Global Cochineal Extract Market Size, Share, Report Analysis By Grade (Food Grade, Pharmaceutical Grade, Others), By Application (Food, Beverages, Cosmetics and Personal Care, Textiles, Pharmaceuticals, Dietary Supplements, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156344

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

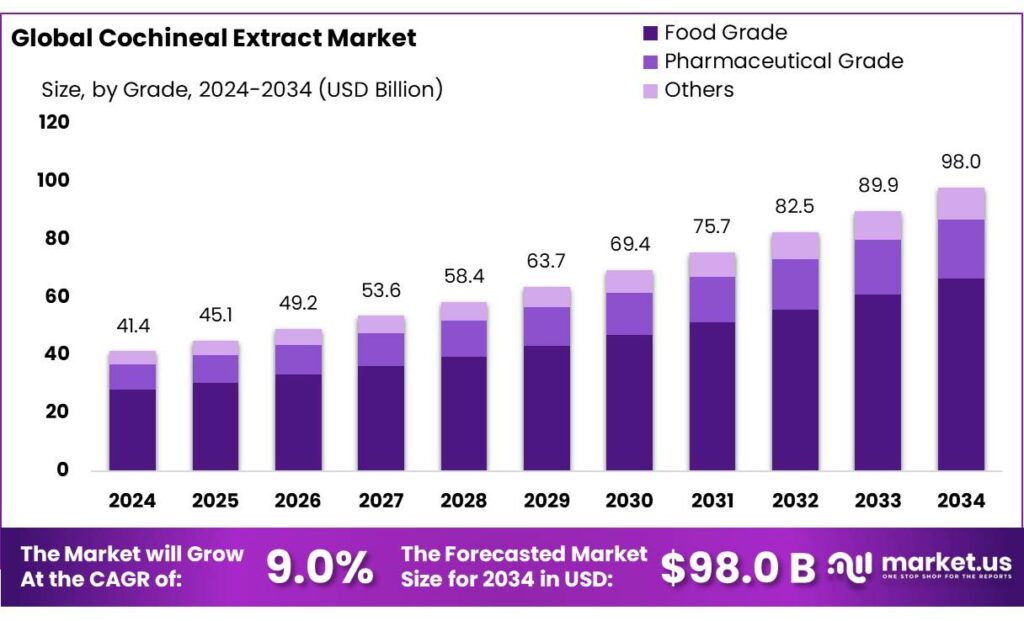

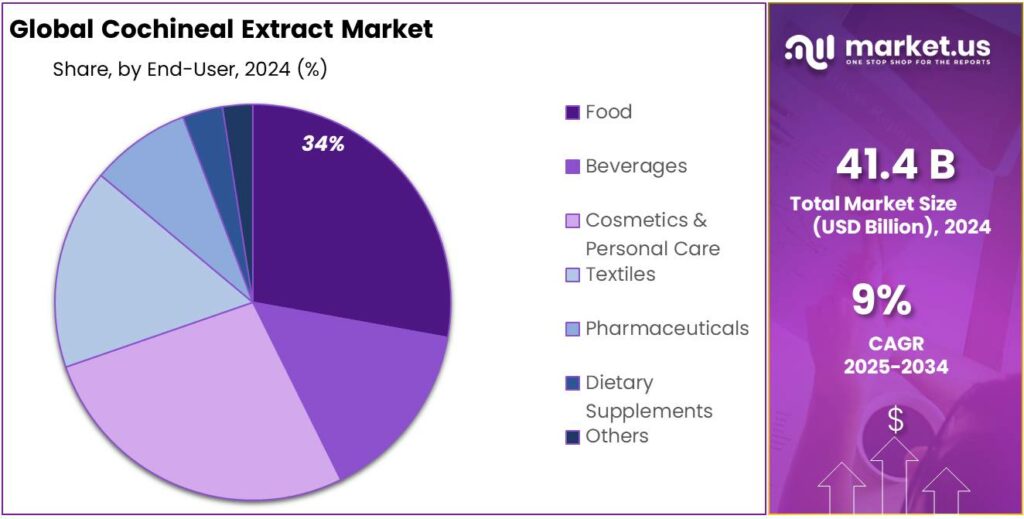

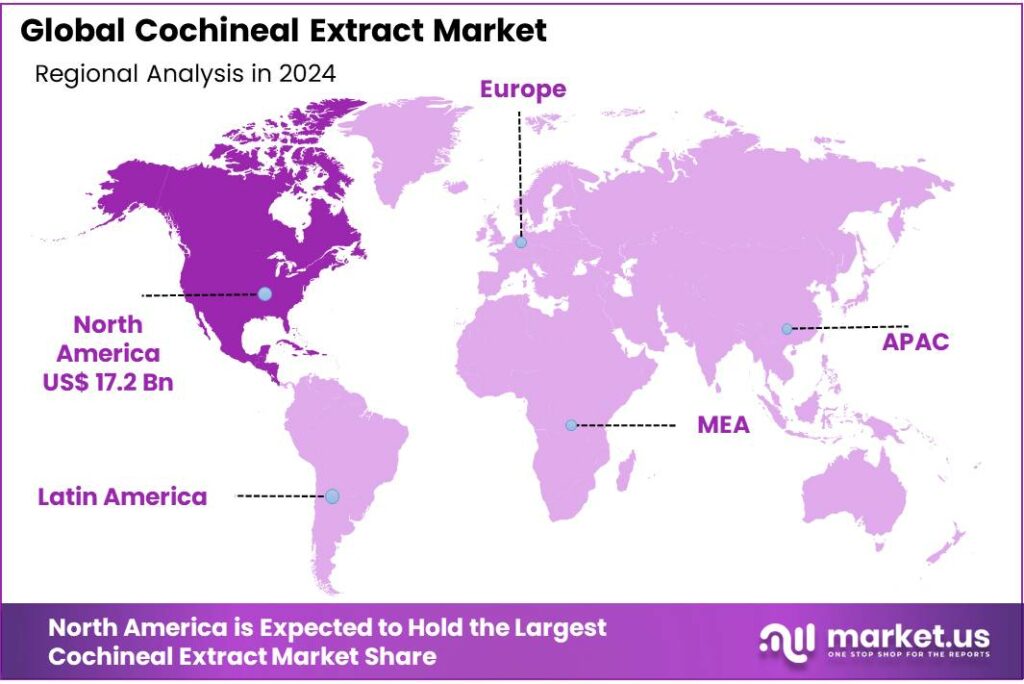

The Global Cochineal Extract Market size is expected to be worth around USD 98.0 Billion by 2034, from USD 41.4 Billion in 2024, growing at a CAGR of 9.0% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 41.70% share, holding USD 17.2 Billion revenue.

Cochineal extract—derived from scale insects of the genus Dactylopius, particularly D. coccus—is a natural red pigment featuring carminic acid at 17–24 % of the dried insect’s weight. Historically valued as a dye in textiles and arts, cochineal has reemerged as a preferred natural coloring agent in food, cosmetics, and pharmaceuticals due to consumer health concerns over synthetic alternatives.

- In 2005, Peru, the leading producer, yielded approximately 200 tonnes of cochineal dye annually, followed by the Canary Islands with 20 tonnes. Global annual production today is estimated at 150–180 tonnes, of which about 90 % originates from Peru; the remainder comes principally from the Canary Islands.

From an industrial standpoint, Peru dominates global production, accounting for approximately 80‑83% of supply. The government of Peru actively promotes cochineal production as a means of rural employment and economic development. For instance, Peru’s Instituto de Investigación Tecnológica Industrial y de Normas Técnicas (ITINTEC), in collaboration with Simon Fraser University, has developed more efficient dye extraction processes. Local processing facilities are intentionally located near farming communities to maximize rural employment, and cochineal farmers reportedly earn more than 10% of the total market revenue.

