Global Delivery Tracking Platform Market Size, Share, Industry Analysis Report By Solution (Delivery Tracking Platform and Services), By Type (Real-time Tracking, Mobile Apps, API Integrations, and Delivery Management), By Application (Logistics, E-commerce, Retail, Shipping, Supply Chain, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 157386

- Number of Pages: 250

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Analysts’ Viewpoint

- Investment and Business benefits

- Role of Generative AI

- U.S. Market

- By Solution Analysis

- By Type Analysis

- By Application Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driving Factor

- Restraining Factor

- Growth Opportunity

- Key Player Analysis

- Recent Developments

- Report Scope

Report Overview

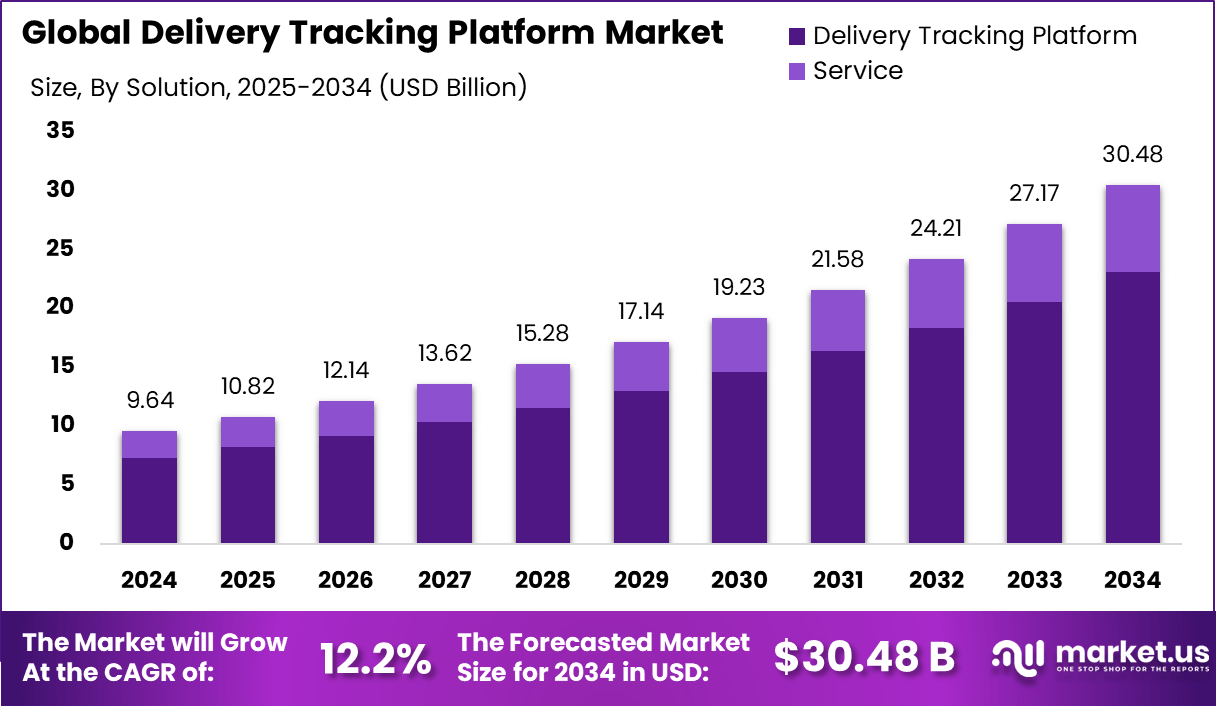

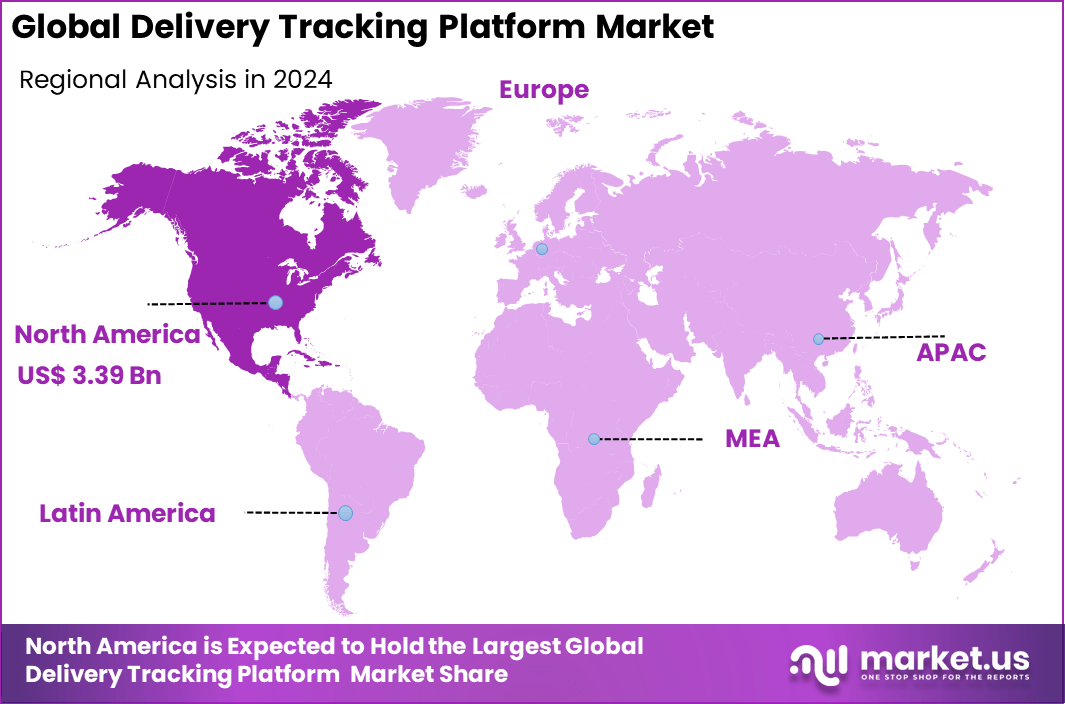

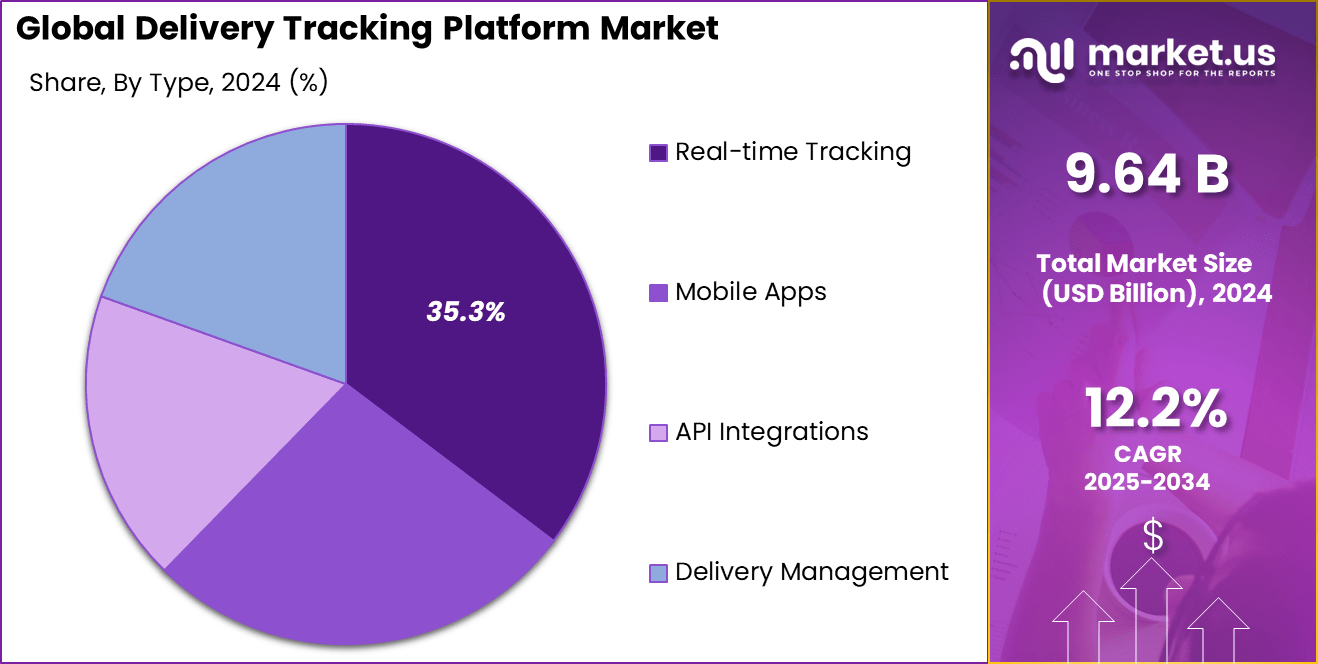

