Global Data Validation Market Size, Share and Analysis Report By Component (Software/Solutions, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By Application (Pre-Ingestion Validation, In-Process Transformation Validation, Post-Load Analytics Validation, Others), By End-User Industry (IT and Telecommunications, Banking, Financial Services, and Insurance, Healthcare, Retail and E-commerce, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 175878

- Number of Pages: 346

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Key Insights Summary

- Drivers Impact Analysis

- Restraint Impact Analysis

- Increasing Adoption Technologies

- Investment Opportunities

- Business Benefits

- U.S. Data Validation Market Size

- Component Analysis

- Deployment Mode Analysis

- Organization Size Analysis

- Application Analysis

- End-User Industry Analysis

- Emerging Trends Analysis

- Opportunity Analysis

- Challenge Analysis

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

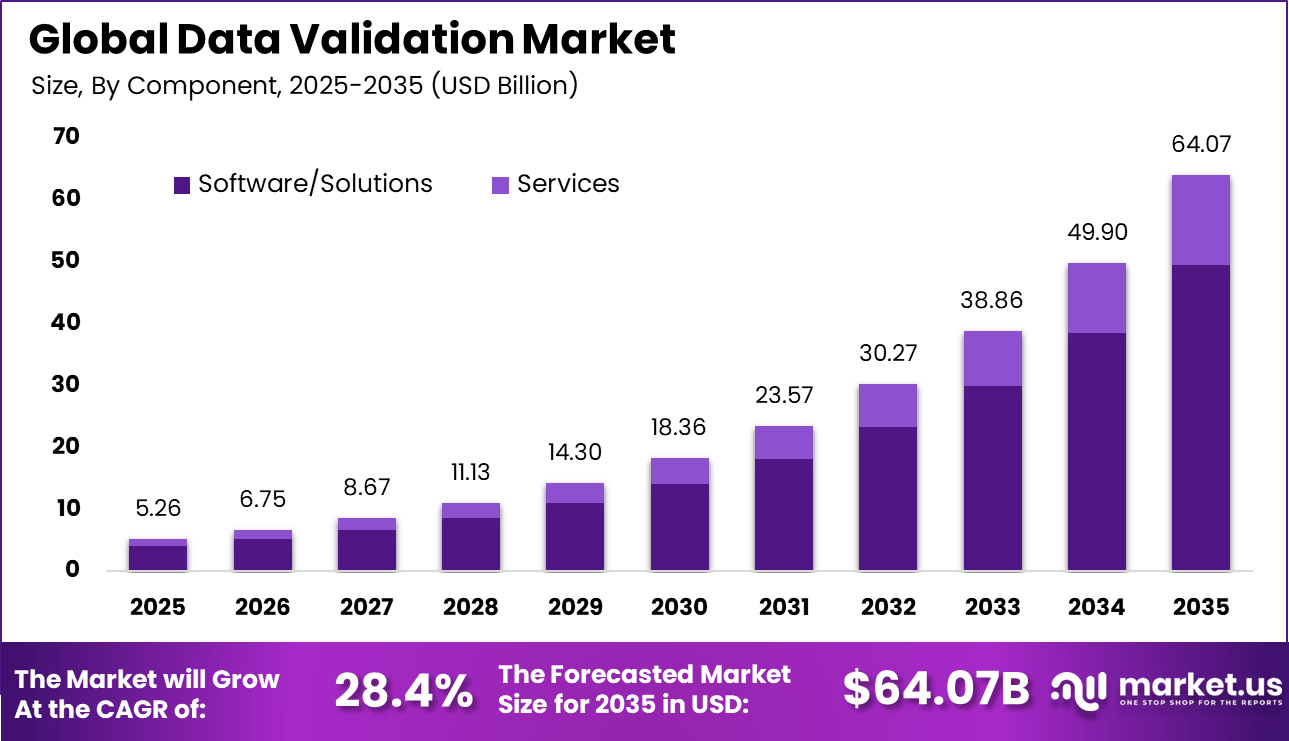

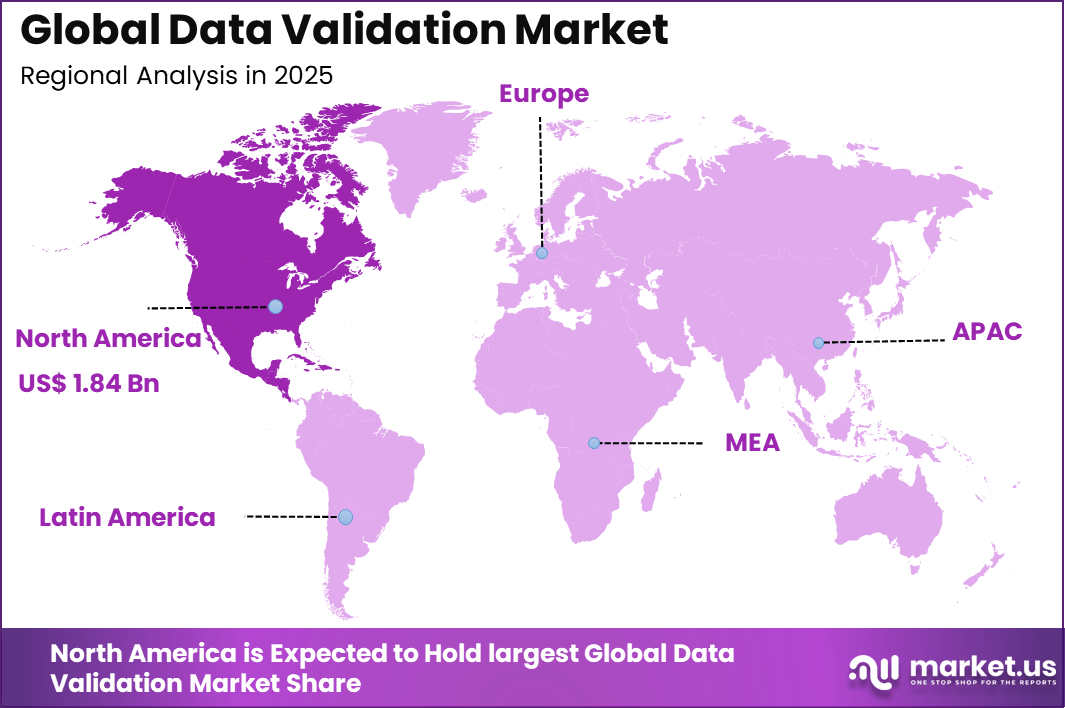

The Global Data Validation Market is experiencing rapid expansion, projected to grow from USD 5.26 billion in 2025 to approximately USD 64.07 billion by 2035, registering a robust CAGR of 28.4% throughout the forecast period. In 2025, North America dominated the market with over 35.16% share, accounting for USD 1.84 billion in revenue.

The data validation market refers to the segment of data management solutions that focus on checking whether data is accurate, complete, consistent, and usable before it is processed or analyzed. Data validation ensures that incoming data meets predefined rules and formats so that errors are detected early in the data lifecycle. This process is applied across databases, data pipelines, applications, and analytics systems where incorrect data can lead to faulty outputs.

The market exists to support organizations that rely on data for daily operations and strategic decisions. Data validation is used across structured and unstructured data environments, including transactional systems, cloud platforms, and analytical tools. It acts as a control layer between data sources and downstream applications, reducing the risk of poor data quality entering business systems. As organizations handle larger and more complex datasets, validation has shifted from manual checks to automated and rule-based systems.

A major driving factor for the data validation market is the rising dependence on data for business decisions. Studies across digital enterprises indicate that nearly 30% of business decisions are influenced by data that contains quality issues, leading to financial and operational risks. Organizations are therefore placing stronger emphasis on validating data at the point of entry to avoid downstream errors. This need has made data validation a core requirement rather than an optional process.

For instance, in September 2025, Precisely enhanced its Data Integrity Suite with AI-powered natural language interfaces for data quality. Users can now describe tasks in plain English, generating rules and sample data automatically. This opens advanced validation to everyone, not just tech experts.