Key drivers include rising consumer health awareness, resulting in accelerated demand for natural colorants in place of synthetic alternatives. Regulatory frameworks—such as exemptions for naturally derived colors by the U.S. FDA and European Food Safety Authority—enhance cochineal extract’s market appeal. In India, the broader “food colorant” industry reached an estimated USD 3.2 billion in 2023, with double‑digit CAGR growth above 7%, laying a favorable background for natural alternatives like cochineal extract. Consumers increasingly reject synthetic dyes amid health concerns, further boosting natural pigment adoption.

On the broader front of organic and natural farming, several schemes advance natural-input production—essential for raw materials like cochineal. The Prakritik Kheti Khushal scheme (Subhash Palekar Natural Farming) and Paramparagat Krishi Vikas Yojana (PKVY) support organic farming clusters, offering up to INR 20,000 per acre benefit over three years and fostering chemical‑free cultivation practices. The MOVCD‑NER scheme targets organic value‑chain development in India’s North‑East, supporting farmers with subsidies, certification, and processing infrastructure.

Key Takeaways

- Cochineal Extract Market size is expected to be worth around USD 98.0 Billion by 2034, from USD 41.4 Billion in 2024, growing at a CAGR of 9.0%.

- Food Grade held a dominant market position, capturing more than a 67.8% share of the global cochineal extract market.

- Food held a dominant market position, capturing more than a 34.9% share of the global cochineal extract market.

- North America stands as the dominating region in the global cochineal extract market, commanding approximately 41.70% share, equivalent to around USD 17.2 billion.

By Grade Analysis

Food Grade Cochineal Extract leads with 67.8% share in 2024

In 2024, Food Grade held a dominant market position, capturing more than a 67.8% share of the global cochineal extract market. This strong position is largely due to its widespread use in beverages, confectionery, dairy products, and bakery items, where natural coloring agents are increasingly preferred over synthetic alternatives. Food-grade cochineal extract is highly valued for its stability, vibrant red pigment, and safety profile, making it the top choice among food manufacturers.

The dominance of the food-grade segment in 2024 reflects the shift in consumer preferences toward natural and clean-label products. Many beverage producers, including those in soft drinks, juices, and alcoholic beverages, adopted cochineal extract as a sustainable alternative, supporting its market expansion. By 2025, demand is expected to grow further as regulatory authorities in North America and Europe continue to encourage the use of natural colors, enhancing opportunities for food-grade applications.

By Application Analysis

Food Application dominates Cochineal Extract Market with 34.9% share in 2024

In 2024, Food held a dominant market position, capturing more than a 34.9% share of the global cochineal extract market. This leadership was driven by its extensive use in bakery, confectionery, dairy, and beverage products, where natural coloring agents are steadily replacing artificial ones. Food manufacturers widely favored cochineal extract because of its rich red hue, heat stability, and natural origin, aligning well with the growing consumer demand for clean-label and chemical-free ingredients.

The segment’s strength in 2024 was further supported by rising awareness of health and wellness, with consumers actively choosing naturally derived additives. Cochineal extract found broad applications in yogurts, fruit-flavored drinks, candies, and frozen desserts, ensuring a consistent demand base. By 2025, the food segment is expected to retain its leading position, boosted by regulatory encouragement in key markets such as the U.S. and the EU to adopt more natural food colorings.

Key Market Segments

By Grade

- Food Grade

- Pharmaceutical Grade

- Others

By Application

- Food

- Bakery &Confectionery

- Dairy

- Fruit Preparations

- Meat, Poultry, Fish, & Eggs

- Potatoes, Pasta, & Rice

- Sauces, Soups, & Dressings

- Pet Food

- Others

- Beverages

- Alcoholic Beverages

- Non-Alcoholic Beverages

- Cosmetics & Personal Care

- Textiles

- Pharmaceuticals

- Dietary Supplements

- Others

Emerging Trends

Ingredient Movement Drives Complete Label Declaration Requirements

The food industry has witnessed a revolutionary shift toward complete ingredient transparency, with cochineal extract emerging as a prime example of how modern consumers demand full disclosure about what goes into their food. This transparency trend has fundamentally changed how manufacturers handle natural colorants, creating new opportunities for companies that embrace honest labeling while challenging those who prefer to hide ingredient details from their customers.