The Global Delivery Tracking Platform Market size is expected to be worth around USD 30.48 billion by 2034, from USD 9.64 billion in 2024, growing at a CAGR of 12.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 35.2% share, holding USD 3.39 billion in revenue.

The Delivery Tracking Platform Market enables businesses and consumers to monitor shipments in real time, providing visibility, accurate ETAs, and proactive notifications across logistics, e-commerce, retail, and supply chains. These platforms integrate cloud, mobile, IoT, and AI technologies to enhance efficiency and customer experience.

The market is propelled by growing consumer demand for transparency in delivery and rapid logistics due to online shopping. Businesses are investing in platforms that offer real‑time updates and better customer experience. In addition, the rise of e‑commerce and emphasis on operational efficiency support adoption. Emerging technologies like AI and IoT are enabling predictive delivery insights and more dynamic route control.

Key Takeaways

- The global delivery tracking platform market size is projected at USD 9.64 billion in 2024, growing at a strong CAGR of 12.2%, driven by increasing demand for transparency, speed, and efficiency in deliveries.

- Delivery Tracking Platforms dominate by solution, accounting for 75.8% of market share, as businesses prioritize real-time visibility and automation over standalone services.

- Real-time Tracking is the leading type segment with a 35.3% share, highlighting the importance of instant shipment updates and predictive tracking in logistics and e-commerce.

- E-commerce is the top application segment with 45.6% share in 2024, fueled by rising online shopping volumes, customer expectations for fast delivery, and growing last-mile logistics needs.

- North America leads regionally with a 35.2% market share, supported by advanced digital adoption, strong e-commerce penetration, and investments in logistics infrastructure.

