Global Canned Meat Market Size, Share Analysis Report By Product Type (Lunchean Meat, Ham, Sausage, Bacon, Corned Beef, Others), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online Retail, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173317

- Number of Pages: 372

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

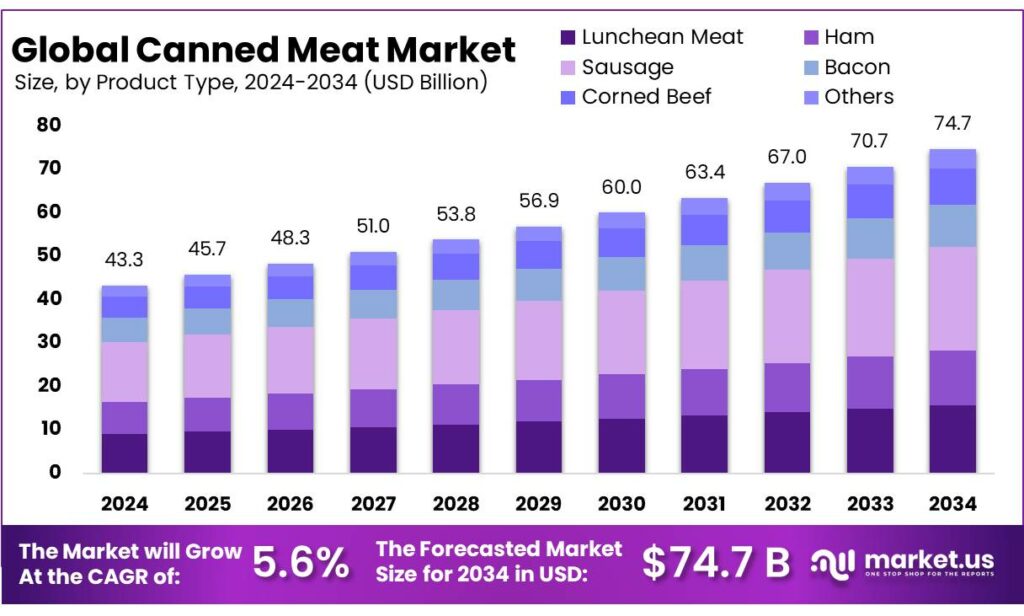

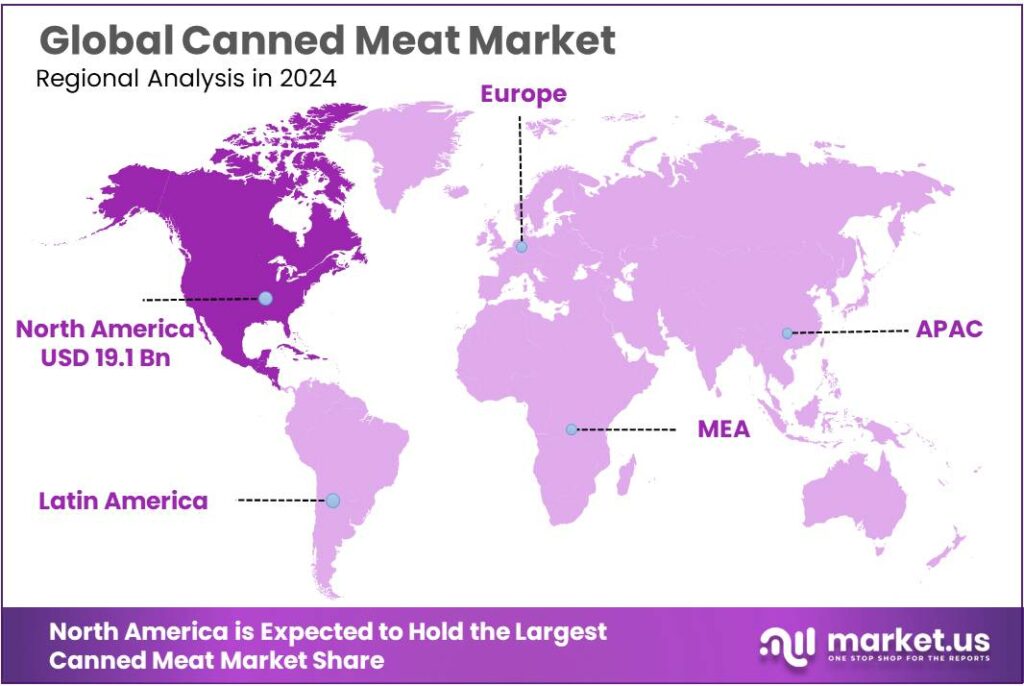

The Global Canned Meat Market size is expected to be worth around USD 74.7 Billion by 2034, from USD 43.3 Billion in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 44.3% share, holding USD 19.1 Billion in revenue.

