Global Botulinum Toxin Market By Type (Botulinum toxin A and Botulinum toxin B), By Application (Therapeutic and Aesthetic), By End-User (Hospitals, Dermatology Clinics, and Spas & cosmetic Center), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 99817

- Number of Pages: 261

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

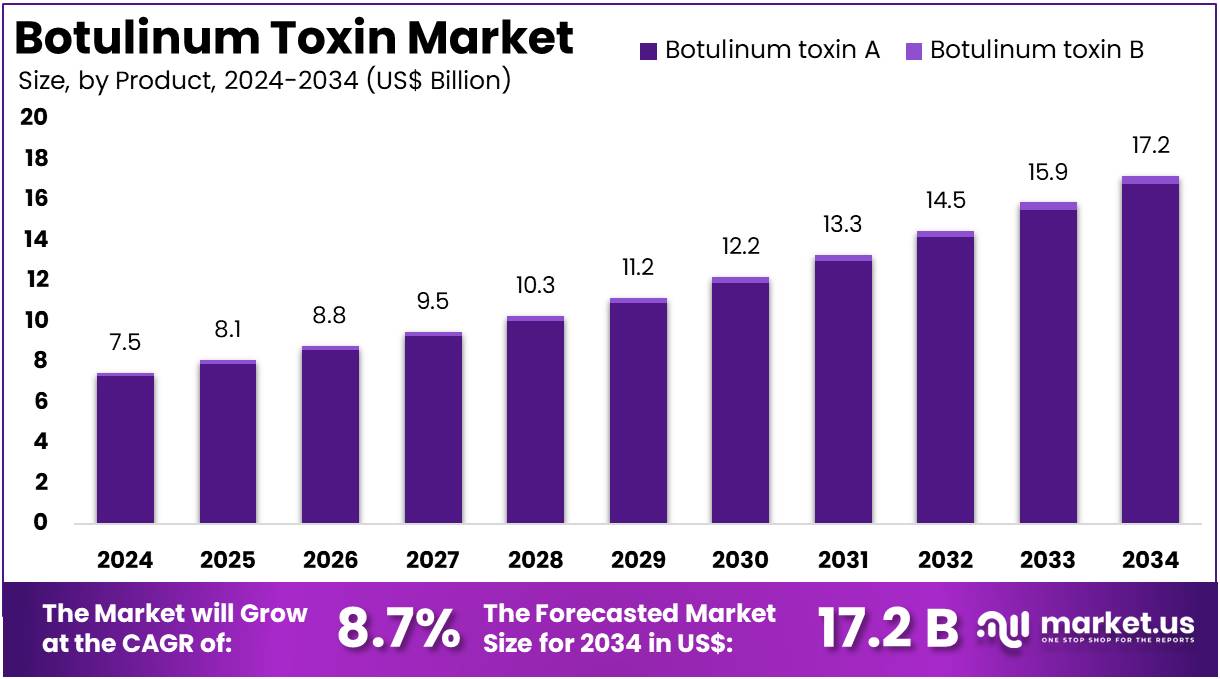

The Global Botulinum Toxin Market Size is expected to be worth around US$ 17.2 Billion by 2034, from US$ 7.5 Billion in 2024, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

Botulinum Toxin Market, Global Analysis, 2020-2024 (US$ Billion)

Global 2020 2021 2022 2023 2024 CAGR Revenue 2.8 5.1 6.5 6.9 7.5 8.7% Botulinum toxins are natural proteins produced by the bacterium clostridium botulinum. These powerful substances work by blocking the release of a chemical called acetylcholine, which helps muscles contract. This blockage leads to temporary muscle relaxation or paralysis. Among the different types of botulinum toxins, types A and B are most commonly used in medicine and cosmetics.

Botulinum toxins are widely used in both medical and cosmetic fields for various treatments. Medically, they are effective for chronic migraines, muscle spasticity (cerebral palsy, stroke, multiple sclerosis), hyperhidrosis, overactive bladder, cervical dystonia, strabismus, and blepharospasm by relaxing overactive muscles and blocking pain signals.

