Global Compostable Pouch Market Size, Share, Growth Analysis By Material (Polylactic Acid (PLA), Paper, Starch Blend, Others), By Product Type (Stand Up Compostable Pouches, Flat Compostable Pouches, Others), By Application (Food & Beverages, Pharmaceuticals, Cosmetics, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 166261

- Number of Pages: 334

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

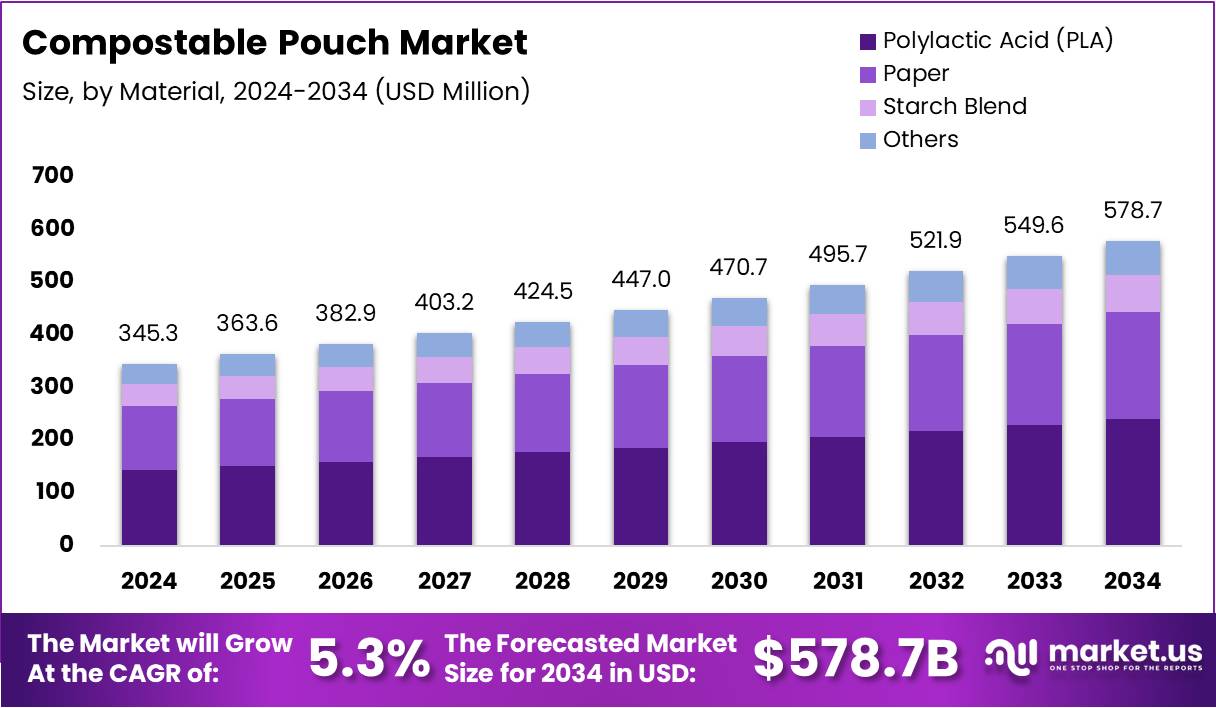

The Global Compostable Pouch Market size is expected to be worth around USD 578.7 Million by 2034, from USD 345.3 Million in 2024, growing at a CAGR of 5.3% during the forecast period from 2025 to 2034.

The compostable pouch market is expanding as companies shift toward environmentally responsible packaging solutions. These pouches decompose naturally and reduce reliance on fossil-fuel plastics, making them ideal for brands in food, personal care, and agriculture. Rising sustainability goals continue to position compostable formats as essential packaging assets.

Furthermore, compostable pouches offer durability, strong barrier performance, and lightweight structures, improving logistics and product safety. Businesses adopt these materials to enhance brand value and align with customer expectations. This transition also supports long-term cost efficiency as demand for bio-based packaging steadily accelerates across global markets.

Moreover, growing government focus on waste reduction and biodegradable packaging is boosting adoption. Investments, incentives, and supportive regulations are encouraging companies to adopt certified compostable formats. These developments create opportunities for manufacturers to scale innovation in plant-based films and compostable stand-up pouches.

