Global Cotton Spinning Machinery Market Size, Share, Growth Analysis By Machinery Type (Ring Spinning, Compact Spinning, Rotor Spinning, Air Jet Spinning), By Application (Apparel & Garments, Yarn Manufacturing, Home Textiles, Industrial Textiles, Medical Textiles, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 176835

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

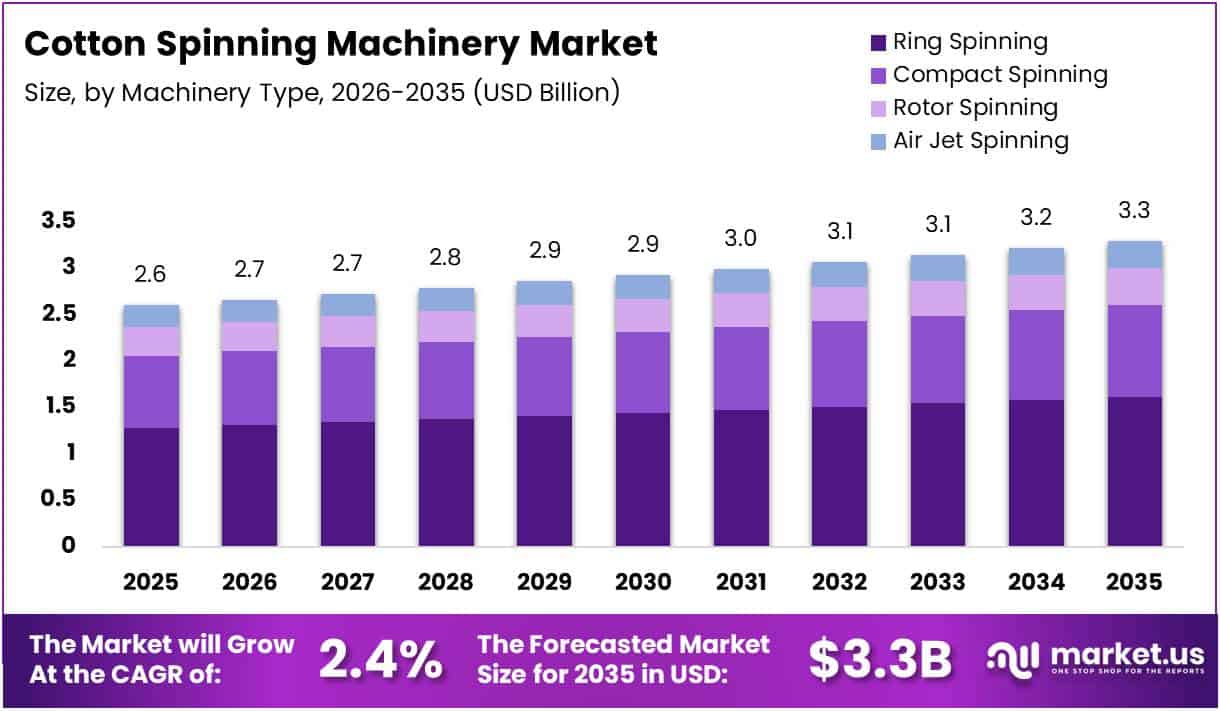

The Global Cotton Spinning Machinery Market size is expected to be worth around USD 3.3 Billion by 2035 from USD 2.6 Billion in 2025, growing at a CAGR of 2.40% during the forecast period 2026 to 2035.

Cotton spinning machinery represents specialized industrial equipment designed to convert raw cotton fibers into continuous yarn through mechanical processes. These machines facilitate critical textile manufacturing operations including fiber opening, carding, drawing, roving, and final spinning stages.

The market encompasses various spinning technologies tailored for different production requirements and yarn characteristics. Ring spinning, compact spinning, rotor spinning, and air jet spinning systems serve diverse applications across the textile industry. Each technology offers distinct advantages in terms of yarn quality, production speed, and operational efficiency.

Moreover, the global cotton spinning machinery sector is experiencing steady expansion driven by increasing demand for consistent, high-quality yarn production. Textile manufacturers are investing in advanced machinery to enhance productivity and maintain competitive positioning. Consequently, this trend supports sustained market growth across established and emerging textile manufacturing regions.

However, government initiatives promoting textile sector modernization further accelerate market development. Countries with strong textile manufacturing traditions are implementing policies to upgrade aging infrastructure with technologically advanced spinning systems. Additionally, sustainable manufacturing practices are gaining prominence, encouraging adoption of energy-efficient machinery solutions.

