Global Cardiac Rhythm Management Devices Market Analysis By Product (Pacemakers, Defibrillators, Cardiac Resynchronization Therapy), By Application (Congestive Heart Failure, Arrhythmias, Bradycardia, Tachycardia, Others), By End-User (Hospitals & Clinics, Ambulatory Surgical Centers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2023

- Report ID: 14832

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

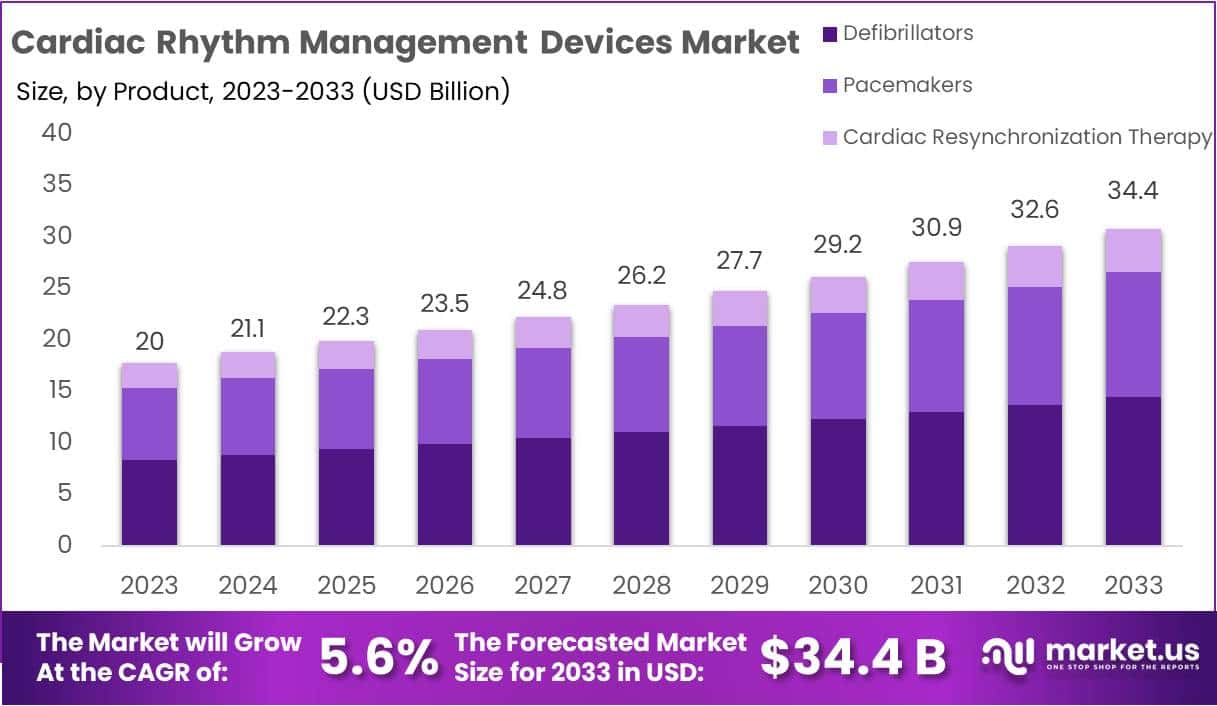

The Cardiac Rhythm Management Devices Market Size is anticipated to reach approximately USD 34.4 Billion by 2033, exhibiting substantial growth from USD 20 Billion in 2023. This represents a compound annual growth rate (CAGR) of 5.6% during the forecast period spanning from 2024 to 2033.

Cardiac Rhythm Management (CRM) devices encompass pacemakers and implantable cardioverter-defibrillators (ICDs), vital in treating heart rhythm disorders. Pacemakers, implanted under the skin with leads to the heart, regulate the heart’s electrical activity, ensuring a normal rhythm. Implantable Cardioverter-Defibrillators (ICDs), also implanted, monitor heart rhythm and deliver shocks if life-threatening arrhythmias are detected.

