Global Connected Device Analytics Market By Component (Solutions, Services), By Deployment Type (Cloud, On-Premises), Application (Security & Emergency, Sales & Customer, Remote Monitoring, Predictive Maintenance & Asset, Inventory, Energy), Industry Vertical (BFSI, Healthcare & Life Sciences, Retail & E-Commerce, Manufacturing, Energy & Utilities), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov. 2023

- Report ID: 73691

- Number of Pages: 329

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Based on Component Analysis

- Based on Deployment Type Analysis

- Based on Application Analysis

- Based on Industry Vertical Analysis

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Challenges

- Key Market Trends

- Key Market Segmentation

- Regional Analysis

- Key Players Analysis

- Recent Development

- Report Scope

Report Overview

The Global Connected Device Analytics Market is anticipated to be USD 245.7 billion by 2033. It is estimated to record a steady CAGR of 23.2% in the Forecast period 2023 to 2033. It is likely to total USD 30.5 billion in 2023.

Connected Device Analytics refers to solutions and capabilities that allow the gathering, processing and analysis of data from internet-enabled smart devices and equipment in order to generate actionable insights. As more technology products embed internet connectivity and sensors to become part of the “Internet of Things (IoT)”, vast amounts of device data gets created. Connected device analytics leverages this data to uncover usage patterns, performance issues, emerging faults or product improvements among connected products, assets and hardware.

The Connected Device Analytics market deals with the systems, applications and managed services as well as consulting models provided by analytics vendors to tap into device-generated big data sources. Leading technology companies and startups offer software capabilities to handle the volume, variety and velocity of machine and sensor data that gets generated across facilities, fleets, factories and energy/utility infrastructure. Customers are equipment manufacturers who want to improve after-sales product support, companies focused on enhancing field service operations as well as firms who want to use IoT data to redesign processes, reduce downtime risks or uncover new revenue opportunities.

Note: Actual Numbers Might Vary In Final Report

Key capabilities offered in the connected device analytics market include cloud-based and on-premise analytics dashboards, real-time monitoring of device performance indicators, predictive maintenance applications powered by AI/ML, anomaly detection and diagnoses of incidents, augmented reality interfaces to view assets health and remote assistance mobile tools. There is growing demand for connected device analytics across industries like manufacturing, transportation, energy, healthcare and high-tech sectors running complex, expensive and mission-critical equipment to drive significant ROI from IoT data.

Key Takeaways

- Market Size and Growth: The Connected Device Analytics Market is projected to reach approximately USD 245.7 billion by 2033, with a steady Compound Annual Growth Rate (CAGR) of 23.2%. In 2023, it is expected to be worth around USD 30.5 billion.

- Component Analysis: Solutions: This segment holds a dominant market share of over 57% in 2023. Solutions include data collection, analysis, visualization, and actionable insights generation.

- Deployment Type Analysis: On-Premises segment leads with a market share of more than 60% in 2023, favored by organizations wanting control over their analytics infrastructure.

- Application Analysis: Security & Emergency Management segment holds a dominant position with a share of more than 19% due to the critical importance of security in today’s interconnected world.

- Industry Vertical Analysis: Banking, Financial Services, and Insurance lead with a market share of more than 23% due to the critical role of data analytics in fraud detection and risk management.

- Driving Factors: IoT Proliferation – Rapid growth of IoT devices generates vast data for analytics, improving operations and decision-making.

- Restraining Factors: Data Security Concerns – Protecting sensitive data is challenging with more connected devices.

- Growth Opportunities: Real-time insights at the data source reduce latency and Enhances predictive capabilities and automates data processing.

- Challenges: Handling the sheer volume and variety of data is challenging.

- Key Market Trends: Real-time Analytics: Organizations demand instant insights for quick decision-making.

