Global Community Garden Insurance Market Size, Share and Analysis Report By Coverage Type (General Liability Insurance, Property Insurance (Tools, Sheds, Infrastructure), Garden Product Liability Insurance, Others), By Garden Type (Allotment Gardens, Neighborhood/Residential Gardens, School & Educational Gardens, Therapeutic & Healthcare Gardens, Others), By Policy Holder (Non-Profit Associations/Garden Clubs, Municipalities & Local Governments, Schools & Universities, Others), By Policy Duration (Annual Coverage, Seasonal Coverage), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Jan. 2026

- Report ID: 173762

- Number of Pages: 346

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- General Community Garden Insights

- Drivers Impact Analysis

- Risk Impact Analysis

- Restraint Impact Analysis

- By Coverage Type

- By Garden Type

- By Policy Holder

- By Policy Duration

- By Region

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Emerging Trends

- Growth Factors

- Opportunity

- Challenge

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

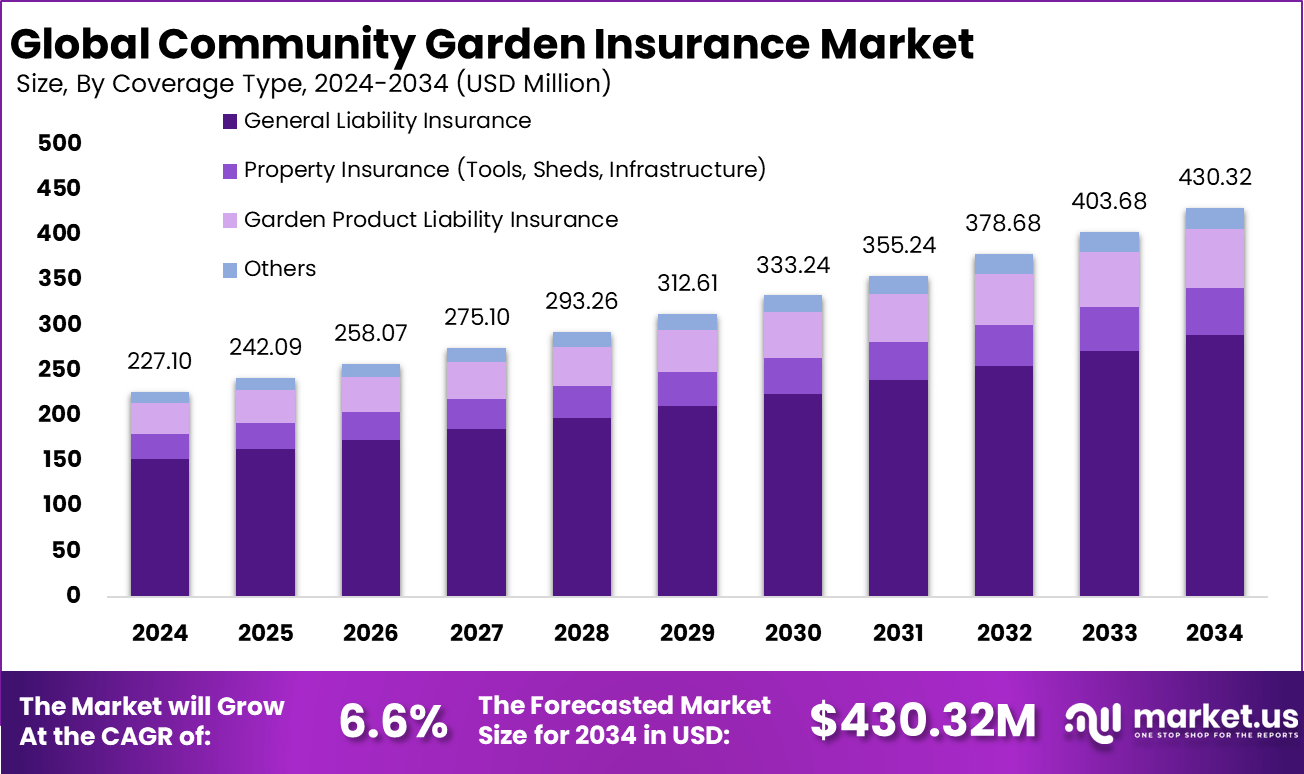

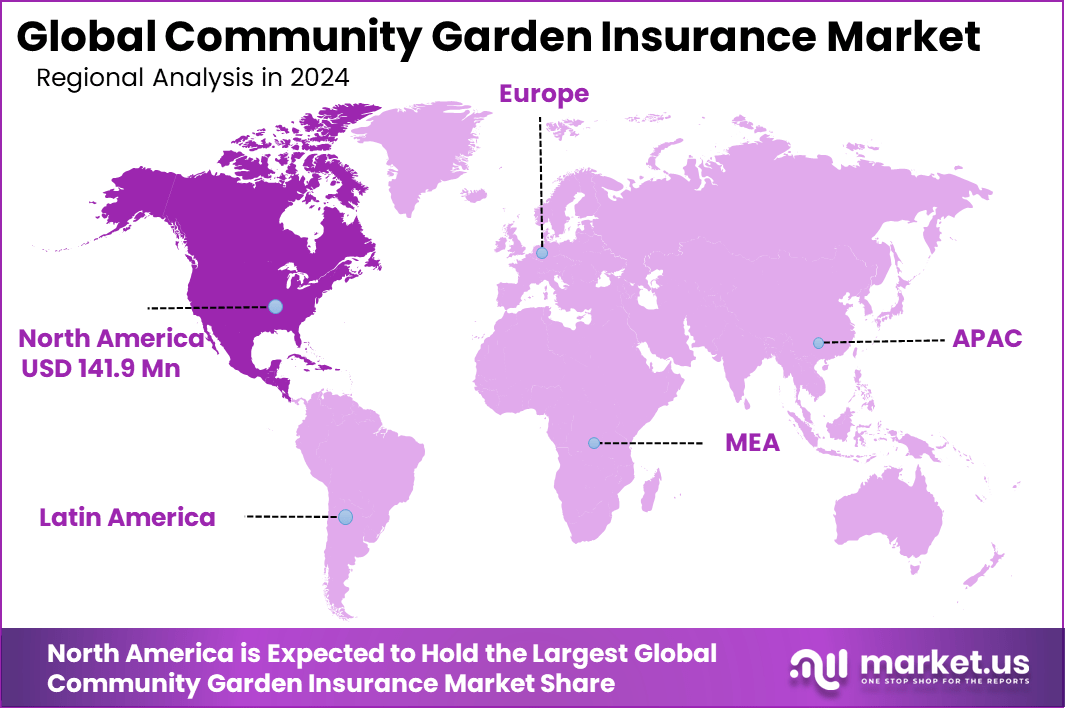

The Global Community Garden Insurance Market size is expected to be worth around USD 430.32 million by 2034, from USD 227.1 million in 2024, growing at a CAGR of 6.6% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 62.5% share, holding USD 141.9 million in revenue.

The community garden insurance market refers to specialized insurance solutions designed to protect community gardening groups, urban agriculture projects, and shared cultivation spaces from financial and legal risks. Coverage typically includes general liability, property damage, volunteer injuries, equipment loss, and third party claims linked to garden operations.

Growth in this market is driven by the rising number of urban agriculture and community gardening initiatives globally. Increased public access, volunteer involvement, and regulatory requirements have elevated the need for structured insurance coverage to manage liability exposure and ensure operational stability.

Demand for community garden insurance has been established primarily within nonprofit and municipal gardening initiatives. Organizations that engage volunteers and invite public participation face exposure to potential lawsuits stemming from injury or property loss. This exposure has increased the uptake of tailored insurance products to ensure that operations are financially protected. Policy adoption is often aligned with best practices in project governance and financial planning.

For instance, in May 2025, Markel launched specialty endorsements for public-access gardens after broker feedback. These tackle theft of shared gear and visitor claims, with $500 starting premiums. A city program in the East added 15 sites under the new options. Underwriters focused on real cases like fence breaks. It carves out their edge in odd-risk community setups.

