Global Curcumin Market By Application (Pharmaceutical, Food, Cosmetics and Other Applications), By Nature (Organic and Conventional), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2022-2032

- Published date: Nov. 2024

- Report ID: 20308

- Number of Pages: 355

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

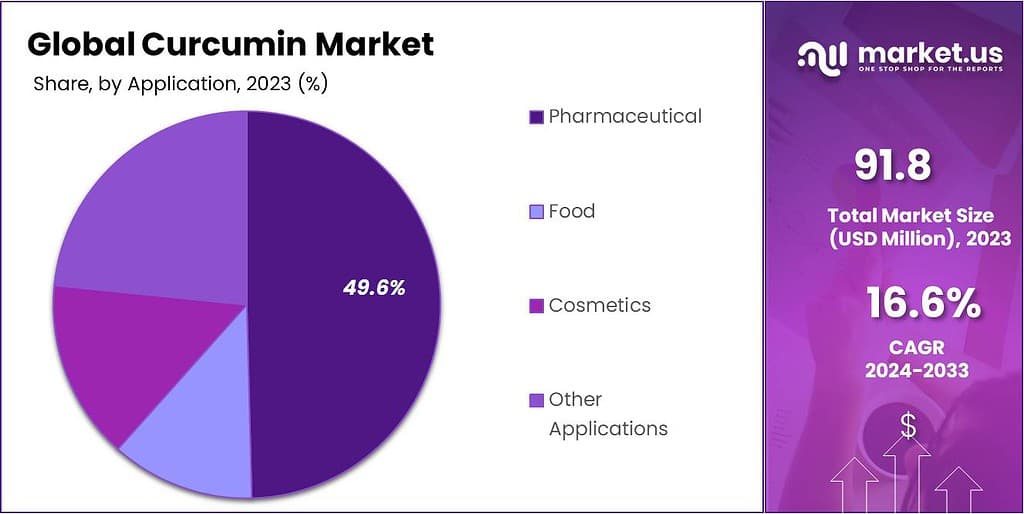

The global curcumin market size is expected to be worth around USD 426.4 Million by 2033, from USD 91.8 Million in 2023, growing at a CAGR of 16.6% during the forecast period from 2023 to 2033.

The product’s inherent properties, such as its anti-cancer and antioxidant properties, are responsible for this increase. It’s also used in skin-care applications like the precluding of ringworms. Curcumin can be found in ginger and turmeric. Turmeric is a widely consumed ingredient in Southeast Asian countries, both in food and medical products.

Note: Actual Numbers Might Vary In the Final Report

Key Takeaways

- Market Growth Projection: Expected market size by 2033: USD 426.4 Million Significant increase from 2023’s USD 91.8 Million at a CAGR of 16.6%.

- Applications Driving Market Demand: Pharmaceuticals: Accounted for over 49.6% of the market in 2023 due to curcumin’s medicinal properties. Cosmetics: Growing demand for anti-inflammatory and anti-aging properties.

- Nature of Curcumin Sold: Organic: Captured 45.2% market share in 2023, appealing to consumers seeking natural, health-focused products.

- Market Drivers: Increased focus on health and natural remedies drives demand for curcumin-based supplements and products. Shifting dietary preferences towards plant-based options escalates the use of curcumin in innovative foods. The beauty industry leverages curcumin’s properties, leading to new skincare and cosmetic products.

- Challenges & Restraints: Competition from cheaper alternatives impact curcumin’s market demand. The strain on the turmeric supply chain due to high demand might compromise product quality. Heavy reliance on specific regions for turmeric cultivation poses supply chain vulnerabilities.

- Opportunities: Rising health consciousness creates a growing interest in natural solutions like curcumin. Innovation in food products incorporating curcumin as a health-oriented ingredient. Continued research presents opportunities for new product development in the health and medicine sectors.

- Regional Insights: Asia Pacific: Largest market share (32.6%) due to rising demand for herbal personal care products. Europe: Predicted to witness fast growth due to strong personal care & cosmetic industries. North America: Significant demand for food & nutritional supplements leveraging curcumin’s properties.

