Global Black Soldier Fly Larvae Market Size, Share and Report Analysis By Product Type (Protein Meal, Biofertilizers (Frass), Whole Dried Larvae, Larvae Oil, Others), By Application (Animal Feed, Agriculture, Pet Food, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 178335

- Number of Pages: 393

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

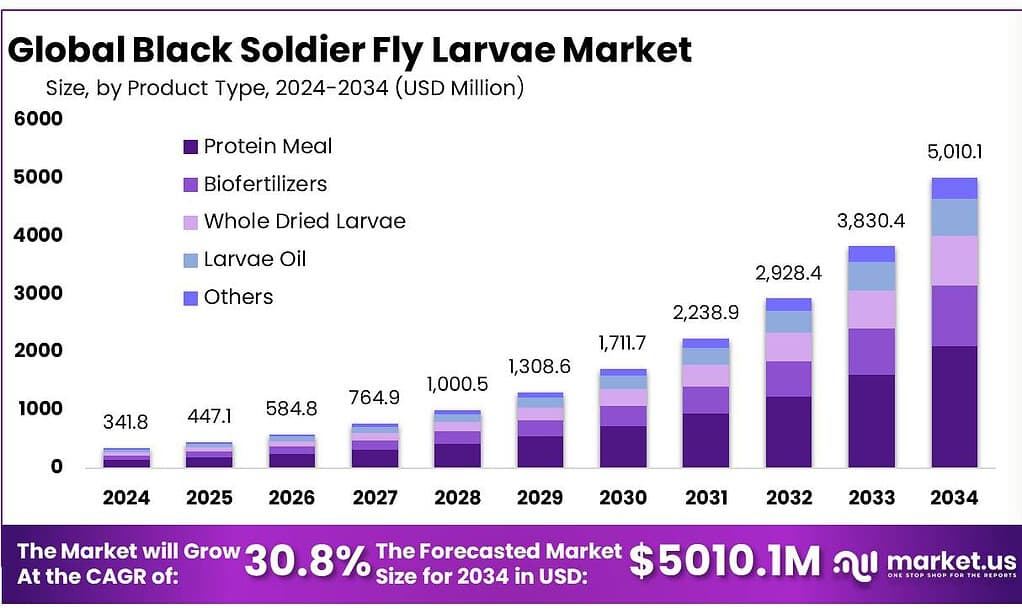

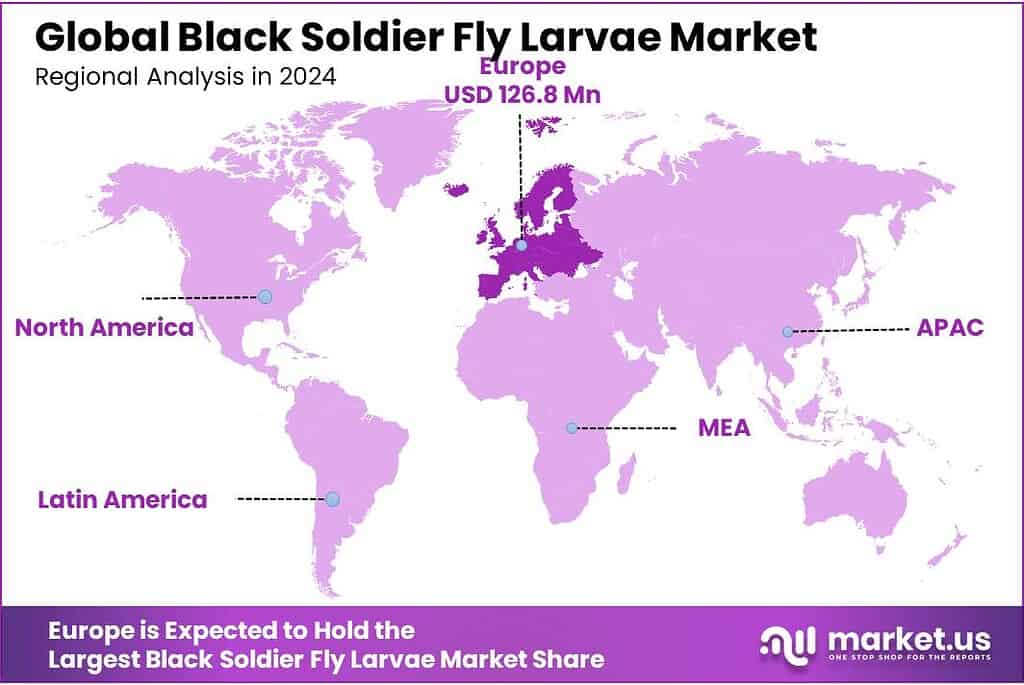

The Global Black Soldier Fly Larvae Market is expected to be worth around USD 5010.1 Million by 2034, up from USD 341.8 Million in 2024, and is projected to grow at a CAGR of 30.8%, from 2025 to 2034. Europe accounted for 37.1%, reaching USD 126.8 Mn.

