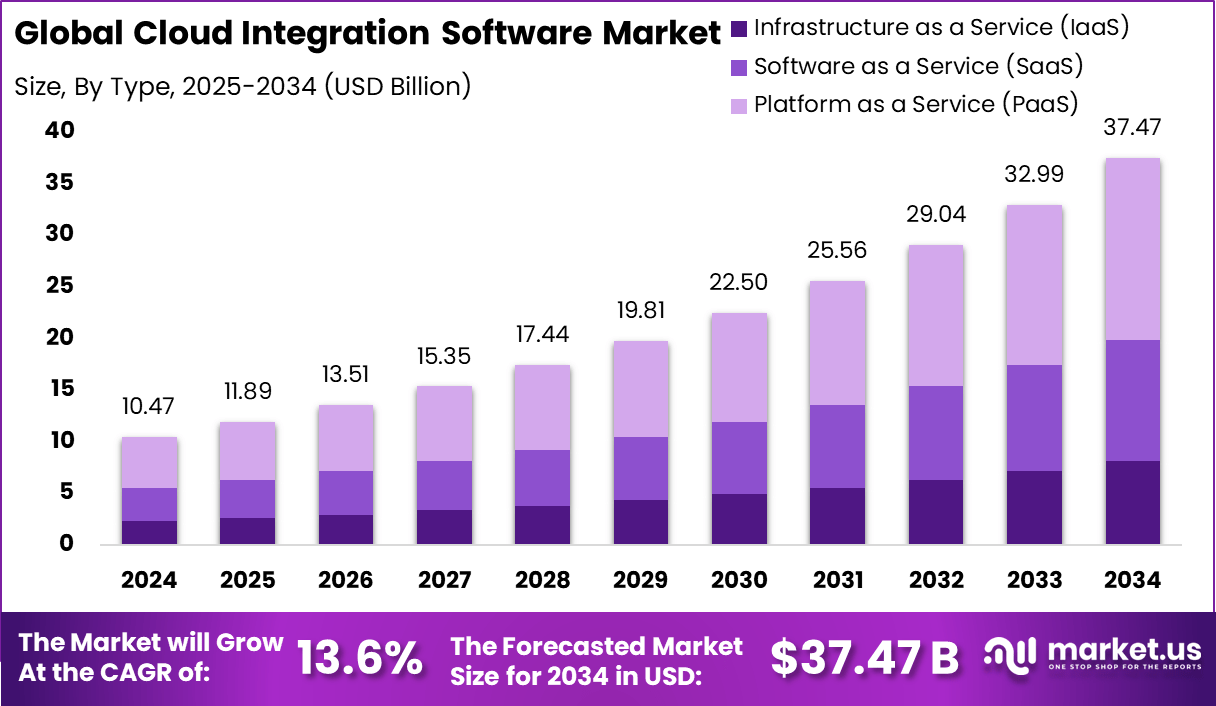

Global Cloud Integration Software Market Size, Share Report By Type (Infrastructure as a Service (IaaS), Software as a Service (SaaS), and Platform as a Service (PaaS)), By Enterprise Size (Large Size Enterprises and Small & Medium Sized Enterprises (SMEs)), By Industry Vertical (IT & Telecommunication, BFSI, Healthcare, Retail and E-Commerce, Manufacturing, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153826

