Global DG Rooftop Solar PV Market Size, Share, And Industry Analysis Report By Type (Crystalline Silicon, Thin Films), By Capacity (Up to 10 kW, 11 kW to 100 kW, Above 100 kW), By Application (Residential, Non-Residential, Utility), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 170819

- Number of Pages: 270

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

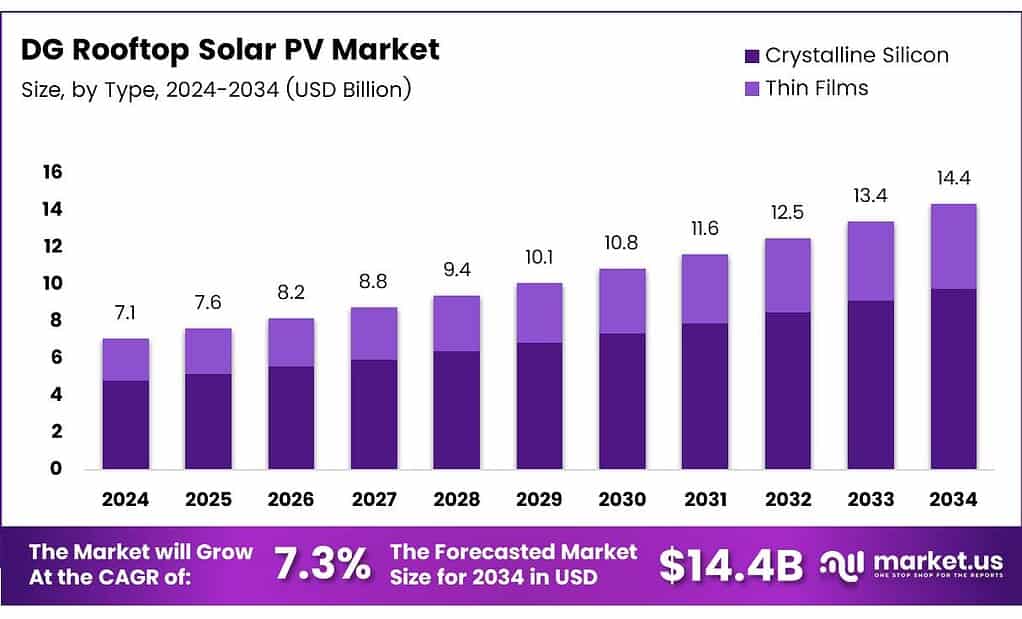

The Global DG Rooftop Solar PV Market size is expected to be worth around USD 14.4 billion by 2034, from USD 7.1 billion in 2024, growing at a CAGR of 7.3% during the forecast period from 2025 to 2034.

The DG Rooftop Solar PV market refers to distributed generation solar systems installed on the rooftops of homes, businesses, and institutions. These systems generate power close to consumption points, reducing grid dependence. In simple terms, DG rooftop solar enables consumers to become power producers while lowering electricity costs and improving energy reliability.

DG rooftop solar is transitioning from an alternative solution to a core power infrastructure asset. As energy demand rises and grids face congestion, rooftop solar PV supports decentralized energy planning. Moreover, falling module prices and digital monitoring tools are improving project bankability and long-term operational confidence.

The International Energy Agency reports that global cumulative solar PV capacity surpassed 2.2 terawatts as deployment accelerated worldwide. In 2024, new installations reached nearly 600 gigawatts, reflecting a 33% year-on-year increase driven by strong investor confidence and supportive policy environments across major solar markets.

- Distributed solar systems, including rooftop installations, accounted for 43% of global installed solar capacity in 2024, according to the IEA. The International Renewable Energy Agency notes that distributed generation supports about 66% of global solar employment. In India, grid-connected rooftop solar capacity reached 23.16 gigawatts within a total installed base of 132.85 gigawatts, reinforcing the DG rooftop solar market’s role as a scalable and job-creating energy investment.

