Global Camera Lens Market Size, Share, Growth Analysis By Lens Type (Interchangeable Lens, Built-In Lens), By Focal Length (Ultra-Wide +16 mm, Wide 16-35 mm, Standard 35-70 mm, Short Telephoto 70-135 mm, Long Telephoto +135 mm), By Mount/Compatibility (Mirrorless Mount, DSLR Mount, C-Mount, F-Mount, CS-Mount, Others), By Application (Consumer Electronics, Automotive, Medical, Industrial & Machine Vision, Others), By End-User (Professional, Enthusiast, Consumer, OEM/Module Suppliers, Research And Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 178636

- Number of Pages: 390

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

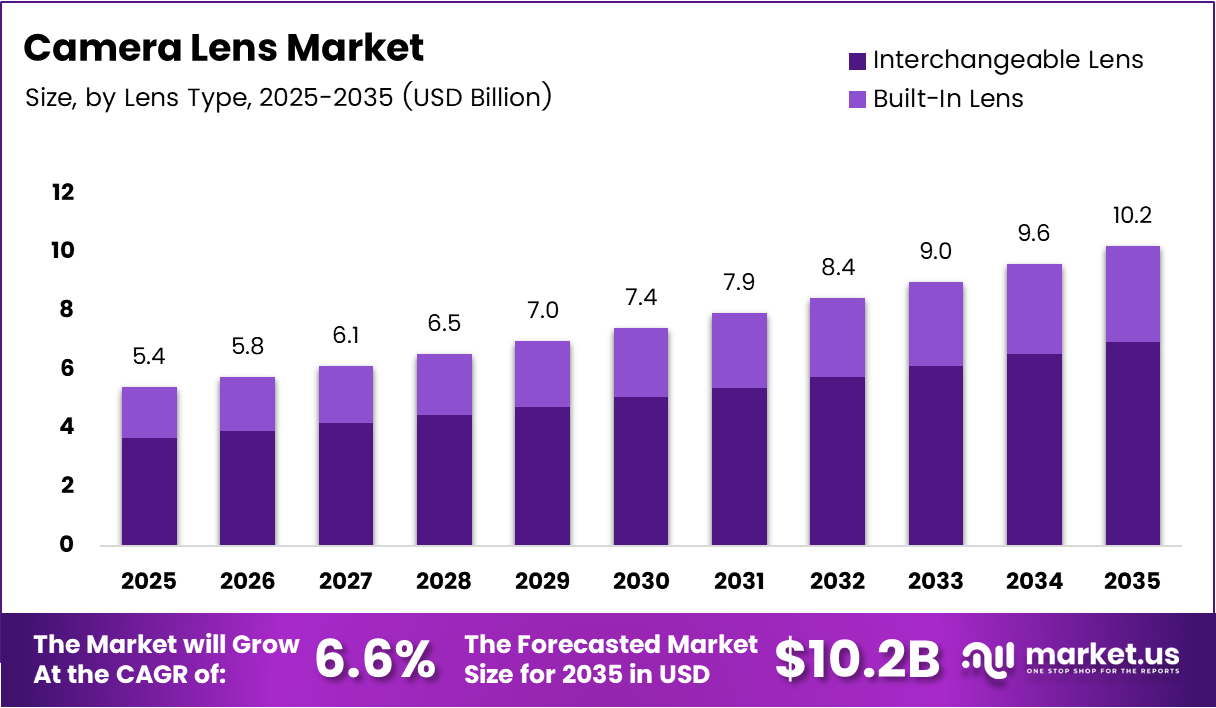

Global Camera Lens Market size is expected to be worth around USD 10.2 Billion by 2035 from USD 5.4 Billion in 2025, growing at a CAGR of 6.6% during the forecast period 2026 to 2035.

The camera lens market covers optical components designed for image capture across consumer electronics, automotive systems, medical imaging, and industrial inspection. These products range from smartphone modules and interchangeable mirrorless lenses to precision optics used in surgical and machine vision systems. This breadth of application makes lens demand structurally resilient across economic cycles.

