Global Creamers Market Size, Share and Report Analysis By Type (Regular, Light, Fat-free), By Form (Powder, Liquid), By Source (Dairy, Non-Dairy), By Nature (Organic, Conventional, By End Use (Processed Food, Dairy Desserts And Beverages, Retail/Household, Beverage Mixes, Foodservice, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175907

- Number of Pages: 371

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

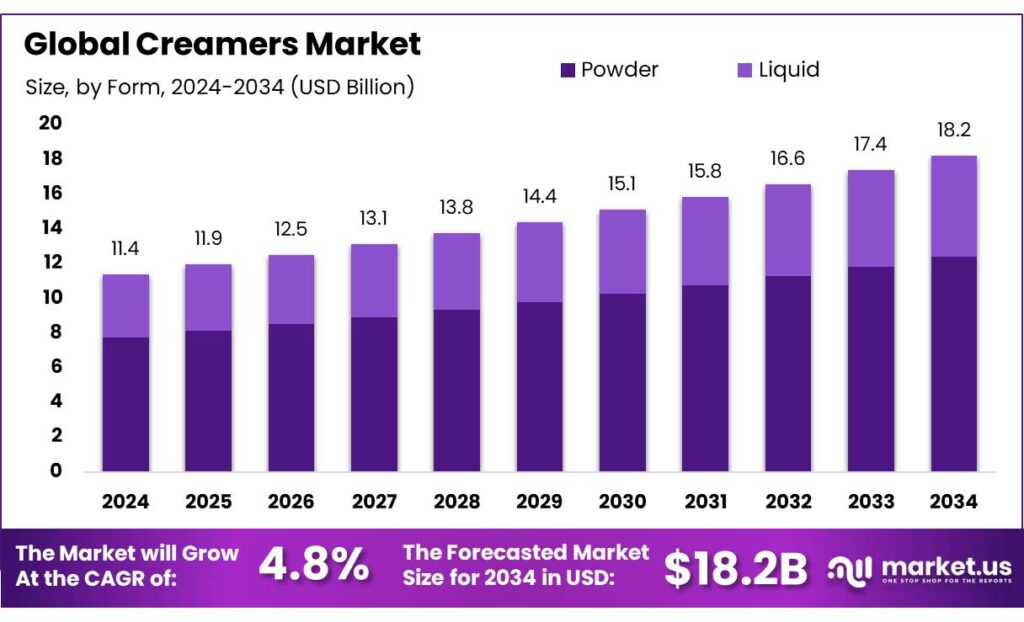

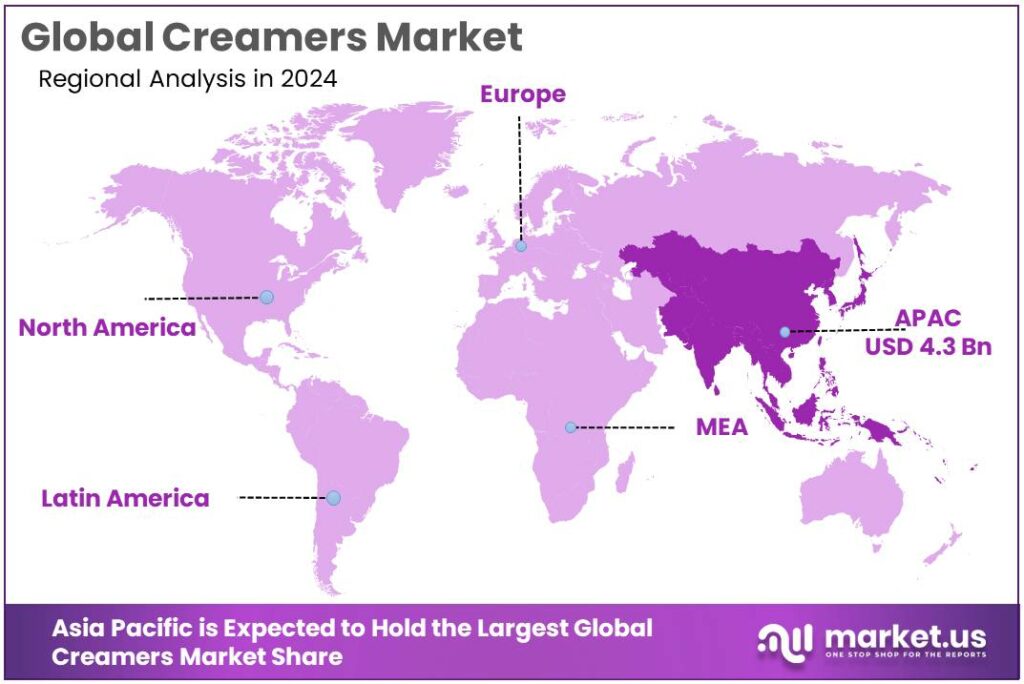

Global Creamers Market size is expected to be worth around USD 18.2 Billion by 2034, from USD 11.4 Billion in 2024, growing at a CAGR of 4.8% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 46.6% share, holding USD 1.1 Billion in revenue.

