Global Christmas Tree Valves Market Size, Share, And Enhanced Productivity By Product Type (Ball Valve, Gate Valve, Globe Valve, Butterfly Valve, Check Valve), By Type (Horizontal Tree, Vertical Tree), By Operation (Manual, Hydraulic, Pneumatic, Electric), By Location (Onshore, Offshore), By Application (Oil Wells, Gas Wells, Water Disposal Wells, Water Injection Wells, Gas Injection Wells, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 177458

- Number of Pages: 201

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

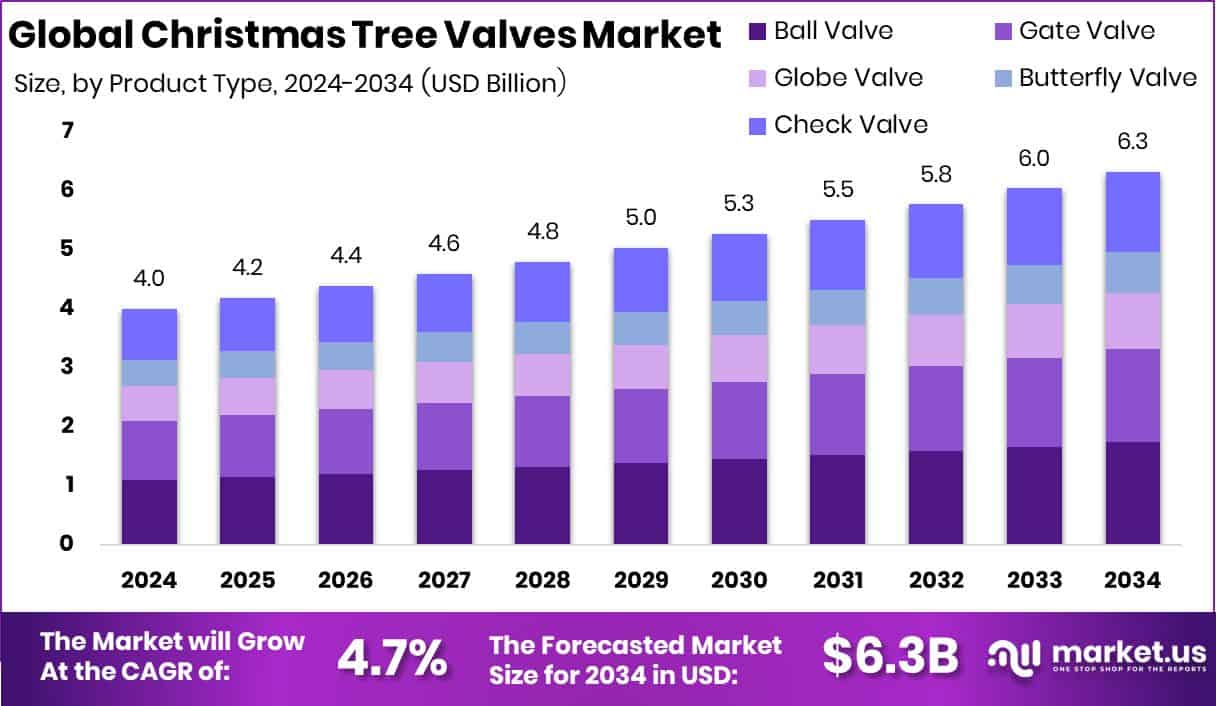

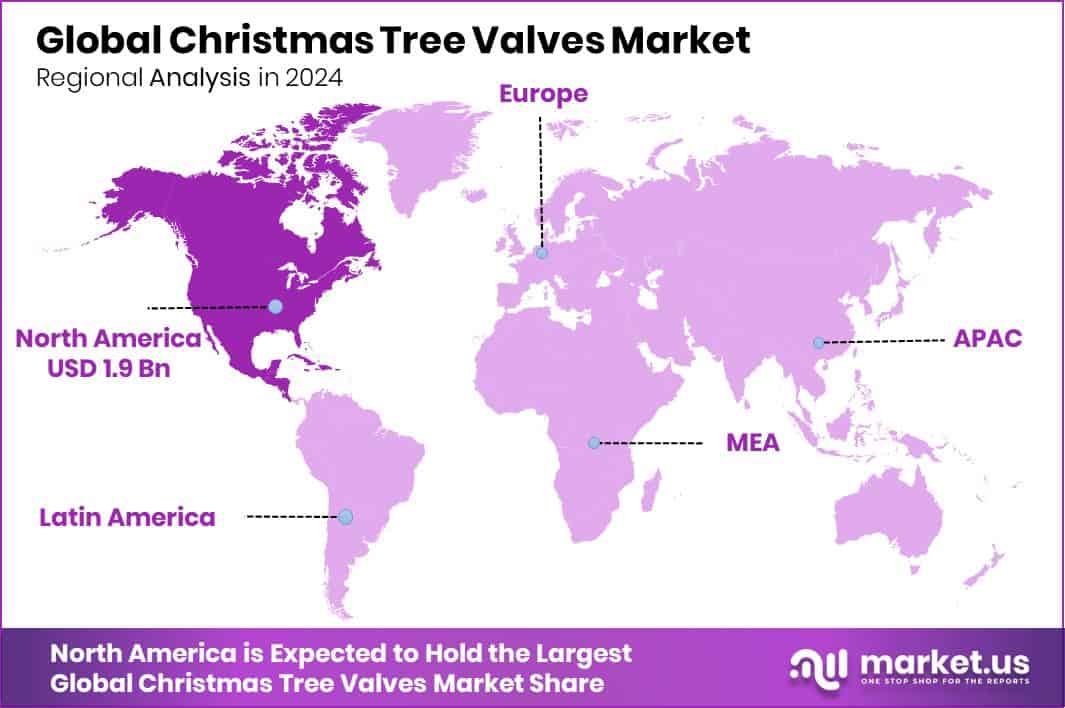

The Global Christmas Tree Valves Market is expected to be worth around USD 6.3 billion by 2034, up from USD 4.0 billion in 2024, and is projected to grow at a CAGR of 4.7% from 2025 to 2034. The region of North America dominated with a 47.9% contribution, totalling USD 1.9 Bn overall.

Christmas tree valves are essential flow-control assemblies installed on oil, gas, and injection wells to manage pressure, regulate production, and ensure safe operations. Built with components such as ball, gate, globe, butterfly, and check valves, they form the core interface between the wellbore and surface or subsea equipment. The Christmas Tree Valves Market represents the global demand for these assemblies across onshore, offshore, and injection applications, driven by drilling activity, well maintenance cycles, and long-term reservoir management.

