Global Digital Oilfield Market Size, Share and Analysis Report By Solution (Hardware Solutions, Software & Services), By Process (Production Optimization, Drilling Optimization, Reservoir Optimization, Safety Management, Others), By Technology (Internet of Things, Artificial Intelligence & Machine Learning, Big Data & Analytics, Cloud Computing, Others), By Application (Onshore, Offshore), By End-User (Upstream, Midstream, Downstream), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 154665

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Performance and Efficiency Gains

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- By Solution

- By Process

- By Technology

- By Application

- By End User

- By Region

- Investment Opportunities

- Business Benefits

- Regulatory Environment

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

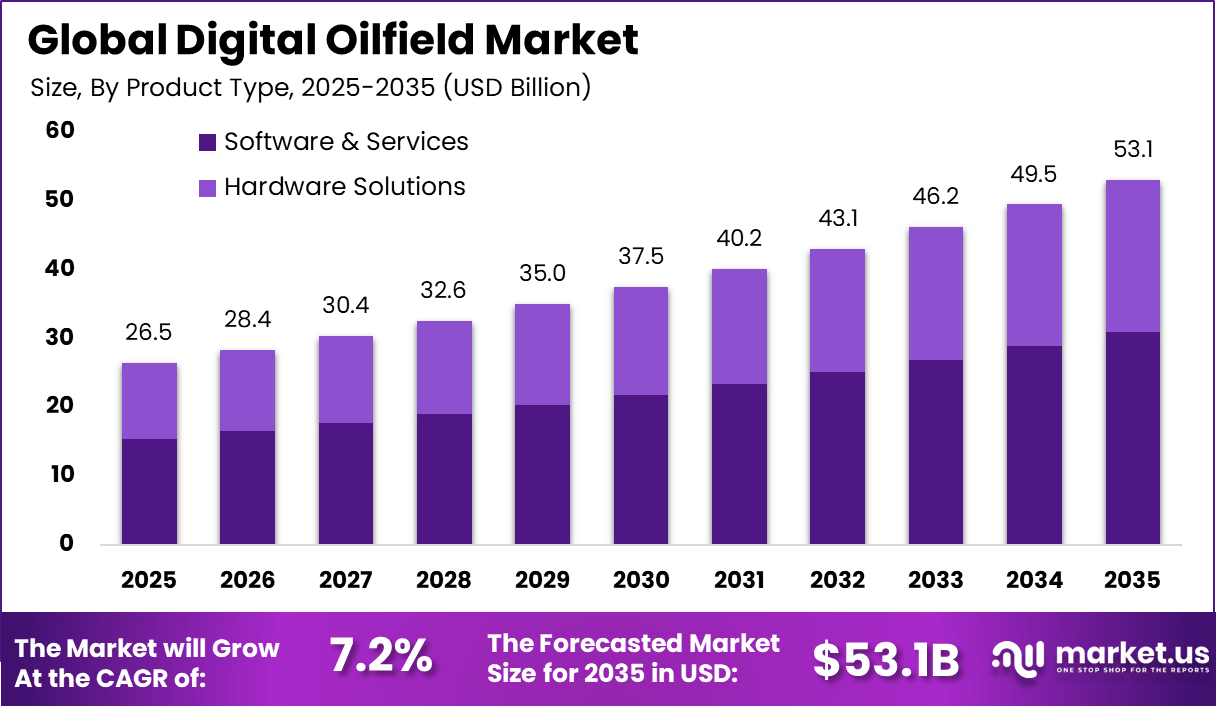

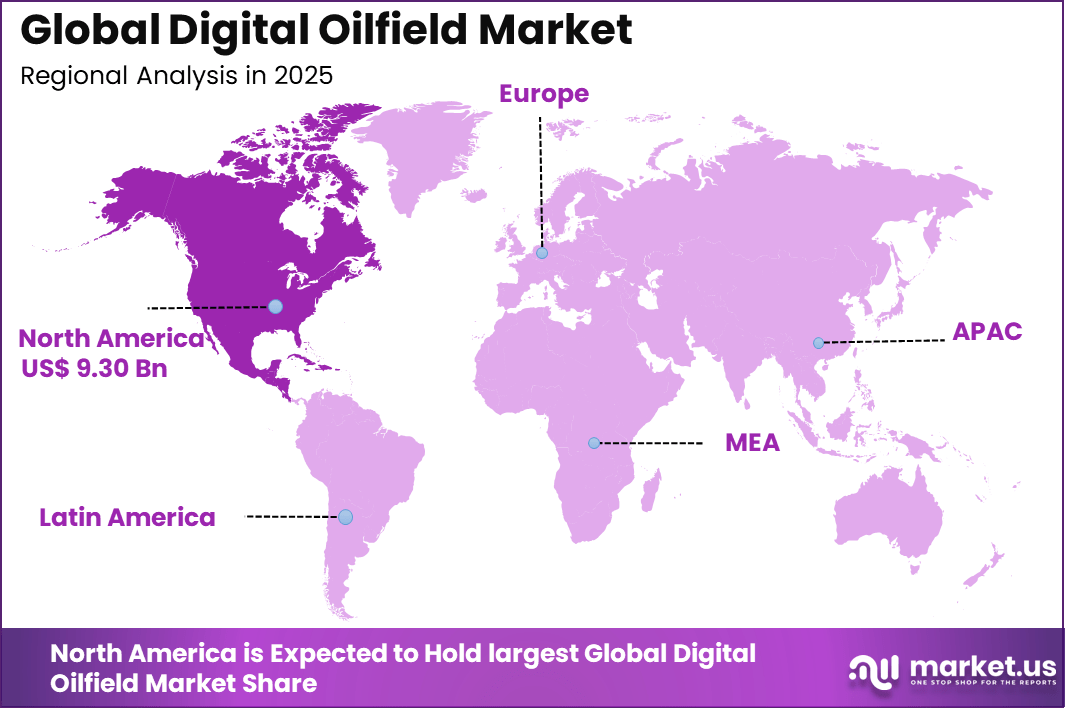

The Global Digital Oilfield Market size is expected to be worth around USD 53.1 billion by 2035, from USD 26.48 billion in 2025, growing at a CAGR of 7.2% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 35.14% share, holding USD 9.30 billion in revenue.

The digital oilfield market refers to the use of digital technologies to monitor, control, and optimize oil and gas exploration, drilling, production, and reservoir management activities. These solutions integrate data from sensors, control systems, and analytics platforms to improve visibility across upstream operations. Digital oilfield systems support real time decision making and remote asset management. Adoption is observed across onshore and offshore operations seeking higher efficiency and safety.

