Global Digital Process Automation Market Size, Share, Upcoming Investments Report By Component (Solution, Services), By Deployment Mode (Cloud-Based, On-Premise), By Enterprise Size (Small and Medium Sized Enterprises, Large Enterprises) By Industry Vertical (IT and Telecommunications, BFSI, Manufacturing, Government, Retail, Healthcare, Other Industry Verticals), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec. 2024

- Report ID: 134475

- Number of Pages: 380

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Impact of AI on DPA Market

- Digital Process Automation Statistics

- Component Analysis

- Deployment Mode Analysis

- Enterprise Size Analysis

- Industry Vertical Segment Analysis

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Growth Factors

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

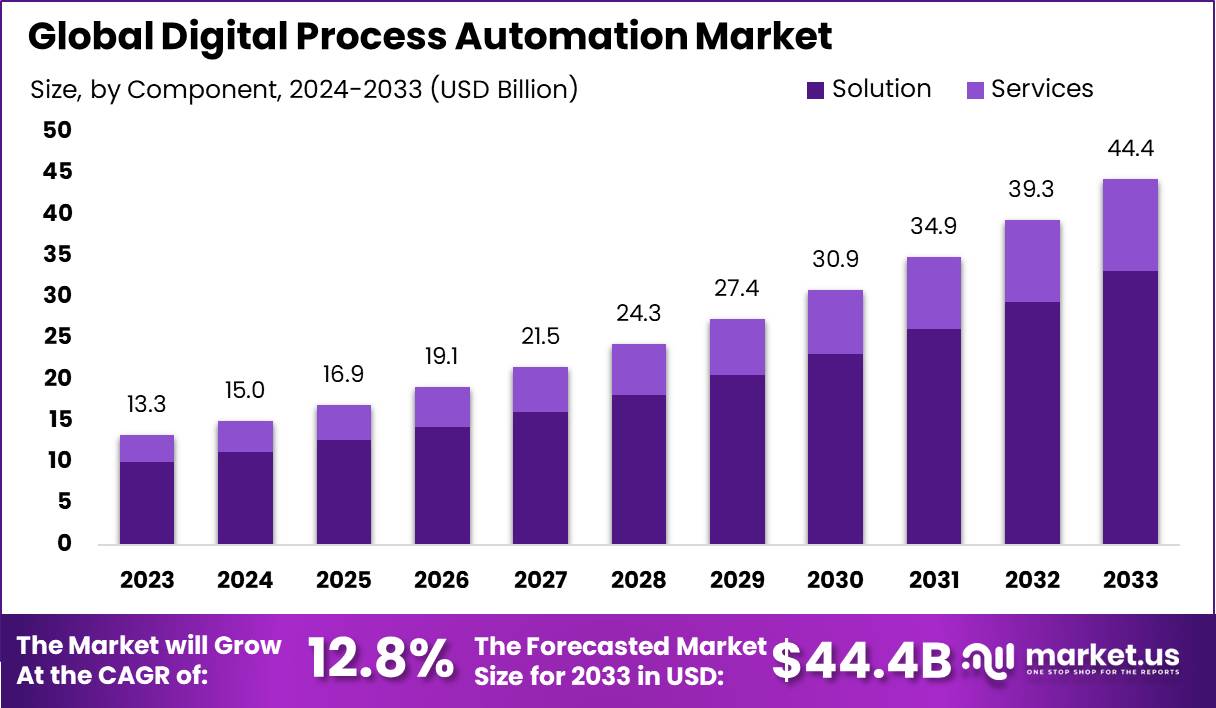

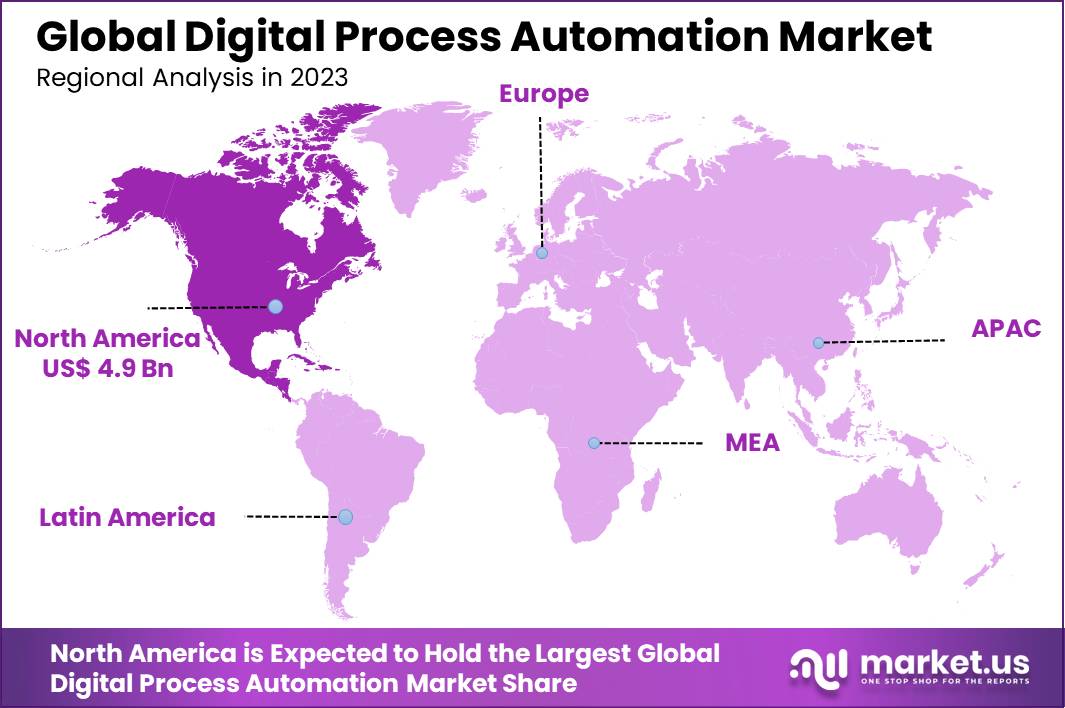

The Global Digital Process Automation Market size is expected to be worth around USD 44.4 Billion by 2033, from USD 13.3 Billion in 2023, growing at a CAGR of 12.8% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 37.4% share, holding USD 1.5 billion revenue.

Digital Process Automation (DPA) is a technological evolution that builds upon traditional business process management (BPM) frameworks. It uses advanced digital tools to automate, streamline, and enhance business processes. DPA is designed to minimize human intervention in routine tasks, thereby allowing employees to focus on more complex and value-adding activities.

The market for Digital Process Automation is expanding as businesses seek to improve efficiencies and enhance customer experiences. Organizations are increasingly adopting DPA technologies to streamline operations, reduce costs, and accelerate the digitalization of their business processes. This trend is driven by the need to handle complex processes that integrate multiple systems and require frequent updates, all while maintaining compliance and reducing operational risks.