Growth in this market is supported by rising well intervention needs and expanding production projects. Demand also increases as operators seek safer, more efficient systems across oil and gas wells. External developments—like a well-known streamer losing $32,000 to malware or a major gaming industry founder purchasing a $300 million deep-ocean exploration vessel—show how broader technology and investment movements continue influencing engineering innovation and digital protection measures within industrial equipment.

Opportunities are further encouraged by public funding and infrastructure support. A U.S. representative recently secured $10 million for regional projects, and an administration awarded $3.5 million to improve water and sewage safety—both indirectly reinforcing the need for dependable flow-control systems similar to those used in well operations. Meanwhile, a leading game studio raising $100 million reflects ongoing capital availability for high-tech engineering, which often spills into industrial valve innovation.

Key Takeaways

- The Global Christmas Tree Valves Market is expected to be worth around USD 6.3 billion by 2034, up from USD 4.0 billion in 2024, and is projected to grow at a CAGR of 4.7% from 2025 to 2034.

- Ball valves dominate product preferences with a 27.5% share, strengthening reliability across global Christmas Tree Valves operations.

- Horizontal tree systems lead the market at 67.1%, driven by improved installation efficiency and operational flexibility.

- Electric operation type accounts for 32.8%, reflecting increasing adoption of automation in wellhead valve control.