Demand for data validation solutions has grown as data volumes and data sources continue to expand. Enterprises now collect data from applications, devices, digital platforms, and external partners, increasing the risk of inconsistent or incomplete records. Research across enterprise data environments shows that poor data quality can reduce productivity by over 20%, highlighting the need for preventive controls. Validation tools help organizations manage this complexity by enforcing quality rules automatically.

Key Takeaway

- By component, software and solutions led the market with 77.3% share, driven by growing need for automated data accuracy checks and validation across complex data environments.

- By deployment mode, cloud based solutions accounted for 84.6%, supported by scalability, faster implementation, and integration with modern data platforms.

- By organization size, large enterprises represented 71.8%, reflecting higher data volumes and stronger requirements for governance and compliance.

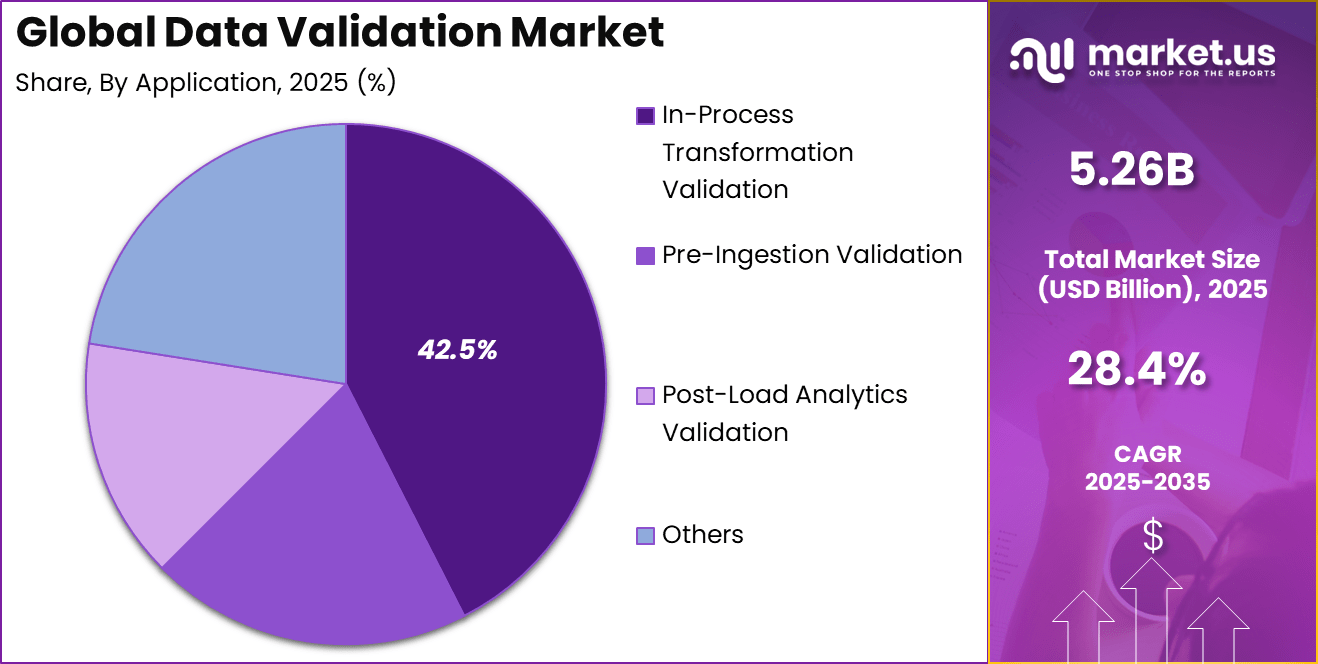

- By application, in process transformation validation held 42.5% share, as organizations focused on ensuring data consistency during real time processing and transformation.

- By end user industry, banking, financial services, and insurance captured 39.7%, driven by strict regulatory standards and reliance on accurate data for decision making.

