Global Circuit Breaker For Data Centers Market Size, Share Analysis Report By Data Center Type (Hyperscale, Colocation, Enterprise), By Voltage (Low Voltage, Medium Voltage, High Voltage), By Rated Current (Less than 500 A, 500 A to 1,500 A, 2,500 A to 4,500 A, Greater than 4,500 A), By Type (Air Circuit Breakers, Vacuum Circuit Breakers, Oil Circuit Breakers, Others), By Application (Power Distribution, Power Transmission) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174441

- Number of Pages: 237

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

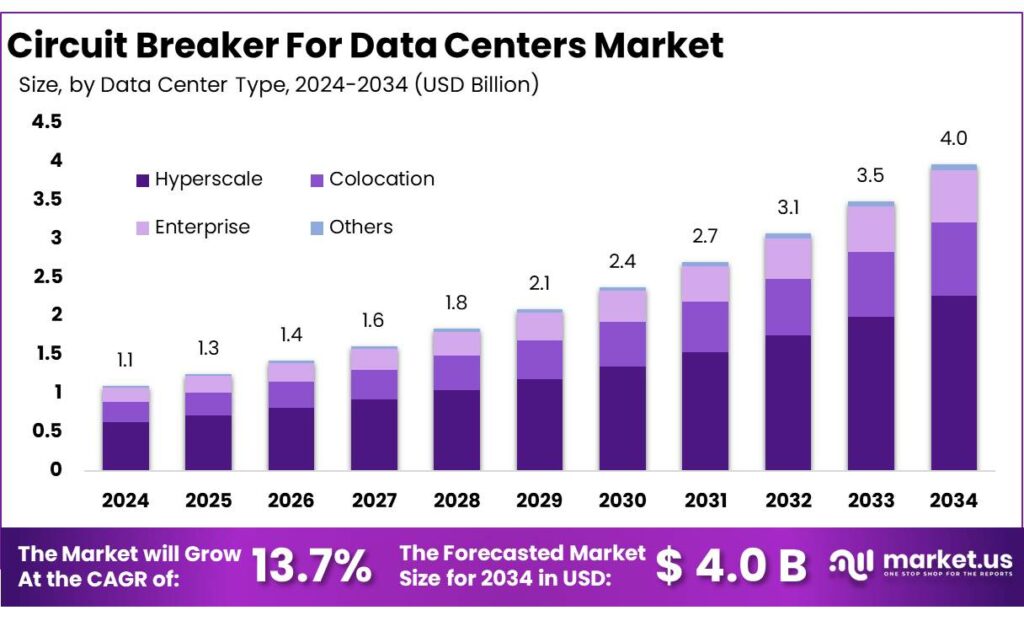

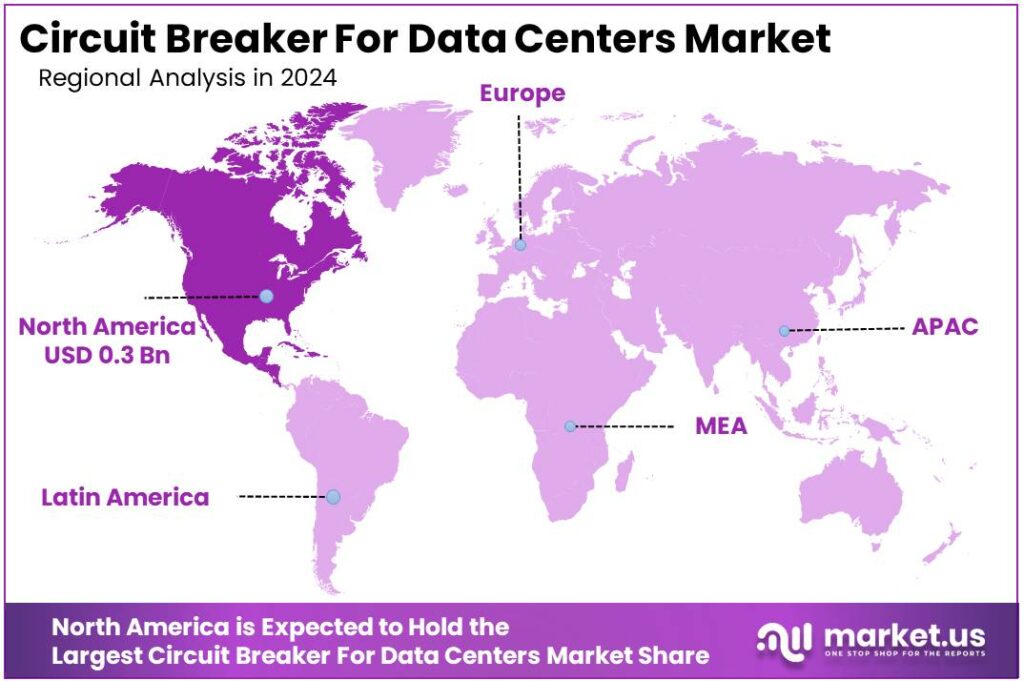

Global Circuit Breaker For Data Centers Market size is expected to be worth around USD 4.0 Billion by 2034, from USD 1.1 Billion in 2024, growing at a CAGR of 13.7% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 36.5% share, holding USD 0.3 Billion in revenue.