Rooftop solar aligns with climate targets and energy security goals. Governments increasingly view distributed solar as a hedge against fuel price volatility. In parallel, commercial users adopt rooftop systems to stabilize power expenses, while residential adoption grows through simplified net-metering and subsidy-backed financing mechanisms.

Key Takeaways

- The DG Rooftop Solar PV Market is projected to grow from USD 7.1 billion in 2024 to USD 14.4 billion by 2034, registering a 7.3% CAGR during 2025–2034.

- Crystalline Silicon dominates the technology landscape with a market share of 84.3%, driven by high efficiency and long operational life.

- Rooftop systems with capacity up to 10 kW lead the market, accounting for 49.2% share due to strong residential and small-business adoption.

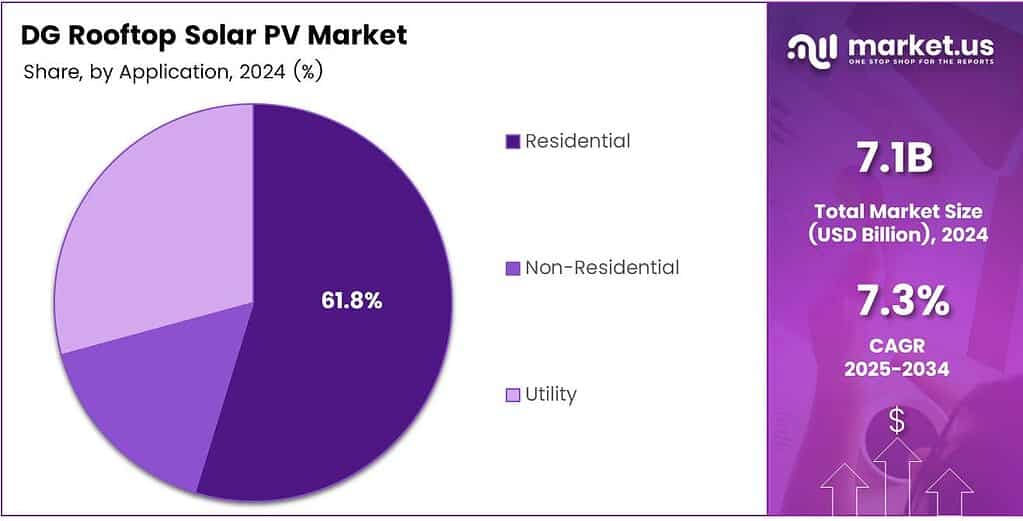

- The Residential segment holds a commanding share of 61.8%, supported by rising energy awareness and favorable rooftop solar policies.

