Global DataOps Market Size, Share and Analysis Report By Component (DataOps Platforms and Automation Tools, Data Quality and Observability Tools, Data Pipeline Orchestration Tools, Testing and Versioning Tools, Professional and Managed Services), By Deployment Mode (Cloud-Based, On-Premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By Application (Data Pipeline Automation and Monitoring, Data Quality Management and Governance, Collaboration and Self-Service Data Access, DevOps Integration for Data Systems, By End-User Industry, IT and Telecommunications, Banking, Financial Services, and Insurance, Retail and E-commerce, Healthcare and Life Sciences, Manufacturing, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 175440

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Key Insights

- By Component

- By Deployment Mode

- By Organization Size

- By Application

- By End-User Industry

- By Region

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Emerging Trends

- Growth Factors

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Key Market Segments

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

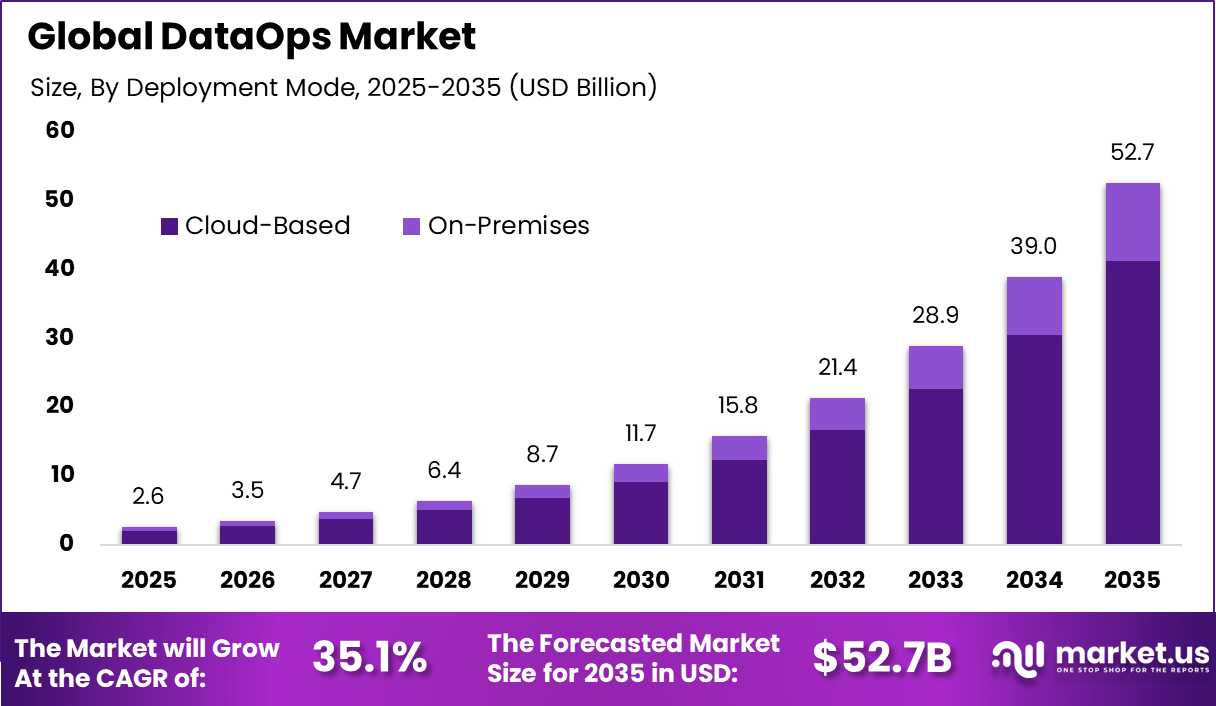

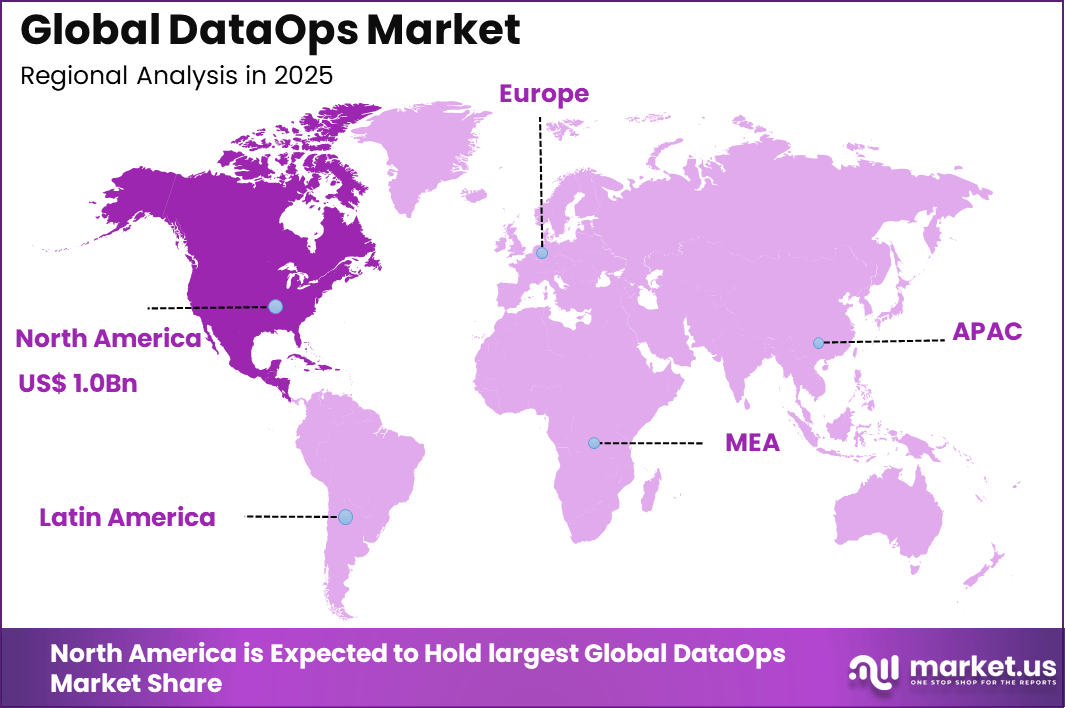

The Global DataOps Market represents a compelling USD 52.7 billion opportunity by 2035, driven by the accelerating adoption of cloud-native architectures, real-time analytics, and data-driven decision-making. The market is projected to expand at a robust CAGR of 35.1%, highlighting strong enterprise demand, scalable platform economics, and attractive long-term returns for investors. North America held a dominan Market position, capturing more than a 42.1% share, holding USD 1.0 Billion revenue.