The market growth is also supported by the increasing adoption of cloud-based solutions, offering scalable and flexible options for businesses to implement DPA solutions without heavy upfront investments. It encompasses technologies like low-code platforms, intelligent automation, and robotic process automation (RPA) to facilitate the digital transformation of business workflows.

The primary driving forces behind the adoption of Digital Process Automation include the demand for higher operational efficiency and the need to improve customer engagement. Enterprises are looking to automate their back-office and customer-facing processes to reduce manual errors and operational costs. Additionally, the integration of AI and machine learning technologies is enhancing the capabilities of DPA solutions, making them smarter and more adaptable to complex business environments.

This integration helps in predictive analysis and decision-making, further driving the DPA adoption. The demand for DPA solutions is significant among sectors that handle large volumes of data and have high transaction frequencies, such as banking, finance, insurance, and healthcare. These sectors benefit greatly from DPA by automating their compliance processes and customer service operations.

The shift towards digital channels, especially post-pandemic, has increased the need for businesses to adopt DPA to offer seamless customer experiences. For instance, according to AAG IT Services, there is an increase in the adoption of cloud technology across the globe. About 9% use a single public cloud (increasing 1% from 2021), and 2% use a single private cloud solution. Of those using multiple clouds, 80% use hybrid solutions, 7% use multiple public clouds, and 2% use multiple private clouds.

