Global Cloud Advertising Market By Type (Public, Private, Hybrid), By Service (Infrastructure as a Software as a Service (IaaS), Software as a Service (SaaS), Platform as a Service (PaaS)), By Enterprise Size (Large Enterprises, SMEs), By End-User (IT & Telecommunications, BFSI, Healthcare, Travel and Hospitality, Manufacturing, Automotive, Retail & Consumer Goods, Media & Entertainment, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 122037

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

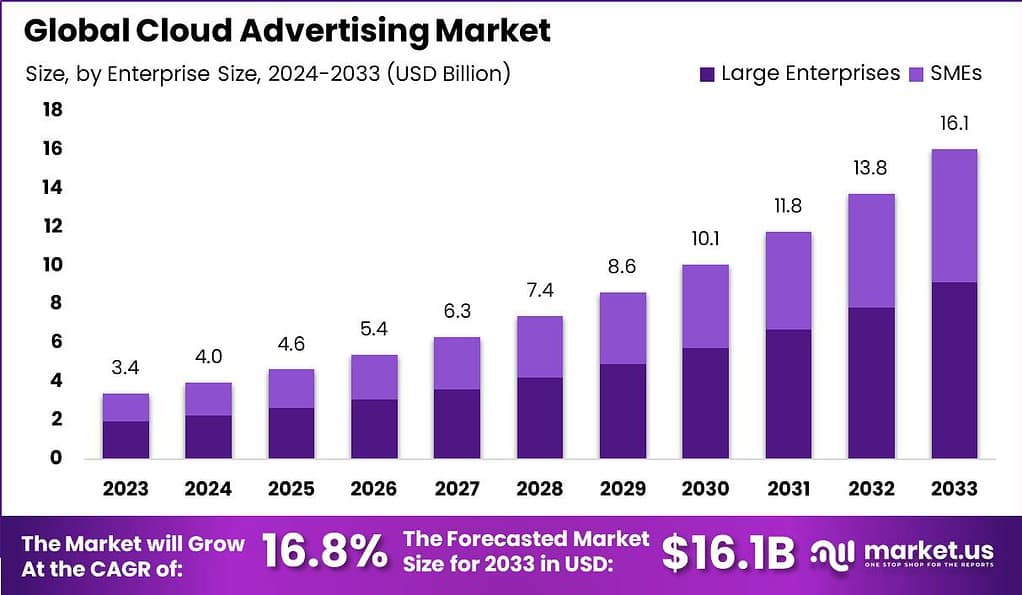

The Global Cloud Advertising Market size is expected to be worth around USD 16.1 Billion By 2033, from USD 3.4 Billion in 2023, growing at a CAGR of 16.8% during the forecast period from 2024 to 2033.

Cloud advertising refers to the use of cloud computing technologies for delivering promotional content and advertising solutions. This method primarily uses remote servers hosted on the internet to manage, store, and process data, rather than relying on a local server or personal computer. Essentially, cloud advertising enables businesses to deliver ads to consumers through digital platforms efficiently and effectively.

The cloud advertising market is experiencing significant growth due to the increasing popularity of digital advertising and advancements in cloud technology. As more people spend time online using smartphones, social media platforms, and streaming services, the demand for digital advertising has surged. Cloud advertising provides a solution for advertisers to manage and deliver ads effectively across multiple channels and devices. It allows them to scale their advertising efforts and reach their target customers more efficiently.

Additionally, cloud advertising enables data-driven strategies by analyzing consumer data, allowing advertisers to create personalized and targeted advertising experiences. Despite challenges such as data privacy and security, the cloud advertising market presents opportunities for new entrants to provide innovative solutions and services tailored to specific industry needs.

However, the cloud advertising market also presents challenges that need to be addressed. One major challenge is data privacy and security. The collection and storage of large amounts of consumer data in the cloud raise concerns about data breaches and unauthorized access. Advertisers and cloud service providers need to implement robust security measures and comply with data protection regulations to ensure the privacy and security of consumer information.

As the demand for cloud-based advertising solutions continues to grow, there is room for innovative companies to offer specialized services and technologies. New entrants can focus on developing advanced data analytics and AI tools that provide deeper insights and more accurate targeting capabilities. They can also explore niche markets or industry verticals that have specific advertising needs and offer tailored solutions.

