Global Data Labeling Solution and Services Market Size, Share Analysis By Sourcing Type (In-House, Outsourced), By Type (Text, Image/Video, Audio), By Labeling Type (Manual, Semi-Supervised, Automatic), By Vertical (IT, Automotive, Government, Healthcare, Financial Services, Retails, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155588

- Number of Pages: 237

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

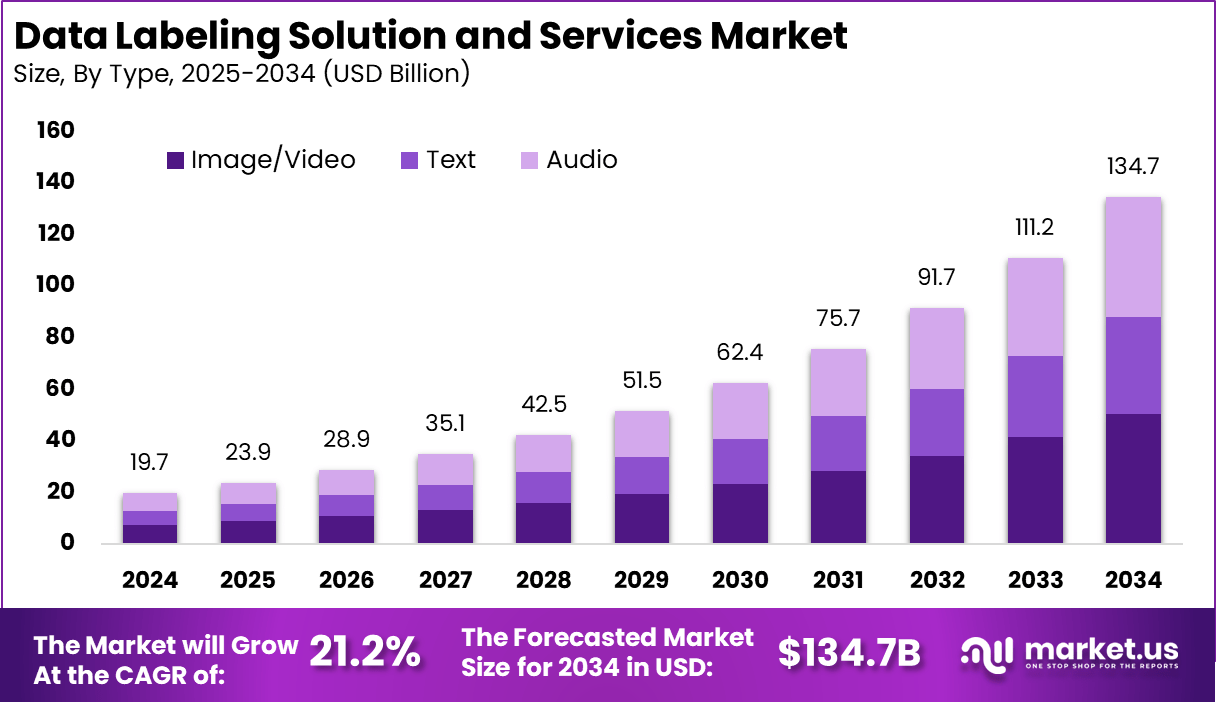

The Global Data Labeling Solution and Services Market size is expected to be worth around USD 134.7 Billion By 2034, from USD 19.7 billion in 2024, growing at a CAGR of 21.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 34.5% share, holding USD 6.7 Billion revenue.

The data labeling solution and services market is growing due to the rising demand for high quality, accurate labeled data that supports the development and reliability of AI and machine learning systems. This demand has intensified as organizations seek to train increasingly sophisticated models, such as those used in computer vision, natural language processing, and generative AI, where the precision and integrity of input data are paramount.

Key Insight Summary

- By sourcing type, the outsourced segment dominated with a 85.6% share, highlighting the reliance on third-party vendors for large-scale annotation projects, cost efficiency, and access to specialized expertise.