Additionally, community gardens that operate educational or food distribution programs are subject to additional liability considerations. Policies may be sought to cover risks related to food safety, contamination, and product handling, especially under frameworks such as produce safety regulations. Insured organizations demonstrate a formal approach to risk management that can influence donor and grantor confidence.

Key Takeaway

- In 2024, general liability insurance dominated the market with a 67.4% share, reflecting strong need for protection against injury claims, property damage, and public liability risks within shared garden spaces.

- The allotment gardens segment held a leading 42.8% share, supported by the widespread presence of community managed plots that require structured insurance coverage for multiple users.

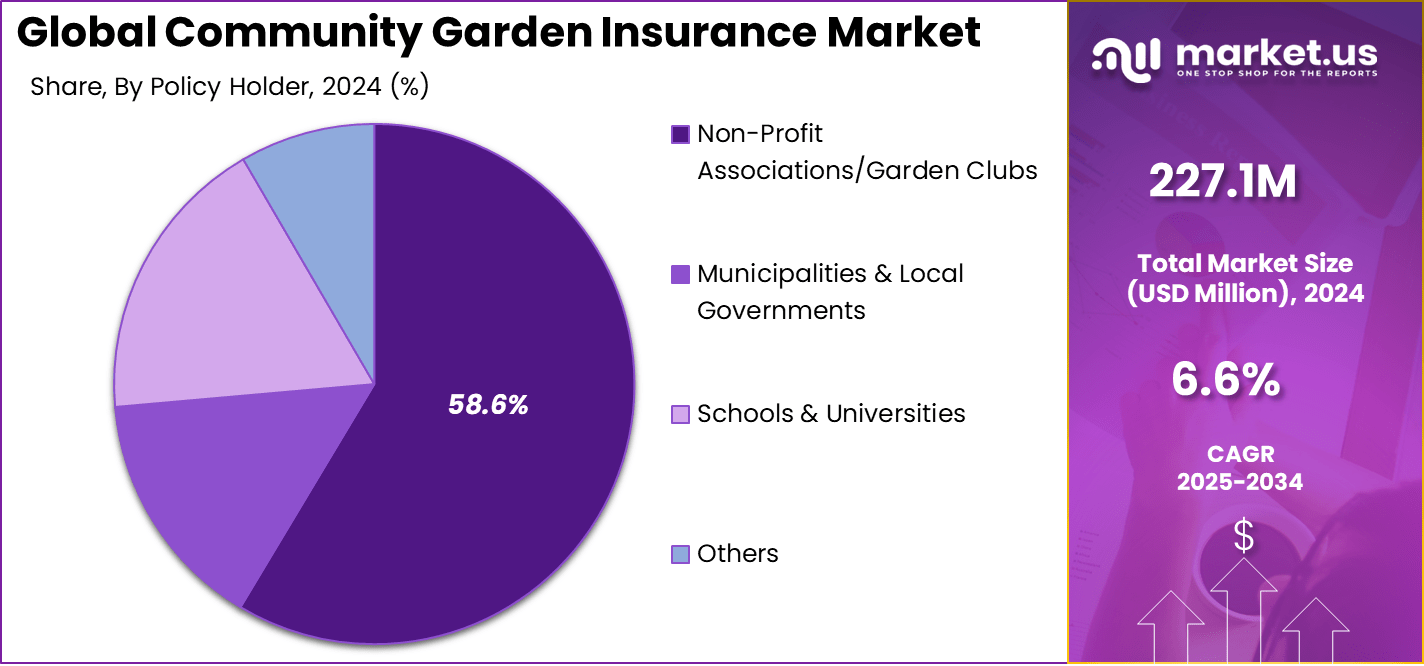

- Non profit associations and garden clubs accounted for 58.6% of total adoption, indicating that organized community groups remain the primary policyholders due to formal governance and compliance requirements.

- Annual coverage plans captured a dominant 81.3% share, showing clear preference for continuous, year round protection rather than short term or seasonal policies.