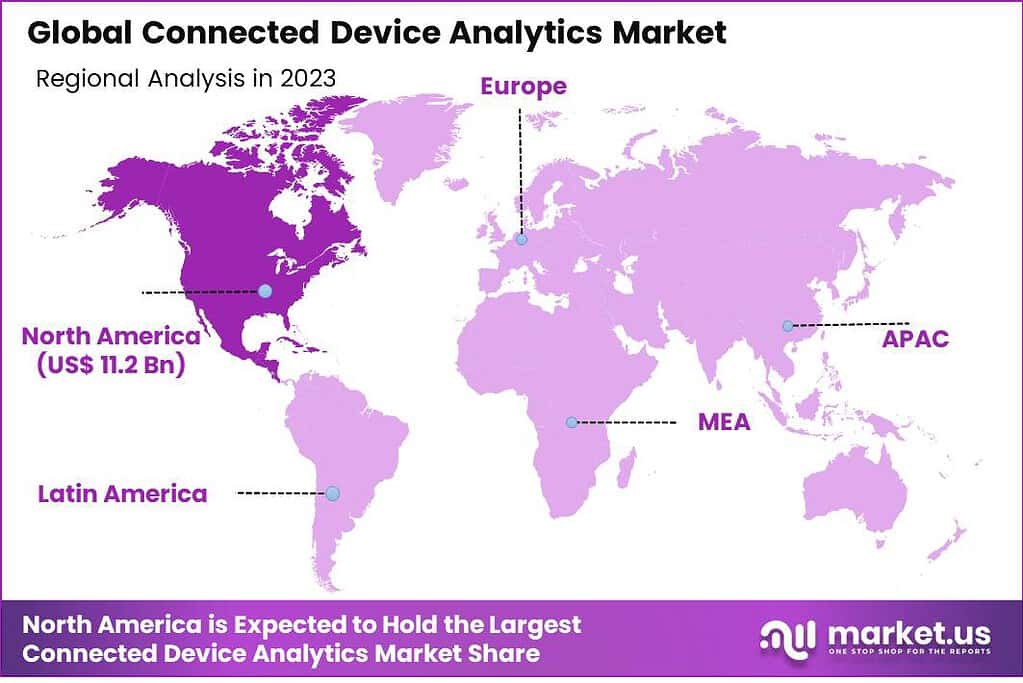

- Regional Analysis: North America dominates the market with a 37% share, driven by early IoT adoption and a mature tech ecosystem.

- Key Players: Notable companies in the market include Adobe Inc., Amazon Web Services Inc., Cisco Systems, Inc., Google LLC, Microsoft Corporation, Oracle Corporation, and more.

Based on Component Analysis

In 2023, the Connected Device Analytics Market displayed distinct dynamics between its component segments, with the Solutions Segment taking a commanding lead by holding a dominant market position, capturing more than a 57% share. This substantial market share can be attributed to the growing demand for comprehensive and integrated solutions that enable organizations to harness the power of connected device data efficiently. These solutions encompass a wide array of capabilities, including data collection, analysis, visualization, and actionable insights generation. Organizations across various industries increasingly rely on these solutions to make data-driven decisions, optimize operations, and enhance customer experiences.

On the other hand, the Services Segment also plays a significant role in the Connected Device Analytics ecosystem. While it may not command the same market share as its counterpart, it remains an essential component. In 2023, the Services Segment contributed significantly to the market, offering consulting, implementation, and support services to organizations seeking to maximize the value of connected device data. These services facilitate the seamless integration of analytics solutions into existing infrastructure, ensuring optimal performance and efficacy.

They also provide invaluable expertise and guidance to organizations navigating the complex realm of connected device analytics. As the adoption of connected device analytics solutions continues to grow, the Services Segment is expected to expand steadily, serving as a crucial companion to the dominant Solutions Segment, and together, they will contribute to unlocking the full potential of connected device data across industries.

Based on Deployment Type Analysis

In 2023, the Connected Device Analytics Market exhibited distinct dynamics in its deployment type segments, with the On-Premises Segment taking a commanding lead by holding a dominant market position, capturing more than a 60% share. This substantial market share can be attributed to various factors, including the preference of certain organizations for maintaining control over their analytics infrastructure within their own premises. On-premises solutions provide these organizations with a sense of security and data governance, especially in industries with stringent compliance requirements.

However, Cloud Segment, while growing rapidly, was challenged by its on-premise counterpart. Cloud-based deployments offer scalability, agility, and accessibility and is a popular option for businesses who want to take advantage of the benefits in connected-device analytics, without the hassle of managing their on-premise infrastructure. The resilience of this segment can be due to the growing use of cloud technology across industries, and the need for quick access to instantaneous analytics data.