- Number of Pages: 210

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

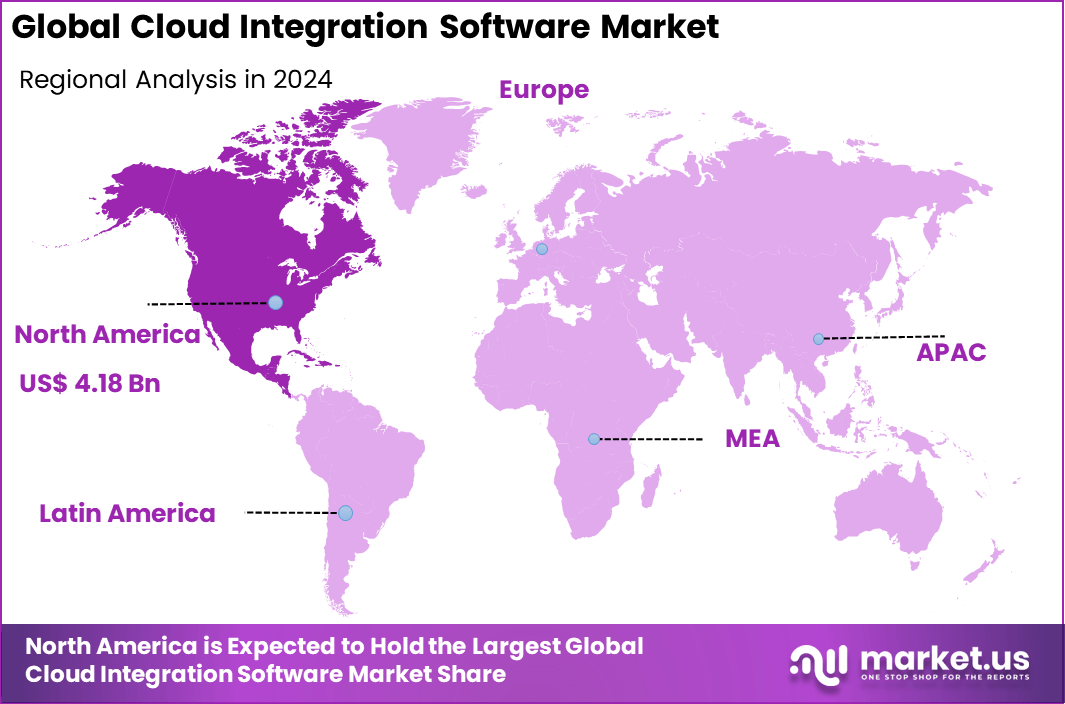

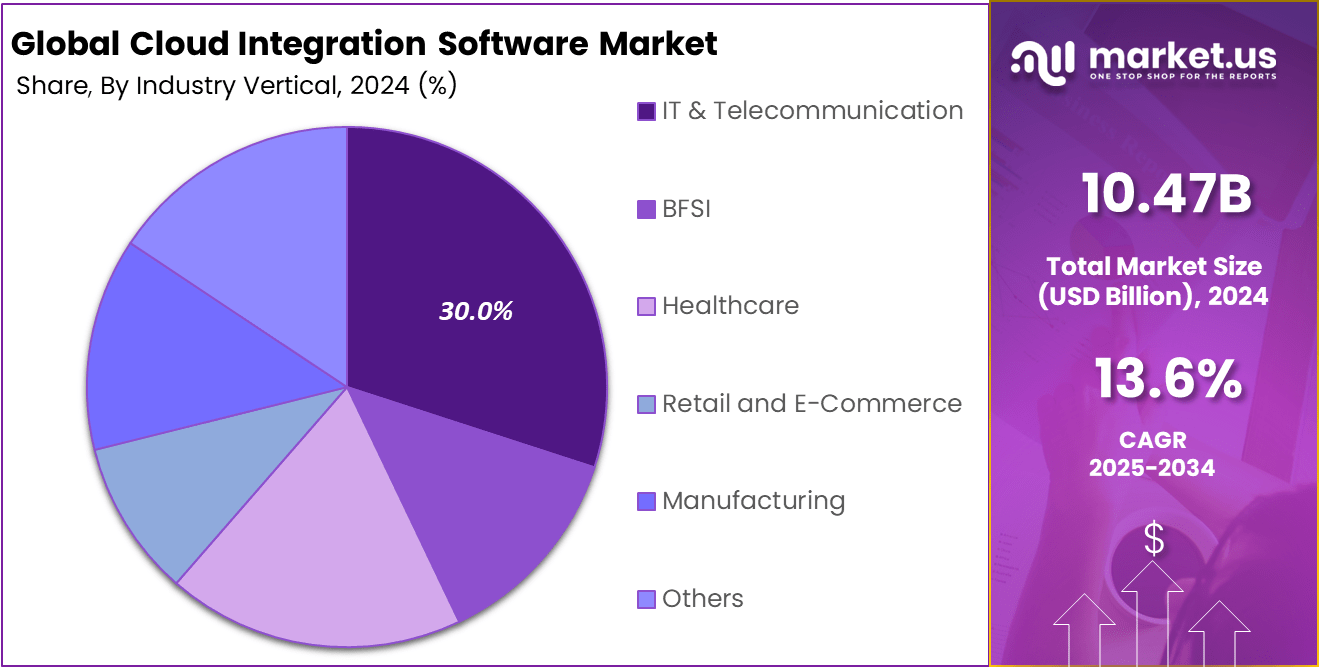

The Global Cloud Integration Software Market size is expected to be worth around USD 37.47 billion by 2034, from USD 10.47 billion in 2024, growing at a CAGR of 13.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 40% share, holding USD 4.18 billion in revenue.