Industrial creamers sit at the intersection of hot beverages, convenience nutrition, and ingredient innovation. In simple terms, a creamer is a formulated whitening and flavor system designed to improve coffee and tea taste, mouthfeel, and appearance, while offering shelf-stability and easy dosing for home, foodservice, and vending.

- Demand is structurally tied to coffee habits at scale: global coffee consumption was estimated at 177.0 million 60-kg bags in coffee year 2023/24, indicating a large and resilient daily-use base that continuously pulls creamer volumes through retail and out-of-home channels.

From an industrial scenario perspective, the category rides on two very large consumption engines: dairy availability and coffee culture. On the supply side, global milk production is forecast to reach ~979 million tonnes in 2024, supporting stable access to core dairy inputs used in many creamer formulations. In high-volume dairy markets, ingredient depth also matters: India reported 239.30 million tonnes of milk production in 2023–24, reinforcing its role as a major base for dairy-derived inputs and localized whitener brands.

Several demand drivers are shaping product strategy. First is the ongoing “coffee culture” expansion across ready-to-drink, pods, and café-at-home routines, which lifts flavor experimentation and seasonal launches. Second is health-led reformulation: regulators and public-health agencies continue to pressure the removal of industrial trans fats and encourage cleaner labels. WHO links trans fat intake to up to 500,000 premature coronary heart disease deaths per year and notes 5 billion people remain unprotected by best-practice policies.

Demand-side momentum is closely tied to coffee and café-style consumption at home and in foodservice. The International Coffee Organization estimated world coffee consumption rebounding to about 177.0 million 60-kg bags in 2023/24, which effectively widens the addressable base for creamers positioned around taste, convenience, and customization.

Government actions are also shaping the industrial scenario, mainly through processing capacity support and clearer labeling expectations. In the U.S., USDA’s Dairy Business Innovation Initiatives list approximately $11.04 million available for projects that can include product development, packaging, and marketing of dairy products—supportive conditions for value-added dairy formulations that overlap with creamer innovation. In India, official releases around White Revolution 2.0 highlight an objective to increase cooperative milk procurement to 1,007 lakh kg/day by 2028–29, alongside a reported national milk production level of 239.30 million tonnes in 2023–24.

Key Takeaways

- Creamers Market size is expected to be worth around USD 18.2 Billion by 2034, from USD 11.4 Billion in 2024, growing at a CAGR of 4.8%.

- Regular held a dominant market position, capturing more than a 47.9% share.

- Powder held a dominant market position, capturing more than a 68.2% share.

- Non-Dairy held a dominant market position, capturing more than a 67.3% share.

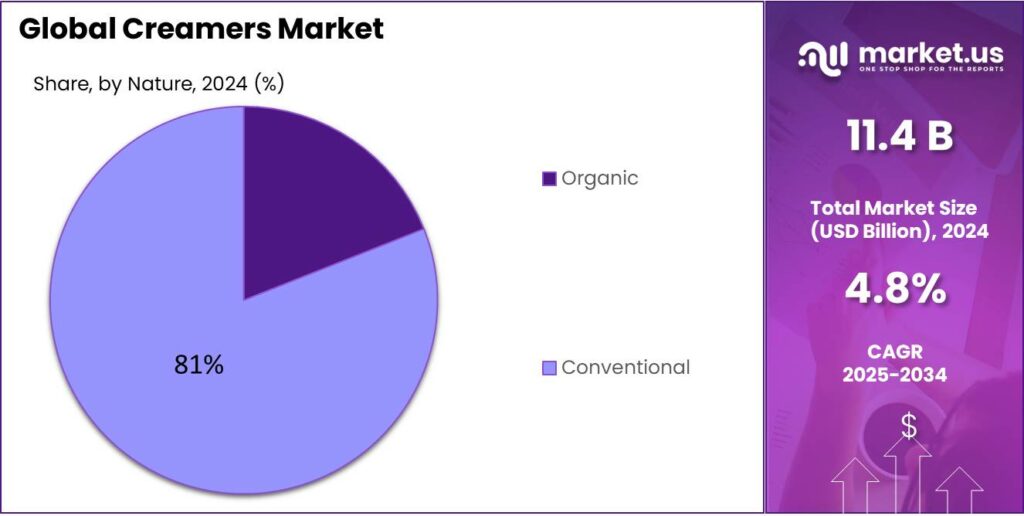

- Conventional held a dominant market position, capturing more than an 81.7% share.

