Global Club Soda Market Size, Share, And Business Benefits By Product Type (Natural Soda, Blending Club Soda, Others), By Packaging (Glass Bottles, Cans, Plastic Bottles), By Distribution Channel (upermarket/Hypermarket, Online Retail, Departmental Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 158297

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

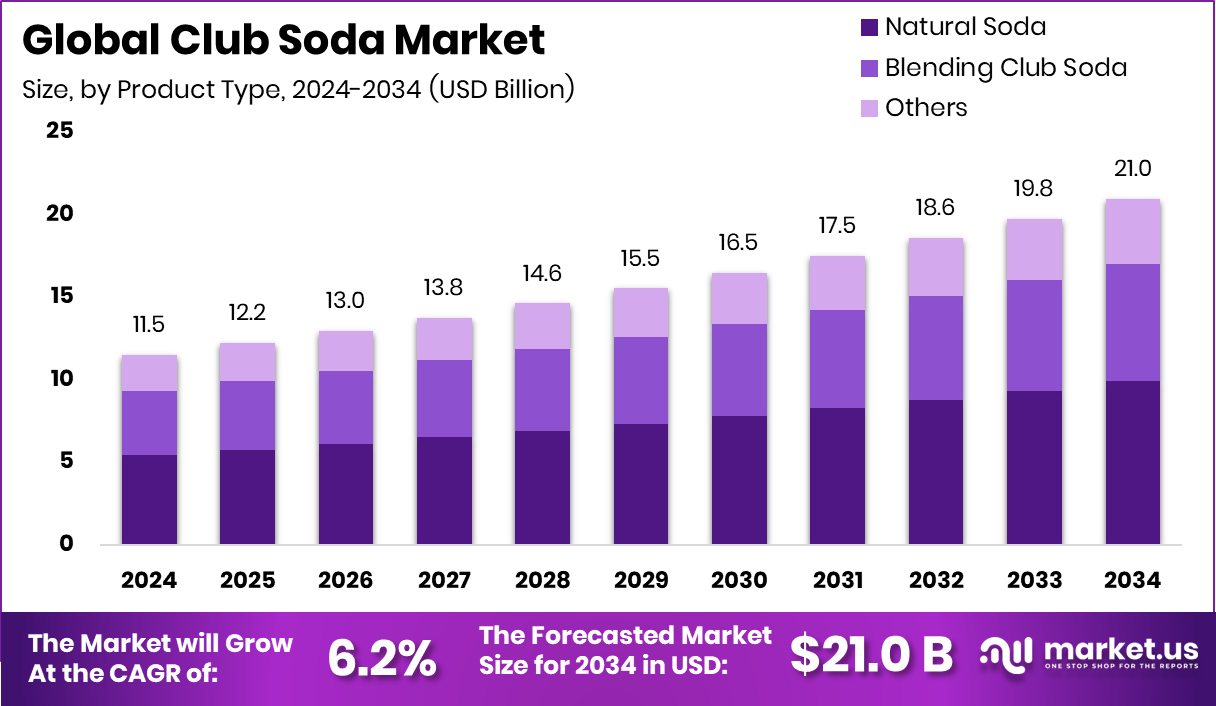

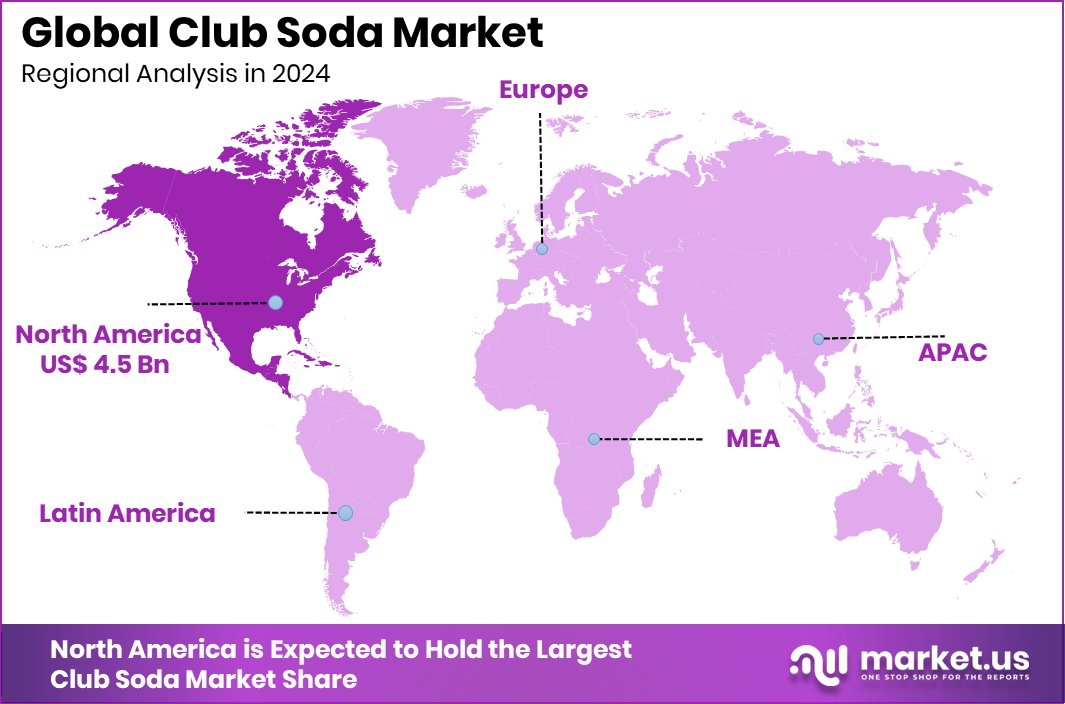

The Global Club Soda Market is expected to be worth around USD 21.0 billion by 2034, up from USD 11.5 billion in 2024, and is projected to grow at a CAGR of 6.2% from 2025 to 2034. With USD 4.5 Bn in revenue, North America dominated the Club Soda Market, capturing 39.70% share.

Club soda is a carbonated water infused with minerals like sodium bicarbonate, potassium sulfate, or sodium chloride, giving it a crisp taste and slight saltiness. Unlike sparkling water from natural springs, club soda is artificially carbonated and enriched with minerals, making it popular as both a standalone refreshment and a mixer in beverages. Its clean profile and subtle fizz have made it a staple in households, restaurants, and bars for decades.

The club soda market is steadily expanding as consumers lean toward healthier alternatives to sugary sodas and artificially flavored drinks. The demand is rising not only from health-conscious individuals but also from mixology enthusiasts who prefer low-calorie, versatile beverages. Brands experimenting with natural flavors and functional benefits are fueling innovation. This trend is also supported by funding activity, with FirstClub recently securing $8 million in seed funding led by Accel and RTP Global, reflecting growing investor confidence.