The Cloud Integration Software Market refers to technologies that help businesses connect various cloud-based and on-premises systems, applications, and data sources into a unified digital environment. These platforms ensure smooth data flow, system coordination, and application interoperability. As organizations move toward hybrid and multi-cloud strategies, the need for seamless integration tools has become more important than ever.

A critical driving factor for this robust market expansion is the unyielding demand for automation and real-time data access. Companies are recognizing that fragmented IT environments lead to inefficiencies and bottlenecks. By deploying cloud integration software, organizations can break down these silos, ensure high-speed data sharing, and significantly boost decision-making capabilities.

Key Takeaways

- The market size in 2024 is valued at USD 10.47 billion, projected to grow at a CAGR of 13.6% from 2025 to 2034, indicating robust demand for integrated cloud solutions across sectors.

- Platform as a Service (PaaS) dominates the market by type with a 47.1% share in 2024, due to its flexibility, scalability, and developer-centric integration capabilities.

- Large enterprises account for the largest market share (62%) by enterprise size, driven by complex integration needs across diversified business functions and higher cloud adoption budgets.

- The IT & Telecommunications sector leads by industry vertical with a 30% share, as these companies require real-time data flow, hybrid cloud support, and agile infrastructure.

- North America remains the dominant regional market with a 40% share in 2024, and the U.S. alone contributes USD 3.9 billion, driven by high digital transformation investments and early cloud adoption.

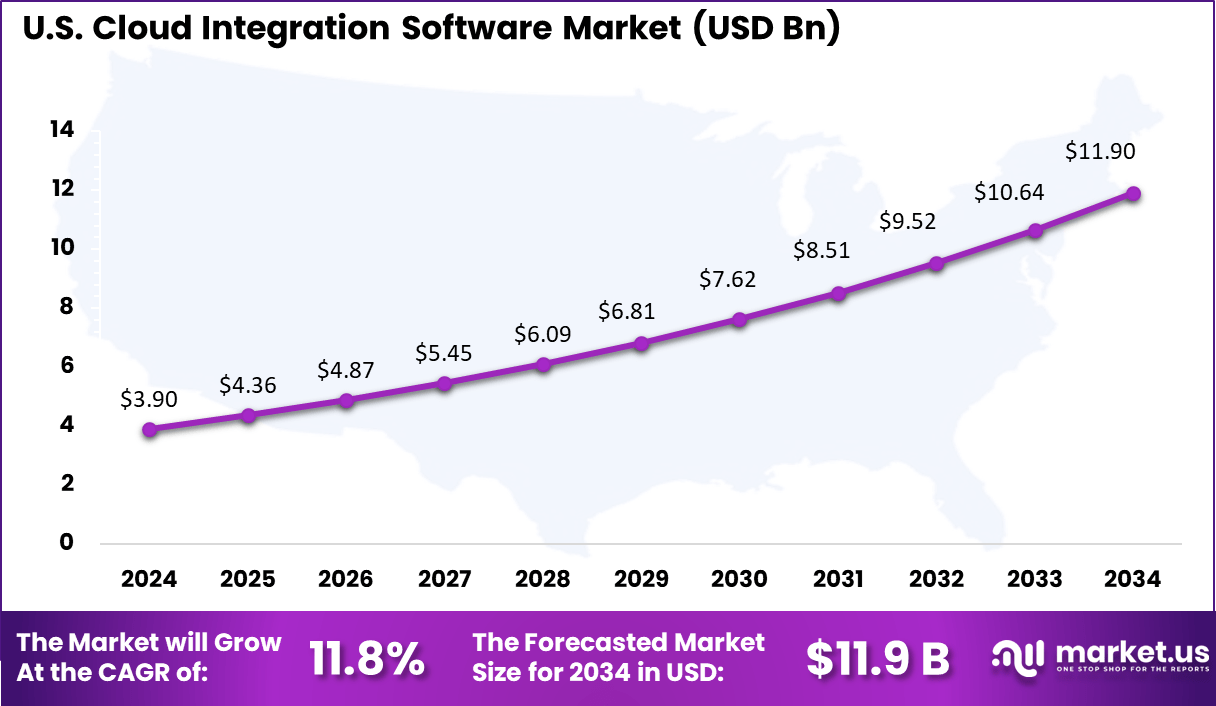

- The U.S. market is expected to grow at a steady pace with a CAGR of 11.8%, supported by increasing enterprise demand for SaaS and hybrid cloud integration.