Additionally, the market benefits from expanding applications across retail, food service, and e-commerce. Brands increasingly view compostable packaging as a strategic move to meet environmental targets and strengthen customer trust. This shift supports innovation in compostable laminates, zipper formats, and flexible pouch structures.

In addition, rising consumer awareness of plastic pollution is accelerating demand. Customers prefer sustainable packaging, driving companies to upgrade from conventional plastics to compostable alternatives. This trend reinforces continuous investment in eco-friendly solutions and improved waste-management systems.

According to industry data, a single reusable bag can replace up to 700 plastic bags over its lifespan, demonstrating clear ecological benefits. Similarly, the use of eco-friendly bags can reduce plastic waste by 80%, supporting rapid adoption of compostable packaging across industries.

Finally, compostable stand-up pouches further strengthen the market outlook because they typically biodegrade within 90–180 days, offering measurable environmental value. These statistics collectively highlight how shifting consumer expectations, regulatory pressure, and sustainability-driven innovation continue to shape the long-term growth of the compostable pouch market.

Key Takeaways

- Global market size reaches USD 345.3 Million in 2024 and is forecast to hit USD 578.7 Million by 2034.

- Market grows at a 5.3% CAGR from 2025–2034 across all major regions.

- Polylactic Acid (PLA) leads material segments with a 43.6% share.

- Stand Up Compostable Pouches dominate product types with 59.4% market share.

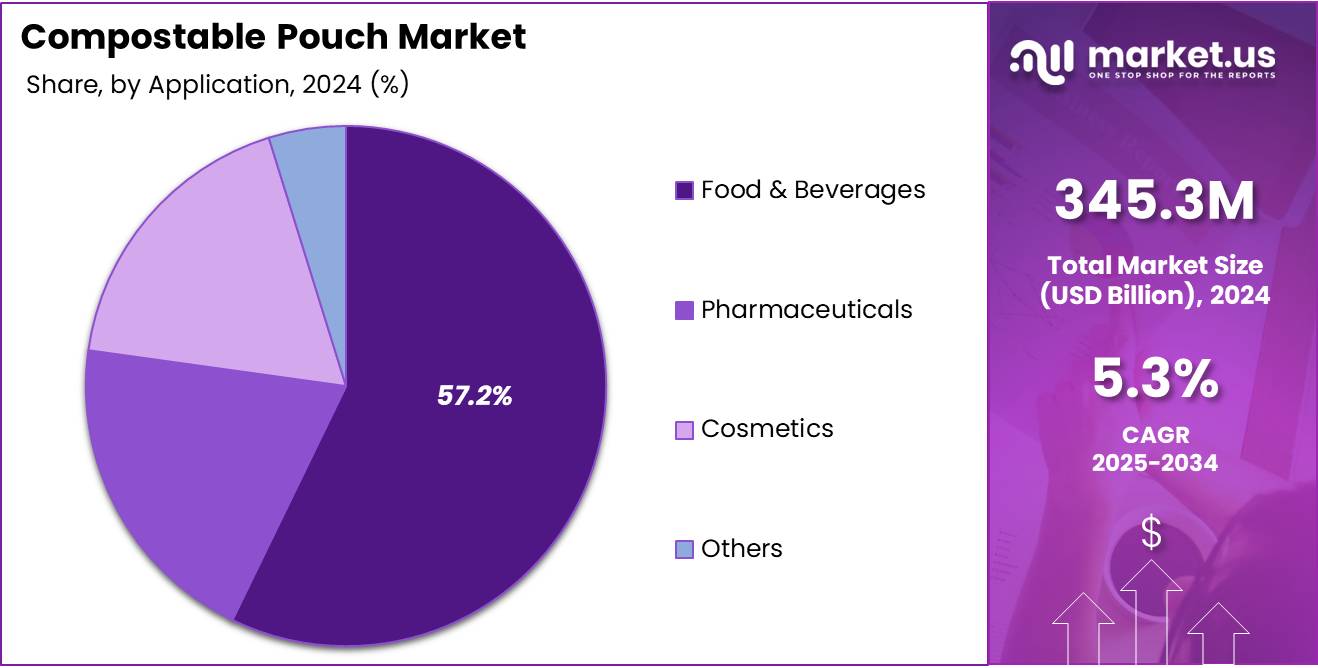

- Food & Beverages remains the top application segment with 57.2% share.