A key growth factor for the club soda market is the consumer shift toward low-sugar and gut-friendly drinks. With prebiotic sodas gaining traction, the valuation of Olipop at $1.85 billion highlights how wellness-driven beverages are reshaping consumer choices. This momentum also benefits the broader club soda space as wellness trends spill over.

In terms of demand, urban consumers are increasingly choosing beverages that blend refreshment with natural, clean-label credentials. The rise of locally made sodas, like the Mizoram all-natural soda hitting a $1.25 million valuation, shows the widening appeal of niche, regionally crafted products. This supports stronger market penetration across both premium and mass-market categories.

Opportunities lie in global expansion and functional innovation. Funding such as Soda’s €11.5 million Series A round signals a strong appetite for scaling beverage startups that focus on authenticity and natural positioning. Club soda brands can tap into this momentum by diversifying flavors, introducing health-focused variants, and leveraging e-commerce channels to reach new consumer bases.

Key Takeaways

- The Global Club Soda Market is expected to be worth around USD 21.0 billion by 2034, up from USD 11.5 billion in 2024, and is projected to grow at a CAGR of 6.2% from 2025 to 2034.

- In 2024, natural soda held a 47.2% share, highlighting consumer preference for authentic club soda choices.

- Glass bottles captured 41.7% of the packaging share, showing strong demand for premium and eco-friendly club soda formats.

