Global Concrete Construction Equipment Market Size, Share, Growth Analysis By Type (Production and Mixing Category, Transportation and Conveying Category), By Process (Pouring and Laying Materials, Vibration Compaction, Leveling and Finishing), By Application (Road Construction, Precast Component Production, Shotcrete, Special Casting, Others), By End-use (Construction, Mining, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170847

- Number of Pages: 325

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

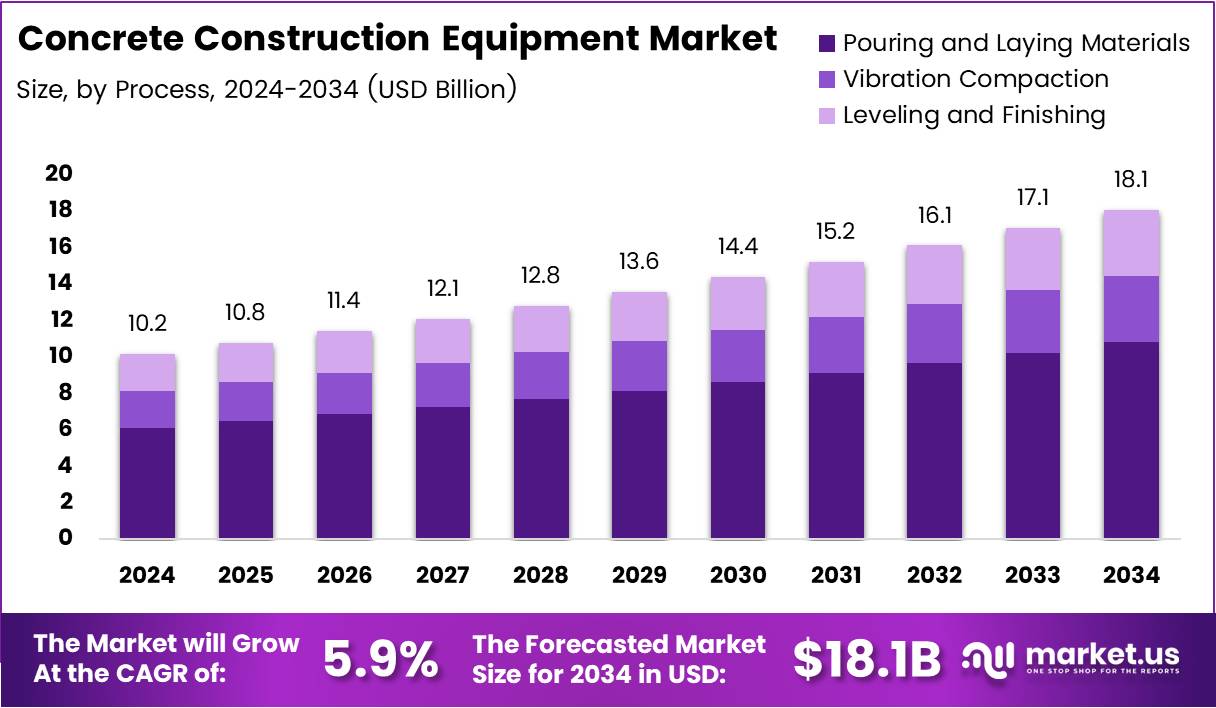

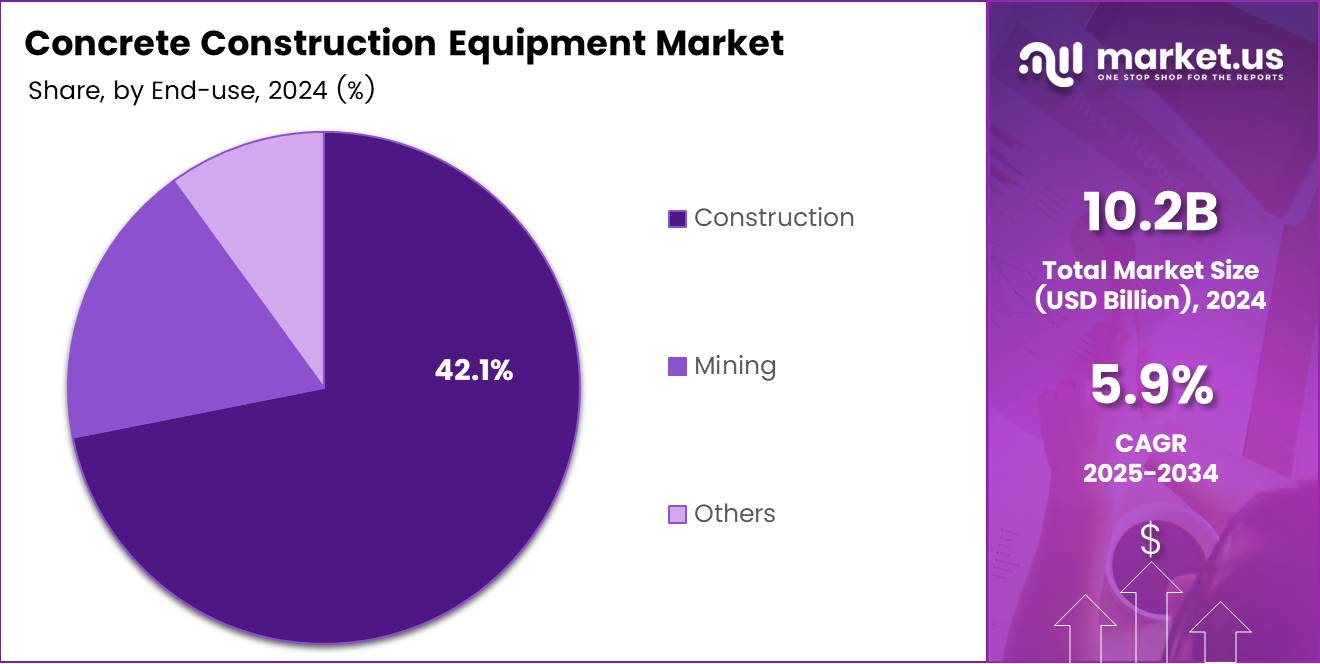

The Global Concrete Construction Equipment Market is projected to reach approximately USD 18.1 Billion by 2034, growing from USD 10.2 Billion in 2024. This expansion reflects a robust compound annual growth rate of 5.9% throughout the forecast period from 2025 to 2034. The market encompasses specialized machinery designed for concrete production, mixing, transportation, placement, and finishing across various construction applications.

Concrete construction equipment represents essential machinery that facilitates efficient handling and application of concrete materials in building projects. These tools range from basic mixers and vibrators to sophisticated batching plants and computerized pumping systems. As urbanization accelerates globally, demand for reliable concrete handling solutions continues strengthening across residential, commercial, and infrastructure development sectors.

