Global Data Center Immersion Cooling Market Size, Share, Industry Analysis Report By Component (Solution, Service), By Cooling Technique (Single phase cooling, Two-phase cooling), By Cooling Fluid (Mineral oil, Synthetic fluid, Fluorocarbons-based fluid), By Organization Size (SME, Large enterprises), By Application (Hyperscale, Supercomputing, Enterprise HPC, Cryptocurrency, Edge/5G computing, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 162740

- Number of Pages: 277

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Role of Generative AI

- Investment and Business Benefits

- U.S. Market Size

- Component Analysis

- Cooling Technique Analysis

- Cooling Fluid Analysis

- Organization Size Analysis

- Application Analysis

- Emerging trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

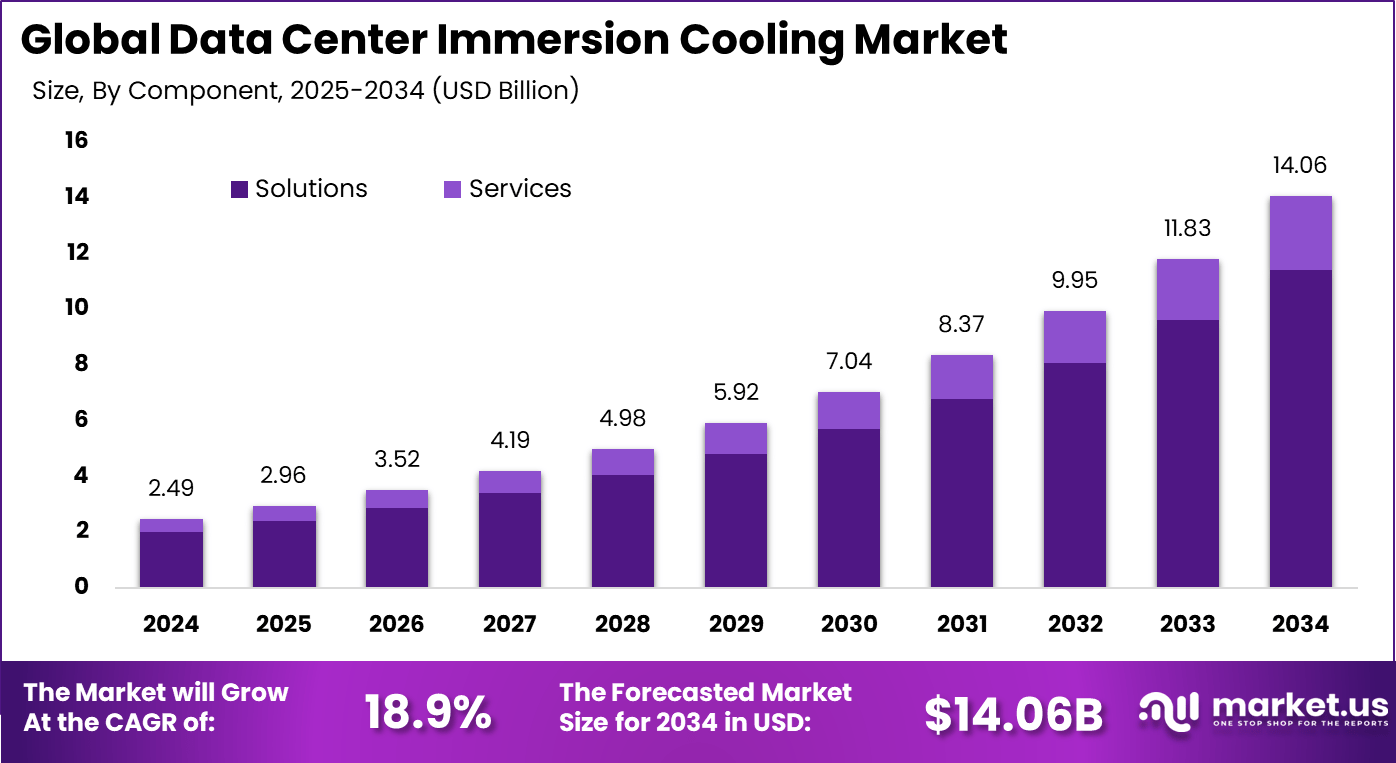

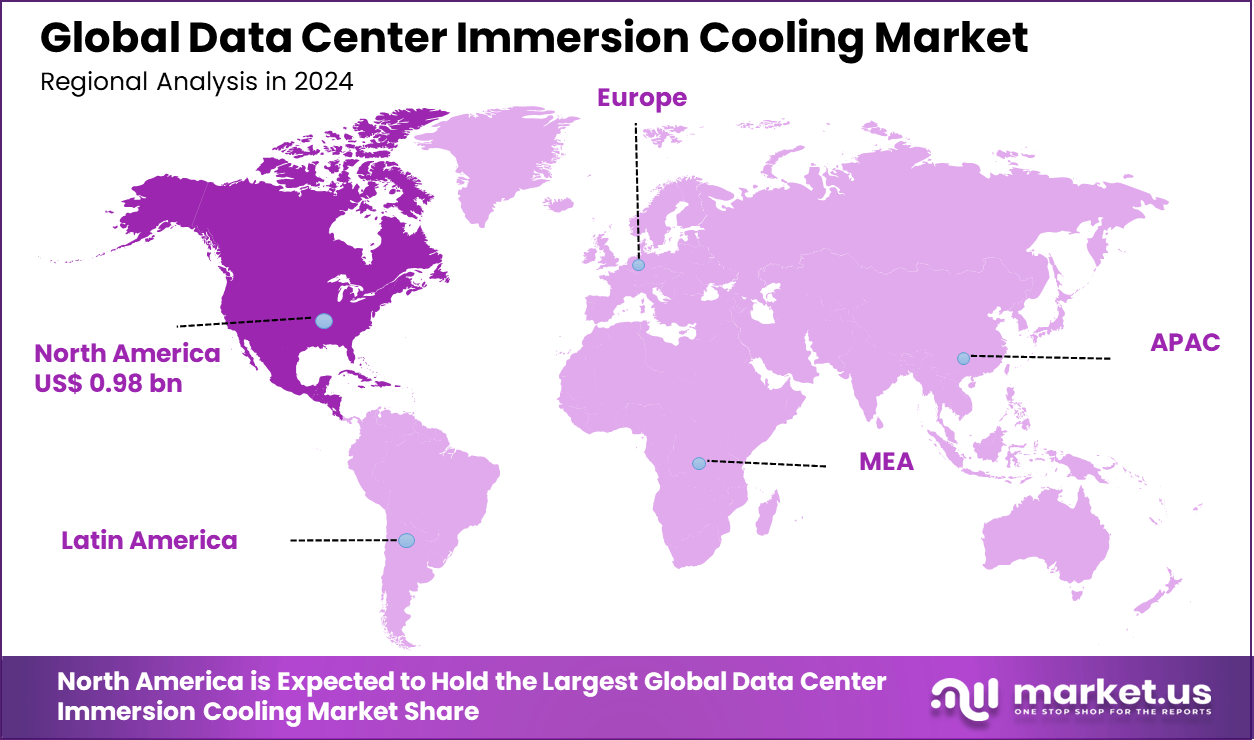

The Global Data Center Immersion Cooling Market size is expected to be worth around USD 14.06 billion by 2034, from USD 2.49 billion in 2024, growing at a CAGR of 18.9% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 39.5% share, holding USD 0.98 billion in revenue.

The Data Center Immersion Cooling market is rapidly gaining ground across the IT landscape, especially among hyperscale, colocation, and enterprise data centers that face rising heat loads from high-density computing. Immersion cooling uses special dielectric fluids to submerge servers or hardware directly, allowing heat to be dissipated efficiently. Adoption is highest in environments using AI, big data, and cloud workloads that need strong cooling and sustainable operations.

One major driving force is the steep rise in global data traffic and the need for high-performance computing, which generates significant heat and pushes traditional air cooling beyond its limits. Operators are motivated by the potential to cut cooling energy used with immersion cooling, helping them meet climate goals and rising regulatory standards around energy efficiency. The surge in energy prices also encourages a shift toward solutions that offer lower operational costs and carbon footprints.

According to market.us, The Global AI Data Center Market is projected to reach around USD 157.3 bn by 2034, rising from USD 14.3 bn in 2024, with a robust CAGR of 27.10% during 2025–2034. North America dominated the market in 2024, accounting for over 40% of total revenue, valued at approximately USD 5.7 billion. The United States alone contributed about USD 5.38 bn and is expected to experience strong growth at a CAGR of 26.4%, driven by expanding AI integration and increasing data processing demands.

