Global Cryogenic Insulation Market Size, Share, And Business Benefits By Material Type (PU/PIR, Polystyrene, Cellular Glass, Others), By Cryogenic Equipment (Tanks, Flasks, Small Vacuum, Dewar, Pumps, Valves, Others), By End-Use (Energy and Power, Food and Beverages, Chemical, Medical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153927

- Number of Pages: 280

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

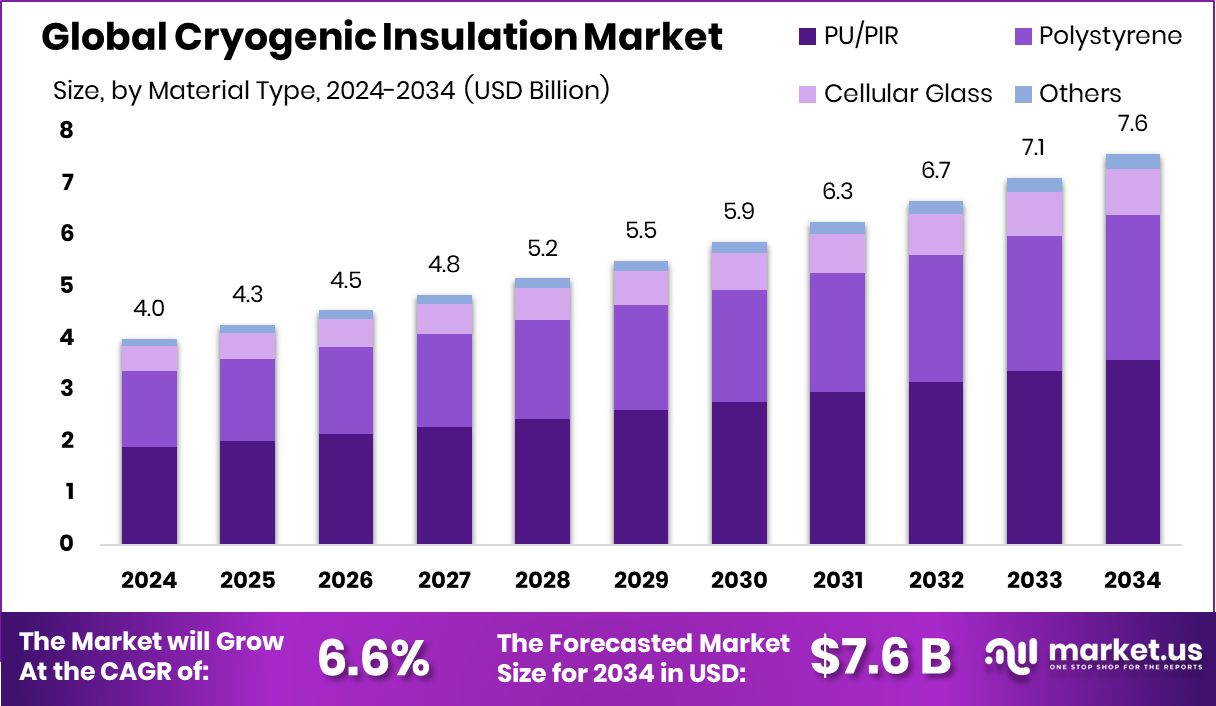

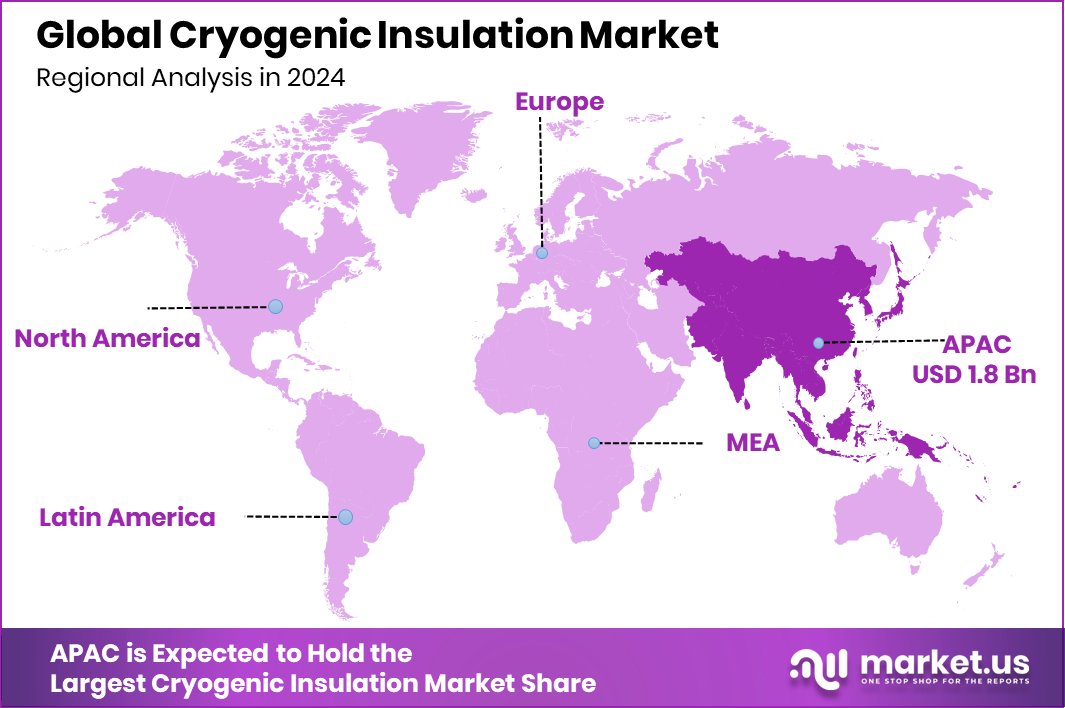

The Global Cryogenic Insulation Market is expected to be worth around USD 7.6 billion by 2034, up from USD 4.0 billion in 2024, and is projected to grow at a CAGR of 6.6% from 2025 to 2034. LNG infrastructure and hydrogen projects are expanding rapidly across the Asia-Pacific USD 1.8 billion region.

Cryogenic insulation refers to specialized materials and technologies used to maintain extremely low temperatures, typically below -150°C, in storage and transport systems. It is essential in applications involving liquefied gases such as LNG (liquefied natural gas), liquid nitrogen, liquid oxygen, and hydrogen. The insulation prevents heat ingress, minimizing evaporation losses and ensuring safety, efficiency, and thermal stability.

Materials such as polyurethane foam, perlite, and multilayer insulation (MLI) are commonly used due to their low thermal conductivity and structural stability in cryogenic conditions. Notably, eco-conscious innovations in insulation are gaining support, such as Polystyvert, which secured $16 million to advance polystyrene recycling technologies, alongside an additional $3.5 million in government support for cryogenic-related sustainability solutions.