Key Takeaways

- The global cloud advertising market is projected to grow from USD 3.4 billion in 2023 to approximately USD 16.1 billion by 2033, exhibiting a robust CAGR of 16.8% throughout the forecast period.

- Hybrid Cloud held the largest market share in 2023, accounting for over 44.4%. This deployment model combines the benefits of both public and private clouds, offering scalability and enhanced security.

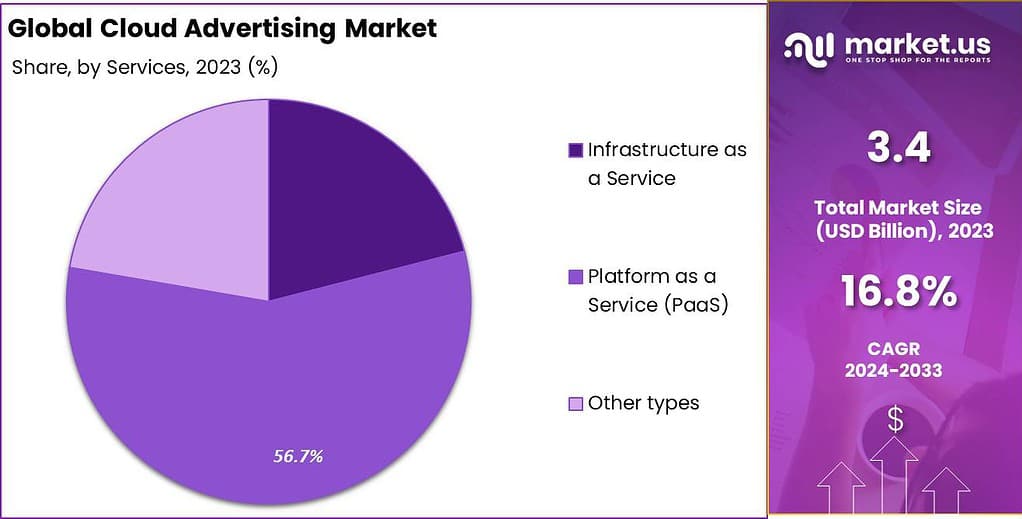

- Platform as a Service (PaaS) led the market with a share of more than 56.7% in 2023. PaaS offers comprehensive development environments, facilitating efficient management and deployment of advertising applications.

- Large Enterprises constituted the largest segment in 2023, capturing over 57.4% of the market. These organizations leverage cloud advertising to enhance scalability, analytics, and global campaign management.

- BFSI (Banking, Financial Services, and Insurance) emerged as a dominant sector, holding a significant 17.8% market share in 2023. Cloud advertising enables BFSI firms to employ data-driven strategies for personalized customer engagement and compliance with regulatory standards.