Mirrorless camera systems now define the consumer upgrade cycle. Canon, Sony, and Nikon have all committed their primary R&D budgets to mirrorless platforms, pulling lens ecosystem investment with them. Consequently, manufacturers supplying mirrorless-compatible optics hold a clear structural advantage over those still centered on legacy DSLR mounts.

Professional content creation — spanning OTT platforms, digital advertising, and social media — continues to expand the addressable buyer base for high-performance optics. Independent filmmakers, hybrid photographers, and commercial studios now purchase lenses at volumes that were historically limited to broadcast and cinema professionals. This structural shift broadens revenue opportunities beyond traditional camera retail channels.

Government and private investment in autonomous vehicles and surgical robotics further extends demand for precision optics into non-consumer markets. Automotive camera modules for ADAS systems and medical endoscopy lenses represent fast-scaling segments where lens performance directly links to product safety certification. These industrial applications carry higher margins and more predictable procurement cycles than consumer channels.

According to data sourced from the Camera & Imaging Products Association (CIPA), total camera lens shipments reached approximately 9.52 million units in 2024, with projections indicating 10.4 million lenses shipped for the full year — marking 2024 as the strongest lens shipment year since before the pandemic. This signals that buyer replacement cycles are shortening as mirrorless adoption accelerates, creating compounding demand for compatible lens libraries.

Further supporting this trajectory, in the first 11 months of 2025, camera brands shipped more than approximately 5.76 million mirrorless cameras worldwide, representing 110.7% year-over-year growth, while DSLR shipments totaled only approximately 638,749 units in the same period (Source: Yahoo Tech). This disparity confirms that the mirrorless transition is not gradual — it is a decisive platform shift that makes compatible lens portfolios a priority investment for both manufacturers and buyers.

Key Takeaways

- The global Camera Lens Market was valued at USD 5.4 Billion in 2025 and is forecast to reach USD 10.2 Billion by 2035, at a CAGR of 6.6%.

- By Lens Type, Interchangeable Lenses dominate with a 56.8% share in 2025.

- By Focal Length, Wide (16-35 mm) lenses hold a 38.5% share.