- Retail/Household held a dominant market position, capturing more than a 34.5% share.

- North America stands as the leading region in the global creamers market, holding a dominant 46.10% share, equivalent to USD 16.9 billion.

By Type Analysis

Regular Creamers lead the category with a strong 47.9% market share in 2024.

In 2024, Regular held a dominant market position, capturing more than a 47.9% share, reflecting its long-standing acceptance in both households and foodservice channels. This segment benefits from its familiar taste, stable performance in hot beverages, and wide availability across retail formats. Regular creamers continue to be the default choice for consumers who prefer a classic dairy or dairy-like profile without added functional claims. Brands in this space strengthened their offerings in 2024 by improving texture stability and expanding into multi-serve pack formats to match rising at-home coffee consumption.

By Form Analysis

Powder creamers dominate the category with a strong 68.2% share in 2024.

In 2024, Powder held a dominant market position, capturing more than a 68.2% share, driven by its long shelf life, easy storage, and suitability for both home and commercial use. Powder creamers remain the preferred choice in regions with high tea and coffee consumption because they dissolve quickly and offer consistent taste. Their portability and low refrigeration needs also make them ideal for travel, vending systems, and institutional settings such as offices and cafés. In 2024, many manufacturers enhanced their powder formulations by improving creaminess and reducing clumping, strengthening their appeal among everyday consumers.

By Source Analysis

Non-dairy creamers lead the category with a strong 67.3% share in 2024.

In 2024, Non-Dairy held a dominant market position, capturing more than a 67.3% share, reflecting the global shift toward lactose-free, plant-forward, and allergen-friendly beverage solutions. Consumers increasingly prefer non-dairy creamers because they offer consistent taste, stable texture in both hot and cold drinks, and longer shelf life compared to traditional dairy options. This segment also benefits from growing awareness around lactose intolerance and changing dietary patterns, which pushed many households and cafés to adopt non-dairy alternatives more widely throughout 2024.

By Nature Analysis

Conventional creamers dominate the category with a strong 81.7% share in 2024.

In 2024, Conventional held a dominant market position, capturing more than an 81.7% share, reflecting its wide consumer acceptance, affordability, and extensive availability across retail and foodservice channels. Conventional creamers remain the default choice for most households because they offer familiar taste, stable texture, and compatibility with a broad range of beverages. Many consumers continue to prefer conventional formulations due to their consistent performance in coffee and tea, especially in regions where traditional flavor profiles are valued. In 2024, the segment also grew as brands expanded distribution in supermarkets, convenience stores, cafés, and vending systems.

By End Use Analysis

Retail/Household creamers lead the market with a strong 34.5% share in 2024.

In 2024, Retail/Household held a dominant market position, capturing more than a 34.5% share, reflecting the rising trend of at-home beverage preparation. Consumers increasingly prepare café-style coffee, tea, and flavored drinks at home, boosting the demand for convenient and versatile creamers. This segment benefits from wide availability in supermarkets, hypermarkets, and online platforms, making it easy for households to experiment with different flavors, formats, and sweetness levels. In 2024, many families preferred creamers that offered long shelf life, smooth texture, and consistent taste, further strengthening the Retail/Household uptake.

Key Market Segments

By Type

- Regular

- Light

- Fat-free

By Form

- Powder

- Liquid

By Source

- Dairy

- Non-Dairy

By Nature

- Organic

- Conventional

By End Use

- Processed Food

- Dairy Desserts & Beverages

- Retail/Household

- Beverage Mixes

- Foodservice

- Others

Emerging Trends

Lower-sugar, “less sweet” creamers are becoming the new mainstream choice.

A clear latest trend in the creamers space is the move toward lower-sugar and less-sweet formulations, driven by everyday shoppers who still want a creamy cup but feel uneasy about hidden sugars in their daily routine. Creamers are often used every morning, sometimes more than once a day, so even small changes—like choosing a lighter or reduced-sugar option—can feel meaningful to consumers. This trend is not just “wellness talk”; it is being reinforced by public guidance and clearer labeling rules that make sugar more visible at the point of purchase.

