Global Coconut Derivatives Market Size, Share Analysis Report By Type (Mature, Young), By Derivatives (Coconut Water, Coconut Oil, Coconut Milk, Desiccated Coconut, Others), By End-User (Food And Beverages, Cosmetics, Pharmaceuticals, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience/Grocery Stores, Specialty/Gourmet Stores, Online Retail/E-commerce, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 177776

- Number of Pages: 346

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

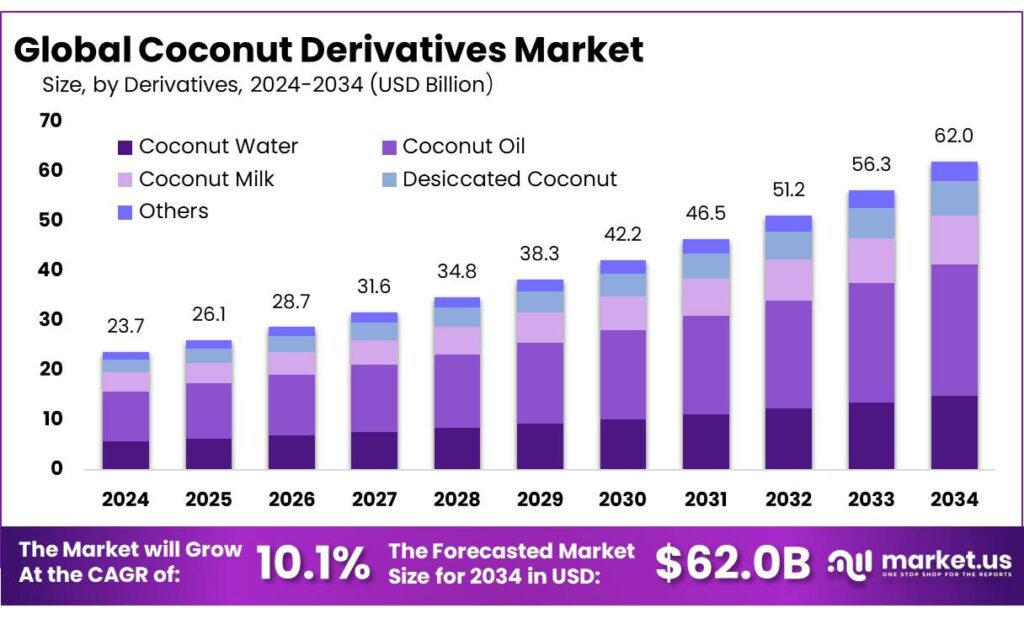

The Global Coconut Derivatives Market is expected to be worth around USD 62.0 Billion by 2034, up from USD 23.7 Billion in 2024, and is projected to grow at a CAGR of 10.1% from 2025 to 2034. The Asia Pacific segment maintained 43.8%, supporting a Psychedelic Mushrooms value of USD 10.3 Bn.

Coconut derivatives sit at the intersection of staple food use and fast-growing “better-for-you” ingredient demand. On the supply side, coconuts remain a high-volume tropical crop: FAO reports global production of ~65 million tonnes of coconuts in recent years, underscoring the scale of raw material available for downstream processing into food, personal care, and industrial inputs. In India’s official compilation of global coconut statistics, world coconut output is shown at 21,373.62 million nuts from 2,165.20 thousand hectares, reflecting both the breadth of cultivation and the continued importance of productivity improvements.

Industrially, the value chain is increasingly “fractionated,” with processors optimizing whole-nut utilization: oil and specialty fats for bakery/snacks and cosmetics; coconut milk/cream for plant-based foods; water for ready-to-drink beverages; and shells/husks for coir and activated carbon. Trade data highlights the concentration of export supply in a few hubs. For crude coconut oil, 2023 exports show the Philippines at ~$816.7 million and ~184.0 million kg, and Indonesia at ~$346.3 million and ~368.0 million kg, indicating both strong value capture and sizable physical flows into global food and oleochemical markets. Separately, OEC estimates global trade in crude coconut oil reached ~$1.83 billion in 2024, signaling renewed commercial momentum as demand expands across food and personal care formulations.