Consumer research reveals the depth of this transparency demand across the marketplace. Packaged Facts’ May 2024 National Online Consumer Survey reveals that 51% of respondents seek out clean label packaged foods, while 40% seek out organic foods. This data shows that transparency has become more important to consumers than even organic certification, demonstrating how deeply people want to understand exactly what they’re eating and feeding their families.

The regulatory environment has evolved to support this transparency trend through specific requirements that benefit naturally sourced ingredients. The Food and Drug Administration (FDA) is revising its requirements for cochineal extract and carmine by requiring their declaration by name on the label of all food and cosmetic products that contain these color additives. This federal mandate ensures that consumers receive complete information about natural colorants, creating a competitive advantage for companies that use recognizable, naturally derived ingredients.

Drivers

Growing Consumer Demand for Clean-Label Natural Ingredients

The food industry today faces unprecedented pressure from health-conscious consumers who are demanding transparency in what they eat. This shift has made cochineal extract one of the most significant natural colorants driving the clean-label movement across the globe. People are becoming more aware of the potential health risks associated with artificial additives, and they want products that contain ingredients they can recognize and trust.

U.S. sales of certified organic products accelerated in 2024 with an annual growth rate of 5.2%, more than double that of the overall marketplace which grew at 2.5% in the same period, with dollar sales reaching a new high of $71.6 billion, according to the Organic Trade Association. This remarkable growth clearly shows how consumers are willing to pay premium prices for products they perceive as healthier and more natural. according to the Organic Trade Association. This remarkable growth clearly shows how consumers are willing to pay premium prices for products they perceive as healthier and more natural.

The Food and Drug Administration has played a crucial role in supporting this trend by maintaining strict safety standards for natural colorants like cochineal extract. FDA regulations require evidence that a color additive is safe at its intended level of use before it may be added to foods, which gives consumers confidence in these natural alternatives. The agency has also implemented specific labeling requirements for cochineal extract and carmine, ensuring complete transparency for consumers who may have dietary restrictions or allergies.

Restraints

Serious Allergic Reactions Create Major Industry Safety Concerns

The food industry faces significant challenges with cochineal extract due to documented cases of severe allergic reactions that have forced regulatory agencies to implement strict labeling requirements. These safety concerns have created ongoing obstacles for manufacturers who rely on this natural colorant, as they must now navigate complex regulatory frameworks while managing consumer health risks that can range from mild discomfort to life-threatening emergencies.

Consumer advocacy groups have played a crucial role in bringing these safety concerns to light. The Center for Science in the Public Interest has been particularly active in documenting the scope of allergic reactions. A small percentage of consumers suffer allergic reactions ranging from hives to life-threatening anaphylactic shock when exposed to carmine and cochineal extract, according to CSPI research. These findings underscore why the organization has continued to push for stronger consumer protections and clearer labeling requirements.

The regulatory response has been swift and comprehensive. Because of potential allergic reactions in some people, carmine/cochineal extract are required to be identified by name on food labels, as mandated by FDA regulations. This requirement means that manufacturers can no longer hide these ingredients under generic terms like “natural coloring” or “color added,” forcing complete transparency about their use.

Opportunity

Expanding Organic Food Market Creates Massive Natural Colorant Demand

The organic food industry represents one of the most promising growth opportunities for cochineal extract, as millions of health-conscious consumers continue driving unprecedented demand for naturally colored products. This surge in organic food consumption has created a perfect environment for natural colorants like cochineal extract to flourish, especially as food manufacturers seek ingredients that align with organic certification requirements while delivering the visual appeal that consumers expect from their favorite products.

