Global Cosmetic Surgery Market by Gender (Female and Male), By Age Group (13 to 29, 30 to 54, And Others), By Procedure (Surgical Procedures and Non-Surgical Procedures), by End Users (Ambulatory surgical facility, Hospital, and clinic, Other End Users), by Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 60957

- Number of Pages: 262

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

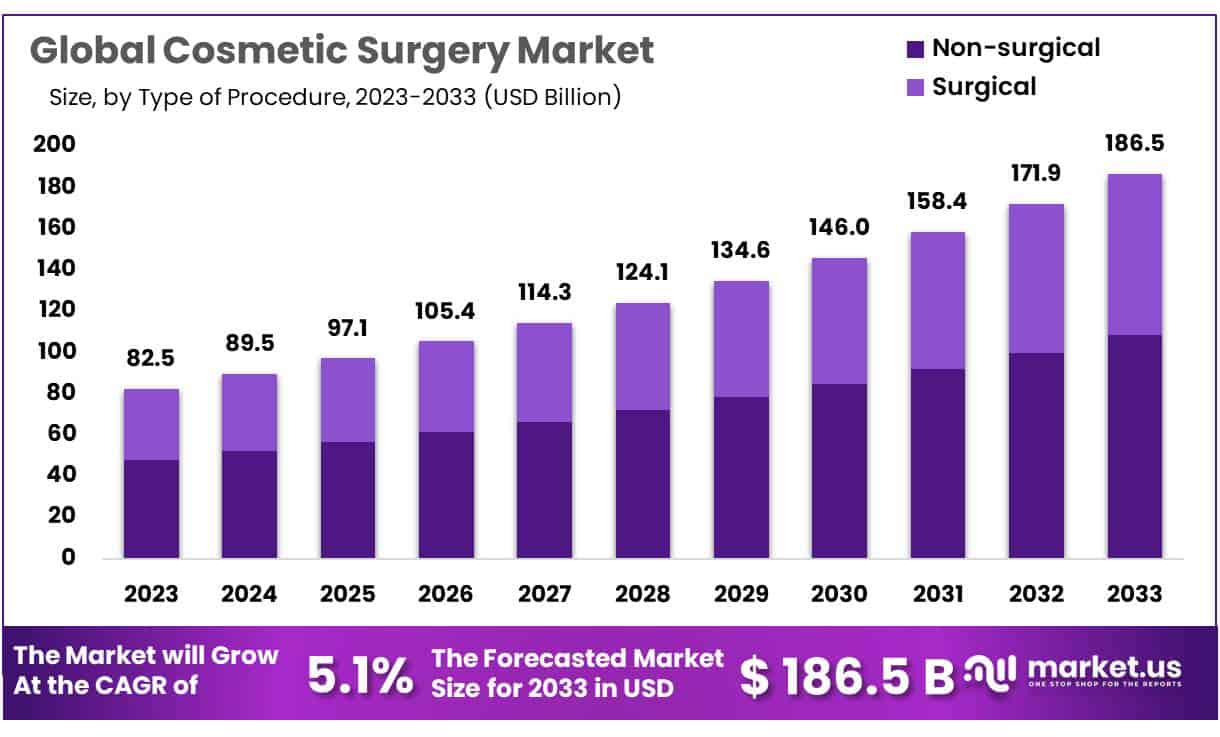

The Global Cosmetic Surgery Market size is expected to be worth around USD 186.5 Billion by 2033 from USD USD 82.5 Billion in 2023, growing at a CAGR of 5.1% during the forecast period from 2024 to 2033.

The demand for aesthetic treatments has increased in recent years due to the innovative products that manufacturers have created. There are lucrative growth opportunities for technologically advanced products such as non-surgical body contouring, which uses fat-freezing technology.

The cosmetic market was significantly affected by the COVID-19 pandemic. The cosmetic medicine market was initially negatively affected by social distancing, a sudden sharp drop in the income levels of consumers. A decline in product demand, limited operations, and temporary closures of beauty centers caused a period of negative growth in the market. This was followed by disruptions in the supply chain.

Nowadays, individuals are more conscious about their appearance. Botox is one of the most popular cosmetic procedures. The interest in non-surgical procedures is rising, while surgical procedures are declining in popularity.

