Global Crystalline Polyethylene Terephthalate Market By Manufacturing Process (Extrusion Process, Molding Process), By Application (Trays, Cups, Films/Sheets, Bottles, Others), By End user (Food And Beverage, Pharmaceutical, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174911

- Number of Pages: 332

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

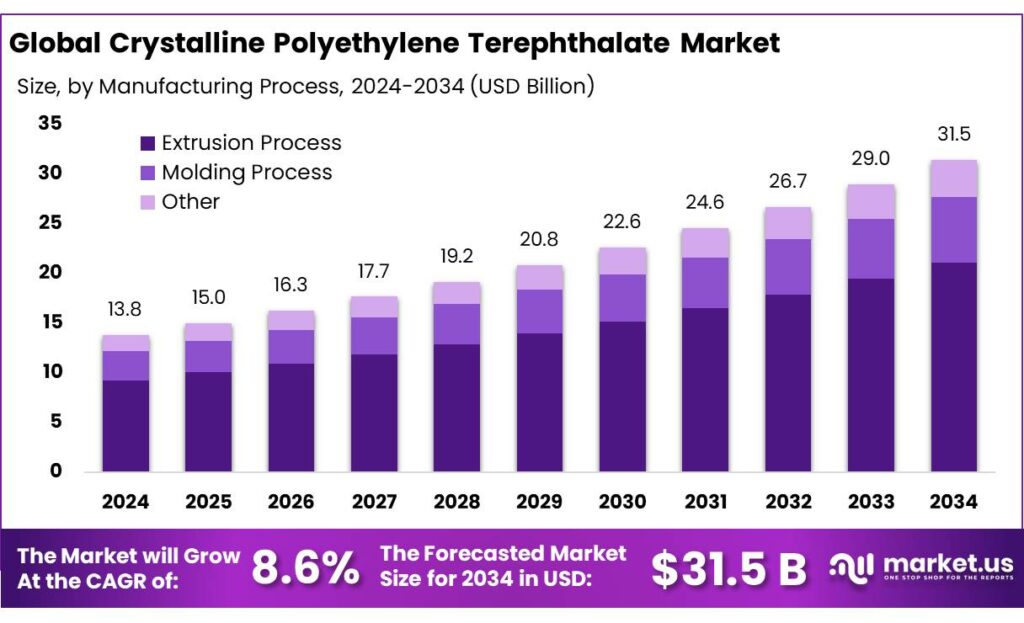

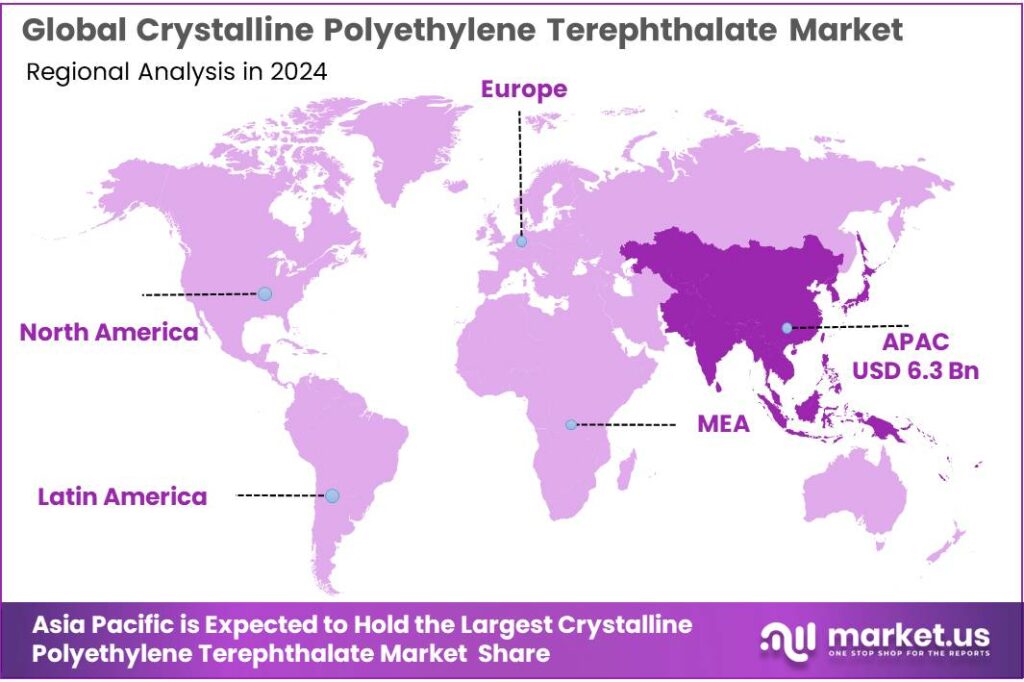

Global Crystalline Polyethylene Terephthalate Market size is expected to be worth around USD 31.5 Billion by 2034, from USD 13.8 Billion in 2024, growing at a CAGR of 8.6% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 45.8% share, holding USD 6.3 Billion in revenue.

Crystalline polyethylene terephthalate (C-PET) is a semi-crystalline form of PET designed to handle higher temperatures and tougher use conditions than amorphous PET. In packaging, this higher crystallinity supports heat resistance for applications such as ovenable or microwaveable food trays, lids, and some hot-fill formats, while still benefiting from PET’s established food-contact track record and broad converting infrastructure. The material sits inside a much larger plastics value chain: world plastics production reached 430.9 million tonnes in 2024, which keeps resin supply, price cycles, and capacity additions highly relevant to C-PET buyers and converters.

Industrially, C-PET demand is closely tied to modern food systems and the shift toward packaged, portioned, and convenience formats. Packaging is also central to the waste and circularity debate: around 40% of the world’s plastic waste comes from packaging, keeping regulators and brand owners focused on redesign, recyclability, and recycled content. At the same time, food organizations highlight why packaging performance still matters: FAO reports 13.2% of food is lost after harvest and before retail, while 19% is wasted at retail, food service, and household level.