According to jusst.org research, in ring spinning mills 40% to 45% of energy is consumed by the ring spin department alone, with 70% to 80% of that energy utilized by spindle motors. This highlights the significant operational cost component associated with spinning operations.

Furthermore, technological advancements demonstrate substantial efficiency improvements in modern systems. According to Rieter documentation, upgrading suction nozzles on Autoconer 338 winding machines reduced energy consumption by 13% and increased machine efficiency by approximately 3%, while simultaneously cutting yarn search failures by approximately 50%.

Additionally, production speed enhancements illustrate the evolution of spinning technology capabilities. According to Qingdao Qizheng, modern spinning machines achieve production speeds up to approximately 250 m/min, significantly boosting output compared to older models operating at approximately 150 m/min. This performance improvement directly impacts manufacturing productivity and cost efficiency.

Key Takeaways

- The Global Cotton Spinning Machinery Market valued at USD 2.6 Billion in 2025, projected to reach USD 3.3 Billion by 2035

- Market expected to grow at a CAGR of 2.40% during the forecast period 2026-2035

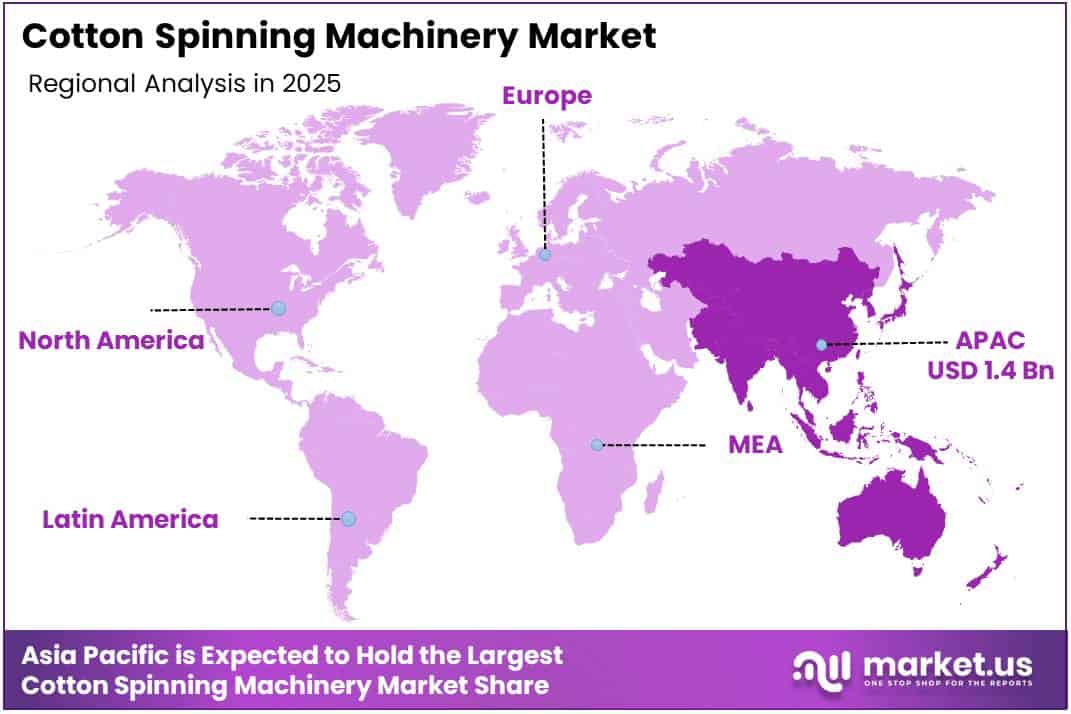

- Asia Pacific dominates the market with 54.1% share, valued at USD 1.4 Billion

- Ring Spinning machinery type holds 49.1% market share in 2025

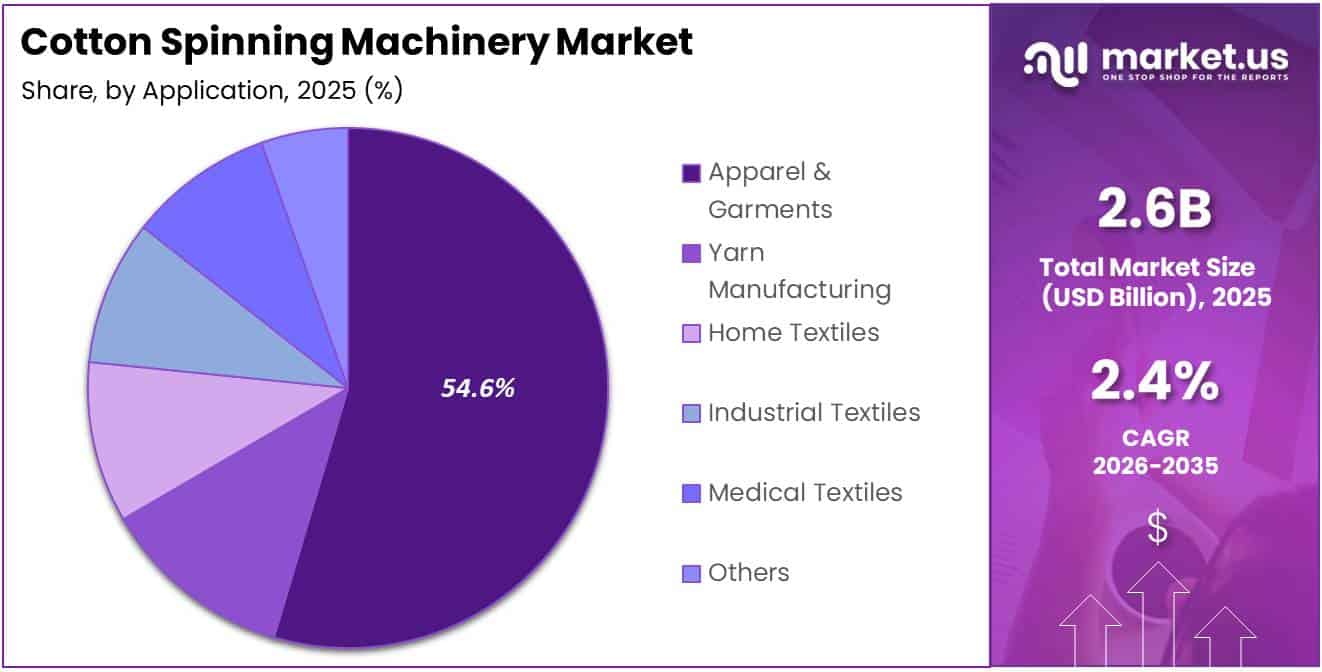

- Apparel & Garments application segment leads with 54.6% market share

Machinery Type Analysis

Ring Spinning dominates with 49.1% due to superior yarn quality and widespread industry adoption.

In 2025, Ring Spinning held a dominant market position in the By Machinery Type segment of Cotton Spinning Machinery Market, with a 49.1% share. This technology remains the preferred choice for producing high-quality yarn with excellent strength and uniformity characteristics. Manufacturers value ring spinning for its versatility across various cotton grades and yarn counts, making it indispensable for premium textile applications.

