Global Calcium Sulfate Market Size, Share Analysis Report By Product Type (Gypsum, Anhydrite), By Grade (Food, Technical, Pharmaceutical, Others), By Form (Powder, Granular, Liquid), By Application ( Construction, Agriculture Sector, Pharmaceuticals, Industrial Sector, Food and Beverages, Paints and Coatings, Cosmetic and Personal Care, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155306

- Number of Pages: 224

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

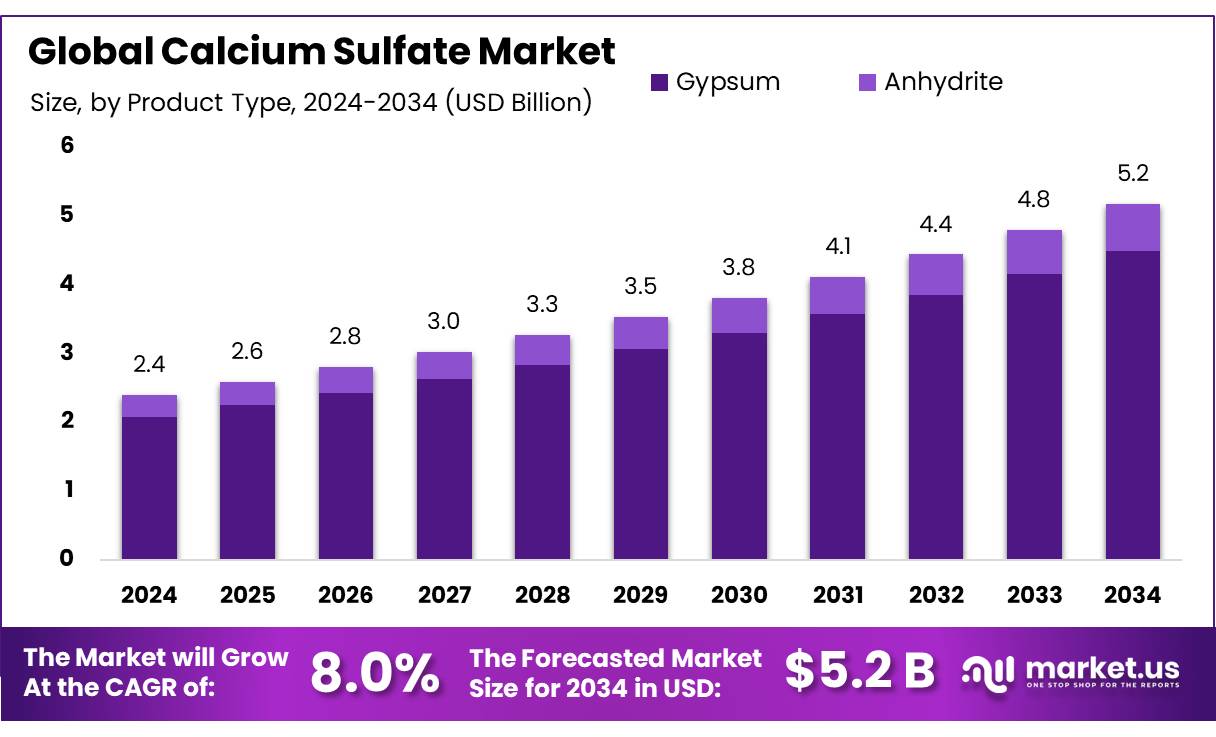

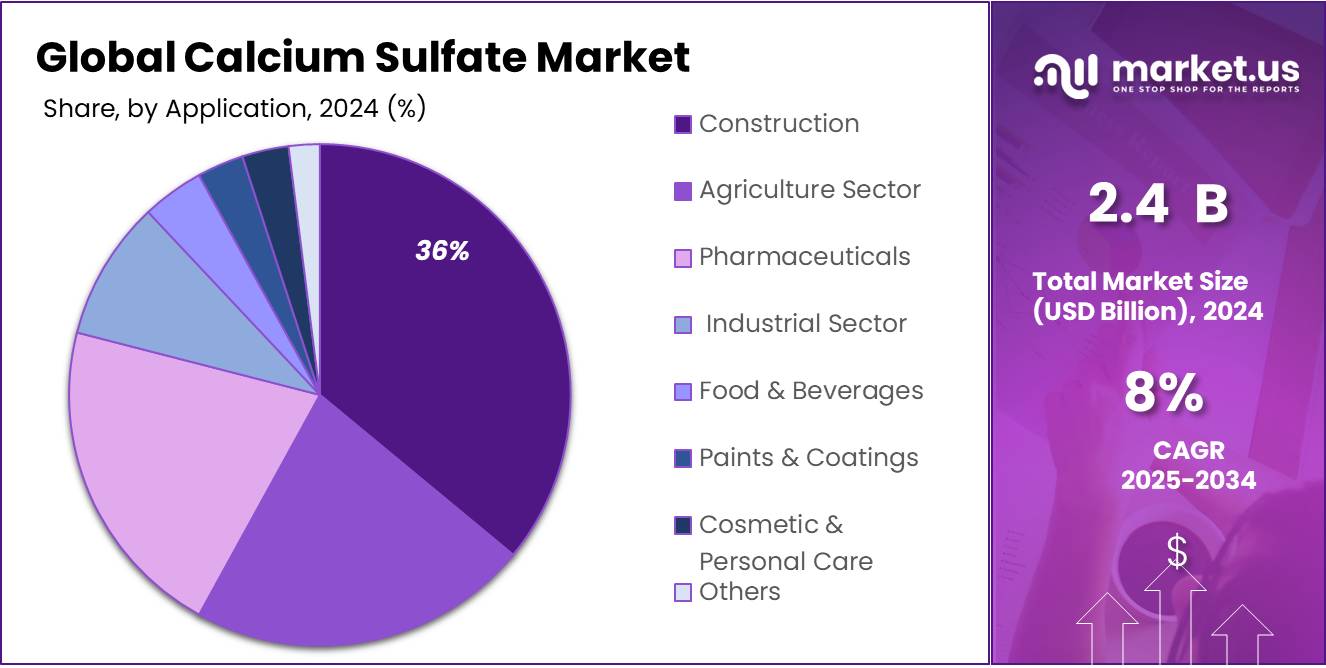

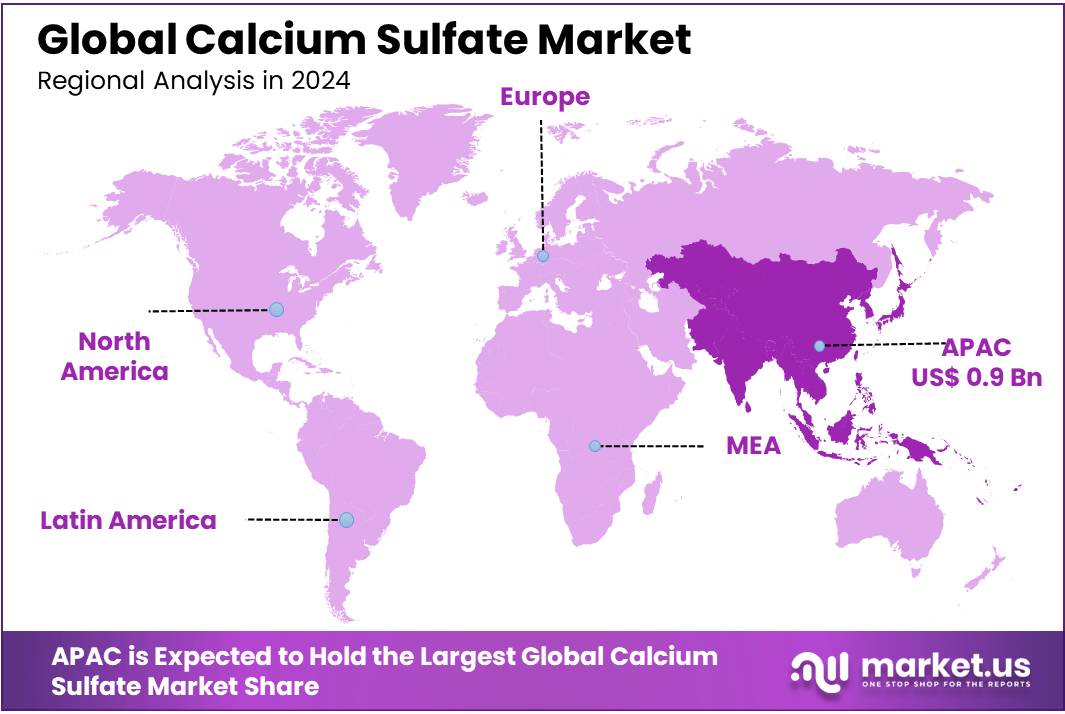

The Global Calcium Sulfate Market size is expected to be worth around USD 5.2 Billion by 2034, from USD 2.4 Billion in 2024, growing at a CAGR of 8.0% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant market position, capturing more than a 39.40% share, holding USD 0.9 Billion revenue.