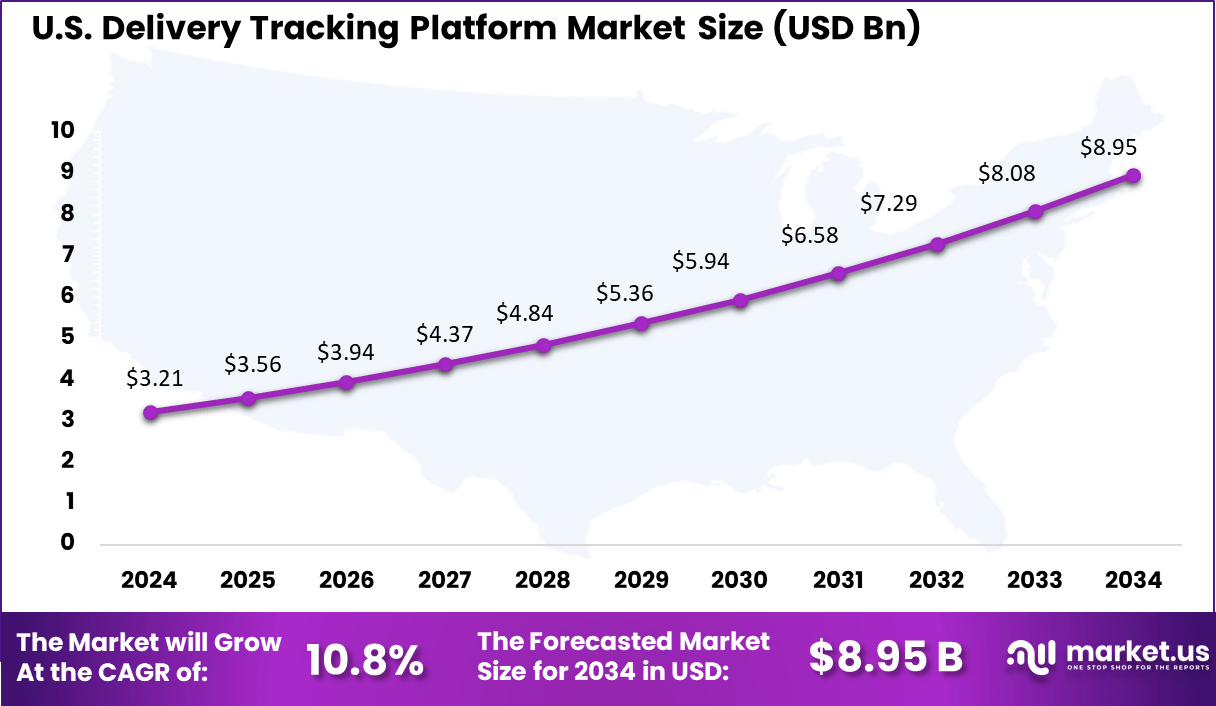

- The United States alone contributes USD 3.21 billion in 2024, expanding at a 10.8% CAGR, making it the single largest national market.

Analysts’ Viewpoint

Technologies seeing increasing adoption include artificial intelligence, Internet of Things (IoT), cloud-based platforms, blockchain, and machine learning. Cloud models enable scalable and rapid integration for both large enterprises and small businesses, while IoT sensors and RFID tags support real-time data sharing from vehicles and packages.

Blockchain is gaining traction for its role in traceability, compliance, and secure chain-of-custody data streams. The key reasons organizations are adopting delivery tracking platforms center on operational efficiency, cost savings, compliance, and customer satisfaction.

Automation allows companies to streamline delivery schedules, allocate fleet resources, and deepen analytics, creating competitive advantage. The ability to provide customers with live shipment updates, proof-of-delivery records, and flexible delivery windows translates directly into brand loyalty.

Investment and Business benefits

Investment opportunities are emerging in advanced AI analytics, last-mile delivery platforms, sustainable logistics initiatives, and expansion into underserved markets. Organizations are ramping up spend on sophisticated tracking and monitoring solutions, drawn by the promise of improved resource allocation, reduced operational expenses, and flexible real-time features suitable for on-demand and one-day deliveries.

Business benefits surrounding delivery tracking platforms are profound: increased operational effectiveness, reduced fuel and labor costs, better inventory management, faster and more reliable deliveries, and significantly enhanced customer experiences. Automation eliminates manual interventions and optimizes resources, while transparency and proactive notifications elevate trust and drive repeat purchases.

The regulatory environment is evolving rapidly, with stricter mandates on data security, consumer privacy, and green logistics practices reshaping how platforms are designed and operated. Compliance requirements in sectors such as food and pharmaceuticals drive adoption of platforms capable of recording detailed chain-of-custody and shipment conditions. Frameworks like GDPR and CCPA raise the importance of secure, privacy-aware solutions.

Role of Generative AI

Points Description Route Optimization Generative AI assesses traffic, weather, and delivery patterns to suggest fastest routes, reducing costs and delays by up to 25%. Demand Forecasting AI analyzes historical and real-time customer data to predict order spikes, enabling proactive resource and inventory allocation. Automated Support AI-driven chatbots and virtual assistants manage customer inquiries and complaints, providing real-time tracking updates and improving satisfaction. Personalized Experiences AI customizes tracking notifications and recommendations, increasing engagement and loyalty through targeted post-purchase communications. Predictive Analytics AI offers predictive insights on delays and disruptions, allowing companies to mitigate risks and optimize operational efficiency. U.S. Market

The U.S. Delivery Tracking Platform Market is projected to reach USD 3.21 billion in 2024, growing at a steady CAGR of 10.8%, driven by the country’s strong e-commerce ecosystem, advanced logistics infrastructure, and high consumer expectations for real-time visibility. U.S. consumers are accustomed to fast and transparent delivery, with surveys indicating that 83% of online shoppers expect regular updates on their shipments.