Compact Spinning represents an advanced variation of conventional ring spinning technology that eliminates fiber hairiness and enhances yarn quality. This machinery type produces cleaner, stronger yarn with reduced surface irregularities, commanding premium prices in specialized textile applications. Consequently, textile mills targeting high-value markets increasingly adopt compact spinning systems for competitive differentiation.

Rotor Spinning offers higher production speeds and lower labor requirements compared to traditional ring spinning systems. This technology suits manufacturers prioritizing output volume over ultimate yarn fineness, particularly for medium-count yarns. Additionally, rotor spinning machinery requires less floor space and generates consistent yarn quality, making it economically attractive for large-scale operations.

Air Jet Spinning delivers the fastest production speeds among all spinning technologies, utilizing compressed air to twist fibers into yarn. This method produces unique yarn characteristics suitable for specific applications including knitted fabrics and industrial textiles. However, the technology remains limited to certain fiber types and yarn counts, restricting broader market penetration.

Application Analysis

Apparel & Garments dominates with 54.6% due to massive global clothing production demand.

In 2025, Apparel & Garments held a dominant market position in the By Application segment of Cotton Spinning Machinery Market, with a 54.6% share. The fashion and clothing industry represents the largest consumer of cotton yarn globally, driving substantial demand for spinning machinery. Moreover, fast fashion trends and expanding middle-class populations in emerging economies continuously fuel apparel production growth.

Yarn Manufacturing encompasses the production of specialized yarns for various industrial and commercial applications beyond direct garment production. This segment includes manufacturers producing yarn for wholesalers, traders, and specialized textile converters. Additionally, yarn manufacturers require diverse machinery configurations to serve multiple customer specifications and quality requirements efficiently.