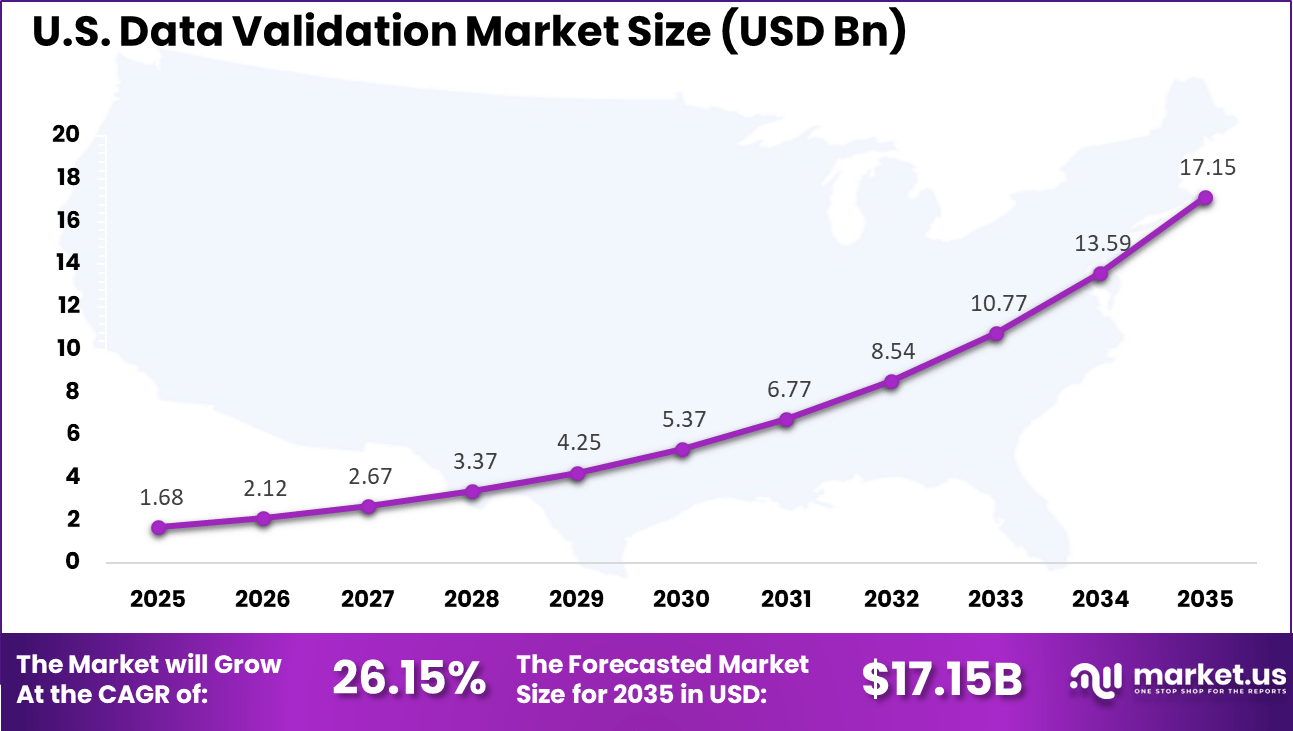

- North America accounted for 35.16% of the global market, with the US valued at USD 1.68 billion and growing at a 26.15% CAGR, supported by advanced digital infrastructure and strong adoption of cloud data technologies.

Key Insights Summary

Adoption Rates and Projections

- According to industry analysis, Around 70% of organizations are expected to adopt modern data quality solutions to support AI driven and digital initiatives.

- By late 2025, nearly 88% of organizations report using AI in at least one business function, increasing the need for embedded data validation across workflows.

- Cloud based validation solutions account for 63.4% of market revenue and are growing at a 19.8% CAGR, as companies move away from legacy on premises systems.

Usage Statistics by Sector

- Adoption is highest in regulated and data intensive industries where accuracy and compliance are critical.

- Banking and financial services hold 22.7% share, driven by regulatory reporting requirements and fraud prevention needs.