The cryogenic insulation market comprises the global demand, production, and application of insulation solutions used in ultra-low temperature environments. It serves key sectors including energy, healthcare, food processing, electronics, and aerospace. The growing adoption of LNG and the increasing use of cryogenic gases across industries have significantly boosted market demand. Furthermore, organizations like the Foam Recycling Coalition have granted over $1 million since 2015, encouraging the development of advanced insulation materials from recycled content.

The expansion of LNG infrastructure is a primary driver for cryogenic insulation. As countries increase LNG import-export terminals and invest in floating storage and regasification units (FSRUs), demand for effective thermal insulation has risen. Additionally, government policies supporting natural gas adoption and carbon reduction have accelerated the development of cryogenic transport and storage systems, pushing the insulation market forward.

The consistent rise in demand for liquefied industrial gases, particularly in medical, metal processing, and electronics sectors, is fueling market growth. Hospitals require liquid oxygen, semiconductors rely on specialty cryogens, and manufacturing depends on gases like argon—all of which require secure, insulated containment.

This widespread usage has created year-round demand, making cryogenic insulation essential across supply chains. To meet this rising demand with sustainable solutions, TemperPack raised $22.5 million in a Series B round to develop eco-friendly packaging that can replace Styrofoam, especially where legacy players are slow to adapt.

Key Takeaways

- The Global Cryogenic Insulation Market is expected to be worth around USD 7.6 billion by 2034, up from USD 4.0 billion in 2024, and is projected to grow at a CAGR of 6.6% from 2025 to 2034.

- PU/PIR dominates the Cryogenic Insulation Market with 47.3% due to excellent thermal performance and durability.

- Tanks lead the Cryogenic Equipment segment with 32.7%, driven by increased LNG and hydrogen storage needs.

