Global CNG Powertrain Market Size, Share, Growth Analysis By Drive Type (Front Wheel Drive, All-wheel Drive, Rear Wheel Drive), By Fuel Type (Bi-fuel, Mono Fuel), By Vehicle Type (Passenger Vehicle, Commercial Vehicle), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169318

- Number of Pages: 278

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

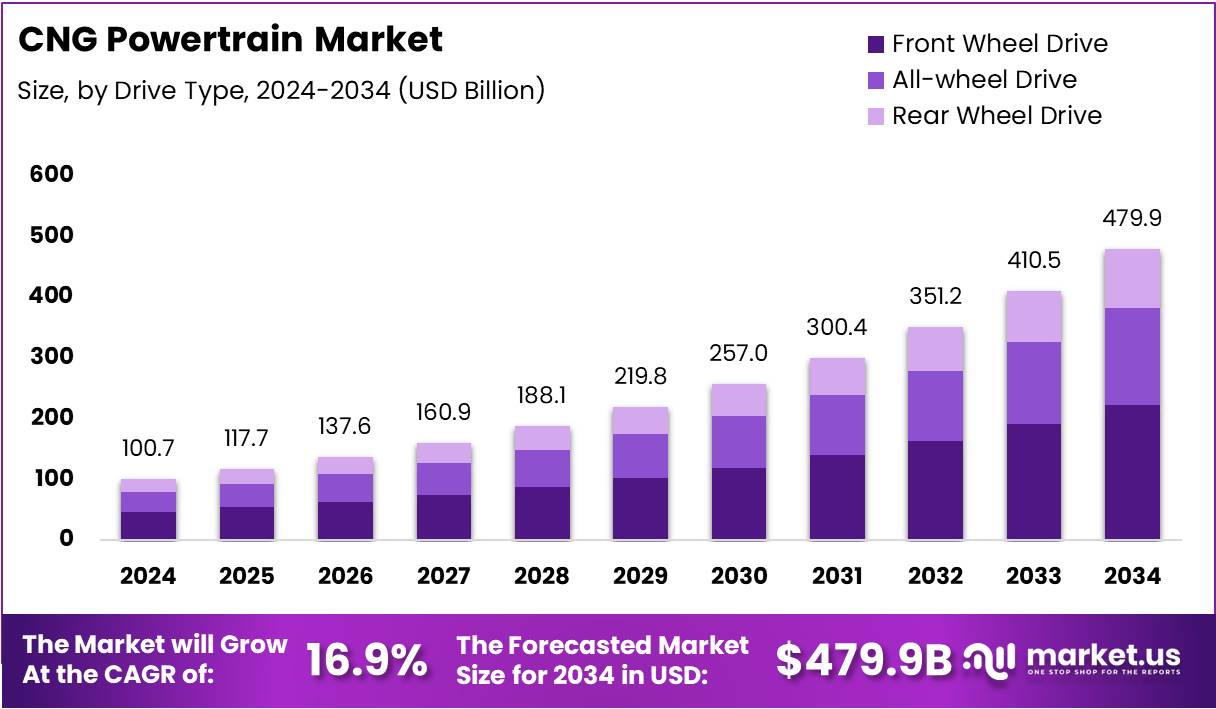

The Global CNG Powertrain Market size is expected to be worth around USD 479.9 Billion by 2034, from USD 100.7 Billion in 2024, growing at a CAGR of 16.9% during the forecast period from 2025 to 2034.

The CNG powertrain market represents engine systems designed to operate on Compressed Natural Gas, supporting cleaner, affordable, and efficient vehicle performance. It plays a crucial role in sustainable mobility by offering reduced emissions and dependable drivability, making it suitable for both passenger and commercial transportation segments seeking practical alternative-fuel solutions.

Moving forward, the market benefits from rising clean-fuel adoption, stronger emission norms, and expanding refueling infrastructure. Governments continue encouraging low-carbon mobility through investments and supportive policies, which gradually strengthen market confidence. These measures create fertile ground for innovation in CNG engine optimization, storage systems, and lightweight components.