These devices are crucial for managing conditions like bradycardia and tachycardia, enhancing patient quality of life. With advancements such as wireless communication and advanced algorithms, CRM devices play a pivotal role in preventing cardiac events and promoting overall cardiac health.

The Cardiac Rhythm Management Devices Market encompasses the development, production, and distribution of medical devices crucial for regulating heart rhythms and treating arrhythmias. This industry includes Implantable Cardioverter Defibrillators (ICDs) for detecting and correcting irregular heartbeats, Cardiac Pacemakers to address bradycardia, and Cardiac Resynchronization Therapy (CRT) Devices enhancing heart pumping efficiency.

Technological strides, such as improved battery life and wireless communication, drive market growth. Factors like a growing aging population and heightened awareness contribute to the market’s expansion. Ongoing research and competitive dynamics among major medical device companies fuel innovation, promising continued advancements in patient care.

Key Takeaways

- Market Growth Projection: The Cardiac Rhythm Management Devices Market is set to reach USD 34.4 billion by 2033, growing at a CAGR of 5.6% from 2024 to 2033.

- Dominant Segment: In 2023, Defibrillators led with a substantial 41.5% market share, driven by increased demand for addressing life-threatening cardiac arrhythmias.

- Application Leadership: Arrhythmias commanded the application landscape with a dominant 26.4% market share in 2023, reflecting the high demand for addressing irregular heartbeats.

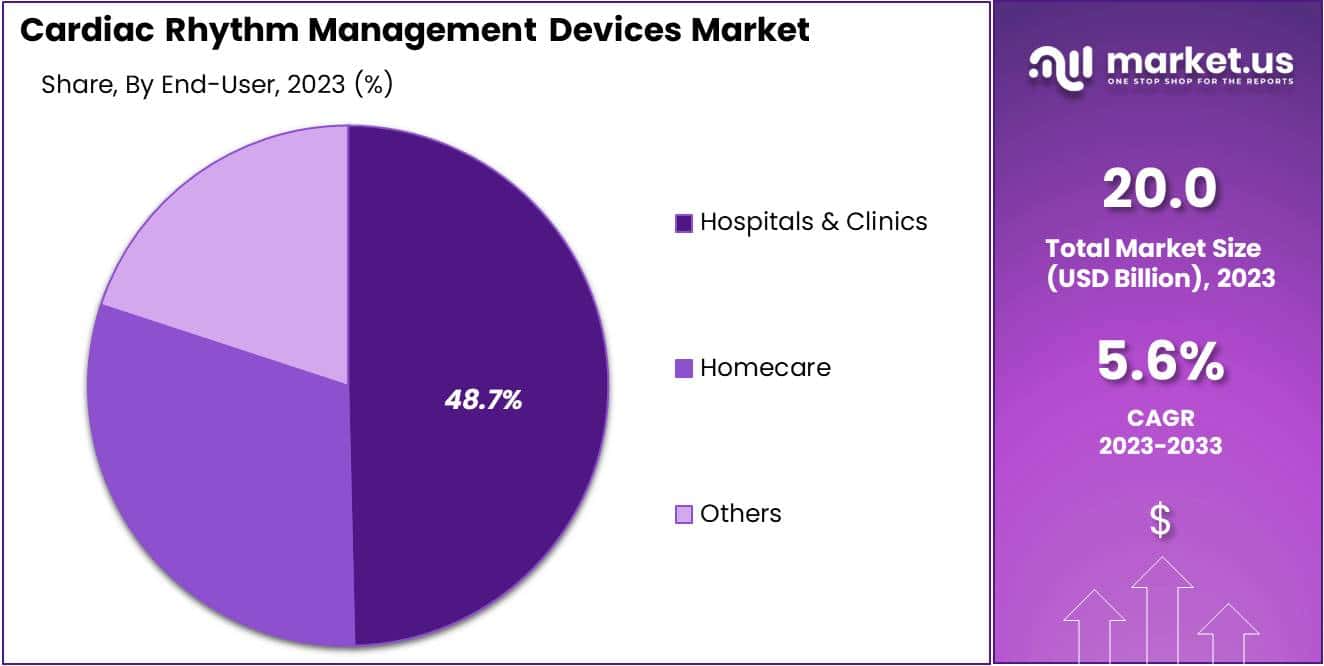

- End-User Dominance: Hospitals & Clinics emerged as the primary end-user, holding over 48.7% market share in 2023, highlighting their pivotal role in cardiac care.

