Global Clinical Information System Market By Product Type (Outpatient Clinical Information Systems, Specialty Clinical Information Systems, Inpatient Clinical Information Systems, and Ancillary Information Systems), By Technology (Cloud-Based, and On-Premise), By Services (Managed Services, and Consulting Services), By Access/Platform (Mobiles/Smart Phones, and Desktop/Laptops), By End-user (Healthcare Facilities, and Payers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 160110

- Number of Pages: 295

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Technology Analysis

- Services Analysis

- Access/Platform Analysis

- End-User Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

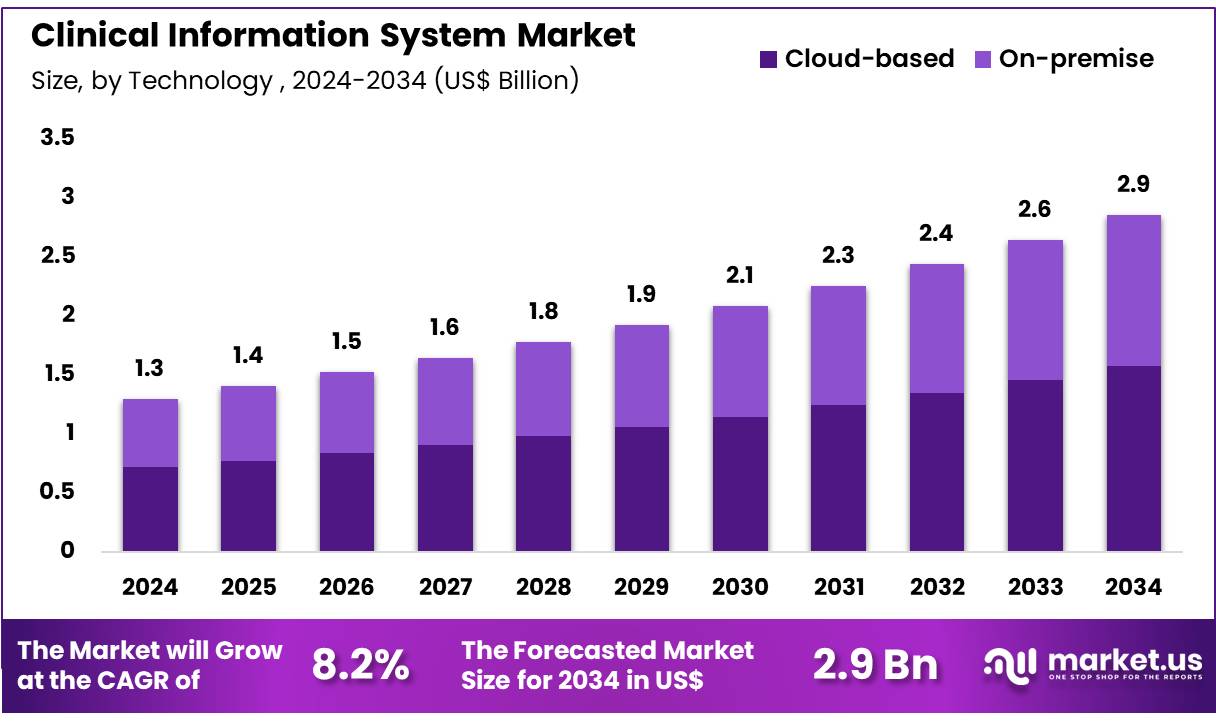

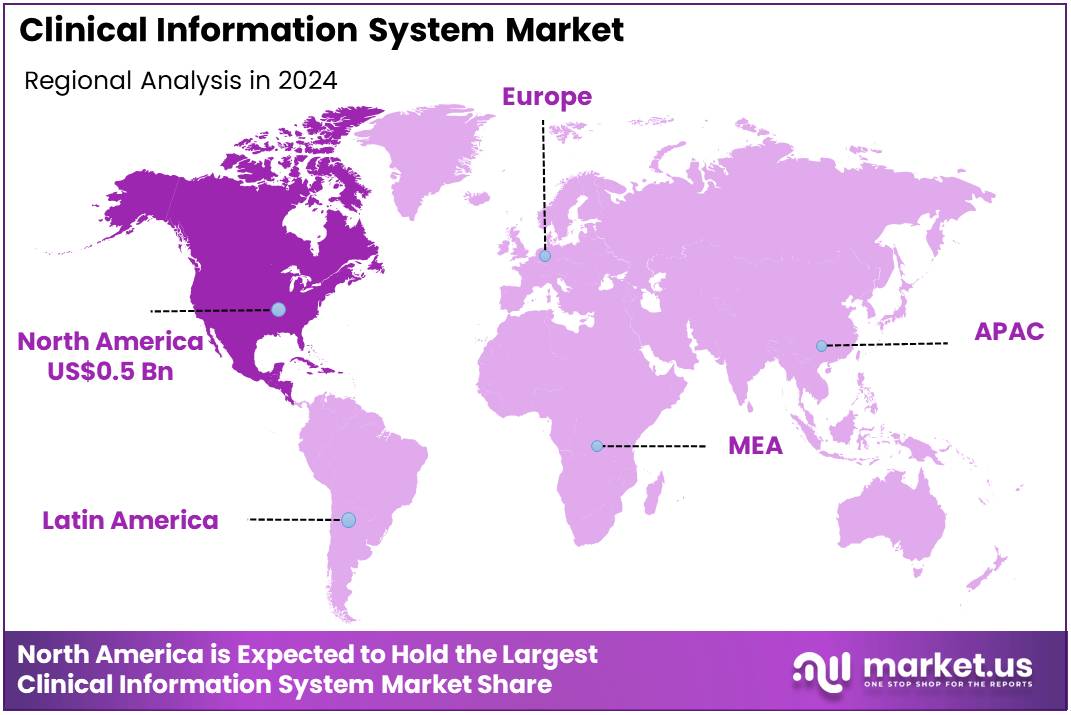

The Global Clinical Information System Market size is expected to be worth around US$ 2.9 Billion by 2034 from US$ 1.3 Billion in 2024, growing at a CAGR of 8.2% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.9% share with a revenue of US$ 0.5 Billion.

Increasing need for efficient clinical workflows and enhanced patient care drives the Clinical Information System (CIS) market. Healthcare organizations are moving away from fragmented, paper-based systems toward unified digital platforms to manage patient data, from electronic health records (EHRs) to diagnostic imaging.

The Centers for Disease Control and Prevention (CDC) reports that 96% of US hospitals have adopted certified EHR technology, with nearly universal use. This widespread adoption is a crucial driver, as it creates a foundation for integrated systems that improve patient safety by reducing medication errors and provide a comprehensive view of a patient’s health history, ultimately supporting more accurate diagnoses and treatment plans.

Growing opportunities are emerging from the integration of artificial intelligence (AI) and advanced analytics into CIS platforms. These technologies are transforming static data repositories into intelligent tools that can assist clinicians with decision-making. A 2024 survey from HIMSS found that 53% of healthcare providers are already using AI to improve operational efficiency and patient outcomes.

