Global CBD Wine Market Size, Share Analysis Report By Source (Hemp-based CBD Wine, Marijuana-based Wine), By Product Type (Low-based CBD Wine, Marijuana-based Wine), By Packaging ( Bottles, Cans), By Distribution Channel (On-trade, Off-trade) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 174672

- Number of Pages: 247

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

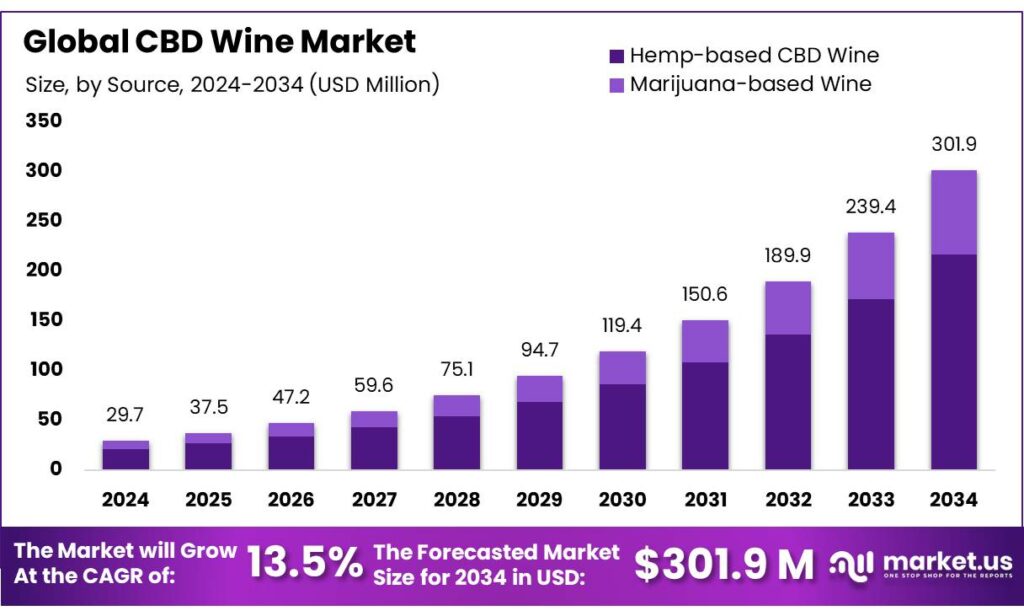

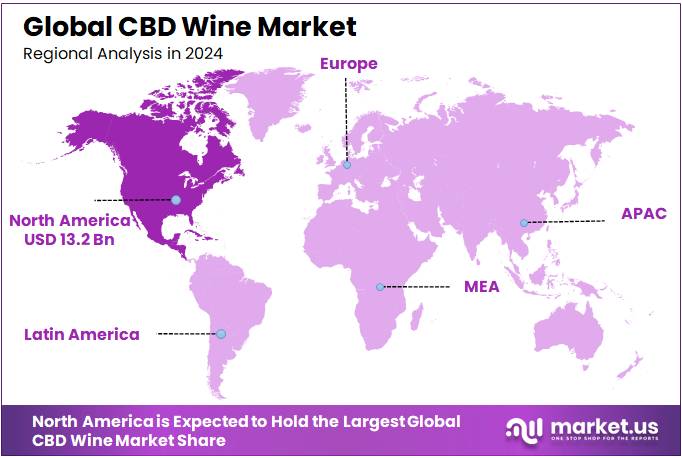

Global CBD Wine Market size is expected to be worth around USD 301.7 Million by 2034, from USD 29.7 Million in 2024, growing at a CAGR of 13.5% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 44.7% share, holding USD 13.2 Million in revenue.