Key demand drivers are health-positioning, clean-label reformulation, and non-food industrial pull. At the same time, pricing and supply volatility has become a defining industrial scenario. Reuters reported coconut oil prices in India reaching a record ₹423,000 per metric ton and global prices hitting $2,990 per ton, with expectations of $2,500–$2,700 per ton in 2H 2025 as supply tightness persists.

Government programs increasingly target structural bottlenecks—aging gardens, low productivity and labor gaps—supporting future growth opportunities. In India, Parliament disclosures show ₹3,028.39 lakh allocated/released for replanting and rejuvenation in 2024–25, with ₹3,211.39 lakh utilized to cover 7,630.65 ha benefiting 9,281 farmers; demonstration efforts covered 44,468 ha benefiting 83,878 farmers, and ₹6,850.35 lakh was earmarked for 2025–26 implementation over 26,345 ha.

Key Takeaways

- Coconut Derivatives Market is expected to be worth around USD 62.0 Billion by 2034, up from USD 23.7 Billion in 2024, and is projected to grow at a CAGR of 10.1%.

- Mature held a dominant market position, capturing more than a 78.3% share.

- Coconut Oil held a dominant market position, capturing more than a 42.7% share.

- Food & Beverages held a dominant market position, capturing more than a 59.1% share.

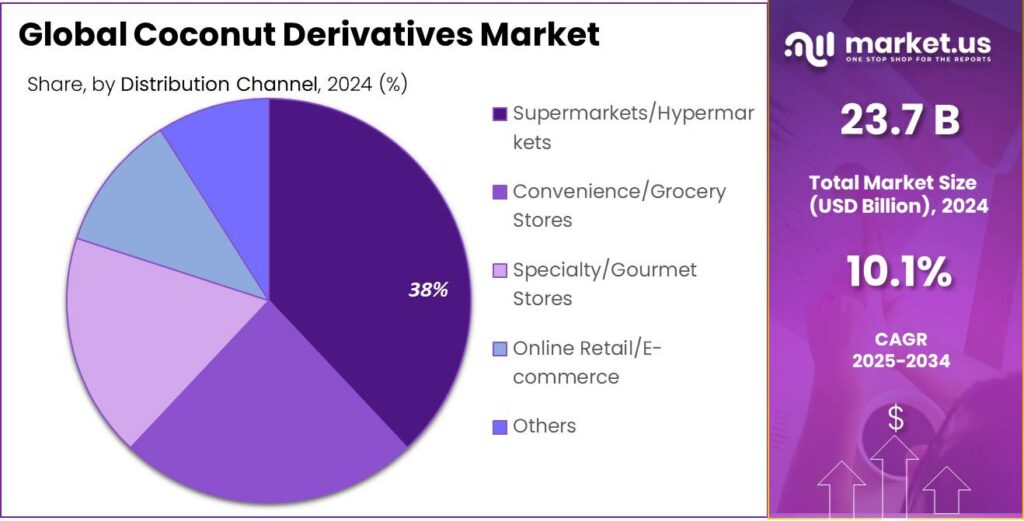

- Supermarkets/Hypermarkets held a dominant market position, capturing more than a 38.6% share.