Infrastructure modernization initiatives worldwide are creating significant opportunities for equipment manufacturers and suppliers. Governments across developing and developed nations are allocating substantial budgets toward road networks, bridge rehabilitation, and metro rail expansion projects. Additionally, the construction industry is witnessing a fundamental shift toward mechanization, reducing manual labor requirements while improving overall project timelines and quality standards.

The rising preference for ready-mix concrete and precast components is transforming traditional construction methodologies. Contractors increasingly favor factory-produced concrete elements that ensure consistent quality and faster on-site assembly. This transition necessitates investment in high-capacity batching plants, specialized transportation vehicles, and advanced pumping equipment capable of handling diverse project specifications and challenging site conditions.

Meanwhile, technological integration is reshaping equipment capabilities and operational efficiency. Manufacturers are incorporating telematics systems, IoT connectivity, and automated controls into their product offerings. These innovations enable real-time performance monitoring, predictive maintenance scheduling, and enhanced precision during concrete placement operations. Furthermore, environmental regulations are driving development of electrified and low-emission equipment variants.

According to the U.S. Census Bureau, total construction spending reached approximately USD 2,169.5 Billion on an annualized basis in August 2025. This substantial investment underscores the industry’s ongoing vitality and equipment demand potential. However, contractors face challenges from rising material costs, with construction material prices increasing 3.5% year-over-year in late 2025, impacting equipment procurement decisions and project budgeting strategies.