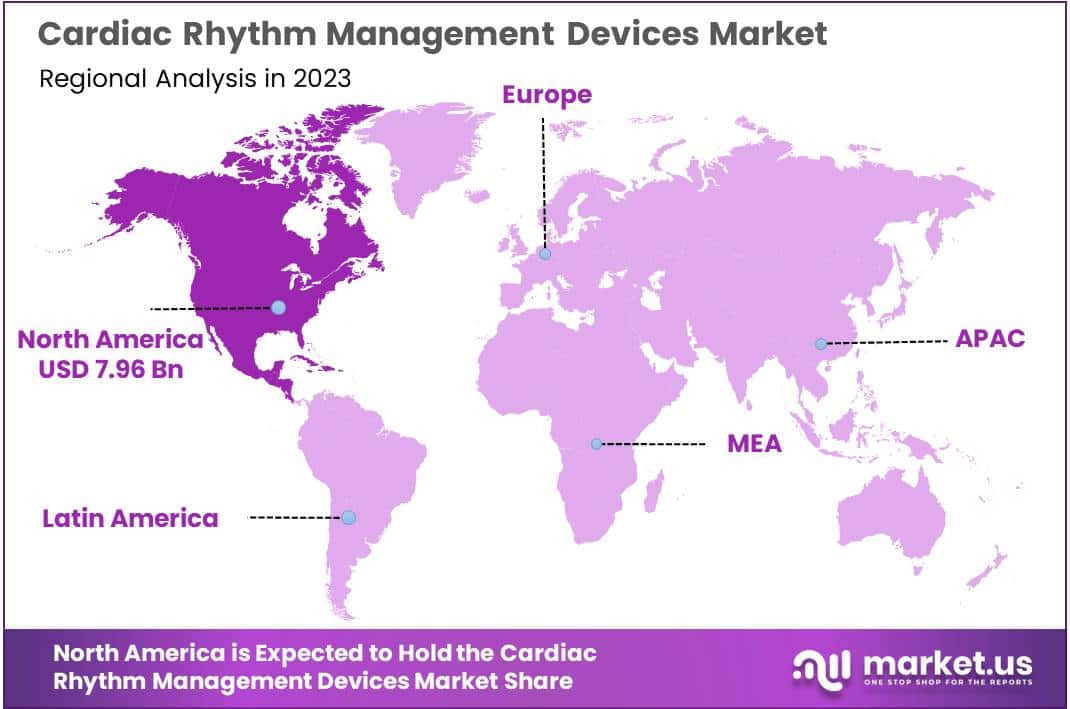

- Geographical Influence: North America dominated the market in 2023, holding a robust 39.8% market share, supported by advanced healthcare infrastructure and a proactive regulatory framework.

- Major Market Players: Key contributors include Physio-Control Inc. (Stryker), Schiller, Medtronic, Abbott, Boston Scientific Corporation, Koninklijke Philips N.V., Zoll Medical Corporation, BIOTRONIK, Progetti Srl, and LivaNova Plc.

- Global Market Value (2023): The market was valued at USD 20 billion in 2023, underlining its substantial size and significance in the healthcare industry.

- Technological Advancements: Ongoing innovations, such as leadless pacemakers and wearable devices, mark key trends in the industry, enhancing patient outcomes and minimizing complications.

- Regional Growth Potential: Beyond North America, regions like Europe and Asia-Pacific show promising developments, driven by factors such as increasing healthcare expenditure and a rising geriatric population.

Product Analysis

In 2023, the cardiac rhythm management devices market showcased a noteworthy landscape with the Defibrillators segment emerging as a frontrunner, securing a robust market share of over 41.5%. This segment, pivotal in addressing life-threatening cardiac arrhythmias, experienced heightened demand and widespread adoption.