As the connected device analytics landscape continues to evolve, the Cloud Segment is expected to adapt and innovate, ensuring its relevance in a dynamic market. The choice between on-premises and cloud deployment will continue to be influenced by organizational preferences, industry requirements, and the specific use cases of connected device analytics solutions.

Based on Application Analysis

In 2023, the Connected Device Analytics Market displayed distinctive dynamics in its application segments, with the Security & Emergency Management Segment taking a dominant lead by capturing more than a 19% share of the market. This significant market share can be attributed to the critical importance of security and emergency management in today’s interconnected world. Organizations across various industries are increasingly investing in connected device analytics solutions to enhance their security postures, detect and respond to threats in real-time, and ensure the safety of their assets and personnel.

Additionally, the Sales & Customer Management Segment played a pivotal role in the connected device analytics landscape, reflecting the growing emphasis on optimizing sales strategies and enhancing customer experiences through data-driven insights. This segment contributed significantly to the market, helping organizations gain a competitive edge by understanding customer behavior and preferences.

Other segments, such as Remote Monitoring, Predictive Maintenance & Asset Management, Inventory Management, Energy Management, and Other Applications, also witnessed growth as organizations recognized the value of connected device analytics in improving operational efficiency, reducing costs, and making informed decisions. The diversity of applications highlights the versatility of connected device analytics solutions and their potential to address a wide range of business challenges.

Based on Industry Vertical Analysis

In 2023, the Connected Device Analytics Market exhibited distinct dynamics in its industry vertical segments, with the BFSI (Banking, Financial Services, and Insurance) Segment holding a dominant market position by capturing more than a 23% share. This substantial market share can be attributed to the critical role of data analytics in the financial sector, where organizations are leveraging connected device analytics to enhance fraud detection, risk management, and customer experience. The BFSI industry relies heavily on real-time data insights to make informed decisions and ensure the security of financial transactions.

Furthermore, the Healthcare & Life Sciences Segment played a significant role in the connected device analytics landscape. With the increasing digitization of patient records and the adoption of IoT devices in healthcare, this segment contributed significantly to the market by improving patient care, optimizing healthcare operations, and ensuring data security and compliance.

Other industry verticals, such as Retail & E-Commerce, Manufacturing, Energy & Utilities, and Other Industry Verticals, also recognized the value of connected device analytics in driving operational efficiency, enhancing customer engagement, and achieving sustainability goals. These segments witnessed growth as organizations across various industries harnessed the power of connected device data to gain a competitive edge and adapt to evolving market trends.

Note: Actual Numbers Might Vary In Final Report

Driving Factors

- IoT Proliferation: The rapid growth of the Internet of Things (IoT) devices across industries is a significant driver. More connected devices generate vast amounts of data that can be harnessed for analytics to improve operations and decision-making.

- Data-Driven Decision-Making: Organizations increasingly rely on data-driven insights to gain a competitive advantage. Connected device analytics enables real-time data processing, allowing businesses to make informed decisions swiftly.

- Enhanced Customer Experience: Connected device analytics empowers businesses to understand customer behavior and preferences better. This leads to improved personalized services and enhanced customer satisfaction, a critical driver for industries like retail and e-commerce.

- Operational Efficiency: Connected device analytics helps organizations optimize their operations by providing insights into asset performance, predictive maintenance, and supply chain management, leading to cost savings and efficiency gains.

Restraining Factors

- Data Security Concerns: With the proliferation of connected devices, data security and privacy become significant concerns. Organizations must ensure robust security measures to protect sensitive data, which can be a challenging task.

- Integration Complexity: Integrating diverse connected devices and data sources can be complex and costly. Achieving seamless interoperability and data flow is a restraint for some organizations.

- Skill Gap: A shortage of skilled professionals who can effectively manage and analyze the data generated by connected devices hinders adoption. Organizations must invest in training or hiring data analytics experts.

- Regulatory Compliance: Compliance with data protection and privacy regulations, such as GDPR, can be a challenge. Ensuring that connected device analytics practices align with these regulations is essential but can be complex.

Growth Opportunities

- Edge Analytics: Edge computing and analytics offer growth opportunities as organizations seek real-time insights at the source of data generation, reducing latency and enhancing decision-making.