Looking forward, compact and mobile equipment solutions are gaining traction in space-constrained urban environments. Simultaneously, emerging economies across Asia Pacific, Latin America, and Middle East regions present lucrative growth prospects. These markets are experiencing rapid infrastructure development, supported by favorable government policies and increasing foreign investment inflows that stimulate equipment procurement activities.

Key Takeaways

- The Global Concrete Construction Equipment Market is valued at USD 10.2 Billion in 2024 and projected to reach USD 18.1 Billion by 2034

- Market exhibits a compound annual growth rate of 5.9% during the forecast period from 2025 to 2034

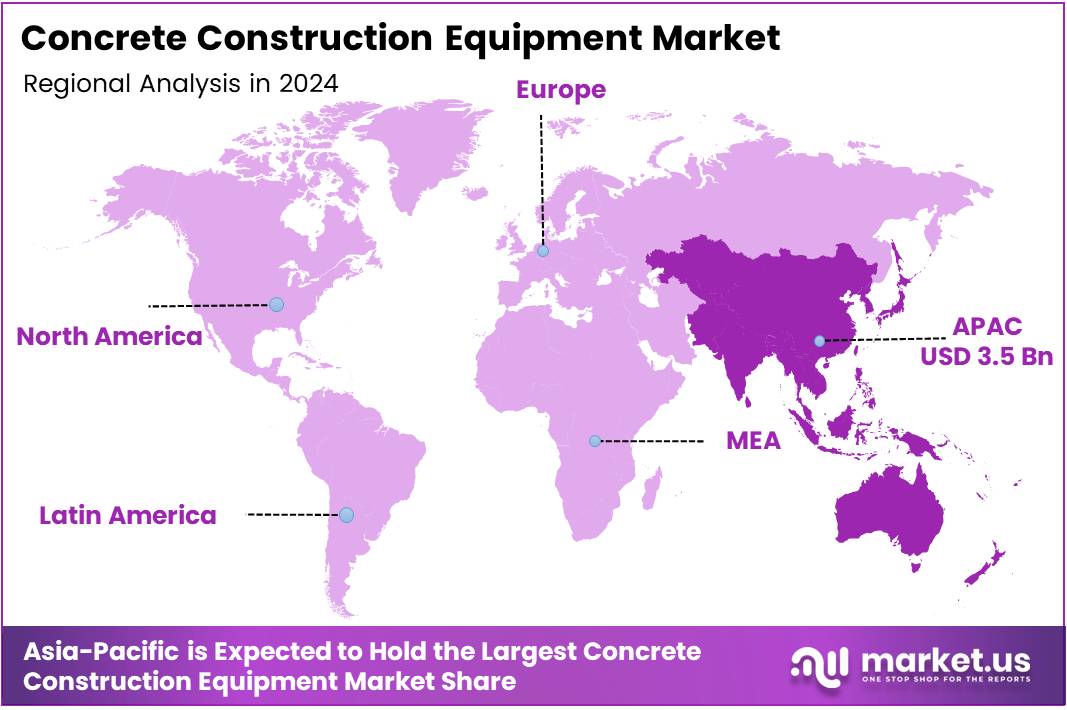

- Asia Pacific dominates the regional landscape with a market share of 34.80%, valued at USD 3.5 Billion

- Production and Mixing Category leads the Type segment with 56.2% market share

- Pouring and Laying Materials accounts for 38.4% in the Process segment

- Road Construction applications represent 41.3% of the Application segment

- Construction end-use dominates with 71.9% market share

Type Analysis

Production and Mixing Category Dominates with 56.2% Due to Essential Role in Concrete Preparation Processes

In 2024, the Production and Mixing Category held a dominant market position in the Type Analysis segment, capturing a 56.2% share. This segment encompasses concrete batching plants, mixers, and blending equipment essential for producing consistent concrete formulations. Consequently, construction projects of all scales require reliable mixing solutions to ensure material quality and structural integrity. The segment benefits from increasing adoption of automated batching systems that deliver precise ingredient proportioning and reduce human error.

Moreover, the shift toward ready-mix concrete operations is accelerating demand for high-capacity central mixing plants. These facilities serve multiple construction sites simultaneously, offering logistical efficiency and cost optimization. Additionally, technological advancements enable computerized control systems that monitor moisture content, temperature, and mixing duration in real-time. Infrastructure projects requiring large concrete volumes particularly drive investment in sophisticated production equipment capable of continuous operation.