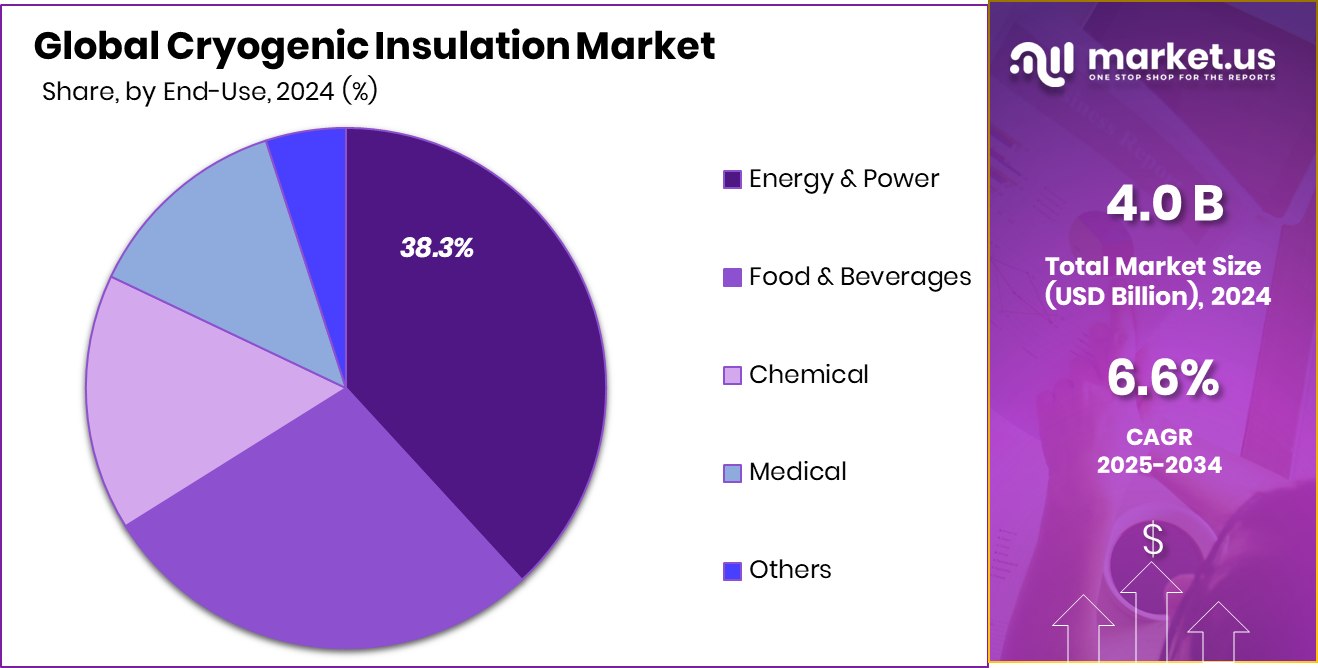

- The energy and power sector holds a 38.3% share, reflecting rising demand for insulated liquefied gas infrastructure.

- The Asia-Pacific market reached a value of USD 1.8 billion, showing strong demand.

By Material Type Analysis

PU/PIR dominates Cryogenic Insulation Market with a 47.3% share.

In 2024, PU/PIR held a dominant market position in the By Material Type segment of the Cryogenic Insulation Market, with a 47.3% share. This leadership can be attributed to the superior thermal insulation performance, low thermal conductivity, and structural stability of polyurethane (PU) and polyisocyanurate (PIR) foams at cryogenic temperatures.

These materials are widely used in LNG storage tanks, pipelines, and transport vessels, where maintaining ultra-low temperatures is critical to minimize boil-off losses and ensure operational safety. PU/PIR systems are also favored for their ease of installation and compatibility with both prefabricated and on-site insulation applications. Their closed-cell structure provides excellent moisture resistance, which is crucial in preventing thermal degradation over time.

As the global demand for liquefied gases continues to rise—particularly in the energy, medical, and industrial sectors—the adoption of reliable and efficient insulation materials like PU/PIR has seen steady growth. Furthermore, ongoing investments in LNG infrastructure and cryogenic logistics have reinforced the dominance of PU/PIR in the material mix.

This segment’s strong position reflects not only its proven performance in extreme conditions but also its cost-effectiveness in large-scale cryogenic insulation projects, making it the material of choice for both existing and new installations across global markets.

By Cryogenic Equipment Analysis

Tanks lead the equipment segment, holding 32.7% of the market share globally.

In 2024, Tanks held a dominant market position in the By Cryogenic Equipment segment of the Cryogenic Insulation Market, with a 32.7% share. This dominance was driven by the widespread use of cryogenic tanks in the storage and transportation of liquefied gases such as LNG, liquid oxygen, nitrogen, and argon. These tanks are essential in both stationary and mobile applications, including LNG terminals, industrial gas facilities, and healthcare systems.