One major driving factor of the digital oilfield market is the need to reduce operational costs amid volatile energy prices. Oil and gas operators seek technologies that improve asset utilization and minimize downtime. Digital monitoring and automation help optimize production rates and reduce unnecessary interventions. These efficiencies support better cost control across the value chain.

For instance, in September 2025, Halliburton Company launched the next-generation Summit Knowledge digital ecosystem with SK Well Pages, delivering real-time oilfield intelligence through an all-in-one electric submersible pump workspace. This Houston innovation helps operators make faster production decisions and cuts downtime significantly.

Internet of Things technologies play a central role in digital oilfield adoption. Sensors and connected devices collect real time data on pressure, temperature, flow rates, and equipment condition. This data enables continuous monitoring and rapid response to changing conditions. IoT integration improves situational awareness across oilfield operations.

Artificial intelligence and advanced analytics are also driving adoption. These technologies analyze large volumes of operational data to identify patterns and predict equipment failures. Predictive analytics support proactive maintenance and production optimization. The use of intelligent algorithms enhances decision accuracy and operational efficiency.

Key Takeaway

- Software and services led the market with a 58.3% share, showing that operators increasingly rely on integrated digital platforms to improve operational visibility, automation, and decision support across oilfield activities.

- Production optimization accounted for a 34.7% share by process, reflecting strong focus on maximizing output, reducing downtime, and improving recovery rates from existing assets.