Defibrillators, distinguished by their ability to restore normal heart rhythm through controlled electrical shocks, demonstrated a considerable lead in the market. This dominance was fueled by their critical role in preventing sudden cardiac arrests and enhancing patient survival rates. The segment’s growth was further propelled by advancements in technology, making these devices more effective and user-friendly.

Pacemakers, another integral player in the cardiac rhythm management devices market, maintained a competitive stance, accounting for a substantial portion of the market. These devices, designed to regulate and normalize heartbeats, continued to be a cornerstone in the management of various cardiac conditions. Their significance in improving the quality of life for individuals with bradycardia or irregular heart rhythms remained a driving force in their market presence.

Cardiac Resynchronization Therapy (CRT) devices, designed to optimize heart function and improve overall cardiac performance, also exhibited promising growth. In 2023, this segment garnered attention for its efficacy in addressing heart failure and enhancing patients’ overall well-being. The increasing prevalence of heart failure cases and the growing awareness of CRT’s benefits contributed to its expanding market share.

As technological innovations persist, driving the development of more sophisticated and patient-friendly cardiac rhythm management devices, the market is poised for continuous evolution. The interplay between these pivotal segments – Defibrillators, Pacemakers, and Cardiac Resynchronization Therapy – forms a dynamic landscape, catering to diverse cardiac conditions and fostering advancements that enhance patient outcomes.

Application Analysis

In 2023, the cardiac rhythm management devices market showcased a notable landscape, with various applications playing key roles in shaping its dynamics. Among these, the Arrhythmias segment emerged as a frontrunner, securing a dominant market position by capturing more than a 26.4% share.

Arrhythmias, characterized by irregular heartbeats, stood out as a significant driver in the cardiac rhythm management devices market. The demand for devices addressing arrhythmias surged, driven by the increasing prevalence of this condition and the growing awareness among patients and healthcare professionals about the available treatment options.

Furthermore, the Congestive Heart Failure segment demonstrated a noteworthy presence, contributing to the overall market growth. In 2023, it accounted for a substantial market share, reflecting the importance of cardiac rhythm management devices in managing heart failure cases. The prevalence of congestive heart failure and the continuous advancements in device technologies contributed to the segment’s robust performance.

The Bradycardia and Tachycardia segments also played vital roles in the market landscape. The Bradycardia segment, associated with slow heart rates, witnessed a commendable market share, highlighting the significance of devices designed to regulate and normalize heart rhythms. On the other hand, the Tachycardia segment, characterized by rapid heartbeats, made substantial strides, emphasizing the demand for effective solutions in addressing this prevalent cardiac condition.

Beyond these primary segments, other applications in the cardiac rhythm management devices market collectively contributed to the industry’s growth. These miscellaneous applications underscored the versatility of these devices in managing a spectrum of cardiac issues, further expanding the market’s reach.

End-User Analysis

In 2023, the Hospitals & Clinics segment emerged as a frontrunner in the Cardiac Rhythm Management Devices market, commanding a substantial market share of over 48.7%. This dominant position can be attributed to the pivotal role played by hospitals and clinics as primary healthcare providers. Patients seeking cardiac care often turn to these institutions for comprehensive and specialized treatment, thereby driving the demand for rhythm management devices.

Ambulatory Surgical Centers, on the other hand, showcased a noteworthy presence in the market, contributing significantly to the overall landscape. With their focus on outpatient care and surgical procedures, these centers provided a convenient alternative for individuals requiring cardiac rhythm management. The market share for Ambulatory Surgical Centers is anticipated to grow steadily, reflecting the increasing trend of outpatient treatments.

In addition to hospitals and ambulatory centers, other end-users also played a crucial role in shaping the market dynamics. This diverse category, which includes specialized clinics and healthcare facilities, contributed to the overall market growth. The flexible nature of cardiac rhythm management devices allows their integration into various healthcare settings, making them accessible to a broad spectrum of end-users beyond traditional medical institutions.