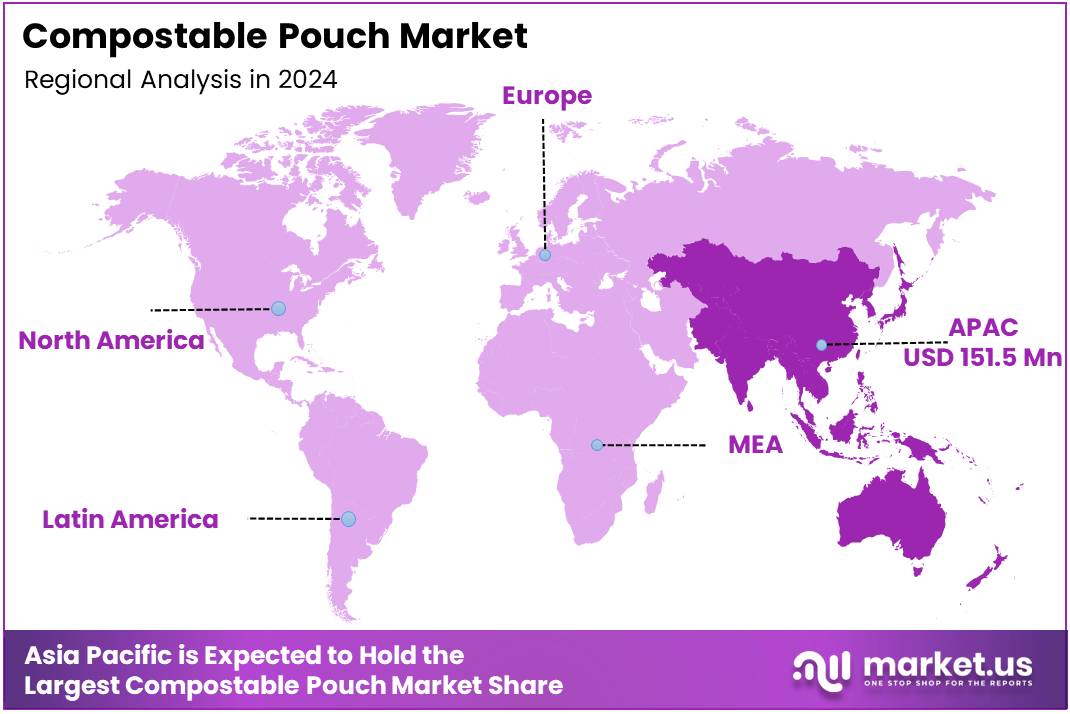

- Asia Pacific leads regionally with 43.9% share valued at USD 151.5 Million.

By Material Analysis

Polylactic Acid (PLA) dominates with 43.6% due to its strong biodegradability and broad packaging adoption.

In 2024, Polylactic Acid (PLA) held a dominant market position in the By Material Analysis segment of the Compostable Pouch Market, with a 43.6% share. This material advances demand as brands shift toward bio-based plastics. It supports high clarity and strength, enabling wider usage across retail packaging formats worldwide.

Paper held a notable position in the By Material Analysis segment of the Compostable Pouch Market. This segment grows as consumers choose fiber-based formats for sustainability. Paper offers easy recyclability and a natural appearance, encouraging adoption among eco-focused food, beverage, and cosmetic packaging brands.

Starch Blend gained traction in the By Material Analysis segment of the Compostable Pouch Market. The segment benefits from its affordability and compostable nature. Starch-based materials serve brands seeking reduced plastic content, helping industries align with regulatory needs for lower environmental impact across packaging categories.

Others contributed steadily in the By Material Analysis segment of the Compostable Pouch Market. These materials include emerging bio-polymers that enhance performance. Their adoption increases as companies explore alternatives that balance flexibility, durability, and compostability while remaining suitable for diverse packaging applications.