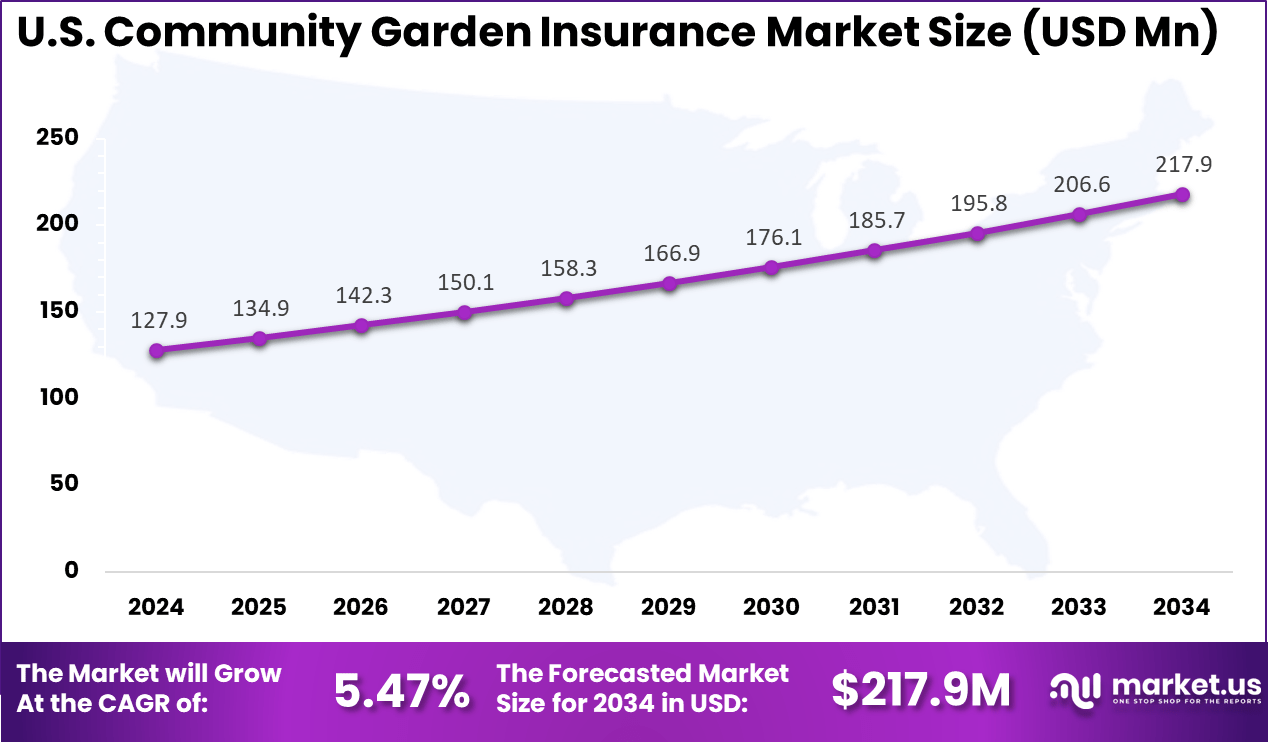

- The U.S. market was valued at USD 127.9 million in 2024, expanding at a steady 5.47% growth rate, supported by increasing urban gardening initiatives and community led green projects.

- North America held more than a 62.5% share in 2024, maintaining strong regional leadership due to high participation in community gardening, established insurance frameworks, and strong awareness of risk management needs.

General Community Garden Insights

- Community gardens have become a well established part of urban and suburban landscapes, with an estimated 18,000 community gardens operating across the United States and Canada. This scale reflects sustained public interest in shared green spaces and local food initiatives.

- Access to private green areas remains limited in several regions, as around 12% of households in the United Kingdom lack access to a private or shared garden. This gap has increased reliance on community gardens for recreation, wellbeing, and social interaction.

- Economic benefits have also been observed, as the presence of community gardens contributed to a 9.4% increase in nearby property values within five years in a major urban study. This demonstrates their positive impact beyond environmental and social value.

- Community engagement continued to rise, as survey data from Australia showed approximately 480,000 annual visits to community gardens in 2024. This marked an increase of 165,000 visits compared with the previous year, indicating growing public participation and awareness.