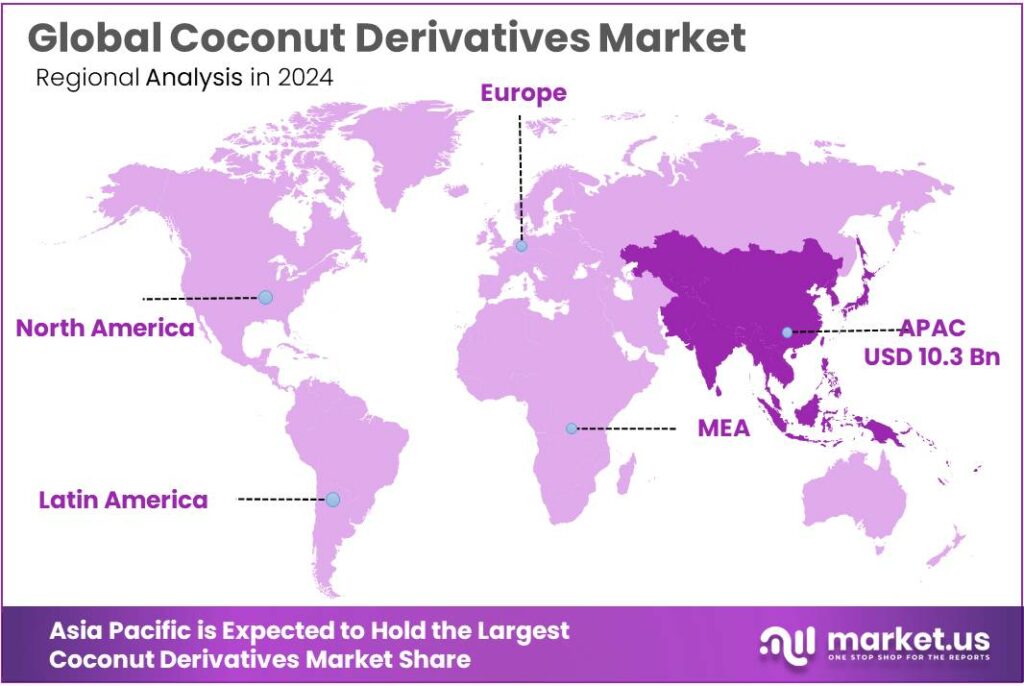

- Asia Pacific leads with 43.8% share about USD 10.3 Bn supply concentration and large-scale processing base.

By Type Analysis

Mature dominates with 78.3% due to its higher oil yield and broad industrial utilization.In 2024, Mature held a dominant market position, capturing more than a 78.3% share. This strong position is mainly linked to its high commercial value across food processing, oil extraction, and industrial applications. Mature coconuts are rich in copra content, which directly supports coconut oil production, desiccated coconut manufacturing, and coconut milk processing. In 2024 and continuing into 2025, processors across major producing countries have increasingly prioritized mature nuts because they deliver better oil recovery rates and stable solid content, which is critical for large-scale refining and oleochemical manufacturing. The strong demand from edible oil refiners and personal care ingredient manufacturers further strengthened its share during the year.By Derivatives Analysis

Coconut Oil dominates with 42.7% driven by strong demand across food and personal care industries.In 2024, Coconut Oil held a dominant market position, capturing more than a 42.7% share. This leadership reflects its wide application across edible oil processing, bakery fats, confectionery coatings, and dairy alternatives. Throughout 2024, refiners and food manufacturers continued to rely heavily on coconut oil due to its stable shelf life, functional properties, and compatibility with plant-based formulations. Its natural composition and clean-label positioning supported steady offtake in both domestic and export-oriented processing markets. Moving into 2025, the segment maintained strong momentum as industrial buyers prioritized coconut oil for bulk food manufacturing and specialty fat applications.By End-User Analysis

Food & Beverages dominates with 59.1% supported by rising plant-based and functional food demand.In 2024, Food & Beverages held a dominant market position, capturing more than a 59.1% share. This strong performance was mainly driven by the extensive use of coconut derivatives in edible oil production, bakery applications, confectionery coatings, ready-to-drink beverages, and dairy alternatives. Throughout 2024, food manufacturers increased the use of coconut oil, coconut milk, coconut cream, and desiccated coconut to meet growing consumer preference for plant-based and naturally sourced ingredients. The segment benefited from the expanding popularity of vegan products and lactose-free alternatives, where coconut-based ingredients serve as reliable substitutes for dairy fats and emulsifiers.By Distribution Channel Analysis