Moreover, as businesses continue to focus on digital transformations, the opportunities for DPA providers to expand their offerings and deliver more customized solutions are expanding. Technological advancements in Digital Process Automation focus on enhancing the usability and functionality of automation tools. The rise of low-code/no-code platforms has democratized the use of DPA, enabling non-technical users to design and deploy automation workflows.

Furthermore, the integration of artificial intelligence and machine learning technologies has improved the ability of DPA systems to manage complex decision-making processes. These advancements contribute to making processes more efficient, accurate, and significantly faster, thus enhancing overall business agility and responsiveness to market changes.

Key Takeaways

- The Global Digital Process Automation (DPA) Market is projected to reach a value of USD 44.4 billion by 2033, growing from USD 13.3 billion in 2023, reflecting a robust compound annual growth rate (CAGR) of 12.8% during the forecast period from 2024 to 2033.

- In 2023, the Solution segment led the market, commanding more than 74.9% of the total market share. This dominance highlights the growing demand for comprehensive solutions that drive efficiency and streamline business operations across industries.

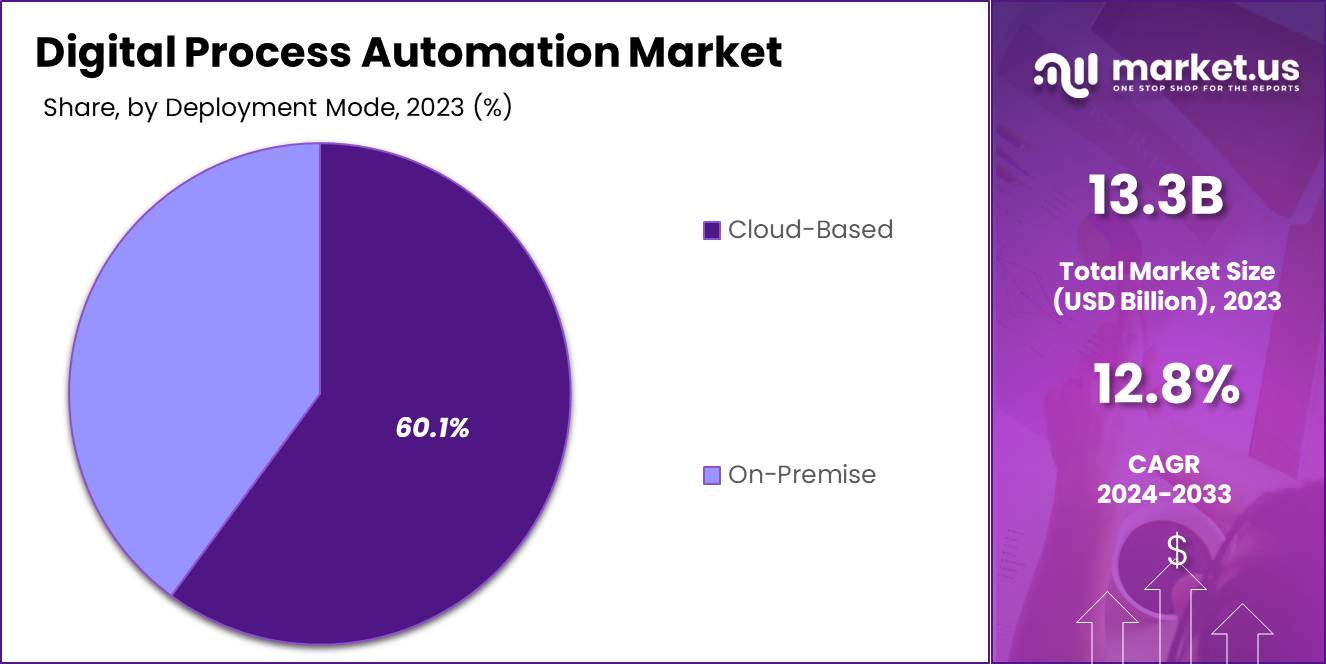

- Furthermore, the Cloud-Based segment also held a strong position in 2023, with a market share of more than 60.1%. As businesses continue to shift towards cloud technologies for their scalability, flexibility, and cost-effectiveness, this trend is expected to persist in the coming years.