The DataOps Market focuses on practices, tools, and platforms that improve the speed, quality, and reliability of data analytics by aligning data engineering, data management, and analytics teams. DataOps applies principles similar to DevOps to data workflows, enabling faster data preparation, testing, deployment, and monitoring. The market has gained importance as organizations rely heavily on data driven insights for decision making, while facing challenges related to data complexity, volume, and governance.

DataOps solutions help ensure that data used for analytics is accurate, timely, and consistent across the organization. The relevance of DataOps has increased with the widespread adoption of cloud platforms, real time analytics, and advanced data architectures. As businesses handle data from multiple sources such as applications, sensors, and digital platforms, the need for coordinated data operations has become critical.

One of the key driving factors of the DataOps Market is the growing dependence on real time and near real time analytics. Organizations increasingly require faster access to trusted data to support operational decisions, customer engagement, and strategic planning. Traditional data management approaches often fail to meet these speed and reliability expectations, driving adoption of DataOps practices.

Another important driver is the rising complexity of data environments. Enterprises now operate across hybrid and multi cloud infrastructures with diverse data formats and pipelines. DataOps addresses this complexity by standardizing processes, automating workflows, and improving coordination between teams responsible for data ingestion, transformation, and analysis.

Demand for DataOps solutions is strongly influenced by the expansion of advanced analytics, artificial intelligence, and machine learning initiatives. These initiatives require high quality, well governed data delivered at scale. DataOps helps reduce data preparation bottlenecks and ensures that analytics teams can rely on consistent and validated datasets.