The appetite for immersion cooling continues to grow, fueled by the elasticity of data center demand in step with global industrial investment, IT spending, and trends in electricity pricing. During economic expansion cycles, data center investments spike, and immersion cooling sees higher adoption. Emerging markets, especially across the Asia Pacific, are showing greater growth as digital infrastructure scales rapidly and governments promote energy-efficient solutions.

For instance, in February 2025, Asperitas launched a new modular product line, the DFCX series, based on Direct Forced Convection immersion cooling technology. This series is designed for use from edge data centers to hyperscale facilities, offering scalability, high cooling performance, and efficiency to meet evolving AI and high-performance computing demands.

Key Takeaway

- The Solutions segment dominated with 81.3%, driven by the rising demand for fully integrated cooling systems that enhance data center efficiency and reduce energy consumption.

- Single-Phase Cooling led with 62.8%, reflecting its widespread adoption due to lower maintenance requirements and operational simplicity.

- The Mining Oil segment accounted for 45.1%, supported by increased use of immersion cooling in cryptocurrency mining and high-performance computing environments.

- Large Enterprises captured 75.9%, as major corporations invest in sustainable data center infrastructure to handle expanding workloads.

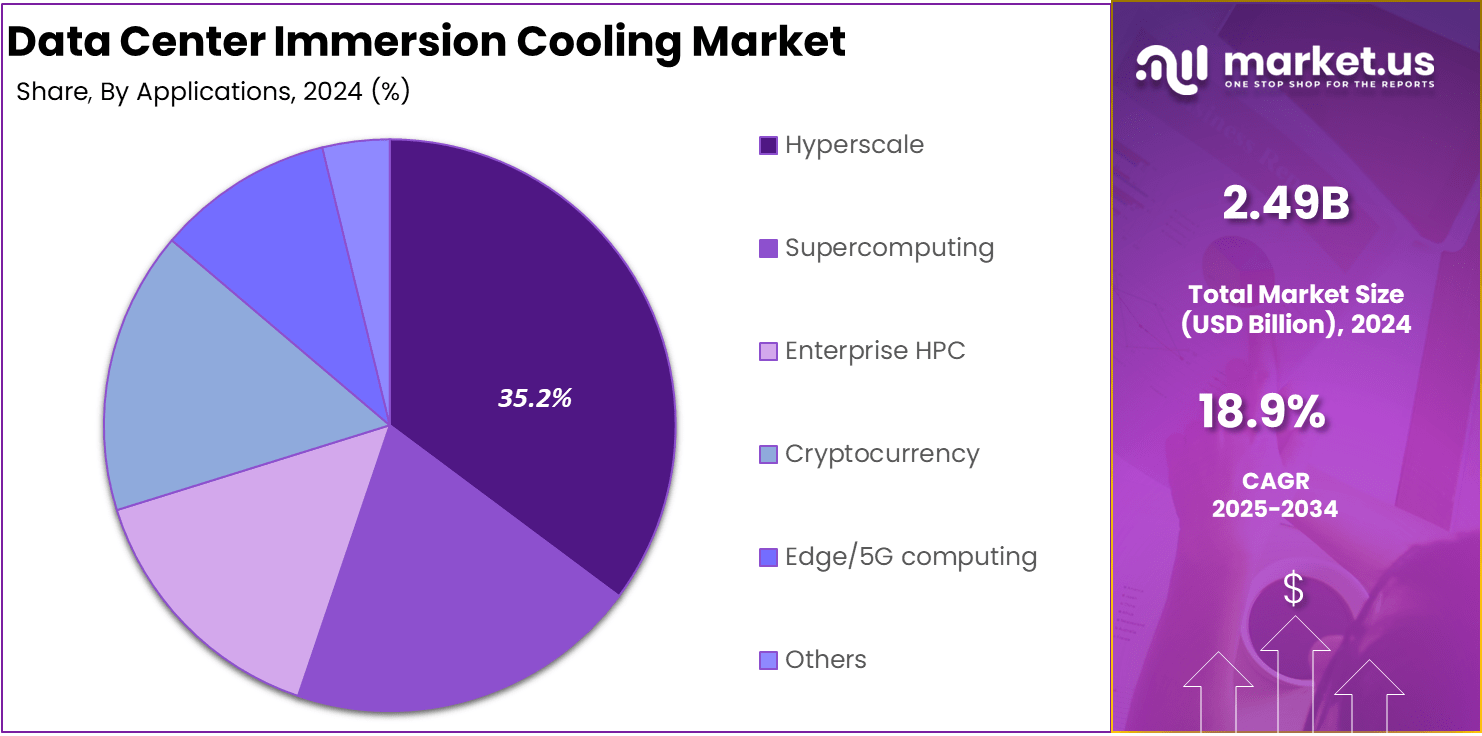

- The Hyperscale segment held 35.2%, highlighting the growing adoption of immersion cooling in large-scale cloud and AI-driven data centers.

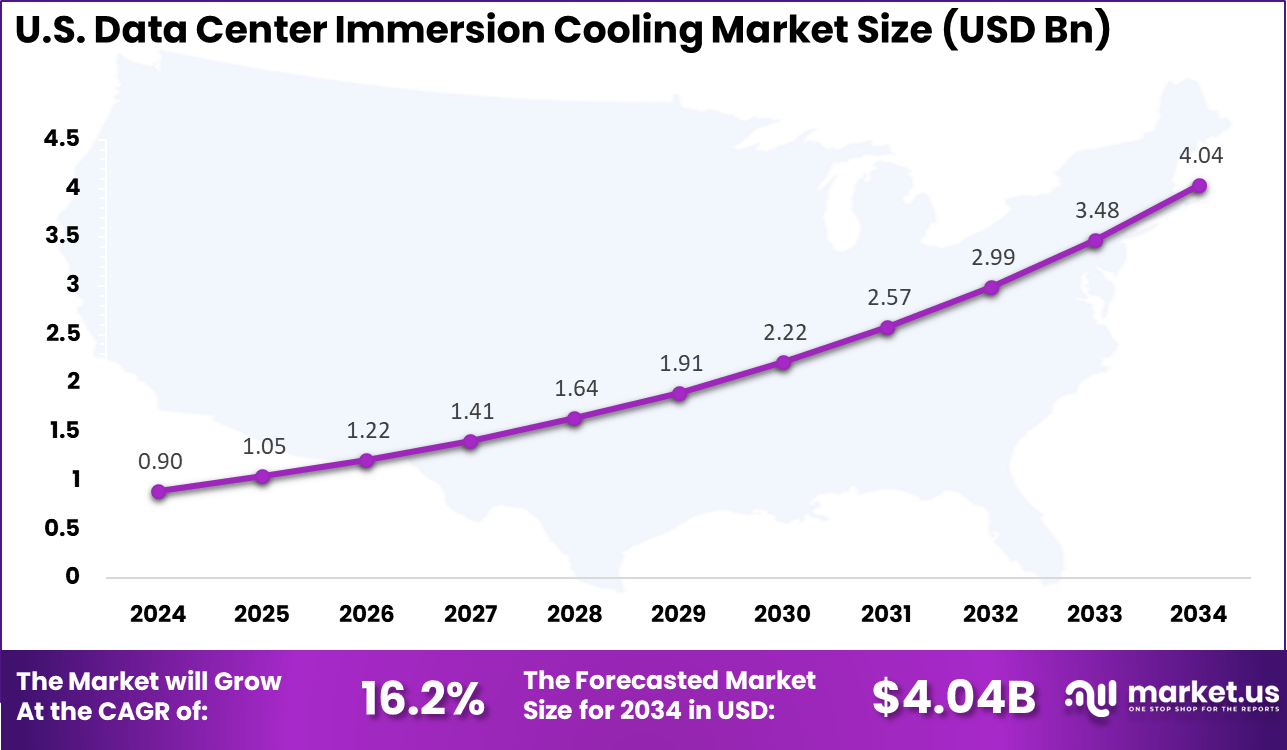

- The US market reached USD 0.90 Billion in 2024, registering a strong 16.2% CAGR, fueled by advanced data center modernization and energy-efficient cooling adoption.

- North America led globally with a 39.5% share, supported by hyperscale expansions, technological innovation, and sustainability-focused data center investments.