Home Textiles applications include bed linens, curtains, upholstery fabrics, and decorative textile products requiring specific yarn characteristics. This segment demands consistent yarn quality and colorfastness properties to ensure product durability. Consequently, home textile manufacturers invest in spinning machinery capable of producing uniform yarn suitable for high-wash-frequency applications.

Industrial Textiles utilize cotton yarn in technical applications including filtration materials, conveyor belts, and reinforcement fabrics. This specialized segment requires yarn with specific strength, elongation, and dimensional stability properties. Therefore, industrial textile producers prioritize spinning machinery delivering precise yarn specifications to meet demanding performance requirements in automotive, construction, and manufacturing sectors.

Medical Textiles represent a growing application area requiring ultra-clean production environments and stringent quality control standards. This segment produces surgical dressings, bandages, and healthcare products demanding exceptional purity and safety. Furthermore, medical textile manufacturers invest in specialized spinning equipment featuring advanced contamination control and regulatory compliance capabilities.

Others include niche applications across diverse industries such as agricultural textiles, geotextiles, and protective clothing materials. This category encompasses specialized yarn requirements for emerging applications including composite reinforcement and smart textiles. Additionally, these segments often require customized spinning solutions to achieve unique yarn characteristics not addressed by standard machinery configurations.

Key Market Segments

By Machinery Type

- Ring Spinning

- Compact Spinning

- Rotor Spinning

- Air Jet Spinning

By Application

- Apparel & Garments

- Yarn Manufacturing

- Home Textiles

- Industrial Textiles

- Medical Textiles

- Others

Drivers

Rising Global Demand for High-Quality and Consistent Cotton Yarn Drives Market Growth

The expanding global textile industry requires increasingly consistent yarn quality to meet stringent manufacturing standards and consumer expectations. Apparel brands and textile manufacturers demand uniform yarn characteristics to ensure predictable fabric performance and minimize production defects. Consequently, spinning mills invest in advanced machinery capable of delivering superior quality control and minimal variation across production batches.

Moreover, premium textile segments including branded apparel and luxury home textiles command higher profit margins, incentivizing manufacturers to upgrade spinning equipment. Advanced machinery incorporating precision control systems enables producers to achieve tighter quality specifications and reduce waste. Therefore, this quality-driven demand creates sustained replacement and expansion cycles in spinning machinery procurement across global markets.

Additionally, integrated textile manufacturing facilities recognize that yarn quality directly impacts downstream processing efficiency and final product value. Consistent yarn properties reduce weaving and knitting defects, improve dyeing uniformity, and enhance overall production economics. This interconnected value chain perspective drives continuous investment in state-of-the-art spinning technologies that deliver measurable quality improvements and operational advantages.

Restraints

High Initial Investment Costs and Operational Complexity Limit Market Adoption

Advanced cotton spinning machinery represents substantial capital expenditure, particularly for small and medium-sized textile manufacturers with limited financial resources. Modern ring spinning frames, compact spinning systems, and automated material handling equipment require significant upfront investment beyond the reach of many operators. Consequently, this financial barrier slows technology adoption rates and extends replacement cycles for aging equipment in price-sensitive markets.

Furthermore, operational complexity associated with sophisticated spinning systems demands skilled technical personnel for proper operation and maintenance. Many textile manufacturing regions face shortages of adequately trained machine operators and maintenance technicians capable of optimizing advanced equipment performance. This skills gap reduces effective machinery utilization rates and increases operational costs through production inefficiencies and extended downtime periods.

Additionally, frequent fluctuations in cotton fiber quality create operational challenges for spinning machinery performance and output consistency. Variations in fiber length, strength, micronaire, and contamination levels require constant machine adjustments and process parameter modifications. Therefore, manufacturers experience increased quality control burdens and reduced productivity when raw material characteristics deviate from optimal specifications, limiting overall operational efficiency.

Growth Factors

Rapid Adoption of Automation and Smart Technologies Accelerates Market Expansion

The textile industry is experiencing transformative digitalization as manufacturers integrate Industry 4.0 technologies into spinning operations for enhanced productivity and quality control. Automated monitoring systems, predictive maintenance algorithms, and real-time process optimization enable mills to maximize equipment effectiveness and minimize unplanned downtime. Consequently, smart spinning machinery delivers measurable return on investment through improved operational efficiency and reduced labor dependency.