Key driving factors are therefore “two-sided.” On one side, food safety, shelf-life protection, and efficiency in cold chains continue to pull demand. On the other, regulation and brand commitments increasingly shape specifications. In the EU, the Single-Use Plastics framework sets bottle-focused signals that ripple through PET recycling economics: it targets 77% separate collection of plastic bottles by 2025 and requires 25% recycled plastic in PET beverage bottles from 2025, with 30% recycled content in all plastic beverage bottles from 2030.

On the policy and sustainability side, governments are raising expectations for collection, recycling, and recycled content—directly affecting PET-based packaging decisions. In the EU, Eurostat reports that 42.1% of generated plastic packaging waste was recycled in 2023, and plastic packaging waste was 35.3 kg per person that year, numbers that keep pressure on packaging producers to improve design-for-recycling and post-consumer recovery. EU single-use plastics rules also set concrete targets that influence PET value chains, including a 77% separate collection target for plastic bottles by 2025 and a requirement to incorporate 25% recycled plastic in PET beverage bottles from 2025.

Key Takeaways

- Crystalline Polyethylene Terephthalate Market size is expected to be worth around USD 31.5 Billion by 2034, from USD 13.8 Billion in 2024, growing at a CAGR of 8.6%.

- Extrusion Process held a dominant market position, capturing more than a 67.1% share.

- Trays and Cups held a dominant market position, capturing more than a 48.5% share.