Cosmetically, botulinum toxins are popular for reducing wrinkles and fine lines, facial contouring, subtle lip enhancements, reducing neck bands, and lifting the brows by relaxing specific facial muscles. These applications highlight the versatility and effectiveness of botulinum toxins in improving health and enhancing physical appearance. To cater the growing demand for the product companies are performing partnership and collaboration activities which further drive the growth of market.

In July 2020, Merz Pharma formed a strategic partnership with Tenjin Pharma. This collaboration focuses on the sale of Tenjin Pharma’s Xeomin (incobotulinumtoxinA). The product, available in doses of 50, 100, and 200 units, has been approved by Japan’s Ministry of Health. It is indicated for treating lower limb spasticity. This agreement aims to strengthen both companies’ business portfolios and enhance their revenue generation opportunities.

Key Takeaways

- The global Botulinum Toxin market was valued at USD 7.5 billion in 2024 and is anticipated to register substantial growth of USD 17.2 billion by 2034, with 8.7% CAGR.

- In 2024, the botulinum toxin A segment took the lead in the global market, securing 97.8% of the total revenue share.

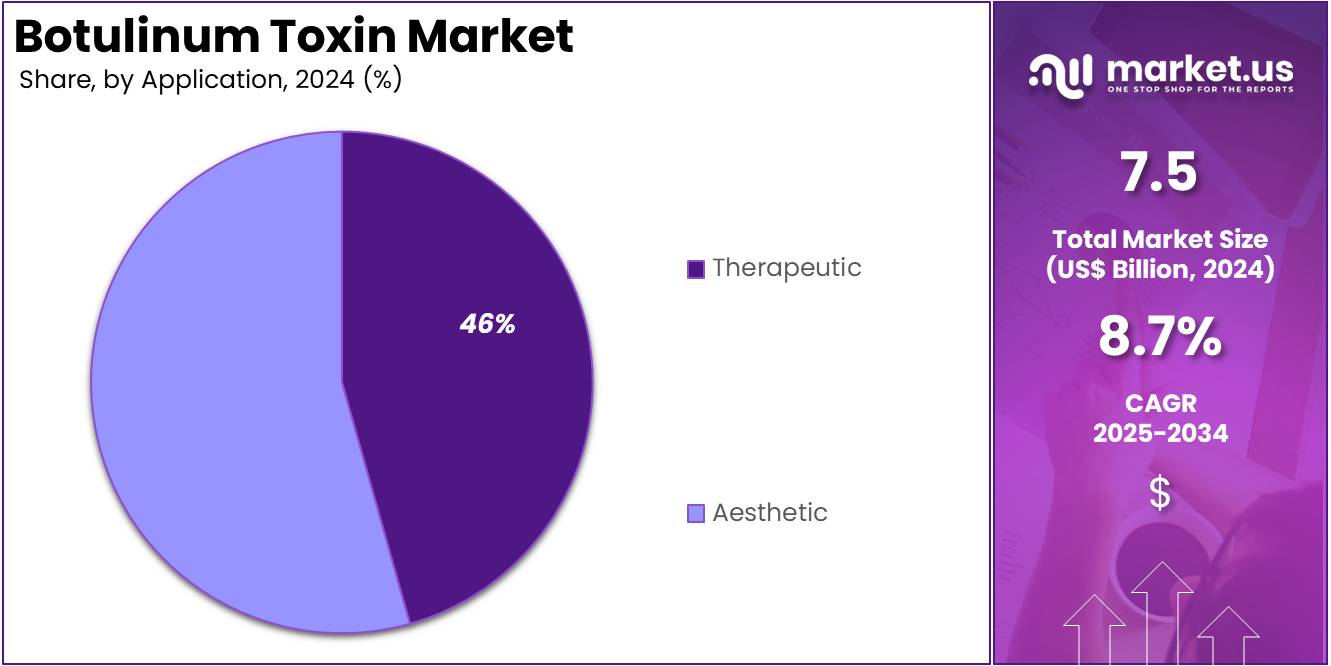

- Based On Application, aesthetic segment dominated, securing a substantial 46% of the market share.

- The aesthetic segment took the lead in the global market, securing 54.9% of the total revenue share.