Moreover, emerging markets in Asia, Africa, and Latin America are establishing new textile manufacturing capacity to serve growing domestic consumption and export opportunities. These regions offer competitive labor costs, expanding middle-class populations, and supportive government policies promoting industrial development. Therefore, substantial investments in modern spinning infrastructure create significant machinery demand, particularly for efficient production systems capable of meeting international quality standards.

Additionally, sustainability considerations are reshaping spinning mill investment decisions as environmental regulations tighten and brands demand reduced carbon footprints. Energy-efficient machinery designs, water conservation technologies, and waste reduction systems provide competitive advantages while ensuring regulatory compliance. Furthermore, resource-efficient spinning processes lower operational costs and enhance corporate social responsibility profiles, making sustainable machinery solutions increasingly attractive to forward-thinking textile manufacturers globally.

Emerging Trends

Digital Transformation and Advanced Spinning Technologies Reshape Market Landscape

Integration of Industry 4.0 principles and digital process control systems represents the most significant technological shift in modern spinning operations. Connected machinery platforms enable real-time production monitoring, automated quality assessment, and data-driven process optimization across entire spinning facilities. Consequently, manufacturers achieve unprecedented visibility into operational performance, facilitating rapid problem identification and continuous improvement initiatives that enhance overall competitiveness.

Moreover, compact and advanced ring spinning technologies are gaining substantial market traction due to superior yarn quality characteristics and enhanced production efficiency. These systems produce yarn with reduced hairiness, improved strength properties, and better uniformity compared to conventional ring spinning equipment. Additionally, compact spinning machinery commands premium positioning in markets serving high-value textile applications where yarn quality directly impacts final product performance.

Furthermore, modern spinning machinery increasingly supports production flexibility to accommodate multiple yarn types, counts, and specifications on the same equipment platform. This versatility enables manufacturers to respond rapidly to changing market demands without significant capital investment or lengthy changeover periods. Therefore, multi-purpose spinning systems provide strategic advantages in dynamic textile markets characterized by shorter product lifecycles and diverse customer requirements.

Regional Analysis

Asia Pacific Dominates the Cotton Spinning Machinery Market with a Market Share of 54.1%, Valued at USD 1.4 Billion

Asia Pacific commands the global cotton spinning machinery market due to the region’s massive textile manufacturing base and continued capacity expansion. Countries including China, India, Bangladesh, and Vietnam operate thousands of spinning mills serving both domestic and international markets. The region’s 54.1% market share, valued at USD 1.4 Billion, reflects ongoing investments in modern equipment and technology upgrades across established and emerging textile manufacturing hubs.

North America Cotton Spinning Machinery Market Trends

North America maintains specialized textile manufacturing focused on technical textiles and high-value products rather than mass-market apparel production. The region emphasizes automation, quality, and sustainable manufacturing practices. Consequently, machinery investments prioritize advanced technologies offering superior efficiency and environmental performance to offset higher labor costs.

Europe Cotton Spinning Machinery Market Trends

Europe’s cotton spinning sector concentrates on premium yarn production for luxury textiles and specialized industrial applications. Countries including Italy, Germany, and Turkey operate technologically advanced spinning facilities serving demanding quality requirements. Moreover, stringent environmental regulations drive adoption of energy-efficient and sustainable spinning technologies across the region.

Latin America Cotton Spinning Machinery Market Trends

Latin America’s textile industry benefits from proximity to major apparel markets and competitive manufacturing costs in countries like Brazil and Mexico. The region experiences moderate growth in spinning capacity driven by domestic consumption and nearshoring opportunities. Additionally, government initiatives supporting textile sector development encourage machinery modernization and technology upgrades.

Middle East & Africa Cotton Spinning Machinery Market Trends

Middle East & Africa represents an emerging market for cotton spinning machinery with significant growth potential in countries establishing textile manufacturing capabilities. Egypt, Turkey, and several African nations are developing spinning infrastructure to serve regional markets. Furthermore, strategic investments in textile industrialization create new opportunities for machinery suppliers targeting these developing markets.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Rieter AG maintains its position as a global leader in cotton spinning technology through continuous innovation and comprehensive machinery solutions. The Swiss manufacturer offers complete spinning preparation and yarn manufacturing systems serving mills worldwide. Their technology portfolio spans the entire spinning process from bale opening through winding, enabling integrated production solutions. Moreover, Rieter’s focus on automation and digitalization addresses modern manufacturing requirements for efficiency and quality control.