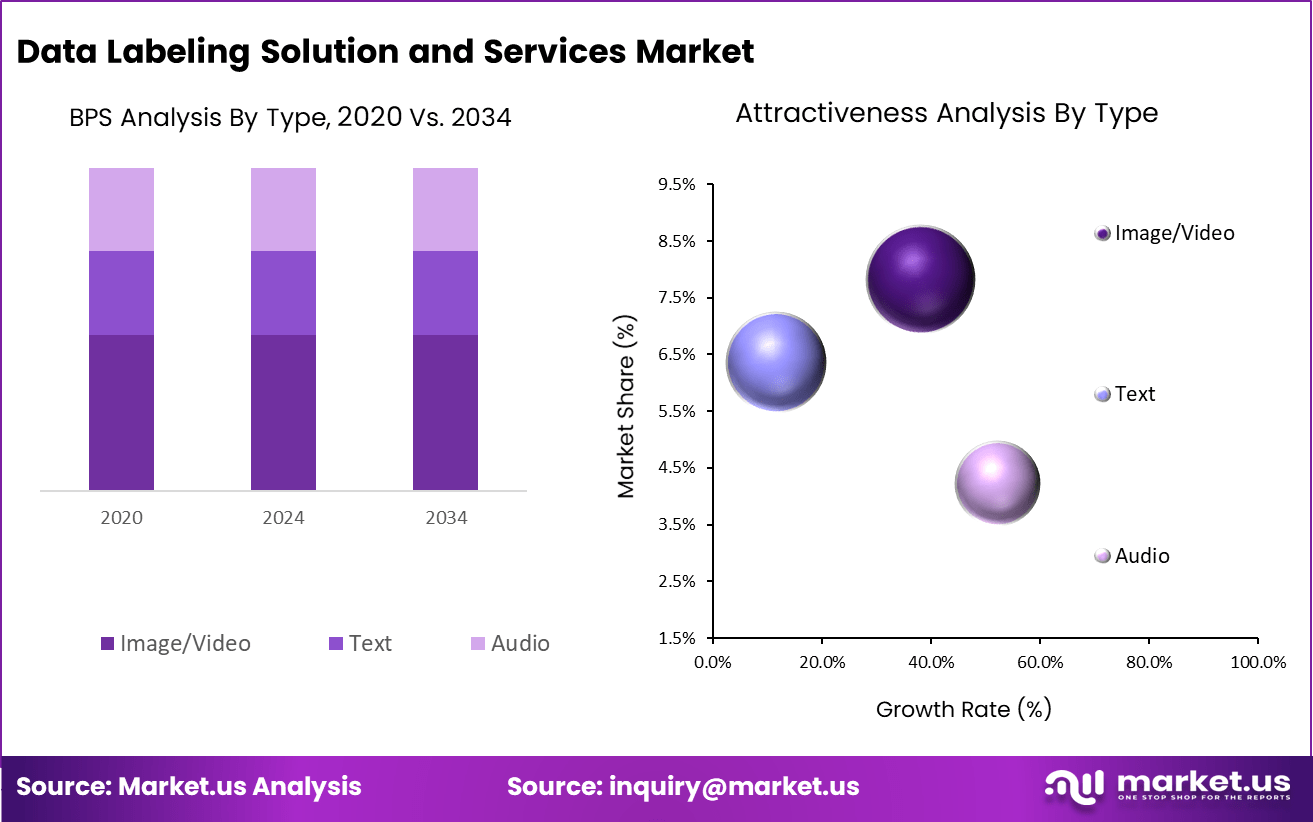

- By type, the image/video labeling segment accounted for 37.5%, reflecting the surge in computer vision applications such as autonomous vehicles, surveillance, and healthcare imaging.