U.S. Market Size

The U.S. Cloud Integration Software Market is a key contributor to the global integration landscape, valued at approximately USD 3.9 billion in 2024, and projected to reach USD 11.9 billion by 2034, growing at a robust CAGR of 13.6% from 2025 to 2034.

The U.S. business environment is characterized by early adoption of hybrid and multi-cloud strategies, which creates a pressing demand for seamless integration solutions. Enterprises in sectors such as banking, healthcare, manufacturing, and retail are actively integrating cloud-native and legacy systems to enable real-time analytics, optimize workflows, and maintain data governance.

The presence of strong internet connectivity, widespread SaaS usage, and mature IT ecosystems further accelerates this need. Moreover, the U.S. regulatory landscape encourages secure data handling and compliance, especially under frameworks such as HIPAA, CCPA, and SOX. These requirements push enterprises to adopt robust integration platforms that offer centralized visibility and audit capabilities.

The regional landscape of the Global Cloud Integration Software Market is led by North America, which accounted for approximately 40% of the global market share in 2024, with the U.S. alone contributing USD 3.9 billion. This dominance is driven by the region’s strong digital infrastructure, high adoption of hybrid cloud models, and early investments in cloud-native technologies.

U.S. based enterprises across sectors such as BFSI, healthcare, retail, and telecom are leveraging advanced integration platforms like MuleSoft, SnapLogic, and IBM Cloud Pak to unify cloud and on-premise systems, streamline workflows, and improve data governance.

Analysts’ Viewpoint

Investment opportunities in the cloud integration software space are vast, particularly in emerging markets and sectors rapidly moving toward digital transformation. As regions in Asia-Pacific and Africa see increasing internet penetration and proactive governmental support for digital infrastructure, they are forecast to drive significant demand for scalable and affordable integration platforms.

Investors are also eyeing areas where AI, ML, and hybrid environments intersect, envisioning a wave of new startups and established players. Businesses that implement cloud integration solutions typically report a range of tangible benefits. Key improvements include greater operational efficiency, real-time access to business-critical data, enhanced collaboration, and the ability to deploy new services rapidly.

Companies can streamline and automate workflows, improve data quality, and scale faster as demand shifts. The flexibility to integrate diverse applications and support remote teams has become a competitive advantage in the modern business world, enabling organizations to focus on innovation and customer engagement instead of struggling with IT complexity.

By Type Analysis

The Type segment of the Global Cloud Integration Software Market is categorized into Infrastructure as a Service (IaaS), Software as a Service (SaaS), and Platform as a Service (PaaS), with PaaS leading the market in 2024, accounting for approximately 47.1% of the global share.

PaaS dominates due to its flexibility, developer-focused environment, and built-in tools that simplify application integration, development, and deployment. It enables businesses to streamline workflows by connecting apps, data sources, and services without needing extensive infrastructure management. An example is Salesforce’s MuleSoft, which enables seamless integration between Salesforce CRM, SAP, Oracle, and custom-built applications using APIs and connectors.

SaaS-based integration tools are widely adopted by enterprises relying heavily on cloud-based applications like Microsoft 365, Slack, Zoom, and Salesforce, enabling smooth data exchange between apps. With over 70% of businesses using more than one SaaS app, integration becomes essential for maintaining operational efficiency and data consistency.

Meanwhile, IaaS integration is gaining traction, especially in large enterprises managing workloads across platforms like AWS, Microsoft Azure, and Google Cloud Platform (GCP). It supports use cases involving scalable infrastructure provisioning, storage synchronization, and cloud security integration. As multi-cloud strategies and cloud-native applications continue to rise, all three service types will see continued demand, with PaaS expected to maintain its lead.

By Enterprise Size Analysis

The Enterprise Size segment of the Global Cloud Integration Software Market is divided into Large Enterprises and Small and Medium-Sized Enterprises (SMEs), with Large Enterprises dominating the market in 2024, accounting for approximately 62% of the global market share.

This dominance is attributed to their complex IT environments, widespread use of hybrid and multi-cloud systems, and the need for seamless integration across a wide array of cloud-based and on-premise applications. Walmart, Pfizer, and JPMorgan Chase use platforms like Dell Boomi, MuleSoft, and IBM Cloud Pak for real-time data sync, centralized monitoring, and secure compliance.