Role of Generative AI

Generative AI is reshaping how immersion cooling works inside data centers by giving operators better ways to track and predict temperature changes. More than 45% of advanced facilities now use AI algorithms for live diagnostics and automatic adjustments, helping to reduce unexpected outages and improve the reliability of heavy workloads running nonstop.

These smart systems allow technicians to focus on more important tasks since AI can monitor equipment health and fine-tune cooling on its own, making daily operations less stressful. The adoption of generative AI has also led to noticeable cost savings, with several facilities reporting a 30% drop in operational expenses compared to older cooling methods.

The ability for AI to learn from data patterns and automatically optimize fluid flow means fewer mistakes and calmer, steadier performance for high-end processors. This new approach is setting a higher bar for what modern data centers can achieve in efficiency.

Investment and Business Benefits

There is rich investment potential in dielectric fluid supply, modular and scalable immersion units, and retrofit solutions for older data centers. Growth is [accelerated by the rise of edge computing and AI], which boosts demand for portable, compact systems. Investors also see value in funding R&D for new cooling fluids, enhanced automation, and solutions that better address environmental and regulatory benchmarks.

Adopting immersion cooling unlocks real business advantages: energy consumption for cooling drops dramatically, sometimes by as much as 90% compared to traditional systems. Operators report improved computing performance, higher rack densities (sometimes up to 300 kW per rack), and lower total cost of ownership. The increased durability means less frequent hardware replacements, reducing both capital and maintenance expenses.

U.S. Market Size

The market for Data Center Immersion Cooling within the U.S. is growing tremendously and is currently valued at USD 0.90 billion, the market has a projected CAGR of 0.98%. This growth is driven primarily by the increasing demand for efficient thermal management of high-performance computing and AI workloads.

As data centers expand in size and density, traditional air cooling methods struggle to keep up, making immersion cooling technologies more attractive for their superior heat dissipation and energy savings. Additionally, sustainability pressures and regulatory support for energy-efficient solutions further drive market adoption in the U.S.

For instance, in January 2025, Green Revolution Cooling (GRC) Inc., a U.S.-based leader in immersion cooling technology, secured a significant investment from Samsung Ventures. This funding and strategic partnership underscore the U.S. dominance in the Data Center Immersion Cooling market by accelerating GRC’s innovation and global expansion efforts.

In 2024, North America held a dominant market position in the Global Data Center Immersion Cooling Market, capturing more than a 39.5% share, holding USD 0.98 billion in revenue. This leadership reflects the region’s well-established IT and telecommunications infrastructure, combined with a high concentration of hyperscale cloud operators and large enterprise data centers.

The growing demand for efficient cooling driven by energy-intensive AI and high-performance computing workloads, alongside governmental support for sustainable and energy-efficient technologies, underpins this dominance. Robust investments and technological innovation further accelerate adoption, positioning North America at the forefront of immersion cooling market growth globally.

For instance, in June 2025, Samsung C&T E&C Group formed a strategic partnership with Green Revolution Cooling to promote immersion cooling adoption in North American data centers, reflecting regional leadership in sustainable, advanced cooling infrastructure.

Component Analysis

In 2024, The Solutions segment held a dominant market position, capturing an 81.3% share of the Global Data Center Immersion Cooling Market. Companies are moving toward complete, integrated immersion cooling systems that offer plug-and-play functionality and easy compatibility with various data center designs. These comprehensive solutions help data center teams reduce set-up time and lower operational complexity, which matters greatly in large or rapidly expanding facilities.

Integrated solutions are also chosen because they help minimize the potential for mistakes and reduce long-term maintenance demands. With validated and customizable performance, these systems help operators feel more confident that their data centers will achieve consistent cooling and uninterrupted uptime.

For Instance, in July 2025, Submer Technologies deployed modular immersion cooling pods at Stellium Datacenters in the UK, making single-phase solutions more accessible for high-density applications in Europe and strengthening their containerized product portfolio.

Cooling Technique Analysis

In 2024, the Single Phase Cooling segment held a dominant market position, capturing a 62.8% share of the Global Data Center Immersion Cooling Market. Operators prefer this method for its reliable temperature management and straightforward mechanisms.

Single-phase systems are easy to install and manage since they don’t require additional handling for vapor or complex fluid cycles, helping data centers maintain stable operations. Its popularity is due to the way it fits with existing architectural layouts and supports effortless expansion for growing server needs. The technique appeals particularly to sites aiming for affordable, incremental upgrades and enhances cost control as workloads rise.