In the United States, the FDA requires “Added Sugars” to be declared on the Nutrition Facts label, and it sets a Daily Value of 50 grams of added sugars per day on a 2,000-calorie diet. This has changed how people compare products on shelf. When a creamer shows a noticeable amount of added sugar per serving, many shoppers simply trade up to reduced-sugar or no-added-sugar options, rather than leaving the category completely. For manufacturers, that has created a practical product race: keep the same smooth taste and mouthfeel while cutting sweetness and keeping labels easy to understand.

Public health messaging is also pushing the “less sweet” direction. The World Health Organization recommends keeping free sugars below 10% of total daily energy intake and suggests that reducing further to 5% can provide additional health benefits. This guidance influences national nutrition programs, consumer education, and the way people interpret “everyday” foods and beverages. In simple terms, as more consumers try to manage sugar across the day, sweetened creamers become a common place to make an easy adjustment—especially because coffee and tea are habitual.

Drivers

At-home coffee habits are pulling creamer demand upward, year after year.

One major driving factor for creamers is the steady rise in everyday coffee consumption, especially the “make it at home” routine that became a permanent habit for many households. When more cups are brewed at home, more people want a simple way to soften bitterness, improve mouthfeel, and add flavor without extra steps. That creates a reliable, repeat-purchase cycle for creamers across retail shelves. A useful signal is global coffee demand itself: the International Coffee Organization estimates world coffee consumption rebounded to about 177.0 million 60-kg bags in 2023/24, supported by stronger consumption in non-producing countries.

On the supply side, the creamer industry also benefits from a large and resilient dairy base for products that rely on milkfat, skim milk solids, or dairy-derived ingredients. FAO’s dairy outlook forecasts world milk production at around 944 million tonnes in 2023, showing the scale of raw material flows that support processed dairy categories, including cream and creamer inputs. In the U.S., USDA reported annual milk production of about 226 billion pounds in 2024, highlighting the industrial capacity that helps keep dairy ingredients available for mass-market formulations.

Government-backed labeling rules and nutrition guidance are also pushing product development in a way that supports creamer innovation rather than slowing it. In the U.S., FDA requires “Added sugars” to appear on the Nutrition Facts label, and it states a Daily Value of 50 grams of added sugars per day. This kind of transparency nudges brands to compete on reduced-sugar options, clearer ingredient choices, and smaller, more controlled servings—features that can attract repeat buyers who still want taste and comfort. In simple terms, more coffee moments plus clearer labeling equals more reasons for consumers to choose a creamer that matches their routine and preferences.

Restraints

Rising health consciousness is slowing the growth pace of traditional creamers.

One major restraining factor for the creamer market is the growing consumer shift toward healthier beverage habits, particularly reduced sugar and lower-fat choices. Many traditional creamers—both dairy and non-dairy—carry added sugars, saturated fats, or artificial stabilizers, which increasingly conflict with public-health guidelines. This disconnect shapes purchasing behavior, especially as people become more aware of the long-term risks associated with excess sugar intake. The World Health Organization advises that adults should limit “free sugars” to less than 10% of total energy intake, and suggests reducing it further to below 5% for added health benefits.

Another pressure point comes from global obesity trends, which are pushing both regulators and consumers to question calorie-dense beverage additives. WHO estimates that worldwide obesity rates have nearly tripled since 1975, and over 1 billion people were living with obesity as of 2022. While this is not about creamers alone, products that add sugars and fats to daily drinks increasingly fall under scrutiny. As a result, some consumers shift toward black coffee, plant milks, or lightened beverage enhancers instead of traditional creamers. This creates a slow but meaningful drag on the segment’s overall growth, especially in markets where wellness culture is strong.

Regulatory interventions further amplify this restraint. Many countries now encourage front-of-pack warnings, sugar taxes, or mandatory nutrition transparency. For example, in the United States, the FDA requires manufacturers to display the exact amount of “Added Sugars” per serving on the Nutrition Facts Panel, assigning a Daily Value of 50 grams per day. Lactose intolerance is another practical restraint affecting dairy-based creamers. According to the National Institutes of Health, an estimated 68% of the global population has some degree of lactose malabsorption.

Opportunity

Better-for-you reformulation is opening the next big lane for creamers.

A major growth opportunity for creamers is the shift toward “better-for-you” options that still deliver the same creamy taste in coffee and tea. Many consumers are not quitting creamers—they are upgrading to products with less added sugar, improved fats, and simpler labels. This creates room for brands to grow through reformulation, not just through new flavors. The direction is reinforced by public nutrition guidance and clearer packaging rules that make shoppers compare products more carefully than before.