However, SMEs are emerging as a high-growth segment, driven by the rising adoption of affordable, low-code/no-code integration solutions that eliminate the need for extensive in-house IT expertise. Tools like Zapier, Microsoft Power Automate, and Make (formerly Integromat) are enabling SMEs to automate business processes such as marketing, accounting, and customer service by integrating commonly used SaaS apps like QuickBooks, Shopify, and HubSpot.

By Industry Vertical Analysis

The Industry Vertical segment of the Global Cloud Integration Software Market is diverse, with IT & Telecommunication leading in 2024, holding approximately 30% of the market share. This dominance stems from the sector’s early adoption of cloud computing and the high demand for seamless integration between communication tools, CRM and ERP systems.

Telecom companies like Verizon and AT&T leverage cloud integration platforms to link billing systems, network management tools, and customer service applications in real time, improving service delivery and operational efficiency. The BFSI sector is another major contributor, using cloud integration to ensure secure data flow between core banking platforms, fraud detection systems, regulatory compliance tools, and digital customer interfaces.

For example, JPMorgan Chase uses integration software to connect internal systems and third-party financial services, enhancing transaction processing and regulatory compliance. In healthcare, providers integrate Electronic Health Records (EHRs) with telehealth, billing, and patient engagement platforms. Hospitals like the Mayo Clinic utilize integration solutions to offer a unified patient experience and streamline workflows.

Retail and e-commerce companies such as Amazon and Shopify merchants depend on cloud integration to connect inventory, order management, and customer support tools, enabling real-time insights and personalized customer engagement. Other sectors like manufacturing and education are also embracing integration to unify IoT devices, supply chain systems, and enterprise applications.

Key Features and Trends

Feature/Trend Details Cloud-Native & iPaaS Solutions Increase in Integration Platform as a Service (iPaaS) and cloud-native integration tools. Hybrid/Edge Integration Orchestration between on-premises, cloud, and edge devices. AI & ML Integration Smarter automation, predictive data mapping, anomaly detection in integration flows. Low-Code/No-Code Capabilities Democratization of integration through intuitive interfaces for non-IT users. Security Enhancements End-to-end encryption, robust API management, data masking, and compliance features. Industry-Specific Solutions Custom platforms for BFSI, healthcare, retail, manufacturing, etc. Driving Factor

Increasing digital transformation initiatives

As organizations modernize their operations and customer experiences, they increasingly adopt a mix of cloud-based applications ranging from CRM and ERP to collaboration and analytics tools. However, without seamless integration, these systems often function in silos, leading to data fragmentation and inefficiencies. Cloud integration software addresses this gap by enabling real-time data exchange and workflow automation across disparate platforms.

For example, in the healthcare sector, hospitals are integrating Electronic Health Records (EHRs) with cloud-based appointment, billing, and telemedicine systems to deliver cohesive patient care. In retail, companies like Walmart and Target are using cloud integration to connect e-commerce, supply chain, and customer loyalty systems, ensuring consistent user experiences and efficient inventory management.

By 2026, 80% of organizations will use multiple cloud services and platforms, creating a critical need for integration. Furthermore, governments and financial institutions are digitizing services to improve transparency and responsiveness. In India, for instance, the Digital India initiative has pushed for cloud integration in public services and banking, creating strong demand for robust integration frameworks.

Restraining Factor

High initial implementation and integration costs

A significant restraint in the Global Cloud Integration Software Market is the high initial implementation and integration costs, which can be a barrier, especially for small and medium-sized enterprises (SMEs). Deploying cloud integration software often requires investments in infrastructure upgrades, customization, professional services, and training.

In many cases, businesses also need to integrate legacy systems with modern cloud platforms – an effort that can be complex and costly. Integration-related expenses can account for up to 40% of an organization’s total IT budget, particularly when dealing with multiple cloud vendors and on-premises systems.

For instance, in the manufacturing sector, integrating production systems like MES (Manufacturing Execution Systems) with cloud-based ERP and IoT platforms often involves substantial consulting and development costs. Similarly, in the healthcare industry, merging cloud-based patient engagement platforms with on-premise EHR systems requires rigorous compliance, security configurations, and data migration efforts, all of which increase the cost burden.

Moreover, smaller businesses may find it challenging to justify upfront costs without guaranteed ROI, slowing their adoption of integration tools. The need for skilled IT personnel further raises operational expenses. These cost-related constraints limit the penetration of cloud integration solutions in price-sensitive or resource-constrained environments, especially in emerging markets.

