Global Dairy-Free Yogurt Market Size, Share Analysis Report By Product Type (Soy, Coconut, Rice, Almonds, Others), By Category (Conventional, Organic), By Distribution Channel (Store-Based, Non-Store-Based) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162405

- Number of Pages: 292

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

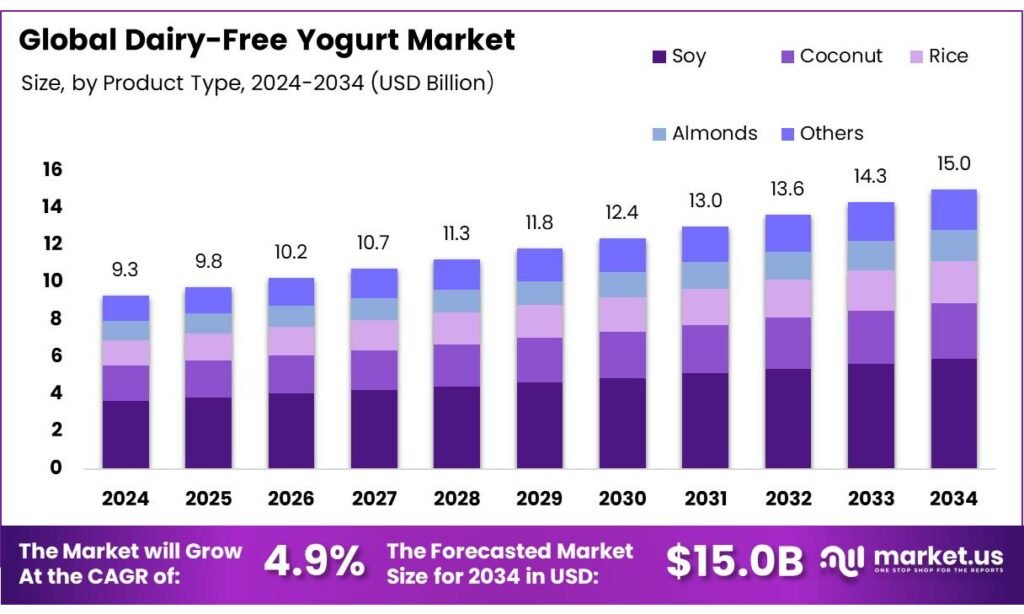

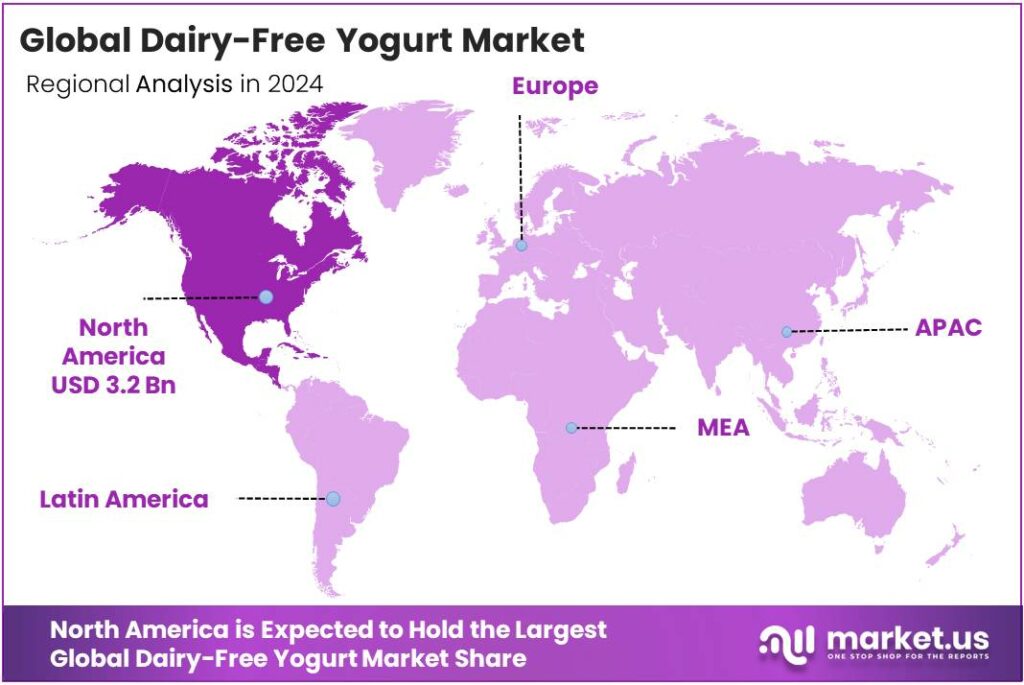

The Global Dairy-Free Yogurt Market size is expected to be worth around USD 15.0 Billion by 2034, from USD 9.3 Billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 34.8% share, holding USD 3.2 Billion in revenue.