By Product Type Analysis

Stand Up Compostable Pouches dominate with 59.4% due to strong visual appeal and functional convenience.

In 2024, Stand Up Compostable Pouches held a dominant market position in the By Product Type Analysis segment of the Compostable Pouch Market, with a 59.4% share. Brands adopt these formats for improved shelf visibility. They also provide better storage efficiency, making them popular among food and personal-care packaging categories globally.

Flat Compostable Pouches remained an essential format in the By Product Type Analysis segment of the Compostable Pouch Market. These pouches expand usage due to their lightweight structure and cost-efficiency. They suit sample packs and single-use applications, helping manufacturers reduce material usage while maintaining sustainable packaging standards.

Others supported growth in the By Product Type Analysis segment of the Compostable Pouch Market. This category includes innovative designs addressing durability and barrier properties. Companies explore these formats to diversify packaging lines and meet evolving sustainability goals across retail and industrial applications.

By Application Analysis

Food & Beverages dominate with 57.2% owing to rising demand for eco-friendly packaging formats.

In 2024, Food & Beverages held a dominant market position in the By Application Analysis segment of the Compostable Pouch Market, with a 57.2% share. This segment accelerates as brands adopt compostable films for snacks, grains, and beverages. Consumer preference for sustainable packaging drives strong adoption across retail channels.

Pharmaceuticals showed consistent growth in the By Application Analysis segment of the Compostable Pouch Market. Companies explore compostable alternatives for non-critical items. The segment evolves as brands integrate sustainability with safety requirements, expanding the use of eco-friendly pouches for supplements and over-the-counter products.

Cosmetics gained momentum in the By Application Analysis segment of the Compostable Pouch Market. Brands shift toward biodegradable solutions to appeal to environmentally conscious consumers. These pouches support lotions, powders, and sample packs, improving brand value while meeting sustainability expectations.

Others contributed positively in the By Application Analysis segment of the Compostable Pouch Market. This category includes home-care and specialty goods. Rising environmental awareness encourages adoption of compostable pouches, helping companies reduce plastic waste and comply with evolving global packaging regulations.

Key Market Segments

By Material

- Polylactic Acid (PLA)

- Paper

- Starch Blend

- Others

By Product Type

- Stand Up Compostable Pouches

- Flat Compostable Pouches

- Others

By Application

- Food & Beverages

- Pharmaceuticals

- Cosmetics

- Others

Drivers

Strong Government Regulations Promoting Biodegradable and Compostable Packaging Solutions

Growing government regulations are playing a major role in driving the compostable pouch market. Authorities across regions are pushing brands to reduce plastic waste and switch to eco-friendly materials. These rules encourage companies to adopt certified compostable pouches, which help them meet compliance standards while improving sustainability performance.

At the same time, many leading brands are committing to carbon-neutral packaging goals. This shift is increasing demand for compostable pouches, as companies aim to reduce their overall environmental footprint. These initiatives also support long-term sustainability planning, pushing brands to invest in materials that are renewable, biodegradable, and align with global green targets.

Consumers are also becoming highly aware of the environmental impact of single-use plastic waste. As a result, they increasingly prefer products with compostable packaging. This rising awareness is encouraging companies to introduce eco-friendly pouch formats to attract environmentally conscious shoppers. The trend is accelerating market growth by creating consistent demand across food, personal care, and household categories.

Overall, these drivers work together to strengthen the compostable pouch market. Government support, brand commitments, and consumer awareness are collectively pushing the packaging industry toward cleaner and more sustainable solutions.

Restraints

Limited Shelf-Life Stability Compared to Conventional Plastic Pouches

The compostable pouch market faces notable restraints, mainly due to shorter shelf-life stability. Unlike traditional plastic pouches, compostable materials can weaken faster when exposed to moisture, heat, or oxygen. This limits their suitability for products that need long-term storage, making some brands hesitant to shift fully to compostable formats.

Moreover, these stability challenges often require additional protective layers or advanced material innovations, which increase production costs. As a result, many companies struggle to balance sustainability goals with product safety and packaging performance, slowing down broader adoption in sensitive sectors like food and beverages.

