~3.3% Global Mid Term Data interoperability issues Fragmented rail IT ecosystems ~2.7% Global Mid Term Change management challenges Resistance to digital workflows ~2.0% Global Long Term Vendor dependency Reliance on specialized suppliers ~1.5% Global Long Term Component Analysis

In 2025, Solutions account for 74.7%, highlighting their central role in digital railway systems. These solutions integrate software platforms for monitoring, control, and analytics. Centralized systems improve visibility across rail networks. Automation supports timely decision-making and operational coordination. Reliability remains a key requirement for rail operations.

The dominance of solutions is driven by the need for end-to-end digital management. Rail operators prefer integrated platforms over standalone tools. Solutions simplify data aggregation from multiple assets. They also support continuous performance optimization. This sustains strong adoption of solution-based components.

Application Analysis

Rail operations management represents 43.9%, making it the leading application area. Digital tools manage scheduling, dispatching, and asset utilization. Real-time insights help reduce delays and improve service quality. Operations management systems support coordinated control across routes. Accuracy and responsiveness are essential.

Growth in this application is driven by network complexity and demand for efficiency. Operators use digital platforms to optimize train movements. Data-driven planning improves capacity utilization. Incident response becomes faster with real-time monitoring. This keeps operations management central to adoption.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior Government authorities Very High ~52% Public safety and mobility Long-term infrastructure funding Public transport operators High ~28% Efficiency and reliability Phased deployment Private rail operators Moderate ~12% Cost and performance optimization Selective adoption Technology providers Moderate ~5% Platform and system expansion Strategic partnerships Logistics operators Low ~3% Freight efficiency Limited deployment Technology Enablement Analysis

Technology Layer Enablement Role Impact on Market Growth (%) Adoption Status Digital signaling systems Real-time train control and safety ~3.6% Mature IoT sensors and analytics Asset monitoring and diagnostics ~3.1% Growing AI based traffic management Predictive scheduling and congestion control ~2.5% Growing Cloud based rail platforms Centralized data and operations ~2.0% Developing Cybersecurity frameworks Protection of digital rail assets ~1.4% Developing Emerging Trends

Key Trend Description AI predictive maintenance Machine learning forecasts failures using IoT sensor data. Digital twins technology Virtual replicas simulate operations for optimization. Intelligent signaling systems ETCS and CBTC enable precise train control. Passenger mobile apps Real time updates, ticketing, and personalized services. 5G connectivity rollout High speed networks support advanced rail communications. Growth Factors

Key Factors Description Urbanization and passenger surge Higher demand requires efficient capacity management. Sustainability initiatives Digital solutions reduce emissions and energy use. Government infrastructure investments Funding for modernization and smart rail projects. IoT and communication advances Enables real time monitoring and data analytics. Aging infrastructure upgrades Digital tech replaces outdated systems for safety. Key Market Segments

By Component

- Solution

- Remote Monitoring

- Route Optimization & Scheduling

- Analytics

- Network Management

- Predictive Maintenance

- Security

- Others

- Service

- Professional Services

- Managed Services

By Application

- Rail Operations Management

- Passenger Information System

- Asset Management

- Other Applications

Regional Analysis

North America accounted for 38.5% share, supported by ongoing modernization of rail infrastructure and increasing adoption of digital technologies across passenger and freight rail networks. Digital railway solutions have been used to improve signaling, traffic management, predictive maintenance, and passenger information systems.

Region Primary Growth Driver Regional Share (%) Regional Value (USD Bn, 2025) Adoption Maturity North America Large-scale rail digitization programs 38.5% USD 34.86 Bn Advanced Europe Safety and signaling modernization 29.1% USD 26.38 Bn Advanced Asia Pacific High-speed and metro rail expansion 24.4% USD 22.12 Bn Developing to Advanced Latin America Urban transit digital upgrades 4.5% USD 4.08 Bn Developing Middle East and Africa Smart rail infrastructure projects 3.5% USD 3.17 Bn Early Demand has been driven by the need to enhance safety, optimize network capacity, and reduce operational disruptions. Rail operators in the region have increasingly relied on data driven platforms to improve asset utilization and service reliability.

The U.S. market reached USD 29.64 Bn and is projected to grow at a 9.5% CAGR, reflecting sustained investment in rail digitization and infrastructure upgrades. Adoption has been driven by the need to improve freight efficiency, enhance passenger safety, and reduce maintenance costs across large and complex rail networks. Digital railway technologies have helped U.S. operators implement predictive maintenance, optimize scheduling, and improve incident response.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

The digital railway market is being driven by the growing need to improve operational efficiency, safety, and passenger experience through intelligent technologies. Rail operators are increasingly adopting digital systems such as predictive maintenance, real-time monitoring, automated signalling, and integrated command-control platforms to enhance network performance and reduce service disruptions.