Saurer Schlafhorst GmbH & Co. KG represents a premier supplier of advanced spinning and winding technologies with particular strength in autoconer systems. The company delivers innovative solutions that enhance productivity while reducing energy consumption and operational costs. Saurer’s machinery incorporates sophisticated quality monitoring and process control capabilities that enable manufacturers to achieve superior yarn characteristics. Additionally, their recent contract wins in emerging markets demonstrate continued global competitiveness and technology leadership.

Trützschler Group specializes in complete fiber preparation systems and spinning machinery that optimize raw material utilization and processing efficiency. The German manufacturer emphasizes sustainable technologies that minimize energy consumption and environmental impact throughout the spinning process. Their comprehensive product range serves diverse customer requirements from small specialized mills to large integrated textile operations. Furthermore, Trützschler’s engineering expertise enables customized solutions addressing specific processing challenges and quality objectives.

Muratec Murata Machinery, Ltd. brings Japanese precision engineering to the cotton spinning machinery market through advanced automation and control technologies. The company’s vortex spinning and automated winding systems deliver exceptional productivity and yarn quality for demanding applications. Muratec’s focus on labor-saving technologies and intelligent manufacturing solutions addresses critical workforce challenges facing the global textile industry. Consequently, their machinery platforms enable manufacturers to maintain competitive operations despite rising labor costs and skills shortages.

Key Players

- Rieter AG

- Saurer Schlafhorst GmbH & Co. KG

- Trützschler Group

- Muratec Murata Machinery, Ltd.

- Savio Macchine Tessili S.p.A.

- Lakshmi Machine Works (LMW)

- A.T.E. Enterprises

- Itema S.p.A.

- Kirloskar Toyota Textile Machinery Pvt. Ltd.

- Marzoli Machines Textile S.r.l.

- Qingdao Jingtian Textile Machinery Co., Ltd.

- Garuda Automation Systems Pvt. Ltd.

- Toyota Industries Corporation

- Jingwei Textile Machinery Co., Ltd.

- Saurer Group

- Other Key Players

Recent Developments

- May 2025 – Rieter announced the acquisition of Barmag from OC Oerlikon for an upfront equity purchase price of CHF 713 million. This strategic transaction expands Rieter’s technology portfolio and strengthens its position in the synthetic fiber machinery segment, complementing existing cotton spinning capabilities.

- October 2025 – Toyota Industries Corporation launched the EST4, a new compact spinning system designed for the RX300 ring spinning frame. This advanced system enhances yarn quality while improving production efficiency, addressing market demand for superior compact spinning technologies in modern textile manufacturing operations.

- October 2025 – Saurer signed a major contract with KTE for Spinning and Weaving (Egypt) for supplying high-end spinning technology. This significant agreement demonstrates continued investment in Egypt’s textile sector and reinforces Saurer’s competitive position in emerging markets seeking advanced manufacturing capabilities.

Report Scope

Report Features Description Market Value (2025) USD 2.6 Billion Forecast Revenue (2035) USD 3.3 Billion CAGR (2026-2035) 2.40% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Machinery Type (Ring Spinning, Compact Spinning, Rotor Spinning, Air Jet Spinning), By Application (Apparel & Garments, Yarn Manufacturing, Home Textiles, Industrial Textiles, Medical Textiles, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Rieter AG, Saurer Schlafhorst GmbH & Co. KG, Trützschler Group, Muratec Murata Machinery, Ltd., Savio Macchine Tessili S.p.A., Lakshmi Machine Works (LMW), A.T.E. Enterprises, Itema S.p.A., Kirloskar Toyota Textile Machinery Pvt. Ltd., Marzoli Machines Textile S.r.l., Qingdao Jingtian Textile Machinery Co., Ltd., Garuda Automation Systems Pvt. Ltd., Toyota Industries Corporation, Jingwei Textile Machinery Co., Ltd., Saurer Group, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cotton Spinning Machinery MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Cotton Spinning Machinery MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Rieter AG

- Saurer Schlafhorst GmbH & Co. KG

- Trützschler Group

- Muratec Murata Machinery, Ltd.

- Savio Macchine Tessili S.p.A.

- Lakshmi Machine Works (LMW)

- A.T.E. Enterprises

- Itema S.p.A.

- Kirloskar Toyota Textile Machinery Pvt. Ltd.

- Marzoli Machines Textile S.r.l.

- Qingdao Jingtian Textile Machinery Co., Ltd.

- Garuda Automation Systems Pvt. Ltd.

- Toyota Industries Corporation

- Jingwei Textile Machinery Co., Ltd.

- Saurer Group

- Other Key Players