Dairy-free yogurt—typically cultured from soy, oats, almonds, coconut, or peas—sits at the intersection of health, sustainability, and regulatory clarity. Health demand is structural: the U.S. National Institute of Diabetes and Digestive and Kidney Diseases estimates about 68% of the world’s population has lactose malabsorption, a key driver for non-dairy fermented alternatives in staple categories like yogurt.

In the U.S., the FDA amended the yogurt Standard of Identity to require a pH ≤ 4.6, clarifying safety parameters for products in this space and their manufacturing processes. The agency has also issued draft guidance for labeling plant-based alternatives, shaping how companies describe composition and nutrition on pack—relevant to cultured non-dairy products marketed alongside dairy.

On the supply side, Europe is actively addressing plant-protein availability: the EU reports a plant-protein deficit requiring 19 million tonnes of crude protein imports, while investing €644 million (2015-2024) across 125 R&I projects to bolster legumes and alternative proteins—inputs that underpin dairy-free yogurt bases. India is simultaneously scaling processing capacity via the Production Linked Incentive (PLI) scheme for food processing, with a ₹10,900 crore outlay (2021–27), catalyzing domestic capability for oats, soy, and nut processing into cultured products.

Sustainability is a primary driving factor. The FAO estimates livestock supply chains emit 7.1 Gt CO₂e; within that, cattle contribute ≈3.8 Gt CO₂e, and milk accounts for ~30% of livestock emissions—spotlighting fermentation-based non-dairy options as practical decarbonization levers in everyday diets. From the energy-sector vantage point, the IEA notes methane has driven ~30% of warming; agriculture is the largest source, with the energy sector at ~130 Mt in 2023—underscoring why shifting portions of dairy demand to plant-based cultured products can complement methane-abatement strategies.

Life-cycle assessments collated by Our World in Data show cow’s milk causes ~3× the GHG emissions and ~10× the land use per liter versus plant-based milks, a pattern broadly applicable to dairy analogs like yogurt when bases and processes are comparable.

Key Takeaways

- Dairy-Free Yogurt Market size is expected to be worth around USD 15.0 Billion by 2034, from USD 9.3 Billion in 2024, growing at a CAGR of 4.9%.

- Soy held a dominant market position, capturing more than a 39.4% share of the dairy-free yogurt market.

- Conventional held a dominant market position, capturing more than a 79.1% share of the dairy-free yogurt market.

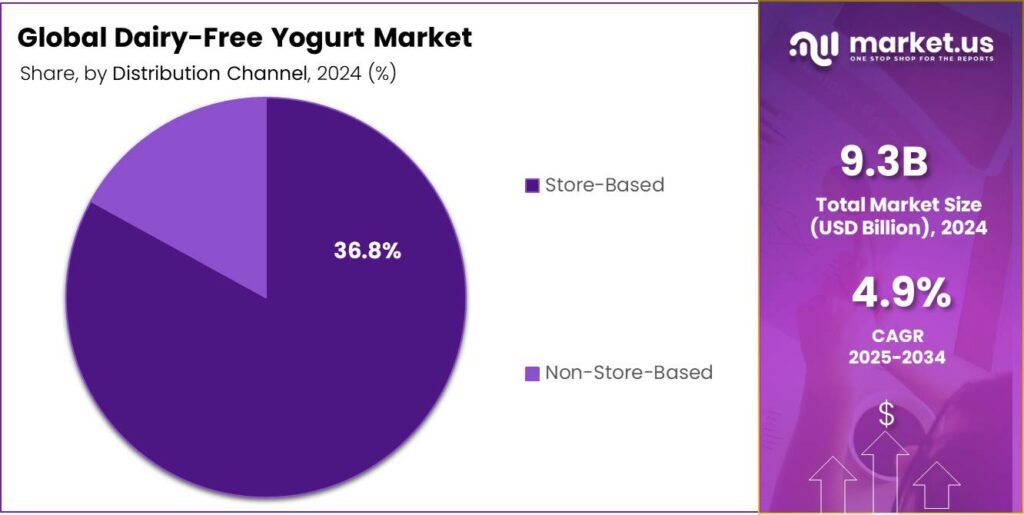

- Store-Based held a dominant market position, capturing more than an 83.2% share of the dairy-free yogurt market.