Furthermore, increasing fuel-price uncertainty pushes consumers and fleet operators toward economical powertrains. CNG offers predictable running costs, making it attractive for logistics, ride-sharing, and urban commuter services. As operational efficiency becomes a key priority, the market experiences growing traction across regions aiming for long-term energy diversification.

Moreover, regulatory incentives accelerate adoption by reducing ownership costs and simplifying compliance requirements. Such support encourages deeper market penetration, enabling manufacturers and system integrators to improve performance standards. This environment fosters opportunities for technology upgrades, better thermal efficiency, and enhanced vehicle integration across multiple use cases.

Additionally, practical advantages strengthen user preference. CNG vehicles deliver reliable performance, extended driving range, and lower maintenance needs. With steady expansion of refueling networks, adoption becomes more viable for daily commuters and commercial operators. These factors collectively reinforce the positive growth potential of the CNG powertrain space.

Finally, CNG passenger vehicles emit 5–10% less CO₂ than gasoline models. They also deliver an average mileage of 25–30 km per kg, improving driving efficiency. Additionally, CNG achieves 12–20% lower fuel consumption than gasoline, further supporting cost savings and boosting long-term market demand.

Key Takeaways

- The Global CNG Powertrain Market is projected to grow from USD 100.7 Billion in 2024 to USD 479.9 Billion by 2034 at a CAGR of 16.9%.

- Front Wheel Drive dominates the drive type segment with a 46.6% share.

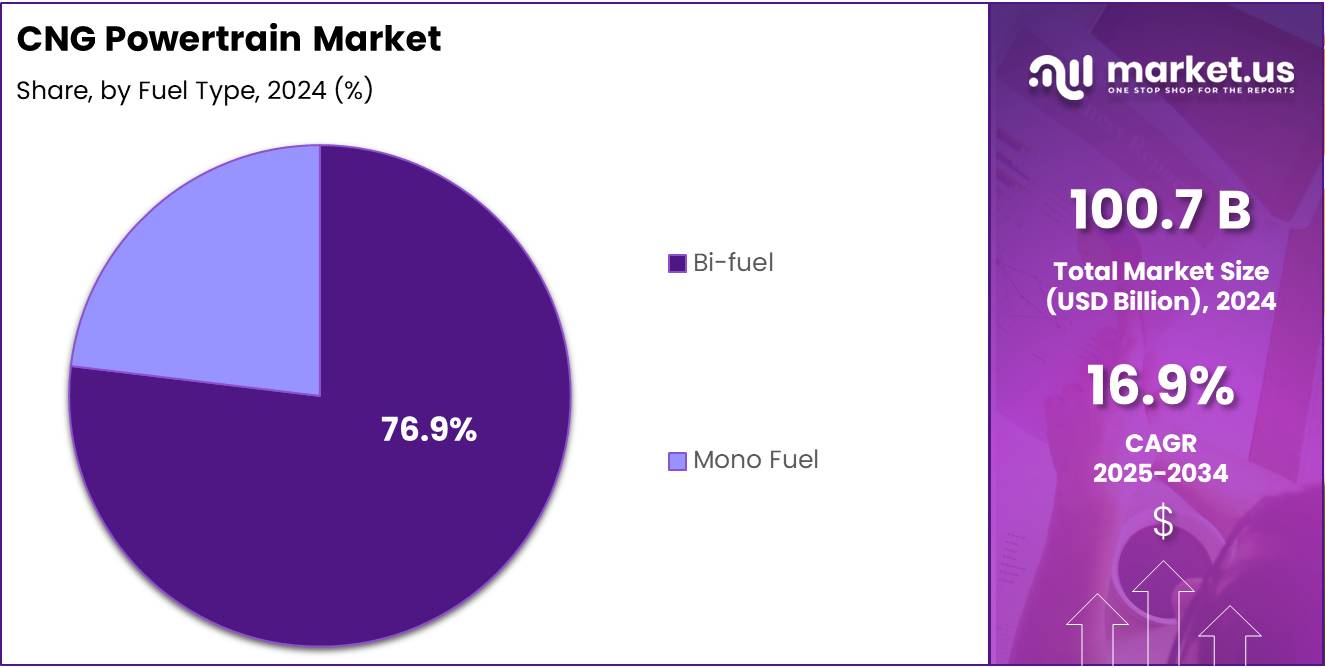

- Bi-fuel leads the fuel type segment with a 76.9% share.