Meanwhile, the Transportation and Conveying Category addresses the critical need for moving mixed concrete from production facilities to placement locations. This segment includes concrete pumps, truck mixers, conveyor systems, and specialized vehicles designed to maintain concrete workability during transit. Urban construction projects increasingly rely on boom pumps capable of reaching elevated floors and navigating restricted access areas. Furthermore, innovations in pump technology enable handling of high-strength and fiber-reinforced concrete mixes.

Process Analysis

Pouring and Laying Materials Segment Leads with 38.4% Driven by Direct Application Requirements

In 2024, Pouring and Laying Materials held a dominant market position in the Process Analysis segment, accounting for 38.4% share. This category includes equipment specifically designed for placing concrete into formwork, molds, or designated areas with precision and efficiency. Accordingly, concrete pumps, placing booms, and distribution equipment form the core of this segment. Large-scale infrastructure projects demand sophisticated pumping solutions capable of delivering concrete across extended distances and significant vertical heights.

Additionally, the complexity of modern architectural designs necessitates advanced placement equipment that ensures uniform concrete distribution without segregation. Contractors increasingly favor stationary and truck-mounted pumps offering flexibility across diverse project requirements. The segment also benefits from growing adoption of shotcrete techniques in tunnel construction, slope stabilization, and swimming pool applications, requiring specialized spraying equipment and trained operators.

Vibration Compaction equipment plays a crucial role in eliminating air pockets and ensuring proper concrete consolidation within formwork. This process enhances structural strength and surface finish quality by maximizing density and minimizing voids. Internal vibrators, surface vibrators, and form vibrators serve distinct applications depending on concrete thickness and accessibility constraints. Furthermore, proper compaction techniques significantly reduce the risk of honeycombing and cold joints.

The Leveling and Finishing segment encompasses equipment used to achieve desired surface flatness, smoothness, and texture specifications. Power trowels, screeds, and finishing machines enable contractors to meet stringent floor flatness requirements in commercial and industrial facilities. Moreover, laser-guided screeding systems deliver exceptional accuracy for large floor slabs. These technologies reduce manual labor requirements while improving consistency and reducing project completion timelines across various construction applications.

Application Analysis

Road Construction Applications Command 41.3% Market Share Through Extensive Infrastructure Development

In 2024, Road Construction held a dominant market position in the Application Analysis segment with 41.3% share. This application demands specialized equipment including concrete pavers, slip-form pavers, and texturing machines for highway and expressway construction. Consequently, government infrastructure spending on transportation networks directly influences equipment procurement patterns. Modern road projects increasingly adopt concrete pavement due to its durability, load-bearing capacity, and lower lifecycle maintenance requirements compared to asphalt alternatives.

Furthermore, automated paving equipment ensures consistent slab thickness, proper joint formation, and uniform surface texture critical for vehicle safety and comfort. Concrete roads withstand heavy traffic loads while offering superior performance in extreme weather conditions. The segment also encompasses equipment for airport runway construction, where stringent quality standards and rapid curing requirements necessitate advanced concrete handling and placement technologies.

Precast Component Production represents a rapidly growing application segment driven by industrialized construction methodologies. This sector utilizes specialized molds, curing chambers, and material handling equipment to manufacture standardized concrete elements including wall panels, beams, columns, and architectural facades. Accordingly, precast manufacturing facilities require significant capital investment in automated production lines that deliver consistent quality and dimensional accuracy.

Shotcrete applications involve spraying concrete pneumatically onto surfaces, commonly used in tunnel lining, underground construction, and structural repair projects. This technique requires specialized pumping equipment, nozzles, and air compressors capable of maintaining consistent material flow and proper adhesion. Additionally, the Special Casting segment serves niche applications including decorative concrete, underwater construction, and specialized foundation systems. The Others category encompasses diverse applications such as canal lining, agricultural structures, and marine construction where concrete remains the preferred building material.

