Global Digital Identity Verification Market By Component (Solutions, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small & Medium Businesses), By Technology (Biometric Verification, Document Authentication, Database & Knowledge-based Checks), By End-User Industry (BFSI, Government, Healthcare, Retail & E-commerce, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 175305

- Number of Pages: 380

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Drivers Impact Analysis

- Restraint Impact Analysis

- Component Analysis

- Deployment Mode Analysis

- By Organization Size

- Technology Analysis

- End-User Industry Analysis

- Emerging Trends Analysis

- Growth Factors Analysis

- Key Market Segments

- Regional Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

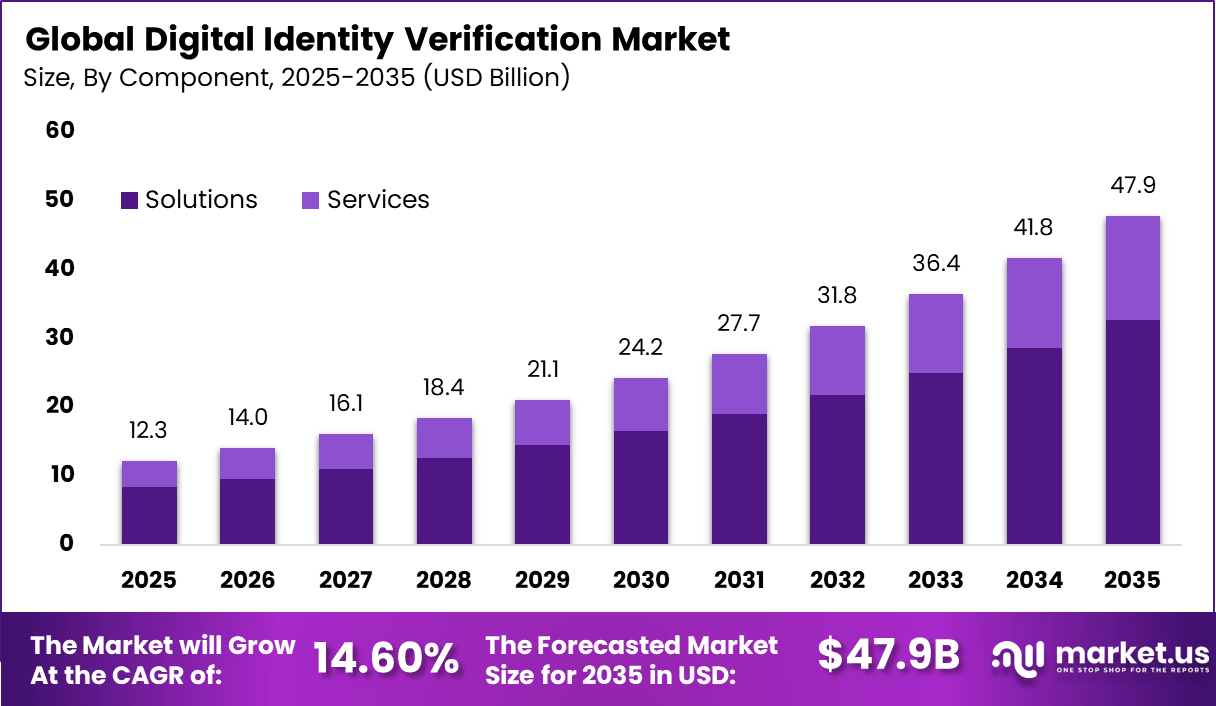

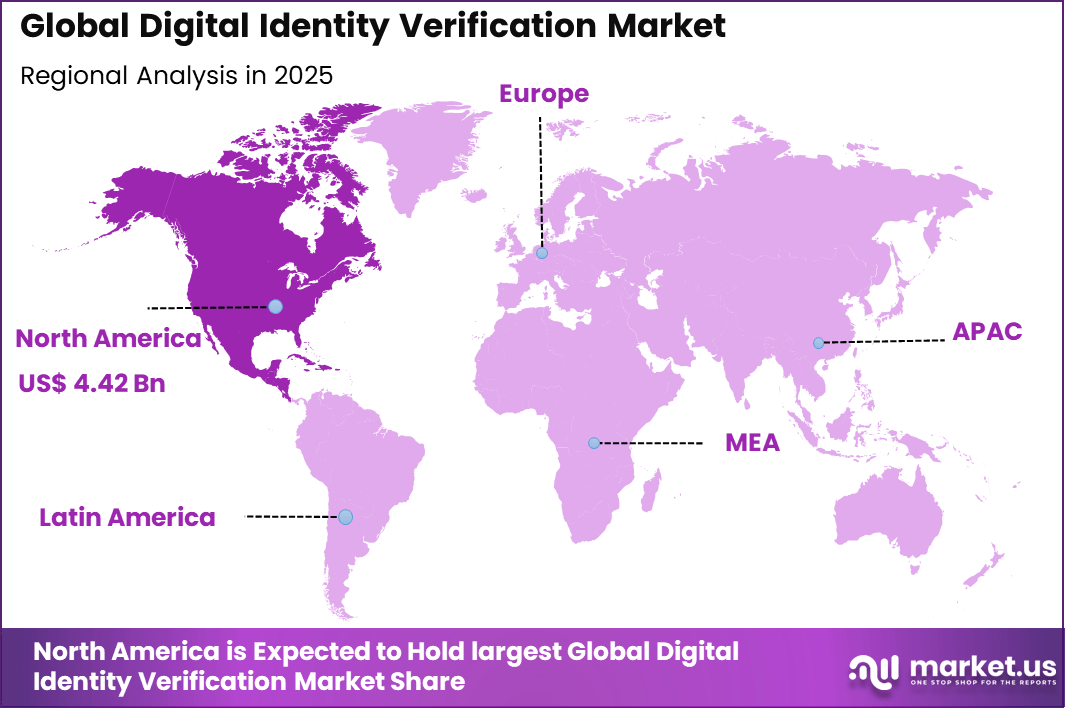

The Global Digital Identity Verification Market generated USD 12.3 billion in 2025 and is predicted to register growth from USD 14 billion in 2026 to about USD 47.9 billion by 2035, recording a CAGR of 14.60% throughout the forecast span. In 2025, North America held a dominant market position, capturing more than a 36.1% share, holding USD 4.42 Billion revenue.

The Digital Identity Verification Market covers technologies and services used to confirm the identity of individuals through digital channels. These solutions verify personal attributes using documents, biometrics, behavioral data, and database checks. Digital identity verification is widely used across financial services, e-commerce, healthcare, telecom, and public services. The market has become essential as physical verification methods decline and digital interactions increase.

Digital identity verification supports trust in remote transactions where face-to-face validation is not possible. It reduces identity fraud while enabling faster customer onboarding and service access. As digital ecosystems expand, identity verification is becoming a core infrastructure component rather than a standalone security function. This shift positions identity verification as a foundational requirement for digital economies.