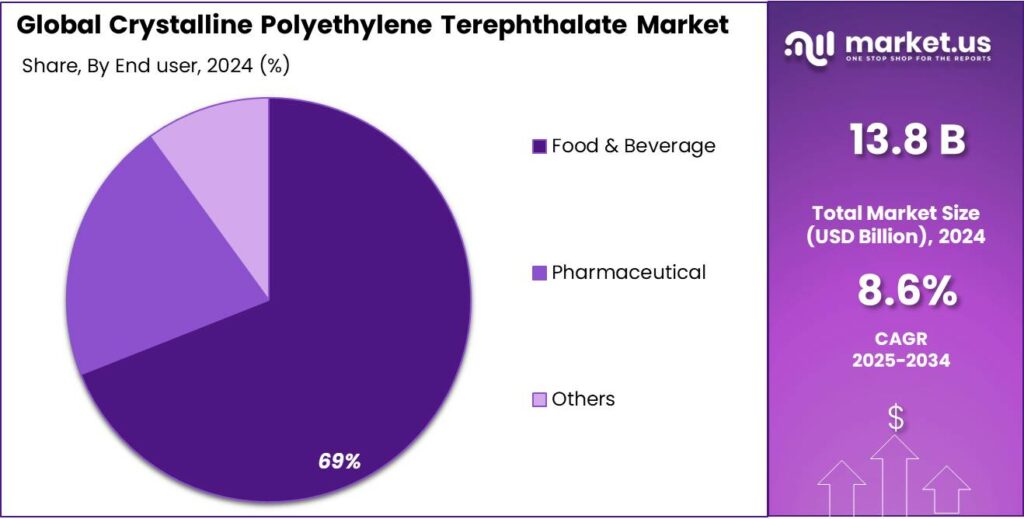

- Food & Beverage held a dominant market position, capturing more than a 69.3% share.

- Asia Pacific emerged as the leading region in the global CPET market, holding a substantial 45.8% share valued at USD 6.3 billion.

By Manufacturing Process Analysis

Extrusion Process leads the market with a strong 67.1% share due to its efficiency and high-volume output

In 2024, the Extrusion Process held a dominant market position, capturing more than a 67.1% share in the Crystalline Polyethylene Terephthalate (CPET) market. Its leadership is driven by its ability to produce consistent, high-quality sheets and containers at large volumes, making it the preferred method for packaging companies and food processors.

In 2024, demand for heat-resistant, lightweight, and recyclable food trays increased steadily, and extrusion offered manufacturers a reliable way to meet safety and performance standards. The process also supported fast production cycles and reduced material waste, which appealed to cost-conscious industries looking to optimize operational efficiency.

By Application Analysis

Trays and Cups dominate with a strong 48.5% share due to rising ready-meal and takeaway demand

In 2024, Trays and Cups held a dominant market position, capturing more than a 48.5% share in the Crystalline Polyethylene Terephthalate (CPET) market. This strong lead is driven by the expanding demand for heat-resistant, microwave-safe, and recyclable food packaging used in ready-meals, bakery items, and takeaway foods.

In 2024, food manufacturers and retail chains increased their use of CPET trays and cups because they provide excellent temperature stability and product protection while meeting consumer expectations for safer and more convenient packaging. The rise in meal-prep kits and frozen foods also boosted usage, as CPET maintains shape and strength in both freezing and heating conditions.

By End user Analysis

Food & Beverage dominates with a strong 69.3% share due to high demand for heat-resistant packaging

In 2024, Food & Beverage held a dominant market position, capturing more than a 69.3% share in the Crystalline Polyethylene Terephthalate (CPET) market. This leadership is closely linked to the growing need for safe, durable, and temperature-resistant packaging across ready meals, frozen foods, bakery items, and beverages.

Food producers increasingly relied on CPET packaging because it performs well under both freezing and high-heat conditions, making it suitable for microwave and oven use. Its ability to preserve food quality while meeting strict hygiene and safety standards further strengthened adoption across large-scale food processing and retail operations.

Key Market Segments

By Manufacturing Process

- Extrusion Process

- Molding Process

By Application

- Trays, Cups

- Films/Sheets

- Bottles

- Others

By End user

- Food & Beverage

- Pharmaceutical

- Others

Emerging Trends

Smart sorting and “tray-to-tray” recycling are becoming the new normal for CPET food trays

A clear latest trend for Crystalline Polyethylene Terephthalate (CPET) is the push to make heat-ready food trays fit into real recycling systems, not just look recyclable on paper. For years, CPET was chosen mainly for performance—staying firm during sealing, freezing, transport, and reheating.

This trend is strongly linked to food waste pressure. The UN Environment Programme estimates that in 2022 the world wasted about 1.05 billion tonnes of food at retail, food service, and household levels combined—around 19% of food available to consumers. When food is wasted, packaging is also wasted, and the public mood hardens against formats that are seen as “hard to recycle.” That is why the conversation is moving beyond heat resistance and toward circular design.

In practical terms, the latest trend is better sorting and clearer design rules for PET thermoforms. Industry groups are publishing “design for recycling” guidance so trays can be compatible with PET recycling streams. For example, the Association of Plastic Recyclers released a PET thermoform packaging design resource in November 2024, aimed at helping designers make PET thermoforms more compatible with existing PET recycling systems.