The market has seen a significant increase in demand over the last few months. The demand for aesthetic treatments has increased in developing countries due to a growing fitness consciousness and desire to look younger. Consumers in developing countries, such as India, South Korea, etc., are increasingly interested in aesthetic procedures such as liposuction and nose reshaping.

According to the International Society of Aesthetic and Plastic Surgery (ISAPS), India was among the top five countries performing non-surgical procedures globally. This highlights the potential for high growth in India for aesthetic manufacturers.

Key Takeaways

- Market Size: Cosmetic Surgery Market size is expected to be worth around USD 186.5 Billion by 2033 from USD USD 82.5 Billion in 2023.

- Market Growth: The growing at a CAGR of 5.1% during the forecast period from 2024 to 2033.

- Procedure Analysis: The non-surgical segment dominated the market with a revenue share of 58.1%.

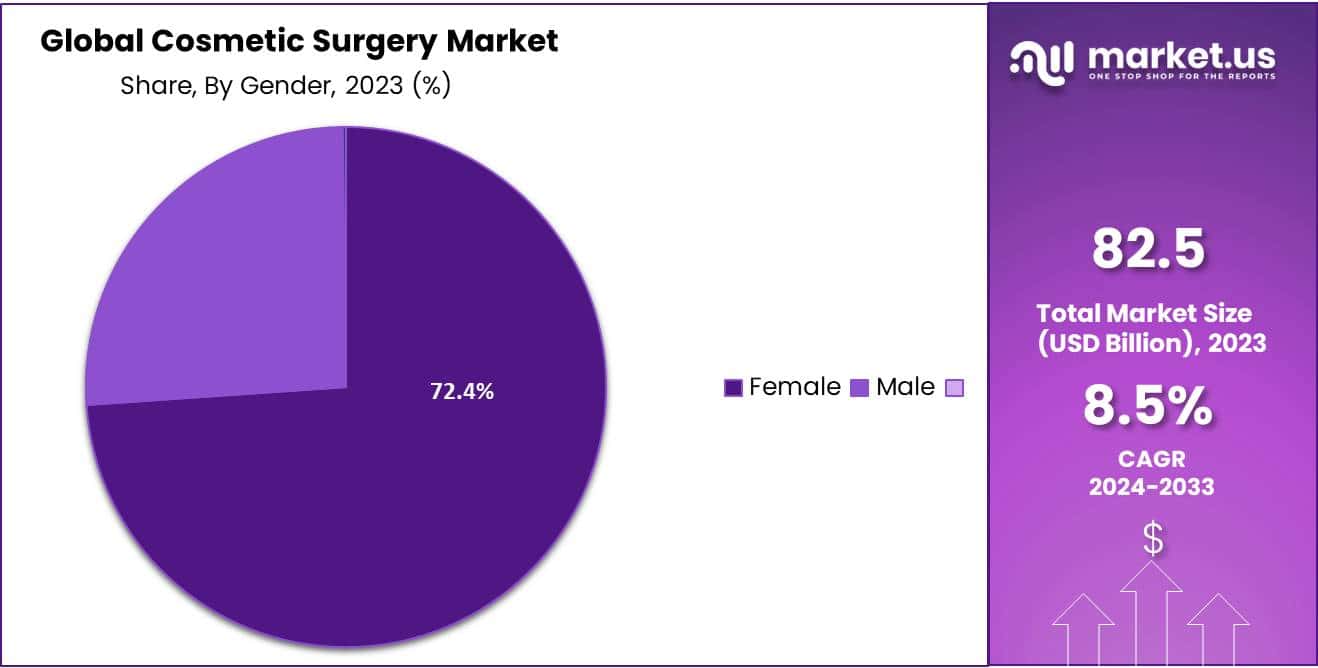

- Gender Analysis: The female market accounts 74.2% market share for cosmetic surgery procedures.

- Age Group Analysis: Individuals between 30 and 54 years of age dominated the market 41.6% with the largest revenue share.

- End-User Analysis: The hospitals and specialty clinics segment held 65.2% market share in 2023.