Canned meat is a shelf-stable protein category built around cooked or cured meat that is heat-processed in sealed containers to deliver long storage life and dependable distribution. In market terms, it sits at the intersection of the global livestock system and the packaged-foods industry: it relies on large, standardized raw-material flows, tightly controlled thermal processing, and packaging formats designed to protect food safety and quality through long logistics chains.

Industrially, canned meat production scales well because it draws from a broad and still-growing meat supply base. The OECD-FAO estimates global meat production rose 1.3% in 2024 to around 365 million tonnes (Mt), and projects production to keep expanding as poultry output grows. FAO similarly forecasts world meat production reaching 384 million tonnes in 2025, up 1.4% from 2024. This matters for canned meat because processors can use a mix of primary cuts and trimmings to optimize yield, while the category’s shelf stability makes it useful for government or institutional channels that value long-life inventories.

Several demand-side forces continue to support canned meat volumes. Convenience and food security remain major drivers in urban households and institutional foodservice, especially where refrigeration is uneven or where consumers value pantry resilience. In the United States, USDA-ERS uses “availability” as a proxy for consumption and reports 226 pounds of red meat and poultry available per consumer in 2025, with beef availability at 58.5 pounds in 2025 and pork at 49.9 pounds in 2024. At the same time, health policy pressure is shaping product design: WHO recommends adults consume less than 2,000 mg/day of sodium, which puts high-salt processed meats under scrutiny and pushes reformulation toward lower-sodium, “better-for-you” lines.

Regulation and packaging performance are central to competitive positioning. In the U.S., FDA’s FSMA Preventive Controls framework has had large businesses required to comply since September 19, 2016, reinforcing the need for documented hazard analysis, process controls, and supplier verification across canned-food plants and ingredient networks. Sustainability is also becoming a procurement and brand requirement: Steel for Packaging Europe reports 82% of steel packaging placed on the EU market was “really recycled” in 2023, supporting the case for metal packaging in circular-economy narratives.

Key Takeaways

- Canned Meat Market size is expected to be worth around USD 74.7 Billion by 2034, from USD 43.3 Billion in 2024, growing at a CAGR of 5.6%.

- Sausage held a dominant market position, capturing more than a 32.6% share.

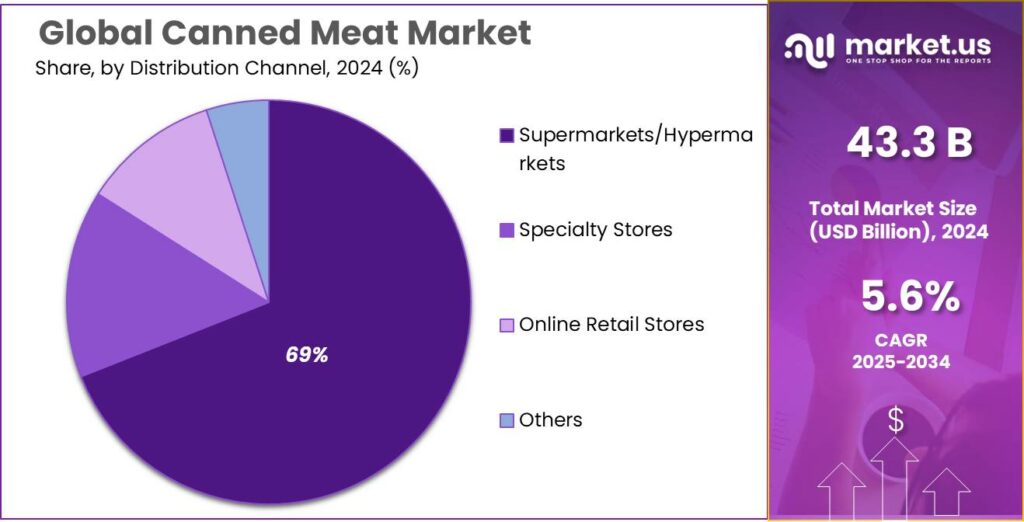

- Supermarkets/Hypermarkets held a dominant market position, capturing more than a 69.2% share.