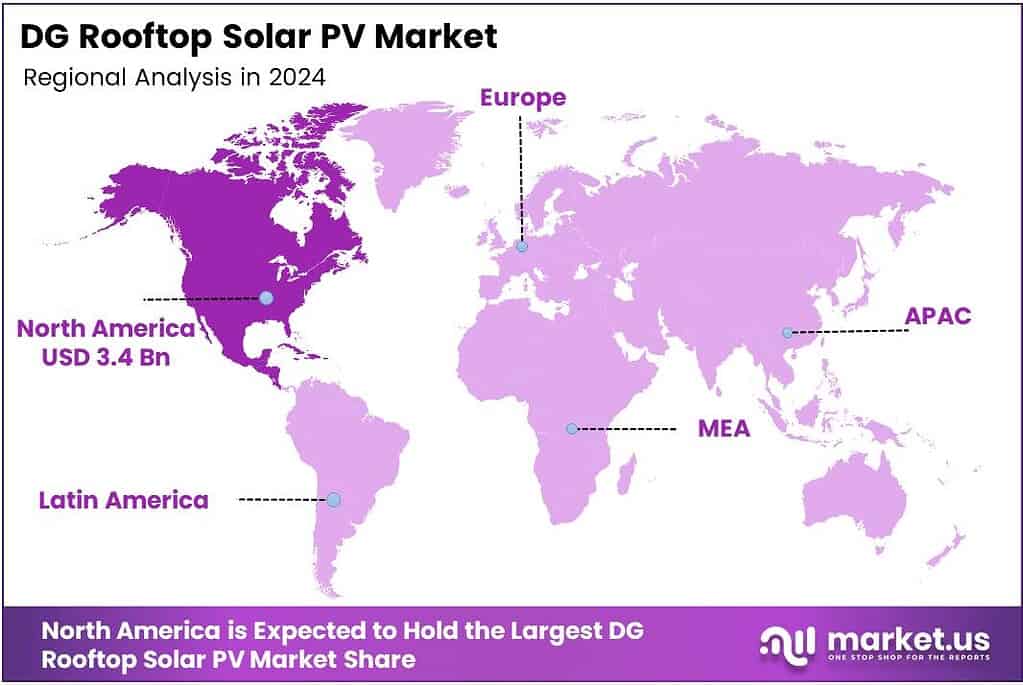

- North America leads the global market with a dominant 48.3% share, valued at USD 3.4 billion.

By Type Analysis

Crystalline Silicon dominates with 84.3% due to its proven efficiency, durability, and wide rooftop adoption.

In 2024, Crystalline Silicon held a dominant market position in the By Type Analysis segment of the DG Rooftop Solar PV Market, with an 84.3% share. This dominance is driven by higher conversion efficiency, long operational life, and strong installer familiarity. As a result, adoption remains strong across residential and commercial rooftops globally.

Thin Films represent a smaller but steady segment within the DG Rooftop Solar PV Market. Although efficiency levels are lower, thin-film panels offer advantages such as a lightweight structure and flexible installation. Consequently, they are increasingly considered for rooftops with load constraints or architectural limitations, supporting niche but consistent demand.

By Capacity Analysis

Up to 10 kW dominates with 49.2%, supported by strong household and small-business rooftop demand.

In 2024, Up to 10 kW held a dominant market position in the By Capacity Analysis segment of the DG Rooftop Solar PV Market, with a 49.2% share. This segment benefits from rising residential installations, net-metering incentives, and simplified permitting processes. Therefore, homeowners increasingly view small systems as cost-effective energy solutions.

11 kW – 100 kW systems mainly serve commercial buildings, schools, and small industries. These installations help reduce operating costs while improving sustainability credentials. As electricity prices fluctuate, businesses increasingly adopt mid-sized rooftop systems to stabilize energy expenses and enhance long-term financial predictability.

Above 100 kW capacity systems address large commercial and institutional rooftops. Although installation complexity is higher, these systems deliver scale advantages and significant power offset. Consequently, warehouses, malls, and large factories increasingly deploy high-capacity rooftop solar to meet sustainability and decarbonization targets.

By Application Analysis

Residential dominates with 61.8% due to rising energy awareness and supportive rooftop policies.

In 2024, Residential held a dominant market position in the By Application Analysis segment of the DG Rooftop Solar PV Market, with a 61.8% share. Growth is supported by falling system costs, government incentives, and household demand for energy independence. As a result, rooftop solar is becoming a mainstream home investment.

Non-residential applications include commercial offices, educational institutions, and healthcare facilities. These users prioritize rooftop solar to manage energy costs and demonstrate sustainability leadership. Consequently, corporate renewable commitments and green-building certifications continue to support adoption across this segment.

Utility applications represent a smaller share but remain strategically important. Rooftop systems installed on public buildings and utility-owned assets help decentralize power generation. Therefore, utilities increasingly integrate rooftop solar into broader distributed generation and grid-resilience strategies.