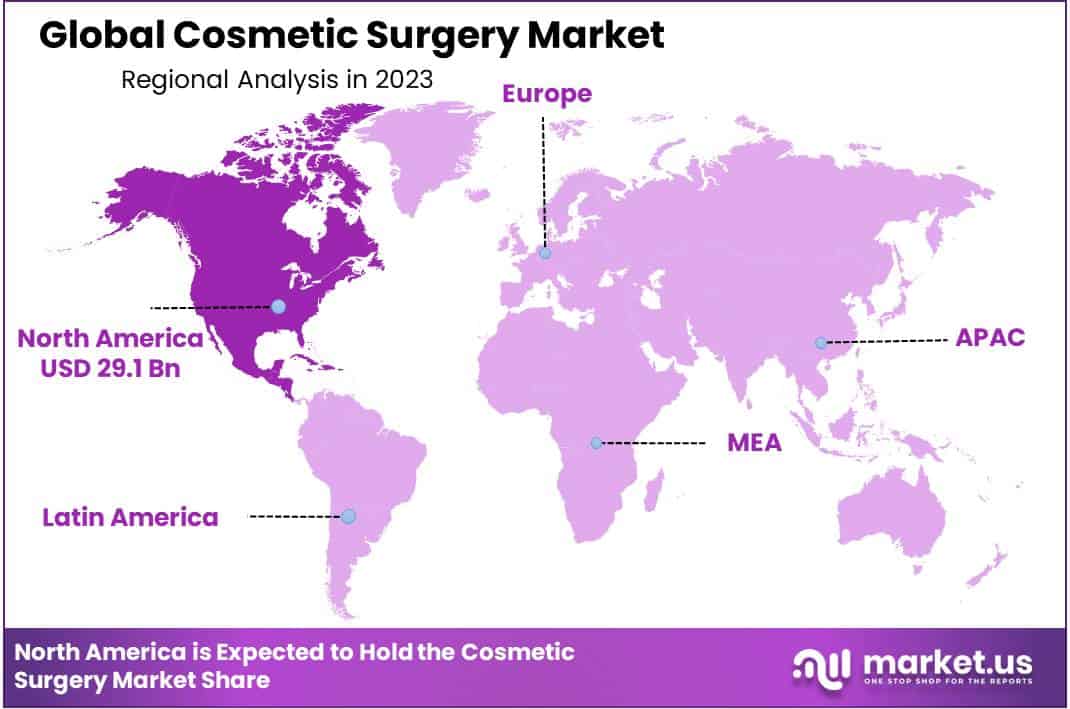

- Regional Analysis: North America accounted for 35.3% market share and hold USD 29.1 Billion market revenue.

Procedure Analysis

The market can be further divided into non-surgical and surgical procedures based on the type of procedure. The non-surgical segment dominated the market with a revenue share of 58.1%. This segment is expected to grow at the fastest CAGR while maintaining its dominant market position for the entire forecast period. Non-surgical procedures are more popular because they offer less pain and can be performed quickly. Botox injections and soft tissue fillers are some of the most popular non-surgical procedures.

Allergan Cosmetic (a subsidiary of AbbVie Inc.) received FDA approval for JUVEDERM(r). VOLUMA(TM). XC to enlarge the chin area in adults over 21 years old. Jeuveau was approved by the FDA in 2019. It is similar to Botox but costs less than Botox. It is effective in reducing wrinkles. Some of the most popular aesthetic procedures include liposuction and breast augmentation. Surgical procedures are increasingly in demand due to the increasing importance of physical appearance.

Gender Analysis

It can be divided by gender into male or female. Because women are increasingly conscious of their physical appearance and desire to improve their aesthetic value, the female market accounts 74.2% market share for cosmetic surgery procedures. Cosmetic surgical procedures are in high demand due to the increasing importance of a beautiful facial structure or physique. This includes procedures that affect the appearance of the eyes, lips, nose, and cheekbones.

Labiaplasty, vaginoplasty, and other parts of the body are also available for cosmetic surgery. These procedures have made a significant contribution to the market’s growth. As a result, the demand for aesthetic perfection is increasing, which also increases the contribution of men. Obesity has risen due to unhealthy eating habits and a more modern lifestyle. Cosmetic surgery has seen a rise in demand due to the increasing number of procedures that can be performed to remove excess fat.

Age Group

Among the age group segment, individuals between 30 and 54 years of age dominated the market 41.6% with the largest revenue share. These are expected to continue to dominate in the future. This age group has seen liposuction as a standard cosmetic surgery procedure. This has led to an increase in demand for cosmetic surgery procedures among this age group.