- North America maintained its leading position in the global market with a share of over 74.68% of the total revenue.

Type Analysis

Based on type the market is fragmented into Botulinum toxin A and Botulinum toxin B. Amongst these, Botulinum toxin A dominated the global Botulinum Toxin market capturing a significant market share of 97.8% in 2024. Each BoNT-A product varies in formulation, potency, onset of action, duration of effect, and specific indications approved by regulatory agencies such as the FDA (Food and Drug Administration) in the United States and the EMA (European Medicines Agency) in Europe.

Healthcare providers carefully select the appropriate BoNT-A based on patient needs, treatment objectives, and their clinical experience with each product. The diversity within the BoNT-A market allows for tailored treatment plans that optimize patient outcomes in both medical and aesthetic settings.

- In 2022, the global administration of Botox treatments surpassed 9 billion, marking a 26.1% increase from the previous year. This significant growth highlights a shift in consumer preferences, with more age groups opting for non-surgical enhancements such as Botox instead of surgical procedures. This trend underscores a broader acceptance and adoption of minimally invasive aesthetic treatments worldwide.

- The study reveals that in 2022, 85.1% of the 9,221,419 Botox procedures were performed on women. Nearly 7.9 billion women opted for Botox injections, compared to 1.37 billion men.

Botulinum Toxin Market, Type Analysis, 2020-2024 (US$ Billion)

Type 2020 2021 2022 2023 2024 Botulinum toxin A 2.7 5.0 6.3 6.8 7.3 Botulinum toxin B 0.1 0.1 0.1 0.2 0.2 Application Analysis

The global Botulinum Toxin market is categorized by application into therapeutic and aesthetic segments. In 2024, the aesthetic segment dominated, securing a substantial 46% of the market share. Botulinum toxins, including well-known brands like Botox, Dysport, and Xeomin, are primarily utilized in aesthetic medicine. Their primary function is to diminish the appearance of wrinkles and fine lines, enhancing facial aesthetics.

These neurotoxins operate by temporarily paralyzing muscles, blocking the neurotransmitter acetylcholine, which is responsible for muscle contraction. When injected into specific facial muscles, botulinum toxins cause these muscles to relax. This relaxation results in a smoother and more youthful appearance of the skin, making it a popular choice for cosmetic enhancement.

- Botulinum toxins are widely used in aesthetic treatments. They effectively target dynamic wrinkles. Common areas treated include crow’s feet around the eyes, frown lines between the eyebrows (glabellar lines), and forehead lines. This application helps achieve a smoother facial appearance.

Botulinum Toxin Market, Application Analysis, 2020-2024 (US$ Billion)

Application 2020 2021 2022 2023 2024 Therapeutic 1.3 2.3 2.9 3.1 3.4 Aesthetic 1.5 2.8 3.5 3.8 4.1 End-User Analysis

The market is fragmented by end-user into hospitals, dermatology clinics, and spas & cosmetic center. Hospitals dominated the global Botulinum Toxin market capturing a significant market share of 54.9% in 2024. Hospitals play a crucial role as end users of botulinum toxin treatments, leveraging their advanced medical infrastructure and expertise to administer these procedures safely and effectively.

Botulinum toxin, particularly types A and B, is used in a wide range of medical applications within hospital settings, addressing both therapeutic and cosmetic needs. Therapeutically, hospitals utilize botulinum toxin for managing various neuromuscular conditions. For instance, it is commonly used to treat spasticity in patients with cerebral palsy, multiple sclerosis, and post-stroke muscle stiffness.

Hospitals also employ botulinum toxin to alleviate chronic migraine headaches, providing relief to patients who suffer from frequent, debilitating migraines. Additionally, botulinum toxin is used in the treatment of overactive bladder and excessive sweating (hyperhidrosis), conditions that significantly impact the quality of life. The precise administration of botulinum toxin in these cases requires the expertise available in hospital settings, ensuring both efficacy and safety.

