Global Canola Oil Market By Nature(Organic, Conventional), By Type(Cold-pressed, Extracted), By Application(Food Processing, Foodservice, Households, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: July 2024

- Report ID: 124157

- Number of Pages: 397

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

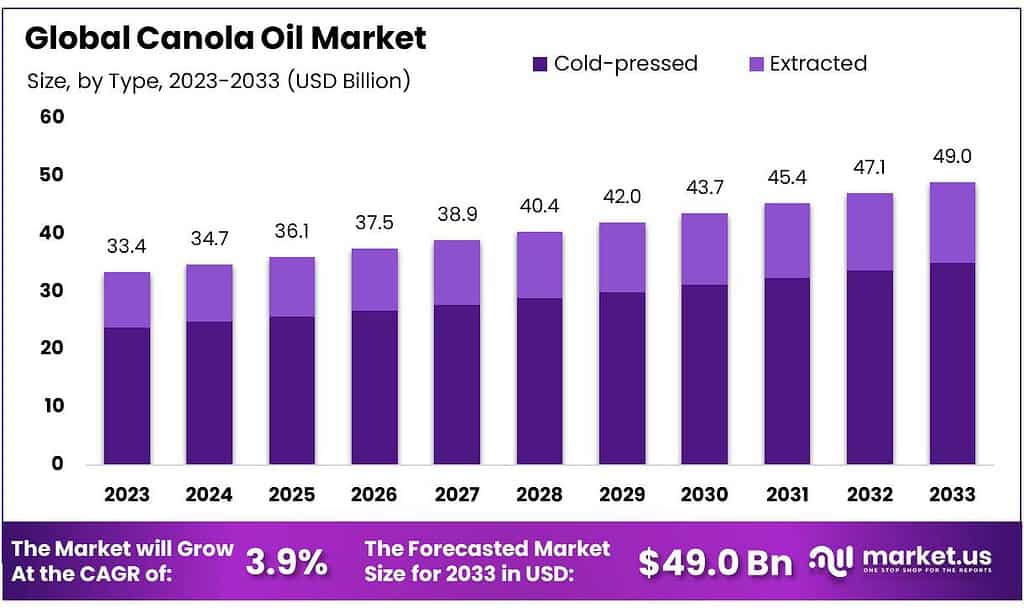

The global Canola Oil Market size is expected to be worth around USD 49.0 billion by 2033, from USD 33.4 billion in 2023, growing at a CAGR of 3.9% during the forecast period from 2023 to 2033.

The Canola Oil Market encompasses the integrated network of production, distribution, and sales of canola oil, engaging diverse stakeholders such as agricultural producers, processors, marketers, and end-users across both the food industry and individual consumers.

Originating from the seeds of canola plants, canola oil is highly valued in culinary applications owing to its mild flavor and high smoke point, making it suitable for various cooking techniques. It is particularly noted for its health benefits, being rich in monounsaturated fats and possessing a beneficial balance of omega-3 to omega-6 fatty acids, which supports cardiovascular health.

This market is influenced by a variety of factors including agricultural methodologies, international trade policies, consumer health consciousness, and advancements in technology related to oil extraction and refining. Moreover, government regulations play a pivotal role in shaping the entire lifecycle of canola oil production from cultivation to global distribution.

Specifically, the Canadian government has actively supported the canola sector through substantial investments, recognizing the crop’s significant economic contribution, largely driven by export demands.

An investment exceeding $1.8 million has been allocated to enhance canola exports to reach a production milestone of 26 million tonnes by the year 2025. This effort is part of Canada’s broader ambition to elevate agri-food exports to $75 billion by the same year. Such governmental initiatives underscore a commitment to advancing the growth and diversification of the canola industry.

On the global stage, Canadian canola oil is a dominant force, maintaining robust export values that underline its competitive position in the international market. This continued economic performance emphasizes Canada’s role as a leading exporter and major player in the global canola oil market.

Key Takeaways

- Canola Oil Market to grow from USD 33.4 billion in 2023 to USD 49.0 billion by 2033, at a CAGR of 3.9%.