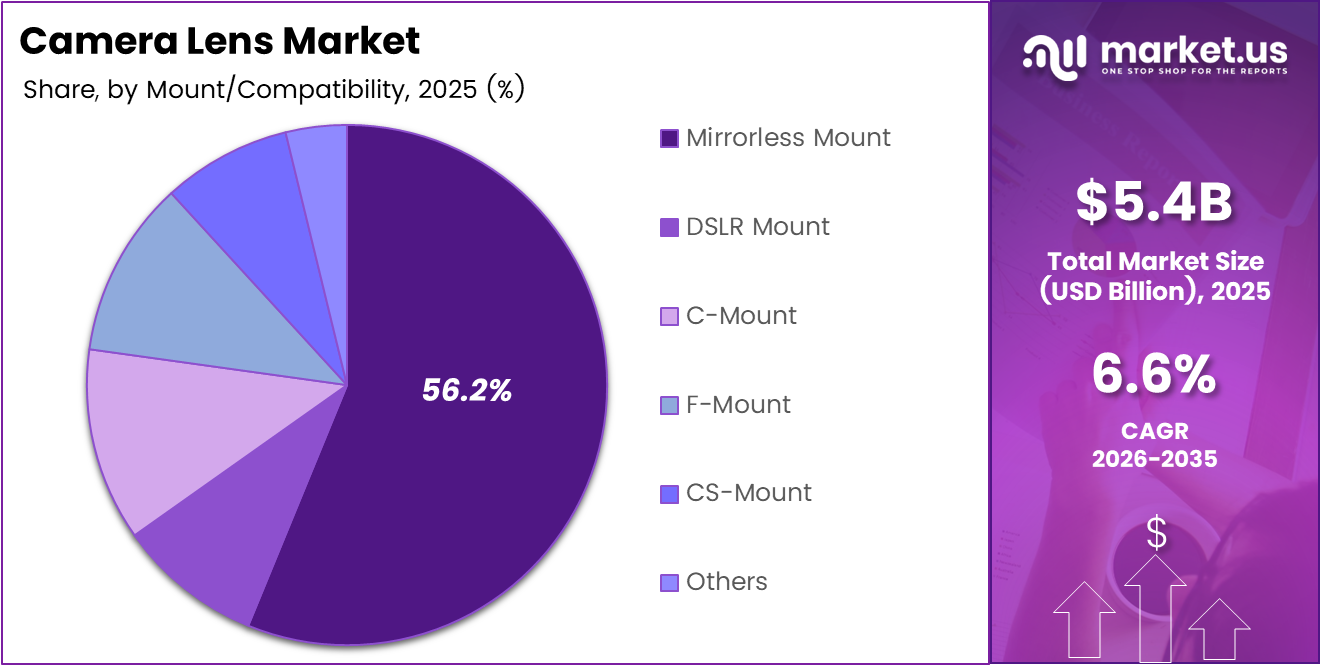

- By Mount/Compatibility, Mirrorless Mount leads with a 56.2% share.

- By Application, Consumer Electronics accounts for 59.6% of total market share.

- By End-User, Professionals represent the largest segment at 46.9%.

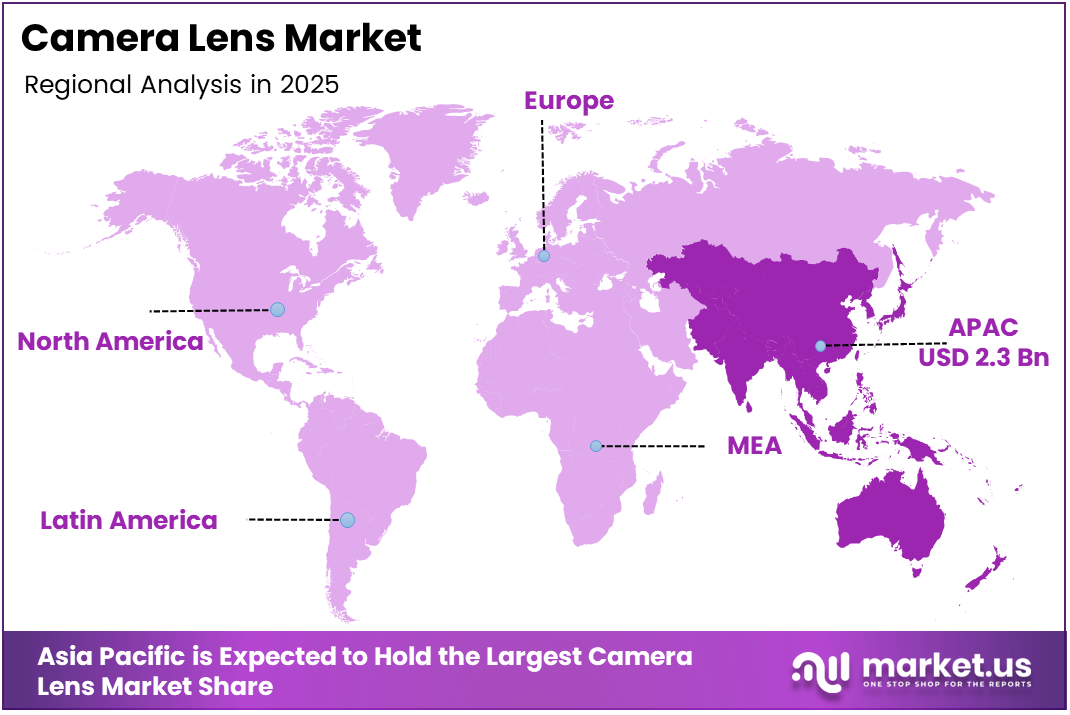

- Asia Pacific leads regional demand with a 43.60% share, valued at USD 2.3 Billion.