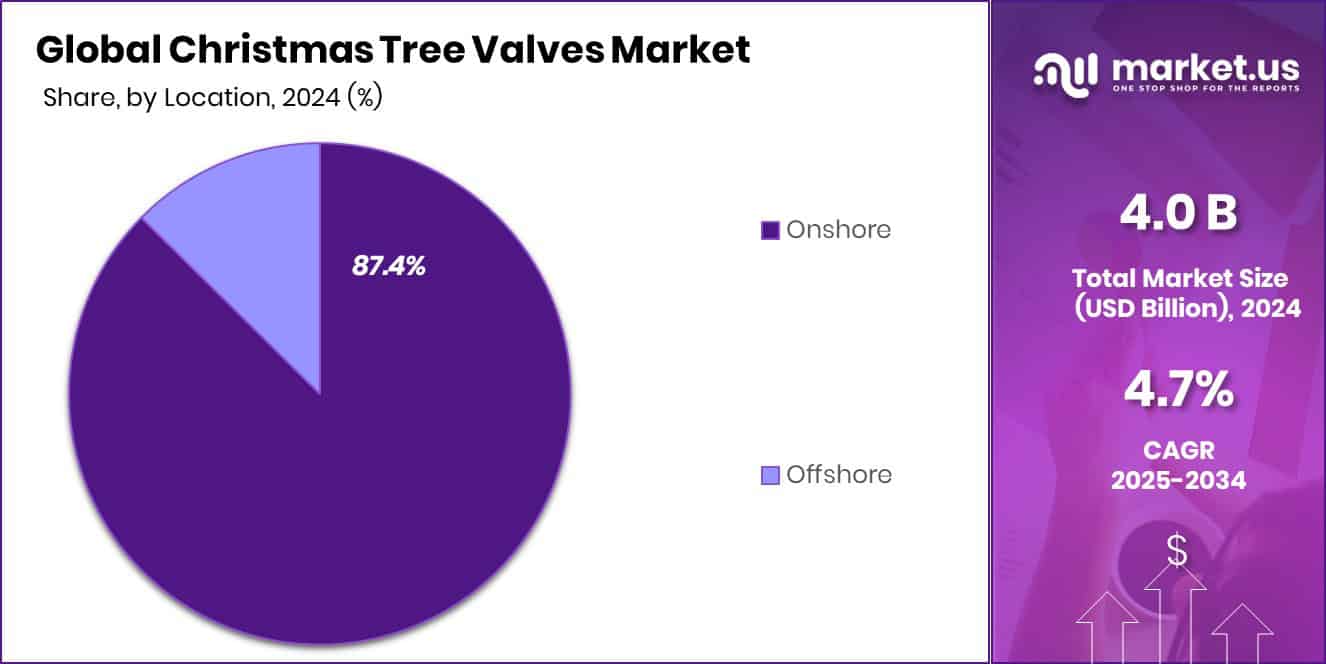

- Onshore installations represent 87.4%, highlighting strong demand for cost-efficient Christmas Tree Valve deployment.

- Oil wells hold 51.7% share, showcasing the sector’s primary reliance on Christmas Tree Valve technologies.

- In North America, the market achieved a 47.9% share, valued at USD 1.9 Bn.

By Product Type Analysis

Ball valve products dominate the market, holding a strong 27.5% global share.

In 2024, the Christmas Tree Valves Market saw strong growth, with Ball Valves holding a dominant 27.5% share among product types. Their reliability, tight sealing features, and ability to manage high-pressure flow in oil and gas wells made them the preferred choice for operators looking for durability and low maintenance.

Companies continued investing in improved metal-seated and corrosion-resistant ball valve designs, ensuring stability even in challenging offshore and onshore drilling environments. The rise in enhanced recovery projects and maturing field operations further supported demand, as operators sought valves that can function efficiently under intense operational cycles. As energy companies prioritize safety and long-term asset integrity, ball valves remain a central component in wellhead architecture.

By Type Analysis

Horizontal tree systems lead the industry with an impressive 67.1% market presence.

In 2024, Horizontal Trees accounted for 67.1% of the market, reflecting their expanding use in subsea and deepwater projects. Their lower profile, ease of installation, and compatibility with advanced subsea processing systems allowed operators to reduce operational risk and improve control efficiency. Horizontal trees also make interventions more streamlined, helping operators reduce downtime during well servicing.

Energy companies investing in long-tieback developments and complex deepwater reservoirs increasingly prefer horizontal tree setups due to their modular design. Additionally, their ability to support high pressures and temperatures made them suitable for unconventional fields. As offshore exploration expands globally, the demand for horizontal trees continues to rise, strengthening their leadership in the Christmas Tree Valves Market.

By Operation Analysis

Electric operation technology continues expanding rapidly, securing a solid 32.8% adoption rate.

In 2024, Electric-operated systems captured 32.8% of the Christmas Tree Valves Market, driven by the shift toward automation and digital control in critical well operations. Electric actuation provides faster response times, improved precision, and lower operational costs compared to hydraulic systems. In remote offshore fields, electric systems also reduce infrastructure complexity by minimizing fluid-handling equipment.