Another key restraint is the inconsistent composting infrastructure across major markets. Many regions lack industrial composting facilities, making it difficult for consumers to dispose of compostable pouches correctly. Without proper composting systems, these pouches may end up in landfills, reducing their environmental benefits.

This infrastructure gap also creates confusion for consumers and brands, as disposal rules differ widely from one area to another. This inconsistency limits the practical value of compostable packaging and affects market growth. Companies often delay investments in these solutions until global composting capabilities improve, leading to slower market expansion overall.

Growth Factors

Expansion of Certified Home-Compostable Packaging Standards Drives Market Growth

Growing opportunities are emerging as more countries introduce certified home-compostable standards. These clear guidelines help brands trust the material quality and ensure proper disposal. As regulations align globally, packaging producers gain a larger market to target, creating room for expansion and easier product approvals.

Premium organic food brands are rapidly adopting compostable pouches to strengthen their sustainable image. This shift opens strong growth potential because these brands influence overall market trends. As demand for clean-label, eco-friendly products grows, the need for compostable pouches increases, encouraging suppliers to scale production and diversify offerings.

Technology advancements in moisture-resistant bio-polymers are also unlocking new growth avenues. These improved materials help compostable pouches perform better in humid or high-moisture conditions, making them suitable for snacks, dry foods, and sensitive products. Better durability and barrier properties increase consumer confidence and enable brands to switch from conventional plastics.

Together, expanding global standards, rising premium brand adoption, and ongoing material innovations create a strong environment for future market growth. These factors not only broaden application areas but also allow manufacturers to capture new customer segments seeking sustainable packaging solutions.

Emerging Trends

Rapid Shift Toward Plastic-Free Retail Packaging Initiatives Drives Market Growth

The compostable pouch market is gaining strong momentum as retailers worldwide move toward plastic-free packaging. Many brands are replacing traditional plastics with compostable pouches to meet new sustainability targets. This trend is creating steady demand, especially among companies focused on improving their environmental footprint. Retailers also view compostable options as a way to strengthen brand image.

At the same time, consumers are increasingly adopting zero-waste lifestyles, pushing brands to offer eco-friendly alternatives. People now prefer packaging that reduces waste and fits into sustainable living routines. This shift encourages manufacturers to innovate with new compostable materials that break down easily and leave no harmful residue. As a result, consumer-driven demand is helping the market grow.

E-commerce is also contributing to this momentum. As online shopping volumes rise, companies are looking for safer and greener packaging options for deliveries. Compostable pouches are emerging as a preferred choice because they offer both convenience and environmental benefits. This rising adoption in e-commerce is accelerating investments in advanced compostable packaging solutions. Together, these factors are shaping a stronger and more future-ready market landscape.

Regional Analysis

Asia Pacific Leads the Compostable Pouch Market with a Market Share of 43.9%, Valued at USD 151.5 Million

Asia Pacific holds the largest share of the compostable pouch market, driven by rapid sustainable packaging adoption and strong government support. The region’s expanding food, personal care, and retail sectors further accelerate demand for eco-friendly solutions. With its dominant 43.9% share and valuation of USD 151.5 million, APAC continues to set the pace for global market growth.

North America Compostable Pouch Market Trends

North America shows steady growth supported by rising consumer preference for low-impact packaging and active sustainability commitments across industries. The region benefits from advanced composting standards and increasing retailer focus on greener packaging formats. Regulatory encouragement and higher adoption of premium eco-friendly goods continue to strengthen regional demand.

Europe Compostable Pouch Market Trends

Europe remains a key market due to its mature sustainability policies and early shift toward circular packaging systems. Strong emphasis on reducing plastic waste and promoting certified compostable materials drives consistent expansion. Consumer awareness, combined with structured waste management infrastructure, supports wider acceptance of compostable pouches.

Middle East & Africa Compostable Pouch Market Trends

The Middle East & Africa region is gradually adopting compostable packaging as governments introduce waste-reduction frameworks. Growth is supported by rising environmental awareness and early investments in sustainable materials. While still developing, the market shows steady movement toward eco-friendly alternatives across food, retail, and consumer goods sectors.

Latin America Compostable Pouch Market Trends

Latin America is experiencing growing interest in compostable pouches fueled by expanding organic product consumption and sustainability campaigns. Countries across the region are increasingly prioritizing environmentally responsible packaging choices. Improved regulatory focus and increased retailer participation support market expansion.