Supermarkets/Hypermarkets dominate with 38.6% driven by strong shelf visibility and bulk consumer access.In 2024, Supermarkets/Hypermarkets held a dominant market position, capturing more than a 38.6% share. This leadership reflects the strong consumer preference for purchasing coconut oil, coconut milk, desiccated coconut, and related products through organized retail chains. Large-format stores provide better shelf space, competitive pricing, and brand variety, making them a preferred destination for everyday grocery shopping. Throughout 2024, retailers expanded their plant-based and health-focused sections, which directly supported higher placement of coconut-based cooking oils, dairy alternatives, and ready-to-use coconut ingredients.

Key Market Segments

By Type

- Mature

- Young

By Derivatives

- Coconut Water

- Coconut Oil

- Coconut Milk

- Desiccated Coconut

- Others

By End-User

- Food & Beverages

- Cosmetics

- Pharmaceuticals

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience/Grocery Stores

- Specialty/Gourmet Stores

- Online Retail/E-commerce

- Others

Emerging Trends

More shelf-stable, export-ready coconut ingredients, with tighter processing and labeling discipline.

Across coconut derivatives, one clear latest trend is the move toward export-friendly, shelf-stable formats—especially for coconut water and coconut milk/cream—supported by stricter food-safety handling, better packaging, and more disciplined product naming on labels. The reason is practical: global retail and foodservice buyers want coconut ingredients that travel well, remain consistent across batches, and meet compliance checks without surprises. This is pushing processors to invest in faster post-harvest handling, improved pasteurisation, and aseptic packaging lines so products can ship longer distances while keeping taste and safety intact.

The trend is strongly linked to how plant-based consumption is showing up in mainstream grocery baskets. In the U.S. retail channel, plant-based milk continues to hold the largest share among plant-based categories, and in 2024 plant-based milk reached a 14% share of total milk dollar sales, according to the Good Food Institute’s retail market tracking. Even though “plant-based milk” is not only coconut, this matters for coconut derivatives because coconut milk and coconut cream are widely used in barista blends, cooking creams, yogurts, desserts, and ready-to-eat meals where dairy is being replaced. For coconut processors, the commercial takeaway is straightforward: buyers increasingly prefer standardized specifications delivered in stable packaging that can sit in warehouses and on shelves without cold-chain complexity.

This push for shelf-stable formats is also reinforced by raw material tightness, which makes reliability more valuable than ever. The International Coconut Community reported coconut oil prices rose 73% in 2024, from $1,126/MT in January 2024 to $1,949/MT in December 2024. When inputs swing like that, food manufacturers tend to lock in longer contracts and favor suppliers who can guarantee consistent specification and delivery schedules. In practice, that rewards processors who upgrade refining, filtration, and packaging—because those upgrades reduce variability and product loss.

Drivers

Plant-based and “clean-label” food demand is pulling more coconut ingredients into everyday recipes.

A major driver for coconut derivatives is the steady shift of food and beverage brands toward plant-based, dairy-free, and simpler-ingredient formulations. Coconut oil, coconut milk/cream, coconut flakes, and coconut-based fats solve practical problems for manufacturers: they add mouthfeel, improve texture, and help replace dairy fats in bakery, confectionery, spreads, desserts, and ready-to-drink beverages. This demand is no longer niche. In the U.S. retail channel alone, plant-based foods were valued at $8.1 billion in 2024, based on sales tracking work referenced by the Good Food Institute and partners.

This pull from food manufacturers becomes even clearer when supply tightens. The International Coconut Community (ICC) reported that coconut oil prices increased 73% in 2024, moving from $1,126/MT in January to $1,949/MT in December, and linked the surge to tightening supply and strong industrial demand. In simple terms, buyers kept needing coconut oil for both food processing and industrial uses, and the market had to “price up” to ration limited availability. That price signal encourages processors to prioritize coconut oil and related fractions (like specialty fats) because they remain high-throughput, high-importance derivatives for downstream customers.