AI-powered CIS applications can analyze vast datasets to predict disease progression, flag potential risks, and optimize resource allocation. The October 2023 implementation of Clintel Systems’ CareRight platform at the Queensland University of Technology, which optimizes billing and claims, demonstrates how these systems are being used to streamline financial operations and improve overall efficiency.

The market is also witnessing a strong trend toward interoperability and cloud-based solutions. Interoperability ensures that patient data can move seamlessly and securely between different healthcare providers and systems, a critical function for coordinated care. Cloud-based CIS offers scalability, security, and accessibility, enabling providers to access patient information from anywhere.

The April 2024 collaboration between iMDsoft and Inetum exemplifies this trend, aiming to expand digital healthcare solutions and meet the rising demand for integrated healthcare systems. This focus on cloud-based interoperability is transforming clinical data management, allowing for better collaboration, streamlined administrative processes, and a more cohesive healthcare ecosystem that benefits both providers and patients.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.3 Billion, with a CAGR of 8.2%, and is expected to reach US$ 2.9 Billion by the year 2034.

- The product type segment is divided into outpatient clinical information systems, specialty clinical information systems, inpatient clinical information systems, and ancillary information systems, with outpatient clinical information systems taking the lead in 2023 with a market share of 38.5%.

- Considering technology, the market is divided into cloud-based and on-premise. Among these, cloud-based held a significant share of 55.0%.