Key Market Segments

By Type

- Crystalline Silicon

- Thin Films

By Capacity

- Up to 10 kW

- 11 kW to 100 kW

- Above 100 kW

By Application

- Residential

- Non-Residential

- Utility

Emerging Trends

Smart Solar Systems and Digital Monitoring Shape Market Trends

Digitalization is a key trend shaping the DG Rooftop Solar PV market. Smart inverters, real-time monitoring, and data analytics help users track system performance and energy savings. These tools improve efficiency and simplify maintenance. Hybrid systems combining solar with battery storage are gaining attention. Storage solutions help manage power during outages and optimize self-consumption.

- This trend is especially relevant in regions with unstable grids or high peak tariffs. The World Bank reports that distributed solar systems have exploded from less than 1 GW two decades ago to over 500 GW. This trend is moving toward Virtual Power Plants, where these individual rooftops are linked together to act like one giant battery for the community.

Building-integrated solar solutions are also emerging. Lightweight panels and flexible designs make rooftop solar suitable for more building types. These providers offer end-to-end solutions, including design, installation, financing, and maintenance. As technology improves and service models mature, DG Rooftop Solar PV systems are becoming more reliable, user-friendly, and widely accepted.

Drivers

Rising Electricity Costs and Energy Independence Drive Market Growth

Rising electricity prices are a major driver for the DG Rooftop Solar PV market. Households, commercial buildings, and industries are looking for ways to control power expenses and reduce long-term energy bills. Rooftop solar allows users to generate their own electricity and depend less on utility grids.

- Energy independence is another strong factor supporting adoption. Distributed rooftop systems help users protect themselves from power outages and grid instability. Solar PV generation globally grew by a record 320 TWh, an increase of 25% over the year before, showing how quickly people are embracing this technology. Solar PV now contributes 5.4% of the world’s total electricity production, a testament to its expanding role in everyday life.

Environmental awareness is equally important. Rooftop solar supports clean energy goals and helps organizations lower carbon emissions. Many businesses are adopting DG solar to meet sustainability targets and improve brand image. Together, cost savings, reliability, policy support, and environmental benefits continue to drive steady demand for DG Rooftop Solar PV systems.

Restraints

High Initial Investment and Technical Barriers Restrain Market Expansion

High upfront installation costs remain a key restraint for the DG Rooftop Solar PV market. Even though long-term savings are attractive, many residential and small commercial users hesitate due to initial capital requirements. Financing options are improving, but are still limited in some regions.

- Grid integration issues present another restraint. In some areas, utilities limit rooftop solar connections due to grid stability concerns. The Solar Energy Industries Association (SEIA) highlighted that in the third quarter of 2025 alone, solar and storage together accounted for a massive 85% of all new capacity added to the grid.

Lack of skilled installers and after-sales service affects system performance and customer confidence. Poor installation can reduce output and increase maintenance needs. These cost, technical, and regulatory challenges continue to restrict faster adoption, especially in price-sensitive and infrastructure-limited markets.

Growth Factors

Expanding Commercial and Industrial Adoption Creates New Opportunities

The commercial and industrial sector presents strong growth opportunities for the DG Rooftop Solar PV market. Warehouses, factories, shopping malls, and offices have large roof areas suitable for solar installations. High daytime power consumption aligns well with rooftop solar generation.

- Falling equipment costs are improving project economics. As panel efficiency improves and installation processes become standardized, system payback periods continue to shorten. On a broader scale, while solar power is growing rapidly — global solar PV generation increased by 320 TWh and accounted for 5.4% of total electricity — many households still struggle with financing mechanisms that match their cash flow realities.

Innovative financing models are opening new doors. Power purchase agreements, leasing, and third-party ownership reduce upfront costs and make adoption easier for smaller businesses. These models also shift maintenance responsibility to service providers.

Regional Analysis

North America Dominates the DG Rooftop Solar PV Market with a Market Share of 48.3%, Valued at USD 3.4 Billion

North America leads the DG Rooftop Solar PV market, holding a dominant 48.3% share and reaching a value of USD 3.4 billion. Strong policy support, net-metering frameworks, and rising electricity tariffs continue to accelerate rooftop installations. Commercial and residential users increasingly adopt DG systems to hedge long-term power costs. Mature financing models further strengthen sustained regional demand.