CBD wine sits at the intersection of two tightly regulated categories: alcoholic beverages and ingestible cannabinoids. In practice, most “CBD wine” concepts involve either adding hemp-derived CBD to finished wine, or positioning a wine-style beverage in markets that already regulate cannabis ingestibles. That matters because the global wine industry itself is navigating weaker demand and supply volatility: the International Organisation of Vine and Wine (OIV) estimated 2024 global wine production at 225.8 million hectolitres and global consumption at 214.2 million hectolitres.

From an industry scenario perspective, producers are under pressure to find premium, differentiated offerings while staying compliant. The OIV’s 2024 outlook also shows how concentrated supply remains: the EU’s 2024 wine production is provisionally estimated at 139 million hectolitres, representing about 60% of global output. In the U.S., trade bodies track an export channel that signals brand reach and demand for higher-value bottles: Wine Institute data shows 2024 U.S. wine exports at 66.9 million gallons, equal to 28.2 million cases, valued at about $1.24 billion.

Key demand drivers are also visible in public-health and beverage data. WHO reports worldwide total alcohol consumption at 5.0 litres of pure alcohol per person (15+) in 2022, reflecting a long-term push toward moderation and lower-risk drinking occasions. For supply-side readiness, hemp cultivation and processing capacity is still stabilizing: USDA’s National Hemp Report (2022 data) recorded 21.0 million pounds of open-grown hemp fiber production and 6,850 acres harvested for fiber, alongside sharp year-over-year volatility.

On the CBD supply side, regulated hemp production creates a measurable input pipeline, especially in the U.S. USDA’s National Hemp Report shows the 2023 value of hemp production “in the open” at $258 million, with floral hemp production of 8.03 million pounds and $241 million in value (open-grown). This indicates there is meaningful agricultural capacity behind CBD ingredient markets, even as product compliance determines what can actually reach alcohol shelves.

Key Takeaways

- CBD Wine Market size is expected to be worth around USD 301.7 Million by 2034, from USD 29.7 Million in 2024, growing at a CAGR of 13.5%.

- Hemp-based CBD Wine held a dominant market position, capturing more than a 72.4% share.

- Low-based CBD Wine held a dominant market position, capturing more than a 78.1% share.

- Bottles held a dominant market position, capturing more than a 81.2% share.

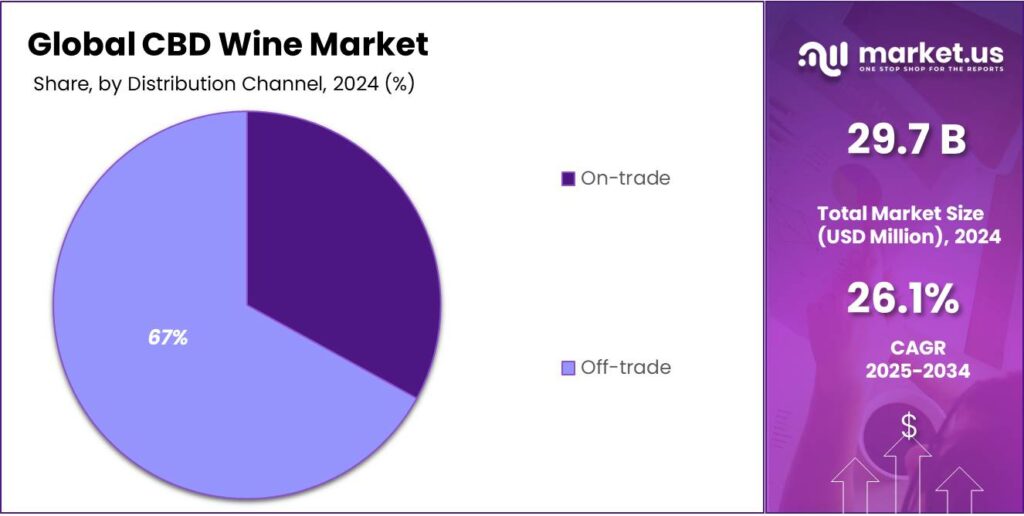

- Off-trade held a dominant market position, capturing more than a 67.6% share.