- Passenger Vehicle dominates the vehicle type segment with an 82.4% share.

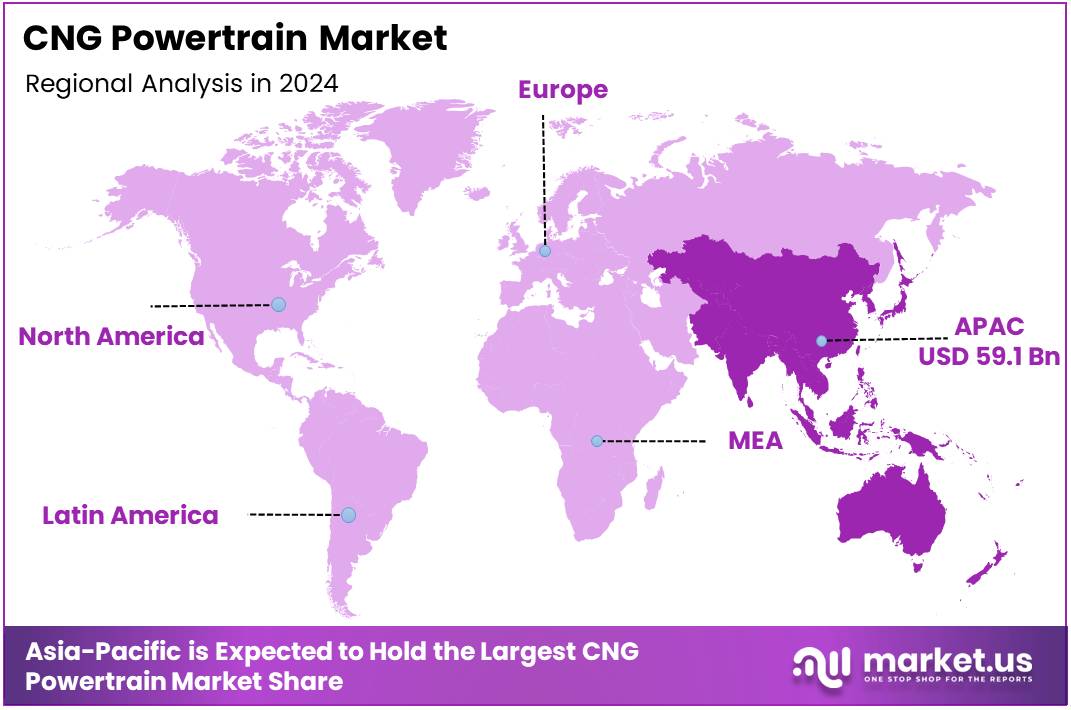

- Asia Pacific is the leading region with a 58.7% market share, valued at USD 59.1 Billion.

Drive Type Analysis

Front Wheel Drive dominates with 46.6% due to its efficiency and strong adoption in compact and mid-size vehicle platforms.

In 2024, Front Wheel Drive held a dominant market position in the By Drive Type segment of the CNG Powertrain Market, with a 46.6% share. This configuration improves traction, reduces weight, and enhances fuel savings. It also supports cost-effective CNG system packaging, driving widespread OEM integration across emerging and developed markets.

All-wheel Drive maintained a steady market role within the CNG Powertrain segment. This configuration supports better stability and power distribution. It appeals to consumers requiring improved handling and performance. As adoption expands in utility and commercial models, demand continues rising gradually, helped by technological refinement and broader drivetrain compatibility.