Looking ahead, the market is expected to witness continued growth across all segments, with Hospitals & Clinics maintaining their prominent position. The increasing prevalence of cardiac disorders and the growing awareness of advanced medical interventions are anticipated to sustain the demand for cardiac rhythm management devices across diverse healthcare settings. As technology continues to advance, these devices are likely to become more versatile and cater to the evolving needs of patients across different end-user segments.

Key Market Segments

Product

- Pacemakers

- Defibrillators

- Cardiac Resynchronization Therapy

Application

- Congestive heart failure

- Arrhythmias

- Bradycardia

- Tachycardia

- Others

End-User

- Hospitals & Clinics

- Ambulatory surgical centers

- Others

Drivers

Increasing Prevalence of Cardiovascular Diseases

The rising incidence of cardiovascular diseases globally is a primary driver for the cardiac rhythm management devices market. As the aging population grows and lifestyle factors contribute to heart-related issues, the demand for these devices to manage cardiac rhythms is on the rise.

Technological Advancements in Device Innovations

Ongoing advancements in technology, such as the development of smart and connected cardiac devices, are driving market growth. Improved features, better diagnostic capabilities, and enhanced connectivity options contribute to the adoption of these devices by both healthcare providers and patients.

Growing Awareness and Education Programs

Increased awareness about the importance of early detection and management of cardiac disorders is promoting the adoption of rhythm management devices. Educational programs and initiatives by healthcare organizations contribute to improved patient understanding and proactive healthcare-seeking behavior.

Rising Geriatric Population

The aging demographic trend is a significant driver as the elderly population is more prone to cardiac disorders. As the global population continues to age, there is a corresponding increase in the demand for cardiac rhythm management devices to address age-related cardiovascular issues.

Restraints

High Cost of Devices and Treatment

The cost associated with cardiac rhythm management devices and related treatments poses a significant barrier to market growth. High expenses can limit access for patients, especially in developing regions, and put strain on healthcare budgets.

Stringent Regulatory Approvals

Stringent regulatory processes and approvals for new devices can impede market growth. The lengthy and rigorous approval timelines may delay the introduction of innovative products to the market, affecting the pace of advancements.

Risk of Infections and Complications

The implantation of cardiac rhythm management devices carries inherent risks, including the potential for infections and complications. Concerns about adverse events can influence both healthcare providers and patients, affecting the acceptance and adoption of these devices.

Limited Reimbursement Policies

Inadequate reimbursement policies for cardiac rhythm management procedures can act as a restraining factor. The lack of comprehensive coverage for these devices may limit their accessibility, particularly for patients who depend on insurance for medical expenses.

Opportunities

Expansion in Emerging Markets

Opportunities for market expansion exist in emerging economies where there is a growing awareness of cardiovascular health. Companies can tap into these markets by introducing cost-effective solutions and leveraging partnerships with local healthcare providers.

Integration of Artificial Intelligence (AI) and Machine Learning (ML)

The incorporation of AI and ML in cardiac rhythm management devices presents a significant growth opportunity. Intelligent algorithms can enhance diagnostic capabilities, improve treatment outcomes, and contribute to personalized patient care.

Telehealth and Remote Monitoring Services

The increasing acceptance of telehealth and remote monitoring creates avenues for growth. Cardiac rhythm management devices that can seamlessly integrate with remote monitoring platforms offer patients and healthcare providers the convenience of real-time data access and management.

Focus on Patient-Centric Solutions

Companies that prioritize patient-centric design and solutions stand to benefit. User-friendly devices, improved patient education, and enhanced overall patient experience contribute to increased adoption and market growth.

Trends

Shift Towards Leadless Pacemakers

A notable trend is the industry’s shift towards leadless pacemakers, which eliminate the need for traditional lead wires. This innovation reduces the risk of complications associated with lead wires and offers a more streamlined and minimally invasive approach.

Emphasis on Wearable and Remote Monitoring Devices

The market is witnessing a trend towards wearable devices that allow continuous monitoring of cardiac rhythms. These devices provide real-time data, enabling both patients and healthcare professionals to track and manage cardiac health remotely.

