Global Construction Machinery Telematics Market Size, Share, Growth Analysis By Machinery Type (Excavator, Crane, Telescopic Handling, Loader and Backhoe, Others), By Technology (GPS Tracking, Cellular Communication, IOT Sensors, Machine Learning, AI, Others), By Customer GAR (100–500m, 1–5b, 500–1b, 50–100m, 10–50m, 10m), By Sales Channel (OEM, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169769

- Number of Pages: 201

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

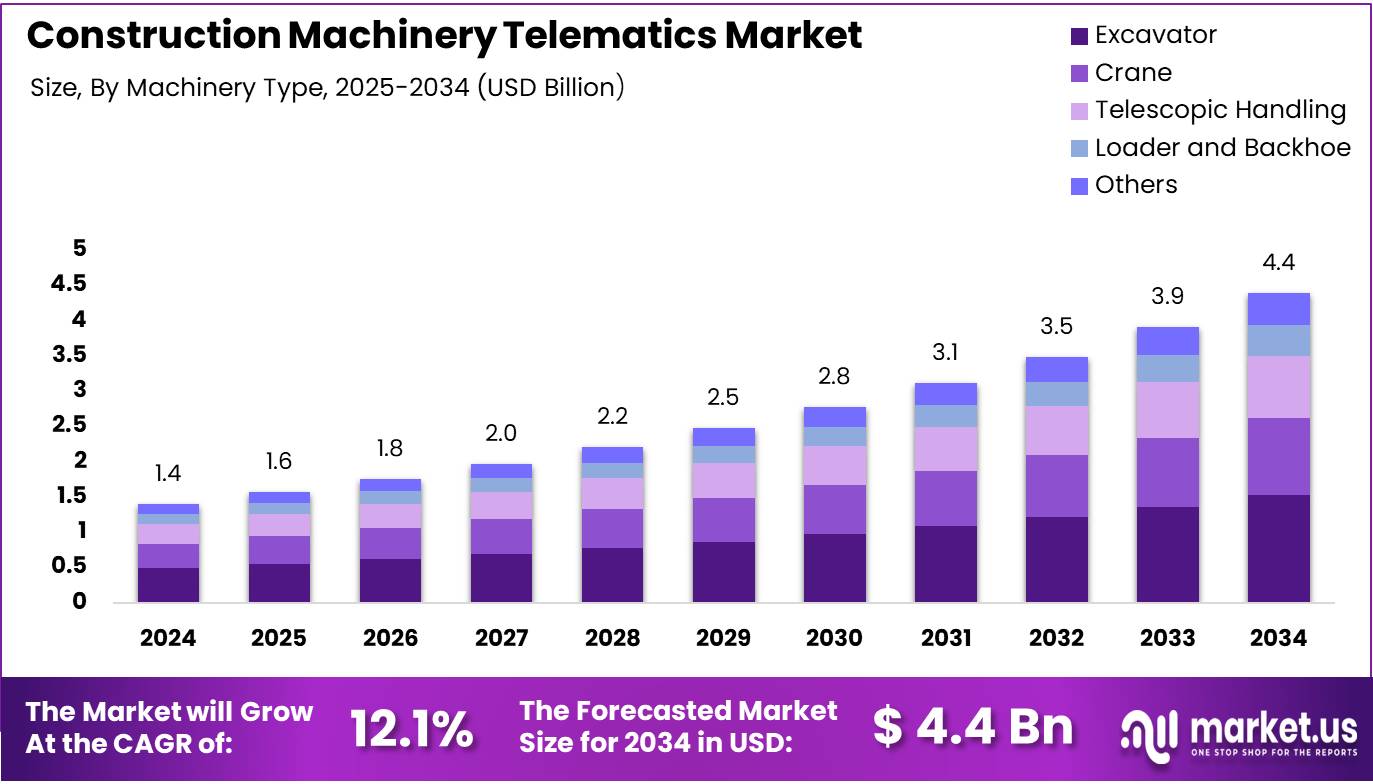

The Global Construction Machinery Telematics Market size is expected to be worth around USD 4.4 Billion by 2034, from USD 1.4 Billion in 2024, growing at a CAGR of 12.1% during the forecast period from 2025 to 2034.

