Global Ceramic Matrix Composites Market By Product (Oxides, Silicon Carbide, Carbon, Others), By Matrix Type (Oxide Matrix, Silicon Carbide Matrix, Carbon Matrix), By Fiber Type (Continuous, Woven, Others), By Application(Aerospace, Defense, Energy and Power, Electrical and Electronics, Others) , Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2025

- Report ID: 137576

- Number of Pages: 379

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

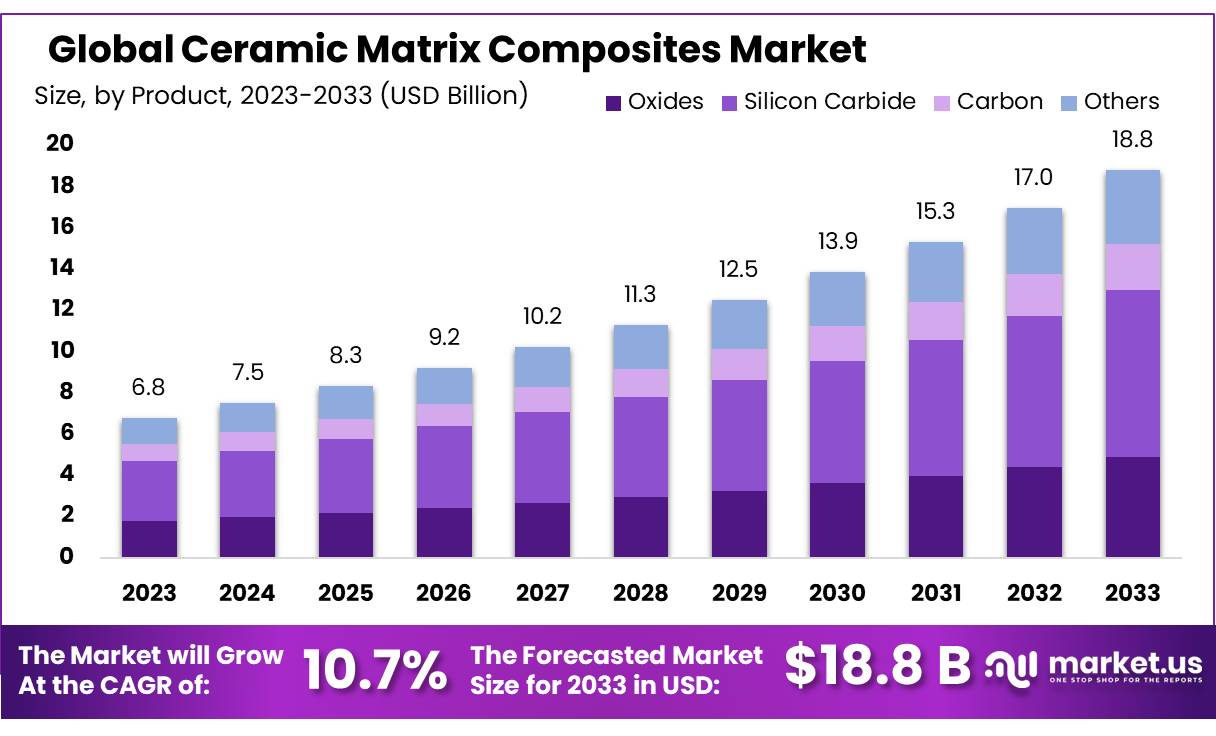

The Global Ceramic Matrix Composites Market size is expected to be worth around USD 18.8 Bn by 2033, from USD 6.8 Bn in 2023, growing at a CAGR of 10.7% during the from 2024 to 2033.

Ceramic Matrix Composites Market are advanced materials that combine ceramic fibers embedded in a ceramic matrix, offering exceptional properties such as high-temperature resistance, low density, and superior mechanical strength. These materials are designed to overcome the brittleness of traditional ceramics, making them ideal for applications in aerospace, defense, energy, and automotive sectors. Their ability to maintain structural integrity under extreme conditions has positioned them as key enablers for innovations in high-performance industries.