Drivers Impact Analysis

Driver Category Key Driver Description Estimated Impact on CAGR (%) Geographic Relevance Impact Timeline Growth of urban community gardens Rising number of shared green spaces ~2.1% North America, Europe Short Term Liability risk awareness Increased focus on visitor and volunteer safety ~1.7% Global Short Term Municipal support programs Public funding and land access initiatives ~1.2% North America, Europe Mid Term Expansion of educational gardening programs School and nonprofit participation ~0.9% Global Mid Term Climate related risk exposure Weather driven damage and loss events ~0.7% Global Long Term Risk Impact Analysis

Risk Category Risk Description Estimated Negative Impact on CAGR (%) Geographic Exposure Risk Timeline Low insurance penetration Many gardens remain uninsured ~1.9% Global Short Term Budget constraints Limited funding for premiums ~1.6% Emerging Markets Short Term Claims volatility Injury and property damage claims ~1.3% Global Mid Term Seasonal operations Irregular policy demand ~1.0% Global Mid Term Limited insurer specialization Few tailored products available ~0.8% Global Long Term Restraint Impact Analysis

Restraint Factor Restraint Description Impact on Market Expansion (%) Most Affected Regions Duration of Impact Low awareness levels Limited understanding of insurance needs ~2.3% Global Short Term Premium affordability Cost sensitivity among small groups ~2.0% Emerging Markets Short to Mid Term Policy complexity Difficulty interpreting coverage terms ~1.6% Global Mid Term Limited customization Generic policies not covering specific risks ~1.2% Global Long Term Administrative burden Documentation and compliance effort ~0.9% Global Long Term By Coverage Type

General liability insurance accounts for 67.4%, showing its importance in protecting community garden activities. This coverage addresses risks related to bodily injury and property damage. Community gardens often involve volunteers and public access. Liability protection helps manage legal exposure from accidents. Coverage supports safe participation.

The dominance of general liability insurance is driven by shared spaces and open access. Garden organizers prioritize protection against unforeseen incidents. Liability coverage also supports compliance with local regulations. Insurance provides financial security for organizers. This sustains strong adoption.

By Garden Type

Allotment gardens represent 42.8%, making them the leading garden type insured. These gardens divide land into individual plots managed by members. Shared infrastructure increases exposure to common risks. Insurance supports coordinated risk management. Structured layouts simplify coverage needs.

Growth in this segment is driven by urban gardening trends. Communities use allotment gardens to promote local food production. Insurance supports long-term garden sustainability. Organizers value predictable coverage terms. This supports steady demand.

By Policy Holder

Non-profit associations and garden clubs account for 58.6%, highlighting their central role. These groups manage garden operations and memberships. Insurance protects organizations against operational risks. Coverage supports volunteer coordination. Financial protection remains essential.

Adoption among non-profits is driven by responsibility to members. Insurance supports event organization and public engagement. Many groups operate with limited budgets. Affordable coverage improves confidence. This sustains strong participation.

By Policy Duration

Annual coverage accounts for 81.3%, reflecting preference for year-long protection. Community gardens operate across multiple seasons. Continuous coverage supports uninterrupted activities. Annual policies simplify renewal processes. Predictable terms improve planning.

The dominance of annual policies is driven by convenience. Organizers avoid frequent policy changes. Insurers offer stable pricing for annual terms. Long-term coverage supports operational stability. This keeps annual policies preferred.

By Region

North America accounts for 62.5%, supported by strong community gardening culture. Urban and suburban areas promote shared green spaces. Insurance awareness is relatively high. Local regulations encourage coverage. The region remains a key contributor.

Region Primary Growth Driver Regional Share (%) Regional Value (USD Mn) Adoption Maturity North America Strong community garden movement 41.2% USD 93.6 Mn Advanced Europe Urban sustainability initiatives 28.5% USD 64.7 Mn Advanced Asia Pacific Growing urban agriculture adoption 19.6% USD 44.5 Mn Developing Latin America Community food security programs 6.2% USD 14.1 Mn Developing Middle East and Africa Early stage urban farming 4.5% USD 10.2 Mn Early For instance, In October 2025, The Hartford Financial Services Group reinforced North American leadership by expanding specialized property and liability insurance for community gardens. Strong premium growth in Q3 2025 business insurance lines supported coverage for volunteer activities, public spaces, and urban risks such as tool injuries and weather related damage, aligning with regulatory requirements for non profit gardens on public land.