Demand is also driven by organizational pressure to improve data reliability and reduce operational risk. Errors in data pipelines can lead to flawed insights and business decisions. DataOps frameworks emphasize monitoring, testing, and continuous improvement, which supports stable and predictable analytics operations across business units.

Top Market Takeaways

- DataOps Platforms and Automation Tools account for 42.8%, driven by demand for standardized data workflows and reduced manual effort across data operations.

- Cloud-based deployment dominates with 78.4%, supported by scalability, faster implementation, and easier collaboration across distributed data teams.

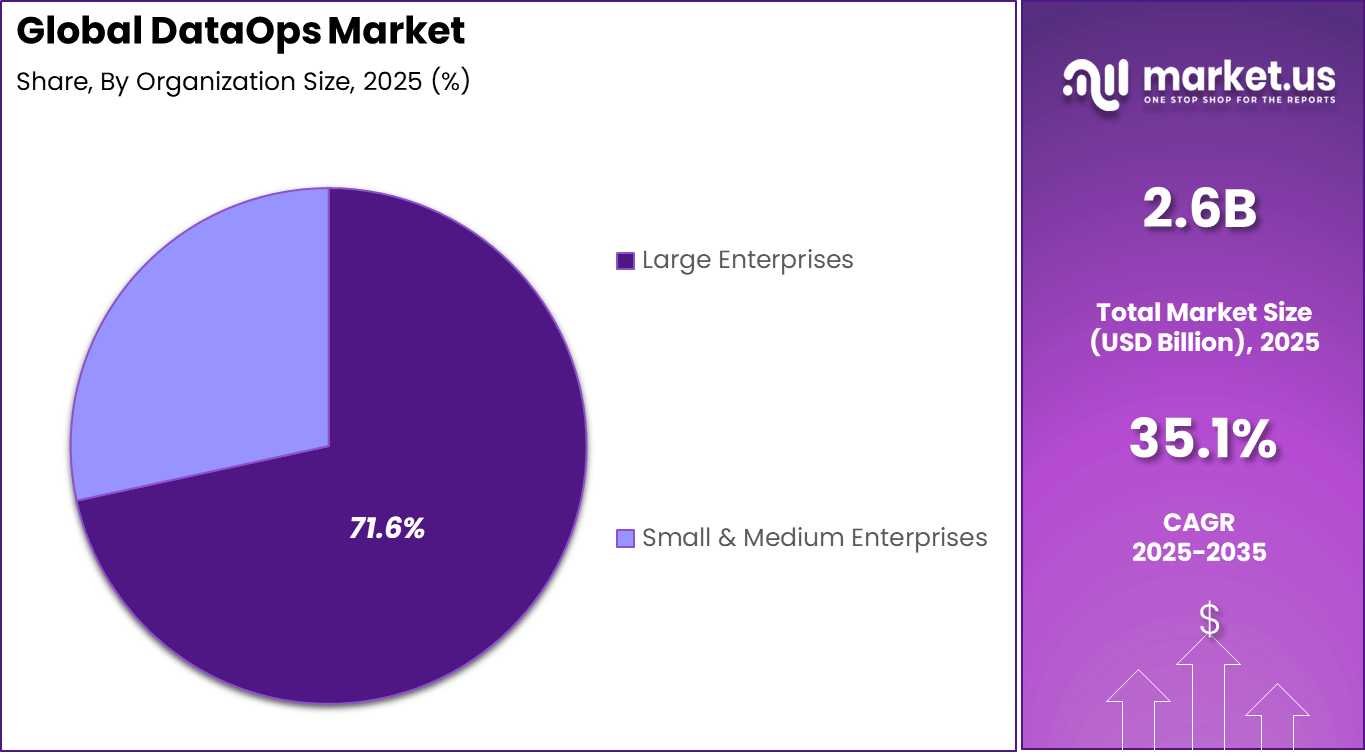

- Large enterprises represent 71.6% of adoption, reflecting higher data complexity, stronger governance needs, and greater investment capacity.

- Data pipeline automation and monitoring lead applications at 58.3%, as organizations focus on improving data reliability and delivery speed.

- IT and telecommunications hold 38.7% share, due to high data volumes, real-time analytics requirements, and continuous service monitoring needs.