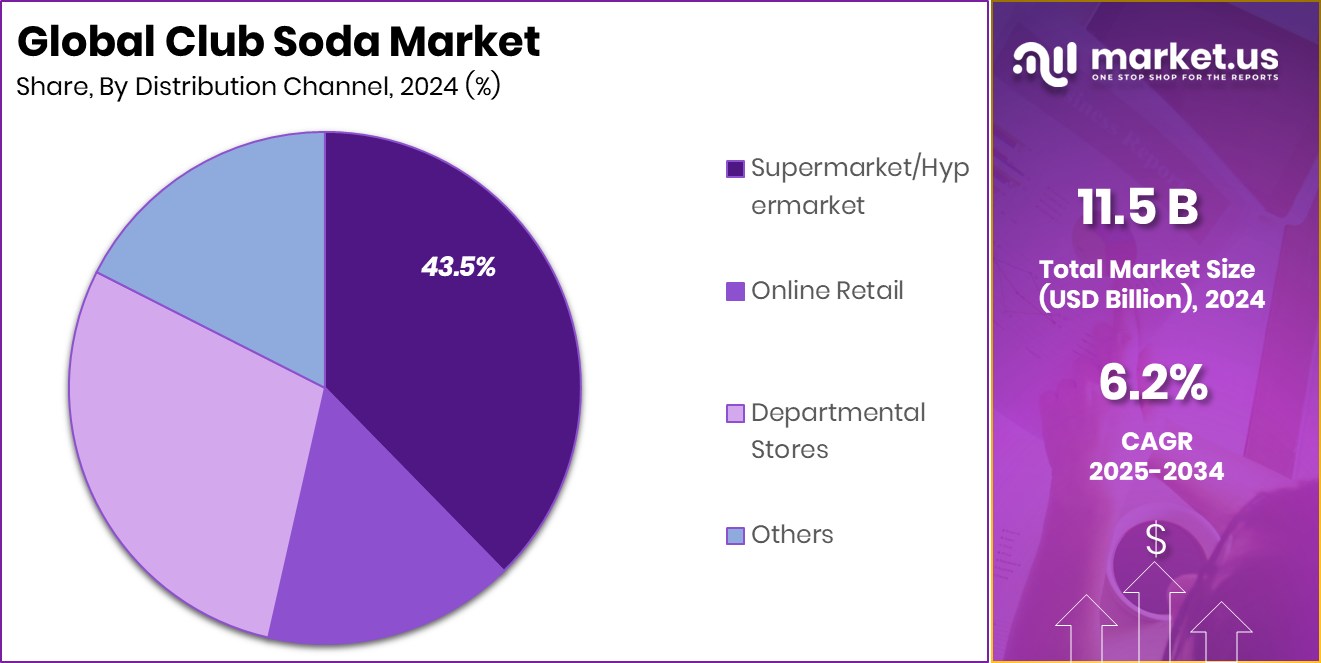

- Supermarkets and hypermarkets dominated with 43.5% share, reflecting their central role in distributing club soda globally.

- In 2024, the Club Soda Market in North America reached USD 4.5 Bn, accounting for 39.70%.

By Product Type Analysis

By Product Type, Natural Soda led the club soda market with 47.2%.

In 2024, Natural Soda held a dominant market position in By Product Type segment of the Club Soda Market, with a 47.2% share. This leadership reflects the strong consumer preference for beverages made with clean-label ingredients and free from artificial additives. Growing awareness about health and wellness has shifted demand toward naturally produced sodas, as they align with the trend of reducing sugar intake while offering a refreshing taste.

The appeal of natural soda is further boosted by its compatibility with functional and prebiotic blends, which are increasingly popular among urban and health-conscious consumers. This segment’s strength underscores how authenticity and natural sourcing are driving long-term growth in the global club soda industry.

By Packaging Analysis

By Packaging, Glass Bottles accounted for a 41.7% share in the club soda market.

In 2024, Glass Bottles held a dominant market position in By Packaging segment of the Club Soda Market, with a 41.7% share. This strong presence is driven by consumer preference for premium and eco-friendly packaging that preserves freshness and carbonation better than alternatives.Glass bottles are widely perceived as a healthier and more sustainable choice, reducing concerns about plastic waste and chemical leaching. Their premium look and feel also make them a preferred option in restaurants, bars, and hospitality outlets, where presentation plays a key role. With rising environmental consciousness and growing demand for recyclable packaging, the dominance of glass bottles highlights their continued importance in shaping the future of the club soda market.