Construction machinery telematics refers to connected technologies that track machine health, fuel use, productivity, and location. These systems integrate GPS, sensors, and communication modules to help construction firms monitor equipment remotely. This capability improves project planning, strengthens asset utilization, and supports timely maintenance decisions across diverse job sites.

Furthermore, the construction machinery telematics market continues expanding as companies prioritize efficiency and digital transformation. Rising infrastructure spending increases the need for better fleet visibility and optimized workflows. As a result, telematics adoption accelerates across contractors who want consistent output and lower operational risks. This sustained momentum supports long-term industry modernization.

Additionally, strong cost-reduction pressure encourages wider telematics deployment. Companies increasingly use data analytics to reduce downtime and monitor real-time machine behavior. These insights help streamline fuel budgeting, avoid unnecessary engine hours, and prevent misuse. Therefore, telematics becomes a financial lever that improves fleet profitability and resource allocation across equipment categories.

Moreover, government investment in infrastructure and regulations on fuel efficiency continue boosting market opportunities. Many regions promote sustainable construction practices, motivating equipment owners to adopt telematics for compliance and reporting. As environmental expectations rise, firms benefit from transparent machine data that supports audits and strengthens operational accountability.

According to findings, non-productive idling can represent 10–30% of total fuel consumed by construction equipment. Studies also indicate fuel-economy improvements of 5.4% to 9.3% when telematics and driver feedback tools influence operator behavior. These measurable efficiency gains reinforce the market’s value proposition for fleet operators managing high daily fuel usage.

Additionally, reducing idle time by 20–30% can deliver savings reaching tens to hundreds of thousands of dollars annually for mid-to-large fleets. Despite this, overall adoption remains under 50% across active fleets, although newer machinery shows higher factory-installed penetration. This gap creates meaningful growth opportunities for telematics providers and construction firms seeking efficiency.

Key Takeaways

- The global market size reached USD 1.4 Billion in 2024 with a forecast of USD 4.4 Billion by 2034.

- The market is expected to grow at a 12.1% CAGR between 2025–2034.