At the same time, the category is supported by a very large agricultural base that keeps coconut relevant as a long-term ingredient platform. FAO’s production statistics highlight global coconut (in-shell) output of around 65 million tonnes. This matters because it shows coconut is not a small specialty crop; it is a major tropical raw material that can feed multiple derivative streams. When plant-based food manufacturers reformulate or scale a coconut-based SKU, they are more confident doing so with ingredients that have broad, established supply chains and familiar processing routes

Governments are also treating coconut productivity and replanting as a practical lever to support long-term supply—another reason the food-driven demand trend is translating into real capacity planning. In India, official parliamentary disclosures note ₹3,028.39 lakh allocated/released for replanting and rejuvenation in 2024–25, and ₹3,211.39 lakh utilized (including revalidated funds) to cover 7,630.65 hectares, benefiting 9,281 farmers.

Restraints

Supply Limitations and Price Volatility Restrict Growth in Coconut Derivatives

One major factor holding back the growth of the coconut derivatives market is the persistent challenge of supply shortages and price volatility. While global demand for coconut-based oils, milks, and other derivatives has strengthened, the production side has struggled to keep pace. Coconut trees take time to mature—typically 6 to 7 years before they produce significant yield—and many producing regions are facing aging plantations that are past their most productive years. This structural constraint directly limits the volume of raw material available for processing into derivatives, creating a bottleneck that translates into higher costs for manufacturers and slower adoption in price-sensitive markets.

The effect of this supply constraint is visible in price movements. For example, the International Coconut Community (ICC) reported that coconut oil prices increased by about 73% in 2024, rising from $1,126 per metric ton in January to $1,949 per metric ton by December. This steep climb in prices was largely linked to insufficient availability of mature coconuts and strong industrial demand, especially from food and personal care sectors.

This volatility doesn’t just affect edible oil applications—it ripples across other derivative streams too. Manufacturers of dairy alternatives, baked goods, snacks, and functional beverages all base their formulations on stable access to coconut oil or coconut milk inputs. When prices spike unexpectedly or supplies dip, these companies are forced to adjust formulations, absorb higher costs, or delay product rollouts. For businesses operating on tight margins, this creates uncertainty that can temper investment into new coconut-based product lines.

The geographic concentration of coconut production also contributes to this supply risk. Countries such as Indonesia, India, and the Philippines produce a large portion of the world’s coconuts. Weather events like droughts or typhoons in these key regions can dramatically reduce output. In fact, forecast reports during the 2024/25 season indicated a 2.5% decline in global coconut oil production due to dry conditions tied to El Niño effects in some producing countries.

Opportunity

Full-nut processing and premium ingredient formats can lift value per coconut, not just volume.

A major growth opportunity for coconut derivatives is moving from single-output processing (only oil, only milk, only coir) to full-nut valorization—using the kernel, water, husk, and shell in one integrated chain. The logic is simple: when raw coconut supply is tight or seasonal, the industry grows faster by extracting more saleable products per nut and by shifting into higher-value derivative formats. This opportunity is backed by the scale of the base crop. FAO’s production statistics show coconuts (in-shell) at roughly 65 million tonnes globally, which means even small improvements in conversion efficiency and by-product use can translate into very large value creation across food, homecare, and industrial channels.

On the food side, the clearest runway comes from plant-based and “clean label” reformulation, where coconut ingredients play a practical role as fat replacers, texture builders, and dairy substitutes. In the U.S. retail channel, plant-based foods were worth $8.1 billion in 2024 (GFI/PBFA, based on SPINS retail sales tracking). This matters for coconut derivatives because plant-based dairy and desserts frequently use coconut cream, coconut milk, or coconut oil fractions to deliver the mouthfeel that consumers expect. In 2025, the opportunity strengthens for suppliers who can offer consistent, food-safe formats—such as shelf-stable coconut milk/cream for beverage and dessert plants, or standardized coconut oil blends for bakery and confectionery—because large manufacturers prefer ingredients that reduce batch variation and simplify labeling.