- North America dominates the CBD Wine Market with 44.7% share, valued at USD 13.2 Mn.

By Source Analysis

Hemp-based CBD Wine leads the category with a strong 72.4% share in 2024

In 2024, Hemp-based CBD Wine held a dominant market position, capturing more than a 72.4% share, driven by rising consumer trust in hemp-derived CBD and its clear legal status across many markets. This segment benefited from the growing preference for low-alcohol or wellness-oriented beverages, where hemp-based formulas are perceived as cleaner, safer, and more consistent in CBD quality. Producers also found it easier to maintain standardized CBD concentrations using hemp extracts, which helped build confidence among new consumers trying CBD wine for relaxation and social drinking.

By Product Type Analysis

Low-based CBD Wine dominates the market with a strong 78.1% share in 2024

In 2024, Low-based CBD Wine held a dominant market position, capturing more than a 78.1% share, reflecting the rising consumer preference for lighter, milder CBD-infused beverages. Many first-time CBD users gravitate toward low-CBD formulations because they offer a gentle relaxation effect without altering taste or causing discomfort. Producers also favour this category because it allows easy integration of CBD into wine without affecting aroma or quality, making it suitable for mainstream retail shelves.

By Packaging Analysis

Bottles dominate CBD wine packaging with a strong 81.2% share in 2024

In 2024, Bottles held a dominant market position, capturing more than a 81.2% share, largely because they maintain the traditional wine experience that consumers prefer. CBD wine buyers often look for a product that feels premium, familiar, and trustworthy, and glass bottles deliver that perception better than cans or alternative formats. The packaging protects flavour stability, preserves CBD infusion quality, and supports longer shelf life—key factors for retailers and producers alike.

By Distribution Channel Analysis

Off-trade channels lead CBD wine distribution with a 67.6% share in 2024

In 2024, Off-trade held a dominant market position, capturing more than a 67.6% share, supported by the rising availability of CBD wine in supermarkets, liquor stores, specialty CBD shops, and online platforms. Consumers increasingly prefer buying CBD wine from these channels because it offers convenience, clear product comparisons, and access to a broader range of brands and CBD strengths at competitive prices. Retailers also expanded their CBD beverage sections, giving this category stronger visibility.

Key Market Segments

By Source

- Hemp-based CBD Wine

- Marijuana-based Wine

By Product Type

- Low-based CBD Wine

- Marijuana-based Wine

By Packaging

- Bottles

- Cans

By Distribution Channel

- On-trade

- Off-trade

Emerging Trends

Micro-dosing and “serving-led” compliance is the newest CBD wine trend

A clear latest trend in CBD wine is the move toward micro-dosed, serving-led formats that are designed to fit within safety guidance and packaging rules, while still feeling like a normal wine occasion. A good example of how the market is talking today is dose transparency on premium cannabis-wine style products: one widely circulated product listing for House of Saka’s non-alcoholic “Saka Pink” describes 5 mg THC + 1 mg CBD per 5 oz serving, with five servings per bottle.

This trend is being shaped strongly by government-backed guidance. In the UK, the Food Standards Agency (FSA) advises healthy adults to limit CBD from food to 10 mg per day (updated precautionary advice first issued in October 2023 and reinforced through later updates). In a July 2025 update, the FSA again highlighted a provisional acceptable daily intake of 10 mg CBD/day, and also pointed to a THC safe upper limit of 0.07 mg THC/day for a 70 kg adult.

Canada shows the same “dose discipline” trend, but through strict packaging rules. Health Canada’s packaging and labelling guidance states that for edible cannabis, each immediate container must not contain more than 10 mg of THC. This kind of cap encourages beverage makers to sell single-serve or clearly portioned formats, and it reinforces why serving math (and consistent filling) matters as much as flavour. Even when a product is wine-inspired, the category is increasingly engineered like a measured functional drink.