One major driving factor is the rise in identity fraud and impersonation across online platforms. Fraudsters exploit stolen credentials, synthetic identities, and document forgery to access financial and digital services. Organizations respond by strengthening verification processes at onboarding and transaction stages. This threat environment directly increases demand for advanced identity verification tools.

According to a recently released data sheet from the ID authority, the government issued 10.5 million civil status and identification services and reached 4 million citizens through digital ID services delivered via ANIP platforms. In addition, 3.8 million identity authentications were carried out by telecommunications operators, supporting secure access to digital services. The data reflects expanding use of digital identity infrastructure across public and private sectors.

Service delivery channels show strong digital adoption. Around 37% of services were accessed through the digital government portal, while 30% were delivered via the ANIP BJ mobile application. Another 8% of services were obtained through USSD codes, ensuring accessibility for users without smartphones. The system also completed 25 million digitals Know Your Customer (eKYC) verifications, highlighting large scale use of digital identity for verification and compliance.

Demand for digital identity verification is driven by organizations that require secure customer onboarding at scale. High-volume industries such as financial services and e-commerce must balance fraud prevention with user experience. Verification solutions that reduce friction while maintaining accuracy are preferred. This demand grows as transaction volumes and customer expectations increase.

Top Market Takeaways

- By component, solutions dominated the digital identity verification market with 68.4% share, delivering platforms for seamless authentication and fraud prevention.