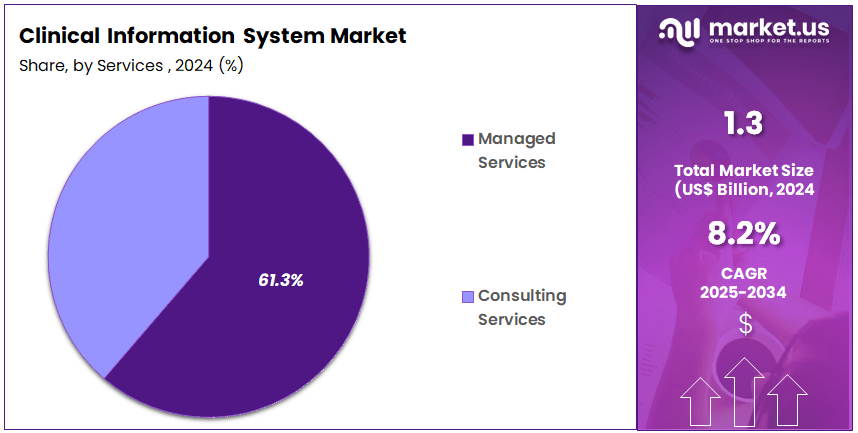

- Furthermore, concerning the services segment, the market is segregated into managed services and consulting services. The managed services sector stands out as the dominant player, holding the largest revenue share of 61.3% in the market.

- The access/platform segment is segregated into mobiles/smart phones and desktop/laptops, with the mobiles/smart phones segment leading the market, holding a revenue share of 51.8%.

- Considering end-user, the market is divided into healthcare facilities and payers. Among these, healthcare facilities held a significant share of 72.6%.

- North America led the market by securing a market share of 39.9% in 2023.

Product Type Analysis

Outpatient clinical information systems lead the market with a 38.5% share. These systems are expected to grow due to the increasing demand for efficient patient data management, especially in outpatient care settings. Outpatient clinics require robust systems to manage patient records, appointment scheduling, and billing processes.

As healthcare systems increasingly adopt electronic health records (EHR), outpatient clinical information systems offer integrated solutions for improved workflow, real-time access to patient information, and better decision-making. The shift towards outpatient care models, driven by rising healthcare costs and patient preference, is anticipated to drive further growth in this segment. Additionally, the increasing adoption of telemedicine and virtual healthcare solutions will contribute to the expansion of outpatient clinical information systems.

Technology Analysis

Cloud-based systems dominate the market with a 55.0% share and are expected to continue growing due to their flexibility, scalability, and cost-effectiveness. Cloud computing enables healthcare providers to store and access vast amounts of patient data securely, facilitating remote access and collaboration across different care settings. These systems offer significant advantages over on-premise solutions, including reduced infrastructure costs, quicker software updates, and enhanced data security.

The growing trend of remote work and the need for real-time data access are key drivers of cloud-based solutions in the clinical information system market. As healthcare providers embrace digital transformation, the demand for cloud-based platforms is likely to grow, making this segment a major contributor to the market’s expansion.

Services Analysis

Managed services hold a dominant 61.3% share in the clinical information system market. The demand for managed services is driven by healthcare organizations’ need for specialized IT services to support their digital health systems. These services offer healthcare facilities the expertise and resources required to manage their information systems, such as system maintenance, troubleshooting, and data management.

Managed services are expected to grow as healthcare providers seek to reduce operational costs and improve the efficiency of their IT infrastructure. By outsourcing complex tasks like network management and system upgrades, hospitals and clinics can focus on patient care while benefiting from improved system reliability and performance. The increasing complexity of healthcare IT and the need for advanced technology solutions will fuel further growth in managed services.

Access/Platform Analysis

Mobiles/smartphones account for 51.8% of the access/platform segment in the clinical information system market. The growing demand for mobile healthcare applications is expected to drive this segment, as smartphones provide healthcare professionals with immediate access to patient data, medical records, and communication tools. Mobile solutions enable healthcare providers to deliver care in real-time, making them particularly valuable in emergency and outpatient settings.

As smartphones continue to serve as an integral part of healthcare delivery, the market for mobile access platforms is anticipated to grow, driven by increased mobile healthcare app adoption and enhanced mobile connectivity. Moreover, the ongoing shift towards patient-centric care, where patients manage their health through mobile applications, will further boost the demand for mobile-based clinical information systems.