Calcium sulfate concentrates (gypsum, hemihydrate, anhydrite) sit at the crossroads of construction materials, food/pharma ingredients, and agriculture. In building products, they are essential for wallboard cores, plasters, and as a set regulator in cement; in food and nutraceuticals, high-purity concentrates are used as a firming agent, dough conditioner, and calcium source; and in agriculture they supply Ca and S while improving soil structure.

The U.S. Geological Survey (USGS) reports total 2024 U.S. gypsum supply at ~42.8 Mt (20.3 Mt mined, 7.13 Mt imported, and an estimated 15.4 Mt synthetic gypsum), with synthetic gypsum representing ~37% of quarterly supply in Q4-2024—underscoring the scale and reliability of this secondary stream for concentrate producers.

Regulatory and standards frameworks support high-purity applications. In foods, calcium sulfate is affirmed by FDA as a multifunctional additive (anti-caking, dough conditioner, stabilizer, etc.) and listed in its Food Additive Status resources; in the EU it is E516, with an assay specification “not less than 99.0% (anhydrous basis),” enabling uniform quality for beverage, bakery, and fortified foods. These specifications sustain the premium end of the concentrates market in food and nutraceuticals.

A significant supply-side driver is flue-gas desulfurization (FGD) gypsum from coal power plants, which the U.S. EPA evaluated in 2023 as an appropriate beneficial use in agriculture—bolstering demand for processing into agricultural-grade concentrates.

India’s policy environment has also pushed FGD deployment in recent years, with NITI Aayog (Jan 2025) documenting installation requirements at coal-based thermal power stations; this creates a structural pathway for additional synthetic gypsum availability (though the pace and scope are evolving). CPCB has issued handling and management guidance for FGD gypsum, improving logistics and environmental compliance for agricultural and industrial reuse.

Key Takeaways

- Calcium Sulfate Market size is expected to be worth around USD 5.2 Billion by 2034, from USD 2.4 Billion in 2024, growing at a CAGR of 8.0%.

- Gypsum held a dominant market position, capturing more than a 86.8% share.

- Technical held a dominant market position, capturing more than a 67.2% share.

- Powder held a dominant market position, capturing more than a 72.3% share.

- Construction held a dominant market position, capturing more than a 36.5% share.

- Asia Pacific held a dominant market position, capturing 39.40% of calcium sulfate demand, valued at roughly USD 0.9 Bn.

By Product Type Analysis

Gypsum leads the pack with 86.8%—thanks to broad, everyday uses.

In 2024, Gypsum held a dominant market position, capturing more than a 86.8% share. Its edge comes from being the go-to calcium sulfate form for wallboard cores, plasters, and as a set regulator in cement, while also fitting clean-label roles in food, nutraceuticals, and agriculture. In 2024, demand was steady across construction and renovation, with gypsum’s consistent performance, easy processing, and reliable sourcing (natural and synthetic) keeping it the default choice for manufacturers. In 2025, the segment continues to benefit from resilient housing activity, retrofit projects, and the growing use of synthetic streams from industrial by-products that support secure supply.

Producers are focusing on tighter quality control for high-purity uses and on process improvements that reduce waste and energy, helping customers meet cost and sustainability targets. Across both years, gypsum’s versatility—moldable for panels and plasters, stable in cement blends, and acceptable in regulated food applications—keeps switching costs low and supplier relationships sticky. Its established standards, global familiarity, and broad distributor networks make it easier for buyers to scale production without requalifying materials. Together, these factors preserve gypsum’s leadership within calcium sulfate product types, reinforcing its role as the practical, high-confidence option for large, repeat-purchase applications.

By Grade Analysis

Technical grade leads with 67.2%—driven by reliability and scale.