- The Internet of Things dominated the technology landscape with a 41.6% share, supported by widespread use of connected sensors, real time monitoring, and remote asset management.

- Onshore applications held a commanding 71.5% share, driven by the large number of land based fields and faster deployment of digital solutions compared with offshore environments.

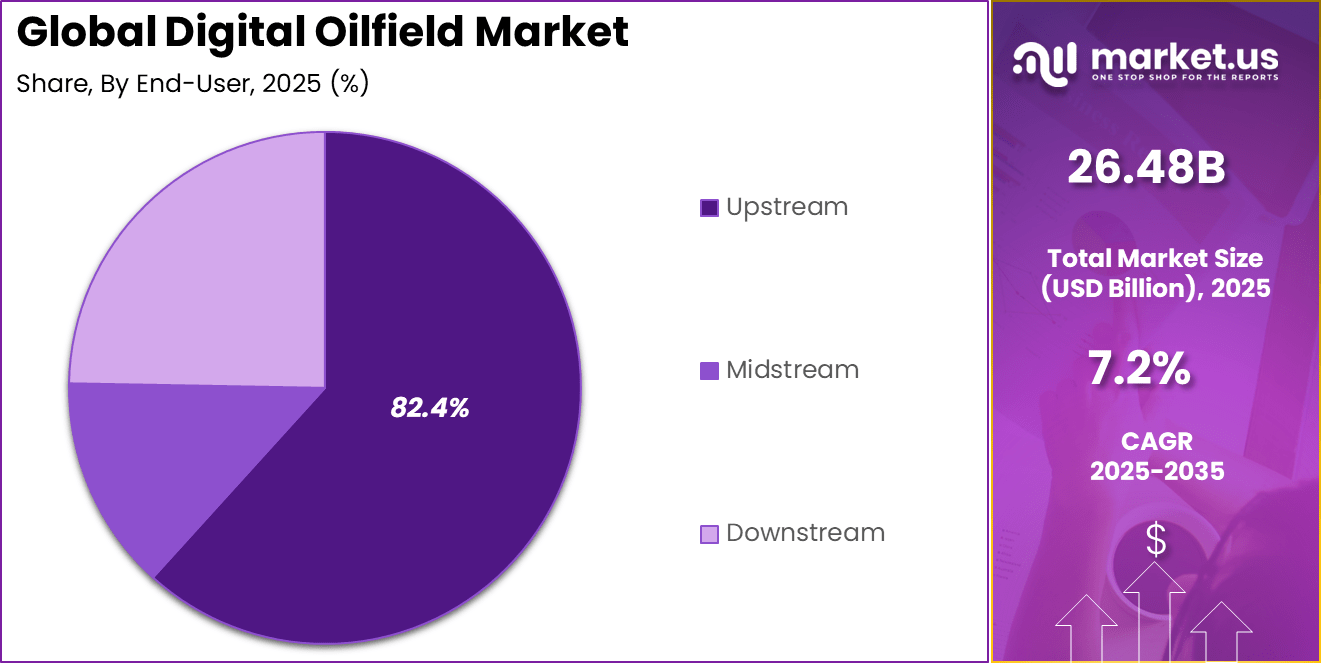

- The upstream sector represented 82.4% of end user adoption, highlighting the importance of digital oilfield technologies in exploration, drilling, and production operations.

- North America maintained regional leadership with a 35.14% share, supported by advanced oil and gas infrastructure, early technology adoption, and strong emphasis on operational efficiency.

Performance and Efficiency Gains

- Cost savings have improved noticeably, as digital adoption reduced operational expenses by up to 20%. At an industry level, cumulative savings from digital transformation were expected to exceed USD 320 billion by 2030, driven by automation and better asset utilization.

- Operational downtime declined significantly, with predictive maintenance and big data analytics cutting unplanned outages by as much as 35%. This improvement strengthened asset reliability and reduced revenue losses from unexpected shutdowns.

- Production and recovery rates benefited from advanced analytics, as AI powered simulations increased hydrocarbon recovery factors by up to 10%. These gains supported higher output from existing fields without proportional increases in capital spending.