U.S. Compostable Pouch Market Trends

The U.S. market reflects rapid adoption of compostable pouches, driven by strong corporate sustainability goals and shifting consumer preferences. Advancements in compostable material performance and growing retailer commitments enhance market visibility. Supportive state-level regulations continue to accelerate demand across food, beverage, and personal care segments.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Compostable Pouch Company Insights

The global compostable pouch market in 2024 reflects the growing shift toward eco-friendly packaging, and leading companies are shaping this transition through innovation and scaling capabilities. TIPA Ltd continues to strengthen its position with advanced bio-based film technologies that offer durability and full compostability. The company’s strong R&D pipeline and partnerships with premium food and personal-care brands enable it to capture rising demand for high-performance sustainable pouches.

Ultra-Green Sustainable Packaging focuses on developing plant-based materials that balance cost efficiency and environmental performance. Its ability to commercialize lightweight, compostable pouches tailored for retail and foodservice applications enhances its competitive advantage. The brand also benefits from the growing push for plastic-free packaging in North America.

Özsoy Plastik is expanding its reach through affordable compostable packaging solutions designed for mainstream consumer goods. The company leverages flexible manufacturing capabilities and growing export networks, enabling it to scale production and serve both regional and global buyers. Its focus on upgrading material quality supports wider adoption in food and household product segments.

International Paper Company strengthens market momentum through fiber-based and paper-structured compostable pouch formats. With a strong global distribution system and sustainability-oriented product development, the company continues to attract brands seeking recyclable and compostable alternatives. Its commitment to circularity also aligns with regulatory pressures influencing packaging choices.

Together, these leading players contribute to accelerating investments, improving product performance, and expanding supply availability within the compostable pouch landscape. Their innovations and scaling strategies are expected to play a significant role in shaping long-term market evolution.

Top Key Players in the Market

- TIPA Ltd

- Ultra-Green Sustainable Packaging

- Özsoy Plastik

- International Paper Company

- Mondi

- Drew & Rogers

- Tetra Pak International SA

- Amcor plc

- DS Smith

- Klabin SA

Recent Developments

- In March 2024, The British Crisp Co. introduced the first recyclable paper chip bag in partnership with Evopak, expanding sustainable snack packaging. It marked a major step toward replacing conventional plastic bags with fiber-based, recyclable formats.

- In November 2025, TIPA acquired SEALPAP, strengthening its position in paper-based sustainable packaging solutions. The move enhanced TIPA’s capabilities to deliver high-performance compostable and recyclable alternatives.

- In October 2024, Accredo Packaging launched a 100% bio-based resin pouch using sugarcane-derived material at PACK EXPO 2024. The pouch featured a Fresh-Lock zipper, targeting brands seeking fully renewable and functional packaging options.

- In July 2024, TIPA partnered with Fresh-Lock to introduce home-compostable reclosable closures designed for compostable pouches. The new line used TIPA’s compostable resin, supporting brands aiming to deliver fully compostable flexible packaging systems.

- In April 2025, TIPA joined the U.S. Plastics Pact as an “Activator” member, aligning with national goals for circular-economy packaging. The membership enabled TIPA to influence policy development and accelerate compostable material adoption in the U.S. market.

Report Scope

Report Features Description Market Value (2024) USD 345.3 Million Forecast Revenue (2034) USD 578.7 Million CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Polylactic Acid (PLA), Paper, Starch Blend, Others), By Product Type (Stand Up Compostable Pouches, Flat Compostable Pouches, Others), By Application (Food & Beverages, Pharmaceuticals, Cosmetics, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape TIPA Ltd, Ultra-Green Sustainable Packaging, Özsoy Plastik, International Paper Company, Mondi, Drew & Rogers, Tetra Pak International SA, Amcor plc, DS Smith, Klabin SA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- TIPA Ltd

- Ultra-Green Sustainable Packaging

- Özsoy Plastik

- International Paper Company

- Mondi

- Drew & Rogers

- Tetra Pak International SA

- Amcor plc

- DS Smith

- Klabin SA