By Distribution Channel Analysis

By Distribution Channel, supermarket/hypermarket dominated with a 43.5% share in the Club Soda Market.

In 2024, Supermarket/Hypermarket held a dominant market position in By Distribution Channel segment of the Club Soda Market, with a 43.5% share. This dominance is supported by the wide availability, bulk purchasing options, and strong visibility these retail outlets provide. Consumers prefer supermarkets and hypermarkets for their convenience, competitive pricing, and access to a wide range of club soda brands and packaging formats under one roof.

Promotional discounts and in-store marketing further enhance sales through this channel, making it the most influential point of purchase. The segment’s strength also reflects the steady growth of modern retail infrastructure globally, ensuring that club soda continues to reach a large and diverse consumer base effectively.

Key Market Segments

By Product Type

- Natural Soda

- Blending Club Soda

- Others

By Packaging

- Glass Bottles

- Cans

- Plastic Bottles

By Distribution Channel

- Supermarket/Hypermarket

- Online Retail

- Departmental Stores

- Others

Driving Factors

Rise in Health Policies Pushes Demand for Club Soda

One major driving factor for the club soda market is government-led health policies and funding, aiming to reduce sugar consumption and promote healthier drink choices. Governments around the world are introducing taxes on sugary drinks, stricter labeling rules, healthier school meals, and public campaigns that favor water or unsweetened beverages over sugary sodas. For example, some U.S. cities use soda tax revenues to pay for nutrition education, wellness programs, and better access to healthy food.

Also, government grants and programs support innovation in non-alcoholic beverages (including club soda), sustainable production, and healthier formulations. These policies help manufacturers invest in cleaner, simpler ingredients, better packaging, and marketing that aligns with public health goals. Because of this backing, consumers are more aware, regulation is stricter, and demand for “healthier soda alternatives” like club soda rises.

Restraining Factors

Substitute Drinks and Government Funding Raise Cost Pressures

One key restraining factor for the club soda market is strong competition from substitute beverages—like flavored sparkling water, tonic water, seltzers, and functional drinks—that often get government support in the form of subsidies, grants or health-driven funding. Governments aiming to promote “healthy beverage choices” may channel funds or tax breaks toward drinks that are marketed with added vitamins, natural flavors, or zero sugar. These alternatives become cheaper or more attractive to consumers due to such funding or favorable regulation.

Because of these policies and funding supports, club soda makers may find themselves at a disadvantage: marketing costs rise, product differentiation becomes harder, and pricing competitiveness suffers. When substitutes are subsidized, or when government health programs endorse them, consumers lean toward those alternatives instead of plain or mineralized club soda—even if club soda is healthier than sugary sodas. This limits growth for traditional club soda producers.

Growth Opportunity

Government-Funding Enables Sustainable Packaging Innovation

One great growth opportunity for the club soda market lies in sustainable packaging innovation, supported by government funding and incentives. Because plastic bottles and environmental concerns are increasingly under scrutiny, companies can use grants, subsidies, or tax breaks to invest in greener bottles (e.g., biodegradable, refillable, or lighter materials) or develop fully recyclable packaging.

Governments around the world have programs that help food and beverage firms pay for cleaner production, packaging upgrades, and waste-reduction technologies. For example, the U.S. has funding for circular-economy projects that reduce waste in beverages, and regions like California offer grants for container redemption and recycling mechanisms.

Latest Trends

Consumers Choose Functional, Natural Club Soda Alternatives

A key latest trend in the club soda market is the rise of functional and naturally flavored club sodas, as people increasingly prefer drinks with added benefits (like minerals, botanicals, or less sugar) over plain-sugary beverages. These versions often avoid artificial sweeteners and lean into clean-label claims, meaning labels show simple, recognizable ingredients.