The demand for insulated tanks has grown steadily due to their role in minimizing thermal losses, maintaining cryogenic temperatures, and ensuring the safety and efficiency of fluid handling under extreme cold conditions. The rising global consumption of LNG, along with the expansion of gas-based infrastructure, has particularly accelerated tank deployments.

Moreover, tanks are often designed with multilayer insulation or advanced materials like PU/PIR to enhance thermal performance, which complements the market trend of adopting high-efficiency systems. As industries focus on reducing energy losses and meeting stricter safety regulations, the need for well-insulated cryogenic tanks has further solidified their leading market share.

Their structural adaptability and ability to store large volumes of cryogenic liquids have made them a preferred choice, reinforcing their position in the overall equipment category.

By End-Use Analysis

The energy and power sector holds 38.3% of the total market demand.

In 2024, Energy and Power held a dominant market position in the By End-Use segment of the Cryogenic Insulation Market, with a 38.3% share. This leadership reflects the growing use of cryogenic insulation across LNG infrastructure, gas-fired power generation, and hydrogen energy projects. As energy systems increasingly transition toward low-emission alternatives, liquefied gases such as LNG and hydrogen have gained significant traction, requiring robust insulation solutions to maintain stability at ultra-low temperatures.

In power generation, especially in gas turbine systems and LNG regasification plants, cryogenic insulation helps ensure operational efficiency by minimizing thermal losses and improving safety. The expansion of LNG import-export terminals, floating storage units, and onshore storage facilities has further contributed to the segment’s prominence. Additionally, increasing investments in clean energy infrastructure have prompted the use of insulated cryogenic tanks and pipelines in hydrogen storage and distribution networks.

The Energy and Power sector’s demand is closely tied to energy security goals and the need for high-performance insulation that ensures both temperature integrity and durability under extreme conditions. This consistent requirement has positioned the segment as the primary end-use driver in the cryogenic insulation market, reflecting its integral role in supporting global energy transformation initiatives.

Key Market Segments

By Material Type

- PU/PIR

- Polystyrene

- Cellular Glass

- Others

By Cryogenic Equipment

- Tanks

- Flasks

- Small Vacuum

- Dewar

- Pumps

- Valves

- Others

By End-Use

- Energy and Power

- Food and Beverages

- Chemical

- Medical

- Others

Driving Factors

Growing LNG Infrastructure Driving Insulation Material Demand

One of the strongest driving factors for the cryogenic insulation market is the rapid growth of LNG infrastructure worldwide. As countries shift towards cleaner energy sources, liquefied natural gas (LNG) is being widely adopted for power generation, transportation, and industrial applications. This shift has led to the expansion of LNG terminals, pipelines, storage tanks, and shipping vessels, all of which require reliable insulation to handle extremely low temperatures.

Cryogenic insulation helps prevent heat transfer, reduce energy loss, and improve the safety and efficiency of LNG systems. With governments and industries investing heavily in LNG infrastructure development, the demand for high-performance insulation materials is rising steadily, making this one of the key growth drivers in the cryogenic insulation market.

Restraining Factors

High Installation Costs Limit Market Growth Potential

A major restraining factor in the cryogenic insulation market is the high cost associated with installation and maintenance. Cryogenic insulation systems require specialized materials and skilled labor to ensure proper application, especially in industries handling liquefied gases at extremely low temperatures. These systems must meet strict safety, durability, and thermal performance standards, which increases the overall project cost.

For small-scale or budget-constrained facilities, the initial investment in cryogenic insulation may seem unaffordable, delaying adoption. In addition, long-term maintenance and periodic inspections add to operational expenses. These financial barriers can limit the market’s expansion, especially in developing regions or sectors that are still exploring cryogenic applications.

Growth Opportunity

Hydrogen Economy Creating New Insulation Market Needs

The rise of the hydrogen economy presents a major growth opportunity for the cryogenic insulation market. As countries invest in hydrogen production, storage, and transport infrastructure, the need for efficient thermal insulation becomes critical. Hydrogen is often stored and moved in liquid form at temperatures below -250°C, requiring highly specialized insulation systems to maintain safety and energy efficiency.

This creates a growing demand for advanced insulation materials that can perform in ultra-low temperature environments. With global initiatives promoting hydrogen as a clean energy source, several pilot projects and commercial ventures are underway. As this trend accelerates, suppliers of cryogenic insulation are well-positioned to benefit from new installations across hydrogen plants, pipelines, and fueling stations worldwide.