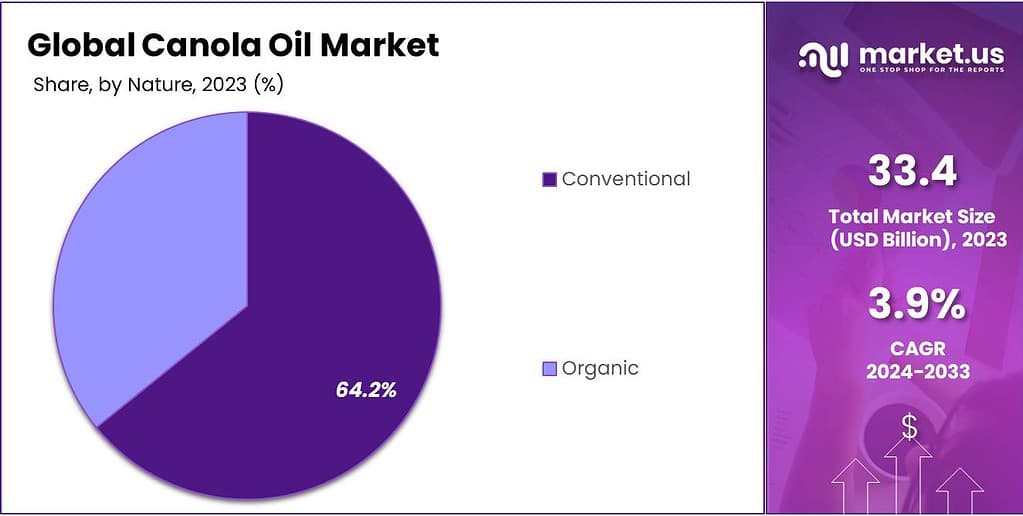

- Conventional canola oil held 64.2% market share in 2023; the organic segment is rapidly growing due to health and sustainability demands.

- Cold-pressed canola oil dominated with 71.4% share in 2023, preferred for retaining natural flavors and nutrients.

- Food processing captured a 34.7% share in 2023, driven by canola oil’s versatility in various food manufacturing processes.

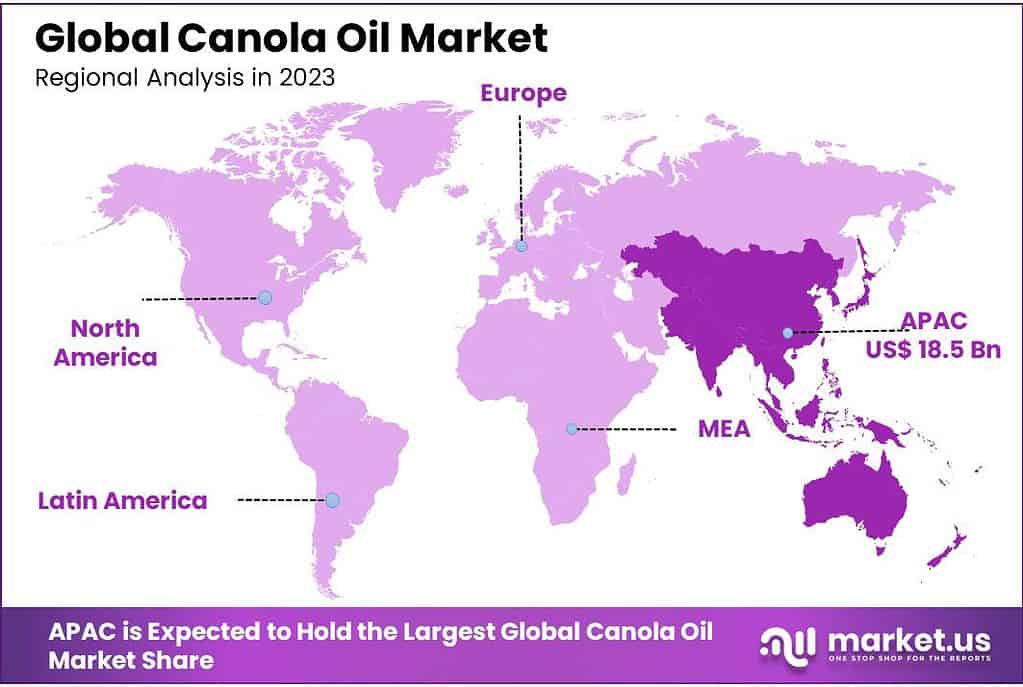

- APAC leads with 55.4% share, valued at USD 18.50 billion, driven by large populations in China and India.

By Nature

In 2023, Conventional canola oil held a dominant market position, capturing more than a 64.2% share. This segment benefits from established agricultural practices and widespread consumer acceptance, making it the primary choice for both industrial and residential use.