Increasing Adoption of Defibrillators with Enhanced Features

Defibrillators with advanced features such as integrated CPR feedback mechanisms and rapid charging technologies are gaining popularity. The emphasis on faster and more effective response to cardiac emergencies is driving the integration of such technologies.

Collaborations and Partnerships for Comprehensive Solutions

Increasing collaborations between device manufacturers, healthcare providers, and technology companies are leading to the development of comprehensive cardiac care solutions. These partnerships aim to combine expertise and resources to deliver integrated and holistic approaches to cardiac rhythm management.

Regional Analysis

In 2023, North America established itself as a dominant force in the Cardiac Rhythm Management Devices Market, securing a substantial market share of more than 39.8%. The region’s robust market presence was underscored by a market value of USD 7.96 billion for the year, signifying a formidable influence on the global landscape of cardiac rhythm management.

North America’s leading position in cardiac rhythm management is fueled by its advanced healthcare infrastructure and high cardiovascular disease prevalence. The U.S., a key driver, boasts a mature healthcare system and significant patient base, spearheading the integration of cutting-edge technologies. A proactive regulatory framework and heightened awareness among healthcare professionals and patients amplify market growth, showcasing the region’s commitment to innovative medical solutions.

Furthermore, strategic collaborations and partnerships between key market players and healthcare institutions in North America have facilitated the development and introduction of technologically advanced cardiac rhythm management devices. These collaborative efforts have not only spurred innovation but have also ensured efficient market penetration.

However, it is crucial to note that while North America has demonstrated a robust market presence, other regions are also poised for significant growth in the cardiac rhythm management devices market. Europe, for instance, has shown promising developments, driven by increasing healthcare expenditure, a rising geriatric population, and a growing emphasis on preventive healthcare measures.

In Asia-Pacific, the market for cardiac rhythm management devices is witnessing accelerated growth, propelled by improving healthcare infrastructure, rising disposable incomes, and an expanding awareness regarding cardiac health. The region’s large and aging population presents a substantial market opportunity, making it an attractive prospect for key market players.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Cardiac Rhythm Management Devices Market thrives on the contributions of key players like Physio-Control Inc. (Stryker), Schiller, Medtronic, and Abbott. Their commitment to technological excellence, quality, and patient-centricity positions them as pivotal forces shaping the industry. As the market evolves, the synergy between these key players and other contributors paves the way for transformative developments in cardiac healthcare.

Physio-Control Inc. (Stryker) stands out for its commitment to cutting-edge technology, consistently delivering high-quality defibrillators and monitoring devices. With a focus on user-friendly designs, they cater to the diverse needs of healthcare professionals, contributing significantly to the market’s growth.

Schiller, another key player, is recognized for its emphasis on precision and reliability in cardiac monitoring solutions. Their portfolio includes a range of advanced ECG devices, ensuring accurate and timely diagnostics. Schiller’s dedication to quality positions them as a trusted name in the Cardiac Rhythm Management Devices Market.

Medtronic, a global leader, leads the market with its comprehensive suite of cardiac rhythm management solutions. Known for continuous innovation, Medtronic’s implantable devices and monitoring systems have set industry benchmarks. Their strategic collaborations and robust research efforts reinforce their pivotal role in advancing cardiac healthcare.

Abbott has carved its niche in the market by integrating cutting-edge technology with patient-centric designs. Their diverse product portfolio, including pacemakers and implantable defibrillators, reflects a commitment to addressing varying patient needs. Abbott’s global presence and focus on accessibility contribute significantly to market expansion.

In addition to these key players, the Cardiac Rhythm Management Devices Market features other noteworthy participants, each bringing unique strengths to the table. These include emerging innovators and established companies continually pushing boundaries in device functionality, connectivity, and patient outcomes. The dynamic interplay between these players fosters a competitive yet collaborative landscape, driving advancements in cardiac care.

Market Key Players

- Physio-Control Inc. (Stryker)

- Schiller

- Medtronic

- Abbott

- Boston Scientific Corporation

- Koninklijke Philips N.V.