- Retail and e commerce is the fastest growing segment with a 23.1% CAGR, supported by demand for consistent product data and personalized customer experiences.

- Pharmaceuticals account for around 40% of the computer system validation market, reflecting strict data integrity requirements for regulatory compliance.

Drivers Impact Analysis

Key Growth Driver Influence on Projected Growth (~%) Geographical Significance Expected Timeframe of Impact Rapid growth in data volumes across cloud and enterprise systems +6.2% Global, strongest in North America and Europe Short to medium term Increasing adoption of AI, ML, and advanced analytics +5.4% North America, Asia Pacific Medium term Rising demand for accurate data in regulatory reporting +4.7% Europe, North America Medium to long term Expansion of data driven decision making in enterprises +3.9% Global Short term Growth of automated data pipelines and real time processing +3.2% North America, developed Asia Pacific Medium term Restraint Impact Analysis

Key Restraint Influence on Projected Growth (~%) Geographical Significance Expected Timeframe of Impact High implementation complexity in legacy environments -3.1% Europe, emerging markets Short to medium term Shortage of skilled data quality and governance professionals -2.6% North America, Europe Medium term Budget constraints among small and mid sized organizations -2.2% Asia Pacific, Latin America Medium term Data integration challenges across siloed systems -1.8% Global Medium to long term Concerns related to data privacy and compliance -1.4% Europe, North America Long term Increasing Adoption Technologies

The data validation market is increasingly supported by automation and rule-based engines that operate at scale. These technologies apply predefined logic to verify formats, ranges, duplicates, and relationships across datasets. Automation allows validation to occur continuously rather than as a one-time activity, improving consistency and coverage. As data pipelines become more complex, automated validation reduces the reliance on manual checks.

Advanced technologies such as pattern recognition and anomaly detection are also being integrated into validation processes. These systems learn normal data behavior and flag unusual values that may indicate errors. This approach is particularly useful in large datasets where rule creation alone may not capture all issues. Technology-driven validation improves both accuracy and speed in data quality management.

Organizations adopt modern data validation technologies to reduce operational risk and rework. Industry assessments indicate that data teams can spend up to 40% of their time fixing data issues after ingestion. Automated validation shifts this effort upstream, allowing teams to focus on analysis and value creation instead of error correction. This efficiency gain is a strong motivator for adoption.

Another reason is the need for scalability in growing data environments. Manual validation processes do not scale well as data volume and velocity increase. Technology-based validation adapts to changing data structures and sources with minimal intervention. This flexibility supports long-term data governance and operational stability.

Investment Opportunities

Investment opportunities in the data validation market are emerging around automated and cloud-based validation frameworks. Organizations are increasingly looking for solutions that can be deployed quickly and scaled across multiple data environments. Investments that support integration with data pipelines and analytics systems are gaining attention due to their practical business value. These solutions reduce setup time and improve adoption rates.

There is also growing investment interest in intelligent validation capabilities that go beyond static rules. Solutions that combine validation with monitoring and alerting provide continuous oversight of data quality. As enterprises aim to reduce data-related risk proactively, such capabilities are becoming more attractive. This trend supports innovation and expansion within the market.

Business Benefits

The primary business benefit of data validation is improved trust in data outputs. When data is validated before use, organizations can rely on reports, dashboards, and models with greater confidence. This reliability supports better decision making and reduces the risk of costly mistakes. Consistent validation also strengthens internal credibility of data teams.

Data validation also delivers measurable efficiency benefits by reducing downstream corrections and system failures. Fewer data errors lead to smoother operations and lower support costs. Organizations that implement validation early in their data processes often experience faster reporting cycles and improved system performance. These benefits make data validation a foundational component of modern data management strategies.

U.S. Data Validation Market Size

The market for Data Validation within the U.S. is growing tremendously and is currently valued at USD 1.68 billion, the market has a projected CAGR of 26.15%. The market grows rapidly due to exploding data volumes from digital transformation, where businesses generate massive info daily but struggle with inaccuracies that hurt decisions.