- AI and Machine Learning Integration: Integration of AI and machine learning into connected device analytics solutions can enhance predictive capabilities and automate data processing, opening doors to advanced applications.

- Cross-Industry Applications: Expanding the use of connected device analytics across industries, such as agriculture, transportation, and smart cities, presents untapped growth potential.

- Data Monetization: Organizations can explore monetizing the data generated by their connected devices by offering data-driven services or insights to other businesses, creating new revenue streams.

Challenges

- Data Volume and Variety: Handling the sheer volume and variety of data from connected devices can be challenging, requiring robust infrastructure and analytics capabilities.

- Interoperability Issues: Ensuring seamless interoperability among different devices and platforms is a persistent challenge, particularly in heterogeneous IoT environments.

- Scalability: Scaling up connected device analytics to accommodate a growing number of devices can be complex and costly, requiring careful planning and investment.

- Data Quality: Ensuring data quality and accuracy is crucial. Inaccurate or incomplete data can lead to flawed insights and decisions.

Key Market Trends

- Real-time Analytics: Real-time analytics is a prevailing trend as organizations demand instant insights to respond quickly to changing conditions and make immediate decisions.

- Edge Device Intelligence: Edge analytics is gaining prominence as more processing and analysis occur closer to the data source, reducing latency and bandwidth requirements.

- Predictive Maintenance: Predictive maintenance using connected device analytics is becoming a standard practice across industries to optimize equipment performance and reduce downtime.

- Cross-Domain Integration: Integration of data from various sources, including IoT, operational technology (OT), and IT systems, is a key trend to provide comprehensive insights for decision-makers.

Key Market Segmentation

Global connected device analytics market is segmented on the basis of – Component, Deployment mode, Application, Industry Vertical, and Region. Represented below is a detailed segmental description:

Based on Component

- Solutions

- Services

Based on Deployment Type

- Cloud

- On-Premises

Based on Application

- Security & Emergency Management

- Sales & Customer Management

- Remote Monitoring

- Predictive Maintenance & Asset Management

- Inventory Management

- Energy Management

- Other Applications

Based on Industry Vertical

- BFSI

- Healthcare & Life Sciences

- Retail & E-Commerce

- Manufacturing

- Energy & Utilities

- Other Industry Verticals

Regional Analysis

In 2023, North America held a dominant market position in the Connected Device Analytics Market, capturing more than a 37% share. This supremacy can be attributed to several factors, including the early adoption of IoT technologies, a robust technological infrastructure, and a high level of digitalization across industries. The presence of major tech hubs and a matured ecosystem for IoT and analytics solutions further bolstered North America’s market leadership.

The demand for Connected Device Analytics in North America reached USD 12.2 billion in 2023, and there are optimistic projections for significant growth in the foreseeable future. Additionally, stringent data privacy regulations have driven organizations in the region to invest heavily in advanced analytics to ensure data security and compliance. The United States, in particular, played a pivotal role in driving the growth of connected device analytics, with a concentration of tech giants and innovative startups leading the way. As a result, North America continues to be a focal point for the evolution and expansion of the Connected Device Analytics Market.

Europe, on the other hand, exhibited significant growth potential in the Connected Device Analytics Market, accounting for a substantial market share in 2023. The region’s emphasis on industrial automation, smart cities, and IoT adoption in various sectors contributed to its market position. European countries, such as Germany and France, played a vital role in driving innovation and the implementation of connected device analytics solutions. Additionally, stringent data protection regulations, including GDPR, encouraged organizations to invest in analytics to ensure compliance and data security.

In the Asia-Pacific (APAC) region, the Connected Device Analytics Market experienced rapid expansion, with a notable market share in 2023. APAC’s economic growth, increased IoT adoption in manufacturing and agriculture, and the presence of emerging economies like China and India fueled the demand for connected device analytics solutions. Moreover, government initiatives and smart city projects across APAC countries created a conducive environment for the deployment of analytics solutions to improve infrastructure and services.

Latin America also made strides in the Connected Device Analytics Market, though at a comparatively slower pace. In 2023, the region captured a noteworthy market share, driven by growing awareness of IoT benefits and increasing investments in digital transformation. Countries like Brazil and Mexico played pivotal roles in shaping the market landscape in Latin America.