- In terms of business size, Large Enterprises accounted for a significant portion of the market in 2023, capturing over 65% of the market share. Larger organizations are increasingly adopting digital process automation to enhance their operational efficiency and stay competitive in an ever-evolving digital landscape.

- The Banking, Financial Services, and Insurance (BFSI) sector was another major contributor to the DPA market in 2023, holding a substantial share of more than 23.5%. The BFSI industry’s need for automating and optimizing complex workflows, improving customer experiences, and ensuring compliance is driving the demand for DPA solutions.

- On a regional scale, North America dominated the global DPA market in 2023, capturing over 37.4% of the market share. The region’s strong adoption of automation technologies, coupled with a well-established digital infrastructure, positions it as a leader in the digital process automation space.

Impact of AI on DPA Market

Digital Process Automation (DPA) has become an essential element in the modern business landscape, helping organizations streamline operations, reduce costs, and improve efficiency. The integration of Artificial Intelligence (AI) into DPA is driving profound changes in how businesses automate tasks. This combination is not just about enhancing automation but transforming it entirely by adding intelligence, adaptability, and learning capabilities.

- Increased Efficiency and Productivity: One of the most immediate impacts of AI on DPA is the significant boost in operational efficiency. AI can handle repetitive tasks, make data-driven decisions in real time, and continuously learn from patterns. This reduces the need for manual intervention, cuts down errors, and allows employees to focus on more strategic activities. According to a 2023 report, AI-enabled DPA systems can reduce processing time by up to 50%, helping businesses achieve faster service delivery.

- Cost Reduction: The integration of AI with DPA tools is a game-changer when it comes to cost savings. AI automates complex decision-making processes, minimizes human errors, and enhances the accuracy of predictions. This reduces the need for extensive human resources and, in turn, cuts operational costs. A study suggests that businesses can expect a 30% reduction in operational costs by adopting AI-driven DPA solutions in the next 3 to 5 years.

- Enhanced Decision-Making: AI empowers DPA systems with data analytics and decision-making capabilities. Machine learning algorithms can predict outcomes, identify trends, and recommend actions, helping businesses make more informed and timely decisions. A report found that companies using AI for decision support have seen a 20-30% improvement in decision-making speed and accuracy, leading to better customer experiences and business outcomes.

- Scalability and Flexibility: AI allows DPA systems to scale and adapt to changing business needs. Whether it’s processing higher volumes of transactions or adapting to new regulatory requirements, AI-driven automation can adjust in real time. This scalability means businesses can grow without worrying about operational bottlenecks. Businesses that leverage AI for DPA are able to scale their processes up to 40% faster than those using traditional automation.

- Improved Customer Experience: AI-powered DPA improves the customer experience by enabling faster response times, more personalized interactions, and higher accuracy in service delivery. Chatbots, for instance, can automatically handle customer inquiries, while predictive analytics helps businesses anticipate customer needs. A recent study revealed that companies employing AI in their customer service processes saw a 25% increase in customer satisfaction and a 15% reduction in customer churn.

- Better Compliance and Risk Management: In regulated industries, compliance is a critical concern. AI enhances DPA by automating compliance checks, monitoring changes in regulations, and ensuring that processes are always up to date. AI systems can analyze vast amounts of data in real time, flagging potential risks and non-compliance issues. According to Deloitte, organizations using AI-powered DPA have reported a 40% reduction in compliance-related risks due to enhanced automation.

- Challenges and Considerations: Despite its many benefits, the integration of AI into DPA is not without challenges. Businesses need to invest in the right infrastructure, ensure data privacy and security, and train their workforce to work alongside AI. AI adoption can also raise concerns about job displacement, though studies suggest that AI will complement human roles rather than replace them. A 2024 survey by Accenture found that 72% of businesses believe AI will enhance, rather than replace, human jobs in the automation process.

Digital Process Automation Statistics

Based on data from Cflowapps:

- 31% of businesses have fully automated at least one key business function, showcasing a strong shift towards automation adoption.

- 13% of organizations are implementing intelligent automation solutions at scale, while 23% are in the implementation phase, and 37% are piloting automation initiatives.

- 41% of respondents are using automation extensively across multiple functions, indicating widespread integration in daily operations.