End-Use Analysis

Construction Sector Dominates with 71.9% Market Share as Primary Equipment Consumer

In 2024, the Construction sector held a dominant market position in the End-Use Analysis segment, capturing 71.9% share. This dominance reflects the fundamental role of concrete in building residential complexes, commercial developments, institutional facilities, and infrastructure projects. Consequently, contractors across all construction disciplines require diverse equipment portfolios to handle varied project requirements. The sector’s growth correlates directly with urbanization trends, population expansion, and economic development indicators across global markets.

Moreover, high-rise construction projects demand sophisticated concrete pumping and placement equipment capable of delivering material to elevated floors efficiently. Mixed-use developments combining residential, retail, and office spaces generate sustained equipment demand throughout multi-year construction timelines. Additionally, smart city initiatives and urban renewal programs create ongoing opportunities for equipment suppliers as municipalities upgrade aging infrastructure and expand public amenities.

The Mining sector represents another significant end-use category requiring concrete equipment for underground tunnel support, processing plant foundations, and surface infrastructure development. Mining operations in remote locations often establish on-site batching plants to ensure material availability without relying on distant ready-mix suppliers. Furthermore, the Others category encompasses applications in energy infrastructure, water treatment facilities, and transportation hubs where concrete forms essential structural components requiring specialized construction equipment.

Key Market Segments

By Type

- Production and Mixing Category

- Transportation and Conveying Category

By Process

- Pouring and Laying Materials

- Vibration Compaction

- Leveling and Finishing

By Application

- Road Construction

- Precast Component Production

- Shotcrete

- Special Casting

- Others

By End-Use

- Construction

- Mining

- Others

Drivers

Accelerated Public Infrastructure Spending Drives Equipment Demand Growth

Government investment in roads, bridges, metro rail systems, and urban development projects continues accelerating across developed and emerging economies. These initiatives require substantial equipment fleets capable of handling large-scale concrete operations efficiently. Consequently, contractors are expanding their machinery inventories to secure infrastructure contracts and meet stringent project delivery timelines. Public-private partnerships further stimulate equipment procurement as private entities bring capital and operational expertise to government-led development programs.

The rising adoption of ready-mix and precast concrete is fundamentally transforming construction practices and equipment requirements. Ready-mix operations demand high-capacity batching plants and specialized transportation vehicles to serve multiple construction sites simultaneously. Similarly, precast manufacturing facilities require automated production equipment that ensures dimensional accuracy and consistent quality. This shift toward factory-produced concrete elements reduces on-site labor requirements while improving overall project efficiency and safety standards.

High-rise residential and commercial construction projects are proliferating in urban centers worldwide, creating sustained demand for advanced concrete handling machinery. These developments require sophisticated pumping equipment capable of reaching upper floors with precision and reliability. Additionally, increasing mechanization of construction sites improves productivity metrics while reducing dependency on manual labor. Automated equipment enables contractors to maintain consistent work quality, accelerate project timelines, and minimize workplace accidents across diverse construction applications.

Restraints

High Capital Costs Limit Equipment Adoption Among Smaller Contractors

The substantial initial investment required for advanced concrete construction equipment presents a significant barrier for small and medium-sized contractors. Modern batching plants, high-capacity pumps, and automated finishing equipment involve capital outlays that strain financial resources. Additionally, ongoing maintenance expenses including spare parts, technical servicing, and operator training further increase total ownership costs. These financial constraints often force smaller firms to rent equipment rather than purchasing, limiting their operational flexibility and long-term profitability potential.

Volatility in construction activity due to interest rate fluctuations and project approval delays creates uncertainty in equipment investment decisions. When central banks raise interest rates to control inflation, construction financing becomes more expensive, causing developers to postpone projects. Consequently, contractors face underutilized equipment and reduced revenue streams during economic downturns. Furthermore, bureaucratic delays in obtaining environmental clearances, land acquisition approvals, and building permits extend project timelines, making it difficult for equipment owners to maintain consistent utilization rates across their machinery fleets.

Growth Factors

Compact Equipment Solutions Address Urban Construction Challenges

Expanding demand for compact and mobile concrete equipment is driven by space-constrained urban construction sites where traditional large-scale machinery proves impractical. Mini concrete pumps, portable mixers, and telescopic placing booms enable contractors to operate efficiently in congested city centers. These solutions offer maneuverability advantages while delivering adequate capacity for mid-sized projects. Moreover, modular equipment designs facilitate rapid deployment and relocation as project phases progress, optimizing resource utilization across multiple job sites.