- North America emerged as the dominant region in the dairy-free yogurt market, accounting for 34.8% of the global market share, valued at approximately USD 3.2 billion.

By Product Type Analysis

Soy-based Dairy-Free Yogurt dominates with 39.4% market share in 2024

In 2024, Soy held a dominant market position, capturing more than a 39.4% share of the dairy-free yogurt market. This leadership can be attributed to its widespread consumer acceptance, affordability, and nutritional benefits, including high protein content and essential amino acids. The popularity of soy-based yogurts has been further strengthened by growing awareness around lactose intolerance and the rising trend of plant-based diets. Consumers favor soy as it provides a creamy texture and familiar taste, closely resembling traditional dairy yogurt, making it an easy transition for those switching to non-dairy alternatives.

The soy segment is expected to maintain its leading position as manufacturers continue to innovate with fortified and flavored variants, catering to health-conscious consumers seeking functional and convenient food options. The segment’s sustained dominance is also supported by increased availability across supermarkets, health stores, and online retail platforms, ensuring wider accessibility and consistent consumer adoption.

By Category Analysis

Conventional Dairy-Free Yogurt leads with 79.1% market share in 2024

In 2024, Conventional held a dominant market position, capturing more than a 79.1% share of the dairy-free yogurt market. This strong presence is driven by its widespread acceptance among consumers who prefer familiar flavors and textures without added specialty ingredients. Conventional dairy-free yogurts offer simplicity, affordability, and easy availability, making them the preferred choice for everyday consumption.

Conventional segment is expected to retain its leadership as it continues to appeal to a broad audience seeking convenient, ready-to-eat plant-based options. Its dominance is further supported by extensive distribution across retail chains, supermarkets, and online platforms, ensuring that consumers have easy access to these products while maintaining consistent demand across regions.

By Distribution Channel Analysis

Store-Based distribution dominates with 83.2% market share in 2024

In 2024, Store-Based held a dominant market position, capturing more than an 83.2% share of the dairy-free yogurt market. This segment’s leadership is largely due to the convenience and reliability of physical retail outlets, including supermarkets, hypermarkets, and specialty grocery stores, where consumers can easily access a variety of dairy-free yogurt options. Shoppers value the ability to examine product labels, check freshness, and compare flavors and brands before making a purchase.

Store-based distribution is expected to maintain its dominance as retailers continue to expand shelf space for plant-based products and offer promotional campaigns to attract health-conscious and vegan consumers. The segment’s stronghold is further reinforced by consistent foot traffic and the trust associated with established brick-and-mortar stores, ensuring continued preference over alternative distribution channels.

Key Market Segments

By Product Type

- Soy

- Coconut

- Rice

- Almonds

- Others

By Category

- Conventional

- Organic

By Distribution Channel

- Store-Based

- Non-Store-Based

Emerging Trends

Ingredient Innovation & Label Simplicity in Dairy-Free Yogurt

A major trend in the dairy-free yogurt category is the growing emphasis on cleaner ingredient lists paired with bold formulation innovation. Consumers are increasingly scrutinising what goes into their yogurts, and brands are responding by simplifying labels, improving textures, and introducing new plant-based bases. A recent overview by Good Food Institute (GFI) notes that in 2024, plant-based yogurt accounted for 3.5% of total yogurt sales in U.S. retail and over 17% of yogurt sales in the natural channel — although unit sales were down 4% while dollar sales rose 1%.

Another sub-trend tied to this innovation is transparency and consumer education. As the plant-based alternative space matures, consumers who might be motivated by taste, digestive comfort, or sustainability want to know what their products contain. For example, the GFI report observed that although only 6% of U.S. households bought plant-based yogurt in 2024, repeat purchase rates improved from 54% in 2023 to 58% in 2024 — suggesting better product-market fit through improved formulations.

On the regulatory side, government and standards bodies are also aligning to support clarity in this category. While not always specific to yogurt, regulators like Food Safety and Standards Authority of India (FSSAI) in India have formalised vegan food regulations and defined official labelling for “vegan” products (2022), which helps non-dairy yogurt makers communicate authentically to consumers. Such frameworks build trust in these alternatives among mainstream shoppers.