End-User Analysis

Healthcare facilities lead the end-user segment with a 72.6% share. This segment is expected to grow as hospitals and clinics continue to embrace advanced clinical information systems to improve patient care and streamline operations. Healthcare facilities are increasingly adopting electronic health records, patient management systems, and other digital tools to enhance the quality and efficiency of care delivery. The rise of value-based care, which emphasizes patient outcomes and cost-efficiency, is driving the adoption of these systems in healthcare settings.

The need for integrated solutions that connect various departments and enhance communication between healthcare professionals will further fuel the growth of clinical information systems in hospitals and clinics. As healthcare providers continue to modernize their infrastructure, healthcare facilities are likely to remain the largest contributors to the market’s expansion.

Key Market Segments

By Product Type

- Outpatient Clinical Information Systems

- Specialty Clinical Information Systems

- Inpatient Clinical Information Systems

- Ancillary Information Systems

By Technology

- Cloud-Based

- On-Premise

By Services

- Managed Services

- Consulting Services

By Access/Platform

- Mobiles/Smart Phones

- Desktop/Laptops

By End-user

- Healthcare Facilities

- Payers

Drivers

The increasing demand for integrated healthcare is driving the market

The growing need for a unified and holistic view of patient information is a key driver for the clinical information systems (CIS) market. In modern healthcare, patient care is often delivered across multiple departments, clinics, and even different healthcare facilities. A fragmented approach, where each department uses a separate system, can lead to data silos, medical errors, and inefficiencies.

CIS addresses this challenge by integrating various clinical and administrative functions such as electronic health records (EHRs), laboratory information systems (LIS), and radiology information systems (RIS)into a single, cohesive platform. This integration enables real-time data sharing among healthcare providers, ensuring that clinicians have immediate access to a complete and accurate patient history. The adoption of EHRs, a foundational component of CIS, has been a significant trend, with a high percentage of hospitals now using these systems.

For example, in 2022, there were over 6,000 hospitals in the US, which had more than 36.3 million annual admissions, all of which require sophisticated systems to manage. This high volume of patient interactions underscores the widespread need for integrated digital systems to improve clinical decision-making, care coordination, and overall patient outcomes.

Restraints

High implementation costs and complexity are restraining the market

The significant cost and technical complexity associated with implementing a clinical information system are major restraints on market growth, particularly for smaller healthcare organizations. The initial investment for a comprehensive CIS can be substantial, including expenses for software licenses, hardware infrastructure, and extensive training for staff. The cost can vary significantly depending on the size and scope of the project.

For example, a simple hospital information system (HIS) for one platform can cost between US$50,000 and US$120,000, while a more complex system can exceed multi-million dollars for large hospitals. Beyond the initial expense, the technical complexity of integrating a new CIS with existing legacy systems, such as billing and administrative software, can also be a major hurdle. This process is often time-consuming and can lead to disruptions in daily operations, which many healthcare providers are hesitant to risk.

According to a 2024 analysis, the cost of implementing AI/ML for diagnostics, predictive analytics, or decision support can increase total costs by 20% to 40%, depending on the scope. These high financial and operational barriers can delay or prevent the adoption of a new CIS, limiting market expansion.

Opportunities

The rise of AI and data analytics is creating growth opportunities

The integration of artificial intelligence (AI) and data analytics is creating significant growth opportunities for the clinical information system market. By leveraging AI and machine learning, CIS can move beyond simple data storage and retrieval to provide clinicians with powerful tools for decision support, predictive analytics, and personalized medicine. For example, AI algorithms can analyze a patient’s electronic health record to identify patterns and flag potential health risks, such as the early onset of sepsis. This predictive capability can enable timely interventions and improve patient outcomes.

According to a 2024 report by the World Economic Forum, a typical hospital can produce 50 petabytes of data per year, and the volume of big data is projected to increase faster in healthcare over the next seven years than in any other field. The ability of CIS to aggregate and analyze these vast amounts of data allows for the development of new solutions that can streamline workflows, automate administrative tasks, and support clinical research, making these systems more valuable and indispensable to healthcare providers.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical dynamics profoundly shape the clinical information system market, compelling healthcare executives to navigate fiscal headwinds alongside imperatives for resilient innovation. Persistent global inflation erodes institutional budgets, prompting providers to defer investments in AI-enhanced platforms that streamline electronic health records and clinical decision support. Economic slowdowns in Europe and Asia-Pacific restrict venture funding, hampering the scalability of integrated analytics for multidisciplinary care coordination.