The Middle East and Africa (MEA) exhibited potential for future growth in the Connected Device Analytics Market. While holding a smaller market share in 2023, MEA showed a growing interest in IoT adoption, particularly in sectors such as energy, healthcare, and agriculture. Increasing digitalization efforts and the exploration of IoT applications in the region are expected to contribute to MEA’s market expansion in the coming years.

Note: Actual Numbers Might Vary In Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Connected Device Analytics market comprises several key players who offer innovative solutions and services to help businesses extract valuable insights from the data generated by connected devices. These key players have established themselves as leaders in the market by providing robust analytics platforms, data integration tools, and consulting services.

Here are some notable companies in the Connected Device Analytics market:

- Adobe Inc.

- Amazon Web Services Inc.

- Cisco Systems, Inc.

- General Electric Company

- Google LLC by Alphabet Inc.

- Guavus Inc.

- Hewlett Packard Enterprise Development LP

- Infor

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- PTC Inc.

- Salesforce Inc.

- SAP SE

- SAS Institute Inc.

- Software AG.

- Other Key Players

Recent Development

- In the year 2023, Salesforce unveiled its Connected Device Analytics Platform, aimed at assisting businesses in extracting insights from their networked devices.

- During 2023, Google Cloud introduced its IoT Analytics Solution, comprising a suite of tools designed to aid businesses in the collection, processing, and analysis of data generated by their connected devices.

- In the same year, Microsoft launched Azure Sphere for IoT Analytics, an operating system with a strong focus on security for connected devices. This operating system incorporates a built-in security chip and a range of security features to safeguard connected devices against cyberattacks.

Report Scope

Report Features Description Market Value (2023) US$ 30.5 Bn Forecast Revenue (2033) US$ 245.7 Bn CAGR (2023-2032) 23.2% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2023-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Solutions, Services), By Deployment Type (Cloud, On-Premises), Application (Security & Emergency, Sales & Customer, Remote Monitoring, Predictive Maintenance & Asset, Inventory, Energy), Industry Vertical (BFSI, Healthcare & Life Sciences, Retail & E-Commerce, Manufacturing, Energy & Utilities) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Adobe Inc., Amazon Web Services Inc., Cisco Systems, Inc., General Electric Company, Google LLC by Alphabet Inc., Guavus Inc., Hewlett Packard Enterprise Development LP, Infor, International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, PTC Inc., Salesforce Inc., SAP SE, SAS Institute Inc., Software AG., Other Key Players Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Connected Device Analytics Market?The Connected Device Analytics Market refers to the industry that deals with the analysis of data generated by connected devices, such as IoT devices. It involves extracting meaningful insights to enhance decision-making and optimize device performance.

Why is Connected Device Analytics important for businesses?Connected Device Analytics is crucial for businesses as it enables them to leverage the data generated by connected devices, leading to informed decision-making, improved operational efficiency, and enhanced user experiences.

How big is Connected Device Analytics Market?The Global Connected Device Analytics Market is anticipated to be USD 245.7 billion by 2033. It is estimated to record a steady CAGR of 23.2% in the Forecast period 2023 to 2033. It is likely to total USD 30.5 billion in 2023.

How does Connected Device Analytics contribute to business intelligence?Connected Device Analytics enhances business intelligence by providing real-time and historical insights into device performance, usage patterns, and potential areas for optimization. This, in turn, aids in strategic decision-making.

What industries benefit the most from Connected Device Analytics?Virtually all industries can benefit from Connected Device Analytics. However, sectors such as manufacturing, healthcare, transportation, and smart cities often derive substantial value by optimizing processes and improving efficiency through analytics.

What are the common challenges in implementing Connected Device Analytics?Challenges may include data privacy concerns, interoperability issues among diverse devices, scalability challenges, and the need for skilled professionals to manage and interpret the analytics.

Connected Device Analytics MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample

Connected Device Analytics MarketPublished date: Nov. 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Adobe Inc.

- Amazon Web Services Inc.

- Cisco Systems, Inc.

- General Electric Company

- Google LLC by Alphabet Inc.

- Guavus Inc.

- Hewlett Packard Enterprise Development LP

- Infor

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- PTC Inc.

- Salesforce Inc.

- SAP SE

- SAS Institute Inc.

- Software AG.

- Other Key Players