Rising infrastructure development in emerging economies supports large-scale equipment procurement as governments prioritize economic growth through construction investment. Nations across Asia, Africa, and Latin America are modernizing transportation networks, expanding urban infrastructure, and developing industrial zones. These initiatives create sustained demand for concrete equipment spanning production, transportation, and placement categories. Additionally, increasing replacement demand for aging construction machinery with energy-efficient models presents opportunities as contractors retire outdated equipment to improve operational economics and meet environmental regulations.

Growing use of concrete equipment in renewable energy projects such as wind turbine foundations and hydropower dams diversifies market applications beyond traditional construction sectors. Wind farms require massive concrete bases to support turbine towers, necessitating specialized batching and pumping equipment capable of delivering large volumes efficiently. Similarly, dam construction and canal lining projects demand reliable concrete placement solutions that maintain material integrity throughout extended construction timelines across challenging site conditions.

Emerging Trends

Digital Technologies Transform Equipment Capabilities and Monitoring

Integration of telematics and IoT systems for real-time monitoring of concrete equipment performance is revolutionizing fleet management and maintenance practices. Connected sensors track machine operating hours, fuel consumption, and component wear patterns, enabling predictive maintenance scheduling that minimizes unexpected breakdowns. Consequently, contractors reduce downtime while optimizing service intervals and spare parts inventory. Remote diagnostics capabilities allow technicians to troubleshoot issues without immediate site visits, improving response times and operational continuity.

The shift toward electrified and low-emission concrete mixers, pumps, and batching plants responds to increasingly stringent environmental regulations and sustainability commitments. Battery-powered equipment eliminates diesel exhaust emissions in enclosed spaces such as underground construction sites and urban areas with air quality restrictions. Moreover, electric machinery reduces noise pollution, enabling extended working hours in noise-sensitive zones. Manufacturers are developing hybrid solutions combining electric and conventional power sources to address range limitations while delivering environmental benefits.

Growing preference for automated and computer-controlled batching and mixing systems enhances concrete quality consistency while reducing operator skill requirements. These systems automatically adjust ingredient proportions based on real-time moisture content analysis and environmental conditions. Furthermore, increasing adoption of modular and transportable concrete plants enables rapid project deployment in remote locations and temporary construction sites, offering flexibility advantages over permanent installations.

Regional Analysis

Asia Pacific Dominates the Concrete Construction Equipment Market with a Market Share of 34.80%, Valued at USD 3.5 Billion

Asia Pacific commands the largest regional market share at 34.80%, valued at approximately USD 3.5 Billion, driven by massive infrastructure development across China, India, Southeast Asian nations, and emerging economies. Rapid urbanization, population growth, and industrialization fuel sustained construction activity requiring extensive equipment deployments. Government initiatives including China’s Belt and Road projects and India’s Smart Cities Mission generate substantial equipment demand. Additionally, the region’s manufacturing capabilities enable local production of cost-competitive machinery, supporting market accessibility across diverse economic segments.

North America Concrete Construction Equipment Market Trends

North America maintains steady equipment demand supported by infrastructure modernization programs, commercial real estate development, and residential construction activity. The United States leads regional consumption with substantial government spending on transportation networks and public facilities. Moreover, technological adoption rates remain high as contractors prioritize automation and digital equipment solutions. Replacement cycles for aging machinery fleets create ongoing procurement opportunities across the region’s mature construction markets.

Europe Concrete Construction Equipment Market Trends

Europe demonstrates stable market conditions characterized by stringent environmental regulations driving adoption of low-emission and electric equipment variants. Infrastructure rehabilitation projects and sustainable building initiatives support consistent equipment demand across Western European nations. Additionally, Eastern European markets experience growth from EU-funded development programs and foreign investment inflows. The region’s focus on circular economy principles encourages equipment manufacturers to develop recyclable and energy-efficient machinery solutions.