Strict rules like CCPA force companies to verify data quality, avoiding huge fines and building customer trust. Cloud adoption and AI tools make validation faster and cheaper, while sectors like finance and healthcare demand real-time checks to fight fraud and ensure compliance. Large firms lead, investing heavily to turn raw data into reliable insights.

For instance, in October 2024, Innovative Systems expanded FinScan’s KYC solution with customer identity document validation and adverse media screening, bolstering data validation for AML compliance. This development reinforces U.S. leadership in secure, accurate data processing for financial institutions.

In 2025, North America held a dominant market position in the Global Data Validation Market, capturing more than a 35.16% share, holding USD 1.84 billion in revenue. This dominance is due to its advanced tech infrastructure and early adoption of cloud, AI, and big data tools.

Home to giants like IBM and Oracle, the region sees heavy investments from large enterprises in finance and healthcare to meet strict regulations such as CCPA. This focus on data governance ensures accuracy amid massive volumes, while a skilled workforce and innovation hubs fuel rapid tool development.

For instance, in February 2025, Melissa launched Alert Service, an industry-first continuous monitoring solution for customer data changes like addresses and property details. This active data quality innovation exemplifies North American dominance in real-time data validation technologies.

Regional Driver Comparison

Region Core Demand Driver Growth Influence Level Market Maturity North America Advanced analytics adoption and strict data governance Very High Mature Europe Regulatory compliance and enterprise data quality mandates High Mature Asia Pacific Rapid digitalization and cloud migration Medium to High Developing Middle East Enterprise modernization and smart infrastructure Medium Developing Latin America Gradual adoption of data quality platforms Low to Medium Early stage Africa Emerging digital transformation initiatives Low Early stage

Component Analysis

In 2025, The Software/Solutions segment held a dominant market position, capturing a 77.3% share of the Global Data Validation Market. Teams now handle huge amounts of information daily, and these tools spot errors automatically without much manual work. Growth comes from better integration with business systems, cutting down on mistakes that could cost time and money.

As data grows faster, companies turn to software for real-time checks that keep everything accurate. This shift helps analysts focus on insights instead of fixing bad data. More firms adopt these solutions since they scale easily for growing data needs. Cloud links and AI features inside software boost speed, making validation part of everyday workflows. Regulations demand proof of clean data, so software provides logs and reports that satisfy checks.

For Instance, in January 2026, IBM introduced Sovereign Core, an AI-ready software for data management that ensures full control over validation in sovereign environments. This helps enterprises validate sensitive data while meeting strict regulations, boosting trust in software solutions for large-scale operations. It fits perfectly into growing needs for compliant, automated validation tools.

Deployment Mode Analysis

In 2025, the Cloud-based segment held a dominant market position, capturing a 84.6% share of the Global Data Validation Market. They scale effortlessly when data surges, cutting costs on hardware and IT staff. Remote teams love accessing validation checks from anywhere, boosting productivity. This shift accelerates because cloud setups update automatically, keeping tools sharp against new threats. Businesses save big while staying agile, a win in tight budgets.

The boom continues as cloud platforms offer top security for sensitive data, vital in regulated sectors. Pay-as-you-go models let small teams test without huge upfront spends, drawing more users. Integration with AI tools adds smart checks, making validation smarter and quicker. Growth mirrors the overall cloud rush, where flexibility trumps everything else for handling unpredictable workloads.

For instance, in October 2025, Talend’s Summer ’25 release improved its cloud platform with Spark-powered processing over 1.2 million records per second and strong validation security like AES-256 encryption. This boosts cloud deployments by enabling fast, secure data handling for global teams without on-premise hassles.

Organization Size Analysis

In 2025, The Large Enterprises segment held a dominant market position, capturing a 71.8% share of the Global Data Validation Market. Growth stems from complex operations where one bad entry can lead to big losses or fines. These firms invest in tools that cover every step, from input to output. As they digitize more processes, validation becomes key to reliable results. It supports their scale without slowing down.

Big players drive this segment with resources for advanced setups that smaller ones skip. Regulations hit them hardest, so validation proves due diligence. Teams use it to unify data across departments, improving decisions. Expansion into new markets adds data variety, pushing tool upgrades.