Product Analysis

Interchangeable Lens dominates with 56.8% due to mirrorless platform expansion and ecosystem lock-in.

In 2025, Interchangeable Lens held a dominant market position in the By Lens Type segment of the Camera Lens Market, with a 56.8% share. According to Digital Camera World, smaller-sensor interchangeable-lens camera bodies shipped approximately 4.45 million units in 2025 versus approximately 2.54 million full-frame units, showing that affordable mirrorless systems are pulling new buyers into lens ecosystems and sustaining high interchangeable lens volumes.

Built-In Lens serves the compact camera and smartphone module segment, where fixed optics are engineered for specific focal ranges. Compact cameras shipped approximately 2.44 million units in 2024 — a roughly 30% year-over-year increase — indicating that built-in lens design improvements are reviving interest in this category and sustaining manufacturer investment in fixed optical systems.

Focal Length Analysis

Wide (16-35 mm) dominates with 38.5% due to versatility across content creation use cases.

In 2025, Wide (16-35 mm) lenses held a dominant market position in the By Focal Length segment of the Camera Lens Market, with a 38.5% share. Wide lenses serve photographers, videographers, and travel content creators simultaneously — a rare multi-buyer appeal that drives consistent volume across both professional and consumer purchase channels.

Ultra-Wide (+16 mm) lenses attract independent filmmakers and architecture photographers who prioritize dramatic spatial compression. Moreover, the growth of action cameras and drones has created a secondary pull for ultra-wide optics beyond traditional camera bodies, expanding the addressable buyer pool beyond dedicated photography.

Standard (35-70 mm) lenses represent the workhorse of portrait, editorial, and event photography. Their optical simplicity allows manufacturers to achieve high image quality at accessible price points, making them the default entry lens for new system buyers and sustaining high replacement volumes.

Short Telephoto (70-135 mm) lenses carry strong margins due to their specialized application in portrait and sports photography. Buyers in this range tend to be enthusiasts and professionals who invest repeatedly in glass upgrades, making this focal length category commercially attractive for premium lens manufacturers.

Long Telephoto (+135 mm) lenses serve wildlife, sports, and surveillance applications where optical reach is non-negotiable. These products command the highest per-unit prices in the focal length spectrum, contributing disproportionately to market revenue relative to their unit volume.

Mount/Compatibility Analysis

Mirrorless Mount dominates with 56.2% due to industry-wide platform migration from DSLR systems.

In 2025, Mirrorless Mount held a dominant market position in the By Mount/Compatibility segment of the Camera Lens Market, with a 56.2% share. According to Digital Camera World, more than 6.3 million mirrorless units shipped in 2025 versus only approximately 690,900 DSLRs, confirming that mirrorless mount compatibility is now the primary technical requirement driving lens purchase decisions.

DSLR Mount lenses still generate meaningful revenue from existing camera owners who have not yet upgraded to mirrorless systems. However, the steep decline in DSLR shipments signals that this installed base will not grow, making DSLR mount a declining but not yet negligible revenue stream for lens manufacturers.

C-Mount lenses serve industrial cameras, medical imaging equipment, and machine vision systems where standardized small-format optics remain the engineering baseline. This segment benefits from consistent procurement cycles in manufacturing and healthcare, insulating it from consumer market volatility.

F-Mount lenses represent Nikon’s legacy DSLR ecosystem, which still commands a substantial global installed base. Additionally, many F-Mount lenses remain compatible with Nikon Z-series mirrorless bodies via adapter, extending their commercial life beyond the DSLR platform transition.

CS-Mount lenses operate primarily in CCTV, surveillance, and security camera applications. Consequently, their adoption ties closely to urban infrastructure investment and commercial building security mandates, giving them a demand profile that is more policy-driven than consumer sentiment-driven.

Others in mount compatibility capture specialty optical formats used in cinema, broadcast, and scientific imaging. These represent low-volume but high-value niches where price sensitivity is minimal and technical specification requirements are precise.