Growth Opportunity

Rising adoption of low-code/no-code platforms

The low-code/no-code platforms enable users with minimal or no programming skills to design, deploy, and manage cloud integrations through visual interfaces and drag-and-drop functionalities. As organizations aim to accelerate digital transformation while reducing dependency on scarce IT resources, low-code/no-code tools offer a faster and more cost-effective alternative for building integration workflows.

Platforms like Zapier, Microsoft Power Automate, and MuleSoft Composer have become popular among business users for integrating cloud apps like Salesforce, Google Workspace, and Slack without writing code. In SMEs, such platforms are empowering non-technical teams to automate marketing, customer support, and finance processes, thereby increasing productivity.

Enterprises are also adopting low-code iPaaS (Integration Platform as a Service) solutions to reduce time-to-market and enhance agility. For example, Coca-Cola Bottling Company United used a low-code integration platform to automate order processing, reducing delays and manual errors. As more businesses seek agile, self-service integration options, the demand for low-code/no-code integration solutions are expected to surge.

Key Market Segments

Type

- Infrastructure as a Service (IaaS)

- Software as a Service (SaaS)

- Platform as a Service (PaaS)

Enterprise Size

- Large-Sized Enterprises

- Small and Medium-Sized Enterprises (SMEs)

Industry Vertical

- IT & Telecommunication

- BFSI

- Healthcare

- Retail and E-Commerce

- Manufacturing

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the Cloud Integration Software Market, Microsoft Corporation, IBM Corporation, and Oracle Corporation are leading due to their deep enterprise IT experience and vast global presence. These firms offer comprehensive integration platforms supported by cloud, hybrid, and on-premise environments. Their tools are widely used across industries for data management, process automation, and workflow orchestration.

Vendors like SAP SE, TIBCO Software Inc., Informatica Corporation, and MuleSoft Inc. focus on enabling data connectivity, API-led integration, and seamless application orchestration. These players address growing enterprise needs for secure, scalable, and low-latency integration. Their cloud-native solutions are designed to handle large data volumes, real-time analytics, and multi-cloud deployments.

Meanwhile, Dell Boomi, Boomi LP, SnapLogic Inc., Zapier Inc., and Accenture Inc. are driving innovation in user-friendly, low-code integration tools. These platforms cater to both SMEs and large enterprises seeking rapid deployment and scalability. Their offerings simplify complex integration tasks through automation and pre-built connectors. Salesforce Inc. also contributes to market growth through ecosystem-based integrations and CRM-centric middleware.

Top Key Players

- Microsoft Corporation

- Oracle Corporation

- TIBCO Software Inc.

- Informatica Corporation

- SAP SE

- Mule Soft Inc.

- Dell Boomi

- SnapLogic Inc.

- Software AG

- IBM Corporation

- Accenture Inc.

- Boomi LP

- Zapier Inc.

- Salesforce Inc.

- Other Key Players

Recent Developments

- July 2025: Hewlett-Packard Enterprise completed the acquisition of Juniper Networks, bolstering its cloud‑native and AI‑driven networking and hybrid‑cloud portfolio.

- May 2025: Salesforce announced a definitive agreement to acquire Informatica for USD 8 billion, strengthening its AI‑driven data management by integrating Informatica’s tools into Salesforce’s Agentforce platform.

- April 2025: Joynd merged with The Cloud Connectors, creating a comprehensive iPaaS solution aimed at the HR technology vertical, and launched ‘Synapse’ in beta.

- March 2025: F5, Inc. acquired LeakSignal, enhancing its multicloud data protection and compliance capabilities.

Report Scope

Report Features Description Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Infrastructure as a Service (IaaS), Software as a Service (SaaS), and Platform as a Service (PaaS)), By Enterprise Size (Large Size Enterprises and Small & Medium Sized Enterprises (SMEs)), By Industry Vertical (IT & Telecommunication, BFSI, Healthcare, Retail and E-Commerce, Manufacturing, and Others Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft Corporation, Oracle Corporation, TIBCO Software Inc., Informatica Corporation, SAP SE, Mule Soft Inc., Dell Boomi, SnapLogic Inc., Software AG, IBM Corporation, Accenture Inc., Boomi LP, Zapier Inc., Salesforce Inc., and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cloud Integration Software MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Cloud Integration Software MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft Corporation

- Oracle Corporation

- TIBCO Software Inc.

- Informatica Corporation

- SAP SE

- Mule Soft Inc.

- Dell Boomi

- SnapLogic Inc.

- Software AG

- IBM Corporation

- Accenture Inc.

- Boomi LP

- Zapier Inc.

- Salesforce Inc.

- Other Key Players