- Key Players and Developments: Leading players include Biomax Life Sciences, Synthite Industries, S V Agro Foods, and more. Recent innovations include nanotechnology-based supplements and new product launches in the health and beauty sectors.

Application analysis

In 2023, Pharmaceuticals were the powerhouse in the curcumin market, claiming over 49.6% of the share. Curcumin’s medicinal properties made it a sought-after ingredient in pharmaceuticals for its potential health benefits, driving its significant presence in this sector.

Its anti-inflammatory, anti-inflammatory, as well as antiaging properties, make it a popular cosmetic product. Exposure to UV radiation results in the formation of free radical species. These react with proteins, DNA, and fatty acids, and irritate the epidermis.

These free radicals also cause skin damage, such as hyperpigmentation and wrinkles. These effects may be diminished by by-products containing curcumin. So, brand owners in personal care and cosmetics verticals are increasingly including curcumin as an add-on.

The market will grow during the forecast period due to increased consumer awareness of the benefits of organic products, and an increase in consumer desire for organically produced products. Because of the widespread use of food additives as food ingredients, the food application segment is expected to experience the second-highest CAGR (16.0%) during the forecast period.

Note: Actual Numbers Might Vary In the Final Report

Nature analysis

In 2023, the curcumin market was divided into two main categories: Organic and Conventional. Organic curcumin, derived from turmeric grown without artificial chemicals, held about 45.2% of the market share.

This type attracted consumers interested in natural, environmentally friendly products, who believed in its potential health benefits and appreciated its sustainable production methods.

The availability of conventional products is easy and they cost much less than organic. This is why the main practice is to use them in these countries. Accordingly, the main market for conventional products is the one that will dominate in the next few years.

Кеу Маrkеt Ѕеgmеntѕ

By Application

- Pharmaceutical

- Food

- Cosmetics

- Other Applications

By Nature

- Organic

- Conventional

Drivers

People all over the world are paying more attention to their health and well-being these days. They’re looking for natural products that can help boost their immunity. Natural extracts, especially ones like turmeric, have gained a lot of attention because they’ve shown they can help with different health issues.

Turmeric, for instance, has been used in India for a long time in medicines and beauty products, and it’s still used today. Research from different organizations has also shown that curcumin, found in turmeric, has good stuff like antioxidants and anti-inflammatory properties. That’s why there’s a bigger demand for supplements and beauty products made from it.

People are also changing the way they eat. They’re getting more aware of the problems caused by eating animal-based foods, not just for their health but also for the environment. So, lots of folks are going for vegetarian options and using herbs like turmeric in their food. Turmeric extracts are becoming popular for making new and creative plant-based foods.

This big change in what people eat is a major reason why the curcumin market is growing worldwide. And because more folks want natural products, companies are spending a lot of money on creating new things like drinks that have curcumin in them. This is a big deal that’s pushing the market forward.

Restraints

One factor affecting the curcumin market growth is the availability of cheaper alternatives. These substitutes, such as mustard powder or certain chemical compounds, can serve similar purposes in food, pharmaceuticals, and dye production.

The presence of these alternatives makes it challenging for curcumin to expand in the market. This situation puts pressure on the supply chain for turmeric, as industries seek raw materials for their production.

Some manufacturers, to meet the high demand, resort to using lower-quality turmeric or adulterated dyes, impacting the overall quality of the final products. Consumer perception can change how they view brands associated with these products, slowing market expansion in affected regions.

Turmeric is widely cultivated across Asia Pacific countries such as China, India, Myanmar and Bangladesh. However, the heavy reliance of regions like America and Europe on these countries for raw material supply creates a significant dependency.

Any changes in the geopolitical scenario or supply chain disruptions in these Asian countries could strain the procurement of turmeric. This disruption could severely hinder the production of curcumin-based products, consequently impeding the market’s growth in these regions.

The interconnectedness between these cultivation countries and the regions reliant on their supply creates a vulnerability that could adversely affect the curcumin market.