Application Analysis

Consumer Electronics dominates with 59.6% due to smartphone module volumes and mirrorless camera adoption.

In 2025, Consumer Electronics held a dominant market position in the By Application segment of the Camera Lens Market, with a 59.6% share. The combination of smartphone camera module production and mirrorless camera lens purchases creates a dual-engine volume dynamic that no other application segment can match in scale.

Mobile camera modules represent the single largest production volume within Consumer Electronics. Smartphone brands integrate multiple rear camera lenses per device, meaning each handset refresh cycle generates multiples of the lens demand that a single dedicated camera would. This multiplication effect makes mobile optics a volume anchor for the entire lens supply chain.

AR/VR/MR optics are an emerging category within Consumer Electronics where optical precision requirements exceed typical smartphone standards. As headset form factors shrink and display resolutions rise, lens manufacturers face a technically demanding but commercially attractive opportunity to supply next-generation spatial computing hardware.

Others within Consumer Electronics include action cameras, drone cameras, and 360-degree capture devices. These products require compact, wide-angle, and weather-resistant lens designs that differ materially from traditional interchangeable optics, creating distinct design and manufacturing demands.

Automotive camera modules represent one of the fastest-scaling non-consumer applications in the lens market. Each ADAS-equipped vehicle integrates multiple cameras — front, rear, and surround-view — which means automotive lens demand scales with vehicle production rather than consumer discretionary spending, offering a more predictable revenue stream.

Medical imaging lenses serve endoscopy, surgical robots, and diagnostic equipment, where optical performance directly affects clinical outcomes. Buyers in this segment operate under procurement frameworks tied to regulatory approval, creating long sales cycles but highly durable customer relationships once established.

Industrial and Machine Vision lenses power automated inspection, robotics, and precision manufacturing systems. Factory automation investment across electronics and automotive sectors directly drives procurement of these optics, linking their demand to capital expenditure cycles rather than consumer trends.

Others in application span security, scientific research, and broadcast production. These segments are smaller by volume but often command premium pricing, contributing a meaningful share of revenue relative to unit count.

End-User Analysis

Professional dominates with 46.9% due to high-frequency purchase behavior and premium optics demand.

In 2025, Professional end-users held a dominant market position in the By End-User segment of the Camera Lens Market, with a 46.9% share. Professional photographers, videographers, and cinematographers replace and expand their lens collections at rates that dwarf casual consumer behavior, making this segment the highest-value revenue driver per customer in the entire market.

Enthusiast buyers represent the fastest-growing buyer class in terms of premium lens adoption. These users invest in interchangeable lens systems comparable to professionals but purchase through retail rather than commercial channels, making them highly responsive to new product launches and third-party lens availability.

Consumer end-users primarily purchase entry-level zoom and kit lenses bundled with camera bodies. Their buying decisions respond to price and convenience rather than optical performance, which pushes manufacturers to optimize production costs rather than technical differentiation for this segment.

OEM/Module Suppliers source lenses as components for integration into finished products such as smartphones, vehicles, and medical devices. Their procurement patterns follow industrial contract cycles, offering lens manufacturers stable forward-looking revenue that partially offsets the seasonality of consumer retail demand.

Research and Industrial end-users acquire highly specialized optics for scientific instruments, quality control systems, and precision measurement equipment. These buyers prioritize technical specification over price, supporting premium margin structures for manufacturers capable of meeting exacting performance standards.

Key Market Segments

By Lens Type

- Interchangeable Lens

- Built-In Lens

By Focal Length

- Ultra-Wide (+16 mm)

- Wide (16-35 mm)

- Standard (35-70 mm)

- Short Telephoto (70-135 mm)

- Long Telephoto (+135 mm)

By Mount/Compatibility

- Mirrorless Mount

- DSLR Mount

- C-Mount

- F-Mount

- CS-Mount

- Others

By Application

- Consumer Electronics

- Mobile

- AR/VR/MR

- Others

- Automotive

- Medical

- Industrial & Machine Vision

- Others

By End-User

- Professional

- Enthusiast

- Consumer

- OEM/Module Suppliers

- Research And Industrial

Drivers

Mirrorless Platform Expansion and High-Resolution Imaging Demand Accelerate Lens Market Revenue

Canon, Sony, and Nikon have collectively redirected their product roadmaps toward mirrorless systems, and lens manufacturers are following. In April 2025, Samyang and Schneider-Kreuznach announced the AF 14-24 mm F2.8 FE lens for Sony E-mount — a direct response to the deepening demand for wide-aperture mirrorless-compatible optics across professional and enthusiast buyer segments.