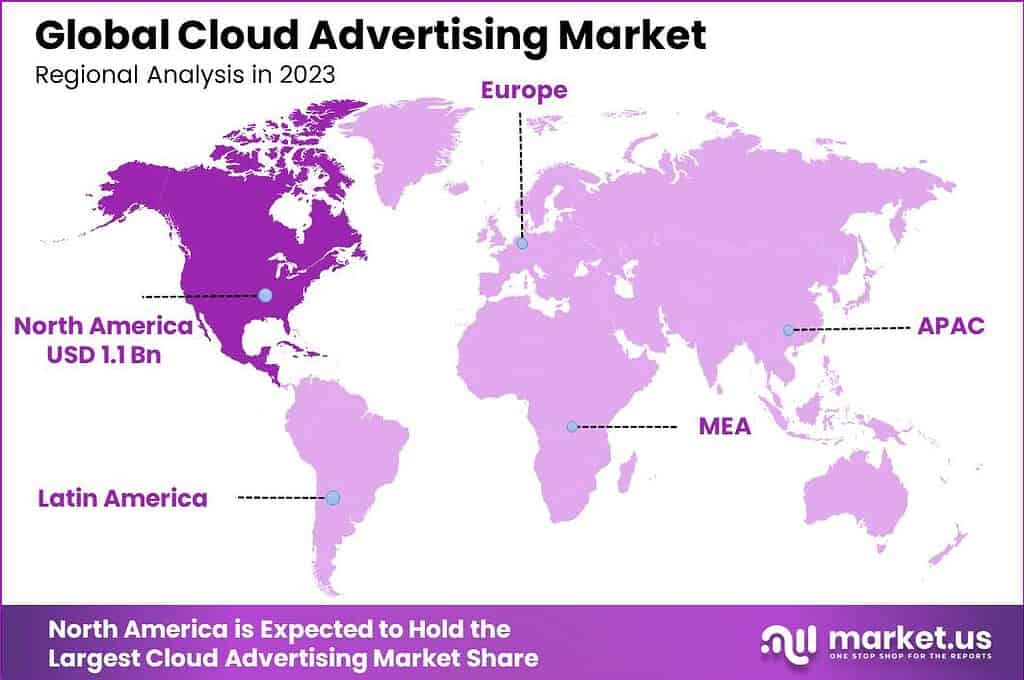

- North America led the market in 2023, accounting for more than 34.7% of the revenue. The region benefits from advanced digital infrastructure and stringent data protection regulations, fostering innovation and adoption of cloud advertising technologies.

Type Analysis

In 2023, the Hybrid segment held a dominant market position within the Cloud Advertising Market, capturing more than a 44.4% share. This prominence is largely due to the segment’s ability to offer the best of both private and public cloud functionalities, providing businesses with both scalability and enhanced security measures.

Hybrid clouds allow organizations to keep critical data secure in a private cloud while utilizing the extensive computational resources of a public cloud for less sensitive tasks. This flexibility is particularly appealing for businesses that handle large volumes of data but must comply with strict data protection regulations. The leading position of the Hybrid segment is further supported by its role in facilitating digital transformation strategies across diverse industries.

Companies are increasingly adopting hybrid cloud solutions as they can dynamically allocate resources, which is cost-effective and efficient for managing varying workloads. The ability to seamlessly move applications and data between private and public clouds helps businesses optimize their advertising strategies without compromising on performance or security. Additionally, hybrid cloud platforms are instrumental in enabling real-time data analytics and personalized advertising campaigns at scale.

The capacity to process and analyze data in real-time helps businesses more accurately target potential customers, thereby increasing the effectiveness of advertising campaigns and enhancing return on investment. With more organizations prioritizing data-driven decision-making, the hybrid cloud’s role in providing robust, scalable, and secure cloud computing resources underscores its dominance in the cloud advertising market.

Service Analysis

In 2023, the Platform as a Service (PaaS) segment held a dominant market position in the Cloud Advertising Market, capturing more than a 56.7% share. This significant market share can be attributed to the comprehensive development environments that PaaS offers, enabling businesses to develop, run, and manage advertising applications without the complexity of building and maintaining the infrastructure typically associated with the process.

PaaS provides a platform with built-in software components, including development tools, database management systems, and middleware, which are essential for advertisers to create innovative and efficient campaigns. The leadership of the PaaS segment is further underlined by its scalability and flexibility, which are crucial for businesses in the dynamic field of digital advertising.

Companies using PaaS can easily scale their operations up or down based on their advertising needs without substantial upfront investments. This capability is particularly valuable for businesses looking to optimize their advertising spend and agility in campaign management. Moreover, PaaS solutions support multiple programming languages and frameworks, which broadens their appeal across different organizations with varied technical preferences and requirements.

Additionally, the integration features of PaaS facilitate seamless connections with existing databases and software, enhancing the functionality of advertising campaigns through advanced analytics and targeted strategies. The ability to integrate with real-time data streams allows advertisers to tailor their approaches based on immediate feedback and interactions, leading to more personalized and effective advertising outcomes.

Enterprise Size Analysis

In 2023, the Large Enterprises segment held a dominant market position in the Cloud Advertising Market, capturing more than a 57.4% share. This segment’s leadership is primarily driven by the substantial resources that large enterprises can allocate towards advanced cloud advertising technologies. These corporations typically have the capital to invest in comprehensive cloud solutions that offer enhanced analytics, greater scalability, and more sophisticated campaign management tools.