Governments are supporting this trend through funding and grants tied to health and wellness programs, subsidies for research into natural flavoring, and incentives to reduce sugar in beverages. For example, programs that fund innovation in foods and drinks aim to help beverage companies reformulate products using natural extracts or minerals. This support helps companies invest in new product development that appeals to health-conscious consumers, giving club soda producers an edge if they embrace functional and natural variants.

Regional Analysis

North America held 39.70% share of the Club Soda Market in 2024, generating USD 4.5 Bn.

The Club Soda Market shows diverse growth across global regions, shaped by consumer preferences, lifestyle shifts, and retail infrastructure. In 2024, North America emerged as the leading regional market, holding a 39.70% share valued at USD 4.5 billion. The region’s dominance is attributed to strong demand for low-sugar, functional beverages and the wide penetration of modern retail formats such as supermarkets and hypermarkets.High consumer awareness regarding clean-label and sustainable products has also supported the adoption of natural and premium club soda offerings. Europe follows closely with a well-established beverage culture, where rising interest in healthier carbonated alternatives continues to influence market trends. Asia Pacific is witnessing rapid expansion, driven by urbanization, a growing middle-class population, and increasing acceptance of global beverage trends.

Meanwhile, Latin America and the Middle East & Africa are gradually gaining traction, supported by improving retail infrastructure and a younger consumer demographic seeking refreshing and modern beverage options. However, North America remains the clear market leader, showcasing how consumer health awareness, innovative product development, and robust distribution channels can consolidate regional dominance and set benchmarks for future growth in the global club soda market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Fever-Tree continues to strengthen its premium positioning by emphasizing natural ingredients, refined taste, and glass-bottle packaging, catering to consumers seeking upscale mixers and health-conscious options. The brand’s focus on quality and its alignment with the rise of premium cocktails have helped it maintain strong consumer loyalty across developed markets.

White Rock Beverages, Inc., one of the oldest players in the sector, leverages its long-standing legacy to maintain credibility and trust among consumers. Its offerings remain well-rooted in traditional soda making, with a balance of affordability and reliability that appeals to a broad audience. The company’s steady presence across retail and local markets demonstrates resilience and adaptability, even as consumer trends evolve toward natural and low-calorie beverages.

Dr Pepper Snapple Group, with its expansive distribution network and wide brand recognition, brings significant scale and reach to the club soda segment. Its ability to leverage existing retail relationships, marketing power, and product variety gives it a strong edge in mainstream adoption. The group’s presence ensures that club soda remains a widely available and affordable choice for households and restaurants alike.

Top Key Players in the Market

- Fever-Tree

- White Rock Beverages, Inc.

- Dr Pepper Snapple Group

- Danone

- East Imperial

- SodaStream Inc

- Stong’s market

- JONES SODA CO.

- Coca-Cola Company

- Hansen Beverage

Recent Developments

- In May 2025, Danone launched a line of shelf-stable protein shakes under its Oikos brand. These shakes have 30 g of protein, 5 g of prebiotic fiber, no added sugar or artificial sweeteners, in flavors like chocolate, vanilla, and salted caramel.

- In February 2025, Fever-Tree entered a strategic partnership with Molson Coors in the U.S., starting, Under this deal, Molson Coors will take exclusive rights for commercialization, production, marketing, sales, and distribution of Fever-Tree’s non-alcoholic lineup (including tonics, ginger beers, cocktail mixers) in the U.S. Fever-Tree also sold an 8.5% stake to Molson Coors as part of this agreement.

Report Scope

Report Features Description Market Value (2024) USD 11.5 Billion Forecast Revenue (2034) USD 21.0 Billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Natural Soda, Blending Club Soda, Others), By Packaging (Glass Bottles, Cans, Plastic Bottles), By Distribution Channel (Supermarket/Hypermarket, Online Retail, Departmental Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Fever-Tree, White Rock Beverages, Inc., Dr Pepper Snapple Group, Danone, East Imperial, SodaStream Inc, Stong’s market, JONES SODA CO., Coca-Cola Company, Hansen Beverage Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Fever-Tree

- White Rock Beverages, Inc.

- Dr Pepper Snapple Group

- Danone

- East Imperial

- SodaStream Inc

- Stong’s market

- JONES SODA CO.

- Coca-Cola Company

- Hansen Beverage