The Ceramic Matrix Composites reflects robust growth, driven by their increasing adoption in aerospace and defense sectors. For instance, CMCs are extensively used in jet engines for components like turbine blades, nozzles, and shrouds, enabling engines to operate at higher temperatures with improved efficiency. The aerospace sector accounted for over 35% of the total CMC demand in 2023, with manufacturers such as Boeing and Airbus integrating CMCs into advanced aircraft designs to reduce weight and enhance fuel efficiency. Additionally, the energy sector has embraced CMCs for applications in gas turbines and nuclear reactors, benefiting from their thermal stability and corrosion resistance.

Key driving factors include the rising demand for lightweight materials that enhance fuel efficiency and reduce emissions. The automotive industry is leveraging CMCs in brake systems and engine components to achieve better performance and compliance with stringent emission norms. For instance, by replacing metal alloys with CMCs, brake discs achieve a weight reduction of up to 60%, directly impacting vehicle fuel economy. Moreover, the global push for decarbonization has led to increased investments in energy-efficient technologies, further propelling the adoption of CMCs in clean energy solutions.

Emerging trends in the CMC market highlight a surge in demand for silicon carbide (SiC) and carbon fiber-reinforced composites. These variants are gaining traction for their superior thermal properties and versatility across various sectors. In 2022, SiC-based CMCs represented approximately 50% of the total market share, with the adoption in high-stress environments like aerospace and power generation. Additionally, advancements in additive manufacturing (3D printing) are revolutionizing the production of CMC components, enabling cost-efficient and precise fabrication.

Future growth opportunities for CMCs are vast, particularly in space exploration and hypersonic vehicles, where their ability to withstand temperatures exceeding 2,000°C makes them indispensable. The defense sector’s increasing investments in missile systems and next-generation aircraft will further drive demand. Furthermore, as industries prioritize sustainability, recycling and secondary applications of CMCs are gaining importance. The market is poised for exponential growth, supported by innovations in material science and increasing adoption across emerging economies, solidifying CMCs as a cornerstone of modern high-performance materials.

Key Takeaways

- Ceramic Matrix Composites Market size is expected to be worth around USD 18.8 Bn by 2033, from USD 6.8 Bn in 2023, growing at a CAGR of 10.7%.

- Silicon Carbide held a dominant market position in the Ceramic Matrix Composites (CMC) sector, capturing more than a 43.3% share.

- Silicon Carbide Matrix segment held a dominant market position in the Ceramic Matrix Composites market, capturing more than a 48.4% share.

- Continuous fiber type held a dominant market position in the Ceramic Matrix Composites (CMC) sector, capturing more than a 55.6% share.