- Zoll Medical Corporation

- BIOTRONIK

- Progetti Srl

- LivaNova Plc

- Other Key Players

Recent Developments

- In September 2023, Abbott Laboratories, a major player in the global healthcare industry, revealed its intention to purchase Lifetech, a prominent developer of implantable cardiac rhythm management (CRM) devices, for around $4.9 billion. The acquisition, anticipated to be finalized in early 2024, is poised to significantly enhance Abbott’s CRM portfolio, which already encompasses pacemakers, defibrillators, and leadless pacing systems.

- In October 2023, Boston Scientific, a renowned medical device manufacturer, introduced a new cardiac rhythm management (CRM) system. This cutting-edge system boasts advanced features designed to enhance patient outcomes and minimize complications. Among its components are a next-generation pacemaker, a defibrillator featuring innovative shock therapy algorithms, and a leadless pacing system that administers therapy without the traditional need for leads.

- In November 2023, Biotronik, a leading global manufacturer of cardiovascular medical technology, made headlines by acquiring MicroPort Innovation, a developer of cutting-edge cardiac rhythm management (CRM) technologies. The financial details of the acquisition were not disclosed, but the move is expected to fortify Biotronik’s position in the CRM market, providing access to MicroPort Innovation’s advanced CRM technology portfolio.

Report Scope

Report Features Description Market Value (2023) USD 20 Bn Forecast Revenue (2033) USD 34.4 Bn CAGR (2024-2033) 5.6% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Pacemakers, Defibrillators, Cardiac Resynchronization Therapy), By Application (Congestive Heart Failure, Arrhythmias, Bradycardia, Tachycardia, Others), By End-User (Hospitals & Clinics, Ambulatory Surgical Centers, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Physio-Control Inc. (Stryker), Schiller, Medtronic, Abbott, Boston Scientific Corporation, Koninklijke Philips N.V., Zoll Medical Corporation, BIOTRONIK, Progetti Srl, LivaNova Plc, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Cardiac Rhythm Management Devices market in 2023?The Cardiac Rhythm Management Devices market size is USD 20 billion in 2023.

What is the projected CAGR at which the Cardiac Rhythm Management Devices market is expected to grow at?The Cardiac Rhythm Management Devices market is expected to grow at a CAGR of 5.6% (2024-2033).

List the segments encompassed in this report on the Cardiac Rhythm Management Devices market?Market.US has segmented the Cardiac Rhythm Management Devices market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Product, market has been segmented into Pacemakers, Defibrillators, and Cardiac Resynchronization Therapy (CRT). By End User, the market has been further divided into Hospitals, Clinics & Cardiac Specialty Centers, Ambulatory Care Centers, and Home Care Settings.

List the key industry players of the Cardiac Rhythm Management Devices market?Physio-Control Inc. (Stryker), Schiller, Medtronic, Abbott, Boston Scientific Corporation, Koninklijke Philips N.V., Zoll Medical Corporation, BIOTRONIK, Progetti Srl, LivaNova Plc, Other Key Players engaged in the Cardiac Rhythm Management Devices market.

Which region is more appealing for vendors employed in the Cardiac Rhythm Management Devices market?North America is accounted for the highest revenue share of 39.8%. Therefore, the Cardiac Rhythm Management Devices industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Cardiac Rhythm Management Devices?The U.S., Canada, U.K., Germany, Italy, France, Spain, Japan, Etc., are key areas of operation for Cardiac Rhythm Management Devices Market.

Which segment accounts for the greatest market share in the Cardiac Rhythm Management Devices industry?With respect to the Cardiac Rhythm Management Devices industry, vendors can expect to leverage greater prospective business opportunities through the defibrillators segment, as this area of interest accounts for the largest market share.

Cardiac Rhythm Management Devices MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample

Cardiac Rhythm Management Devices MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Physio-Control Inc. (Stryker)

- Schiller

- Medtronic

- Abbott

- Boston Scientific Corporation

- Koninklijke Philips N.V.

- Zoll Medical Corporation

- BIOTRONIK

- Progetti Srl

- LivaNova Plc

- Other Key Players