These solutions help detect equipment failures before they occur, optimise asset utilisation, and streamline scheduling processes, contributing to lower operational costs and higher reliability. Passenger expectations for seamless travel information, on-board connectivity, and efficient ticketing also encourage rail organisations to deploy digital technologies that support enhanced service quality and customer satisfaction.

Restraint Analysis

A key restraint in the digital railway market arises from the substantial capital investment and complexity associated with upgrading legacy infrastructure to digital platforms. Many existing rail networks operate with entrenched mechanical and analogue systems that require significant modification or replacement to support digital capabilities.

This transformation demands careful planning, phased implementation, extensive testing, and specialised technical expertise. For rail authorities and operators with constrained budgets or fragmented governance structures, the high upfront costs and integration challenges present significant barriers that may delay comprehensive digital deployment.

Opportunity Analysis

Emerging opportunities in the digital railway market are linked to the integration of advanced analytics, Internet of Things connectivity, and artificial intelligence to enable predictive operations and enhanced decision-making. Real-time data aggregation from sensors, rolling stock, and infrastructure components can support dynamic traffic control, congestion management, and energy optimisation, improving overall system performance.

Digital platforms also open avenues for value-added passenger services such as personalised travel information, mobile ticketing solutions, and contactless access control. Collaboration with smart city initiatives offers further potential to integrate rail networks with urban mobility systems, facilitating seamless intermodal transport experiences.

Challenge Analysis

A central challenge confronting the digital railway market relates to ensuring cybersecurity and data privacy amid increased connectivity and data exchange. Digital railway systems generate vast quantities of operational and passenger data, which requires robust security frameworks to protect against cyber threats, unauthorised access, and data breaches.

Implementing comprehensive cybersecurity measures across distributed networks, legacy systems, and third-party integrations requires continuous vigilance, investment in specialised expertise, and alignment with evolving regulatory standards. Maintaining system resilience while advancing digital capabilities remains a nuanced operational challenge.

Competitive Analysis

Leading players such as Cisco Systems, Inc., Hitachi Ltd., and Alstom focus on digital signaling, communications, and control systems. Their solutions improve network reliability and operational safety. AI and data analytics are applied to traffic management and predictive maintenance. Strong experience in large rail projects supports long term contracts. These companies benefit from government led rail modernization programs across major regions.

Industrial and technology focused vendors such as ABB Ltd., IBM Corporation, and Huawei Technologies Co., Ltd. strengthen digital railway ecosystems. Their offerings support asset monitoring, cybersecurity, and data platforms. Fujitsu Limited and Nokia Corporation add expertise in mission critical communication. These players address the need for integrated and secure railway operations.

Engineering and regional specialists such as Honeywell International Inc., Indra Sistemas, S.A., and Toshiba Corporation support signaling and automation upgrades. DXC Technology, Atkins, Televic, and Advantech Co., Ltd. expand system integration capabilities. Other vendors increase regional competition. This landscape supports steady digital transformation across global rail networks.

Top Key Players in the Market

- CISCO

- HITACHI

- ABTEC

- ALSTOM

- IBM

- ABB

- HUAWEI

- FUJITSU

- DXC

- HONEYWELL

- INDRA

- NOKIA

- ATKINS

- TOSHIBA

- TELEVIC

- ADVANTECH

- Others

Future Outlook

Growth in the Digital Railway market is expected to remain strong as rail operators modernize networks to improve safety, efficiency, and passenger experience. Digital systems are being used for signaling, traffic management, predictive maintenance, and real time passenger information.

Rising urbanization and demand for reliable public transport are supporting investment in digital rail solutions. Over time, better integration of data platforms, automation, and connectivity is likely to improve network capacity and reduce operational disruptions.

Recent Developments

- Alstom upgraded UK signaling in November 2025 with 90 LED signals and rolled out digital twins for faster rail transformations, plus a 5-year metro maintenance deal in May 2025.

- Hitachi made waves by acquiring Omnicom in August 2025 to supercharge its digital asset management, enhancing the HMAX system now on 2,000+ trains globally.

Report Scope

Report Features Description Market Value (2025) USD 90.6 Bn Forecast Revenue (2035) USD 296.7 Bn CAGR(2025-2035) 12.60% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solution (Remote Monitoring,Route Optimization and Scheduling,Analytics,Network Management,Predictive Maintenance,Security,Others),Service (Professional Services,Managed Services)), By Application (Rail Operations Management,Passenger Information System,Asset Management,Other Applications) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape CISCO, HITACHI, ABTEC, ALSTOM, IBM, ABB, HUAWEI, FUJITSU, DXC, HONEYWELL, INDRA, NOKIA, ATKINS, TOSHIBA, TELEVIC, ADVANTECH, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- CISCO

- HITACHI

- ABTEC

- ALSTOM

- IBM

- ABB

- HUAWEI

- FUJITSU

- DXC

- HONEYWELL

- INDRA

- NOKIA

- ATKINS

- TOSHIBA

- TELEVIC

- ADVANTECH

- Others