For instance, in June 2025, LiquidStack unveiled its latest single-phase immersion cooling offering called DataTank, engineered for rapid retrofitting in both existing and greenfield high-performance computing facilities. The solution improves cooling efficiency for AI and hyperscale tasks.

Cooling Fluid Analysis

In 2024, The Mineral Oil segment held a dominant market position, capturing a 45.1% share of the Global Data Center Immersion Cooling Market. This dominance is due to its excellent electrical insulation and heat transfer properties. It safely submerges sensitive electronics without causing corrosion or damage. Many data center operators use mineral oil because of its reliability in maintaining even temperature distribution and protecting hardware from common issues like dust and fan failure.

Its adoption is especially strong in hyperscale and enterprise data centers that require robust and consistent cooling over extended periods. Mineral oil also supports sustainability goals by reducing the need for more energy-intensive air cooling methods.

For Instance, in June 2025, Green Revolution Cooling’s production deployment at Shell was recognized as a finalist in a North American data center project, highlighting the successful commercial application of mineral oil-based immersion cooling.

Organization Size Analysis

In 2024, The Large Enterprises segment held a dominant market position, capturing a 75.9% share of the Global Data Center Immersion Cooling Market. These organizations manage massive data loads and require continuous uptime for their digital services. Choosing immersion cooling helps large businesses maximize hardware density and efficiency while also controlling operating costs through reduced energy consumption.

Because of their scale, large enterprises often lead market trends, implementing innovative cooling solutions before others. Such organizations have the resources to test and validate new technologies, and their widespread adoption helps set standards that the rest of the industry often follows.

For Instance, in October 2025, Intel Corporation continued testing immersion cooling platforms with GRC for server installations in large enterprise environments. The collaboration supports rapid scaling of AI-focused services while maintaining reliable operations.

Application Analysis

In 2024, The Hyperscale segment held a dominant market position, capturing a 35.2% share of the Global Data Center Immersion Cooling Market. These vast facilities rely heavily on immersion cooling to handle rapid increases in heat produced by artificial intelligence, big data, and other intense workloads. Their cooling requirements drive the adoption of robust and scalable immersion systems.

Operators managing hyperscale sites see immersion cooling as a practical way to extend their infrastructure and reduce energy usage. They also tend to lead in experimenting with and deploying cutting-edge cooling strategies due to ongoing demand for higher server performance and energy savings.

For Instance, in September 2025, LiquidStack introduced new scalable immersion cooling solutions tailored for hyperscale operators, enhancing thermal management capabilities for next-generation cloud and AI workloads.

Emerging trends

Recent trends point to a shift toward more modular cooling setups, with over 60% of upgrades in North America favoring flexible tanks that can be installed quickly. This change means firms can scale up computing power with less hassle, choosing units and layouts that suit their needs instead of sticking to rigid designs.

The modular style is attracting more mid-size companies that want a smooth path to building bigger data centers without major construction delays. Sustainable cooling fluids are rising in popularity, with biodegradable options now used by around 50% of new facilities this year.

These greener fluids reduce health risks for workers and make it easier to follow local safety rules. The growing interest in environmentally friendly solutions shows how industry priorities are changing, with more attention on safety and compliance in cooling technology.

Growth Factors

Growth is accelerating as power density surges in next-gen processors. Deployments of advanced GPU clusters, especially for generative AI workloads, are up by roughly 35% in immersion-cooled settings because traditional air systems struggle under the heat loads involved. Operators are finding it easier to scale compute resources with immersion platforms, reducing constraints tied to air-cooling hardware.

At the same time, concern over energy bills has made immersion cooling a preferred solution for directors looking to lower the cost per kilowatt. Recent operating data highlights a net energy savings of about 40% in immersion-cooled configurations for AI clusters compared to legacy cooling, making adoption both a financial and operational win.