As oil companies adopt smart well technologies, electric-powered valves allow real-time monitoring, remote diagnostics, and predictive maintenance—helping boost operational efficiency. Their environmental benefits, including zero hydraulic leaks and reduced energy consumption, further support adoption. With digital oilfield strategies gaining traction, electric actuation continues to evolve as a preferred solution for modern wellhead valve systems.

By Location Analysis

Onshore installations remain the priority segment, accounting for a commanding 87.4% share.

In 2024, the Onshore segment dominated with 87.4% of the Christmas Tree Valves Market, reflecting the widespread drilling activity in mature and emerging oil-producing regions. Onshore operations benefit from lower installation costs, easier accessibility, and simplified maintenance procedures, making advanced valve systems more feasible across various field sizes.

Countries investing in enhanced oil recovery, shale development, and redevelopment of aging wells boosted demand for robust, cost-effective wellhead valves. Onshore fields also rely on standardized tree configurations that speed up deployment and reduce operational downtime. As global energy demand remains steady, continued investment in onshore exploration and revitalization projects keeps this segment firmly in the lead within the Christmas Tree Valves Market.

By Application Analysis

Oil wells represent the core application, contributing 51.7% to overall market demand.

In 2024, Oil Wells accounted for 51.7% of the total application share in the Christmas Tree Valves Market, reflecting their central role in global hydrocarbon production. Christmas tree assemblies in oil wells ensure precise flow control, safe pressure management, and reliable shut-in capability, especially in high-productivity zones.

The increasing number of conventional and unconventional drilling projects continues to fuel demand for dependable valve systems built to withstand extreme conditions. Operators are also upgrading older wells with modern valve technologies to extend field life and enhance output. With global crude consumption stabilizing and several regions expanding drilling operations, oil wells remain the primary driver of Christmas tree valve demand across onshore and offshore fields.

Key Market Segments

By Product Type

- Ball Valve

- Gate Valve

- Globe Valve

- Butterfly Valve

- Check Valve

By Type

- Horizontal Tree

- Vertical Tree

By Operation

- Manual

- Hydraulic

- Pneumatic

- Electric

By Location

- Onshore

- Offshore

By Application

- Oil Wells

- Gas Wells

- Water Disposal Wells

- Water Injection Wells

- Gas Injection Wells

- Others

Driving Factors

Rising drilling activities boost valve demand

Rising drilling activities continue to boost demand for Christmas tree valves because operators require reliable flow-control equipment to manage pressure and production in both new and mature wells. The overall momentum in well development aligns with broader funding efforts that indirectly strengthen engineering and infrastructure capabilities.

A recent example is the $3.7 million AHA grant awarded to launch a Rheumatic Heart Disease Center, which, although healthcare-focused, reflects how technical research funding supports advancements in precision equipment and monitoring technologies. Such external investments help elevate expectations around safety, durability, and system accuracy—factors that positively reinforce demand for advanced valve assemblies in drilling environments where reliability remains essential for uninterrupted operations.

Restraining Factors

High installation costs limit adoption

High installation costs continue to limit broader adoption of Christmas tree valves, particularly in smaller onshore operations where budgets remain tight. These systems require quality materials, strict testing, and skilled labor, all of which elevate upfront expenses. This financial pressure mirrors broader economic patterns, such as Discord raising $150 million in new funding, highlighting how organizations across industries must secure large capital pools to support advanced technology development.

For operators in oil and gas, not all have the flexibility to allocate significant funds upfront, causing delays or scaled-down adoption of modern valve configurations despite operational advantages.

Growth Opportunity

Digital monitoring systems create new possibilities

Digital monitoring systems offer new possibilities for Christmas tree valves by allowing operators to track pressure, temperature, flow behavior, and safety conditions in real time. As fields become more complex, these smart systems help reduce downtime and prevent unexpected failures. Broader public investments also reflect growing interest in advanced monitoring infrastructure.

For example, Kalamazoo, Michigan, approved $2 million for smart water meters, reinforcing how sectors are shifting toward connected, data-driven equipment. This same push toward smarter infrastructure creates a strong opportunity for intelligent valve technologies in well operations, where predictive insights enable improved production and safer well management.

Latest Trends

Rapid shift toward automated valve systems

A rapid shift toward automated valve systems is shaping the Christmas Tree Valves Market, as operators prioritize remote control, consistent performance, and reduced intervention risks. Automation provides smoother well management, especially in high-pressure or hard-to-reach environments like deepwater locations.