What is making this trend feel “new” is the rise of smarter sorting technology, especially digital watermarking. The HolyGrail 2.0 initiative reports that its final phase of trials ran from 2023 and finished in 2024, testing digital watermarks on several packaging types under real industrial conditions. A 2024 presentation linked to the initiative reported average 96% detection rates and 95% ejection rates in prototype sorting tests for watermark detection.

Drivers

Rising pressure to cut food waste and deliver safe, reheat-ready meals is pushing CPET Use

One major force behind Crystalline Polyethylene Terephthalate (CPET) is the growing need to keep food protected from factory to fork, especially for ready meals and heat-and-eat products. CPET is valued because it stays firm at high temperatures after crystallization, so trays can hold shape during sealing, transport, chilling, and reheating. That stability is not just about convenience; it is tied to food quality, portion control, and fewer packs being rejected on fast packing lines.

Food waste numbers make this pressure real. The UN Food and Agriculture Organization has long warned that roughly one-third of food produced for human consumption is lost or wasted globally—about 1.3 billion tonnes per year. The UN Environment Programme’s Food Waste Index estimates that in 2022 the world wasted about 1.05 billion tonnes of food at the retail, food service, and household levels combined, and that this equals 19% of food available to consumers. The same UNEP figures also highlight where waste sits: around 631 million tonnes from households, 290 million tonnes from food service, and 131 million tonnes from retail in 2022.

Government and regulatory action adds another layer to the same driver: the push to use packaging that performs well while also meeting circular economy expectations. In the EU, single-use plastics rules set hard targets that affect PET value chains, including a 77% separate collection target for plastic bottles by 2025 and a requirement to include 25% recycled plastic in PET beverage bottles from 2025. At the same time, Eurostat reports that the EU generated 35.3 kg of plastic packaging waste per person in 2023, with 14.8 kg recycled.

Restraints

Recycling Challenges and Environmental Concerns Slow Down CPET Adoption

One major restraining factor for Crystalline Polyethylene Terephthalate (CPET) is the difficulty in recycling it effectively at scale, especially when compared with more common packaging materials. While CPET offers strong heat resistance and performance for ready meals and ovenable food packs, its crystalline nature makes it harder to sort and recycle through existing post-consumer recycling systems.

Real world numbers show how challenging plastic recycling streams can be. For example, the European Union reported that in 2023, only 42.1% of plastic packaging waste was recycled, meaning over half still goes to incineration or landfill, with PET recycling generally higher than less commonly recovered resins like CPET. In the United States, the Environmental Protection Agency (EPA) estimated that in 2021 only 5.9% of all plastic waste generated was recycled — a stark reminder of how far many systems have to go.

Another part of the issue is contamination. Food packaging often contains leftover food residue, oils, or mixed layers (such as films or labels) that make recycling more complex. The UNEP Food Waste Index Report 2022 points out that global food waste reached 1.05 billion tonnes at retail and consumer levels, which also increases packaging contamination challenges. More waste means more packaging soiled with food remnants, making separation and clean recycling harder.

Governments are trying to address recycling gaps with policy, but these measures themselves can slow CPET uptake if the packaging format is not recognized in regulatory frameworks. For instance, EU single-use plastics directives set recycled content and collection targets for major categories like PET bottles, but CPET trays are not always covered by the same streamlined paths. In the EU, a 77% separate collection target for plastic bottles by 2025, rising to 90% by 2029, encourages investment in bottles but leaves less well-defined routes for more specialized resins.

Opportunity

Tray-to-tray circular packaging is a big growth opportunity for CPET in ready meals

A major growth opportunity for Crystalline Polyethylene Terephthalate (CPET) is the move toward “circular-ready” food packaging—especially PET tray systems that can be collected, sorted, and recycled back into packaging-grade material. CPET already fits many ready-meal formats because it stays stable when food moves from cold storage to reheating. Now the bigger opportunity is to keep that performance while making the end-of-life path clearer and easier. When brands can say, with confidence, “this tray is made to be recycled,” it reduces reputational risk and supports long-term supply contracts with retailers that are tightening packaging standards.

This opportunity is getting stronger because food waste is still painfully high, and better packaging is one practical way to reduce avoidable losses in households and food services. UNEP estimates that in 2022 the world wasted about 1.05 billion tonnes of food at the consumer level (retail, food service, and households), equal to 19% of food available to consumers. UNEP also breaks this down as 631 million tonnes from households, 290 million tonnes from food service, and 131 million tonnes from retail.