Rising adoption of 8K video and ultra-high megapixel sensors creates a technical forcing function: existing lens inventories often cannot resolve the detail that newer camera bodies capture. Buyers face a compulsory upgrade cycle, not a discretionary one. According to MPB, total global digital camera shipments grew approximately 6.6% year-over-year in 2025, signaling that active camera ownership — and therefore active lens demand — is expanding rather than contracting.

Professional content creation across social media, OTT platforms, and digital advertising continuously onboards new buyers into the market. Independent creators who previously shot on smartphones now invest in interchangeable lens systems as their platforms monetize. Additionally, industrial and medical imaging applications pull lens demand into procurement cycles that are structurally insulated from consumer market slowdowns, providing revenue diversification for lens suppliers.

Restraints

Smartphone Computational Photography and High Manufacturing Costs Constrain Standalone Lens Market Growth

Apple and Samsung have fundamentally changed buyer expectations around image quality. Their computational photography systems now replicate shallow depth of field, low-light performance, and optical zoom through software — capabilities that once required dedicated lenses. This creates a ceiling on first-time camera system conversions, as smartphone users face a higher justification bar before purchasing interchangeable lens equipment.

Precision glass elements and specialized optical coatings require exacting manufacturing tolerances that drive up production costs. Each additional optical element in a lens design multiplies alignment and quality control requirements. Consequently, high-performance lens assembly cannot easily migrate to lower-cost manufacturing environments without sacrificing the optical consistency that professional and enthusiast buyers demand.

These two forces operate simultaneously: smartphones reduce the entry-level buyer pool while manufacturing complexity constrains cost reduction for mid-range products. Lens makers targeting the gap between smartphone quality and professional optics face the narrowest margin structure in the market, limiting their ability to fund product development at scale without either raising prices or compromising specifications.

Growth Factors

Automotive ADAS Integration and OTT Cinematic Production Unlock High-Value Industrial and Professional Lens Demand

Netflix and Amazon Prime Video’s ongoing investment in original content production has created a durable demand signal for cinema-grade optics. Productions that previously relied on rented equipment now specify lens purchases as capital requirements. Tamron reinforced this trend in July 2025 by launching the 16-30 mm F2.8 Di III VXD G2 for Sony E-mount and Nikon Z-mount — directly targeting the professional and hybrid creator segment expanding through OTT production growth.

Automotive camera modules for ADAS and autonomous driving represent a structurally different demand profile from consumer optics. Each vehicle integrates multiple camera units, and safety certification requirements mandate performance consistency that commodity lenses cannot deliver. According to Yahoo Tech, worldwide lens shipments for the first 11 months of 2025 reached approximately 101.9% of the prior year’s figure, with lenses for smaller sensor cameras up approximately 106.9% — reflecting the combined pull of both consumer mirrorless and compact automotive module demand.

Compact interchangeable lenses are also penetrating emerging markets across Asia and Latin America, where price-sensitive buyers are upgrading from smartphones to entry mirrorless systems. Additionally, lightweight hybrid glass-plastic lens assemblies for drones and action cameras create an entirely new product category with its own supply chain and margin profile — one that traditional full-frame lens manufacturers are not yet positioned to dominate, leaving space for specialized entrants.