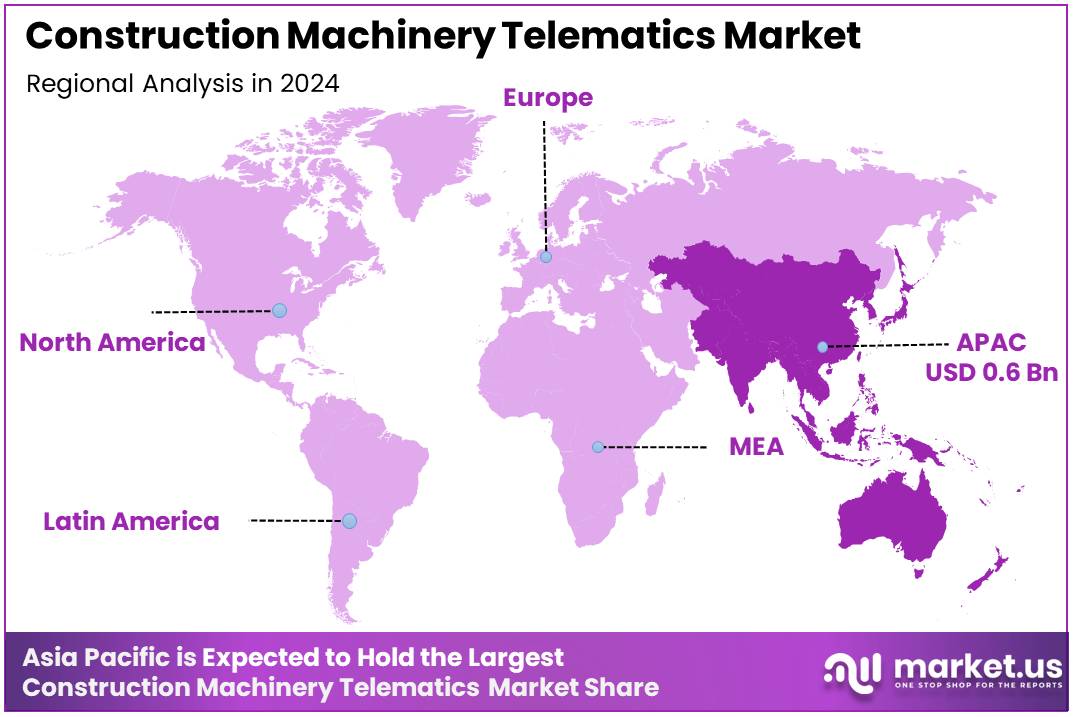

- Asia Pacific led the regional market with a 48.8% share valued at USD 0.6 Billion.

- Excavators dominated the machinery type segment with a 34.8% share.

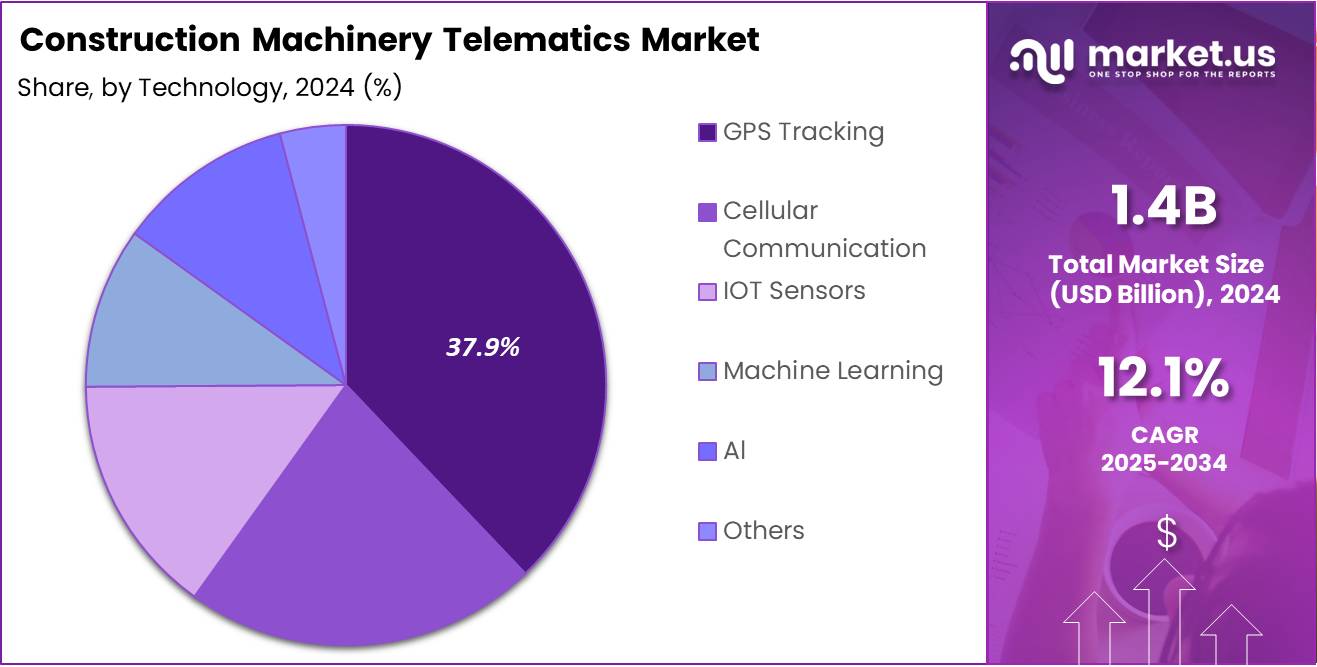

- GPS Tracking led the technology segment with a 37.9% market share.

- The 100–500m customer GAR segment held the highest share at 43.3%.

- The OEM sales channel accounted for a dominant 73.5% share.

Machinery Type Analysis

Excavator held a dominant market position in the By Machinery Type segment of Construction Machinery Telematics Market, with a 34.8% share.