Trade tensions and supply chain disruptions inflate costs for imported semiconductors and cloud infrastructure essential to these technologies. Vendors confront heightened cybersecurity risks from state-sponsored threats, complicating secure data exchanges in cross-border networks. Regulatory divergences under frameworks like the EU AI Act delay harmonized deployments for predictive patient monitoring modules.

The growing global burden of chronic diseases, with six in ten adults in the US having at least one such condition as per the CDC, compels a shift towards digital systems. Leaders counter these pressures through diversified sourcing in stable regions and resilient hybrid architectures, fostering innovation that elevates clinical efficiencies and patient outcomes.

Current US tariffs reshape the clinical information system market by escalating procurement expenses while incentivizing domestic fortification and agile strategies. Trade barriers and retaliatory duties surge costs for servers and IoT devices critical to real-time data processing. Hospital networks postpone platform integrations, perpetuating silos in care documentation and straining responses to rising diagnostic volumes. Strategy directors reallocate IT budgets from algorithm advancements to compliance audits, exacerbating vulnerabilities in global supply chains for cloud-based solutions.

However, tariffs galvanize US reshoring efforts, enabling vendors to leverage CHIPS Act subsidies and create specialized jobs in secure manufacturing. Alliances with domestic chipmakers expedite modular, duty-resilient architectures that prioritize data sovereignty. By pursuing exemptions for core inputs, the industry transforms adversities into catalysts for sustained expansion through innovative, cost-optimized clinical tools.

Latest Trends

Increased focus on interoperability is a recent trend

A prominent trend in the clinical information system market in 2024 is the heightened focus on interoperability. While CIS has long been focused on internal integration within a single healthcare organization, the new emphasis is on enabling seamless data exchange between different healthcare providers, systems, and platforms. This trend is driven by the need to create a more connected and collaborative healthcare ecosystem.

For instance, a patient’s information can now be easily shared between a hospital, a primary care physician, and a specialist’s office, ensuring that every provider has access to the most up-to-date information. The US Centers for Medicare & Medicaid Services (CMS) has continued to push for this with rules that require certain payers to implement application programming interfaces (APIs) for data exchange to improve the electronic sharing of healthcare data. This push for standardized data exchange protocols and the development of open APIs is a key development, as it allows for a more fluid flow of health data, which is essential for coordinated care and population health management.

Regional Analysis

North America is leading the Clinical Information System Market

In 2024, North America secured a 39.9% share of the global Clinical Information System market, driven by regulatory pushes for interoperability and electronic health record upgrades to address clinician burnout and optimize patient data amid rising chronic care needs. Hospitals adopted integrated platforms for real-time order entry and results reporting, enabling teams to streamline complex treatments with fewer errors. The Office of the National Coordinator for Health Information Technology’s standards boosted seamless data sharing, fostering trust in cloud-based analytics for population health.

Vendor-government pilots advanced AI-assisted documentation, easing administrative burdens while meeting HIPAA requirements. Post-pandemic reimbursement expansions from the Centers for Medicare & Medicaid Services spurred ambulatory centers to modernize legacy systems, enhancing rural access via mobile interfaces.

Economic benefits from reduced duplicate tests drove scalable solution investments. Venture capital fueled predictive alerting tools, optimizing bed management during surges. Physician and clinical services expenditures rose 7.4% to US$978.0 billion in 2023, outpacing the 4.6% growth in 2022, reflecting robust clinical infrastructure funding.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts project the Asia Pacific Clinical Information System sector to surge during the forecast period, as governments digitize healthcare to manage urbanization and aging populations. National ministries fund nationwide electronic record systems, pushing hospitals to adopt centralized platforms for unified patient data and automated referrals. Pharma firms collaborate with local developers to embed analytics, anticipating sharper pharmacogenomic insights from aggregated data.