Opportunities

Health Focus: As more people care about their health, there’s a rising interest in natural solutions like curcumin. This drives the demand for curcumin-based supplements and health products.

Food Innovation: People changing their diets to include more plant-based and vegetarian options create a cool opportunity for curcumin. It’s becoming popular as a natural ingredient for making healthier foods that folks want.

Beauty Products: Curcumin’s use in ancient beauty traditions continues today. Its good stuff like antioxidants and anti-inflammatory properties make it perfect for skincare and cosmetics, leading to new beauty products with curcumin.

Continual Research: Scientists are still discovering new things about curcumin. This opens doors for making new kinds of products in areas like medicine and health supplements.

Global Reach: While curcumin traditionally comes from specific regions, its popularity is spreading worldwide. This means chances to introduce it to new places and different types of people are growing.

Challenges

Substitute Competition: Cheaper alternatives like mustard powder or certain chemicals can do similar jobs as curcumin. This creates competition as they can be used in similar products, affecting curcumin’s market demand.

Supply Chain Stress: Meeting the high demand for curcumin puts a strain on the supply chain of turmeric. Some manufacturers might compromise quality by using lower-grade turmeric or mixing in dyes, which impacts the final product’s quality and how people view the brand.

Reliance on Specific Regions: The majority of turmeric cultivation happens in just a few countries, such as India and China. Any issues in these regions, like political problems or disruptions in the supply chain, could affect the availability of curcumin globally.

Regulatory Complexity: Rules and regulations governing curcumin-based products can be tricky. Meeting these standards while effectively communicating the benefits to consumers poses a challenge for companies.

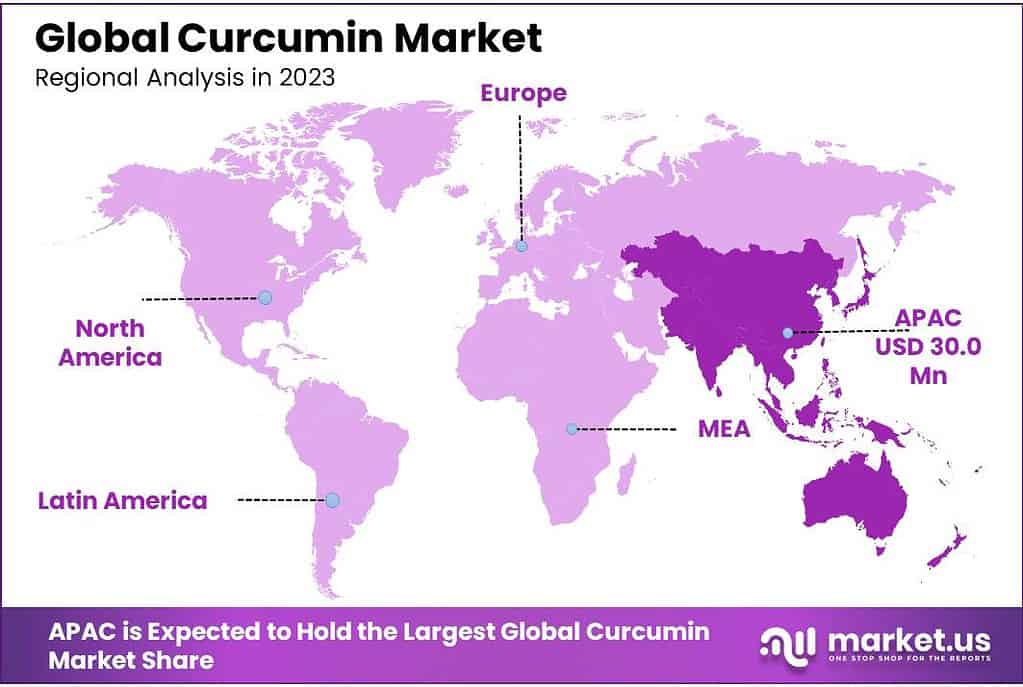

Regional Analysis

The Asia Pacific is the largest region with a market share of 32.6% over the forecast. This can be attributed largely to the lower consumer awareness in this region regarding the health benefits associated with curcumin.