In 2024, Technical held a dominant market position, capturing more than a 67.2% share. Buyers favored this grade for cement set regulation, wallboard cores, plasters, and industrial fillers where consistent performance, moisture control, and predictable setting behavior matter more than ultra-high purity. Technical grade also benefits from flexible sourcing—natural gypsum and synthetic streams—helping producers stabilize costs and reduce supply risk in routine, high-volume applications.

In 2024, downstream construction and renovation activity kept throughput steady, while manufacturers prioritized tight particle-size control and low impurity variability to reduce line downtime. In 2025, the segment’s lead is reinforced by retrofit and repair demand, broader use of energy-efficient board lines, and process tweaks that cut waste and improve kiln and dryer efficiency. Customers stick with technical grade because it integrates easily into existing formulations, requires minimal requalification, and is supported by mature standards across regions. Together, these factors sustain Technical’s leadership within calcium sulfate grades into 2025.

By Form Analysis

Powder dominates with 72.3% because it’s easy to handle, blend, and scale.

In 2024, Powder held a dominant market position, capturing more than a 72.3% share. Producers and end users preferred powder for its predictable flow, tight particle-size control, and easy dosing into automated batching lines across cement, wallboard, dry-mix mortars, agricultural soil amendments, and food-grade applications. Powder also ships efficiently in bulk bags and silos, reducing handling losses and enabling cleaner, faster changeovers on high-throughput lines. In 2024, steady construction activity and retrofit work supported recurring orders for powder formulations that integrate seamlessly as set regulators and fillers without reformulating downstream processes.

In 2025, the segment’s lead is reinforced by broader adoption of pre-blended dry mixes, rising demand for consistent whiteness and moisture control in premium skus, and secure sourcing from both natural and synthetic gypsum streams. Suppliers are focusing on de-dusting, anti-caking, and tighter sieving to improve consistency and shelf life, which helps customers cut waste and downtime. Because powder grades are widely standardized and well understood by regulators and QA teams, buyers face minimal requalification risk, keeping supplier relationships sticky and costs predictable. Together, these practical advantages keep powder the default form factor for high-volume, repeat-purchase applications into 2025.

By Application Analysis

Construction leads with 36.5%—because walls, boards, and cement never stop building.

In 2024, Construction held a dominant market position, capturing more than a 36.5% share. Demand was anchored by gypsum board manufacturing (as the core material), cement set regulation, plasters, and dry-mix mortars that require consistent setting times and moisture control. Builders favored calcium sulfate for its fire resistance, dimensional stability, and acoustic performance, which makes it a safe, easy choice for interior partitions, ceilings, and finishing systems.

Renovation and retrofit projects kept orders steady, while prefabrication and ready-mix lines leaned on powder grades for clean dosing and fast changeovers. Reliable supply—drawn from both natural reserves and synthetic streams—helped contractors manage cost and delivery risk without reformulating. In 2025, the application continues to benefit from housing upgrades, commercial fit-outs, and infrastructure finishing works, with producers fine-tuning particle size, de-dusting, and quality control to reduce waste and downtime on job sites. Together, these practical, day-to-day advantages keep construction the anchor application for calcium sulfate across major building markets.

Key Market Segments

By Product Type

- Gypsum

- Anhydrite

By Grade

- Food

- Technical

- Pharmaceutical

- Others

By Form

- Powder

- Granular

- Liquid

By Application

- Construction

- Agriculture Sector

- Pharmaceuticals

- Industrial Sector

- Food & Beverages

- Paints & Coatings

- Cosmetic & Personal Care

- Others

Emerging Trends

Emerging Trends in Calcium Sulfate Utilization for Food Fortification

Calcium sulfate is gaining attention in the food industry, particularly in fortification efforts aimed at addressing calcium deficiencies. This trend is driven by increasing awareness of the importance of calcium for bone health and the need to improve dietary intake among populations at risk of deficiency.

In India, the Food Safety and Standards Authority of India (FSSAI) has recognized the role of calcium sulfate in food fortification. The FSSAI’s “Compendium of Food Fortification Regulations” outlines guidelines for the addition of essential nutrients to foods to improve their nutritional quality and provide public health benefits. Calcium sulfate is listed as a permissible fortificant in various food categories, including wheat flour, salt, and edible oils, under specific conditions and maximum limits. This regulatory framework facilitates the incorporation of calcium sulfate into food products, ensuring both safety and efficacy.