Data centers are essentially always-on factories for digital services, and the circuit breaker sits at the center of their electrical safety and uptime strategy. In a modern facility, breakers are not just “on/off” devices; they are coordinated protection layers across utility intake, medium-voltage switchgear, transformers, UPS outputs, PDUs, busways, and rack-level distribution.

The industrial scenario is being shaped by a sharp increase in electricity demand tied to digital infrastructure. The International Energy Agency estimates ~415 TWh of electricity consumption from data centres in 2024, growing around 12% per year over the last five years. In its Energy and AI analysis, the IEA projects data centre electricity consumption to more than double to about ~945 TWh by 2030, with AI a major driver of this growth. In the United States specifically, Pew Research summarizes that data centers accounted for about 4% of total U.S. electricity use in 2024 and that demand is expected to more than double by 2030.

Reliability economics are another major driver. Uptime Institute’s outage research highlights that outages remain expensive: 54% of respondents said their most recent significant outage cost more than $100,000, and 16% said it exceeded $1 million. Uptime also notes that power issues are consistently the most common cause of serious and severe data center outages.

Policy and grid constraints are increasingly shaping investment priorities. In the U.S., electricity consumption reached a record 4,198 billion kWh in 2025, with the EIA projecting 4,256 billion kWh in 2026 and 4,364 billion kWh in 2027, citing data centers among the key growth factors. On the government-initiative side, the U.S. DOE’s Federal Energy Management Program explicitly pushes agencies toward improving data center energy efficiency, aligning with federal cloud and efficiency guidance—an approach that tends to favor modern, metered, and more controllable power trains where intelligent breakers and switchgear integrate into energy and resilience management.

Key Takeaways

- Circuit Breaker For Data Centers Market size is expected to be worth around USD 4.0 Billion by 2034, from USD 1.1 Billion in 2024, growing at a CAGR of 13.7%.

- Hyperscale held a dominant market position, capturing more than a 57.2% share in the circuit breaker for data centers market.

- Low Voltage held a dominant market position, capturing more than a 63.9% share in the circuit breaker for data centers market.

- 500 A to 1,500 A held a dominant market position, capturing more than a 51.3% share in the circuit breaker for data centers market.

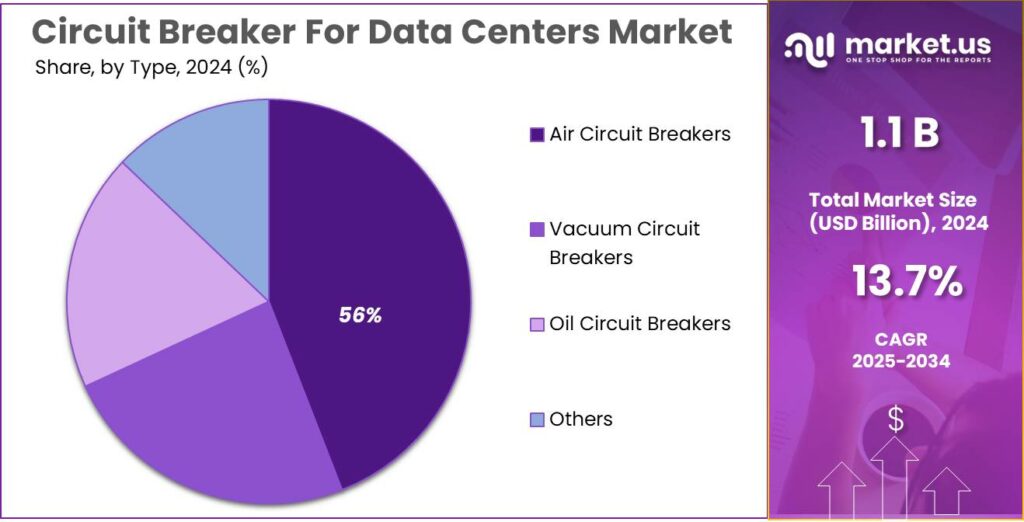

- Air Circuit Breakers held a dominant market position, capturing more than a 44.1% share.