The United States reached USD 127.9 Million with a CAGR of 5.47%, indicating steady growth. Expansion is driven by increased community participation. Gardens seek protection for shared activities. Insurance adoption continues to rise gradually. Market growth remains stable.

For instance, In December 2025, Nationwide Mutual Insurance Company reinforced U.S. leadership in community garden insurance through tailored coverage for non profits and municipalities. The offering combines general liability, property, and equipment protection with structured risk management and digital claims support.

Investor Type Impact Matrix

Investor Type Adoption Level Contribution to Market Growth (%) Key Motivation Investment Behavior Community organizations Very High ~58.4% Liability and asset protection Annual policy purchase Municipal bodies High ~18% Public safety and land management Subsidized coverage Educational institutions Moderate ~11% Student and volunteer safety Program based insurance Non profit foundations Moderate ~8% Risk mitigation for funded projects Bundled coverage Private sponsors Low to Moderate ~5% Reputation and risk sharing Selective adoption Technology Enablement Analysis

Technology Layer Enablement Role Impact on Market Growth (%) Adoption Status Digital policy platforms Easy enrollment and renewal ~2.0% Growing Online risk assessment tools Faster underwriting ~1.6% Developing Claims management systems Streamlined incident handling ~1.3% Developing Data analytics Risk profiling by location ~1.0% Early Mobile insurance access On site incident reporting ~0.7% Early Emerging Trends

In the community garden insurance market, one clear trend is the growth of customised coverage that reflects the unique risks of community-based gardening activities. Policies are increasingly tailored to address issues such as volunteer injuries, property damage to garden structures, and liability for events held on shared grounds. These tailored options help organisers protect their networks without overpaying for irrelevant coverage.

Another trend is the integration of risk management guidance with insurance products. Some providers now offer educational materials, safety checklists, and planning resources alongside coverage. This combination supports community leaders in identifying hazards, improving site safety, and reducing the frequency of claims over time.

Growth Factors

A key growth factor in the community garden insurance market is the expanding number of community gardening initiatives in urban and suburban areas. As interest in local food production, sustainability, and outdoor activities grows, more groups establish shared garden spaces. Increased participation creates a broader customer base for insurance products that support event, volunteer, and property risks.

Another growth factor is the recognition by property owners and municipalities of the need for formal risk protection. Landowners that host community gardens often require proof of insurance before granting use rights. This requirement encourages organisers to secure appropriate policies to satisfy contractual conditions and protect both volunteers and hosts.

Opportunity

An opportunity exists in the development of modular insurance packages that align with the scale and activities of gardens. For example, basic liability coverage paired with optional add-ons for tools, kiosks, or event risks can help organisers choose protection that matches their needs and budgets. These adjustable options can increase accessibility.

Another opportunity lies in education and advisory support for garden organisers. Providers that offer clear explanations of risk exposures, coverage options, and claims processes can help demystify insurance. Better understanding can lead to higher adoption and more confident decision making among volunteers and leaders.

Challenge

One challenge for the community garden insurance market is ensuring clarity in coverage terms and limits. Many organisers are not familiar with insurance language, and ambiguous policy wording can create misunderstanding about what is protected. Clear, plain-language explanations are essential to ensure organisers select appropriate insurance without gaps.

Another challenge involves supporting consistent adoption across varied garden communities. Community gardens differ widely in size, risk profile, location, and governance. Designing a product range that addresses this diversity while remaining manageable for insurers requires careful product planning and flexibility.

Key Market Segments

By Coverage Type

- General Liability Insurance

- Property Insurance (Tools, Sheds, Infrastructure)

- Garden Product Liability Insurance

- Others

By Garden Type

- Allotment Gardens

- Neighborhood/Residential Gardens

- School & Educational Gardens

- Therapeutic & Healthcare Gardens

- Others

By Policy Holder

- Non-Profit Associations/Garden Clubs

- Municipalities & Local Governments

- Schools & Universities

- Others

By Policy Duration

- Annual Coverage

- Seasonal Coverage

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Community Garden Insurance Market is led by large insurers with strong commercial and liability capabilities. The Hartford Financial Services Group, Inc., Nationwide Mutual Insurance Company, and State Farm Mutual Automobile Insurance Company provide coverage suited for shared land use and volunteer involvement. Liberty Mutual Insurance Company and Travelers Companies, Inc. offer flexible liability and property policies.