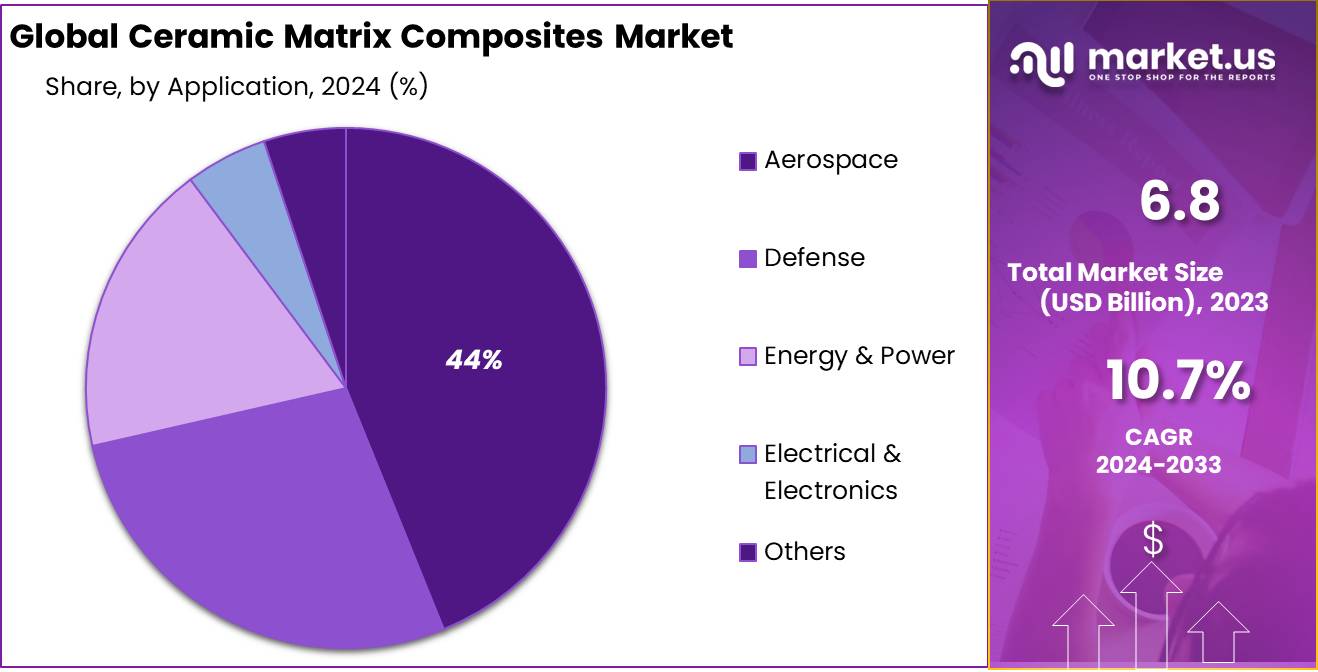

- Aerospace sector held a dominant market position in the Ceramic Matrix Composites (CMC) market, capturing more than a 43.5% share.

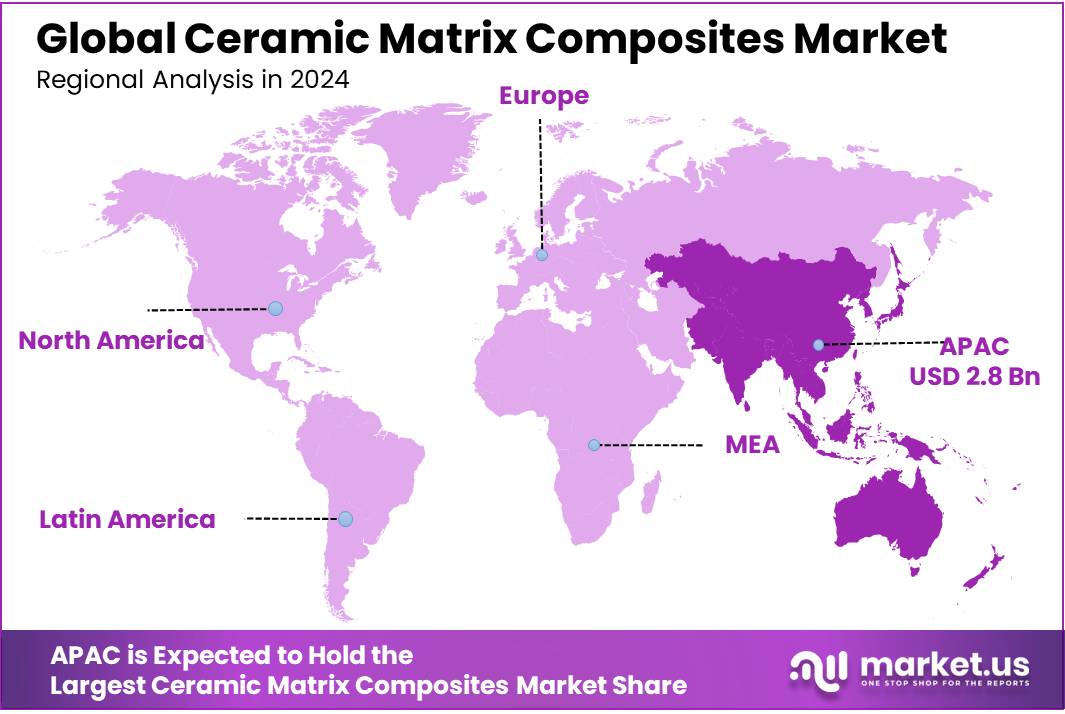

- North America leading with a dominating 42.1% market share, valued at USD 2.8 billion.

By Product

In 2023, Silicon Carbide held a dominant market position in the Ceramic Matrix Composites (CMC) sector, capturing more than a 43.3% share. This material is highly valued for its exceptional heat resistance and mechanical properties, making it ideal for applications in aerospace, automotive, and energy sectors. The demand for Silicon Carbide is driven by its ability to enhance the performance of components exposed to extreme conditions, contributing to its large market share.