Industry context helps explain why micro-dosing is becoming the “safe default.” The wine system is huge, mature, and export-driven, so any CBD wine that wants to look credible tends to borrow wine’s standard serving language. In 2024, the Wine Institute reported U.S. wine exports of 66.9 million gallons (about 253.4 million liters) with export value around $1.24 billion.

Drivers

Wellness-led, legally defined hemp CBD is expanding CBD wine demand

One major driving factor for CBD wine is that hemp-derived CBD has become easier to source and explain to consumers, while more people look for “relaxation” drinks that feel lighter than traditional alcohol. The category sits at the intersection of two familiar habits—wine occasions and functional ingredients—and that overlap makes trial less intimidating. A key enabler is legal clarity around hemp in major markets. In the U.S., federal law defines hemp as cannabis with no more than 0.3% total THC on a dry-weight basis, which supports broader supply chains for hemp-derived extracts used in beverages.

The wine industry’s scale also helps CBD wine piggyback on existing consumer behavior. Even when overall wine trends fluctuate, wine remains a large, well-developed system of grapes, bottling, logistics, and retail distribution. In 2024, the Wine Institute reported U.S. wine exports of 66.9 million gallons (about 253.4 million liters) with export value around $1.24 billion.

Another driver is the wider normalization of legal cannabis purchasing, especially in regulated markets like Canada, which reduces stigma and makes cannabinoid beverages feel less “niche.” Health Canada’s official cannabis market reporting (updated in October 2025) shows continued activity and notes that total medical and non-medical cannabis sales were up 17% from March 2024 (in packaged units, by product type).

Retail dynamics also support the category because CBD wine often sells best through off-trade and e-commerce discovery. A good signal is that consumers continue to spend heavily on food-and-beverage retail in general, which gives new beverage formats a practical route to market. For example, Reuters reported that in Canada, food and beverage retailers saw a 3.5% increase in sales in December 2024 during a period of stronger holiday spending.

Restraints

Regulatory uncertainty and compliance rules hold CBD wine back

One major restraining factor for CBD wine is regulatory uncertainty, especially where CBD is treated as a food/beverage ingredient and where alcohol rules overlap with cannabinoid rules. This is not just a legal detail—it directly affects product launches, retail distribution, labeling, and even basic claims like “calm” or relaxation.

In the United States, the biggest brake is that the FDA has repeatedly said current food and supplement frameworks are not appropriate for CBD, and it has continued enforcement against products that break food and beverage rules. Even for hemp-derived CBD, the legal “hemp” definition itself adds compliance pressure: U.S. federal guidance defines hemp as cannabis containing no more than 0.3% delta-9 THC on a dry-weight basis.

In Great Britain, the constraint looks different but feels similar: CBD in foods is treated as a novel food, and products require authorization to be sold legally. The same guidance also advises healthy adults not to exceed 10 mg of CBD per day, which limits how strongly beverage brands can dose while staying aligned with safety messaging.

Canada shows another limiting pattern: regulations are clear, but strict. Health Canada’s packaging and labeling guidance notes that for edible cannabis, each immediate container must not contain more than 10 mg of THC.

Opportunity

Low- and no-alcohol momentum opens a big lane for CBD wine

One major growth opportunity for CBD wine is its ability to ride the fast-growing consumer shift toward “lighter drinking”—people still want a wine moment, but with fewer downsides and more control. This is where CBD wine fits naturally: many products are built as de-alcoholized or lower-alcohol options and then positioned around calm, social relaxation. In 2024, large beverage groups kept investing in “choice” portfolios, which signals that moderation is not a niche trend anymore.

The second reason this opportunity is strengthening is that the traditional wine supply-demand backdrop is under pressure, and that encourages experimentation with new formats. The International Organisation of Vine and Wine (OIV) reported global wine production fell to 225.8 million hectolitres in 2024 (down 4.8% year-on-year), while global consumption was estimated at 214.2 million hectolitres (down 3.3%).