Major players like Amazon, UPS, and FedEx have set industry benchmarks by offering precise ETAs, live location tracking, and proactive notifications through AI- and IoT-enabled platforms. For example, Amazon Map Tracking allows customers to follow packages in real time, while UPS’s ORION system leverages big data analytics to optimize routes and reduce fuel consumption.

Furthermore, last-mile delivery demand in the U.S. is surging due to rising same-day and next-day delivery services, making advanced tracking platforms critical for efficiency. Cloud-based solutions are gaining traction, with companies like ShipStation and AfterShip helping SMEs compete by offering affordable, scalable tracking capabilities.

Additionally, industries such as healthcare and retail are increasingly adopting delivery tracking platforms to ensure compliance and improve customer satisfaction. With continued growth in e-commerce and logistics automation, the U.S. will remain the largest and most influential market for delivery tracking platforms globally.

North America Dominates the Market with a Major Revenue Share of 35.2%.

In the regional analysis, North America leads the Delivery Tracking Platform Market with a 35.2% share in 2024, driven by advanced e-commerce penetration, strong logistics infrastructure, and high consumer expectations for real-time delivery visibility.

The United States alone accounts for USD 3.21 billion, reflecting widespread adoption of cloud-based tracking solutions and AI-driven logistics platforms. Companies like Amazon, UPS, and FedEx are pioneering real-time tracking innovations, integrating IoT sensors, predictive analytics, and mobile applications to optimize last-mile delivery and enhance customer experience.

Europe follows with growing investments in smart logistics and sustainable delivery solutions, while Asia-Pacific is witnessing rapid growth due to e-commerce expansion in China, India, and Southeast Asia. Latin America and the Middle East & Africa are emerging markets, with increasing demand for cloud-based tracking solutions among SMEs and logistics providers.

By Solution Analysis

In the solution segment, the Delivery Tracking Platform category dominates with 75.8% market share in 2024, reflecting the growing reliance on software platforms to manage real-time visibility, optimize delivery routes, and improve customer experience.

Within this, cloud-based platforms are increasingly preferred due to scalability, lower upfront costs, and seamless integration with e-commerce and logistics systems. For example, AfterShip and Shippo offer cloud-native platforms widely adopted by retailers to provide customers with proactive shipment updates.

On the other hand, on-premise solutions still find relevance among large enterprises with strict data security or compliance needs, such as in defense and healthcare. Complementing platforms, professional services, and managed services ensure proper deployment, customization, and ongoing support, especially for enterprises seeking tailored solutions.

Companies leveraging cloud-based logistics platforms achieve 20–30% faster delivery times, highlighting the business impact of these solutions. This strong adoption underpins delivery tracking platforms as the backbone of the market’s growth.

By Type Analysis

In the type segment, Real-time Tracking leads with a 35.3% market share in 2024, driven by increasing demand for instant shipment visibility and enhanced customer experience. Real-time tracking enables businesses to monitor deliveries continuously, predict estimated arrival times, and proactively manage exceptions, which is critical in industries such as e-commerce, retail, and healthcare.

For instance, Amazon’s real-time tracking feature allows customers to follow their packages minute-by-minute, while FedEx SenseAware provides live location and condition monitoring for sensitive shipments like pharmaceuticals.

Complementary types, such as mobile apps and API integrations, facilitate seamless updates and allow businesses to integrate tracking capabilities directly into their platforms, improving operational efficiency. Delivery management tools further support route optimization, driver assignment, and exception handling.

Companies leveraging real-time tracking can reduce delivery delays by up to 30%, demonstrating its tangible benefits. This adoption trend underscores real-time tracking as a pivotal driver of market growth and customer satisfaction.

By Application Analysis

In the application segment, E-commerce is the largest contributor, holding a 45.6% share in 2024, fueled by the surge in online shopping and rising customer expectations for faster, transparent deliveries. Consumers now demand precise ETAs, real-time notifications, and easy returns, making delivery tracking platforms essential for retailers.