Globally, the Food and Agriculture Organization (FAO) emphasizes the role of food fortification in combating micronutrient deficiencies. The FAO’s guidelines highlight the addition of nutrients like calcium to commonly consumed foods as an effective strategy to address deficiencies in populations. While the FAO has primarily focused on other micronutrients, the principles outlined in their fortification guidelines are applicable to calcium fortification efforts.

The growing awareness of calcium’s health benefits, such as its role in bone health and prevention of osteoporosis, is driving consumer demand for calcium-fortified foods. This trend presents a significant opportunity for manufacturers to incorporate calcium sulfate into their products, catering to health-conscious consumers seeking to meet their calcium needs through diet.

Drivers

Increasing Demand for Calcium Sulfate in Food and Agriculture Sectors

Calcium sulfate is increasingly being recognized for its essential role in food and agriculture sectors, driven by its versatile applications and growing demand for sustainable farming practices. It serves as a food additive, anti-caking agent, and soil conditioner, all of which are critical for enhancing product quality and agricultural productivity.

In the food industry, calcium sulfate is often used as a food additive and in baking powder formulations, providing a source of calcium, which is crucial for human health. As consumers become more health-conscious, the demand for fortified foods, including those with calcium supplements, is growing, thus driving the use of calcium sulfate in food production.

The agricultural industry has also experienced a shift towards sustainable farming, where calcium sulfate plays a key role in soil enhancement. It is widely used as a soil amendment to improve soil structure, reduce soil salinity, and provide sulfur and calcium, two essential nutrients for plant growth. The rising need for sustainable farming practices, coupled with the increasing demand for high-quality crops, has contributed to the growing use of calcium sulfate in agriculture. The U.S. Department of Agriculture (USDA) reports that improving soil health is a top priority in modern agriculture, which directly correlates to the growing adoption of calcium sulfate.

According to the Food and Agriculture Organization (FAO), the global demand for food products containing essential nutrients like calcium is projected to rise, as the population continues to grow. With over 60% of the global population expected to live in urban areas by 2050, there is a corresponding need for more efficient agricultural production.

Restraints

Regulatory Challenges Hindering the Widespread Use of Calcium Sulfate in Food Applications

Despite its recognized benefits in food and agriculture, the adoption of calcium sulfate is constrained by stringent regulatory frameworks that vary across regions. These regulations are designed to ensure consumer safety and product quality but can pose significant barriers to manufacturers seeking to incorporate calcium sulfate into their products.

In India, the Food Safety and Standards Authority of India (FSSAI) governs the use of food additives, including calcium sulfate. According to the Food Safety and Standards (Food Products Standards and Food Additives) Regulations, 2011, calcium sulfate is permitted as a food additive under specific conditions. For instance, it is allowed as a firming agent in tofu and other soy-based products, but its use is subject to compliance with prescribed limits and quality standards.

Similarly, in the European Union, the European Food Safety Authority (EFSA) evaluates the safety of food additives, including calcium sulfate. EFSA’s scientific opinions provide guidelines on acceptable usage levels to ensure consumer safety. For example, EFSA has assessed the safety of calcium sulfate when used as a food additive and has established acceptable daily intake levels based on scientific data.

These regulatory requirements necessitate manufacturers to conduct thorough safety assessments and obtain necessary approvals before incorporating calcium sulfate into their products. This process can be time-consuming and costly, particularly for small and medium-sized enterprises. Moreover, the variability in regulations across different regions can complicate international trade and market access for products containing calcium sulfate.

Opportunity

Growth Opportunity: Vegan Cheese – A Plant-Based Revolution

Calcium sulfate plays a crucial role in vegan cheese production, particularly in achieving the desired texture and meltability. It acts as a coagulant, aiding in the curdling process and contributing to the firmness and sliceability of the cheese. This functionality is vital in replicating the sensory experience of traditional dairy cheese, which is a key factor driving consumer acceptance of plant-based alternatives.

The increasing adoption of plant-based diets, driven by health considerations, ethical concerns, and environmental awareness, is fueling the demand for vegan cheese. Calcium sulfate’s role in enhancing the texture and nutritional profile of these products positions it as a valuable ingredient in the expanding plant-based food sector.

Moreover, the growing trend towards clean-label products, where consumers prefer foods with minimal and recognizable ingredients, aligns with calcium sulfate’s natural origin and recognized safety in food applications. This preference further supports the inclusion of calcium sulfate in vegan cheese formulations, as it meets the demand for transparency and simplicity in food labeling.