Conventional canola oil is favored for its cost-effectiveness and extensive availability, supported by efficient, large-scale farming methods that ensure consistent supply and price stability. This type of oil is predominantly used in the food service industry due to its high smoke point and neutral flavor, ideal for frying and baking.

On the other hand, the Organic segment, while smaller, is experiencing rapid growth driven by increasing consumer demand for health-centric and environmentally sustainable products. Organic canola oil is produced under stringent conditions that forbid the use of synthetic pesticides and fertilizers, appealing to health-conscious consumers.

Although organic canola oil comes at a premium price, its market share is expanding as more consumers are willing to invest in higher quality, eco-friendly products. This shift is supported by a broader consumer trend towards organic and natural food choices, reflecting a deeper awareness of health and wellness.

By Type

In 2023, Cold-pressed canola oil held a dominant market position, capturing more than a 71.4% share. This method of oil production is highly favored for retaining the natural flavors, nutrients, and antioxidants in canola oil, making it a preferred choice among health-conscious consumers.

The cold-pressed method involves mechanically pressing the canola seeds to extract oil without the use of heat, thereby preserving its nutritional integrity. This type of canola oil is particularly popular in markets where consumers prioritize organic and natural products, driving its substantial market share.

Conversely, the Extracted segment, which involves the use of heat or chemicals to extract oil from canola seeds, occupies a smaller portion of the market. This method is typically more cost-efficient and yields higher volumes of oil, making it suitable for large-scale commercial applications.

However, it often results in lower nutritional quality, which can be a significant drawback for health-focused consumers. Despite its efficiency, this segment faces challenges in market growth due to increasing consumer awareness and preference for minimally processed foods.

By Application

In 2023, Food Processing held a dominant market position in the Canola Oil Market, capturing more than a 34.7% share. This segment leverages canola oil for its neutral flavor and high smoke point, making it ideal for various food manufacturing processes. The oil’s versatility allows it to be used in a wide range of products from baked goods to fried snacks, contributing to its substantial market share.

The food service segment also maintains a significant presence, utilizing canola oil in restaurants and catering services due to its cooking properties and health benefits. Its ability to withstand high temperatures makes it a preferred choice for cooking and frying.

Households represent another important segment, with canola oil being a staple in home kitchens for everyday cooking. Its health advantages, such as being low in saturated fats and high in omega-3 fatty acids, make it appealing to health-conscious consumers.

Key Market Segments

By Nature

- Organic

- Conventional

By Type

- Cold-pressed

- Extracted

By Application

- Food Processing

- Foodservice

- Households

- Others

Drivers

Expanding Market Demand and Growth in the Food Processing Sector

The Canola Oil Market is witnessing significant growth, particularly in the food processing sector, which held the highest revenue share in 2023. This growth is primarily driven by the oil’s neutral flavor and high smoke point, making it ideal for various processed food preparations like mayonnaise, cream spreads, and salad dressings. The food processing industry’s increasing reliance on canola oil is due to its ability to maintain the natural taste of foods while offering health benefits, which are becoming more crucial to consumers globally.

The Asia-Pacific region, notably China and India, leads in canola oil consumption due to rising awareness of healthy lifestyles and increasing disposable incomes. The demand in these countries is augmented by the expanding food processing industry and the growing popularity of Western-style cuisines, which often use canola oil for cooking and food preparation.

Moreover, the canola oil market is set to expand by USD 5.54 billion from 2023 to 2028, at a compound annual growth rate (CAGR) of 3.04%. This expansion is fueled by the versatile applications of canola oil across both food and non-food sectors, including its use in biodiesel production due to its excellent cold-flow properties.

These growth dynamics illustrate canola oil’s increasing integration into the global supply chain and its critical role in meeting the culinary and health-oriented needs of modern consumers. The market’s trajectory suggests a sustained increase in demand, underscored by canola oil’s health benefits and application versatility.

Restraints

Competitive Pressure from Alternative Edible Oils

One of the major restraining factors for the growth of the canola oil market is the intense competition it faces from other types of edible oils. This competitive landscape is influenced by the availability and consumer preference for oils like olive, soybean, and palm oils, which are seen as comparable alternatives due to their similar health benefits and culinary applications. These oils often compete directly with canola oil, particularly in markets where price sensitivity and traditional cooking practices favor the use of more established oil types.