For instance, Shopify integrates with AfterShip and ShipStation to provide order visibility and proactive updates, while Amazon’s Map Tracking has become an industry benchmark for real-time package monitoring. Logistics providers like UPS and DHL also collaborate with e-commerce platforms to enable seamless last-mile visibility.

The U.S. e-commerce sales are expected to exceed USD 1.1 trillion by 2025, further amplifying the need for robust tracking solutions. Beyond enhancing customer experience, e-commerce companies benefit from improved operational efficiency, route optimization, and reduced delivery failures. As online retail continues to expand globally, e-commerce will remain the dominant application segment, driving the adoption of delivery tracking platforms.

Emerging Trends

Key Trends Description Autonomous Deliveries Increased use of autonomous vehicles and drones for last-mile delivery and tracking. Contactless Solutions Growing deployment of contactless delivery, payments, and proof of delivery processes to meet evolving consumer preferences. AI-driven Analytics Expanded integration of predictive analytics and AI-led performance monitoring for smarter logistics. Blockchain & IoT Integration Enhanced tracking accuracy and security through blockchain authentication and IoT sensors in parcels and vehicles. Sustainability Focus Carbon-aware route optimization and green delivery methods to align with regulations and consumer values. Growth Factors

Key factors Description E-commerce Expansion Explosive online shopping growth driving demand for reliable, scalable tracking platforms. Real-time Visibility Businesses prioritizing platforms that provide exact location, status, and ETA in real time for every order. Advanced Technology Adoption Shift to AI, IoT, and cloud-based models enabling faster, more flexible platform deployments. Regulatory Push Data protection, traceability, and compliance mandates driving advanced tracking solutions adoption. Customer Experience Priority Growing emphasis on transparency, branded notifications, and loyalty-building experiences. Key Market Segments

Solution

- Delivery Tracking Platform

- Cloud based

- On-Premise

- Service

- Professional Services

- Managed Services

Type

- Real-time Tracking

- Mobile Apps

- API Integrations

- Delivery Management

Application

- Logistics

- E-commerce

- Retail

- Shipping

- Supply Chain

- Others

Key Regions and Countries Covered

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of MEA

Driving Factor

Rising demand for real-time visibility in logistics and supply chain operations to enhance customer experience

The rising demand for real-time visibility in logistics and supply chain operations directly enhances customer experience and operational efficiency. Around 74% of consumers cite delivery visibility as a key factor influencing their purchase decisions, highlighting the growing pressure on retailers and logistics providers to invest in tracking solutions.

Real-time visibility not only builds trust with end-users but also helps companies minimize disruptions, optimize routes, and reduce last-mile delivery delays. For example, Amazon and UPS utilize advanced real-time tracking platforms that provide customers with live updates and estimated delivery windows, significantly improving satisfaction and retention.

Similarly, FedEx’s SenseAware platform integrates IoT sensors to provide real-time location and condition monitoring for sensitive shipments, such as pharmaceuticals. In addition, supply chain visibility solutions can reduce delivery exceptions by up to 30%, cutting operational costs while ensuring reliability.

Restraining Factor

Dependence on third-party service providers, leading to vendor lock-in risks

The dependence on third-party service providers can lead to vendor lock-in risks. Many businesses rely on external vendors to manage their delivery tracking systems, especially when deploying cloud-based platforms. While this outsourcing offers scalability and reduces upfront investment, it often creates long-term dependency on a single provider’s infrastructure, pricing model, and technological ecosystem.

This dependency can limit flexibility, hinder system interoperability, and increase switching costs if businesses want to migrate to a different provider. For example, logistics companies using Amazon Web Services (AWS) or Microsoft Azure cloud platforms for tracking and analytics face challenges in migrating workloads to alternative vendors due to proprietary architectures and integration complexities.

Around 71% of enterprises cited vendor lock-in as a top concern in cloud adoption, reflecting its impact across industries. Additionally, smaller retailers or logistics providers using specialized third-party delivery tracking software may find themselves restricted by limited customization options and escalating subscription costs. In worst-case scenarios, service disruptions or policy changes by providers can directly affect business continuity.