- North America emerged as the dominant regional segment in the Canned Meat Market, capturing 44.30 % share with an estimated USD 19.1 billion.

By Product Type Analysis

Sausage leads the canned meat segment with a 32.6% share, supported by taste familiarity and long shelf life.

In 2024, Sausage held a dominant market position, capturing more than a 32.6% share. This leadership was supported by its wide consumer acceptance, familiar taste profile, and ease of use across households and foodservice settings. Canned sausages are valued for their long shelf life, stable quality, and simple storage needs, which makes them suitable for emergency food stocking and everyday meals. Demand in 2024 was also strengthened by rising urban populations and busy lifestyles, where ready-to-eat protein options gained steady traction.

In 2025, the segment continued to benefit from consistent consumption patterns, particularly in regions where canned meat is a regular pantry item. The growth of modern retail channels further improved product visibility and accessibility. Sausage products also fit well with evolving meal formats, including quick breakfasts and packaged meal kits, supporting repeat purchases. Overall, the segment’s strong performance reflects a balance of convenience, affordability, and consumer trust, allowing sausages to remain a key contributor to the canned meat market.

By Distribution Channel Analysis

Supermarkets/Hypermarkets dominate with a 69.2% share, driven by wide product choice and easy access.

In 2024, Supermarkets/Hypermarkets held a dominant market position, capturing more than a 69.2% share. This strong position was supported by their ability to offer a broad range of canned meat products under one roof, allowing consumers to compare brands, pack sizes, and prices with ease. These retail formats benefit from high footfall, organized shelf placement, and frequent promotional activities, which helped drive impulse and bulk purchases during 2024. The availability of chilled and ambient food sections in the same store further supported cross-category buying.

In 2025, supermarkets and hypermarkets continued to remain the preferred channel as consumers relied on large-format stores for routine grocery shopping and value-driven purchases. The presence of private-label canned meat products also supported steady demand by offering cost-effective options. Overall, the dominance of this channel reflects consumer trust, convenience, and consistent availability, making supermarkets and hypermarkets the primary point of sale for canned meat products.

Key Market Segments

By Product Type

- Lunchean Meat

- Ham

- Sausage

- Bacon

- Corned Beef

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retail

- Others

Emerging Trends

Rise of protein-forward, low-waste meals

One of the latest trends in canned meat is how it fits into people’s changing ideas about protein, waste, and affordable meals. Today’s consumers are not just buying food to fill up—they want meals that deliver protein efficiently, reduce waste, and fit into tight schedules. Canned meat, once seen mainly as a convenience product for emergencies or camping, is increasingly finding a place on everyday dinner tables because it solves real needs: it is ready to eat, has a long shelf life, and rarely goes bad before use.

Protein matters to modern eaters. The Food and Agriculture Organization (FAO) notes that global meat production is projected to reach 373 million tonnes in 2024, up 1.4% from 2023—evidence of steady demand for protein sources around the world. That protein is not evenly distributed; some regions rely more on canned meats because fresh proteins are expensive or hard to keep fresh. When households face food price pressures, they look for options that preserve nutrition while limiting waste. Canned meat fits this niche because a single can can be used over multiple meals without worrying about spoilage, unlike fresh meat that needs fast cooking or freezing.

At the same time, consumers are thinking differently about waste. Households and governments are more conscious of food waste because it affects both budgets and food security. The United Nations estimates that about 13.8% of the food available to consumers in 2022 was lost or wasted at the household level before it even got eaten. Canned meat helps reduce this kind of waste because once a can is opened, portions can be used across meals—like adding diced chicken to salads one day and mixing corned beef into a stir-fry the next. This reduces the risk that a whole fresh chicken or pack of ground meat sits too long and becomes unusable.