A second, often underappreciated opportunity is the shell-to-activated-carbon pathway. Food and beverage processing, packaged drinking water, and beverage bottling depend heavily on filtration and purification steps, and coconut-shell activated carbon is a widely used input for those systems. In 2024, India’s activated carbon exports rose to 117,368 MT from 106,051 MT in 2023 (up 10.7%), and export value increased to USD 225.7 million from USD 184.3 million (up 22.5%).

Regional Insights

Asia Pacific leads with 43.8% share about USD 10.3 Bn supply concentration and large-scale processing base.

Asia Pacific remains the dominating region for coconut derivatives, and Asia Pacific (43.8%; USD 10.3 Bn) reflects how strongly the value chain is anchored in the region—from farm output to export-oriented processing. The region hosts the world’s largest coconut-growing economies and the densest network of oil mills, desiccated coconut plants, coconut milk/cream processors, and co-product industries (coir, shell charcoal, activated carbon). FAO’s statistical reporting continues to position Asia as the center of gravity for coconut production and downstream availability, which gives regional processors a cost and logistics advantage when serving both domestic food markets and global buyers.

In trade terms, the Philippines’ coconut oil shipments illustrate the scale: the International Coconut Community (ICC) reported that Jan–Oct 2024 coconut oil exports reached 1.35 million MT (up 31.3% year-on-year) with export value rising to $1.61 billion.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

PT Global Coconut is positioned as a leading coconut processor in North Sulawesi, close to plantation supply. A key differentiator is industrial-scale throughput: its facility is described with a peak operating capacity of 250,000 nuts/day, designed as an eco-friendly, modern production setup. The same profile highlights multiple certifications used by global food buyers (including Halal and food-safety systems), supporting export-ready coconut ingredients and derivatives across consistent quality requirements.

Hain Celestial is a health-and-wellness focused packaged food company where coconut derivatives mainly fit through dairy-alternative beverages and plant-based meal solutions. For fiscal year 2024, Hain reported total net sales of $1,736 million. Within that year, the Beverages segment showed $253 million in net sales (reported), reflecting continued room for coconut-based formulations where non-dairy and better-for-you positioning matters in retail shelves and foodservice formats.

Top Key Players Outlook

- Superstar Coconut Products Co., Inc.

- Celebes Coconut Corporation

- PT Global Coconut

- McCormick & Company, Inc.

- Hain Celestial Group, Inc.

- Danone S.A.

- Vita Coco

- Agrim Pte Ltd.

Recent Industry Developments

In 2024–2025, Celebes continued to ship products internationally, with export intelligence showing at least 4,017 export shipments to 275 verified buyers—a strong sign of recurring demand and broad market presence.

In 2024, Hain reported $419 million in net sales for one quarter and over $1.74 billion in total revenue, reflecting the scale of its natural foods and plant-based business that indirectly uses coconut derivatives in formulations.

Report Scope

Report Features Description Market Value (2024) USD 23.7 Bn Forecast Revenue (2034) USD 62.0 Bn CAGR (2025-2034) 10.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Mature, Young), By Derivatives (Coconut Water, Coconut Oil, Coconut Milk, Desiccated Coconut, Others), By End-User (Food And Beverages, Cosmetics, Pharmaceuticals, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience/Grocery Stores, Specialty/Gourmet Stores, Online Retail/E-commerce, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Superstar Coconut Products Co., Inc., Celebes Coconut Corporation, PT Global Coconut, McCormick & Company, Inc., Hain Celestial Group, Inc., Danone S.A., Vita Coco, Agrim Pte Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Superstar Coconut Products Co., Inc.

- Celebes Coconut Corporation

- PT Global Coconut

- McCormick & Company, Inc.

- Hain Celestial Group, Inc.

- Danone S.A.

- Vita Coco

- Agrim Pte Ltd.