- Staffing efficiency improved across several operations, as digital technologies enabled remote monitoring and control. In some offshore installations, on site workforce requirements were reduced by 25%, improving safety and lowering long term operating costs.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Production optimization demand Need to maximize recovery from existing assets ~2.1% North America, Middle East Short to Mid Term Rising operational efficiency focus Cost reduction through automation and analytics ~1.8% Global Short Term Expansion of IoT in oilfields Real time monitoring of assets and wells ~1.5% Global Mid Term Integration of AI and analytics Predictive maintenance and reservoir modeling ~1.1% North America, Europe Mid Term Workforce digitalization Remote operations and reduced field exposure ~0.7% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline Cybersecurity threats Increased attack surface from connected assets ~1.9% Global Short Term Oil price volatility Reduced digital investment during downturns ~1.6% Global Short Term Integration complexity Compatibility with legacy field systems ~1.3% Global Mid Term Skills gap Shortage of digital and data expertise ~1.0% Global Mid Term Data quality issues Inconsistent sensor and field data ~0.7% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact High upfront investment Capital intensive digital deployments ~2.2% Emerging Markets Short to Mid Term Legacy infrastructure Older assets difficult to digitize ~1.7% Global Mid Term Uncertain ROI timelines Delayed financial returns ~1.3% Global Mid Term Regulatory constraints Data handling and operational rules ~1.0% North America, Europe Long Term Vendor dependence Reliance on specialized providers ~0.6% Global Long Term By Solution

Software and services account for 58.3%, indicating their central role in digital oilfield operations. These solutions support data collection, analysis, and operational decision-making across oilfield assets. Software platforms help integrate data from drilling, production, and reservoir systems. Services support deployment, maintenance, and optimization of digital tools. Together, they improve operational visibility and control.

The dominance of software and services is driven by the need for continuous monitoring and optimization. Oilfield operators rely on digital platforms to manage complex operations. Service support ensures smooth implementation and system reliability. Software solutions reduce manual intervention and errors. This sustains strong adoption across oilfield operations.

For Instance, in November 2025, Schlumberger Limited launched a new AI product focused on digital sales growth. This tool integrates data analytics software to streamline oilfield operations and support faster decision-making in complex environments. Operators benefit from enhanced software platforms that tie into services for seamless deployment.

By Process

Production optimization represents 34.7%, making it a key process segment. Digital oilfield tools analyze production data to improve output efficiency. Optimization helps identify bottlenecks and performance issues. Real-time insights support informed operational decisions. This improves resource utilization and production stability.

Growth in production optimization is driven by cost control and efficiency goals. Operators seek to maximize output from existing assets. Digital tools support proactive adjustments to production parameters. Optimization reduces downtime and losses. This process remains critical in digital oilfield strategies.

For instance, in August 2025, Halliburton launched SK Well Pages as part of its Summit Knowledge digital ecosystem. This platform offers an all-in-one workspace for electric submersible pumps to aid production decisions and boost output. It targets key optimization challenges in real-time field management.

By Technology

Internet of Things technology holds 41.6%, highlighting its importance in digital oilfields. IoT devices collect real-time data from equipment and wells. Sensors monitor pressure, temperature, and flow rates continuously. This data supports predictive and preventive actions. Connectivity enables remote monitoring.

Adoption of IoT is driven by demand for real-time visibility. Operators use connected devices to reduce manual inspections. IoT supports faster response to operational issues. Data-driven insights improve decision-making. This keeps IoT central to digital oilfield development.

For Instance, in December 2025, ABB Ltd collaborated with Enovate Upstream on an onshore digital oilfield solution using IoT. The ADA AI Digital Ecosystem connects sensors for remote monitoring and data flow. This advances IoT applications in production fields.

By Application

Onshore applications account for 71.5%, making them the dominant application area. Onshore oilfields are easier to digitize due to accessibility. Digital solutions support drilling, production, and maintenance activities. Onshore operations generate large volumes of operational data. Digital tools help manage this complexity.