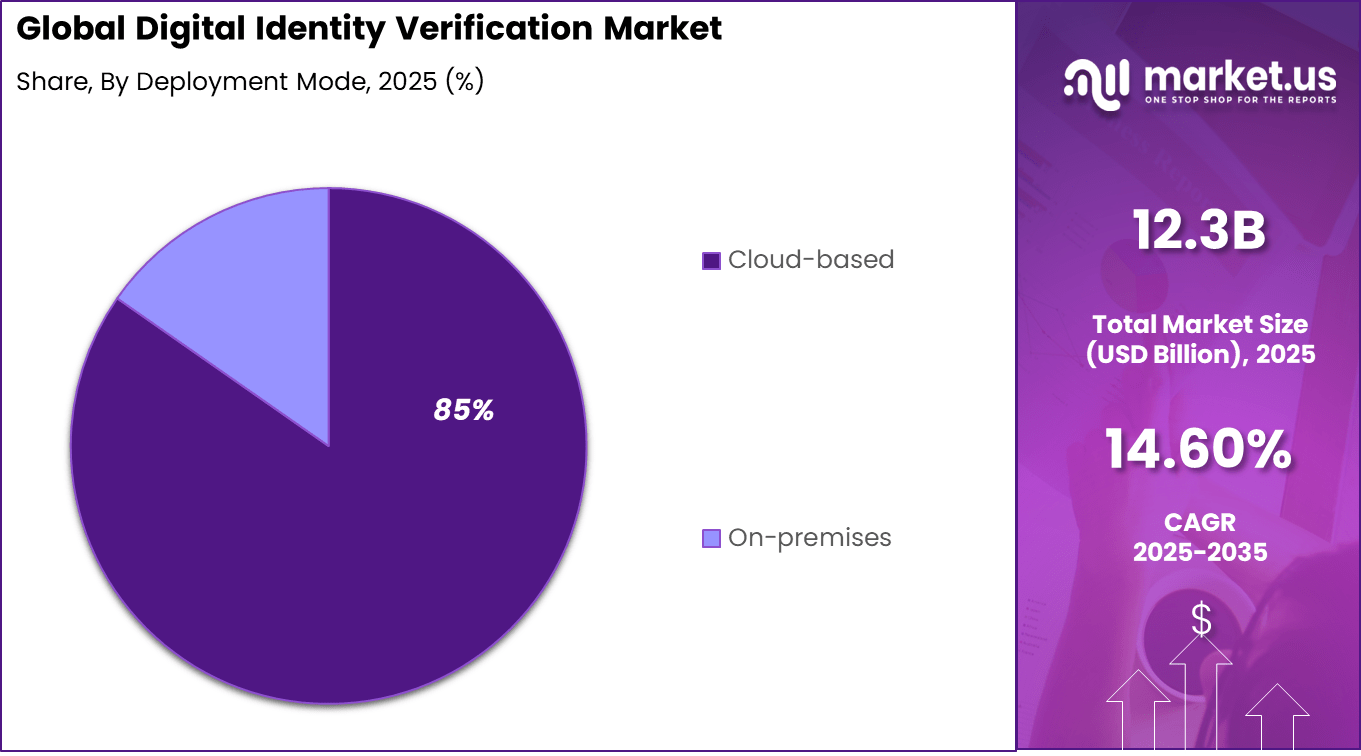

- By deployment mode, cloud-based systems captured 84.7%, offering scalability and integration for remote verification processes.

- By organization size, large enterprises held 58.9%, implementing robust solutions to secure high-volume customer onboarding.

- By technology, biometric verification led at 41.3%, using facial recognition and fingerprints for accurate, user-friendly identity checks.

- By end-user industry, BFSI accounted for 52.7%, prioritizing digital ID to comply with KYC regulations and combat account fraud.