- A remarkable 94% of business professionals prefer a unified automation platform to streamline workflows rather than juggling multiple systems.

- The workflow automation market is growing at a rapid pace of 20% per year and is expected to reach $5 billion USD by 2024.

- Over 80% of business leaders are accelerating work process automation while expanding remote work capabilities to adapt to modern demands.

- 43% of businesses plan to reduce their workforce by adopting automation technologies, reflecting a focus on operational efficiency.

- 36% of organizations are already using BPM software to automate workflows and improve process management.

- Half (50%) of business leaders are planning to increase automation for repetitive tasks in their organizations.

- According to Deloitte, 29% of companies are gearing up to implement BPM software soon.

- 48% of organizations are working on deploying process automation solutions to better handle manual tasks.

- A significant 67% of businesses are implementing BPA solutions to improve visibility across their systems.

Component Analysis

In 2023, the Solution segment held a dominant market position within the Digital Process Automation (DPA) market, capturing more than a 74.9% share. This substantial market share can be attributed to the increasing demand for streamlined business processes and the integration of advanced technologies such as artificial intelligence and machine learning in business operations.

Solutions in DPA typically include software platforms that automate complex business processes, thereby enhancing efficiency and reducing operational costs. The robust growth of the Solution segment is further driven by the need for organizations to improve their operational agility and responsiveness to changing market conditions.

As businesses continue to focus on digital transformation, DPA solutions provide a critical tool in redefining business workflows, ensuring compliance, and improving customer experience. This segment benefits from the adoption of cloud-based solutions, offering scalability and accessibility advantages that are essential in today’s dynamic business environment.

Additionally, the expansion of industries such as finance, healthcare, and retail, which heavily rely on process automation to optimize operations, has significantly contributed to the growth of the Solution segment. Companies in these sectors are leveraging DPA solutions to automate tasks ranging from data entry and analysis to customer relationship management and procurement, which underscores the segment’s substantial impact on the market.

Looking ahead, the Solution segment is expected to maintain its leading position due to continuous innovations and the increasing integration of Internet of Things (IoT) devices, which further enhance the capabilities of digital process automation platforms. As organizations increasingly prioritize efficiency and customer satisfaction, the demand for comprehensive DPA solutions that can deliver advanced analytics, real-time feedback, and improved decision-making is likely to surge, propelling the segment’s growth well into the future.

Deployment Mode Analysis

In 2023, the Cloud-Based segment of the Digital Process Automation (DPA) market held a dominant position, capturing more than a 60.1% market share. This prevalence is largely attributed to the flexibility, scalability, and cost-efficiency that cloud-based solutions offer to organizations of all sizes. Cloud deployment allows businesses to implement DPA solutions without substantial upfront investments in IT infrastructure, which is particularly advantageous for small and medium-sized enterprises that may have limited capital resources.

Cloud-based DPA platforms facilitate rapid deployment and easy scalability, enabling businesses to adjust their automation capabilities as their needs evolve. Additionally, these platforms provide enhanced collaboration capabilities that are essential for maintaining the efficiency of distributed teams. The accessibility of DPA tools from any device and location, as long as there is internet connectivity, significantly enhances operational flexibility, a critical factor in today’s fast-paced business environment.

Furthermore, cloud-based DPA solutions are continuously updated by providers to include the latest security measures and compliance standards, which helps businesses protect their data and meet regulatory requirements without additional overhead. The ongoing shift towards digital business models, accelerated by the COVID-19 pandemic, has made the scalability and remote accessibility features of cloud-based DPA solutions even more pertinent, thus driving their increased adoption.

For instance, according to Quixy, The Remote Work and Compensation Pulse Survey says that 48% of employees prefer to work remotely permanently, whereas 44% want a hybrid working model. Cloud solutions facilitate seamless collaboration, enabling employees to access automation tools from anywhere, ensuring continuity and efficiency in business operations.

In contrast, on-premise DPA solutions, while offering control over data and more customization options, often come with higher costs related to maintenance, energy, and space requirements, which can be a significant barrier for many businesses. As a result, the shift towards cloud-based solutions is expected to continue, with more businesses adopting these solutions to leverage their benefits of cost savings, improved security, and compliance, as well as enhanced flexibility and scalability.