The dominance of onshore applications is driven by widespread onshore oilfield presence. Operators invest in digital systems to improve efficiency. Lower deployment costs compared to offshore support adoption. Onshore digitalization improves asset performance. This sustains strong focus on onshore operations.

For Instance, in September 2025, Weatherford International plc supplied automated systems for Romgaz onshore production. The infrastructure optimizes output using real-time data tailored to onshore setups. This aids onshore operators in maximizing well performance.

By End User

Upstream operations represent 82.4%, highlighting their leading role in digital oilfield adoption. Upstream activities include exploration, drilling, and production. These stages benefit significantly from digital monitoring and analytics. Accurate data supports better planning and execution. Risk reduction is a key priority.

Adoption in the upstream segment is driven by operational complexity. Digital tools help manage uncertainty and variability. Real-time insights support faster decisions. Upstream operators invest in technology to improve recovery rates. This keeps upstream as the primary end user.

Use Case Adoption

Industry Vertical Primary Use Case Adoption Share (%) Adoption Maturity Upstream operations Well monitoring and optimization 82.4% Advanced Midstream Pipeline integrity monitoring 9.6% Developing Downstream Refinery process optimization 8.0% Developing For Instance, in December 2025, Schlumberger Limited entered a collaboration with Shell for upstream AI infrastructure. The open data platform unifies workflows in subsurface and well construction for upstream users. It speeds up digital adoption in exploration stages.

By Region

North America accounts for 35.14%, supported by advanced oilfield infrastructure. The region shows strong adoption of digital technologies. Operators focus on efficiency and cost management. Digital oilfield solutions support mature asset optimization. The region remains a key contributor.

For instance, in October 2025, Baker Hughes advanced its $13.6 billion acquisition of Chart Industries, integrating cryogenic technologies with digital analytics to create unified energy ecosystems for digital oilfields and emissions reduction. Houston’s strategic move highlights North American dominance in data-driven oilfield transformation.