Oxide-based ceramic matrix composites also represent a segment of the market. These composites are preferred for their thermal and chemical stability, which are crucial in high-temperature environments such as those found in gas turbines and nuclear reactors. In 2023, the growing push for more efficient energy solutions has spurred increased adoption of Oxide CMCs, reflecting their critical role in modern industrial applications.

Carbon-based CMCs are another important segment, known for their low weight and high strength. These characteristics make them suitable for use in defense and aerospace industries, where the reduction of equipment weight is essential for performance and fuel efficiency. The development of new manufacturing processes and the introduction of more cost-effective production techniques are expected to boost the market growth for Carbon CMCs in the coming years.

By Matrix Type

In 2023, the Silicon Carbide Matrix segment held a dominant market position in the Ceramic Matrix Composites market, capturing more than a 48.4% share. This matrix type is highly favored for its exceptional thermal conductivity and resistance to thermal shock, making it indispensable in industries such as aerospace, automotive, and electronics. The durability and high-performance characteristics of Silicon Carbide Matrix composites under extreme conditions drive their widespread adoption.

Oxide Matrix segment, which is also crucial to its ability to withstand high temperatures and corrosive environments without degrading. Oxide Matrix composites are especially relevant in applications requiring long life and reliability under stress, such as in gas turbines and nuclear reactors. The segment’s growth is propelled by the increasing demand for materials that can maintain integrity in high-temperature operations.

The Carbon Matrix segment, although smaller in market share, plays a pivotal role to its lightweight and high-strength properties. This matrix type is particularly valuable in the defense and aerospace sectors, where the reduction in weight can lead to performance improvements and fuel savings. As manufacturing techniques evolve and become more cost-effective, the potential for Carbon Matrix composites continues to expand.

By Fiber Type

In 2023, the Continuous fiber type held a dominant market position in the Ceramic Matrix Composites (CMC) sector, capturing more than a 55.6% share. This fiber configuration is particularly favored for its high strength and stiffness, which are critical in applications requiring superior mechanical performance and durability, such as in aerospace components and automotive parts. Continuous fibers are preferred because they provide enhanced load-bearing capacity and improved impact resistance, making them ideal for complex engineering applications where reliability is paramount.

Woven fibers also form a part of the CMC market. Woven fibers are notable for their multidirectional strength, which provides unique structural benefits that are crucial in various manufacturing processes. This type of fiber is often used where the material needs to withstand forces from multiple directions, such as in protective armor and certain automotive applications. The flexibility and adaptability of Woven fibers make them suitable for a wide range of uses, contributing to their substantial market presence.

By Application

In 2023, the Aerospace sector held a dominant market position in the Ceramic Matrix Composites (CMC) market, capturing more than a 43.5% share. This segment’s prominence is primarily to the critical role CMCs play in enhancing the performance and efficiency of aerospace components. These composites are highly valued for their ability to withstand extreme temperatures and stresses, making them ideal for use in jet engines and spacecraft structures where traditional materials might fail.

Defense sector also represents a application area for CMCs. In this sector, the materials are used for their lightweight and high-strength properties, contributing to the production of military vehicles and protective gear that require enhanced ballistic protection and durability under combat conditions.

The Energy & Power sector utilizes CMCs in high-temperature environments such as turbine blades and nuclear reactors, where conventional materials might degrade. The adoption of CMCs in this sector is driven by their excellent thermal resistance and longevity, supporting more efficient and reliable power generation systems.

In the Electrical & Electronics sector, CMCs are important to their insulating properties and resistance to thermal shock, making them suitable for semiconductor manufacturing and electronic packaging. This sector benefits from the ability of CMCs to ensure the stability and performance of electronic components in demanding operational conditions.