End-User Analysis

Based on end-users, the market can be classified into ambulatory surgical facilities, hospitals, clinics, cosmetic surgical centers & others. Among these end-users, the hospitals and specialty clinics segment held 65.2% market share in 2023. The majority of cosmetic procedures are performed at hospitals & specialist clinics rather than in other facilities.

This is due to the increased demand for minimally surgical procedures and the shift in patients towards specialty clinics. Plastic surgeons are more likely to associate with hospitals and specialist clinics that provide various services.

However, the spas and cosmetic surgery centers segment is expected to grow positively in the coming years because of the strong growth of medical tourism as well as the emergence and expansion of new spas and clinics. The segment’s growth is also fueled by a gradual rise in cosmetic center procedures during the forecast period.

Key Market Segments

By Procedure

- Surgical Procedures

- Breast augmentation

- Eyelid surgery

- Liposuction

- Rhinoplasty

- Others

- Non-surgical Procedures

- Botulinum Toxin

- Hyaluronic Acid

- Hair Removal

- Nonsurgical Fat Reduction

- Photo Rejuvenation

- Others

By Gender

- Female

- Male

By Age Group

- 13 to 29

- 30 to 54

- 55 and above

By End-User

- Ambulatory Surgical Facility

- Hospital and Clinic

- Cosmetic Surgical Center

- Other End Users

Drivers

As cosmetics have become an integral part of everyday life, the demand has changed over recent years. The market has promising prospects due to increased attention to aesthetic features. The demand for cosmetic procedures is rising because of the increasing interest of women in cosmetic procedures such as breast augmentation and liposuction, breast augmentation, eyelid surgery (abdominoplasty), breast augmentation, and other procedures.

The International Society of Aesthetic Plastic Surgery 2022 found that women make up 88.0% of all cosmetic surgeries worldwide. Patients are choosing non-invasive, minimally surgical cosmetic procedures over surgery. On-surgical procedures are preferred due to their many advantages, including reduced recovery times, pain, and healthcare costs. These factors, along with increased research and development investment and new product launches from key players, are driving market growth and contributing to market growth.

Restraints

More cosmetic procedures are being performed due to the increasing popularity of aesthetic procedures in countries such as the U.S., Germany, and Brazil. This has led to increased complications, which in turn has impacted the market growth. Several complications can arise during and after a cosmetic procedure. Non-physicians performing procedures in salons, spas, or other non-medical settings are creating more complications. Scarring, infection, nerve damage, and swelling are common complications from aesthetic procedures.

Side effects are also holding the market back from facial fillers. Redness, skin pigmentation, and bruising are the most common side effects. Individuals have safety concerns, and that limits the number of who can undergo cosmetic procedures. This has resulted in a reduction in demand for cosmetic procedures and a decrease in market growth.

Trends

Due to increasing age-related concerns, cosmetic procedures are becoming more popular and common among men. More men are adopting these procedures to keep their youthful appearance. The market is also growing due to the increased demand for non-surgical procedures like botulinum toxins and dermal fillers. Eyelid surgery, liposuction, and gynecomastia are the most popular non-surgical procedures for men. These factors, along with a steadily improving gender balance, are leading to a greater demand for cosmetic procedures in the male population.

Regional Analysis

In 2023, North America Accounted for 35.3 Billion Dollars in Market Value.

In 2023, North America accounted for 35.3% market share and hold USD 29.1 Billion market revenue. This region’s dominance is due to its high number of qualified plastic surgeons who perform various cosmetic procedures. Also, the increasing number of aesthetic clinics in Canada and the U.S. is responsible for this region’s growth. This region is also experiencing rapid growth due to the adoption of advanced aesthetic devices on the market. Europe occupied the second spot in the global market. This region is experiencing market growth due to the increasing use of non-surgical procedures and new spas opening in France, Germany, and other countries.

According to data from the German National Tourist Board, there are approximately 350 medical spas in Germany. The highest CAGR is expected in Latin America during the forecast period. This market is driven by the growing demand for medical tourism and the acceptance of new techniques in different aesthetic clinics. It also offers affordable cosmetic procedures to patients.

Key Regions

North America

- The US

- Canada

- Mexico

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

Globally, the market is fragmented, and many local players compete with international players. The market is restricted by strict regulatory approvals that limit the ability to introduce new products. The main factors that affect the market’s competitiveness are technological advancement and the rapid adoption of new devices. The top players have turned to mergers and acquisitions to gain maximum market share.