Rear Wheel Drive contributed moderately to the CNG Powertrain Market. This configuration favors balanced weight distribution and strong load-carrying capability. It is preferred in light trucks and select commercial fleets. As operators seek reliable performance with cleaner fuel options, rear-wheel systems continue gaining interest in specialized and logistics-focused applications.

Fuel Type Analysis

Bi-fuel dominates with 76.9% due to flexibility and strong operational cost benefits.

In 2024, Bi-fuel held a dominant market position in the By Fuel Type segment of the CNG Powertrain Market, with a 76.9% share. This configuration enables seamless switching between CNG and gasoline, supporting range extension and cost efficiency. Fleet operators prefer this option because it reduces fuel risks while ensuring reliable nationwide operability.

Mono Fuel systems held a focused but growing presence in the CNG Powertrain Market. These systems deliver optimized combustion efficiency and lower emissions by operating solely on CNG. As manufacturers refine dedicated CNG engines, adoption increases among cost-conscious users seeking higher performance consistency and improved environmental compliance across regions.

Vehicle Type Analysis

Passenger Vehicle dominates with 82.4% driven by affordability, lower emissions, and growing urban mobility demand.

In 2024, Passenger Vehicle held a dominant market position in the By Vehicle Type segment of the CNG Powertrain Market, with an 82.4% share. Rising fuel savings, economical ownership, and cleaner emissions strongly support adoption. Urban commuters increasingly favor CNG cars as governments promote alternative fuel mobility with incentives and infrastructure expansion.

Commercial Vehicles captured a stable share within the CNG Powertrain Market. Demand strengthens as logistics operators shift to cost-efficient and eco-friendly fuels. CNG trucks and vans reduce operational expenses and support regulatory compliance. As cities enforce cleaner fleet policies, commercial CNG adoption continues to expand across delivery, transport, and utility applications.

Key Market Segments

By Drive Type

- Front Wheel Drive

- All-wheel Drive

- Rear Wheel Drive

By Fuel Type

- Bi-fuel

- Mono Fuel

By Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

Drivers

Government Push for Cleaner Transportation Drives CNG Powertrain Market Growth

Governments worldwide are tightening emission rules, and this is encouraging the shift toward cleaner powertrain options. As stricter mandates come into force, automakers and fleet operators are adopting CNG systems to reduce emissions and stay compliant. This regulatory push continues to create strong demand for CNG powertrains across multiple vehicle categories.

Additionally, public transport agencies and commercial fleet operators are steadily increasing their reliance on CNG vehicles. The rapid adoption is driven by lower operating costs, reduced emissions, and better fuel efficiency compared to conventional fuels. As cities expand their fleet modernization programs, CNG-powered buses, vans, and delivery vehicles are becoming more common, strengthening overall market growth.

Moreover, the industry is seeing growing interest in renewable CNG, often known as Bio-CNG. This fuel offers even lower emissions and aligns with long-term sustainability goals. Automakers are now exploring ways to integrate Bio-CNG more effectively into modern powertrains. As renewable fuels gain momentum, CNG powertrains are expected to become even more attractive for both public and private fleet operators.

Restraints

Limited High-Pressure Refueling Infrastructure Availability Restrains Market Expansion

The CNG powertrain market continues to grow, but limited availability of high-pressure refueling stations remains a major restraint. Many regions still lack a strong CNG network, making it difficult for users to refuel conveniently. This gap slows the adoption of CNG vehicles, especially in areas where alternative fuels already have better coverage. As a result, buyers hesitate to shift toward CNG despite its cost and emission advantages.

Moreover, building high-pressure CNG stations requires heavy investment, strict safety standards, and specialized equipment. These factors often delay infrastructure development, causing uneven market growth across regions. The market experiences bottlenecks because commercial fleets need reliable and easily accessible refueling points for daily operations. Without consistent infrastructure support, long-distance and high-usage fleets face operational challenges.