In 2024, Excavators maintain their leading position due to their extensive deployment across construction, mining, and infrastructure projects globally. These machines require continuous monitoring for operational efficiency, fuel consumption, and predictive maintenance. Fleet managers prioritize telematics integration in excavators to optimize productivity, reduce downtime, and enhance safety protocols. The widespread adoption of GPS-enabled tracking systems and real-time performance analytics further strengthens excavator telematics demand across diverse construction applications.

Cranes represent a significant segment driven by the critical need for load monitoring, safety compliance, and operational visibility. Telematics solutions enable crane operators to track lifting capacity, boom angles, and structural stress in real-time. The growing emphasis on accident prevention and regulatory compliance accelerates telematics adoption in tower cranes, mobile cranes, and crawler cranes deployed in high-rise construction and heavy lifting operations.

Telescopic Handlers benefit from telematics integration through enhanced load management, attachment tracking, and operator behavior monitoring. These versatile machines operating in agriculture, construction, and warehousing environments leverage connectivity solutions for improved fleet utilization and service scheduling, thereby reducing operational costs and extending equipment lifespan.

Loaders and Backhoes increasingly adopt telematics for fuel efficiency optimization, idle time reduction, and geofencing capabilities. Construction companies deploy connected solutions to monitor material handling operations, track equipment location, and streamline maintenance schedules, resulting in improved project timelines and reduced total cost of ownership.

Others encompass specialized construction machinery including bulldozers, graders, and compactors that utilize telematics for performance optimization and fleet management. These machines benefit from remote diagnostics, usage analytics, and automated reporting features that enhance operational transparency and decision-making capabilities across construction sites.

Technology Analysis

GPS Tracking held a dominant market position in the By Technology segment of Construction Machinery Telematics Market, with a 37.9% share.

In 2024,GPS Tracking remains the cornerstone technology providing real-time location visibility, geofencing capabilities, and route optimization for construction fleets. Equipment owners leverage satellite-based positioning to prevent theft, monitor unauthorized usage, and optimize asset deployment across multiple job sites. The maturity, reliability, and cost-effectiveness of GPS technology ensure its continued dominance in telematics implementations worldwide.

Cellular Communication enables seamless data transmission between construction machinery and cloud-based management platforms. This technology facilitates remote diagnostics, firmware updates, and instant alert notifications. The expansion of 4G and 5G networks enhances connectivity reliability, supporting bandwidth-intensive applications such as video streaming from machine-mounted cameras and high-frequency sensor data transmission for comprehensive fleet management solutions.

IoT Sensors capture critical operational parameters including engine temperature, hydraulic pressure, vibration levels, and fuel consumption rates. These intelligent devices enable predictive maintenance strategies by identifying potential failures before breakdowns occur. Construction companies benefit from reduced unplanned downtime, extended component lifespan, and optimized maintenance schedules through continuous condition monitoring and data-driven insights.

Machine Learning algorithms analyze historical operational data to identify patterns, predict equipment failures, and recommend optimal operating conditions. This technology enhances decision-making by providing actionable insights on fuel efficiency improvements, operator performance benchmarking, and proactive maintenance scheduling, thereby maximizing equipment uptime and operational efficiency.

Artificial Intelligence transforms raw telematics data into intelligent recommendations for fleet optimization, automated reporting, and anomaly detection. AI-powered systems enable autonomous decision-making, advanced diagnostics, and sophisticated predictive analytics that continuously improve through adaptive learning, delivering increasingly accurate performance forecasts and maintenance recommendations.

Others include emerging technologies such as edge computing, blockchain for secure data management, and augmented reality interfaces for remote equipment support. These innovations complement traditional telematics capabilities by enhancing data security, reducing latency in decision-making, and providing immersive troubleshooting experiences for maintenance technicians and operators.

Customer GAR Analysis

100-500m held a dominant market position in the By Customer GAR segment of Construction Machinery Telematics Market, with a 43.3% share.

In 2024, The 100-500m customer segment demonstrates the highest adoption rate due to their substantial fleet sizes and operational complexity requiring comprehensive monitoring solutions. These mid-to-large construction companies prioritize telematics investments to achieve measurable returns through improved fleet utilization, reduced fuel costs, and optimized maintenance schedules. Their financial capacity enables deployment of advanced connectivity solutions across diverse equipment types and geographic locations.