Government-backed labeling is a practical tailwind for this opportunity. In the U.S., the FDA requires “Added Sugars” to be shown on the Nutrition Facts label and sets a Daily Value of 50 grams of added sugars per day. This same FDA guidance points back to the Dietary Guidelines message of keeping added sugars below 10% of daily calories. When shoppers see added-sugar grams clearly printed, many start choosing lighter creamers, smaller serving packs, or “no added sugar” versions that still feel indulgent. That change in shopping behavior creates a direct innovation runway for reduced-sugar and sugar-free creamers that can keep taste and texture stable in hot drinks.

The size of the coffee habit makes the upside meaningful. The International Coffee Organization estimated world coffee consumption at 177.0 million 60-kg bags in 2023/24. A large share of those cups are consumed outside cafés, where people control ingredients and are more likely to adjust sugar intake over time. That creates steady demand for creamers that deliver “café-like” mouthfeel with fewer calories or less sugar. In simple terms, when coffee stays a daily ritual, improved creamers can win share cup-by-cup without needing consumers to change their routine.

Regional Insights

North America Leads the Global Creamers Market with 46.10% Share Valued at USD 16.9 Billion

North America stands as the leading region in the global creamers market, holding a dominant 46.10% share, equivalent to USD 16.9 billion, supported by a deeply rooted coffee culture and strong consumer preference for convenience-based beverage add-ins. The United States continues to anchor this demand, where daily coffee drinking remains a core habit—about 67% of American adults reported drinking coffee every day in 2024, marking one of the highest levels recorded. This high-frequency consumption directly boosts the use of creamers across households, workplaces, and on-the-go settings.

In addition to high consumption, North America’s well-structured retail and foodservice ecosystem ensures widespread access to both dairy and non-dairy creamers. The region also benefits from a substantial dairy supply chain. U.S. milk production reached approximately 226 billion pounds in 2024, providing a strong raw-material foundation for dairy-derived creamers and hybrid formulations. Canada adds further depth to regional demand, with per-capita coffee availability reaching 107.42 liters in 2023, underlining the sustained popularity of coffee-based beverages in both urban and rural markets.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Nestlé remains a major force in the creamers category through brands like Coffee-mate, supported by its scale of USD 108.2 billion revenue (2023) and operations in 188 countries. The company runs more than 340 factories globally and continues expanding low-sugar and plant-based creamers to meet rising health-focused consumer demand.

Organic Valley is a leading U.S. organic dairy cooperative with more than 1,600 family farms and annual sales exceeding USD 1.2 billion. The company focuses on organic milk and cream products, maintaining strict standards across 100% certified organic dairy inputs, supporting clean-ingredient creamers in retail and foodservice channels.

PT. Santos Premium Krimer is Indonesia’s leading non-dairy creamer manufacturer, producing high-volume spray-dried creamers for beverages and bakery industries. The company operates multiple integrated production lines with annual capacity exceeding 150,000 tonnes, supplying regional and global clients with cost-efficient powdered creamer formulations.

Top Key Players Outlook

- Nestle S.A.

- Danone

- Organic Valley

- Royal FrieslandCampina N.V.

- PT. Santos Premium Krimer

- Califia Farms, LLC

- Oatly

- Chobani

- Lactalis Group

- Arla Foods

- Saputo Inc.

Recent Industry Developments

In 2024, Danone achieved €27,376 million in sales with a 4.3% like-for-like growth, supported by stronger volumes in dairy and coffee-related beverages, including creamers that appeal to consumers seeking both traditional and plant-based options.

In 2024, Organic Valley’s cooperative continued to scale availability through its farmer network of more than 1,600 organic family farms, which helps it keep a steady supply of organic milk and cream for retail packs.

Report Scope

Report Features Description Market Value (2024) USD 11.4 Bn Forecast Revenue (2034) USD 18.2 Bn CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Regular, Light, Fat-free), By Form (Powder, Liquid), By Source (Dairy, Non-Dairy), By Nature (Organic, Conventional, By End Use (Processed Food, Dairy Desserts And Beverages, Retail/Household, Beverage Mixes, Foodservice, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Nestle S.A., Danone, Organic Valley, Royal FrieslandCampina N.V., PT. Santos Premium Krimer, Califia Farms, LLC, Oatly, Chobani, Lactalis Group, Arla Foods, Saputo Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Nestle S.A.

- Danone

- Organic Valley

- Royal FrieslandCampina N.V.

- PT. Santos Premium Krimer

- Califia Farms, LLC

- Oatly

- Chobani

- Lactalis Group

- Arla Foods

- Saputo Inc.