Government initiatives and trusted policy signals are also pushing companies toward PET-based circular solutions. In the European Union, the European Commission summarizes key measures under the single-use plastics framework for beverage bottles: a 77% separate collection target by 2025 (rising to 90% by 2029) and a requirement to incorporate 25% recycled plastic in PET beverage bottles from 2025 (and 30% in all plastic beverage bottles from 2030).

In India, the push is also visible through Extended Producer Responsibility (EPR). The Plastic Waste Management (Amendment) Rules, 2022 set out EPR responsibilities for producers, importers, and brand owners. India also operates a centralized EPR portal through the CPCB to manage registration and compliance.

Regional Insights

Asia Pacific dominates the Crystalline Polyethylene Terephthalate (CPET) Market with a 45.8% share, valued at USD 6.3 billion, driven by strong food packaging demand and manufacturing growth

Asia Pacific emerged as the leading region in the global CPET market, holding a substantial 45.8% share valued at USD 6.3 billion. This dominance is supported by the region’s expanding food processing sector, rising consumption of ready meals, and the rapid growth of organized retail formats. Countries such as China, India, Japan, and South Korea continue to invest heavily in high-performance packaging solutions, pushing manufacturers to scale up CPET production.

In 2024, growing consumer preference for microwave-safe and heat-resistant packaging significantly boosted demand for CPET trays and containers, especially within urban areas experiencing fast-paced lifestyle changes.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Dow and DuPont together manage USD 100+ billion combined asset base, with annual revenues of USD 45–50 billion across businesses. Their polymer divisions produce CPET-related resins used in food packaging and industrial thermoforming. With operations in 60+ countries and 35,000+ employees, the companies support high-volume supply and innovation in heat-resistant PET formulations.

Eastman reports USD 10.6+ billion revenue and operates more than 50 manufacturing sites worldwide. The company supplies specialty PET and CPET-compatible polymers used in packaging requiring high clarity and heat performance. With 14,000+ employees and ongoing investment in advanced recycling, Eastman strengthens its position in sustainable polyester-based packaging markets.

Indorama Ventures generates USD 18+ billion revenue and is one of the world’s largest producers of PET and CPET-grade polymers. It operates 147 manufacturing facilities across 35 countries, producing more than 5 million tons of PET annually. IVL’s strong recycling infrastructure and global distribution network make it a crucial CPET supplier for packaging converters.

Top Key Players Outlook

- Far Eastern New Century Corporation

- DowDupont Inc., S. A. de C. V.

- Indorama Ventures Public Limited Company

- DAK Americas LLC,

- Eastman Chemical Company

- Others

Recent Industry Developments

In 2024, Indorama Ventures Public Company Limited (IVL) continued to be a major player in the Crystalline Polyethylene Terephthalate (CPET) and wider PET market, leveraging its position as the world’s largest PET resin and recycled PET producer with around USD 21.5 billion in revenue and ~24,000 employees worldwide.

In 2024, the company that once operated as DowDuPont Inc. remains influential in the Crystalline Polyethylene Terephthalate (CPET) value chain through its successor businesses, Dow Inc. and DuPont de Nemours, Inc., which together trace their legacy back to the merged Dow–DuPont platform. Dow Inc. reported approximately $43.0 billion net sales in 2024, showing the scale of its material science operations that include PET and related resin products used in packaging and industrial applications.

Report Scope

Report Features Description Market Value (2024) USD 13.8 Bn Forecast Revenue (2034) USD 31.5 Bn CAGR (2025-2034) 8.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Manufacturing Process (Extrusion Process, Molding Process), By Application (Trays, Cups, Films/Sheets, Bottles, Others), By End user (Food And Beverage, Pharmaceutical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Far Eastern New Century Corporation, DowDupont Inc., S. A. de C. V., Indorama Ventures Public Limited Company, DAK Americas LLC,, Eastman Chemical Company, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Crystalline Polyethylene Terephthalate MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Crystalline Polyethylene Terephthalate MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Far Eastern New Century Corporation

- DowDupont Inc., S. A. de C. V.

- Indorama Ventures Public Limited Company

- DAK Americas LLC,

- Eastman Chemical Company

- Others