The shift is distinctly human: many people who once accepted dairy by default are now reading labels, seeking grains or nuts they recognise, avoiding long chemical-laden ingredient lists, and expecting dairy-free yogurts to deliver not just “okay” but “as good as or better” than dairy. Early adopters were drawn primarily by vegan or dairy-free positioning, but today the net broader audience includes digestively sensitive shoppers, sustainability-minded consumers, and taste- obsessed millennials and Gen Z — and they’re more demanding.

Drivers

Widespread Lactose Intolerance and Digestive Sensitivity

One of the most profound drivers behind the growth of dairy-free yogurt is the large and growing number of people who cannot comfortably digest traditional dairy due to lactose intolerance. According to epidemiological studies, roughly 70% of the world’s adult population has some degree of lactose malabsorption. In simpler terms, this means at least 7 out of every 10 adults are, to some extent, challenged when it comes to consuming standard milk products.

In practical terms, this widespread digestive limitation creates a meaningful opportunity for dairy-free yogurt alternatives. For someone who experiences bloating, gas, or discomfort after eating standard yogurt, a plant-based yogurt made from almond, oat, soy, or pea offers a tangible solution. The Good Food Institute reported that in the U.S. in 2024, four in ten households purchased plant-based milk and 76% of those buyers made repeat purchases—indicating not only initial trial but ongoing acceptance. While this data is about milk, it strongly correlates with the broader non-dairy culture and the acceptance of alternatives like yogurt.

Lactose intolerance tends to be more prevalent in certain populations—such as up to 90% of East Asian adults potentially experiencing significant intolerance symptoms — the geographic and demographic tailwinds for dairy-free yogurt are clear. In countries where lactose intolerance is endemic, consumers seek alternatives not just for ethical or environmental reasons, but simply because they feel better. That human comfort dimension is often under-emphasized in industry analyses. When someone finds they can enjoy a breakfast, a smoothie bowl or a snack without discomfort, loyalty builds.

Government and regulatory frameworks also support this trend. For example, health authorities such as the U.S. Food & Drug Administration (FDA) and the Food Safety and Standards Authority of India (FSSAI) are increasingly recognising, regulating and standardising plant-based and dairy-alternative products, thereby increasing consumer trust and reducing risk for manufacturers entering this space. The fact that regulatory bodies are adapting to the reality of widespread intolerance and shifting consumer demand signals that this is no niche segment, but one anchored in lived experience and health-driven consumption.

Restraints

Higher Production and Unit Costs

One of the significant restraints facing the dairy-free yogurt category is the elevated production cost compared to conventional dairy yogurts. This cost pressure arises from a number of converging factors — from raw materials and formulation complexity, through processing and sensory optimisation, to regulatory and labelling considerations — all of which narrow the margin for brands and lift the shelf price for consumers. Understanding this cost burden helps explain why dairy-free yogurts are often priced at a premium and why wider adoption can be slower.

Plant-based ingredients used in dairy-free yogurts — such as almond, oat, pea, soy or coconut bases — often cost more per unit than conventional milk protein. In the review “A Novel Approach to Structure Plant-Based Yogurts” authors note that manufacturing plant-based yogurts requires additional steps, specialised equipment and tailored formulations to mimic the creaminess and texture of traditional yoghurt. Meanwhile, in broader plant-based dairy alternatives the pricing gap is already visible: the study “Dairy and Plant‐Based Milks” reveals that in the U.S., for plant-based milks the average retail unit price was ~20% higher than for cow’s milk. While this statistic refers to milks rather than yogurts, it clearly signals the cost challenge which translates into yogurt analogues too.

Furthermore, regulatory and labelling complexity adds another layer of overhead. For example, the U.S. Food & Drug Administration and other authorities are refining standards around what may be labelled “yogurt” and how plant-based analogues must present themselves. This compliance drives legal, formulation, and marketing expenses. Because many consumers are price-sensitive, especially in markets with lower disposable incomes, a higher shelf price becomes a real barrier to adoption. As noted in the literature, the higher cost of plant-based milks made them less accessible to lower-income groups — a parallel which likely holds for yogurt analogues.

Opportunity

Policy-Backed Protein Diversification in Everyday Eating

A big growth opening for dairy-free yogurt is the momentum behind “protein diversification” in public policy and food systems. Governments and agencies are nudging diets toward more plant-based proteins for health, supply security, and climate reasons. That shift creates real, repeat demand for cultured non-dairy options in breakfasts, school meals, and workplace canteens—places where yogurt is a familiar, convenient format.