Performance constraints in heavy-duty and high-torque applications further limit market potential. CNG engines generally perform well in light and medium vehicles but struggle to deliver the same power levels required for demanding operations. Heavy trucks, construction machinery, and high-load transport often require stronger torque output, making diesel or hybrid alternatives more practical.

Growth Factors

Expansion of OEM-Backed Factory-Fitted CNG Powertrain Lineups Unlocks Market Growth

The CNG powertrain market is witnessing strong growth opportunities as next-generation engine control units become more advanced. These Engine Control Units help optimize combustion, improve fuel efficiency, and lower emissions. As technology evolves, manufacturers can enhance engine responsiveness, giving CNG vehicles better performance while keeping operating costs low.

Moreover, the market stands to benefit from a major push by OEMs to expand factory-fitted CNG vehicle options. This shift supports long-term demand because factory-integrated systems offer better reliability, warranty coverage, and convenience for buyers. As more models enter the market, adoption becomes easier for both personal and commercial users seeking cost-effective transportation.

Additionally, rising demand for low-emission fleets in urban mobility programs is widening growth prospects. Cities are increasing their focus on cleaner transport solutions, and CNG fleets offer an immediate pathway to reduce pollution. This includes buses, last-mile delivery vans, and shared mobility vehicles, all of which benefit from CNG’s lower running cost and reduced carbon footprint.

Emerging Trends

Adoption of Advanced Onboard Diagnostics Drives Market Growth

The CNG powertrain market is witnessing strong momentum as advanced onboard diagnostics become more common across modern vehicles. These systems help monitor engine health, track fuel efficiency, and detect issues early. As a result, fleet operators and consumers gain better reliability and lower maintenance costs. This shift is strengthening confidence in CNG-based mobility and supporting wider adoption.

At the same time, the increasing use of lightweight composite CNG cylinders is shaping market trends. These cylinders offer higher storage capacity, better safety, and reduced vehicle weight. Lighter systems improve performance and driving range, making CNG vehicles more attractive for both daily commuting and commercial usage. This innovation aligns well with the demand for more efficient and durable fuel systems.

Additionally, the market is moving toward dual-fuel CNG–hydrogen compatible engine platforms. This trend reflects the industry’s push for flexible, cleaner, and future-ready technologies. Such engines allow manufacturers to prepare for hydrogen integration while still supporting the growing CNG ecosystem. This compatibility is expected to gain importance as cities and industries transition toward low-carbon fuels.

Regional Analysis

Asia Pacific Leads the CNG Powertrain Market with a Market Share of 58.7%, Valued at USD 59.1 Billion

Asia Pacific dominates the global CNG powertrain market, supported by strong vehicle production, rapid urban mobility expansion, and rising adoption of cleaner fuels. The region’s large population base and increasing focus on cost-efficient transportation continue to accelerate CNG vehicle demand. Asia Pacific’s dominant share of 58.7%, valued at USD 59.1 Billion, reflects its strong policy push toward sustainable mobility.

North America CNG Powertrain Market Trends

North America shows steady growth driven by expanding natural gas availability and rising adoption of alternative fuel commercial fleets. Supportive government initiatives promoting low-emission mobility enhance the regional demand. The U.S. contributes significantly due to increasing fleet conversions and expanding refueling infrastructure.

Europe CNG Powertrain Market Trends

Europe’s market growth is influenced by strict emission norms and rising interest in renewable CNG options. The region is adopting CNG powertrains across passenger and light commercial segments to reduce carbon intensity. Continuous investments in cleaner transport pathways support the region’s long-term demand outlook.

Middle East & Africa CNG Powertrain Market Trends

Middle East & Africa is witnessing gradual growth supported by increasing efforts to diversify energy use and reduce fuel costs. Several countries are focusing on shifting part of their transport fleets toward natural gas. Infrastructure development and policy alignment remain key to accelerating adoption in the region.