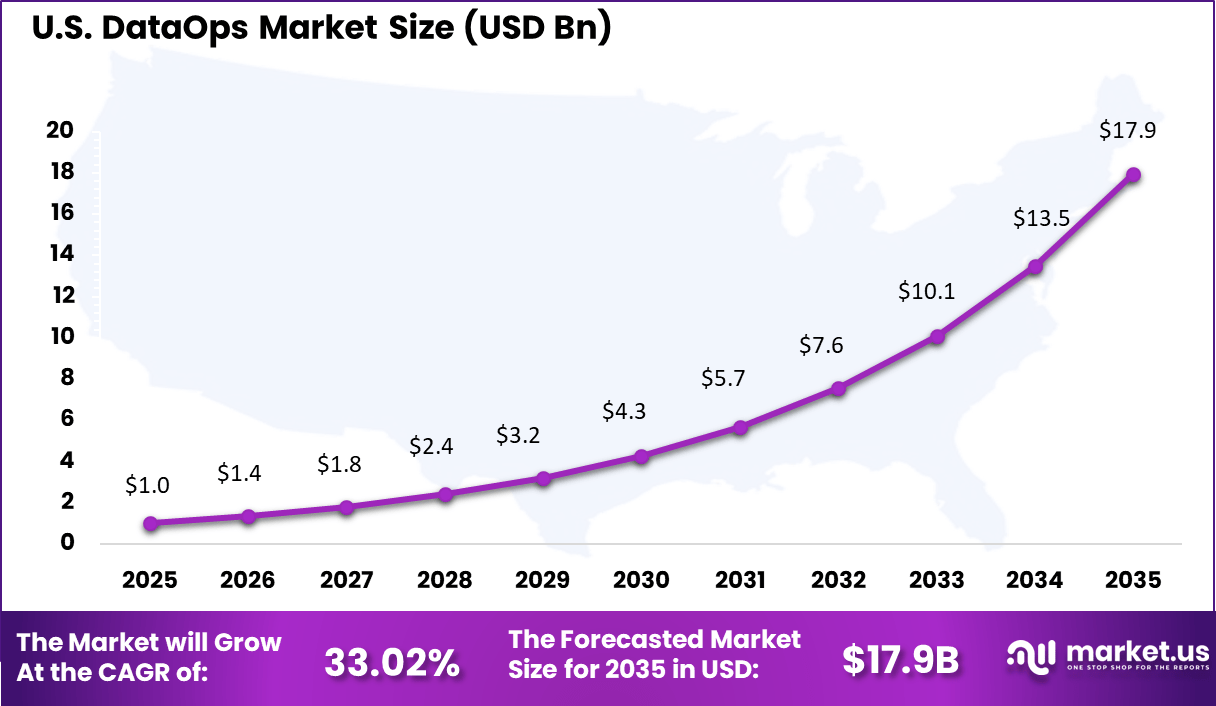

- North America accounts for 42.1% of the market, with the US valued at USD 1.02 billion and a 33.02% CAGR, supported by strong cloud usage and mature data engineering practices.

Key Insights

- 70% of companies have active plans to hire dedicated DataOps professionals, showing strong workforce demand.

- Global data volume is expected to reach 180 zettabytes by 2025, increasing pressure to manage large and complex data environments efficiently.

- Organizations adopting DataOps have reduced late delivery of analytics outputs by 49%, improving operational reliability.

- Automated DataOps practices can deliver up to 87% savings in development costs by reducing manual design and rework.

- Data engineers spend around 18% of their time on troubleshooting, which DataOps automation aims to shift toward higher value activities.

- Continuous testing and monitoring under DataOps have reduced production errors from about 10 per week to almost zero in some organizations.

- Between 60% and 85% of big data projects fail due to siloed teams and poor collaboration, highlighting the need for integrated DataOps models.

- Nearly 88% of collected data remains unused, indicating significant efficiency gaps that DataOps seeks to address.

- As 75% of databases move to cloud platforms, 70% of organizations report cloud security breaches, accelerating the adoption of DataSecOps practices.