This investment allows them to leverage cloud advertising to maintain a competitive edge, reach a broader audience, and optimize their marketing spend more effectively. Large enterprises also benefit from the integration capabilities of cloud advertising platforms, which allow them to synchronize their extensive data repositories across various channels and platforms.

This synchronization facilitates the creation of unified and targeted marketing strategies that can be finely tuned to the behavior and preferences of a diverse customer base. Furthermore, the ability to deploy global campaigns with localized content efficiently makes cloud advertising particularly attractive for large businesses operating in multiple markets.

Moreover, the robust security features provided by leading cloud advertising platforms align well with the needs of large enterprises, which often handle sensitive data and are subject to stringent regulatory requirements. By ensuring data privacy and compliance, these platforms enable large enterprises not only to protect their customer information but also to maintain their reputation and trustworthiness in the marketplace.

End User Analysis

In 2023, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position within the Cloud Advertising Market, capturing more than a 17.8% share. This significant market share can be attributed to the increasing digital transformation initiatives across the sector, aimed at enhancing customer experience and operational efficiency.

Financial institutions are leveraging cloud-based advertising solutions to target specific customer segments more effectively and personalize marketing efforts, which is crucial in a competitive market landscape. The leadership of the BFSI segment in cloud advertising is further reinforced by the growing need for data-driven marketing strategies to cross-sell and upsell financial products.

As banks and financial services companies handle vast amounts of customer data, cloud advertising platforms enable them to analyze this data in real-time to deliver tailored advertisements across multiple channels. This capability not only helps in customer retention but also attracts new customers by offering them personalized financial solutions based on their behaviors and preferences.

Moreover, the adoption of cloud advertising in the BFSI sector is driven by regulatory compliance requirements that mandate the secure handling and storage of consumer data. Cloud platforms offer robust security features that ensure compliance with regulations like GDPR and CCPA, which is pivotal for financial institutions. This compliance, combined with the scalability and cost-effectiveness of cloud solutions, makes cloud advertising increasingly popular among BFSI entities, positioning it as a leader in the cloud advertising market.

Key Market Segments

By Type

- Public

- Private

- Hybrid

By Service

- Infrastructure as a Service (IaaS)

- Software as a Service (SaaS)

- Platform as a Service (PaaS)

By Enterprise Size

- Large Enterprises

- SMEs

By End-User

- IT & Telecommunications

- BFSI

- Healthcare

- Travel and Hospitality

- Manufacturing, Automotive

- Retail & Consumer Goods

- Media & Entertainment

- Others

Driver

Increasing Adoption of Cloud Services

One significant driver in the Cloud Advertising Market is the increasing adoption of cloud services. This trend is primarily fueled by businesses’ needs to scale operations and enhance their marketing efforts without substantial upfront investments in IT infrastructure. Cloud services offer flexibility, scalability, and advanced analytics capabilities, which are essential for effective and targeted advertising campaigns.

As companies continue to value data-driven marketing strategies to better understand and engage with their customers, the demand for cloud-based advertising solutions is expected to grow. This ongoing shift from traditional advertising to more dynamic, online strategies underscores the vital role of cloud services in the modern advertising landscape.

Restraint

Data Security Concerns

A major restraint in the market is the vulnerability associated with data security. Despite the many advantages of cloud advertising, concerns over data breaches, loss of sensitive information, and compliance with data protection laws are significant hurdles. These issues are particularly acute in sectors such as finance and healthcare, where data sensitivity is high. The apprehension around these security risks can make companies hesitant to adopt cloud-based advertising solutions fully, impacting the growth of the cloud advertising market.

Opportunity

Integration of AI and Machine Learning

There is a substantial opportunity in the integration of artificial intelligence (AI) and machine learning (ML) within cloud advertising services. These technologies can dramatically enhance the personalization of advertising campaigns by analyzing large sets of data to identify patterns and preferences in consumer behavior.

AI and ML enable the automation of complex processes and real-time decision-making, which can improve the efficiency and effectiveness of advertising campaigns. As AI and ML technologies continue to advance, their incorporation into cloud advertising platforms represents a significant growth opportunity for service providers.