The structural foundation of the organic market continues expanding at an impressive pace. Certified organic cropland acres increased by 79 percent to 3.6 million acres, and certified operations increased by more than 90 percent according to USDA National Agricultural Statistics Service surveys comparing 2011 to 2021 data. This dramatic expansion of organic farming infrastructure demonstrates the long-term commitment that producers are making to meet growing consumer demand for organic products.

The strengthening of organic oversight creates even more opportunities for naturally sourced ingredients. The Strengthening Organic Enforcement rule that took full effect by March 19, 2024, closes loopholes that had enabled ingredients that do not meet NOP standards to enter the organic supply chain according to Food Business News reporting. This regulatory tightening means that organic food manufacturers need reliable, naturally sourced ingredients like cochineal extract to maintain their certification status.

Regional Insights

North America stands as the dominating region in the global cochineal extract market, commanding approximately 41.70% share, equivalent to around USD 17.2 billion in value. This region leads owing to a combination of high demand in food and beverage sectors seeking clean-label colorants, stringent regulatory frameworks limiting synthetic dyes, and a rising consumer preference for natural ingredients.

This commanding share reflects North America’s well‑established food and beverage sector, where demand for clean‑label and naturally derived ingredients has surged in recent years. Consumers increasingly favor naturally sourced dyes over synthetic alternatives, and cochineal extract’s vibrant red hue aligns perfectly with this trend. The region’s regulatory environment, which includes approvals from agencies like the U.S. FDA, further supports the widespread adoption of cochineal in food, cosmetics, and pharmaceuticals.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Gentle World is a nonprofit educational organization that advocates for cruelty-free alternatives and ethical living, including awareness around natural dyes like cochineal extract. While not a direct commercial producer, the group plays a significant role in consumer education and ethical sourcing advocacy, influencing demand patterns for plant- and insect-based colorants. Its outreach initiatives contribute to shifting consumer preferences towards sustainable and transparent ingredients, indirectly supporting the cochineal extract market’s long-term visibility and ethical discourse.

Roha Dyechem Pvt. Ltd. is one of the world’s leading manufacturers of natural and synthetic food colors, with a strong presence in the cochineal extract market. The company offers a wide portfolio of insect-derived carmine and cochineal solutions suitable for food, beverage, and cosmetic applications. Its strong global distribution network, continuous innovation, and investments in research ensure regulatory compliance and product stability. Roha’s reliability, scale, and diversified offerings help it cater to both emerging and developed markets.

BioconColors is a recognized supplier of natural and nature-identical food colorants, including cochineal extract and carmine derivatives. With a focus on quality consistency and sustainability, the company provides color solutions that meet international safety standards for food and cosmetics. BioconColors serves major food processors and health product manufacturers, offering customization and stability solutions across temperature and pH-sensitive applications. Its R&D capabilities and customer-centric approach enhance its footprint in the natural food coloring space globally.

Top Key Players Outlook

- Gentle world

- Givaudan Sense Colour

- GREENING

- Roha Dyechem Pvt. Ltd.

- BioconColors

- ColorMaker Inc.

Recent Industry Developments

In fiscal year 2024 Roha Dyechem, delivered a consolidated turnover of around ₹2,414 crore, marking a healthy 10% year‑on‑year growth.

In 2024 GREENING, celebrated their 10‑year anniversary, a milestone that speaks to steady growth and trusted relationships.

Report Scope

Report Features Description Market Value (2024) USD 41.4 Bn Forecast Revenue (2034) USD 98.0 Bn CAGR (2025-2034) 9.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Food Grade, Pharmaceutical Grade, Others), By Application (Food, Beverages, Cosmetics and Personal Care, Textiles, Pharmaceuticals, Dietary Supplements, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Gentle world, Givaudan Sense Colour, GREENING, Roha Dyechem Pvt. Ltd., BioconColors, ColorMaker Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Gentle world

- Givaudan Sense Colour

- GREENING

- Roha Dyechem Pvt. Ltd.

- BioconColors

- ColorMaker Inc.