Key Market Segments

By Component

- Solution

- Cooling fluids

- Cooling racks/modules

- Filters

- Pumps

- Heat exchangers

- Others

- Service

- Installation & maintenance

- Training & consulting

By Cooling Technique

- Single-phase cooling

- Two-phase cooling

By Cooling Fluid

- Mineral oil

- Synthetic fluid

- Fluorocarbons-based fluid

By Organization Size

- SME

- Large enterprises

By Application

- Hyperscale

- Supercomputing

- Enterprise HPC

- Cryptocurrency

- Edge/5G computing

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising Demand for Energy-Efficient Cooling

The market is increasingly driven by the urgent need for energy-efficient cooling solutions. As data centers face rising computational demands, traditional air cooling struggles to handle high heat outputs effectively. Immersion cooling, which submerges servers in special liquids, delivers superior heat management and significantly lowers energy consumption compared to air cooling.

This cuts operational costs and also helps data centers align with sustainability goals by reducing their carbon footprint. This push for energy efficiency is critical as global digital activities and AI workloads surge, increasing power density in modern data centers.

Operators adopt immersion cooling to achieve effective thermal management that supports higher performance while controlling electricity usage. The result is a forward-looking cooling technology that responds to both economic and environmental pressures facing the data center industry.

For instance, in June 2025, Green Revolution Cooling secured additional investments, including a strategic partnership with Samsung C&T E&C Group. This enabled GRC to meet the rising market demand for single-phase immersion cooling solutions, underpinning the driver of energy efficiency as data centers worldwide seek better cooling technologies.

Restraint

High Initial Capital Investment

A major challenge restraining the growth of immersion cooling adoption is the substantial initial investment required. Setting up an immersion cooling system involves significant changes to data center infrastructure, including purchasing specialized hardware and modifying existing layouts. These high upfront costs can deter many data centers, especially smaller ones, from transitioning to this technology despite its long-term benefits.

Further complications arise because immersion cooling demands compatible equipment and skilled technical expertise for installation and maintenance, increasing operational complexity. This financial and logistical barrier makes some operators hesitant to switch from familiar air cooling systems until the ROI from energy and maintenance savings becomes clear enough to justify the expenditure.

For instance, in September 2025, Submer expanded into the Indian market with plans for a local manufacturing hub and partnerships to integrate its liquid cooling solutions. However, this expansion highlights the substantial infrastructure overhaul needed to adopt immersion cooling in regions with legacy systems, illustrating the restraint posed by high initial capital and integration complexity despite promising long-term benefits.

Opportunities

Expansion in Hyperscale and Edge Data Centers

The rapid expansion of hyperscale and edge data centers presents an exciting opportunity for immersion cooling. These data centers require dense computing power within limited physical spaces, making traditional cooling methods inefficient. Immersion cooling offers a compact, highly effective cooling solution that allows operators to pack more servers safely and boost performance without thermal risks.

Additionally, as digital transformation accelerates globally, the proliferation of cloud computing, 5G, and AI workloads is fueling demand for new, innovative cooling technologies. Immersion cooling providers can capitalize on this trend by offering tailored solutions for next-generation data centers built to handle extreme workloads in energy-conscious ways. This market segment promises substantial growth and technological advancement.

For instance, in March 2025, LiquidStack opened a second manufacturing facility in Texas to scale production of its advanced single-phase liquid cooling solutions. This investment reflects the opportunity presented by rapid hyperscale and AI-driven data center growth, enabling faster delivery of immersion cooling technologies tailored for high-performance workloads, supporting the market’s expansion in hyperscale and edge data centers.

Challenges

Coolant Fluid Safety and Environmental Concerns

While immersion cooling has clear thermal advantages, there are challenges related to the safety and environmental impact of the liquids used. These dielectric fluids must be non-conductive and thermally efficient, but concerns remain about their toxicity, biodegradability, and disposal. Some fluids may pose risks to the environment, prompting stricter regulations and cautious adoption by operators.

Ensuring long-term compatibility with hardware and maintaining fluid integrity over time are also significant technical hurdles. Addressing these issues through ongoing research and regulation compliance is critical to building trust and enabling broader acceptance of immersion cooling as a sustainable data center cooling solution.

For instance, in January 2025, Iceotope enhanced its liquid cooling offerings with energy-efficient server designs targeting AI workloads. As it scales, the company must address challenges around coolant fluid safety and environmental impact, focusing on sustainable and non-toxic dielectric fluids to satisfy regulatory and market demands, which remains a critical hurdle for broader adoption.