Challenge

Need for Seamless Integration

A critical challenge in the cloud advertising market is the need for seamless integration of cloud advertising platforms with existing business systems. Many organizations use a variety of software and platforms, and integrating new cloud advertising solutions with these can be complex and costly.

Additionally, ensuring that these integrations are secure and do not compromise the functionality of existing systems adds another layer of complexity. Overcoming these integration challenges is crucial for the widespread adoption of cloud advertising solutions, especially among businesses that rely on a multitude of digital tools for their operations.

Growth Factors

- Increasing Internet Penetration: The rising number of internet users globally expands the audience for digital advertising, driving demand for cloud advertising solutions.

- Adoption of Mobile Devices: The widespread use of smartphones and tablets enhances the reach and effectiveness of mobile advertising, contributing to market growth.

- Advanced Analytics and AI Integration: The incorporation of artificial intelligence (AI) and machine learning (ML) in cloud advertising platforms enables more precise targeting and personalization, improving campaign performance.

- Shift to Digital Marketing: Businesses are increasingly shifting their advertising budgets from traditional media to digital platforms, boosting the demand for cloud-based advertising solutions.

- Scalability and Flexibility: Cloud advertising platforms offer scalable and flexible solutions that can easily adapt to changing market conditions and business needs, making them attractive to companies of all sizes.

- Data-Driven Decision Making: The ability to collect, analyze, and utilize vast amounts of consumer data allows businesses to make informed decisions and optimize their advertising strategies.

Latest Trends

- AI and Machine Learning Integration: Increasing use of artificial intelligence (AI) and machine learning (ML) to enhance targeting, personalization, and predictive analytics in advertising campaigns.

- Programmatic Advertising: Growth of programmatic advertising, which automates the buying and selling of ad space in real-time using AI-driven algorithms, improving efficiency and targeting.

- Mobile Advertising Dominance: Continued rise of mobile advertising driven by the increasing use of smartphones and mobile apps, allowing for location-based and personalized ad experiences.

- Social Media Advertising Expansion: Significant growth in advertising on social media platforms like Facebook, Instagram, Twitter, and LinkedIn, leveraging user data for precise targeting.

- Video Advertising Growth: Increasing popularity of video ads on platforms such as YouTube, TikTok, and social media, due to higher engagement rates compared to traditional formats.

Regional Analysis

In 2023, North America held a dominant market position in the Cloud Advertising Market, capturing more than a 34.7% share with revenue amounting to USD 1.1 billion. This region’s leadership is primarily due to the high penetration of advanced digital technologies and the early adoption of cloud-based solutions across various industries.

North American businesses, particularly in the United States and Canada, are at the forefront of embracing innovative advertising technologies that leverage big data, artificial intelligence, and machine learning to optimize advertising strategies and customer engagement. The dominance of North America in the cloud advertising sector is further supported by the robust infrastructure for cloud computing and a competitive business environment that drives innovation in advertising technologies.

The region is home to some of the world’s leading tech giants and advertising firms that continually push the boundaries of what’s possible in digital marketing. Furthermore, the presence of a highly digital-savvy consumer base encourages companies to adopt cloud advertising solutions to reach out to customers with personalized, real-time, and effective marketing messages.

Additionally, the North American market benefits from stringent data protection regulations that foster trust in cloud-based solutions among businesses concerned about data security and privacy. This regulatory environment, combined with significant investments in cloud technology from both private and public sectors, continues to propel the growth of cloud advertising in this region, ensuring its leading position in the global market landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the rapidly evolving Cloud Advertising market, several key players are pivotal in shaping industry trends and technological advancements. Among them, Google LLC and Amazon Web Services, Inc. stand out due to their expansive infrastructure and advanced analytics capabilities, enabling widespread adoption of data-driven advertising strategies.

Google’s vast array of advertising services, including Google Ads and Google Marketing Platform, allows businesses to harness detailed consumer insights and optimize their advertising efforts efficiently. Similarly, Amazon leverages its e-commerce insights to offer targeted advertising solutions that are highly effective in reaching a precise audience.