For instance, palm oil, known for its cost-effectiveness and high yield per hectare, continues to dominate the global vegetable oils market, affecting the market share that canola oil might otherwise capture. In the 2021/22 market year, palm oil production reached approximately 77.22 million metric tons, significantly overshadowing canola oil’s market presence in several regions.

Moreover, the preference for organic and non-GMO products also plays a critical role in shaping consumer choices, with a growing segment of the market leaning towards oils that are certified organic or non-GMO. This shift in consumer preference tends to favor oils that have established a stronger presence in the organic sector over canola oil, which is often produced from genetically modified seeds, especially in the conventional segment.

Additionally, environmental concerns and the regulatory landscape surrounding the agricultural practices of canola cultivation, such as the use of pesticides and the impact on biodiversity, also pose challenges. These factors can influence consumer perception and market dynamics, particularly in regions with strict regulations on agricultural products.

This competitive environment necessitates strategic responses from canola oil producers, including differentiation in terms of product quality, sustainability practices, and marketing efforts to highlight the unique attributes of canola oil, such as its low saturated fat content and heart-healthy profile

Opportunity

Rising Demand in Health-Conscious Markets

The canola oil market is poised for significant growth, driven primarily by the increasing demand among health-conscious consumers globally. Canola oil, known for its low saturated fat content and beneficial balance of omega-3 and omega-6 fatty acids, is becoming a staple in health-oriented diets. This shift is particularly pronounced in regions with a rising prevalence of cardiovascular diseases and a growing population aware of the health impacts of dietary choices.

North America, which held a substantial market share in 2022, continues to dominate the global market due to its wide-ranging applications in both food and non-food sectors such as cosmetics and personal care products. The region’s market expansion is supported by government policies that encourage the use of trans-fat-free oils and provide subsidies for canola cultivation, thus fostering an environment conducive to market growth.

The Asia Pacific region is projected to experience the fastest growth rate, driven by a surge in population and an increase in health awareness. The demand in this region is not only limited to the food sector but extends to industrial applications like biodiesel, benefiting from canola oil’s low-fat content and environmental sustainability.

This market expansion is further supported by the increasing use of canola oil in the food service sector due to its high smoke point and neutral flavor, making it ideal for various cooking methods. The growing global food processing industry also contributes significantly to the demand for canola oil, as it is increasingly used in products ranging from baked goods to snack foods.

Trends

Emerging Biofuel Applications for Canola Oil

One of the most significant trends in the canola oil market is its growing use in biofuel production, particularly renewable diesel and jet fuel. This trend is supported by canola oil’s low carbon footprint and sustainability, making it an attractive option for reducing greenhouse gas emissions in the transportation sector. The U.S. Environmental Protection Agency (EPA) recently approved canola oil for generating compliance credits under the Renewable Fuel Standard (RFS), significantly bolstering its use in renewable fuels.

The demand for canola-based biofuels is expected to continue rising, driven by high petrol prices and the search for more cost-effective, sustainable alternatives. Canola oil is now being used as a blend for diesel fuel, suitable for on-road vehicles, municipal fleets, and long-haul trucks. This development not only diversifies the feedstock supply for the clean fuels industry but also presents a potential growth area not fully accounted for in current production targets, highlighting its underutilized capacity and the room for expansion in this sector.

Moreover, the biofuels segment, where canola oil is a key player, is anticipated to see a steady increase in its market share. The inherent properties of canola oil, including its renewability and environmental benefits, make it a viable option for biofuel production, aligning with global efforts towards more sustainable energy sources.

This shift towards biofuel applications could significantly influence the future dynamics of the canola oil market, presenting new opportunities for growth and innovation within this industry.

Regional Analysis

The Asia-Pacific (APAC) region dominates the global canola oil market, accounting for 55.4% of the market share, valued at approximately USD 18.50 billion. This dominance is fueled by the large populations in China and India, where increasing disposable incomes and changing dietary habits drive the demand for healthier cooking oils. APAC’s market growth is further supported by the expanding food processing industry and rising awareness of canola oil’s health benefits.

In North America, particularly in Canada and the United States, the market is robust due to extensive canola cultivation and processing infrastructure. Canada is a leading global exporter of canola oil, leveraging its advanced agricultural techniques and supportive government policies. The region’s market benefits from strong domestic demand driven by health-conscious consumers who prefer canola oil for its nutritional benefits.

In Europe, the market is characterized by significant demand for non-GMO and organic canola oil. Countries like Germany and France lead in consumption, driven by stringent food safety regulations and a strong preference for sustainable and healthy cooking oils. The European market continues to grow as consumers shift towards healthier dietary choices and environmentally friendly products.