By Component

DataOps platforms and automation tools account for 42.8%, reflecting their central role in DataOps adoption. These platforms enable coordination between data engineering, analytics, and operations teams. Automation tools streamline data ingestion, validation, and transformation processes. Centralized platforms improve visibility across data workflows. Reliability and consistency remain essential requirements.

The dominance of platforms and automation tools is driven by increasing data complexity. Organizations manage data across multiple sources and formats. Automation reduces manual intervention and operational errors. Integrated platforms support faster data delivery cycles. This sustains strong demand for DataOps platforms.

By Deployment Mode

Cloud-based deployment holds 78.4%, highlighting strong preference for scalable environments. Cloud platforms support elastic data processing and storage. Organizations benefit from faster deployment and easier integration. Centralized access supports collaboration across teams. Flexibility remains a key advantage.

Adoption of cloud-based deployment is driven by distributed data environments. Enterprises operate hybrid and cloud-native data systems. Cloud platforms support continuous integration and delivery. Secure access controls meet enterprise needs. This keeps cloud-based deployment dominant.

By Organization Size

Large enterprises represent 71.6%, making them the primary adopters of DataOps solutions. These organizations manage high data volumes and complex pipelines. DataOps improves coordination across departments. Automation supports governance and compliance. Scale increases the need for standardized processes.

Adoption among large enterprises is driven by operational complexity. Manual data management becomes inefficient at scale. DataOps improves reliability and speed. Centralized monitoring supports performance tracking. This sustains strong enterprise-level adoption.

By Application

Data pipeline automation and monitoring account for 58.3%, making it the leading application area. Automated pipelines reduce delays in data delivery. Monitoring tools identify issues in real time. Visibility improves data quality and reliability. Continuous monitoring supports operational stability.

Growth in this application is driven by real-time data needs. Organizations rely on timely analytics for decisions. Automation reduces pipeline failures. Monitoring supports proactive issue resolution. This keeps pipeline automation central to DataOps adoption.

By End-User Industry

IT and telecommunications account for 38.7%, making them the leading end-user industry. These sectors manage large and diverse data streams. DataOps supports rapid data processing and analysis. Automation improves service performance monitoring. Reliability is critical in this industry.

Adoption in IT and telecom is driven by digital service expansion. Networks generate continuous data flows. DataOps platforms improve operational insight. Integration with analytics tools supports optimization. This sustains strong adoption in this industry.

By Region

North America accounts for 42.1%, reflecting strong adoption of DataOps practices across enterprises. Organizations in the region focus on improving data reliability and speed. Cloud infrastructure maturity supports large-scale DataOps deployment. Enterprises prioritize automation to manage complex data environments. The region remains a key contributor to market development.

Region Primary Growth Driver Regional Share (%) Regional Value (USD Bn) Adoption Maturity North America Advanced cloud and analytics ecosystems 42.1% USD 1.02 Bn Advanced Europe Regulatory driven data governance initiatives 27.8% USD 0.74 Bn Advanced Asia Pacific Rapid enterprise digitalization 20.4% USD 0.54 Bn Developing Latin America Growing cloud adoption 5.6% USD 0.15 Bn Developing Middle East and Africa Early stage analytics modernization 4.1% USD 0.11 Bn Early

The US market reached USD 1.02 Billion with a CAGR of 33.02%, indicating rapid growth momentum. Expansion is driven by rising demand for real-time analytics. Enterprises invest in automated data pipelines and monitoring tools. Data-driven decision-making continues to gain importance. Market growth remains strong and sustained.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Growth of data driven enterprises Need for faster analytics and insights ~8.4% Global Short Term Cloud data platform adoption Demand for scalable data operations ~7.3% North America, Europe Short Term Expansion of AI and ML workloads Reliable data pipelines for model training ~6.4% Global Mid Term Increasing data complexity Automation of data workflows and monitoring ~5.5% Global Mid Term DevOps and Agile data practices Continuous data delivery requirements ~4.6% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline Data security risks Exposure of sensitive enterprise data ~5.2% Global Short Term Tool integration complexity Compatibility with existing data stacks ~4.6% Global Mid Term Skills shortage Lack of experienced DataOps professionals ~4.0% Global Mid Term Vendor dependency Platform lock in concerns ~3.2% Global Long Term Governance challenges Managing data quality and compliance ~2.7% North America, Europe Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration High implementation effort Complex setup across data environments ~6.1% Global Short to Mid Term Change management resistance Cultural shift toward automated data workflows ~5.3% Global Mid Term Data standardization issues Inconsistent data formats and sources ~4.5% Global Mid Term Cost concerns for smaller firms Enterprise focused pricing models ~3.7% Emerging Markets Long Term Compliance complexity Industry specific data regulations ~3.1% North America, Europe Long Term Driver Analysis