Growth Opportunity

Rising adoption of AI, IoT, and big data analytics for predictive tracking and route optimization

Traditional delivery tracking only provides current location updates, but advanced technologies are enabling predictive insights that improve efficiency, reduce delays, and enhance customer satisfaction. AI-powered algorithms can analyze historical traffic, weather patterns, and real-time conditions to forecast delivery times more accurately.

IoT devices, such as GPS sensors and RFID tags, provide continuous data streams from vehicles and shipments, enabling dynamic rerouting and proactive alerts. For example, DHL uses AI and IoT-driven platforms to optimize last-mile delivery routes, reducing fuel costs and improving on-time performance. Similarly, UPS’s ORION system, powered by big data and AI, reportedly saves the company 100 million miles annually through optimized routing, translating into significant cost savings and reduced carbon emissions.

Predictive logistics solutions can reduce delivery delays by up to 40% and improve fleet utilization by 20–30%. As e-commerce volumes continue to surge, businesses are turning to AI-driven predictive tracking not only to meet rising customer expectations for accurate ETAs but also to achieve operational efficiency and sustainability goals, presenting a major growth avenue for the market.

Key Player Analysis

The Global Delivery Tracking Platform Market is moderately consolidated, with key players capturing significant shares through technology innovation, strategic partnerships, and geographic expansion. Leading companies such as Amazon, UPS, FedEx, DHL, AfterShip, Shippo, and FarEye dominate the market, leveraging cloud-based platforms, AI-powered predictive tracking, and IoT-enabled real-time monitoring.

For instance, Amazon and UPS maintain competitive advantages through proprietary tracking solutions like Amazon Map Tracking and UPS ORION, enhancing last-mile efficiency. Emerging players like ShipStation and Shippo focus on SMEs, offering scalable, API-integrated solutions. Collectively, these players drive technological adoption, operational efficiency, and customer satisfaction, shaping market growth and maintaining leadership in both mature and developing regions.

Top Key Players in the Delivery Tracking Platform Market

- Oracle

- SAP

- Project44

- FourKites

- AfterShip

- TrackingMore

- Parcel Perform

- FarEye

- UPS

- FedEx

- DHL

- Amazon Logistics

- ShipStation

- Onfleet

- Locus.sh

- Other Key Players

Recent Developments

- May 2025: Maersk is deploying its OneWireless platform across 450 vessels to enable smart container and cargo tracking with real-time IoT data, enhanced supply chain visibility, and operational efficiency. Supporting 4G, NB-IoT, and LTE, it integrates edge computing from ZEDEDA, allowing centralized management of onboard applications and improved monitoring of temperature-sensitive cargo.

- September 2025: Best Buy is launching an AI-powered delivery tracking system offering minute-by-minute updates using real-time data and predictive analytics. Aimed at improving transparency and reducing customer frustration, the system enhances last-mile efficiency, builds trust for high-value purchases, and aligns with rising consumer expectations, giving Best Buy a competitive edge in retail logistics.

Report Scope

Report Features Description Market Value (2024) USD 9.6 Bn Forecast Revenue (2034) USD 30.4 Bn CAGR(2025-2034) 12.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Solution (Delivery Tracking Platform and Services), By Type (Real-time Tracking, Mobile Apps, API Integrations, and Delivery Management), By Application (Logistics, E-commerce, Retail, Shipping, Supply Chain, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Oracle, SAP, Project44, FourKites, AfterShip, TrackingMore, Parcel Perform, FarEye, UPS, FedEx, DHL, Amazon Logistics, ShipStation, Onfleet, Locus.sh, and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Delivery Tracking Platform MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Delivery Tracking Platform MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Oracle

- SAP

- Project44

- FourKites

- AfterShip

- TrackingMore

- Parcel Perform

- FarEye

- UPS

- FedEx

- DHL

- Amazon Logistics

- ShipStation

- Onfleet

- Locus.sh

- Other Key Players