Key Market Segments

By Product

- Oxides

- Silicon Carbide

- Carbon

- Others

By Matrix Type

- Oxide Matrix

- Silicon Carbide Matrix

- Carbon Matrix

By Fiber Type

- Continuous

- Woven

- Others

By Application

- Aerospace

- Defense

- Energy & Power

- Electrical & Electronics

- Others

Drivers

Advancements in Aerospace Technology

One of the major driving factors for the growth of the Ceramic Matrix Composites (CMC) market is the advancements in aerospace technology. As aerospace engines and systems become more complex, the demand for materials that can withstand extreme conditions while maintaining performance has dramatically increased. Ceramic Matrix Composites, known for their high-temperature stability, lightweight, and resistance to wear and tear, are increasingly being integrated into aerospace applications.

The growing number of aerospace projects, including both commercial and military aircraft, necessitates the use of materials that contribute to fuel efficiency and performance improvements. For instance, the use of CMCs in jet engine components can reduce the weight of the engine, enhancing fuel efficiency and reducing emissions. According to recent data from government aerospace agencies, the integration of CMCs can lead to a weight reduction of up to 50% in certain engine components compared to traditional materials. This substantial decrease in weight directly correlates with an increase in fuel efficiency and a reduction in operational costs.

CMCs are capable of operating at temperatures hundreds of degrees higher than metals without cooling. This attribute allows for engines to run at higher temperatures, thus improving their efficiency. Aerospace giants and government bodies are investing heavily in research and development to capitalize on these properties. For example, several aerospace manufacturers have ongoing projects funded by national aerospace agencies aimed at enhancing the performance capabilities of CMCs, particularly focusing on their high-temperature operational limits.

These advancements are not just limited to traditional aerospace sectors. The rise of private space exploration companies has also played a crucial role in pushing the boundaries of what’s possible with CMCs. These companies are exploring ways to use CMCs in spacecraft, where durability and resistance to extreme fluctuations in temperature are critical for the safety and success of missions.

Government initiatives aimed at reducing carbon footprints have also supported the adoption of CMCs in aerospace applications. Regulatory bodies in major economies have implemented guidelines that encourage the use of environmentally friendly materials. Ceramic Matrix Composites, with their superior performance and reduced environmental impact, are increasingly seen as a key material in meeting these regulatory standards.

Restraints

High Production Costs of Ceramic Matrix Composites

One of the factor restraining the growth of the Ceramic Matrix Composites (CMC) market is the high cost of production associated with these materials. The advanced manufacturing processes required to produce CMCs involve sophisticated equipment, high-quality raw materials, and substantial energy consumption, all of which contribute to elevated production costs.

The complex fabrication process of CMCs typically includes the use of costly precursors and a need for controlled environments to achieve the desired material properties. For instance, the production of silicon carbide matrix composites, one of the most popular types of CMCs, requires precise temperature and atmosphere control to prevent material degradation or defects that could compromise the composite’s structural integrity. These stringent production conditions necessitate the use of high-end technological setups and skilled labor, further driving up costs.

The raw materials required for manufacturing CMCs, such as high-purity ceramic powders and reinforcing fibers, are expensive. The price of these materials is influenced by the limited availability of suitable quality raw materials and the costs associated with their processing and refinement. This is particularly true for fibers like carbon and silicon carbide, which are critical for the performance of CMCs but come with a high price tag to their complex production techniques.

Additionally, the energy-intensive nature of CMC production, which often involves high-temperature furnaces and lengthy processing times, adds to the overall cost. Energy costs can be a portion of the total production expenses, especially in regions where energy prices are high or fluctuating.

Government initiatives and industry regulations can also indirectly contribute to these costs. For example, environmental regulations may require manufacturers to invest in pollution control technologies or to adopt more expensive but less polluting processes. These regulatory compliances, while beneficial for environmental protection, can increase operational costs and slow down the adoption of CMCs across industries.

Opportunity

Expansion into Renewable Energy Applications

A growth opportunity for the Ceramic Matrix Composites (CMC) market lies in the renewable energy sector. As the global push towards sustainable energy solutions intensifies, the demand for materials that can withstand extreme environments while maintaining high efficiency is increasing. CMCs are uniquely positioned to meet these needs to their excellent high-temperature capabilities and resistance to wear and corrosion.

In wind energy, for example, turbine efficiency can be substantially improved by using CMCs in the construction of turbine blades. These composites can withstand the mechanical stresses and environmental factors associated with high-speed rotation and variable weather conditions, which often cause conventional materials to fail. According to industry studies, using CMCs in wind turbines could increase their lifespan and reduce maintenance costs, making wind energy more cost-effective and reliable.