Oracle and IBM Corporation are also significant contributors to the Cloud Advertising landscape, providing robust cloud platforms that support sophisticated marketing and advertising functionalities. Oracle’s focus on integrating artificial intelligence into its cloud solutions enhances its appeal by offering more personalized and engaging advertising experiences. IBM’s marketing solutions are recognized for their ability to manage large datasets and complex advertising operations, making them ideal for large enterprises that require reliability and scalability.

Salesforce, Inc. and Adobe are noteworthy for their customer relationship management and digital marketing solutions, respectively. Salesforce’s marketing cloud enables seamless engagement across various platforms, while Adobe’s Creative Cloud and Experience Cloud are essential tools for creating compelling and visually appealing advertisements.

Top Key Players in the Market

- Viant Technology LLC

- Cavai

- Kubient

- Imagine Communications

- Google LLC

- Oracle

- IBM Corporation

- Amazon Web Services, Inc.

- Adobe, Salesforce, Inc.

- Wipro

- The Nielsen Company (US), LLC.

- Other Key Players

Recent Developments

- Google Cloud Integration (May 2024): Viant Technology announced a new integration with Google Cloud’s BigQuery data clean rooms, enhancing privacy-safe data handling and enabling advanced data activation capabilities in programmatic advertising.

- Kubient: In May 2023, Kubient announced a definitive merger agreement with Adomni, a move that highlights its strategic efforts to expand and strengthen its capabilities in the digital advertising sector. This merger is particularly significant as it represents a consolidation aimed at enhancing the cloud-based advertising solutions provided by Kubient

Report Scope

Report Features Description Market Value (2023) USD 3.4 Bn Forecast Revenue (2033) USD 16.1 Bn CAGR (2024-2033) 16.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Public, Private, Hybrid), By Service- Infrastructure as a Software as a Service (IaaS), Software as a Service (SaaS), Platform as a Service (PaaS)), By Enterprise Size (Large Enterprises, SMEs), By End-User (IT & Telecommunications, BFSI, Healthcare, Travel and Hospitality, Manufacturing, Automotive, Retail & Consumer Goods, Media & Entertainment, Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Viant Technology LLC; Cavai; Kubient; Imagine Communications; Google LLC; Oracle; IBM Corporation; Amazon Web Services, Inc.; Adobe, Salesforce, Inc.; Wipro; The Nielsen Company (US), LLC. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is cloud advertising?Cloud advertising refers to the use of cloud-based technologies to deliver advertisements across various digital channels such as social media, search engines, websites, and mobile apps. This approach leverages the scalability, flexibility, and data-driven nature of cloud platforms to optimize ad delivery and targeting.

How big is Cloud Advertising Market?The Global Cloud Advertising Market size is expected to be worth around USD 16.1 Billion By 2033, from USD 3.4 Billion in 2023, growing at a CAGR of 16.8% during the forecast period from 2024 to 2033.

What factors are driving the growth of the cloud advertising market?Key drivers include the increasing adoption of digital marketing strategies, the rise of e-commerce, the need for real-time data analytics, and the demand for personalized advertising experiences. The growth in internet access and the shift towards online shopping also play crucial roles.

Which sectors are the biggest users of cloud advertising?Major sectors utilizing cloud advertising include BFSI (Banking, Financial Services, and Insurance), retail, IT and telecommunications, media and entertainment, and healthcare. Each sector leverages cloud advertising to enhance customer engagement, optimize marketing campaigns, and deliver personalized ads.

Who are the key players in the cloud advertising market?Leading companies in the cloud advertising market include: Viant Technology LLC; Cavai; Kubient; Imagine Communications; Google LLC; Oracle; IBM Corporation; Amazon Web Services, Inc.; Adobe, Salesforce, Inc.; Wipro; The Nielsen Company (US), LLC.

Which regions are leading the cloud advertising market?In 2023, North America held a dominant market position in the cloud advertising market, capturing more than a 34.7% share.

-

-

- Viant Technology LLC

- Cavai

- Kubient

- Imagine Communications

- Google LLC

- Oracle

- IBM Corporation

- Amazon Web Services, Inc.

- Adobe, Salesforce, Inc.

- Wipro

- The Nielsen Company (US), LLC.

- Other Key Players