Regional Driver Comparison

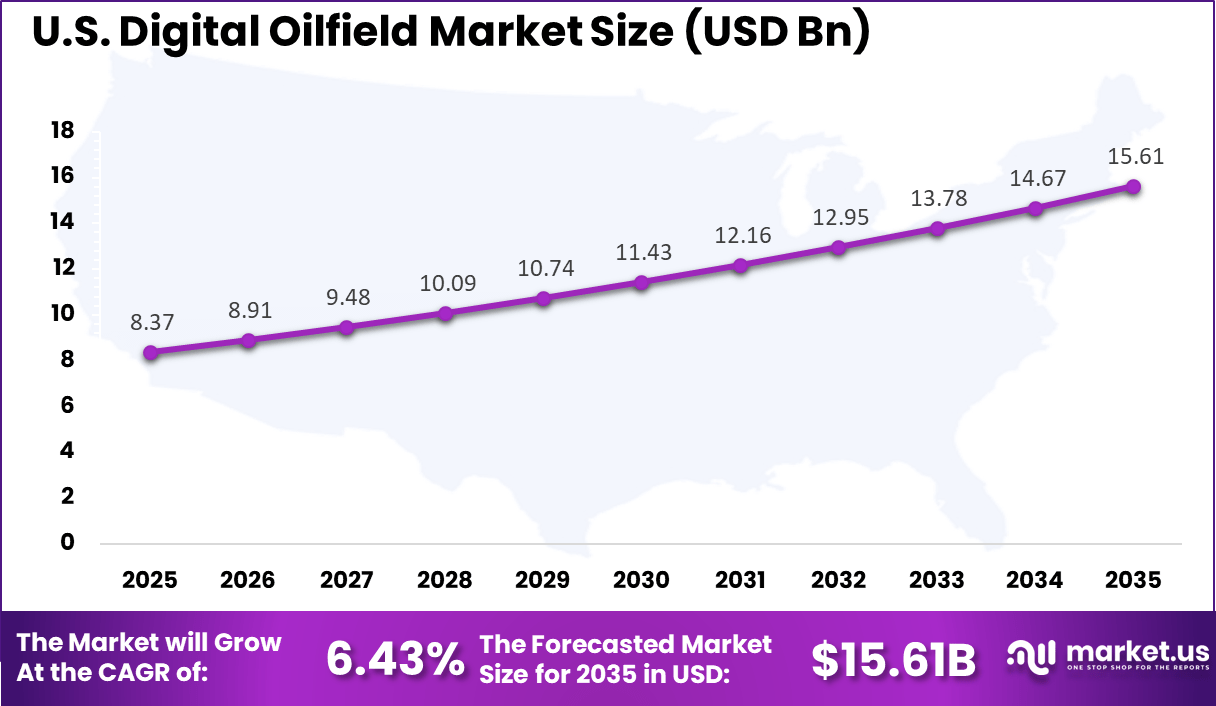

Region Primary Growth Driver Regional Share (%) Regional Value (USD Bn, 2025) Adoption Maturity North America Shale optimization and advanced analytics 35.14% USD 9.30 Bn Advanced Middle East Large scale field digitization 27.8% USD 7.36 Bn Advanced Europe Offshore asset optimization 18.6% USD 4.93 Bn Developing Asia Pacific Production efficiency initiatives 12.4% USD 3.28 Bn Developing Latin America and Africa Asset monitoring modernization 6.1% USD 1.61 Bn Early The United States reached USD 8.37 Billion with a CAGR of 6.43%, reflecting steady market growth. Expansion is driven by digital transformation in oil and gas operations. Operators invest in data-driven systems. Technology adoption supports long-term productivity. Market growth remains stable.

For instance, in August 2025, Halliburton unveiled the next-generation Summit Knowledge® (SK™) digital ecosystem with SK Well Pages, featuring an all-in-one electric submersible pump workspace for real-time oilfield intelligence and agile production decisions. This Houston-based innovation reinforces U.S. leadership in digital oilfield optimization.

Investment Opportunities

Investment opportunities in the digital oilfield market exist in integrated platforms that combine data acquisition, analytics, and automation. Solutions that offer end to end visibility across exploration and production stages attract strong interest. Investors may focus on platforms that support scalability and interoperability. These capabilities align with long term digital transformation goals.

Another opportunity lies in cybersecurity and data management solutions for oilfield systems. As operations become more connected, protection of critical infrastructure is essential. Technologies that secure data flow and ensure system resilience add significant value. Investment in secure digital oilfield infrastructure supports sustainable adoption.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior Upstream oil operators Very High ~82.4% Production efficiency and safety Long term digital programs National oil companies High ~28% Asset performance optimization Capital intensive deployment Integrated oil companies High ~22% Operational integration Platform based adoption Service providers Moderate ~14% Digital service expansion Partnership driven Independent operators Low to Moderate ~9% Cost control Selective adoption Technology Enablement Analysis

Technology Layer Enablement Role Impact on Market Growth (%) Adoption Status Industrial IoT platforms Real time data acquisition ~2.3% Growing Advanced analytics Production and reservoir insights ~1.9% Growing Cloud computing Centralized data processing ~1.4% Mature Digital twins Asset and field simulation ~1.0% Developing Edge computing Low latency field analytics ~0.6% Developing Business Benefits

Adoption of digital oilfield solutions delivers measurable improvements in operational efficiency and cost management. Automated monitoring reduces manual intervention and operational delays. Predictive maintenance lowers repair costs and extends equipment life. These benefits contribute to improved profitability.

Digital oilfield technologies also support better strategic planning and asset management. Historical and real time data provide insights into long term field performance. Operators can make informed decisions about investments and production strategies. Enhanced planning supports business resilience and growth.

Regulatory Environment

The regulatory environment for the digital oilfield market is shaped by safety, environmental, and data governance standards. Oil and gas operations must comply with regulations related to emissions, workplace safety, and environmental protection. Digital monitoring supports compliance by providing accurate and auditable data. Regulatory alignment is a key adoption driver.

Data security and operational integrity regulations also influence digital oilfield deployments. Operators must ensure that digital systems meet cybersecurity and reliability standards. Compliance with industry and national regulations is required for critical infrastructure. Adherence to these frameworks supports trust and long term market development.