Key Players Analysis

The Data Center Immersion Cooling Market is led by technology innovators such as Green Revolution Cooling (GRC) Inc., Submer Technologies SL, LiquidStack Inc., and Asperitas. These companies specialize in single-phase and two-phase immersion cooling systems designed to reduce energy consumption and improve thermal efficiency in high-performance data centers.

Major data center and hardware companies including Dell Technologies, Intel Corporation, NVIDIA Corporation, Schneider Electric SE, and Vertiv Holdings Co. are integrating immersion cooling into server architecture and infrastructure design. Their strategic focus lies in developing optimized server racks, power distribution, and advanced monitoring systems that enhance performance density while reducing total energy and water usage.

Supporting contributors such as Midas Green Technologies, LiquidCool Solutions, Iceotope Technologies Ltd., DCX Ltd., Asetek A/S, and Hypertec Group, along with fluid and material specialists including Shell plc (Immersion Cooling Fluids), Cargill Inc. (NatureCool), 3M Company, Chemours Company, and Molex LLC, play a crucial role in advancing dielectric fluid innovation and component compatibility.

Top Key Players in the Market

- Green Revolution Cooling (GRC) Inc.

- Submer Technologies SL

- LiquidStack Inc.

- Asperitas

- LiquidCool Solutions

- Midas Green Technologies

- Iceotope Technologies Ltd.

- Wiwynn Corporation

- DCX Ltd.

- Dell Technologies

- Intel Corporation

- Schneider Electric SE

- Vertiv Holdings Co.

- NVIDIA Corporation

- Asetek A/S

- Shell plc (Immersion Cooling Fluids)

- Cargill Inc. (NatureCool)

- 3M Company

- Chemours Company

- Molex LLC

- Hypertec Group

- Alibaba Cloud

- Tencent Cloud

- Others

Recent Developments

- In June 2025, Green Revolution Cooling (GRC) Inc. secured additional investment with Samsung Ventures joining major shareholders and Samsung C&T forming a strategic partnership to support global growth. GRC continues to lead in single-phase immersion cooling technology for data centers, focusing on lowering the total cost of ownership and expanding production and innovation.

- In March 2025, LiquidStack Inc. opened a second manufacturing facility in Carrollton, Texas, expanding its production capacity and adding R&D and training capabilities to meet strong global demand, particularly driven by increased AI workloads in data centers. Their CDU-1MW liquid cooling product was recognized on NVIDIA’s Recommended Vendor List.

Report Scope

Report Features Description Market Value (2024) USD 2.49 Bn Forecast Revenue (2034) USD 14.06 Bn CAGR(2025-2034) 18.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Component (Solution, Service), By Cooling Technique (Single-phase cooling, Two-phase cooling), By Cooling Fluid (Mineral oil, Synthetic fluid, Fluorocarbons-based fluid), By Organization Size (SME, Large enterprises), By Application (Hyperscale, Supercomputing, Enterprise HPC, Cryptocurrency, Edge/5G computing, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Green Revolution Cooling (GRC) Inc., Submer Technologies SL, LiquidStack Inc., Asperitas, LiquidCool Solutions, Midas Green Technologies, Iceotope Technologies Ltd., Wiwynn Corporation, DCX Ltd., Dell Technologies, Intel Corporation, Schneider Electric SE, Vertiv Holdings Co., NVIDIA Corporation, Asetek A/S, Shell plc (Immersion Cooling Fluids), Cargill Inc. (NatureCool), 3M Company, Chemours Company, Molex LLC, Hypertec Group, Alibaba Cloud, Tencent Cloud, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to choose from: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users, Printable PDF)  Data Center Immersion Cooling MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Data Center Immersion Cooling MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Green Revolution Cooling (GRC) Inc.

- Submer Technologies SL

- LiquidStack Inc.

- Asperitas

- LiquidCool Solutions

- Midas Green Technologies

- Iceotope Technologies Ltd.

- Wiwynn Corporation

- DCX Ltd.

- Dell Technologies

- Intel Corporation

- Schneider Electric SE

- Vertiv Holdings Co.

- NVIDIA Corporation

- Asetek A/S

- Shell plc (Immersion Cooling Fluids)

- Cargill Inc. (NatureCool)

- 3M Company

- Chemours Company

- Molex LLC

- Hypertec Group

- Alibaba Cloud

- Tencent Cloud

- Others