The DataOps market is being driven by the growing need for organisations to improve the speed, quality, and reliability of data delivery across increasingly complex data environments. Traditional data management approaches often struggle with delays, inconsistent processes, and quality issues that impede analytics, business intelligence, and operational decision making.

DataOps provides a framework for continuous integration, continuous delivery, and collaboration between data engineers, analysts, and operations teams, which helps streamline data pipelines and automate testing and monitoring. As enterprises prioritise real-time insights and faster time to value from data initiatives, investment in DataOps practices and platforms continues to strengthen.

Restraint Analysis

A key restraint in the DataOps market relates to organisational and cultural barriers that can slow adoption. DataOps requires cross-functional alignment between data engineering, analytics, IT operations, and business stakeholders, which can be difficult in organisations with siloed teams, unclear ownership structures, or limited data literacy.

Achieving this alignment often demands significant changes to processes, governance standards, and performance metrics, which can meet resistance or prolonged adjustment periods. In addition, the initial cost of implementing DataOps tools, training staff, and adapting legacy systems may deter organisations with limited budgets or internal expertise.

Opportunity Analysis

Emerging opportunities in the DataOps market are linked to the integration of artificial intelligence, machine learning, and automation to enhance data pipeline orchestration, anomaly detection, and quality assurance. AI-enabled DataOps platforms can automate routine tasks, detect data drift, and suggest remediation actions to improve reliability and reduce manual effort.

There is also opportunity in expanding support for hybrid and multicloud environments that require seamless data flow and governance across distributed platforms. Solutions that offer clear visibility into data lineage, impact analysis, and real-time performance metrics can provide strategic value by increasing trust and transparency in enterprise data processes.

Challenge Analysis

A central challenge confronting this market involves balancing the need for automation with robust governance and security controls. While DataOps promotes rapid development and delivery cycles, organisations must ensure that data pipelines, access policies, and compliance requirements are properly enforced.

Rapid iteration without appropriate controls can increase risk of data breaches, compliance violations, and inconsistent analytics outcomes. Establishing strong governance frameworks that operate alongside flexible DataOps practices demands careful design, ongoing monitoring, and clear accountability to maintain both agility and control.

Emerging Trends

Emerging trends in the DataOps landscape include the adoption of unified platforms that combine data pipeline automation, monitoring, testing, and collaboration into a single interface. These platforms support end-to-end visibility into data processing, quality checkpoints, and deployment status, which improves coordination across teams.

Another trend is the use of continual testing and validation that embeds verification checks directly into data workflows, reducing defects before they reach production environments. There is also increasing focus on integrating observability tools that provide real-time insights into data performance, resource usage, and potential bottlenecks.

Growth Factors

Growth in the DataOps market is supported by the expanding volume, variety, and velocity of enterprise data that require scalable and reliable management frameworks. Organisations are investing in analytics, artificial intelligence, and automation to accelerate decision making, and DataOps provides the discipline and tooling necessary to sustain these investments.

Advancements in cloud computing, containerisation, and orchestration technologies enhance the flexibility and scalability of DataOps implementations. As businesses seek to reduce time-to-insight, improve data quality, and support collaborative workflows, DataOps becomes an essential element of modern data strategy and operational excellence.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Pattern Large enterprises Very High ~71.6% Reliable and scalable data pipelines Long term platform adoption IT and telecom companies High ~38.7% High volume data operations Strategic deployments Cloud service providers High ~22.4% Platform ecosystem expansion Technology partnerships Data engineering vendors Moderate ~11.3% Tool innovation and integration R and D driven SMEs Low ~6.1% Cost sensitive automation Selective adoption Technology Enablement Analysis