The 1-5b segment comprises major construction conglomerates and multinational contractors operating extensive machinery fleets across multiple continents. These organizations implement enterprise-level telematics platforms with advanced analytics, custom integrations, and dedicated support infrastructure. Their scale demands sophisticated solutions for centralized fleet management, standardized reporting, and strategic decision-making based on comprehensive operational data.

The 500-1b customer category includes large regional contractors and specialized construction firms with significant equipment investments. These companies leverage telematics for competitive differentiation, operational excellence, and compliance management. Their adoption focuses on scalable solutions that balance functionality with investment requirements while supporting growth initiatives and market expansion strategies.

The 50-100m segment represents growing construction businesses transitioning from manual tracking to digital fleet management. These companies recognize telematics value in reducing operational costs and improving project profitability. Their adoption typically begins with core tracking features before expanding to advanced diagnostics and analytics as operational maturity increases.

The 10-50m customer group consists of small-to-medium construction enterprises seeking cost-effective telematics solutions for essential fleet visibility and basic maintenance tracking. These organizations prioritize simple implementations with quick deployment timelines and minimal training requirements, focusing on immediate returns through theft prevention and basic utilization monitoring.

The 10m segment includes independent contractors and small construction firms with limited equipment portfolios. Their telematics adoption remains constrained by budget limitations and perceived complexity. However, affordable entry-level solutions and subscription-based models increasingly enable these smaller operators to access basic tracking and monitoring capabilities for critical equipment assets.

Sales Channel Analysis

In 2024, OEM held a dominant market position in the By Sales Channel segment of Construction Machinery Telematics Market, with a 73.5% share.

The OEM channel dominates through factory-integrated telematics systems providing seamless hardware-software integration and comprehensive warranty coverage. Construction companies prefer OEM telematics for guaranteed compatibility, manufacturer support, and simplified procurement processes. The convenience of single-point accountability and bundled financing strengthens OEM preference among fleet operators.

The Aftermarket channel serves customers seeking retrofit solutions for existing equipment fleets. Independent providers offer flexible platforms compatible with multiple machinery brands, enabling unified fleet management. This channel appeals to cost-conscious operators and companies requiring vendor-neutral solutions with competitive pricing and rapid deployment capabilities.

Key Market Segments

By Machinery Type

- Excavator

- Crane

- Telescopic Handling

- Loader and Backhoe

- Others

By Technology

- GPS Tracking

- Cellular Communication

- IOT Sensors

- Machine Learning

- AI

- Others

By Customer GAR

- 100–500m

- 1–5b

- 500–1b

- 50–100m

- 10–50m

- 10m

By Sales Channel

- OEM

- Aftermarket

Drivers

Demand for Enhanced Operational Efficiency and Equipment Productivity Drives Market Growth

The Construction Machinery Telematics Market is gaining strong traction as companies increasingly focus on boosting operational efficiency. Contractors want better visibility into how machines are used, helping them reduce idle time and improve fuel performance. This shift is driving steady adoption of telematics across fleets in both small and large projects.

Growing use of connected construction machinery is also accelerating market expansion. Large infrastructure and commercial projects now rely on real-time data to coordinate equipment, workers, and timelines more effectively. As project complexity rises, companies prefer machines equipped with GPS tracking devices, sensors, and digital monitoring tools.

Telematics systems are becoming essential for predictive maintenance, which reduces unexpected equipment failures. Fleet managers can now identify issues early, plan repairs faster, and cut unplanned downtime. This capability not only extends machine life but also lowers overall operating costs for construction firms.

Government initiatives promoting smart construction and infrastructure modernization further support market growth. Many regions are investing in digital technologies to improve project transparency and quality. These policies encourage adoption of telematics as a standard feature in modern construction machinery, strengthening the market outlook in the coming years.

Restraints

High Complexity in Integrating Telematics with Older Construction Equipment

The construction machinery telematics market faces restraints mainly due to the difficulty of integrating modern systems with older equipment. Many contractors still operate legacy machines that lack the hardware or digital interfaces needed for seamless telematics installation. As a result, adoption becomes slow and costly, especially for small and mid-size fleets trying to upgrade gradually.