At the same time, sustainability conversations are nudging canned meat makers to consider packaging and sourcing. Governments in several countries are setting targets to cut food waste and improve packaging recyclability. For example, the EU’s Circular Economy Action Plan pushes food industries to reduce waste and design packaging that is easier to recycle, though specific numbers are updated regularly at national levels. These policies are encouraging meat processors to think about recyclable cans and labels as part of the product experience.

Drivers

Food security programs push steady demand

A major driving factor for canned meat is its role as a reliable, shelf-stable protein for food security, emergency response, and institutional feeding. When governments and humanitarian agencies need food that can move fast, store safely, and feed people without refrigeration, canned meat fits the job. It travels well, lasts long, and can be portioned for families or group feeding. That “ready when needed” function becomes even more important during conflict, disasters, and supply shocks, because cold-chain logistics are harder to manage and fresh meat availability can swing quickly.

This demand is not just theoretical—it shows up in procurement signals and volumes. The World Food Programme (WFP) has formally sought to expand its international list of pre-approved suppliers for Ready-to-Eat Rations and Canned food, which is a practical indicator that large buyers expect ongoing need and want more supply options in place. WFP also issued an Expression of Interest specifically tied to canned food, which reflects that canned, protein-based products are part of structured procurement planning rather than occasional purchasing.

The scale shift can be sharp during crises. In WFP’s procurement reporting, canned foods such as meat, chicken, tuna, and others increased from 3,000 metric tons to 21,000 metric tons per month in just two months (October–November 2023). In the same document, WFP noted a 97% increase in its total procurement of canned foods in the last quarter of 2023, reflecting the surge in demand. For canned meat producers, this kind of swing matters because it rewards manufacturers that can meet specifications, ensure consistent quality, and scale output quickly without breaking food safety rules.

That scale helps processors plan long runs, secure contracts, and diversify inputs (poultry, pork, mixed meats) to keep canned products available across price tiers. On the demand side, longer-term consumption trends stay positive: OECD-FAO projects global per-capita meat consumption will rise by 2% by 2032—an increase of about 0.7 kg per person per year (retail weight equivalent).

Restraints

Health concerns and reformulation pressure slow growth

One major restraining factor for canned meat is the growing health pushback against “processed” meat products—especially because many canned meats are high in sodium and are often grouped in the same public health conversations as other processed meats. This does not mean people stop buying canned meat overnight, but it does mean the category faces extra scrutiny from regulators, health groups, and cautious shoppers.

Sodium is the most visible issue because it is easy to measure and easy to compare on labels. The World Health Organization (WHO) recommends adults consume less than 2,000 mg of sodium per day (about 5 g of salt per day). At the same time, the U.S. Centers for Disease Control and Prevention (CDC) notes that Americans consume more than 3,300 mg of sodium per day on average—well above the federal recommendation of less than 2,300 mg/day for teens and adults.

Beyond sodium, processed-meat risk messaging adds another layer of restraint. WHO explains that an analysis of 10 studies estimated that every 50 g portion of processed meat eaten daily increases colorectal cancer risk by about 18%. Canned meats are not always identical to bacon or sausages in ingredients and processing steps, but they often sit in the same “processed meat” perception bucket for consumers. That perception can quietly shift demand toward fresh, minimally processed proteins or plant-forward meals, particularly among younger and health-conscious buyers.

Governments are also tightening expectations through sodium-reduction initiatives, which increases reformulation cost and complexity. In the U.S., the FDA issued draft guidance for Voluntary Sodium Reduction Goals (Edition 2) in August 2024, aimed at lowering sodium in commercially processed and prepared foods; FDA notes these targets would support reducing intake to about 2,750 mg/day, around 20% lower than intake prior to the earlier phase of targets.

Opportunity

Healthier, better-for-you canned meat as diets change

One major growth opportunity for canned meat is straightforward: upgrade the nutrition profile—especially sodium—without losing the big benefits people already value (long shelf life, easy storage, quick protein). Public health guidance is steadily pushing consumers and food producers toward lower-salt eating. The World Health Organization recommends adults keep sodium intake below 2,000 mg per day. At the same time, the U.S. CDC reports that Americans consume more than 3,300 mg of sodium per day on average, which is well above the federal recommendation of less than 2,300 mg/day for teens and adults.