Technology Layer Enablement Role Impact on Growth (%) Adoption Status Data pipeline orchestration Automated data flow management ~8.1% Growing Cloud native data platforms Scalable processing and storage ~7.0% Mature Monitoring and observability tools Data quality and performance tracking ~6.2% Growing API based integration layers Interoperability across data tools ~5.1% Growing Automation and CI CD frameworks Continuous data delivery ~4.4% Mature Key Market Segments

By Component

- DataOps Platforms and Automation Tools

- Data Quality and Observability Tools

- Data Pipeline Orchestration Tools

- Testing and Versioning Tools

- Professional and Managed Services

By Deployment Mode

- Cloud-Based

- On-Premises

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises

By Application

- Data Pipeline Automation and Monitoring

- Data Quality Management and Governance

- Collaboration and Self-Service Data Access

- DevOps Integration for Data Systems

By End-User Industry

- IT and Telecommunications

- Banking, Financial Services, and Insurance

- Retail and E-commerce

- Healthcare and Life Sciences

- Manufacturing

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

Large enterprise technology providers such as IBM, Microsoft, Oracle, and SAP lead the DataOps market through integrated data management and analytics ecosystems. Their platforms support automated data pipelines, governance, and real-time monitoring. Strong cloud integration and AI-driven capabilities improve data reliability at scale. These players benefit from large enterprise adoption and long-standing customer relationships across regulated industries.

Specialized DataOps and data integration vendors such as Informatica, Talend, and StreamSets focus on pipeline orchestration and data quality assurance. DataKitchen, Acceldata, and RightData emphasize observability, validation, and reliability. These solutions help enterprises reduce data downtime and improve analytics confidence. Adoption is driven by growing data complexity and real-time decision requirements.

IT service providers such as Infosys, Wipro, HCL Technologies, and Tech Mahindra support DataOps implementation and customization. Nexla addresses data product management and automation needs. These players enable scalable deployment across hybrid environments. Other vendors expand innovation and regional market reach, supporting steady growth of DataOps adoption.

Top Key Players in the Market

- IBM

- Microsoft

- Oracle

- SAP

- Informatica

- Talend

- DataKitchen

- Acceldata

- RightData

- StreamSets

- Nexla

- TechMahindra

- Wipro

- Infosys

- HCL Technologies

- Others

Recent Developments

- February, 2025 – IBM announced plans to acquire DataStax, a key player in AI and data solutions, to boost its watsonx platform for better data management in generative AI setups. This move helps enterprises handle unstructured data more smoothly, fitting right into DataOps needs for scalable pipelines.

- February, 2025 – SAP teamed up with Databricks to integrate their strengths directly into SAP Business Data Cloud, making data and AI workflows easier for businesses dealing with trust issues in their data.

- May, 2025 – Salesforce signed a deal to buy Informatica for around $8 billion, aiming to supercharge its Data Cloud with top-notch data integration and governance tools essential for DataOps and AI agents.

Report Scope

Report Features Description Market Value (2025) USD 2.6 Bn Forecast Revenue (2035) USD 52.7 Bn CAGR(2026-2035) 35.1% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (DataOps Platforms and Automation Tools, Data Quality and Observability Tools, Data Pipeline Orchestration Tools, Testing and Versioning Tools, Professional and Managed Services), By Deployment Mode (Cloud-Based, On-Premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By Application (Data Pipeline Automation and Monitoring, Data Quality Management and Governance, Collaboration and Self-Service Data Access, DevOps Integration for Data Systems, By End-User Industry, IT and Telecommunications, Banking, Financial Services, and Insurance, Retail and E-commerce, Healthcare and Life Sciences, Manufacturing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM, Microsoft, Oracle, SAP, Informatica, Talend, DataKitchen, Acceldata, RightData, StreamSets, Nexla, TechMahindra, Wipro, Infosys, HCL Technologies, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- IBM

- Microsoft

- Oracle

- SAP

- Informatica

- Talend

- DataKitchen

- Acceldata

- RightData

- StreamSets

- Nexla

- TechMahindra

- Wipro

- Infosys

- HCL Technologies

- Others