Health need is broad and persistent. The U.S. National Institute of Diabetes and Digestive and Kidney Diseases estimates about 68% of the world’s population has lactose malabsorption. In Asia and Africa, it is “most people,” while it’s ~36% in the U.S.. When that many people struggle with lactose, offering a plant-based yogurt is not niche; it’s inclusion. It also reduces the quiet daily trade-off many consumers make between comfort and taste.

Supply security is another practical tailwind. The European Commission notes the EU still imports ~19 million tonnes of crude plant protein each year, but is actively funding more local protein. Since 2015, the EU has invested €644 million across 125 R&I projects to develop competitive legume and plant-protein chains. It also forecasts ~7.2 million tonnes of crude protein from EU protein-rich crops in 2023/24, up sharply over 15 years. More local soy, pea, oat, and pulse supply means steadier input streams for non-dairy yogurt bases—and, ultimately, better prices and availability for consumers.

Climate policy is an equally strong driver. The FAO estimates livestock supply chains emit ~7.1 Gt CO₂e, roughly 14.5% of global anthropogenic GHGs. Dairy (milk from cattle) is a major slice of that footprint. As food companies and public buyers publish Scope-3 targets, they look for “everyday” swaps that keep nutrition and familiarity while cutting emissions. A plant-based yogurt at breakfast or as a snack can be one of those swaps.

Regional Insights

North America leads Dairy-Free Yogurt Market with 34.8% share in 2024

In 2024, North America emerged as the dominant region in the dairy-free yogurt market, accounting for 34.8% of the global market share, valued at approximately USD 3.2 billion. This robust market presence is attributed to several factors, including heightened consumer awareness of plant-based diets, increasing lactose intolerance, and a growing preference for sustainable and allergen-free food options. The United States and Canada are at the forefront of this trend, with a significant number of consumers actively seeking dairy alternatives.

The region’s market growth is further bolstered by the presence of major industry players and a well-established retail infrastructure. Companies such as Chobani and Danone have expanded their product offerings to include a variety of dairy-free yogurt options, catering to diverse consumer preferences. For instance, Chobani announced a $1.2 billion investment to establish its third U.S. dairy processing plant in New York, aiming to meet the rising demand for plant-based products.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Danone is a global leader in the dairy-free yogurt market, holding a significant share in North America. The company offers a range of plant-based yogurt products under brands like Alpro and Silk. Danone’s commitment to health and sustainability is evident in its product formulations, which emphasize clean ingredients and nutritional benefits. The company’s strategic focus on plant-based innovations positions it as a key player in the growing dairy-free segment.

Chobani has rapidly expanded its presence in the dairy-free yogurt market, capturing approximately 20% of the U.S. yogurt market. The company’s plant-based offerings, such as oat-based and almond-based yogurts, cater to the increasing demand for dairy alternatives. Chobani’s commitment to innovation and quality has solidified its position as a leading brand in the dairy-free segment.

Silk, a brand under Danone, is renowned for its dairy-free yogurt alternatives made from almond and soy bases. The brand emphasizes non-GMO ingredients and offers a variety of flavors to cater to diverse consumer preferences. Silk’s products are widely available in North America, contributing to the brand’s strong presence in the dairy-free yogurt market.

Top Key Players Outlook

- Danone

- Chobani

- Silk

- So Delicious

- Kite Hill

- Forager Project

- The Coconut Collaborative

- Almond Breeze Yogurt

- Good Karma

Recent Industry Developments

In 2025 Kite Hill reported that a survey of 1,004 U.S. consumers found 83% of Gen Z tried dairy-free products a few times a month or more, and 68% of all consumers said they were willing to try dairy-free options in 2025.

In 2024, Silk helped drive the group’s plant-based/dairy-alternative growth by being part of the “Dairy & Plant-Based” segment, in which Danone reported €27.4 billion in total group sales and a like-for-like growth of +4.3% for the year.

Report Scope

Report Features Description Market Value (2024) USD 9.3 Bn Forecast Revenue (2034) USD 15.0 Bn CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Soy, Coconut, Rice, Almonds, Others), By Category (Conventional, Organic), By Distribution Channel (Store-Based, Non-Store-Based) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Danone, Chobani, Silk, So Delicious, Kite Hill, Forager Project, The Coconut Collaborative, Almond Breeze Yogurt, Good Karma Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Danone

- Chobani

- Silk

- So Delicious

- Kite Hill

- Forager Project

- The Coconut Collaborative

- Almond Breeze Yogurt

- Good Karma