Similarly, in solar energy applications, CMCs can be used to enhance the durability and heat resistance of components in concentrated solar power plants. These plants require materials that can handle high thermal loads without degrading over time, a requirement perfectly suited to the properties of CMCs. The ability to operate at higher temperatures also allows for greater thermal efficiency, translating to more electricity generated per unit of sunlight.

The adoption of CMCs in the renewable energy sector is also encouraged by various government initiatives aimed at reducing carbon emissions and promoting clean energy technologies. These initiatives often come with financial incentives such as grants, tax breaks, and subsidies, which can help offset the higher initial costs of using advanced materials like CMCs.

The government policies are leading to technological advancements that make CMCs more attractive. For instance, recent breakthroughs in manufacturing technologies have begun to lower the cost of producing CMCs, making them more competitive with traditional materials.

The renewable energy sector’s rapid expansion presents a vast market for CMCs to replace traditional materials in high-performance applications. As the world increasingly turns to green technology, the demand for materials that can meet the rigorous demands of renewable energy applications is expected to drive a growth in the CMC market. This shift not only highlights the material’s economic potential but also its role in fostering sustainable industrial practices.

Trends

Integration of CMCs in Electric Vehicle Manufacturing

The Ceramic Matrix Composites (CMC) market is their increasing integration into electric vehicle (EV) manufacturing. As the automotive industry shifts towards electric mobility, the demand for lightweight, high-strength, and thermally resistant materials has surged, positioning CMCs as a key material in this transformation.

CMCs are being increasingly used in electric vehicles for components such as brake rotors, battery casings, and electrical insulation. Their ability to withstand high temperatures and offer superior thermal management makes them ideal for use in battery modules and electric motors, where heat accumulation can affect performance and safety. For instance, the use of silicon carbide-based CMCs in electric motor components can improve efficiency by reducing energy losses to heat.

This trend is driven by the automotive industry’s need to meet stringent emissions regulations and improve vehicle efficiency. Lightweight materials like CMCs contribute to a reduction in overall vehicle weight, which directly translates into better battery efficiency and extended range for electric vehicles. According to industry analyses, reducing a vehicle’s weight by 10% can lead to a 6% to 8% increase in driving range, a critical factor in consumer acceptance of EVs.

Government initiatives around the world to promote electric vehicles through subsidies and tax incentives are further accelerating this trend. These policies aim to reduce carbon footprints by encouraging the adoption of cleaner technologies. For example, several countries in Europe and Asia have set ambitious targets to phase out internal combustion engines over the next few decades, which is boosting investments in electric vehicle technology and associated materials like CMCs.

Moreover, collaborations between automotive manufacturers and material science companies are fostering innovation in this space. These partnerships are focused on developing new CMC formulations that are cost-effective and tailored for mass production in the automotive sector. The ongoing research is not only making CMCs more accessible but also optimizing their properties for specific applications in electric vehicles.

The increasing use of CMCs in electric vehicle manufacturing is not just a trend; it represents a fundamental shift in material selection criteria within the automotive industry, driven by the need for sustainability and performance. As the global demand for electric vehicles continues to grow, CMCs are set to play a pivotal role in the future of automotive design and manufacturing, making this one of the most growth opportunities in the material science sector.

Regional Analysis

In 2023, the Ceramic Matrix Composites (CMC) market saw North America leading with a dominating 42.1% market share, valued at USD 2.8 billion. This region’s prominence in the market is largely to advancements in aerospace and defense sectors, where CMCs are extensively utilized for their superior thermal and mechanical properties. The presence of major aerospace and defense manufacturers, along with high investments in research and development of advanced materials, drives North America’s leading position.

Europe follows closely, leveraging its strong automotive and aerospace industries. The region’s focus on reducing vehicle emissions and increasing the efficiency of aerospace engines has spurred the adoption of CMCs. Europe’s stringent environmental regulations also promote the use of materials that contribute to energy efficiency and emission reductions, further integrating CMCs into industrial applications.