Emerging Trends

AI-Optimized Autofocus, Wide-Aperture Primes, and Compact Design Preferences Reshape Lens Product Strategy

Independent filmmakers and hybrid creators are choosing wide-aperture prime lenses as their primary storytelling tools. These buyers prioritize subject isolation and cinematic rendering over zoom flexibility — a preference that rewards optical quality over convenience. In October 2025, Tamron announced the 25-200 mm F2.8-5.6 Di III VXD G2, targeting creators who want a single versatile lens but still expect premium optical performance throughout the zoom range.

Third-party lens manufacturers such as Sigma and Tamron are capturing share from first-party brands by offering comparable optical performance at lower price points. According to CIPA data via Petapixel, compact cameras shipped approximately 2.44 million units in 2024 after approximately a 30% year-over-year production increase — indicating that the optics market is broadening across format categories, giving third-party manufacturers more addressable platforms to target with new lens designs.

AI-optimized autofocus motors and enhanced optical stabilization systems are becoming table-stakes expectations rather than premium differentiators. Buyers now filter lens purchases partly on autofocus speed and subject tracking performance. Moreover, consumer preference for compact, travel-friendly, and weather-sealed designs forces manufacturers to solve miniaturization and sealing challenges simultaneously — a combination that increases R&D cost but also raises the barrier to entry for underfunded competitors.

Regional Analysis

Asia Pacific Dominates the Camera Lens Market with a Market Share of 43.60%, Valued at USD 2.3 Billion

Asia Pacific commands 43.60% of the global camera lens market, valued at USD 2.3 Billion in 2025. This dominance reflects the region’s role as both the primary manufacturing hub — hosting Largan Precision, Sunny Optical, and AAC Technologies — and a high-volume consumer market, particularly in China, Japan, South Korea, and India. The vertical integration of lens design, component supply, and final assembly within the region gives Asia Pacific producers a structural cost and speed-to-market advantage that other regions cannot easily replicate.

North America Camera Lens Market Trends

North America maintains a strong position as a high-value end-market, driven by professional content production, advertising, and an established base of enthusiast camera buyers. The region’s OTT production ecosystem — centered in the United States — generates consistent procurement of cinema and mirrorless optics. Moreover, ADAS adoption in the North American automotive sector creates parallel industrial lens demand that is policy-supported by federal vehicle safety standards.

Europe Camera Lens Market Trends

Europe’s camera lens demand concentrates in Germany, the UK, and France, where professional photography, broadcast production, and precision manufacturing all require high-grade optics. The region has a strong legacy in optical engineering — particularly in Germany — which supports both local manufacturing and a knowledgeable buyer base that favors technical performance over price. Industrial machine vision applications in European automotive and electronics manufacturing sustain steady B2B lens procurement.

Latin America Camera Lens Market Trends

Latin America represents an early-stage but commercially relevant growth region for interchangeable lens systems, particularly in Brazil and Mexico where middle-class consumer electronics adoption is broadening. Entry-level mirrorless systems and affordable third-party lenses are the primary growth catalysts in this market. However, import duties and currency volatility create price barriers that slow adoption of premium optical products.

Middle East and Africa Camera Lens Market Trends

The Middle East and Africa market is driven by two distinct dynamics: GCC nations investing in media production infrastructure and professional content creation, and African markets where mobile-first consumers are beginning to adopt compact camera systems. Security and surveillance applications across urban infrastructure projects in GCC countries also generate B2B lens procurement volumes that supplement consumer demand in the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Largan Precision Co. Ltd holds a dominant position in the smartphone lens module segment, supplying high-spec compact optics to the world’s leading handset manufacturers. Their strategic advantage lies in proprietary lens design IP and vertically integrated manufacturing, which enables them to maintain tight quality control across extremely high production volumes — a combination that rivals with less integrated supply chains struggle to match at equivalent scale.

Sunny Optical Technology (Group) Company Limited operates across both consumer and industrial optical segments, giving it a revenue profile that is less exposed to smartphone cycle volatility than pure-play mobile lens suppliers. Their positioning across automotive camera modules, surveillance optics, and consumer handset lenses allows them to shift production capacity between segments as demand conditions change — a structural flexibility that improves margin management across cycles.