Europe shows steady DG rooftop solar adoption, supported by decarbonization targets and energy-security priorities. High retail power prices encourage residential and small commercial rooftop deployments. Policy alignment with climate goals promotes self-consumption and distributed generation. Urban rooftop utilization remains a key growth lever across developed economies.

Asia Pacific demonstrates rapid momentum driven by urbanization, grid constraints, and distributed energy programs. Rooftop solar adoption benefits from rising power demand in the residential and MSME segments. Governments promote DG systems to reduce transmission losses and peak-load pressure. Manufacturing ecosystems also support cost-effective deployment.

The U.S. remains a core contributor within North America’s DG rooftop solar landscape. Rooftop systems benefit from federal incentives and state-level policies. Residential solar adoption is supported by financing innovations and energy-storage integration. Commercial rooftops continue to scale as electricity costs rise.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Jinko Solar stayed a high-volume, bankable choice for DG rooftop projects in 2024, mainly because installers value stable module availability and predictable field performance. From an analyst lens, the company’s strength is execution: consistent product rollout, broad channel reach, and the ability to serve both residential and commercial rooftops without supply gaps. This makes it easier for EPCs to standardize designs and control project timelines.

Trina Solar continued to position itself as a dependable rooftop supplier in 2024 by focusing on modules that balance efficiency, durability, and lifecycle value. The company tends to appeal to DG developers that care about total cost of ownership—where output stability, warranty comfort, and long-term serviceability matter as much as headline power ratings. For distributed projects, that “low hassle” profile can reduce callbacks and improve customer satisfaction.

Canadian Solar remained relevant in 2024 for DG rooftop buyers who want a practical mix of performance and commercial flexibility. In many rooftop tenders, the decision comes down to delivery confidence, quality consistency, and financing acceptance, and the company’s track record supports that buying behavior. Analysts typically view it as a safe pick when developers need to scale across many small sites.

JA Solar in 2024 benefited from strong demand for reliable, high-efficiency modules suited to space-constrained rooftops. The brand is often selected where customers want more energy yield per square meter and predictable degradation behavior over time. For rooftop portfolios, this can translate into better generation per site and smoother operations, especially under tight roof-area limits.

Top Key Players in the Market

- Jinko Solar

- Trina Solar

- Canadian Solar

- JA Solar

- Hanwha

- First Solar

- Yingli

- Sun Power

- Sharp

- SolarWorld

Recent Developments

- In 2025, Jinko Solar has been active in distributed generation (DG) rooftop solar PV, with several announcements focused on large-scale rooftop projects, residential modules, and optimized products for distributed applications. Commissioned a 9.728 MWp rooftop PV system at Krung Thep Aphiwat Central Terminal in Bangkok, Thailand, using Tiger Neo modules. This represents one of the largest rooftop installations in the region for distributed generation.

- In 2025, Trina Solar highlighted advancements in modules suited for space-constrained rooftop installations, particularly in commercial & industrial (C&I) and residential segments. Released guidance on using Vertex N TOPCon PV modules to address constraints in rooftop C&I solar projects, allowing higher power output within limited roof space for distributed generation.

Report Scope

Report Features Description Market Value (2024) USD 7.1 billion Forecast Revenue (2034) USD 14.4 billion CAGR (2025-2034) 7.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Crystalline Silicon, Thin Films), By Capacity (Up to 10 kW, 11 kW to 100 kW, Above 100 kW), By Application (Residential, Non-Residential, Utility) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Jinko Solar, Trina Solar, Canadian Solar, JA Solar, Hanwha, First Solar, Yingli, SunPower, Sharp, SolarWorld Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  DG Rooftop Solar PV MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

DG Rooftop Solar PV MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Jinko Solar

- Trina Solar

- Canadian Solar

- JA Solar

- Hanwha

- First Solar

- Yingli

- Sun Power

- Sharp

- SolarWorld