For Instance, in October 2025, Ataccama partnered with Atlan to embed automated quality scores in enterprise catalogs, helping large firms trust data for AI decisions. This native integration reduces risks in big-scale operations by providing instant validation insights across tools.

Application Analysis

In 2025, The In-Process Transformation Validation segment held a dominant market position, capturing a 42.5% share of the Global Data Validation Market. Pipelines transform raw info constantly, and early checks prevent garbage outputs. This saves rework and builds confidence in analytics. Demand rises with more ETL jobs in AI and reporting. It’s efficient for ongoing flows.

Automation in this area speeds up processes while keeping quality high. Real-time flags let teams fix on the spot, vital for live dashboards. As data moves faster, waiting for batch validation fails. It fits agile methods where quick iterations rule. From tracking markets, this keeps reports timely and trustworthy.

For Instance, in October 2024, Syniti’s Data First strategy aided Bridgestone EMEAs S/4HANA migration, improving master data accuracy by 90% during in-process validation. This approach streamlined transformations, setting up reliable data for ongoing operations and innovation.

End-User Industry Analysis

In 2025, The Banking, Financial Services, and Insurance segment held a dominant market position, capturing a 39.7% share of the Global Data Validation Market. This strong positioning is largely driven by the industry’s high reliance on data accuracy for fraud detection, regulatory compliance, and risk management. Financial institutions process vast volumes of sensitive customer and transactional data daily, making robust validation tools essential for maintaining operational integrity and trust.

Moreover, the surge in digital banking, online payments, and automated loan processing further fueled the demand for advanced data validation solutions. Organizations across the BFSI sector are increasingly adopting AI-driven validation technologies to streamline workflows, ensure KYC/AML compliance, and enhance decision-making.

For Instance, in May 2025, SAP introduced a new balance validation process in S/4HANA Cloud, shifting checks to accounting for BFSI compliance. It catches inconsistencies early in consolidation, speeding processes and improving data quality for financial reporting.

Emerging Trends Analysis

A prominent trend in the data validation market is the integration of artificial intelligence and machine learning to automate the detection and correction of data errors at scale. Organizations are increasingly deploying validation solutions that use predictive models and pattern recognition to identify inconsistencies, anomalies, and deviations without manual rule definition.

This evolution enhances the speed and precision of validation processes and reduces dependency on human intervention for routine checks. The adoption of automated techniques reflects broader efforts to embed validation deeper into data lifecycles. Another trend is the migration of data validation capabilities to cloud-native platforms, which supports scalability and collaboration across distributed teams and data sources.

Cloud-based validation services allow real-time rule enforcement and shared governance for data assets regardless of location. These platforms also enable integration with enterprise data pipelines and analytics stacks, reducing latency between validation and downstream usage. The emphasis on flexible deployments and managed services is shaping how validation tools are consumed.

Opportunity Analysis

An opportunity exists in offering unified platforms that combine data validation with broader quality and governance capabilities. Organizations increasingly seek single consoles that handle validation, cleansing, enrichment, and monitoring to streamline data management workflows.

Integrating validation into data quality dashboards and governance systems can improve operational efficiency and elevate trust in data assets across business units. This integrated approach enhances the strategic value of validation beyond error prevention.

Another opportunity lies in managed validation services that lower barriers to entry for organizations without deep in-house expertise. As cloud-based solutions mature, vendors can offer subscription-based validation tools with configuration support, reducing the need for internal technical skills.

Managed services also enable continuous updates to validation logic in response to changing business rules and regulatory requirements. These offerings can broaden access to effective validation for mid-market and emerging enterprises.

Challenge Analysis

A significant challenge for the data validation market is ensuring the balance between thorough validation and data processing performance, particularly in real-time and high-throughput environments. Rigorous validation checks can introduce latency, which conflicts with the need for prompt data availability for analytics and operational systems.

Organizations must design validation that preserves speed without compromising accuracy, a technical tension that requires careful rule optimization. Another challenge lies in aligning validation processes with evolving business definitions and data standards.