Market Key Players

With the presence of many local and regional players, the cosmetic surgery market is fragmented. Market players are subject to intense competition from top players, particularly those with strong brand recognition and high distribution networks. Companies have gained various expansion strategies, such as partnerships and product launches, to stay on top of the market. The following are some of the major players in the global cosmetic surgery industry

- Abbvie Inc.

- Bausch Health Companies Inc.

- Candela Syneron

- cynosure Inc.

- Galderma SA

- Merz Pharma GmbH and Co. KGaA

- Sientra Inc.

- Sinclair Pharmaceuticals Limited

- Teoxane Laboratories

- Johnson and Johnson

- Other Key Players

Recent Developments

October – December 2023

- AbbVie Inc.: Acquired Allergan Aesthetics, gaining access to a portfolio of popular dermal fillers like Juvederm and Voluma.

- Bausch Health Companies Inc.: Received FDA approval for the first non-surgical fat reduction device, SculpSure iD.

- Candela Syneron: Launched the UltraClear Plus system, a new platform combining PicoSure and NanoSmooth technologies for wrinkle reduction and skin rejuvenation.

- cynosure Inc.: Presented data at the American Society for Dermatologic Surgery meeting showing positive results for the Posedidon device in treating cellulite.

- Galderma SA: Announced a strategic partnership with the University of California, San Francisco, to research and develop new injectable fillers.

- Sientra Inc.: Launched Silimed Smooth Expander, a new breast implant designed for improved natural-looking results.

Report Scope

Report Features Description Market Value (2023) USD 82.5 Billion Forecast Revenue (2033) USD 186.5 Billion CAGR (2024-2033) 5.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Procedure: Surgical Procedures (Breast augmentation, Eyelid surgery, Liposuction, Rhinoplasty, Others); Non-surgical Procedures (Botulinum Toxin, Hyaluronic Acid, Hair Removal, Nonsurgical Fat Reduction, Photo Rejuvenation, Others)

By Gender: Female, Male;

By Age Group: 13 to 29, 30 to 54, 55 and above;

By End-User: Ambulatory surgical facility, hospital, and clinic, cosmetic surgical center, other end usersRegional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Abbvie Inc., Bausch Health Companies Inc., Candela Syneron, cynosure Inc., Galderma SA, Merz Pharma GmbH and Co. KGaA, Sientra Inc., Sinclair Pharmaceuticals Limited, Teoxane Laboratories, Johnson and Johnson, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Cosmetic Surgery Market?The Cosmetic Surgery Market encompasses medical procedures aimed at enhancing a person's appearance, including surgical and non-surgical treatments.

How big is the Cosmetic Surgery Market?The global Cosmetic Surgery Market size was estimated at USD 186.5 Billion in 2023 and is expected to reach USD 82.5 Billion in 2033.

What is the Cosmetic Surgery Market growth?The global Cosmetic Surgery Market is expected to grow at a compound annual growth rate of 5.1%. From 2024 To 2033

Who are the key companies/players in the Cosmetic Surgery Market?Some of the key players in the Cosmetic Surgery Markets are Abbvie Inc., Bausch Health Companies Inc., Candela Syneron, cynosure Inc., Galderma SA, Merz Pharma GmbH and Co. KGaA, Sientra Inc., Sinclair Pharmaceuticals Limited, Teoxane Laboratories, Johnson and Johnson, Other Key Players.

How is the market evolving?The market has shown growth, driven by factors like changing beauty standards, increased awareness, and technological advancements.

What are the risks associated with cosmetic surgery?Risks may include complications during surgery, infections, and dissatisfaction with results. It's crucial for patients to be well-informed.

Is there a demographic trend in cosmetic surgery?Cosmetic surgery is popular among various age groups, but trends show a rising interest among millennials and Generation Z.

What are the ethical considerations in the cosmetic surgery market?Ethical concerns relate to patient consent, body image issues, and the responsibility of medical professionals to prioritize patient well-being.

-

-

- Abbvie Inc.

- Bausch Health Companies Inc.

- Candela Syneron

- cynosure Inc.

- Galderma SA

- Merz Pharma GmbH and Co. KGaA

- Sientra Inc.

- Sinclair Pharmaceuticals Limited

- Teoxane Laboratories

- Johnson and Johnson

- Other Key Players