The Asia Pacific region is experiencing rapid growth in the CMC market, fueled by expanding manufacturing sectors and increasing investments in infrastructure development, particularly in China and India. The region benefits from the rising demand for high-performance materials in automotive, aerospace, and renewable energy sectors, making it a player in the global market.

The Middle East & Africa and Latin America are emerging markets for CMCs, with growth driven by the development of industries such as energy and construction. These regions are increasingly adopting advanced materials to improve the performance and durability of critical infrastructure.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Ceramic Matrix Composites (CMC) market features a diverse array of key players, each contributing unique advancements and innovations. General Electric (GE) and Rolls-Royce Holdings plc are prominent figures in the aerospace sector, leveraging CMCs to enhance jet engine efficiency and performance under extreme conditions. These companies are pioneers in adopting CMCs for high-temperature applications in turbine blades, demonstrating fuel efficiency improvements and operational reliability.

Hexcel Corporation, CeramTec GmbH, and 3M Company focus on developing CMC applications across various industries, including automotive, energy, and electronics. Hexcel Corporation, for instance, provides lightweight CMCs that are critical for modern aerospace and automotive structures. CeramTec GmbH offers ceramic components that are essential in medical technology and electronics, emphasizing the material’s versatility.

Kyocera Corporation and Siemens AG, are expanding the use of CMCs in energy and industrial applications. Siemens uses CMCs in gas turbines to increase the operational efficiency and lifespan of power generation systems, while Kyocera incorporates these composites in high-wear applications such as machinery and cutting tools.

Top Key Players

- General Electric (GE)

- Rolls-Royce Holdings plc

- Hexcel Corporation

- CeramTec GmbH

- United Technologies Corporation (UTC) Aerospace Systems

- Kyocera Corporation

- Siemens AG

- SGL Carbon SE

- 3M Company

- Huntsman Corporation

- Mitsubishi Chemical Holdings Corporation

- Heraeus Holding GmbH

- ITW Performance Polymers

- Alcoa Corporation

- Schunk Carbon Technology

- Materion Corporation

- Morgan Advanced Materials

- Cambridge Nanotherm Ltd

- NASA

- Textron, Inc.

Recent Developments

In 2023, GE’s advancements in CMC technology were exemplified by the GE9X engine, which incorporates over 65 CMC components, including combustor liners and turbine shrouds. These components enable the engine to operate at higher temperatures with improved fuel efficiency.

In 2023 Rolls-Royce Holdings plc, the company reported a increase in underlying operating profit, reaching £1.6 billion, with an operating margin of 10.3%.

Report Scope

Report Features Description Market Value (2023) USD 6.8 Bn Forecast Revenue (2033) USD 18.8 Bn CAGR (2024-2033) 10.7% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Oxides, Silicon Carbide, Carbon, Others), By Matrix Type (Oxide Matrix, Silicon Carbide Matrix, Carbon Matrix), By Fiber Type (Continuous, Woven, Others), By Application(Aerospace, Defense, Energy and Power, Electrical and Electronics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape General Electric (GE), Rolls-Royce Holdings plc, Hexcel Corporation, CeramTec GmbH, United Technologies Corporation (UTC) Aerospace Systems, Kyocera Corporation, Siemens AG, SGL Carbon SE, 3M Company, Huntsman Corporation, Mitsubishi Chemical Holdings Corporation, Heraeus Holding GmbH, ITW Performance Polymers, Alcoa Corporation, Schunk Carbon Technology, Materion Corporation, Morgan Advanced Materials, Cambridge Nanotherm Ltd, NASA, Textron, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Ceramic Matrix Composites MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Ceramic Matrix Composites MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- General Electric (GE)

- Rolls-Royce Holdings plc

- Hexcel Corporation

- CeramTec GmbH

- United Technologies Corporation (UTC) Aerospace Systems

- Kyocera Corporation

- Siemens AG

- SGL Carbon SE

- 3M Company

- Huntsman Corporation

- Mitsubishi Chemical Holdings Corporation

- Heraeus Holding GmbH

- ITW Performance Polymers

- Alcoa Corporation

- Schunk Carbon Technology

- Materion Corporation

- Morgan Advanced Materials

- Cambridge Nanotherm Ltd

- NASA

- Textron, Inc.