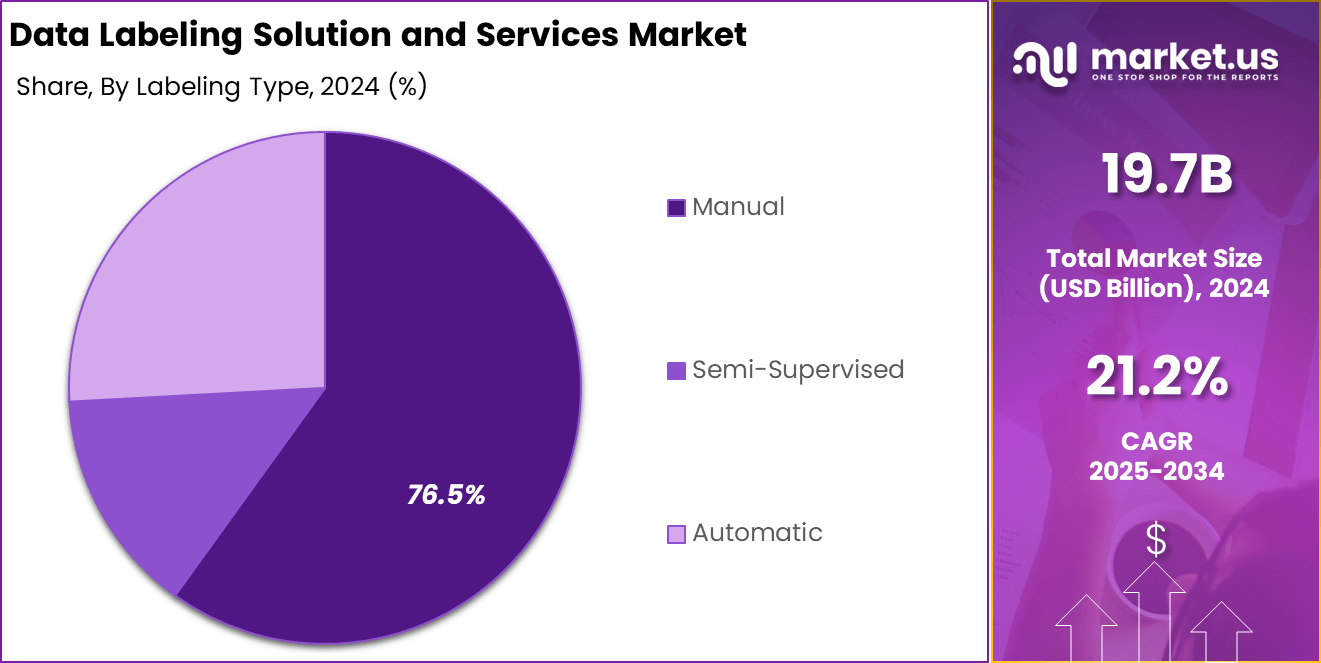

- By labeling type, the manual segment led with a 76.5% share, as human-driven annotation continues to play a crucial role in ensuring accuracy, particularly in complex datasets.

- By vertical, the IT segment emerged as the primary user of data labeling, supported by AI development, machine learning model training, and natural language processing use cases.

- Regionally, North America captured 34.5% of the global market, driven by advanced AI ecosystems, high adoption of machine learning applications, and strong presence of technology companies.

According to llcbuddy, when 80% of objects fall into a single category, about 80% of the training data also reflects that category. In such a case, the task agreement score reaches 67%, as two out of three annotations align. The first and second annotations are grouped under the task agreement criteria, which apply a 40% threshold to determine consistency among annotations.

The comparison between managed employees and crowdsourced workers further highlights differences in accuracy. For sentiment analysis, the average accuracy achieved by managed employees was 50%, while crowdsourced workers reached 40%. In transcription tasks, the managed employees recorded only a 1% mistake rate, compared to a 4% rate for crowdsourced workers.

Cost efficiency also plays a central role in dataset preparation. With a 20% price applied to HITs containing up to nine assignments, the total cost for processing a modest dataset amounts to $120. At the same time, long-term economic potential remains significant, with AI expected to add an extra $13 trillion in global economic activity by 2030. Together, these insights underline the dual importance of quality control and economic scalability in shaping the data labeling industry’s future.

Sourcing Type Analysis

In 2024, the outsourced segment led the Data Labeling Solution and Services Market by sourcing type, capturing 85.6% of the total share. This dominance is mainly driven by organizations seeking efficiency, scalability, and cost advantages. Outsourcing data labeling tasks allows companies to tap into specialized expertise, leverage global talent pools, and accelerate project timelines while keeping operational costs in check.

For industries working with large datasets and complex models, outsourcing provides immediate access to skilled annotators equipped with the latest tools and methodologies. Additionally, the flexibility to scale labeling efforts up or down depending on project requirements and market conditions makes outsourcing a preferred approach for both startups and enterprises seeking high-quality, consistent outputs.

By Type Analysis

In 2024, by type, the image/video segment accounted for 37.5% of the Data Labeling Solution and Services Market. The surge in data labeling for visual content stems from explosive growth in AI applications such as computer vision, autonomous vehicles, facial recognition, and retail analytics. Image and video labeling are fundamental for training advanced machine learning models to detect, classify, and understand real-world scenarios with precision.

This segment’s growth is further propelled by demand in sectors like healthcare (for medical imaging), security (surveillance footage), and entertainment (content tagging and recommendations), where accurate labeled data significantly impacts the quality and reliability of AI systems.