Mid-sized and specialty insurers focus on customized risk coverage. Church Mutual Insurance Company serves nonprofit and community-based gardens. Markel Corporation addresses event and participant liability risks. Farmers Insurance Group, American Family Mutual Insurance Company, and CNA Financial Corporation emphasize local underwriting and scalable coverage. Chubb, Ltd. supports higher-limit insurance needs.

Regional and niche providers improve market reach and affordability. Erie Insurance Group and Acuity Insurance rely on regional expertise and personalized service. Philadelphia Insurance Companies is known for nonprofit-focused programs. Allstate Insurance Company adds flexible policy options and claims efficiency. Other players continue to enter the market, increasing competition and customization.

Top Key Players in the Market

- The Hartford Financial Services Group, Inc.

- Nationwide Mutual Insurance Company

- State Farm Mutual Automobile Insurance Company

- Liberty Mutual Insurance Company

- Travelers Companies, Inc.

- Church Mutual Insurance Company

- Markel Corporation

- Farmers Insurance Group

- American Family Mutual Insurance Company

- CNA Financial Corporation

- Chubb, Ltd.

- Allstate Insurance Company

- Erie Insurance Group

- Acuity Insurance

- Philadelphia Insurance Companies

- Others

Recent Developments

- In October 2025, Church Mutual rolled out tailored liability riders for nonprofit garden projects tied to faith groups. This came after talks with urban leaders facing more volunteer sites. The add-ons cover slips on wet paths and tool mishaps, with limits up to $2 million. Groups like food pantries with plots saw quicker approvals. It fits their niche in serving community spots that mix green work with outreach.

- In July 2025, Travelers updated their community resiliency program to include garden liability workshops in high-risk zones. After storms hit urban plots hard, they trained 50 groups on coverage gaps. Policies now bundle weather tools with basic protection up to $1 million. Organizers called it a game-changer for keeping plots open year-round. This strengthens their role in neighborhood renewal efforts.

Report Scope

Report Features Description Market Value (2024) USD 227.1 Mn Forecast Revenue (2034) USD 430.3 Mn CAGR(2025-2034) 6.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Coverage Type (General Liability Insurance, Property Insurance (Tools, Sheds, Infrastructure), Garden Product Liability Insurance, Others), By Garden Type (Allotment Gardens, Neighborhood/Residential Gardens, School & Educational Gardens, Therapeutic & Healthcare Gardens, Others), By Policy Holder (Non-Profit Associations/Garden Clubs, Municipalities & Local Governments, Schools & Universities, Others), By Policy Duration (Annual Coverage, Seasonal Coverage) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape The Hartford Financial Services Group, Inc., Nationwide Mutual Insurance Company, State Farm Mutual Automobile Insurance Company, Liberty Mutual Insurance Company, Travelers Companies, Inc., Church Mutual Insurance Company, Markel Corporation, Farmers Insurance Group, American Family Mutual Insurance Company, CNA Financial Corporation, Chubb, Ltd., Allstate Insurance Company, Erie Insurance Group, Acuity Insurance, Philadelphia Insurance Companies, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Community Garden Insurance MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample

Community Garden Insurance MarketPublished date: Jan. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- The Hartford Financial Services Group, Inc.

- Nationwide Mutual Insurance Company

- State Farm Mutual Automobile Insurance Company

- Liberty Mutual Insurance Company

- Travelers Companies, Inc.

- Church Mutual Insurance Company

- Markel Corporation

- Farmers Insurance Group

- American Family Mutual Insurance Company

- CNA Financial Corporation

- Chubb, Ltd.

- Allstate Insurance Company

- Erie Insurance Group

- Acuity Insurance

- Philadelphia Insurance Companies

- Others