A third part of the opportunity is distribution infrastructure. Even niche wine products can scale faster than expected because wine logistics and retail channels already exist. In the U.S., the Wine Institute reports 2024 wine exports of 66.9 million gallons (about 253.4 million litres) with a value of roughly $1.24 billion. That doesn’t mean CBD wine exports at that scale—but it shows the system is mature: bottling formats, compliance workflows, shipping, and retailer categories are established.

Finally, regulated cannabis markets are creating a broader “permission space” for cannabinoid beverages, which helps CBD wine feel more normal. Canada’s official cannabis market data (updated October 30, 2025) notes total medical and non-medical sales in packaged units were up 17% from March 2024.

Regional Insights

North America dominates the CBD Wine Market with 44.7% share, valued at USD 13.2 Mn

In 2024, North America led the CBD wine market because the region already has strong demand for functional beverages and a wide retail base that understands CBD positioning. The U.S. market benefits from the legal availability of hemp-derived CBD, where federal law defines hemp as cannabis with no more than 0.3% delta-9 THC (dry-weight basis). This definition supports mainstream distribution of hemp-based CBD ingredients, which helps CBD wine brands scale in off-trade channels.

At the same time, the region’s regulatory complexity still shapes how products are formulated and marketed—especially because the FDA continues to flag risks and compliance issues for CBD products that are positioned as foods or supplements without an approved pathway, which pushes brands to be more careful with claims and labeling.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Rebel Wine.Co.UK: Rebel Wine.Co.UK offers 100% vegan, CBD-infused wine spritzers, each 200 ml can containing 10 mg CBD sourced from organic hemp grown in Colorado. Its portfolio includes white and rosé options marketed for casual, relaxed occasions like picnics or gifts, sold in recyclable cans and direct-to-consumer packs.

Viv & Oak: Viv & Oak, based in California’s Napa region, blends premium local grapes with cannabis extracts such as CBD and THC to craft de-alcoholized, functional wines. Its products include sparkling rosé options with variable dosages for consumer choice, using nano-encapsulation to remove 99.5% alcohol, aiming for effects within minutes and appealing to health-oriented drinkers after traditional alcohol alternatives.

Top Key Players Outlook

- House of Saka

- Rebel Wine.Co.UK

- Viv & Oak

- Wines of Uruguay

- CannaVines

- Burdi W.

- Hempfy

- Bodegas Santa Margarita

Recent Industry Developments

In 2024, Rebel continued to sell CBD-infused wine in 200 ml fully recyclable cans, with 10 mg CBD per can, using CBD from organic hemp grown in Colorado and positioning the range as 100% vegan—a simple value set that suits off-trade and online gifting.

In 2024, House of Saka positioning stayed anchored in its Napa Valley luxury “vinfusions,” built on a platform of standardized cannabinoid delivery: one commonly cited format is a 750 ml bottle where 1 oz ≈ 1.5 mg THC, and a full bottle carries about 40 mg THC + 5 mg CBD for controlled micro-dosing.

Report Scope

Report Features Description Market Value (2024) USD 29.7 Mn Forecast Revenue (2034) USD 301.9 Mn CAGR (2025-2034) 13.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Hemp-based CBD Wine, Marijuana-based Wine), By Product Type (Low-based CBD Wine, Marijuana-based Wine), By Packaging ( Bottles, Cans), By Distribution Channel (On-trade, Off-trade) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape House of Saka, Rebel Wine.Co.UK, Viv & Oak, Wines of Uruguay, CannaVines, Burdi W., Hempfy, Bodegas Santa Margarita Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- House of Saka

- Rebel Wine.Co.UK

- Viv & Oak

- Wines of Uruguay

- CannaVines

- Burdi W.

- Hempfy

- Bodegas Santa Margarita