Latin America CNG Powertrain Market Trends

Latin America demonstrates expanding adoption of CNG powertrains due to rising fuel price sensitivity and government encouragement for low-emission transport. The region benefits from abundant natural gas reserves, supporting vehicle conversions and new CNG model deployments. Urban mobility initiatives continue to build momentum for further market expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key CNG Powertrain Company Insights

Cummins Inc. is positioned as a scale leader in CNG powertrains, leveraging deep engine expertise and a broad service network to support fleet conversions and aftermarket uptakes. Its strength lies in integrating robust CNG engines with proven durability metrics, which reduces total cost of ownership for commercial operators. As regulatory pressure tightens, Cummins’ ability to optimize combustion and emissions control keeps it central to large-fleet decarbonization programs.

AB Volvo focuses on heavy-duty CNG applications, aligning powertrain development with commercial vehicle platforms and logistics customer needs. Volvo’s engineering emphasis on torque delivery and fuel-efficiency in urban and regional haul segments makes its CNG offerings attractive for public transport and distribution fleets. Continued investments in factory-fit options and dealer training amplify its market adoption in regulated metropolitan zones.

Robert Bosch GmbH. operates primarily as a systems and components innovator, supplying high-precision fuel-injection, sensors, and ECU solutions tailored to CNG combustion characteristics. Bosch’s strength is enabling OEMs to achieve tighter control over combustion, diagnostics, and onboard monitoring, which improves reliability and serviceability for CNG powertrains. Its technology ecosystem supports modular integration across vehicle classes, accelerating OEM time-to-market.

FPT Industrial S.P.A. is a specialist powertrain house that combines compact CNG engine architectures with flexible transmission and aftertreatment options for medium and heavy vehicles. FPT’s modular approach and close OEM partnerships allow rapid customization for regional fuel quality and duty cycles, supporting both OEM factory fits and retrofit markets. The company’s focus on alternative fuels, including bio-CNG readiness, positions it well for policy-driven fleet renewals.

Top Key Players in the Market

- Cummins Inc.

- AB Volvo

- Robert Bosch GmbH.

- FPT Industrial S.P.A.

- Ford Motor Company

- Maruti Suzuki India Limited

- Volkswagen AG

- Hyundai Motor Company

- Nissan Motor Co., Ltd.

- Honda Motor Company

Recent Developments

- In November 2025, the FTA in the U.S. allocated USD 2 billion in funding, focusing on CNG and hybrid bus replacement programs. This move is expected to accelerate the adoption of alternative fuel public transportation.

- In November 2025, Westport unveiled a new CNG solution for its HPDI natural gas engine technology. This launch aims to strengthen its presence and expand market share in North America.

- In December 2024, Aramco completed the acquisition of a 10% stake in Horse Powertrain Limited, a joint venture between Renault Group and Geely. The investment is aimed at fostering innovation in sustainable mobility technologies.

- In September 2024, Cummins launched the X15N natural gas engine designed for heavy-duty, long-haul applications in North America. This engine is expected to offer improved fuel efficiency and lower emissions for commercial fleets.

Report Scope

Report Features Description Market Value (2024) USD 100.7 Billion Forecast Revenue (2034) USD 479.9 Billion CAGR (2025-2034) 16.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Drive Type (Front Wheel Drive, All-wheel Drive, Rear Wheel Drive), By Fuel Type (Bi-fuel, Mono Fuel), By Vehicle Type (Passenger Vehicle, Commercial Vehicle) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Cummins Inc., AB Volvo, Robert Bosch GmbH., FPT Industrial S.P.A., Ford Motor Company, Maruti Suzuki India Limited, Volkswagen AG, Hyundai Motor Company, Nissan Motor Co., Ltd., Honda Motor Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cummins Inc.

- AB Volvo

- Robert Bosch GmbH.

- FPT Industrial S.P.A.

- Ford Motor Company

- Maruti Suzuki India Limited

- Volkswagen AG

- Hyundai Motor Company

- Nissan Motor Co., Ltd.

- Honda Motor Company