Enterprise Size Analysis

In 2023, the Large Enterprises segment held a dominant market position in the Digital Process Automation (DPA) market, capturing more than a 65% share. This significant market share can be attributed to the extensive requirements of large enterprises for automating complex and voluminous business processes.

Large organizations typically face diverse challenges that require robust and integrated solutions, making them prime candidates for adopting DPA technologies. These enterprises prioritize DPA to streamline operations, reduce human error, and achieve economies of scale, which significantly enhance their operational efficiency and productivity.

Furthermore, large enterprises have the capital investment capacity to adopt advanced DPA solutions that incorporate artificial intelligence, machine learning, and data analytics. This investment enables them to not only automate routine tasks but also gain insightful analytics for strategic decision-making. The scale of their operations necessitates extensive system integrations that DPA platforms are well-equipped to handle, thus ensuring seamless workflow across various departments and geographies.

The adoption of DPA by large enterprises is also driven by the need to maintain competitive advantage and comply with stringent regulatory requirements across different regions. DPA solutions help these companies adhere to compliance standards by automating documentation, audit trails, and reporting processes. This is particularly critical in industries such as finance, healthcare, and manufacturing, where compliance and data integrity are paramount.

Looking forward, the Large Enterprises segment is expected to continue its dominance in the DPA market. As these organizations increasingly focus on digital transformation as a core strategic initiative, the demand for comprehensive DPA solutions that can optimize end-to-end processes and enhance customer experiences is anticipated to grow. This growth will be supported by continuous technological advancements that expand the capabilities of digital process automation tools, making them more essential to the operational success of large enterprises.

Industry Vertical Segment Analysis

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position in the Digital Process Automation (DPA) market, capturing more than a 23.5% share. This significant share is primarily attributed to the critical need within the BFSI sector for efficiency and compliance, which are effectively addressed by DPA solutions.

These tools automate complex, repetitive tasks, thereby reducing the risk of human error and increasing operational efficiency. For financial institutions, this means faster response times, improved customer service, and enhanced ability to comply with ever-evolving regulatory requirements. Moreover, the adoption of DPA in the BFSI sector is propelled by the need to manage large volumes of data and facilitate real-time transaction processing.

Automation enables financial organizations to streamline processes such as loan processing, account opening, customer onboarding, and compliance reporting. By integrating DPA solutions, banks and financial institutions can not only optimize these processes but also gain valuable insights through analytics, further helping to tailor services and products to customer needs.

Additionally, as cybersecurity remains a paramount concern in the BFSI sector, DPA solutions offer advanced security features that help protect sensitive financial information against potential breaches. By automating workflows and data management, these institutions minimize human intervention, which in turn reduces the potential for security vulnerabilities.

Moving forward, the demand within the BFSI segment for DPA solutions is expected to continue growing. This growth will be driven by increasing digital transactions, the need for seamless customer experiences, and the requirement for stringent compliance with regulatory standards. As DPA technologies evolve, their integration into BFSI processes will become more profound, making them indispensable for staying competitive in a rapidly changing financial landscape.

Key Market Segments

By Component

- Solution

- Services

By Deployment Mode

- Cloud-Based

- On-Premise

By Enterprise Size

- Small and Medium-Sized Enterprises

- Large Enterprises

By Industry Vertical

- IT and Telecommunications

- BFSI

- Manufacturing

- Government

- Retail

- Healthcare

- Other Industry Verticals

Drivers

Growing adoption of the low code automation platform

The growing adoption of low-code automation platforms is a significant driver for the Digital Process Automation market. These platforms empower users with limited coding experience to create and deploy automation solutions quickly. This democratization of technology accelerates the adoption of Digital Process Automation across industries, particularly small and medium enterprises.

Low code platforms reduce the development time and cost associated with traditional programming. By simplifying the automation process, businesses can scale operations faster and improve efficiency without relying heavily on specialized IT teams. This enables faster implementation of automation across various business functions.

Restraint

Lack of technical expertise

Lack of technical expertise is a significant restraint in the Digital Process Automation market. Many organizations struggle to implement advanced automation technologies due to a shortage of skilled professionals who understand the complexities of AI, RPA, and cloud integration. This skills gap can slow down digital transformation efforts and hinder automation adoption.