Middle East and Africa Concrete Construction Equipment Market Trends

Middle East nations including UAE, Saudi Arabia, and Qatar drive regional equipment demand through mega-project developments in commercial, hospitality, and infrastructure sectors. Oil-producing countries allocate petroleum revenues toward economic diversification initiatives requiring substantial construction activity. Meanwhile, African markets present emerging opportunities as governments prioritize infrastructure development to support economic growth, though political instability and financing constraints moderate growth potential across certain nations.

Latin America Concrete Construction Equipment Market Trends

Latin America exhibits moderate growth potential supported by urbanization trends and infrastructure investment needs across Brazil, Mexico, and Argentina. However, economic volatility and political uncertainties create cyclical demand patterns affecting equipment procurement decisions. Nevertheless, housing shortages and transportation infrastructure deficiencies present long-term opportunities as governments address development gaps. International development bank financing facilitates equipment acquisition for public infrastructure projects across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Concrete Construction Equipment Company Insights

The global concrete construction equipment market features diverse manufacturers ranging from specialized regional players to multinational corporations offering comprehensive product portfolios.

GOMACO maintains strong positioning in concrete paving equipment with innovative slip-form technology serving highway and airport construction applications. The company’s focus on automation and precision control systems differentiates its offerings in demanding infrastructure projects.

ENAR GROUP specializes in vibration equipment and concrete finishing solutions targeting both rental fleets and contractor-owned inventories. Their product range addresses diverse application requirements from small residential projects to large commercial developments. Meanwhile, Farrell Equipment serves construction markets through comprehensive equipment sales, rental, and service operations, providing contractors access to leading machinery brands alongside technical support capabilities.

MBW, Inc. delivers compaction and concrete finishing equipment favored by contractors seeking reliable performance in demanding site conditions. Their focus on durability and operator-friendly designs supports strong customer loyalty. Additionally, companies including Acme Equipment, Maxon Industries, MyPutzmeister, Truemax, Zoomlion, and SCHWING Stetter India contribute to competitive market dynamics through continuous product innovation and regional market penetration strategies.

These manufacturers increasingly emphasize technological integration, environmental compliance, and aftermarket service capabilities to differentiate their offerings. Strategic partnerships, dealer network expansion, and equipment financing programs enable companies to strengthen market presence across diverse geographic regions. Furthermore, participation in industry exhibitions and demonstration events facilitates customer engagement and product awareness building across construction professional communities.

Key Companies

- GOMACO

- ENAR GROUP

- Farrell Equipment

- MBW, Inc.

- Acme Equipment Pte Ltd

- Maxon Industries, Inc

- MyPutzmeister

- Truemax

- Zoomlion

- SCHWING Stetter India

Recent Developments

- In June 2025, Putzmeister unveiled its latest addition to the stationary concrete pump range, featuring enhanced pumping capacity and improved operational efficiency. This new model addresses contractor demands for reliable high-volume concrete delivery systems in large-scale infrastructure and commercial construction projects across global markets.

- In April 2025, at Bauma 2025, CIFA presented the world premiere of a new concrete mixer-pump model featuring a 35-meter carbon boom at its exhibition stand. This innovative design combines lightweight carbon fiber construction with extended reach capabilities, enabling contractors to access difficult placement locations while reducing equipment weight and fuel consumption requirements.

Report Scope

Report Features Description Market Value (2024) USD 10.2 Billion Forecast Revenue (2034) USD 18.1 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Production and Mixing Category, Transportation and Conveying Category), By Process (Pouring and Laying Materials, Vibration Compaction, Leveling and Finishing), By Application (Road Construction, Precast Component Production, Shotcrete, Special Casting, Others), By End-use (Construction, Mining, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape GOMACO, ENAR GROUP, Farrell Equipment, MBW, Inc., Acme Equipment Pte Ltd, Maxon Industries, Inc., MyPutzmeister, Truemax, Zoomlion, SCHWING Stetter India Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Concrete Construction Equipment MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Concrete Construction Equipment MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- GOMACO

- ENAR GROUP

- Farrell Equipment

- MBW, Inc.

- Acme Equipment Pte Ltd

- Maxon Industries, Inc

- MyPutzmeister

- Truemax

- Zoomlion

- SCHWING Stetter India