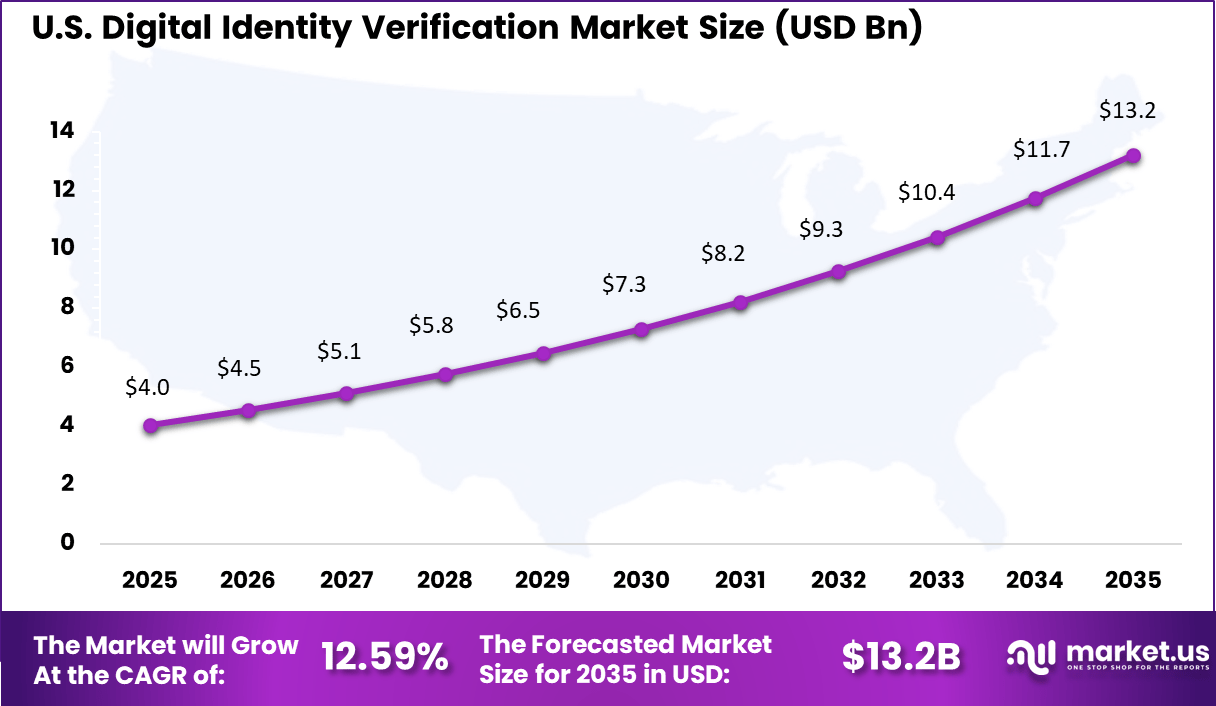

- North America represented 36.1% of the global market, with the U.S. valued at USD 4.04 billion and growing at a CAGR of 12.59%.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~) % Geographic Relevance Impact Timeline Rising digital fraud, identity theft, and account takeover incidents +4.3% Global Short term Rapid growth of online banking, fintech, and digital payments +3.6% North America, Europe, Asia Pacific Short to medium term Regulatory requirements for KYC, AML, and customer due diligence +3.1% Europe, North America Medium term Expansion of e-commerce, remote onboarding, and digital services +2.2% Global Medium term Increasing adoption of remote work and digital access systems +1.4% North America, Europe Medium to long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~) % Geographic Relevance Impact Timeline Data privacy concerns and user consent challenges -2.6% Europe, North America Short to medium term High implementation costs for advanced biometric systems -2.1% Emerging Markets Medium term Integration complexity with legacy enterprise systems -1.8% Global Medium term Accuracy limitations in biometric and document verification -1.5% Global Short term Regulatory fragmentation across regions -1.2% Asia Pacific, Latin America Medium to long term Component Analysis

Solutions account for 68.4% of overall adoption in the Digital Identity Verification Market. This dominance reflects strong demand for integrated platforms that manage identity capture, verification, and ongoing authentication within a single framework. Organizations prioritize solution based offerings to reduce onboarding friction and strengthen fraud prevention.

The preference for solutions is also driven by compliance requirements across regulated industries. End to end platforms simplify audit readiness and reporting. As digital interactions expand, solution centric deployments remain the primary choice.

Deployment Mode Analysis

Cloud based deployment leads the market with a share of 845%. Cloud infrastructure supports rapid scaling, centralized management, and real time verification across geographies. These capabilities are essential for handling high verification volumes and fluctuating demand.

Cloud adoption is further supported by lower upfront infrastructure requirements and faster integration with digital services. Continuous updates and security enhancements can be deployed efficiently. This sustains cloud-based models as the dominant deployment approach.

By Organization Size

Large enterprises represent 58.9% of market demand by organization size. These organizations manage complex user bases and face higher exposure to identity fraud and regulatory scrutiny. Comprehensive identity verification is treated as a core operational control.

Adoption among large enterprises is reinforced by enterprise-wide digital transformation initiatives. Standardized verification processes improve user trust and operational efficiency. This maintains strong concentration of demand within this segment.

Technology Analysis

Biometric verification accounts for 41.3% of technology adoption. This segment leads due to its ability to deliver higher accuracy and stronger assurance compared to knowledge based methods. Facial recognition, fingerprinting, and liveness detection are widely used to reduce impersonation risk.

The growth of biometric verification is supported by improved sensor quality and algorithm performance. User acceptance has increased due to convenience and speed. These factors continue to support biometric methods as a primary technology choice.