Botulinum Toxin Market, End-User Analysis, 2020-2024 (US$ Billion)

End-User 2020 2021 2022 2023 2024 Hospitals 1.1 2.0 2.6 2.7 3.0 Dermatology Clinics 0.6 1.1 1.4 1.5 1.6 Spas & cosmetic Center 1.1 2.0 2.5 2.7 2.9 Key Segments Analysis

By Product

- Botulinum toxin A

- Botox

- Dysport

- Xeomin

- Others

- Botulinum toxin B

By Application

- Therapeutic

- Chronic Migraine

- Overactive Bladder

- Cervical Dystonia

- Spasticity

- Others

- Aesthetic

- Glabellar Lines

- Crow’s Feet

- Forehead Lines

- Others

By End-user

- Hospitals

- Dermatology Clinics

- Spas & cosmetic Center

Drivers

Increasing Number of Product Launch and Approvals

The global botulinum toxin market is witnessing robust growth, driven significantly by an increasing number of product launches and regulatory approvals. These advancements are expanding the market’s reach and providing healthcare professionals with a broader range of therapeutic options. One of the notable drivers is the continuous introduction of new botulinum toxin products tailored to address diverse medical and cosmetic needs.

- For instance, in 2019, Evolus Inc. launched Jeuveau®, a botulinum toxin type A product specifically developed for aesthetic purposes, targeting the reduction of glabellar lines. This product introduction not only diversified the available options but also intensified competition, spurring innovation and better pricing strategies.

- Additionally, in October 2022, Croma-Pharma successfully launched its botulinum toxin across eleven major European markets. These include Austria, Poland, the UK/Ireland, Germany, Italy, France, the Netherlands, Portugal, Spain, and Romania. This product targets the treatment of glabellar lines, commonly known as frown lines. The approval process in Europe was underpinned by compelling results from three randomized, placebo-controlled phase III trials. These studies collectively enrolled over 1,000 subjects from Europe and the United States, ensuring robust testing.

Restraints

High Treatment Costs

The high treatment costs associated with botulinum toxin therapies represent a significant barrier that restrains the market’s potential growth and accessibility. Botulinum toxin, primarily used for both medical and cosmetic purposes, commands a substantial price due to several contributing factors, one such being the cost of manufacturing and refining botulinum toxin.

The manufacturing cost of botulinum toxin is intricate and requires specialized facilities and technologies to ensure purity and safety. This process involves stringent regulatory oversight to meet quality standards, contributing significantly to the final product’s expense.

Additionally, the application of botulinum toxin often necessitates multiple injections over time to maintain effectiveness, particularly for cosmetic treatments aimed at reducing wrinkles or medical treatments for conditions like muscle spasticity or chronic migraines. These recurring treatments result in cumulative costs that can be prohibitive for many patients

- For instance, a single vial of Botox®, one of the most well-known brands, can range from $600 to $1200, depending on the country and healthcare provider. This cost is exacerbated by the need for multiple injections over time to maintain results, as the effects of botulinum toxin are temporary, typically lasting three to six months.

- In the United States, the average cost of a botulinum toxin injection session for cosmetic purposes, such as reducing wrinkles, ranges from US$300 to US$600 per area treated

Opportunities

Geographical Expansion

Geographical expansion presents a significant opportunity for the global botulinum toxins market, driven by rising disposable incomes, increasing awareness of cosmetic and therapeutic applications, and improving healthcare infrastructure in emerging markets. The potential for market growth in regions such as Asia-Pacific, Rest of the World, and the Middle East is substantial.

In Asia-Pacific, countries like China, India, South Korea, and Japan are experiencing increased demand for both cosmetic and therapeutic botulinum toxin treatments. China’s growing middle class and increasing disposable income have fueled the demand for cosmetic procedures, while government initiatives to improve healthcare access and quality are driving the adoption of botulinum toxin for medical conditions such as spasticity and chronic migraines.

- According to National Bureau of Statistics a three-person household earning in China is between 100,000 yuan and 500,000 yuan an year.

- While, Hugel, a leading global company in total medical aesthetics, announced that it has obtained marketing approval from the U.S. Food and Drug Administration (FDA) on the 29th (local time) for its botulinum toxin Letybo in 50 units and 100 units. The FDA’s approval of Letybo underscores Hugel’s commitment to product excellence and industry credibility.