- Power Distribution held a dominant market position, capturing more than a 71.8% share in the circuit breaker for data centers market.

- North America held a dominant position in the circuit breaker for data centers market with 36.5% share, valued at USD 0.3 Bn.

By Data Center Type Analysis

Hyperscale data centers dominate with a 57.2% share driven by scale, uptime needs, and rapid capacity growth.

In 2024, Hyperscale held a dominant market position, capturing more than a 57.2% share in the circuit breaker for data centers market. This leadership reflects the sheer size and power density of hyperscale facilities, where uninterrupted operations are critical. Large cloud operators design campuses with multiple power rooms, redundant feeds, and high fault-level equipment. As a result, demand concentrates on robust circuit breakers that can handle high currents, fast fault isolation, and frequent switching without downtime. These sites also standardize equipment across campuses, which further boosts volume adoption within the hyperscale segment.

By Voltage Analysis

Low Voltage dominates with a 63.9% share due to its wide use in core data center power distribution.

In 2024, Low Voltage held a dominant market position, capturing more than a 63.9% share in the circuit breaker for data centers market. This strong position comes from the extensive use of low-voltage breakers across power distribution units, switchboards, and server rack systems. Data centers rely on low-voltage systems to safely distribute power to IT loads, cooling equipment, and auxiliary systems. These breakers are preferred because they offer fast fault protection, easy installation, and reliable performance in environments where uptime is critical. Their compatibility with standardized electrical designs also makes them the first choice across new builds and expansions.

By Rated Current Analysis

500 A to 1,500 A dominates with a 51.3% share due to its balance of capacity and operational flexibility.

In 2024, 500 A to 1,500 A held a dominant market position, capturing more than a 51.3% share in the circuit breaker for data centers market. This rated current range is widely used in main and sub-distribution panels where power needs are high but still manageable within compact electrical layouts. Data center operators favor this range because it supports critical loads such as power distribution units, cooling systems, and IT rows without oversizing equipment. It offers a practical balance between load handling, safety margins, and space efficiency, which is essential in modern high-density facilities.

By Type Analysis

Air Circuit Breakers dominate with a 44.1% share due to their reliability in high-load data center environments.

In 2024, Air Circuit Breakers held a dominant market position, capturing more than a 44.1% share in the circuit breaker for data centers market. Their leadership comes from their strong performance in main low-voltage switchboards, where large current flows must be controlled safely and consistently. Data centers depend on air circuit breakers for their high breaking capacity, stable operation under continuous loads, and clear visual isolation during maintenance. These features make them a trusted choice for protecting critical power paths in facilities where even short interruptions can cause serious operational losses.

By Application Analysis

Power Distribution dominates with a 71.8% share due to its central role in data center operations.

In 2024, Power Distribution held a dominant market position, capturing more than a 71.8% share in the circuit breaker for data centers market. This dominance reflects the critical need to manage and protect electricity as it moves from incoming utility feeds to IT equipment and cooling systems. Circuit breakers used in power distribution ensure stable load handling, quick fault isolation, and safe maintenance across switchgear, panels, and distribution units. Because every data center depends on reliable power flow, this application naturally represents the largest share of breaker demand.

Key Market Segments

By Data Center Type

- Hyperscale

- Colocation

- Enterprise

By Voltage

- Low Voltage

- Medium Voltage

- High Voltage

By Rated Current

- Less than 500 A

- 500 A to 1,500 A

- 2,500 A to 4,500 A

- Greater than 4,500 A

By Type

- Air Circuit Breakers

- Vacuum Circuit Breakers

- Oil Circuit Breakers

- Others

By Application

- Power Distribution

- Power Transmission

Emerging Trends

Higher AI Rack Densities Are Reshaping Power Protection

A clear latest trend in circuit breakers for data centers is the move toward much higher rack power, driven by AI and accelerated computing. When racks draw more power, the electrical system has to carry higher currents, deal with higher fault levels, and isolate problems faster. That is changing what operators expect from breakers: not only reliable interruption, but also sharper selectivity, safer maintenance features, and better visibility into loading and power quality.

Trusted public sources show why this shift is happening now. The U.S. Department of Energy reports U.S. data-center electricity use rose to 176 TWh in 2023 and could reach 325–580 TWh by 2028. When demand rises that quickly, data centers cannot just “add more of the same.” They redesign electrical rooms, UPS output sections, and distribution layouts to handle larger, more variable loads, which lifts demand for advanced breakers and coordinated protection schemes.