End-User Industry Analysis

The banking, financial services, and insurance sector represents 52.7% of end user demand. This dominance is driven by strict regulatory obligations related to customer due diligence and anti fraud controls. Identity verification is essential for account opening, transaction monitoring, and digital service access.

Financial institutions prioritize secure and compliant verification to protect customers and maintain trust. High transaction volumes and digital channel usage further increase reliance on robust identity systems. This sustains the leading position of the BFSI sector.

Emerging Trends Analysis

An emerging trend in the digital identity verification market is the increased use of biometric authentication methods. Facial recognition and liveness detection are being adopted to reduce reliance on passwords and static credentials. These methods enhance security by verifying physical presence and reducing the risk of identity spoofing. Biometric adoption is supported by improvements in device camera quality and processing capabilities.

Another notable trend is the movement toward decentralized and user controlled identity models. These approaches allow individuals to manage their own identity credentials and share only necessary information with service providers. This trend aligns with growing emphasis on privacy, data minimization, and user consent. Decentralized identity concepts are gradually influencing future system designs.

Growth Factors Analysis

One of the key growth factors for the digital identity verification market is the expansion of digital financial services. Online banking, digital payments, and financial applications require secure identity verification to prevent fraud and meet compliance standards. As financial inclusion initiatives increase digital account creation, identity verification demand grows in parallel.

Another growth factor is the global rise in cybercrime and identity theft incidents. Organizations are under pressure to strengthen security controls without slowing digital adoption. Digital identity verification provides a scalable method to reduce fraud risk while supporting remote interactions. This risk driven demand continues to support steady market expansion.

Key Market Segments

By Component

- Solutions

- Services

By Deployment Mode

- Cloud-based

- On-premises

By Organization Size

- Large Enterprises

- Small & Medium Businesses

By Technology

- Biometric Verification

- Document Authentication

- Database & Knowledge-based Checks

By End-User Industry

- BFSI

- Government

- Healthcare

- Retail & E-commerce

- Others

Regional Analysis

North America accounted for 36.1% share, supported by strong demand for secure digital onboarding and identity authentication across banking, fintech, healthcare, government, and online services. Digital identity verification solutions have been widely adopted to prevent fraud, ensure regulatory compliance, and improve customer onboarding experiences.

Demand has been driven by growth in digital transactions, remote account opening, and stricter know your customer and anti money laundering requirements. Organizations in the region have increasingly relied on automated identity checks to balance security with user convenience.

The U.S. market reached USD 4.04 Bn and is projected to grow at a 12.59% CAGR, reflecting steady expansion across financial services, eCommerce, and public sector applications. Adoption has been driven by the need to reduce identity fraud, improve compliance efficiency, and support fully digital customer journeys. Digital identity verification tools have helped U.S. organizations accelerate onboarding while maintaining high security standards.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Rising Need to Prevent Identity Theft and Digital Fraud

The digital identity verification market is being driven by the increasing occurrences of identity theft, account takeover fraud, and data breaches in online services. As consumers and businesses conduct more interactions digitally, the risk of impersonation and fraudulent access has risen significantly. Providers of digital identity verification solutions are seeing stronger demand from sectors such as banking, e-commerce, and online platforms that must confirm customer identities before granting access or processing transactions.

The need for robust verification is also reinforced by regulatory expectations for secure customer onboarding and authentication. Financial institutions and regulated industries are being required to implement stronger identity proofing and verification controls to satisfy compliance standards and protect sensitive customer data. This trend has led organisations to adopt multi-factor authentication and biometric verification methods, which in turn supports widespread implementation of digital identity verification technologies.

Restraint Analysis

Lack of Consistent Standards and Difficult System Integration

A key restraint on the digital identity verification market arises from the absence of consistent standards across industries and regions. Different countries and sectors follow their own rules for data protection, user consent, and identity checks, which makes it difficult to deploy a single verification approach across markets. This lack of uniformity increases both cost and effort for organisations that must adjust their identity systems to meet varying legal and technical requirements.

Another limiting factor is the difficulty of integrating identity verification tools with existing IT systems, especially those built on older infrastructure. These solutions often need to work with several databases, digital channels, and authentication layers at the same time. Managing these connections can delay implementation and discourage smaller organisations that do not have the technical capacity or resources to support complex system upgrades.