Impact of macroeconomic factors / Geopolitical factors

The botulinum toxin market is significantly influenced by macroeconomic factors such as economic growth, disposable income, and healthcare spending. In regions with higher income levels, there’s a higher tendency to invest in aesthetic treatments like Botox, which boosts market growth. Conversely, economic downturns can reduce spending on non-essential cosmetic procedures, slowing market expansion. These economic indicators are crucial for predicting consumer behavior and market trends.

Geopolitical factors also play a vital role in shaping the botulinum toxin market. Political stability, international trade policies, and regulatory frameworks can affect the market. For instance, trade tensions or sanctions may disrupt the supply chain, increasing production costs. Moreover, regulatory changes in healthcare across countries can alter market dynamics, while geopolitical instability might reduce market access and consumer confidence, impacting the demand for Botulinum Toxin. Monitoring these factors is essential for developing effective market strategies.

Trends

The botulinum toxin market is witnessing several emerging trends. There is a growing demand for non-invasive aesthetic procedures, particularly Botox, driven by increasing consumer interest in anti-aging treatments. Minimally invasive treatments with little downtime have gained popularity, especially among younger demographics seeking preventive care.

The medical use of Botulinum Toxin is expanding beyond traditional aesthetic applications to include therapeutic treatments for conditions like chronic migraines, excessive sweating (hyperhidrosis), and muscle spasticity, increasing the product’s market reach. Additional, the technological advancements in injection techniques and the development of new formulations, such as longer-lasting or more effective botulinum toxin products, are enhancing treatment outcomes, driving adoption rates.

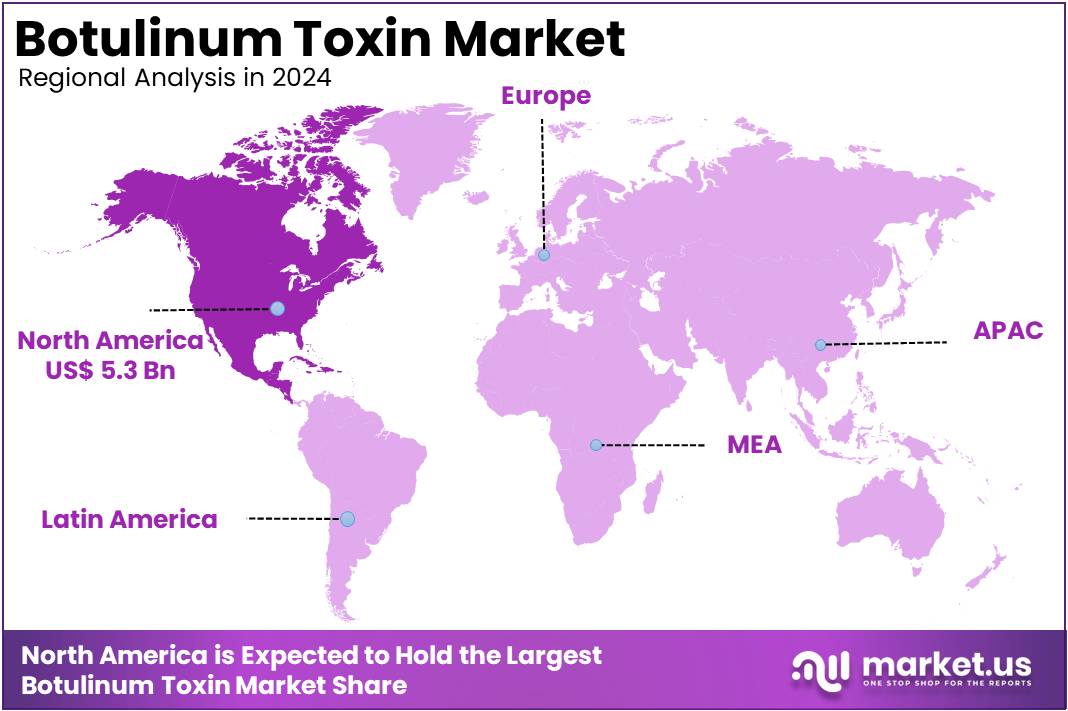

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 74.68% share and holds US$ 5.3 Billion market value for the year. North America held a significant share in the global botulinum toxin market driven by several factors, such as the increasing number of product launches, the presence of large companies, and the growing acceptance of these procedures among people in the region.