Key Market Segments

By Solution

- Hardware Solutions

- Sensors & Intelligent Wells

- Control Systems

- Communication Systems

- Others

- Software & Services

- Data Management Software

- Visualization & Simulation Software

- Drilling Optimization Services

- Production Optimization Services

- Others

By Process

- Production Optimization

- Drilling Optimization

- Reservoir Optimization

- Safety Management

- Others

By Technology

- Internet of Things

- Artificial Intelligence & Machine Learning

- Big Data & Analytics

- Cloud Computing

- Others

By Application

- Onshore

- Offshore

By End-User

- Upstream

- Midstream

- Downstream

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Schlumberger Limited, Halliburton Company, and Baker Hughes Company dominate the digital oilfield market through advanced data platforms and reservoir analytics. Their solutions support real-time drilling optimization and production monitoring. Strong domain expertise improves operational accuracy. These companies serve national and international oil companies. Integration of automation and digital twins is emphasized. Long-term contracts support stable revenues.

Weatherford International plc, Siemens AG, Schneider Electric SE, ABB Ltd., and Rockwell Automation, Inc. focus on digital control and automation. Their platforms integrate sensors, control systems, and analytics. Emphasis is placed on asset reliability and energy efficiency. These vendors support both offshore and onshore fields. Strong industrial automation experience improves system interoperability.

Honeywell International Inc., Emerson Electric Co., Kongsberg Gruppen ASA, National Oilwell Varco, Inc., Pason Systems Inc., Hexagon AB, and CGG SA address specialized digital oilfield needs. Their offerings include drilling data, visualization, and subsurface modeling. Focus is placed on decision support and accuracy. Other players serve niche and emerging digital applications.

Top Key Players in the Market

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- Weatherford International plc

- Siemens AG

- Schneider Electric SE

- ABB Ltd.

- Rockwell Automation, Inc.

- Honeywell International Inc.

- Emerson Electric Co.

- Kongsberg Gruppen ASA

- National Oilwell Varco, Inc.

- Pason Systems Inc.

- Hexagon AB

- CGG SA

- Others

Recent Developments

- In March 2025, Schneider Electric unveiled the One Digital Grid Platform, an AI powered solution designed to improve grid resiliency and operational efficiency. The platform is expected to be available later in 2025 and supports advanced analytics for better energy management. Alongside this launch, the company announced a USD 700 million investment plan in the United States to strengthen energy infrastructure and expand AI capabilities.

- In April 2025, ABB India delivered integrated automation and digital solutions for IndianOil’s cross country pipeline network to enhance efficiency and safety. The system enables real time monitoring and includes strong cybersecurity measures. Spanning over 20,000 kilometers, the network transports 125 million metric tons of oil and 49 million metric standard cubic meters of gas annually, supporting India’s critical energy requirements.

Report Scope

Report Features Description Market Value (2025) USD 26.5 Bn Forecast Revenue (2035) USD 53.1 Bn CAGR (2025-2035) 7.2% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Solution (Hardware Solutions, Software & Services), By Process (Production Optimization, Drilling Optimization, Reservoir Optimization, Safety Management, Others), By Technology (Internet of Things, Artificial Intelligence & Machine Learning, Big Data & Analytics, Cloud Computing, Others), By Application (Onshore, Offshore), By End-User (Upstream, Midstream, Downstream) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Schlumberger Limited, Halliburton Company, Baker Hughes Company, Weatherford International plc, Siemens AG, Schneider Electric SE, ABB Ltd., Rockwell Automation, Inc., Honeywell International Inc., Emerson Electric Co., Kongsberg Gruppen ASA, National Oilwell Varco, Inc., Pason Systems Inc., Hexagon AB, CGG SA, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- SLB

- Weatherford

- Halliburton

- Baker Hughes Company

- NOV

- Pason Systems Corp.

- Kongsberg Digital

- Viridien (CGG)

- Honeywell International Inc.

- Nabors Industries Ltd.