But, brand owners can use this opportunity to educate the public and launch products to address the local demand. Regional market growth can also be supported by rising demand in herbal personal care products and Ayurveda products.

Europe is predicted to record the second-fastest growth rate over the forecast period. The strong personal care & cosmetics industries. Because of the high product demand for food & nutritional supplements, North America was the country with the third-highest revenue share. North America is also home to many premium cosmetic brands. This market offers growth opportunities by incorporating organic ingredients into its products.

Note: Actual Numbers Might Vary In the Final Report

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

The global market is highly competitive and fragmented. This market is mainly driven by the application of nutraceuticals in cosmetics and other nutraceuticals. This product is extracted from ginger or turmeric. Therefore, production plants need to be within close proximity of the source.

This lowers the final product cost and reduces logistics problems. India is the largest producer of turmeric with 78% of all global production. In India, companies are increasingly concentrating their efforts to set up production plants. In the years ahead, the market will continue to be supported by supportive government policies and favorable regulatory regimes. The prominent players in curcumin’s global market are:

Маrkеt Кеу Рlауеrѕ

- Biomax Life Sciences Ltd.

- Synthite Industries Ltd.

- S V Agro Foods

- Arjuna Natural Ltd

- Herboveda India Pvt. Ltd.

- Ningbo Herb

- Zhongda Bio

- Star Hi Herbs

- Tairui Biotech

- Sabinsa

- Indena

Recent Developments

February 2023: Herbalife Nutrition incorporated nanotechnology to develop a turmeric-based supplement. This technology will improve solubility and concentration of curcumin in the body. First introduced in Indonesia, soon to be made available across Asia Pacific.

September 2022: NextEvo Naturals launched Revive CBD Complex Curcumin and Hemp ExtractNextEvo Naturals, a premium supplement brand focused on revolutionizing the delivery of nutritional compounds. Revive is set to provide consumers with the best possible experience through its vegan, non-GMO, and gluten-free formula product.

July 2022: OmniActive Health Technologies launched Curcumin Ultra. It is a unique nutritional solution for managing knee joint comfort and mobility issues, including cartilage health. This product was launched under the company’s product portfolio and increased its portfolio range in the market.

Report Scope

Report Features Description Market Value (2023) USD 91.08 Million Forecast Revenue (2033) USD 426.4 Million CAGR (2023-2032) 16.6% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Application (Pharmaceutical, Food, Cosmetics and Other Applications), By Nature (Organic and Conventional) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Biomax Life Sciences Ltd., Synthite Industries Ltd., S V Agro Foods, Arjuna Natural Ltd, Herboveda India Pvt. Ltd., Ningbo Herb, Zhongda Bio, Star Hi Herbs, Tairui Biotech, Sabinsa, Indena Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is curcumin?Curcumin is a natural compound found in turmeric, a spice commonly used in cooking. It is known for its antioxidant and anti-inflammatory properties.

What are the primary applications of curcumin?Curcumin is widely used in various industries, including pharmaceuticals, food and beverage, cosmetics, and dietary supplements, due to its health benefits. It's used in supplements for joint health, anti-inflammatory medications, skincare products, and as a natural food coloring agent.

How is the future of the curcumin market expected to be?The market is projected to grow due to increasing consumer awareness of natural health supplements, ongoing research into curcumin's health benefits, and its diverse applications across multiple industries. The development of innovative products and formulations may further drive market expansion.

Are there any regulatory concerns surrounding curcumin?In some regions, there might be regulatory concerns regarding the purity and quality standards of curcumin products. Compliance with regulations and standards for food, pharmaceuticals, and supplements is essential for market players.

-

-

- Biomax Life Sciences Ltd.

- Synthite Industries Ltd.

- S V Agro Foods

- Arjuna Natural Ltd

- Herboveda India Pvt. Ltd.

- Ningbo Herb

- Zhongda Bio

- Star Hi Herbs

- Tairui Biotech

- Sabinsa

- Indena