As definitions of accuracy, completeness, and consistency change over time and across functions, validation rules must be updated continually to reflect current requirements. This ongoing maintenance requires coordination between business stakeholders and data teams, which can strain resources and slow response to market or regulatory shifts.

Investor Type Impact Matrix

Investor Type Strategic Objective Risk Tolerance Market Influence Enterprise software providers Expansion of data management portfolios Medium High Cloud platform vendors Strengthening data reliability ecosystems Low to Medium High Venture capital firms High growth SaaS data platforms High Medium to High Private equity investors Scalable and recurring revenue models Medium Medium Strategic data analytics investors End to end data quality solutions Medium Medium Technology Enablement Analysis

Technology Enabler Functional Role Impact on Adoption Adoption Timeline Automated data validation engines Continuous accuracy checks across datasets Very High Short term AI driven anomaly and error detection Proactive identification of data issues High Short to medium term Rule based and metadata driven validation Standardized quality enforcement High Medium term Cloud native data quality platforms Scalable and flexible deployment Very High Short term Advanced reporting and audit trails Improved transparency and compliance Medium Medium to long term Key Market Segments

By Component

- Software/Solutions

- Services

By Deployment Mode

- Cloud-based

- On-premises

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises

By Application

- In-Process Transformation Validation

- Pre-Ingestion Validation

- Post-Load Analytics Validation

- Others

By End-User Industry

- IT and Telecommunications

- Banking, Financial Services, and Insurance

- Healthcare

- Retail and E-commerce

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Large enterprise software providers such as IBM, Oracle, and SAP lead the data validation market through integrated data management platforms. Their solutions support validation across transactional, analytical, and master data environments. Strong governance, security, and scalability make them suitable for regulated industries. SAS Institute strengthens this segment with rule-based and statistical validation capabilities. These players benefit from long-standing enterprise relationships and broad global deployments.

Specialized data quality and integration vendors such as Informatica, Talend, and Ataccama focus on accuracy, consistency, and completeness of enterprise data. Precisely and Syniti emphasize validation for data migration and transformation projects. Their tools are widely adopted during cloud migration and ERP modernization initiatives. Demand is driven by the need to reduce data errors and improve trust in analytics outputs.

Niche and domain-focused providers such as Experian, Data Ladder, and Innovative Systems address customer data and identity validation use cases. Melissa and DQ Global support regulatory compliance and operational accuracy. Unravel Data extends validation into data pipeline monitoring. Other vendors expand regional reach and customization, supporting steady market growth.

Top Key Players in the Market

- IBM

- Informatica

- Oracle

- SAP

- SAS Institute

- Talend

- Ataccama

- Experian

- Precisely

- Syniti

- Data Ladder

- Innovative Systems

- Melissa

- DQ Global

- Unravel Data

- Others

Recent Developments

- In October 2025, Informatica rolled out its Fall 2025 release for the Intelligent Data Management Cloud, featuring CLAIRE Agents for autonomous data management. These AI agents automate data quality and governance tasks, making high-quality data ready for agentic AI. A smart step forward for Redwood City-based Informatica.

Report Scope

Report Features Description Market Value (2025) USD 5.2 Bn Forecast Revenue (2035) USD 64.0 Bn CAGR(2026-2035) 28.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software/Solutions, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By Application (Pre-Ingestion Validation, In-Process Transformation Validation, Post-Load Analytics Validation, Others), By End-User Industry (IT and Telecommunications, Banking, Financial Services, and Insurance, Healthcare, Retail and E-commerce, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM, Informatica, Oracle, SAP, SAS Institute, Talend, Ataccama, Experian, Precisely, Syniti, Data Ladder, Innovative Systems, Melissa, DQ Global, Unravel Data, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- IBM

- Informatica

- Oracle

- SAP

- SAS Institute

- Talend

- Ataccama

- Experian

- Precisely

- Syniti

- Data Ladder

- Innovative Systems

- Melissa

- DQ Global

- Unravel Data

- Others