Additionally, the installation process often requires specialized technicians and customized solutions. This raises integration time and project expenses, making companies evaluate whether the benefits outweigh the upfront cost. Such challenges reduce the pace of telematics penetration across mixed-age fleets, particularly in emerging regions where older machinery is common.

Data privacy concerns also limit the use of cloud-based platforms. Contractors worry about sharing sensitive operational information, equipment location, and utilization patterns over digital networks. These concerns increase hesitation among firms that prioritize data confidentiality and internal security.

Furthermore, the absence of clear regulations and standardized data governance adds uncertainty. Companies want assurance that their operational data will not be misused or accessed by unauthorized parties. Because of this, many fleet owners prefer limited or offline telematics solutions, which slows the transition toward fully connected and cloud-driven construction environments.

Growth Factors

Expansion of Telematics Services in Emerging Economies Drives Market Growth

The Construction Machinery Telematics Market is witnessing strong growth opportunities as emerging economies invest heavily in roads, housing, and industrial projects. These countries are increasingly adopting connected equipment to manage rising fleet sizes and improve overall productivity. This shift creates new demand for advanced telematics platforms.

Additionally, the development of AI-driven predictive maintenance offers a major opportunity. Construction companies are looking for smarter systems that can predict failures, reduce downtime, and extend machine life. AI-enabled telematics allows operators to make faster decisions, lower repair costs, and maintain higher equipment availability.

The growing adoption of electric and hybrid construction machinery also opens fresh prospects. These machines depend heavily on continuous monitoring for battery performance, charging cycles, and energy consumption. Telematics plays a key role in delivering this real-time intelligence, supporting smooth fleet operations during the energy transition.

Moreover, collaborations between telematics service providers and equipment manufacturers are expanding. Such partnerships help create customized solutions tailored to specific machine types and project needs. This trend supports better system integration, improved user experience, and broader adoption across small and large construction fleets.

Emerging Trends

Increasing Use of IoT-Enabled Sensors for Real-Time Equipment Monitoring Drives Market Trends

The construction machinery telematics market is witnessing strong momentum as IoT-enabled sensors become more common across heavy equipment. These sensors help monitor engine health, fuel usage, and machine location in real time. As a result, contractors gain better visibility into daily operations, helping them reduce errors and improve decision-making.

Fleet management solutions designed specifically for construction sites are becoming more popular. These platforms allow operators to track multiple machines, optimize routes, and schedule tasks efficiently. This shift supports better control over fleet utilization and ensures that equipment downtime is minimized, especially during large-scale projects.

Moreover, digital twin technology is emerging as a major trend. By creating a virtual model of machinery, companies can simulate performance, detect issues early, and plan maintenance more accurately. This approach helps reduce unexpected breakdowns and improves long-term machine reliability.

Smart telematics tools help measure idle time, optimize fuel consumption, and monitor emissions. This supports construction firms in meeting environmental goals while lowering operational costs through better resource utilization. Together, these trends are shaping the future of connected construction machinery.

Regional Analysis

Asia Pacific Dominates the Construction Machinery Telematics Market with a Market Share of 48.8%, Valued at USD 0.6 Billion

In 2024, Asia Pacific held a dominant position in the Construction Machinery Telematics Market, accounting for 48.8% of the total market, valued at USD 0.6 Billion. Rapid infrastructure development, urbanization, and increasing adoption of connected construction machinery are driving market growth. Countries like China, India, and Japan are investing heavily in smart construction solutions, which fuels the demand for telematics solutions. Additionally, government initiatives supporting efficient equipment utilization and digital monitoring contribute to market expansion.

North America Construction Machinery Telematics Market Trends

North America is witnessing steady growth in the construction machinery telematics market due to high adoption of advanced technologies in construction and mining sectors. The region emphasizes operational efficiency and predictive maintenance, which supports market growth. Integration of fleet management solutions and IoT-enabled monitoring is becoming more widespread, particularly across large-scale construction projects in the U.S. and Canada.