Opportunity Analysis

Advancements in Biometric and Real-Time Verification

An important opportunity for the market lies in advancements in biometric technologies and real-time verification capabilities. Techniques such as facial recognition, liveness detection, and behavioural biometrics allow businesses to authenticate users more quickly and accurately without heavy manual processes. These capabilities can significantly reduce friction in onboarding and login experiences while maintaining high assurance levels of identity accuracy.

Expansion of digital services that require reliable identity proofing creates further opportunity for vendors to innovate. For example, regulatory changes and consumer expectations for secure, seamless online interactions open space for identity verification solutions that combine biometric confirmation with contextual risk analysis. Firms that can offer flexible, user-centric authentication experiences are positioned to capture demand from sectors where trust and speed of verification are critical.

Challenge Analysis

Balancing Security with User Experience

A persistent challenge for the digital identity verification market is balancing strong security with a smooth user experience. On one hand, high-assurance verification methods such as multi-factor authentication and biometric scans reduce fraud risk. On the other hand, overly complex verification flows can frustrate users and lead to abandonment during onboarding or transaction processes. Providers and adopters must calibrate their solutions to maintain both security and convenience.

Evolving threats such as AI-enabled deepfakes and synthetic identities further complicate this balance. As fraud techniques grow more sophisticated, identity verification systems must incorporate advanced detection mechanisms without introducing excessive friction. This requires ongoing investment in technology updates, monitoring, and user education to sustain trust in digital interactions while keeping verification processes accessible.

Competitive Analysis

Global identity and security providers such as IDEMIA, Thales, and GBG lead large-scale deployments across government and regulated industries. Their platforms combine biometrics, document authentication, and cryptographic security. Strong compliance with KYC and AML regulations supports adoption. These players benefit from deep public sector experience and global data coverage. Demand is driven by rising digital onboarding and fraud prevention requirements.

Technology-focused verification vendors such as Jumio, Onfido, and Trulioo emphasize AI-based document checks and facial recognition. Acuant and Mitek Systems support fast, mobile-first onboarding. These solutions are widely used by fintech, eCommerce, and mobility platforms. Adoption is supported by the need to balance security with low customer friction.

Data bureau and emerging platform providers such as TransUnion, Experian, and Equifax integrate identity verification with risk scoring. LexisNexis, Veriff, and Persona expand configurable workflows. Shufti Pro addresses global coverage needs. Other vendors increase competition and innovation across digital identity ecosystems.

Top Key Players in the Market

- IDEMIA

- Jumio

- Onfido

- Trulioo

- Acuant

- Mitek Systems

- Thales

- GBG

- TransUnion

- Experian

- Equifax

- LexisNexis

- Shufti Pro

- Veriff

- Persona

- Others

Future Outlook

Growth in the Digital Identity Verification market is expected to remain strong as online services require secure and reliable user authentication. Businesses are using digital verification tools to reduce fraud, meet compliance needs, and improve customer onboarding.

Rising adoption of digital banking, eCommerce, and remote services is supporting steady demand. Over time, better biometric accuracy, automation, and privacy focused design are likely to improve trust and user experience.

Recent Developments

- Jumio announced support for eIDAS-compliant eIDs from 16 EU countries in September 2025, enabling businesses to verify identities via web and mobile SDKs without lengthy accreditation. It leverages biometrics, liveness detection, and fraud intelligence for secure checks, aligning with upcoming EU digital wallet regulations around 2026-2027. This positions companies ahead of EUDI Wallet mandates.

- In October 2025, Trulioo won Platinum for KYC Innovation and Gold for Identity Verification at Juniper Research Future Digital Awards 2025, with its platform verifying 14,000+ IDs across 195 countries and 700M businesses, cutting onboarding by 60%

Report Scope

Report Features Description Market Value (2025) USD 12.30 Billion Forecast Revenue (2035) USD 47.9 Billion CAGR(2025-2035) 14.60% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solutions, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small & Medium Businesses), By Technology (Biometric Verification, Document Authentication, Database & Knowledge-based Checks), By End-User Industry (BFSI, Government, Healthcare, Retail & E-commerce, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IDEMIA, Jumio, Onfido, Trulioo, Acuant, Mitek Systems, Thales, GBG, TransUnion, Experian, Equifax, LexisNexis, Shufti Pro, Veriff, Persona, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Identity Verification MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Digital Identity Verification MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- IDEMIA

- Jumio

- Onfido

- Trulioo

- Acuant

- Mitek Systems

- Thales

- GBG

- TransUnion

- Experian

- Equifax

- LexisNexis

- Shufti Pro

- Veriff

- Persona

- Others