Furthermore, the rapidly evolving nature of Digital Process Automation technologies requires continuous upskilling and training. Organizations that lack internal expertise may face difficulties in maintaining or upgrading their systems, which can result in inefficiencies and increased costs.

The absence of technical knowledge also leads to poor decision-making in automation strategy. Without skilled professionals, businesses may fail to optimize their Digital Process Automation solutions, missing opportunities for maximum impact and value.

Opportunities

Integration of Machine learning and AI

The integration of machine learning and AI into Digital Process Automation presents a significant market opportunity by enhancing decision-making processes. These technologies enable automation systems to analyze a vast amount of data in real-time, leading to more accurate and informed decisions. As AI and ML evolve, they bring higher levels of predictive capabilities, improving efficiency and reducing errors.

With AI’s ability to learn from historical data, it allows for continuous process improvements. Machine learning models adapt to changing data trends, ensuring Digital Process Automation systems stay relevant and effective in dynamic environments, which appeals to businesses seeking agility.

Challenges

Complexity in integration with existing systems and tools

Integrating Digital Process Automation with the existing systems and tools poses a significant challenge due to the complexity of legacy infrastructures. Many organizations still rely on outdated software that may not be compatible with new automation technologies, requiring costly and time-consuming upgrades or replacements.

Additionally, integration often involves aligning various applications, databases, and platforms, which can create data silos and hinder seamless communication. Organizations must invest in proper APIs, middleware, and specialized expertise to ensure smooth connectivity between the new and old systems.

Growth Factors

The Digital Process Automation (DPA) market is poised for significant expansion, driven by a variety of growth factors. Key among these is the increasing need for businesses to enhance operational efficiency and streamline business processes. The integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) within digital process automation platforms is significantly enhancing their capability, allowing for more sophisticated, automated decision-making processes that can handle complex tasks more efficiently.

This integration helps in improving accuracy and speed, crucial for industries like finance and healthcare where decision-making needs are dynamic and data-driven. Moreover, the push towards digital transformation across various sectors is urging companies to adopt DPA solutions. This shift is largely due to the need for agility in operations and the competitive advantage that streamlined, automated processes offer. As businesses move to digital-first approaches, the demand for DPA to manage and automate these new digital processes is increasing.

Emerging Trends

Emerging trends in the DPA market include the growing adoption of cloud-based solutions, which offer scalability, flexibility, and reduced upfront costs, making DPA technologies accessible to a broader range of businesses, including small and medium-sized enterprises. Another trend is the increasing focus on customer experience enhancements. DPA tools are being used to automate customer service processes, thereby reducing wait times and improving service delivery, which in turn boosts customer satisfaction and loyalty.

The use of DPA in conjunction with IoT devices is also on the rise, enabling more interconnected and automated workflows. This integration facilitates real-time data collection and analysis, enhancing the ability to make informed decisions quickly and accurately. Additionally, as more organizations prioritize sustainability, DPA is being leveraged to optimize resource use and reduce waste, contributing to more sustainable business practices.

Business Benefits

Implementing DPA offers numerous business benefits, key among them being significant cost reductions. By automating routine and complex processes, businesses can reduce the labor intensity and minimize errors, which often lead to cost savings. DPA also supports regulatory compliance by standardizing processes according to set guidelines, thereby mitigating risks associated with non-compliance.

Another benefit is the enhancement of scalability. As businesses grow, DPA solutions can easily be scaled to accommodate increased loads and complexities without the need for proportional increases in human resources. This scalability supports business expansion activities and the ability to quickly adapt to market changes or opportunities.

Furthermore, DPA enables businesses to improve their analytical capabilities and data-driven decision-making. By automating data collection and processing, companies can gain deeper insights into their operations and markets, allowing for better strategic planning and increased competitiveness in their respective industries.

Overall, the growth of the DPA market is supported by technological advancements and the shifting needs of modern businesses towards more agile and efficient operations. As companies continue to embrace digital transformations, the role of digital process automation becomes increasingly central, driving both market growth and operational improvements across various industry verticals.