Regional Insights

Asia Pacific on top with 39.40% and a solid US$0.9 Bn in 2024.

In 2024, Asia Pacific held a dominant market position, capturing 39.40% of calcium sulfate demand, valued at roughly USD 0.9 Bn. The region’s scale comes from everyday building uses—gypsum board cores, plasters, and cement set regulation—supported by steady residential upgrades and commercial fit-outs across large urban centers. Powder form remains the workhorse for automated batching and dry-mix lines, while technical grade is preferred for reliable setting behavior and low variability on high-throughput board plants.

Construction applications mirror global patterns, with interior partitions, ceilings, and finishing systems relying on calcium sulfate for fire resistance, acoustic control, and dimensional stability. The 2024 outturn also reflects secure sourcing from both natural deposits and synthetic streams, which helps buyers manage cost and delivery risk without reformulating.

Demand from agriculture (soil conditioning and sulfur replenishment) and regulated food uses adds a steady secondary pull, but the core remains construction. At a global level, Asia Pacific’s US$0.9 Bn footprint implies a total market near US$2.28 Bn, reinforcing the region’s role as the anchor customer base for producers seeking volume stability and predictable offtake.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

GFS Chemicals, Inc. supplies high-purity calcium sulfate for lab, food, and pharma uses where consistency and documentation matter. Its portfolio covers anhydrite and hemihydrate grades used as diluents, firming agents, flow aids, and drying components. Strengths include tight specifications, lot traceability, and small-batch flexibility for R&D or specialty runs. In 2024–2025 the focus is on GMP-aligned quality systems, cleaner powder handling, and tech support for reformulation projects. Key risks are feedstock purity swings, freight costs, and qualification timelines at customers.

Imerys is a performance minerals company with engineered calcium sulfate plasters and specialty binders used in construction finishes, dry-mix mortars, and industrial casting. Its scale, application labs, and plants help customers optimize setting profiles, whiteness, and moisture control across high-throughput lines. In 2024–2025 the focus is on low-dust powders, tighter PSDs, and energy-efficient calcination to cut costs and emissions. Key sensitivities include energy and transport costs, while opportunities lie in lightweight formulations and sourcing of synthetic gypsum where quality allows.

JONOUB Gypsum is a vertically integrated miner and exporter supplying gypsum rock, plaster, and ground calcium sulfate to construction, cement, and agricultural customers. Its strengths are deposits, consistent whiteness, and access to Persian Gulf ports that support bulk shipments to South Asia and Africa. In 2024–2025 the company’s focus is on capacity utilization, micronized powders, and screening to reduce variability. Key risks include currency volatility, sanctions-related constraints, and freight availability, which can influence delivery schedules, working capital, and landed costs.

Top Key Players Outlook

- GFS Chemicals, Inc.

- GMCI

- Imerys

- JONOUB Gypsum

- JUNSEI CHEMICAL CO., LTD.

- Lafarge

- National Gyp

- Omya AG

- Saint-Gobain

- Solvay

Recent Industry Developments

In 2024, GMCI was recognized as one of the top calcium sulfate manufacturers globally, holding a significant market share of 16.2%.

In 2024 Imerys, reported a revenue of €3.6 billion, marking a 1% organic growth compared to the previous year. Imerys’ high-purity calcium sulfate products are utilized across various industries, including construction, agriculture, and pharmaceuticals.

Report Scope

Report Features Description Market Value (2024) USD 2.4 Bn Forecast Revenue (2034) USD 5.2 Bn CAGR (2025-2034) 8.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Gypsum, Anhydrite), By Grade (Food, Technical, Pharmaceutical, Others), By Form (Powder, Granular, Liquid), By Application ( Construction, Agriculture Sector, Pharmaceuticals, Industrial Sector, Food and Beverages, Paints and Coatings, Cosmetic and Personal Care, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape GFS Chemicals, Inc., GMCI, Imerys, JONOUB Gypsum, JUNSEI CHEMICAL CO., LTD., Lafarge, National Gyp, Omya AG, Saint-Gobain, Solvay Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- GFS Chemicals, Inc.

- GMCI

- Imerys

- JONOUB Gypsum

- JUNSEI CHEMICAL CO., LTD.

- Lafarge

- National Gyp

- Omya AG

- Saint-Gobain

- Solvay