By Labeling Type

In 2024, manual labeling represented 76.5% of the market by labeling type, highlighting the continuing reliance on human expertise for nuanced and context-rich data annotation. Despite the advances in automated tools and AI-assisted labeling, manual annotation remains essential when complex judgment, contextual understanding, or intervention is needed.

Industries such as healthcare, autonomous driving, and legal tech frequently require precise, error-free labeling that only trained individuals can provide. This approach ensures that data quality and integrity are upheld, which is critical for model training, regulatory compliance, and product safety. The manual segment’s high share reflects the value placed on accuracy and the limitations that automated labeling still faces when handling ambiguous, sensitive, or highly specialized data.

By Vertical Analysis

In 2024, the IT vertical stood as a major contributor to the Data Labeling Solution and Services Market. IT companies drive demand for labeled datasets to fuel innovations in machine learning, artificial intelligence, and data-driven product development.

The sector’s involvement ranges from software and app development to cloud computing, cybersecurity, and digital transformation initiatives that all rely on robust, well-annotated data sources. IT organizations, in particular, prioritize high-volume and high-accuracy data labeling to support continuous improvement in AI-powered platforms and applications, cementing the industry’s pivotal role in advancing the global data labeling landscape.

Key Market Segments

By Sourcing Type

- In-House

- Outsourced

By Type

- Image/Video

Text

Audio

By Labeling Type

- Manual

- Semi-Supervised

- Automatic

By Vertical

- IT

- Automotive

- Government

- Healthcare

- Financial Services

- Retails

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Trends & Innovations

Trend Description AI-Powered Automation Use of AI and active learning to improve accuracy and annotation speed Hybrid Human-Machine Workflows Combining manual expertise with automated solutions Crowdsourcing & Distributed Labeling Leveraging global talent for scalable annotation projects Multimodal & Synthetic Data Labeling Labeling across diverse data types and for generative AI workflows Medical & Edge Data Labeling Specialized annotation for healthcare and real-time edge applications Explainable & Compliance Metadata Traceable, regulation-ready annotation for safety and transparency Top 5 Growth Factors

Growth Factors Description AI & ML Adoption Need for labeled data to train and validate machine learning models in all industries Automation & Advanced Tools Increasing use of AI/ML-assisted and semi-/fully automated labeling Cloud-Based Platforms Adoption of cloud annotation for scalability, remote access, and flexibility Digital Transformation Expanding data volumes from IoT, social media, mobile, business operations Specialized Sector Expansion High demand in automotive, healthcare, e-commerce, finance, robotics, and more Driver

Strong Need for Accurate Data

The biggest reason more companies use data labeling solutions is the need for accurate and consistent data. AI and machine learning models perform better when trained on well-labeled data. Industries such as healthcare, finance, and retail require precise data annotations to make smart decisions and improve their services.

Companies are also working closely with labeling providers to get customized solutions that fit their unique needs. Many want labeling systems that easily connect with their existing data tools. Overall, the demand for high-quality annotated data keeps growing because it is essential for building reliable AI systems.

Restraint

High Cost and Time Requirements

Data labeling requires significant time and money. For especially complex data or small companies, the costs can be a major obstacle. Manual labeling often needs experts who add to the expense. These costs make it hard for some organizations to afford large-scale labeling projects.

Besides money, the process can be slow and difficult to manage. Keeping annotations consistent and maintaining privacy add extra challenges. Even automated labeling tools require time to set up and learn. Due to these factors, many companies find it hard to balance cost, speed, and quality when labeling data.

Opportunity

Synthetic Data and Industry-Focused Labeling

Using synthetic data is a growing opportunity. Synthetic data is artificially created but looks real. It helps solve problems like limited data availability and privacy concerns. At the same time, offering labeling services specialized for industries such as healthcare or automotive can create new business opportunities.

Regions like Asia-Pacific and Latin America are rapidly adopting these technologies. Service providers who offer customized and flexible solutions, including synthetic data, can expand into these growing markets. This approach helps businesses meet specific requirements while advancing AI capabilities.

Challenge

Maintaining Quality Over Large Datasets

As data amounts grow, making sure labeling is accurate and consistent is the biggest challenge. Poor quality labels reduce the effectiveness of AI models and can cause problems in real-world use. Labeling complex data such as videos requires careful attention and expertise.