Similar momentum is visible in other engineering sectors, such as Trisol Medical, raising $2.7 million for heart valve innovation, reflecting strong financial interest in precision-driven control systems. These advancements reinforce how industries are moving toward smarter, sensor-integrated components, a trend that aligns directly with the growing adoption of automated Christmas tree valve technologies.

Regional Analysis

North America led the Christmas Tree Valves Market with 47.9%, reaching USD 1.9 Bn.

In the Christmas Tree Valves Market, North America remained the leading region in 2024, contributing a dominant 47.9% share valued at USD 1.9 Bn, supported by extensive onshore drilling activity and steady well intervention programs across the U.S. and Canada.

Europe followed with stable demand driven by mature field redevelopment and strict operational standards that encourage the use of advanced valve assemblies. In the Asia-Pacific region, rising exploration projects and expanding energy requirements continued to strengthen adoption across emerging oil-producing economies.

Meanwhile, the Middle East & Africa maintained steady consumption as national oil companies focused on production optimization in large conventional reservoirs. Latin America also recorded consistent uptake, supported by ongoing well development activities in key hydrocarbon basins. Across all regions, demand remained closely tied to drilling intensity, reservoir management needs, and long-term field production strategies.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Schlumberger continued shaping the market through its strong engineering capabilities and broad wellhead equipment portfolio, enabling operators to enhance performance across complex onshore and offshore wells. The company’s emphasis on reliability and precision in pressure-control systems helped strengthen its role in high-volume field development programs.

Baker Hughes maintained a competitive stance with its advanced tree valve designs tailored for challenging drilling conditions. Its focus on durability, operational safety, and lifecycle efficiency positioned the company as a preferred partner for operators upgrading or expanding well infrastructure. Baker Hughes’ ability to integrate valve systems with digital monitoring tools further supported dependable field operations.

Meanwhile, Aker Solutions remained influential in subsea Christmas tree architectures, particularly in deepwater environments where technical precision is essential. The company’s engineering depth and experience in subsea production systems contributed to streamlined installation, intervention, and long-term performance. Across all three players, 2024 highlighted a common emphasis on robust design, operational efficiency, and sustained field reliability—core priorities driving customer demand in the Christmas Tree Valves Market.

Top Key Players in the Market

- Schlumberger

- Baker Hughes

- Aker Solutions

- TechnipFMC

- Kingsa

- Stream-Flo Industries

- Shreeraj Industries

- Worldwide Oilfield Machine (WOM)

- American Completion Tools

- ITAG International Qatar

Recent Developments

- In August 2025, Baker Hughes completed the acquisition of Continental Disc Corporation (CDC) for about USD 540 million, adding CDC’s pressure-control and safety valve products to its portfolio. CDC makes critical pressure-relief and safety devices that support overall flow control equipment used in oil, gas, and industrial systems. This move expands Baker Hughes’ valve capabilities and strengthens its position in supplying robust control systems for complex field operations.

- In April 2024, Schlumberger announced a definitive all-stock agreement to acquire ChampionX, a specialised oilfield technology and controls company. This strategic move is meant to strengthen Schlumberger’s equipment and digital services portfolio, potentially improving capabilities around wellhead systems and associated control technologies used with Christmas tree valves by integrating deeper production and automation expertise. This deal was intended to enhance operational life and equipment integration across production systems.

Report Scope

Report Features Description Market Value (2024) USD 4.0 Billion Forecast Revenue (2034) USD 6.3 Billion CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Ball Valve, Gate Valve, Globe Valve, Butterfly Valve, Check Valve), By Type (Horizontal Tree, Vertical Tree), By Operation (Manual, Hydraulic, Pneumatic, Electric), By Location (Onshore, Offshore), By Application (Oil Wells, Gas Wells, Water Disposal Wells, Water Injection Wells, Gas Injection Wells, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Schlumberger, Baker Hughes, Aker Solutions, TechnipFMC, Kingsa, Stream-Flo Industries, Shreeraj Industries, Worldwide Oilfield Machine (WOM), American Completion Tools, ITAG International Qatar Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Christmas Tree Valves MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Christmas Tree Valves MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Schlumberger

- Baker Hughes

- Aker Solutions

- TechnipFMC

- Kingsa

- Stream-Flo Industries

- Shreeraj Industries

- Worldwide Oilfield Machine (WOM)

- American Completion Tools

- ITAG International Qatar