Regional Analysis

In 2023, North America maintained a leading position in the Digital Process Automation (DPA) market, capturing over 37.4% of the market share, with revenues reaching approximately USD 1.5 billion. This dominant position can be attributed to several factors that are unique to the region.

North America benefits from the presence of major technology innovators and a robust technological infrastructure, which facilitates the early adoption and integration of advanced digital solutions like DPA across various industries. Additionally, the region’s organizations are highly focused on enhancing operational efficiencies and reducing costs, driving them to invest in DPA technologies.

The concentration of numerous global and dynamic industries, including financial services, healthcare, and manufacturing in this region, further accelerates the deployment of DPA solutions. These industries are rapidly digitizing their processes to improve service delivery and comply with stringent regulatory requirements. According to Signity Solutions, 32.84% of North American businesses have adopted Artificial Intelligence and RPA in different industries.

The tech-savvy workforce and the proactive adoption of cloud-based solutions also contribute significantly to the market growth. The integration of artificial intelligence and machine learning with DPA tools has been particularly notable in North America, enhancing automation capabilities and business process management across the board.

Moreover, the strategic initiatives by leading market players such as IBM Corporation, Microsoft Corporation, and Oracle Corporation, which are headquartered in North America, have been pivotal. These companies continuously innovate and expand their DPA solutions, often through partnerships and acquisitions, to cater to the growing demand for automated and efficient operational processes. This trend is expected to continue, further strengthening the region’s market position in the coming years

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- UK

- Spain

- Austria

- Rest of Europe

- Asia-Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Rest of Asia-Pacific

- Latin America

- Brazil

- Middle East & Africa

- South Africa

- Saudi Arabia

- United Arab Emirates

Key Players Analysis

One of the leading players in the market is IBM Corporation which provides AI-powered automation platforms like IBM Cloud part for automation, thus integrating workflow automation, decision-making, and AI for enterprise solutions.

Another significant player operating in the market is Pegasystems which offers low code, AI-infused digital process automation solutions. It emphasizes customer engagement and process automation for streamlined business processes.

Top Key Players in the Market

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Salesforce, Inc.

- SAP SE

- Pegasystems Inc.

- Appian

- UiPath

- Automation Anywhere, Inc.

- SS&C Blue Prism

- Other Key Players

Recent Developments

- November 2023: Salesforce announced the launch of its new DPA tool designed to enhance workflow automation across its CRM platform. This tool integrates AI capabilities to streamline customer interactions and improve service delivery.

- October 2023: IBM acquired a leading AI-driven DPA company to bolster its automation portfolio. This acquisition aims to enhance IBM’s capabilities in intelligent automation solutions, focusing on improving operational efficiency for clients.

- September 2023: UiPath introduced a new version of its RPA platform that includes advanced machine learning features for better process automation. This update is expected to significantly reduce manual intervention in repetitive tasks.

- August 2023: Microsoft launched new features in its Power Automate platform that enable users to automate complex workflows with minimal coding. This move is part of Microsoft’s strategy to democratize automation for businesses of all sizes.

- July 2023: Oracle expanded its DPA offerings by integrating process automation capabilities into its cloud applications. This integration aims to provide users with seamless automation experiences across various business functions.

Report Scope

Report Features Description Market Value (2023) USD 13.3 Bn Forecast Revenue (2033) USD 44.4 Bn CAGR (2024-2033) 12.8% Largest Market North America (USD 4.9Bn) Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Solution, Services), By Deployment Mode (Cloud-Based, On-Premise), By Enterprise Size (Small and Medium Sized Enterprises, Large Enterprises), By Industry Vertical (IT and Telecommunications, BFSI, Manufacturing, Government, Retail, Healthcare, Other Industry Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, Microsoft Corporation, Oracle Corporation, Salesforce, Inc., SAP SE, Pegasystems Inc., Appian, UiPath, Automation Anywhere, Inc., SS&C Blue Prism, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Process Automation MarketPublished date: Dec. 2024add_shopping_cartBuy Now get_appDownload Sample

Digital Process Automation MarketPublished date: Dec. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Salesforce, Inc.

- SAP SE

- Pegasystems Inc.

- Appian

- UiPath

- Automation Anywhere, Inc.

- SS&C Blue Prism

- Other Key Players