To meet these demands, providers use quality checks, audits, and smart tools to catch errors. Since labeling teams may be large and varied, technology helps maintain standards. However, human judgment remains important to make decisions when data is unclear. Balancing quality and scale is a constant challenge in the data labeling industry.

Competitive Analysis

In the data labeling solution and services market, companies such as CloudFactory Limited, Cogito Tech LLC, Deep Systems LLC, edgecase.ai, and Alegion have established strong positions by focusing on scalable human-in-the-loop models. Their services combine workforce management with AI-driven tools to ensure accuracy in labeling complex datasets. These providers are recognized for offering flexible outsourcing models that serve industries such as healthcare, finance, and automotive.

A second group of players, including Amazon Mechanical Turk Inc., Appen Limited, Clickworker GmbH, CloudApp, Explosion AI GmbH, and Heex Technologies, has gained traction through crowdsourcing platforms and cloud-based collaboration tools. These companies provide diverse annotation services at scale, supported by distributed workforces and automation. Their focus on cost efficiency and global workforce availability has helped enterprises accelerate AI development cycles.

Another segment is led by technology-driven innovators such as Labelbox Inc., Lotus Quality Assurance, Mighty AI Inc., Playment Inc., Scale AI, Shaip, Steldia Services Ltd., Tagtog Sp. z o.o., Trilldata Technologies Pvt Ltd, and Yandez LLC. These firms emphasize proprietary platforms, AI-assisted annotation, and advanced automation. By combining intuitive interfaces with robust APIs, they enable enterprises to integrate labeling workflows directly into AI pipelines.

Top Key Players in the Market

- CloudFactory Limited

- Cogito Tech LLC

- Deep Systems, LLC

- edgecase.ai

- Alegion

- Amazon Mechanical Turk, Inc.

- Appen Limited

- Clickworker GmbH

- CloudApp

- Explosion AI GmbH

- Heex Technologies

- Labelbox, Inc.

- Lotus Quality Assurance

- Mighty AI, Inc.

- Playment Inc.

- Scale AI

- Shaip

- Steldia Services Ltd.

- Tagtog Sp. z o.o.

- Trilldata Technologies Pvt Ltd

- Yandez LLC

Recent Developments

- February 2025: V7 Labs, a key player in the annotation landscape, entered a partnership with TaskUs and Digital Divide Data. This alliance is meant to broaden ethical, large-scale annotation capacity – highlighting the market’s seriousness about responsible AI.

- In February 2025, a key partnership in the U.S. connected a data analytics platform provider with a data-labeling startup to improve the accuracy of AI models for federal and intelligence use. Through this integration, agencies using the Foundry system could request high-quality labeling services, ensuring stronger datasets and more reliable outcomes in mission-critical decision-making.

- In October 2024, South Korea saw the launch of trans-AI Annotator, a proprietary solution developed to automate labeling tasks with AI-driven image and text analysis. By reducing manual work and speeding up dataset preparation, the platform addressed growing enterprise demand for efficiency in model training.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Sourcing Type (In-House, Outsourced), By Type (Text, Image/Video, Audio), By Labeling Type (Manual, Semi-Supervised, Automatic), By Vertical (IT, Automotive, Government, Healthcare, Financial Services, Retails, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape CloudFactory Limited, Cogito Tech LLC, Deep Systems, LLC, edgecase.ai, Alegion, Amazon Mechanical Turk, Inc., Appen Limited, Clickworker GmbH, CloudApp, Explosion AI GmbH, Heex Technologies, Labelbox, Inc., Lotus Quality Assurance, Mighty AI, Inc., Playment Inc., Scale AI, Shaip, Steldia Services Ltd., Tagtog Sp. z o.o., Trilldata Technologies Pvt Ltd, Yandez LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Data Labeling Solution and Services MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Data Labeling Solution and Services MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- CloudFactory Limited

- Cogito Tech LLC

- Deep Systems, LLC

- edgecase.ai

- Alegion

- Amazon Mechanical Turk, Inc.

- Appen Limited

- Clickworker GmbH

- CloudApp

- Explosion AI GmbH

- Heex Technologies

- Labelbox, Inc.

- Lotus Quality Assurance

- Mighty AI, Inc.

- Playment Inc.

- Scale AI

- Shaip

- Steldia Services Ltd.

- Tagtog Sp. z o.o.

- Trilldata Technologies Pvt Ltd

- Yandez LLC