- In 2019, the American Society of Plastic Surgeons (ASPS) reported that 1.3 billion procedures were conducted using botulinum toxin products.

- Additionally, according to the ISAPS, approximately 3,945,282 botulinum toxin procedures were performed in the U.S. in 2022.

The growth of product launches and the increasing regulatory approvals of these products for therapeutic and aesthetic applications is one of the major reasons for the dominance of the region.

- The FDA has approved Letybo, a new botulinum toxin formulation by Hugel America, Inc., a division of Hugel Inc., for aesthetic use in the United States. Letybo, specifically indicated for treating moderate-to-severe glabellar (frown) lines in adults, is anticipated to be launched in the latter part of 2024.

Mass Spectrometry Imaging Market, Regional Analysis, 2020-2024 (US$ Billion)

Region 2020 2021 2022 2023 2024 North America 2.1 3.8 4.7 5.0 5.4 Europe 0.3 0.5 0.7 0.7 0.8 Asia Pacific 0.4 0.7 0.9 1.0 1.1 Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global Botulinum Toxin market is intensely competitive, driven by the presence of several key players such as Allergan, Ipsen, and Merz Pharmaceuticals. These companies are at the forefront of research and development, constantly striving to innovate and expand the range of both therapeutic and cosmetic applications for Botulinum Toxin.

The market dynamics are influenced by continuous advancements in product formulations and delivery methods to enhance efficacy, safety, and patient outcomes. Merz Pharma is a global, family-owned pharmaceutical and healthcare company headquartered in Frankfurt, Germany. It focuses on innovative treatments in areas such as dermatology, neurology, and aesthetics.

Merz is known for its Botulinum Toxin product, Xeomin, which competes in the aesthetic and therapeutic botulinum toxin market. In addition, AbbVie, an American multinational biopharmaceutical company, acquired Allergan in 2020, strengthening its presence in aesthetics and neuroscience. Known for its blockbuster drug, Botox, Allergan’s botulinum toxin product is widely used for both cosmetic and medical treatments.

Top Key Players in the Botulinum Toxin Market

- Merz Pharma

- AbbVie Inc. (Allergan)

- Ipsen Biopharmaceuticals Inc.

- Galderma

- Revance Therapeutics

- HUGEL

- Medytox

- Daewoong Pharmaceutical Co.Ltd.

- Aquavit Pharmaceuticals

- Evolus Inc.

Recent Developments

- In April 2022: Medytox’s subsidiary, Medytox Korea, successfully completed the Phase III clinical trial for their next-generation Botulinum Toxin (BTX) product, MBA-P01. Such advancements facilitate the process of obtaining marketing approval for the product.

- In October 2023: AbbVie Inc. announced positive topline results from two Phase 3 clinical studies, M21-500 and M21-508. These studies evaluated trenibotulinumtoxinE (BoNT/E) for treating moderate to severe glabellar lines. The findings support its potential as a new option in aesthetic treatments.

Report Scope

Report Features Description Market Value (2024) US$ 7.5 billion Forecast Revenue (2034) US$ 17.2 billion CAGR (2025-2034) 8.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Botulinum toxin A and Botulinum toxin B), By Application (Therapeutic and Aesthetic), By End-User (Hospitals, Dermatology Clinics, and Spas & cosmetic Center) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Merz Pharma, AbbVie Inc. (Allergan), Ipsen Biopharmaceuticals, Inc., Galderma, Revance Therapeutics, HUGEL, Medytox, Daewoong Pharmaceutical Co.,Ltd., Aquavit Pharmaceuticals, and Evolus, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Merz Pharma

- AbbVie Inc. (Allergan)

- Ipsen Biopharmaceuticals Inc.

- Galderma

- Revance Therapeutics

- HUGEL

- Medytox

- Daewoong Pharmaceutical Co.Ltd.

- Aquavit Pharmaceuticals

- Evolus Inc.