On the rack side, the step-up is striking. A recent technical review on grid impacts of AI data centers notes that traditional racks often operate around 7–10 kW, while AI computing racks can reach 30–100+ kW per rack. This matters because higher kW per rack typically means higher feeder currents, more parallel paths, and tighter coordination requirements between upstream main breakers and downstream branch protection. In some new AI-focused builds, published project details already point to very high densities: an India-based AI data center park announced rack density options of 80 kW to 200 kW per rack in its first phase.

As a result, breaker “spec sheets” are being pulled in new directions. Operators want protection that reduces the chance of a wide outage from a local fault, because outages are expensive and reputationally damaging. Uptime Institute’s outage research shows 54% of operators said their most recent significant outage cost more than $100,000, and around one in five reported costs above $1 million.

Drivers

Rising Data-Center Power Loads Drive Breaker Demand

One major driving factor for circuit breakers in data centers is simple: power demand is rising fast, and the electrical “plumbing” has to keep up safely. Data centers are no longer only about cooling and racks; they are becoming high-power industrial sites where uptime depends on how well electricity is delivered and protected. When power flows increase, the consequences of a short circuit, arc fault, or a poorly coordinated trip become more severe.

Trusted energy agencies are now putting hard numbers on this shift. The International Energy Agency (IEA) projects global electricity consumption for data centres will more than double to around 945 TWh by 2030. The IEA also notes data-centre electricity use grows around 15% per year from 2024 to 2030 in its base case—far faster than overall electricity demand growth.

This load growth also shows up in national power outlooks. The U.S. Energy Information Administration (EIA) projects U.S. electricity consumption rising from a record 4,198 billion kWh in 2025 to 4,256 billion kWh in 2026 and 4,364 billion kWh in 2027, and the report explicitly points to rising demand from data centers supporting AI and crypto among key drivers. For data-center owners, that wider grid context matters: as more regions face capacity constraints and longer interconnection queues, operators become even more sensitive to electrical efficiency, losses, and reliability.

The “why” becomes even clearer when outage economics are considered. Uptime Institute reports that 54% of respondents said their most recent significant outage cost more than $100,000, and about one in five said it exceeded $1 million. Uptime also flags that power issues remain the most common cause of serious and severe data-center outages.

Restraints

Long Lead Times and Skilled-Labor Gaps Slow Electrical Upgrades

A major restraining factor for circuit breakers in data centers is the project reality behind the hardware: even when budgets are approved, getting the right power equipment on-site and commissioned on time is hard. Many operators are building new capacity while also retrofitting live facilities. That combination creates a “do it fast, don’t break anything” environment, where any delay in switchgear components, protective devices, or installation labor can push timelines out and raise costs.

Trusted industry surveys show how persistent these bottlenecks are. In Uptime Institute’s Supply Chain Survey, 36% of operators said they do not have adequate visibility into the supply-chain information of key data center equipment vendors. In the same summary, operators pointed to expected shortages affecting critical infrastructure categories—highlighting how supply constraints can ripple through an entire build, even if one component arrives late.

Labor is the second half of the restraint. Circuit breakers are not plug-and-play at data-center scale: they need coordination studies, correct settings, acceptance testing, labeling, documentation, and careful energization plans. Uptime’s Global Data Center Survey 2024 reports that vendors rank “forecasting future capacity requirements” as customers’ top challenge, but “lack of qualified staff” is close behind, and the report notes that over half of vendors say data center staff shortages will limit growth. In the same document, the trend line shown for “agree” sits around 50% in 2024.

Government data reinforces why these constraints are getting tighter. The U.S. Department of Energy reports that data centers used about 176 TWh in 2023 and could rise to 325–580 TWh by 2028, representing roughly 6.7% to 12% of total U.S. electricity use. More sites coming online at the same time means more competition for the same ecosystem of gear and skilled people. Even if breakers themselves are available, upstream equipment and field labor availability can still hold projects back, forcing staged energizations or temporary operating modes that buyers would rather avoid.

Opportunity

Smart, Metered Power Trains Create a Big Upgrade Cycle

One major growth opportunity for circuit breakers in data centers is the shift toward smart, metered, and software-visible power distribution. Operators are under pressure to add capacity quickly, but they also need tighter control of risk and energy use. That combination is pushing data centers to modernize switchgear rooms, UPS output sections, busways, and distribution panels with breakers that can measure, communicate, and support predictive maintenance—not just trip during a fault. In simple terms, the breaker is becoming a data source, not only a safety device, and that opens a clear upgrade path across both new builds and retrofits.