Seoul and Mumbai hubs pioneer federated systems, enabling community clinics to access specialists seamlessly. China prioritizes blockchain-secured ledgers for cross-province data sharing, projecting faster outbreak responses. Japan advances AI dashboards for elder care, syncing with insurance portals for proactive interventions. Southeast Asian coalitions deploy low-cost modules for primary care, bridging gaps in remote areas with offline syncing. Japan’s Ministry of Health, Labour and Welfare allocated approximately US$ 400 million in fiscal year 2024 to digital health innovations, including clinical data management platforms.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading firms in the clinical information systems sector spur expansion by unveiling AI-integrated platforms that automate documentation and deliver actionable insights to enhance clinical decisions. They orchestrate acquisitions to weave in cutting-edge data analytics, enriching their offerings for superior interoperability across healthcare environments. Organizations cultivate alliances with academic centers and device suppliers to devise bespoke, compliant solutions that quicken adoption and refine patient outcomes.

Executives channel funds into innovation pipelines, harnessing cloud technologies for secure data sharing and predictive modeling. They advance into vibrant regions such as Asia-Pacific and the Middle East, customizing deployments to navigate local policies and boost accessibility. Moreover, they deploy flexible subscription frameworks for ongoing support and upgrades, nurturing client allegiance and predictable cash flows.

Epic Systems Corporation, founded in 1979 and headquartered in Verona, Wisconsin, crafts comprehensive electronic health record platforms that unify patient data and streamline operations for healthcare providers worldwide. Its MyChart portal empowers patients with secure access to records, appointments, and communication tools to foster proactive care. Epic commits robust resources to R&D, embedding AI for workflow optimization and population health analytics.

CEO Judy Faulkner oversees an employee-owned enterprise that prioritizes privacy and usability in software design. The company partners with institutions to integrate solutions seamlessly, supporting millions in diverse settings from hospitals to clinics. Epic reinforces its prominence by emphasizing scalable, innovative tools that evolve with regulatory and technological shifts.

Top Key Players

- TELUS

- Systematic A/S

- Orion Health

- Nuance Communications, Inc.

- Medical Information Technology, Inc

- INFINITT North America Inc

- iMDsoft

- Epic Systems Corporation

- Emerging Systems

- eClinicalWorks

- Allscripts Healthcare Solutions, Inc

- 3M Health Information Systems

Recent Developments

- In September 2025, Epic and Quest Diagnostics announced a strategic collaboration aimed at enhancing the laboratory testing experience for both healthcare providers and patients in the US. Epic will contribute a suite of technologies and services to support Quest’s “Project Nova,” which seeks to simplify and improve customer-facing processes. The partnership will utilize Epic’s Diagnostic Enterprise system, including MyChart, to streamline testing procedures and improve the overall patient experience.

- In September 2025, Siemens Healthineers launched the “Knowing is Comforting” campaign in India, designed to address “Scanxiety” the fear and anxiety many patients feel before, during, and after medical imaging procedures. The initiative features educational videos available in English and nine regional languages, aiming to reduce patient stress by showcasing how advancements in diagnostic imaging technologies have made procedures more patient-friendly and accessible.

- In July 2025, Medtronic received CE Mark approval for its MiniMed™ 780G system in Europe, expanding its indications to include a broader range of diabetes patients. The system is now approved for use by children as young as two, pregnant individuals, and patients with type 2 diabetes, following successful studies that demonstrated its effectiveness in these new patient groups. This approval marks a significant step toward expanding the system’s reach and impact in managing diabetes.

Report Scope

Report Features Description Market Value (2024) US$ 1.3 Billion Forecast Revenue (2034) US$ 2.9 Billion CAGR (2025-2034) 8.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Outpatient Clinical Information Systems, Specialty Clinical Information Systems, Inpatient Clinical Information Systems, and Ancillary Information Systems), By Technology (Cloud-Based, and On-Premise), By Services (Managed Services, and Consulting Services), By Access/Platform (Mobiles/Smart Phones, and Desktop/Laptops), By End-user (Healthcare Facilities, and Payers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape TELUS, Systematic A/S, Orion Health, Nuance Communications, Inc., Medical Information Technology, Inc, INFINITT North America Inc, iMDsoft, Epic Systems Corporation, Emerging Systems, eClinicalWorks, Allscripts Healthcare Solutions, Inc, 3M Health Information Systems. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Clinical Information System MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Clinical Information System MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- TELUS

- Systematic A/S

- Orion Health

- Nuance Communications, Inc.

- Medical Information Technology, Inc

- INFINITT North America Inc

- iMDsoft

- Epic Systems Corporation

- Emerging Systems

- eClinicalWorks

- Allscripts Healthcare Solutions, Inc

- 3M Health Information Systems