Europe Construction Machinery Telematics Market Trends

Europe shows moderate growth in construction machinery telematics, driven by digital transformation in the construction industry. Focus on sustainability and regulatory compliance is encouraging the use of telematics to reduce fuel consumption and emissions. Germany, France, and the U.K. are investing in smart construction machinery to enhance productivity and operational efficiency.

Middle East & Africa Construction Machinery Telematics Market Trends

The Middle East & Africa region is gradually adopting construction machinery telematics solutions, supported by infrastructure expansion projects and urban development. Countries like UAE, Saudi Arabia, and South Africa are leveraging telematics for equipment tracking and resource optimization. The market growth is also encouraged by increasing awareness of cost efficiency and real-time equipment monitoring.

Latin America Construction Machinery Telematics Market Trends

Latin America is in the early stages of telematics adoption in construction machinery. Brazil, Mexico, and Chile are gradually integrating fleet management and predictive maintenance solutions to optimize construction operations. Market growth is supported by infrastructure development initiatives and rising interest in smart machinery to improve productivity and reduce downtime.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Construction Machinery Telematics Company Insights

Caterpillar continues to dominate the market with its comprehensive telematics offerings. The company emphasizes integration across its equipment line, providing real-time monitoring, predictive maintenance, and detailed performance analytics. Caterpillar’s solutions help construction companies improve uptime, reduce fuel consumption, and make informed operational decisions, reinforcing its position as a market leader.

Fleet Complete has strengthened its presence through scalable and flexible fleet management platforms. By combining GPS tracking, IoT-enabled sensors, and actionable analytics, Fleet Complete enables companies to monitor equipment usage, manage maintenance schedules, and ensure safety compliance. Their focus on user-friendly interfaces and seamless integration with existing systems has increased adoption among mid- and large-scale construction firms.

Geotab offers highly customizable telematics solutions designed to integrate seamlessly with existing construction operations. The platform focuses on data-driven decision-making, providing insights on fleet utilization, fuel efficiency, and predictive maintenance. Geotab’s emphasis on analytics and integration capabilities allows operators to optimize machinery performance while minimizing downtime and operational risks.

HCSS leverages its strong software expertise to connect telematics with project management tools. Their solutions enable construction managers to track machinery performance, plan maintenance efficiently, and improve job site productivity. By linking equipment data to actionable insights, HCSS helps companies control costs, enhance safety standards, and streamline workflows.

Top Key Players in the Market

- Caterpillar

- Fleet Complete

- Geotab

- HCSS

- MiX Telematics

- Omnitracs

- Samsara

- Teletrac Navman

- Tenna

- TOPCON

Recent Developments

- In January 2025, CASE India launched the “myCASE Construction” app, a smart telematics platform designed to streamline real-time fleet management.Alongside this, the company introduced seven new construction equipment models, enhancing operational efficiency and connectivity across projects.

- In January 2025, Kubota unveiled new excavators and a compact track loader, including the SVL97-3 model.These machines come equipped with KubotaNOW Telematics as a standard feature, enabling better monitoring, predictive maintenance, and performance tracking.

- In August 2024, Align Technologies completed the acquisition of telematics provider FleetWatcher to consolidate its fleet management capabilities.This move allows the company to offer heavy civil contractors a unified platform for equipment tracking, fleet optimization, and operational solutions.

Report Scope

Report Features Description Market Value (2024) USD 1.4 Billion Forecast Revenue (2034) USD 4.4 Billion CAGR (2025-2034) 12.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Machinery Type (Excavator, Crane, Telescopic Handling, Loader and Backhoe, Others), By Technology (GPS Tracking, Cellular Communication, IOT Sensors, Machine Learning, AI, Others), By Customer GAR (100–500m, 1–5b, 500–1b, 50–100m, 10–50m, 10m), By Sales Channel (OEM, Aftermarket) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Caterpillar, Fleet Complete, Geotab, HCSS, MiX Telematics, Omnitracs, Samsara, Teletrac Navman, Tenna, TOPCON Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Construction Machinery Telematics MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Construction Machinery Telematics MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Caterpillar

- Fleet Complete

- Geotab

- HCSS

- MiX Telematics

- Omnitracs

- Samsara

- Teletrac Navman

- Tenna

- TOPCON