The numbers behind load growth are strong enough to justify this investment. The International Energy Agency estimates global electricity use by data centres is set to more than double to around 945 TWh by 2030, with consumption growing about 15% per year from 2024 to 2030 in its base case. When electricity demand rises at that speed, operators cannot rely on “set it and forget it” protection. Higher power densities can mean higher fault levels, more complex coordination settings, and greater consequences from a single mis-operation.

In the U.S., the growth curve is especially steep, which makes modernization projects more likely. The U.S. Department of Energy reported that data centers used 176 TWh in 2023 (about 4.4% of total U.S. electricity), and it estimates demand could rise to 325–580 TWh by 2028, or roughly 6.7% to 12% of total U.S. electricity use. That kind of expansion creates a practical opportunity for breaker makers and integrators: not every site can build new substations instantly, so many will squeeze more value out of existing electrical rooms by improving monitoring, fault selectivity, and maintenance planning—areas where intelligent breakers and digital trip units directly help.

The business case gets even clearer when outage costs are considered. Uptime Institute’s 2024 resiliency findings show 54% of operators said their most recent significant outage cost more than $100,000, and 16% said it exceeded $1 million. Power issues are also repeatedly identified as a leading cause of serious and severe data-center outages.

Regional Insights

North America leads with 36.5% share, valued at USD 0.3 Bn, backed by heavy data-center load growth.

In 2024, North America held a dominant position in the circuit breaker for data centers market with 36.5% share, valued at USD 0.3 Bn. The region’s strength is closely tied to the scale-up of large cloud and AI facilities, where power protection is not optional—it is a reliability requirement. In the U.S., data centers consumed 176 TWh of electricity in 2023, and the U.S. Department of Energy highlights that demand is expected to rise sharply, with a range of 325–580 TWh by 2028 depending on scenario.

From a regional hotspot perspective, Northern Virginia continues to shape North American buildouts. A Virginia JLARC study notes Dominion’s forecast that data center peak demand could reach 9 GW over the next 10 years, materially lifting system peak expectations. When utilities and operators plan for that kind of concentration, procurement shifts toward robust breakers designed for high duty cycles, safer maintenance isolation, and strong short-circuit performance at critical nodes.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ABB supports data center power protection with circuit breakers used across low- and medium-voltage systems. The company operates in over 100 countries and employs more than 105,000 people globally. In 2024–2025, ABB focused on breakers supporting higher fault levels and digital monitoring, helping large data centers manage rising electrical loads and uptime expectations.

Siemens AG supports data centers with circuit breakers integrated into advanced electrical infrastructure solutions. Active in 190+ countries and backed by 300,000+ employees, Siemens strengthened its breaker offerings in 2024–2025 to address higher power densities, ensuring stable distribution and long-term reliability in large and mission-critical data centers.

Eaton provides circuit breakers widely used in data center power distribution systems. The company operates in 160+ countries with approximately 85,000 employees. In 2024, Eaton focused on breakers rated for high-current applications, supporting modular data center growth and helping operators reduce downtime through dependable protection technologies.

Top Key Players Outlook

- ABB

- GE Vernova

- Schneider Electric

- Eaton

- Siemens AG

- Mitsubishi Electric Corporation

- Toshiba

- Atom Power Inc.

- CHINT Group

Recent Industry Developments

In 2024, Schneider Electric posted €38.15 bn revenues, backed by ~177,000 employees serving customers worldwide and strong growth in its data center and infrastructure businesses.

Siemens reported around 327,000 employees as of September 30, 2024, showing the scale behind its engineering, manufacturing, and service support for critical electrification equipment used in data centers.

Report Scope

Report Features Description Market Value (2024) USD 1.1 Bn Forecast Revenue (2034) USD 4.0 Bn CAGR (2025-2034) 13.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Data Center Type (Hyperscale, Colocation, Enterprise), By Voltage (Low Voltage, Medium Voltage, High Voltage), By Rated Current (Less than 500 A, 500 A to 1,500 A, 2,500 A to 4,500 A, Greater than 4,500 A), By Type (Air Circuit Breakers, Vacuum Circuit Breakers, Oil Circuit Breakers, Others), By Application (Power Distribution, Power Transmission) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB, GE Vernova, Schneider Electric, Eaton, Siemens AG, Mitsubishi Electric Corporation, Toshiba, Atom Power Inc., CHINT Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Circuit Breaker For Data Centers MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Circuit Breaker For Data Centers MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB

- GE Vernova

- Schneider Electric

- Eaton

- Siemens AG

- Mitsubishi Electric Corporation

- Toshiba

- Atom Power Inc.

- CHINT Group