Genius Electronic Optical Co. Ltd focuses on precision lens modules for mobile devices and emerging applications including AR/VR systems and automotive cameras. Their competitive strength comes from rapid prototyping capabilities and close design collaboration with device manufacturers during product development phases. This integration into the customer’s engineering process creates switching costs that protect their contract positions beyond price competition alone.

AAC Technologies Holdings Inc. extends beyond pure optics into actuator and module assembly, integrating optical and mechanical components into complete camera systems. This approach allows them to offer smartphone OEMs a more complete solution — lens plus autofocus mechanism — rather than competing solely on glass quality. Their systems-level positioning captures more value per camera module and reduces the number of vendor relationships a buyer must manage.

Key Players

- Largan Precision Co. Ltd

- Sunny Optical Technology (Group) Company Limited

- Genius Electronic Optical Co. Ltd

- AAC Technologies Holdings Inc.

- Samsung Electro-Mechanics Co. Ltd

- Kantatsu Co. Ltd

- Sekonix Co. Ltd

- Canon Inc.

- Sony Corporation

- Nikon Corporation

Recent Developments

- February 24, 2025 — Sigma Corporation announced the 2025 launch schedule for renewed Sigma I-series lenses — nine full-frame mirrorless lenses beginning April 2025 for L-Mount and May 2025 for Sony E-Mount — featuring updated finishes and metal lens cap support, reinforcing their premium compact lens positioning across major mirrorless platforms.

- August 18, 2025 — Tamron lenses received two prestigious EISA Awards for the 2025-2026 cycle: the 28-300 mm F4-7.1 Di III VC VXD was named EISA Superzoom Lens and the 90 mm F2.8 Di III Macro VXD was named EISA Macro Lens, validating Tamron’s quality credentials in the third-party lens market and strengthening buyer confidence in non-OEM optics.

- September 25, 2025 — Sigma revealed four new lenses — including a 35 mm F1.2 II, a 135 mm F1.4, and a 20-200 mm F3.5-6.3 all-purpose zoom — scheduled for release in late 2025 in both L-Mount and Sony E-Mount systems, expanding the high-performance prime and zoom lens options available to mirrorless system owners across two of the most commercially active mounts.

- December 5, 2025 — Voigtlander announced the Septon 40 mm F2 Aspherical lens for Sony E-mount and Nikon Z-mount mirrorless cameras, scheduled for availability in March/April 2026, extending the boutique manual lens category into the mirrorless ecosystem and targeting experienced photographers who prioritize rendering character over autofocus convenience.

Report Scope

Report Features Description Market Value (2025) USD 5.4 Billion Forecast Revenue (2035) USD 10.2 Billion CAGR (2026-2035) 6.6% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Lens Type (Interchangeable Lens, Built-In Lens), By Focal Length (Ultra-Wide +16 mm, Wide 16-35 mm, Standard 35-70 mm, Short Telephoto 70-135 mm, Long Telephoto +135 mm), By Mount/Compatibility (Mirrorless Mount, DSLR Mount, C-Mount, F-Mount, CS-Mount, Others), By Application (Consumer Electronics, Automotive, Medical, Industrial & Machine Vision, Others), By End-User (Professional, Enthusiast, Consumer, OEM/Module Suppliers, Research And Industrial) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Largan Precision Co. Ltd, Sunny Optical Technology (Group) Company Limited, Genius Electronic Optical Co. Ltd, AAC Technologies Holdings Inc., Samsung Electro-Mechanics Co. Ltd, Kantatsu Co. Ltd, Sekonix Co. Ltd, Canon Inc., Sony Corporation, Nikon Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Largan Precision Co. Ltd

- Sunny Optical Technology (Group) Company Limited

- Genius Electronic Optical Co. Ltd

- AAC Technologies Holdings Inc.

- Samsung Electro-Mechanics Co. Ltd

- Kantatsu Co. Ltd

- Sekonix Co. Ltd

- Canon Inc.

- Sony Corporation

- Nikon Corporation