Latest Trends

Advanced Multilayer Insulation Adoption in Cryogenic Systems

A leading trend observed in the cryogenic insulation market is the increased adoption of advanced multilayer insulation (MLI) systems. Multilayer insulation consists of alternating layers of reflective foils and spacer materials, which significantly reduce heat transfer through radiation, conduction, and convection. These systems offer superior thermal performance at extremely low temperatures, making them especially suitable for applications such as liquid hydrogen and LNG storage.

The lightweight and compact nature of MLI allows space-efficient installation in tanks, pipelines, and vessels. Because of its enhanced efficiency, MLI helps to minimize boil‑off rates and improve operational safety over the long term. As cryogenic applications continue to evolve, industries are favoring insulation that can deliver higher performance with reduced physical and thermal loss footprints.

Regional Analysis

Asia-Pacific dominated the cryogenic insulation market with a 47.30% share in 2024.

In the regional landscape of the cryogenic insulation market, Asia‑Pacific stood as the clear leader in 2024, commanding a 47.30% share and generating USD 1.8 billion in revenue. This dominance underlines the region’s robust investment in LNG infrastructure and the evolving hydrogen economy.

While specific figures for North America, Europe, the Middle East & Africa, and Latin America were not disclosed, these regions collectively accounted for the remaining market share. Although exact values are unavailable, these areas continue to show growing demand driven by industrial gas applications, medical sectors, and expanding energy infrastructure.

Asia‑Pacific’s dominance is attributed to its large-scale cryogenic deployment, which has outpaced developments in other regions. Without further regional data, it can be inferred that North America and Europe represent substantial portions of the residual market, supported by established gas supply chains and clean energy initiatives.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Aspen Aerogels exhibited a strong technological focus in cryogenic insulation solutions, leveraging its proprietary aerogel-based products. These materials deliver ultra-low thermal conductivity and minimal thickness, making them well-suited for aerospace, LNG transport, and liquefied gas storage. Aspen’s innovation pipeline and partnerships in industrial applications underscore its influence in pushing insulation performance boundaries.

KAEFER, an engineering and construction specialist, distinguished itself through integrated insulation and turnkey contracting services. With capabilities spanning design, installation, and maintenance across cryogenic tanks, pipelines, and terminals, KAEFER delivers end-to-end engineering solutions. Its strength in executing large-scale LNG infrastructure projects positions the company as a trusted service provider in complex cryogenic environments.

BASF SE, a global chemicals leader, contributed to the cryogenic insulation sector through advanced material science. Its expertise in foam chemistry and performance additives supports the development of PU/PIR materials tailored for ultra-low temperature applications. BASF’s research capabilities facilitate product formulations with enhanced moisture resistance, mechanical strength, and thermal stability.

Top Key Players in the Market

- Aspen Aerogels

- KAEFER

- BASF SE

- Armacell Enterprise GmbH & Co. KG

- Lydall Inc

- Cabot Corporation

- DUNMORE

- Owens Corning

- Röchling

Recent Developments

- In September 2024, Owens Corning unveiled its FOAMGLAS® Cryogenic Piping Systems at the Gastech conference in Houston. These systems are made from cellular glass and designed for LNG process applications operating between –43 °C and –160 °C. They prevent moisture ingress and corrosion, enabling long-term insulation stability in harsh cryogenic environments. A novel technology preview was also introduced for even colder applications, targeting temperatures down to –253 °C with specialized low‑organic accessories.

- In June 2024, Aspen Aerogels received a design award to supply its PyroThin® thermal barrier for a next‑generation electric vehicle platform of a major European luxury sports car brand. This marked the company’s sixth OEM award and demonstrated strong traction of its aerogel-based thermal barriers in automotive applications.

Report Scope

Report Features Description Market Value (2024) USD 4.0 Billion Forecast Revenue (2034) USD 7.6 Billion CAGR (2025-2034) 6.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (PU/PIR, Polystyrene, Cellular Glass, Others), By Cryogenic Equipment (Tanks, Flasks, Small Vacuum, Dewar, Pumps, Valves, Others), By End-Use (Energy and Power, Food and Beverages, Chemical, Medical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Aspen Aerogels, KAEFER, BASF SE, Armacell Enterprise GmbH & Co. KG, Lydall Inc, Cabot Corporation, DUNMORE, Owens Corning, Röchling Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cryogenic Insulation MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Cryogenic Insulation MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Aspen Aerogels

- KAEFER

- BASF SE

- Armacell Enterprise GmbH & Co. KG

- Lydall Inc

- Cabot Corporation

- DUNMORE

- Owens Corning

- Röchling