In the Middle East & Africa, the canola oil market is emerging, with growing demand for healthier oils amid rising urbanization and changing food consumption patterns. The market’s growth in this region is supported by increasing imports from major producing regions and a gradual shift towards more health-conscious food choices.

Latin America sees moderate growth in the canola oil market, with Brazil and Argentina being key players due to their agricultural capabilities. The region’s market is driven by both domestic consumption and export opportunities, as these countries leverage their favorable climates for canola cultivation.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Canola Oil Market features several prominent players who drive the industry through extensive production capabilities, strategic initiatives, and a strong focus on quality and sustainability. Archer Daniels Midland Company and Cargill Incorporated are two leading players with significant market shares.

Both companies leverage their extensive agricultural networks and advanced processing technologies to produce high-quality canola oil. They are heavily invested in research and development to improve crop yields and oil extraction processes, ensuring they meet the growing global demand for healthier oils.

Associated British Foods plc and The J.M. Smucker Company are notable for their strong presence in the consumer market, offering a variety of canola oil products under well-known brands. These companies focus on product innovation and marketing strategies that highlight the health benefits of canola oil, catering to the increasing consumer preference for heart-healthy cooking options.

Louis Dreyfus Company and Bunge are major players in the agricultural commodities sector, with extensive supply chains that support large-scale canola oil production and distribution. Their global reach allows them to efficiently manage supply and demand dynamics, maintaining a competitive edge in the market.

Companies like Jivo Wellness Pvt. Limited and Adani are also key contributors, particularly in emerging markets. Jivo Wellness focuses on promoting canola oil’s health benefits in India, while Adani leverages its robust infrastructure to support production and distribution in the region.

Richardson Oilseed, Viterra, and Pacific Coast Canola are crucial players in North America, where they utilize advanced processing facilities and strong export networks to maintain their market positions. Al Ghurair stands out in the Middle East, catering to the region’s growing demand for high-quality cooking oils. Together, these companies shape the canola oil market through continuous innovation, strategic expansions, and a commitment to sustainability and quality.

Market Key Players

- Archer Daniels Midland Company

- Associated British Foods plc

- Jivo Wellness Pvt. Limited

- The J.M. Smucker Company

- Louis Dreyfus Company

- Cargill Incorporated

- Adani

- Bunge

- Richardson Oilseed

- Viterra

- Al Ghurair

- Pacific Coast Canola

Recent Development

In 2023, ADM announced a substantial investment to build a 265 million liter biodiesel plant in Lloydminster, Alberta, enhancing its North American biodiesel production capacity by 50%.

In 2023, ABF reported significant growth in its canola oil segment, driven by increased consumer demand for healthier cooking oils. By March 2023, ABF’s revenue from the canola oil segment increased by 10% compared to the previous year, reaching approximately £200 million.

Report Scope

Report Features Description Market Value (2023) US$ 33.4 Bn Forecast Revenue (2033) US$ 49.0 Bn CAGR (2024-2033) 3.9% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Nature(Organic, Conventional), By Type(Cold-pressed, Extracted), By Application(Food Processing, Foodservice, Households, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Archer Daniels Midland Company, Associated British Foods plc, Jivo Wellness Pvt. Limited, The J.M. Smucker Company, Louis Dreyfus Company, Cargill Incorporated, Adani, Bunge, Richardson Oilseed, Viterra, Al Ghurair, Pacific Coast Canola Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Canola Oil Market?Canola Oil Market size is expected to be worth around USD 49.0 billion by 2033, from USD 33.4 billion in 2023

What is the CAGR of Canola Oil Market?The Canola Oil Market is growing at a CAGR of 3.9% during the forecast period 2022 to 2032.

Who are the major players operating in the Canola Oil Market?Archer Daniels Midland Company, Associated British Foods plc, Jivo Wellness Pvt. Limited, The J.M. Smucker Company, Louis Dreyfus Company, Cargill Incorporated, Adani, Bunge, Richardson Oilseed, Viterra, Al Ghurair, Pacific Coast Canola

-

-

- Archer Daniels Midland Company

- Associated British Foods plc

- Jivo Wellness Pvt. Limited

- The J.M. Smucker Company

- Louis Dreyfus Company

- Cargill Incorporated

- Adani

- Bunge

- Richardson Oilseed

- Viterra

- Al Ghurair

- Pacific Coast Canola