Canned meat can fit into that space if companies treat reformulation as a product strategy, not just compliance. Even “reduced sodium” canned luncheon meat can still be high: a USDA nutrient reference list shows 580 mg of sodium per 2 oz serving for “luncheon meat… canned, reduced sodium… includes SPAM, 25% less sodium.”

Government initiatives make this opportunity even more real because they push the whole food system toward lower sodium. In the U.S., the FDA started the next phase of its sodium reduction effort on August 15, 2024, stating that the voluntary targets, when finalized, would support reducing sodium intake to about 2,750 mg/day, around 20% lower than levels prior to 2021. That kind of policy direction does two things: it raises expectations for “standard” products over time, and it gives early movers a chance to lead with “lower sodium” ranges before the shelf gets crowded with look-alikes.

There is also a second layer to this growth path: serving institutional and nutrition programs with improved shelf-stable proteins. The World Food Programme has committed to increasing the proportion of fortified staples it distributes from 60% in 2020 to 80% by 2025.

Regional Insights

North America Canned Meat Market – Leading Region with 44.30 % Share and $19.1 Bn in 2024

In 2024, North America emerged as the dominant regional segment in the Canned Meat Market, capturing 44.30 % share with an estimated USD 19.1 billion in market revenue. This commanding position was supported by established consumer habits favouring convenience and shelf-stable protein sources, particularly in the United States and Canada, where busy lifestyles and well-developed retail sectors have sustained consistent demand.

Ready-to-eat canned meat products, including sausages, luncheon meats and mixed canned proteins, remain popular among households and institutional buyers alike due to their long shelf life, ease of preparation and reliable quality. In the U.S., strong consumption of poultry and mixed canned meats reflected broad appeal across both traditional meat categories and newer protein formats backed by food processing infrastructure and regulatory safety standards.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Hormel Foods Corporation: Hormel Foods is a major U.S. food company known for iconic canned meat brands such as SPAM and Hormel Compleats. The company reported 2024 net sales of USD 11.96 billion, driven by strong retail demand and diversified protein offerings that include canned meats, deli products and ready-to-eat meals. Hormel’s branded canned meats maintain broad shelf presence across supermarkets and online channels.

The Bolton Group is an Italian food conglomerate with international presence in meat and branded food categories. Its subsidiary, Princes Group, supplies canned meat and seafood products across Europe. The group reported 2024 revenues of USD 4.03 billion, reflecting stable performance in convenience and packaged food segments inclusive of canned proteins.

Smithfield Foods, a major U.S. pork producer and subsidiary of WH Group, supplies processed meats and canned pork products under various brands. In 2024, Smithfield’s segment contributed to parent WH Group’s overall revenue of USD 22.18 billion, driven by strong demand in retail and export channels for both fresh and value-added products.

Top Key Players Outlook

- Hormel Foods Corporation

- Tyson Foods, Inc.

- Bolton Group

- Smithfield Foods, Inc.

- Vion Group

- Conagra Brands Inc

- Keystone Meats

- Werling & Sons, Inc.

- JBS SA

Recent Industry Developments

In 2025, Hormel expanded its market engagement, posting net sales of USD 12.1 billion with organic net sales up modestly, even as commodity cost pressures and volume fluctuations influenced profitability measures.

In 2025, Tyson continued to grow, reporting annual sales of USD 54,441 million, up about 2.1 % from the prior year, with adjusted operating income rising to USD 2,287 million, indicating stronger underlying profitability despite ongoing industry challenges.

Report Scope

Report Features Description Market Value (2024) USD 43.3 Bn Forecast Revenue (2034) USD 74.7 Bn CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Lunchean Meat, Ham, Sausage, Bacon, Corned Beef, Others), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Hormel Foods Corporation, Tyson Foods, Inc., Bolton Group, Smithfield Foods, Inc., Vion Group, Conagra Brands Inc, Keystone Meats, Werling & Sons, Inc., JBS SA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Hormel Foods Corporation

- Tyson Foods, Inc.

- Bolton Group

- Smithfield Foods, Inc.

- Vion Group

- Conagra Brands Inc

- Keystone Meats

- Werling & Sons, Inc.

- JBS SA