Black Soldier Fly larvae have emerged as a transformative element in the sustainable protein and waste management sectors, driven by global pressures on food systems, resource scarcity, and environmental sustainability. BSFL are rich in nutrients, with reported protein contents ranging from 30% to 60% depending on processing and defatting methods, making them competitive with traditional feed ingredients such as soybean meal and fishmeal in livestock diets.

Industrial momentum is closely tied to what is happening in global protein and feed demand. Aquatic animal production alone reached 185.4 million tonnes in 2022, which keeps long-term pressure on feed ingredients such as fishmeal and soy. On the broader feed side, global feed output is massive—Alltech’s survey-based outlook puts 2024 global feed production at 1.396 billion tonnes, while industry associations estimate world compound feed at just over 1 billion tonnes per year, underlining how even small inclusion rates can translate into meaningful volume demand.

Key growth drivers include feed supply resilience sustainability targets from food and pet brands, and waste-to-value economics, especially where regulations allow safe feedstocks. The broader food system also has a measurable waste challenge: FAO-linked reporting highlights 25–35 million tonnes of fish wasted globally each year due to infrastructure inefficiencies—an illustration of why circular, efficiency-driven solutions are gaining attention across protein value chains.

- InnovaFeed’s Decatur plan sized for 60,000 metric tons of insect protein, 20,000 tons of oils, and 400,000 tons of fertiliser annually at full scale, showing how producers are designing “biorefinery-like” models rather than single-product plants.

Regulation is a major catalyst because it defines allowable substrates and end-markets. In the EU, insect use is anchored in animal-by-product and feed rules: Commission Regulation (EU) 2017/893 enabled insect processed animal proteins in aquaculture feed, and later updates expanded pathways. In the US, AAFCO’s ingredient-definition work shows continued formalisation; a 2025 AAFCO meeting document references updates to the definition of “Dried Black Soldier Fly Larvae” and its feed-grade requirements, which matters for mainstream adoption by large feed formulators.

Key Takeaways

- Black Soldier Fly Larvae Market is expected to be worth around USD 5010.1 Million by 2034, up from USD 341.8 Million in 2024, and is projected to grow at a CAGR of 30.8%.

- Protein Meal held a dominant market position, capturing more than a 42.7% share.

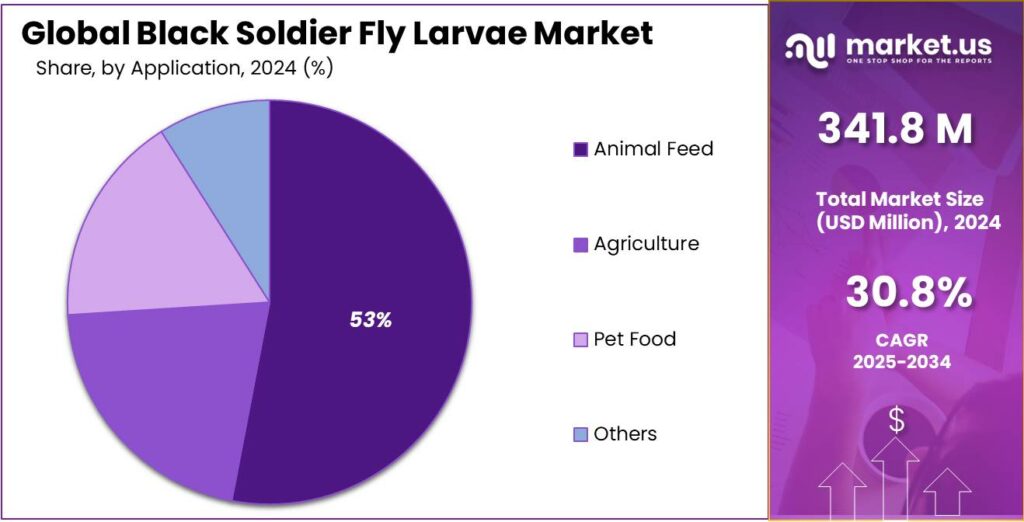

- Animal Feed held a dominant market position, capturing more than a 53.9% share.

- Europe emerged as the dominating region in the Black Soldier Fly Larvae market, accounting for 37.1% of the total market share, valued at USD 126.8 Mn.

By Product Type Analysis

Protein Meal dominates with 42.7% driven by strong demand for sustainable animal feed

In 2024, Protein Meal held a dominant market position, capturing more than a 42.7% share. This leadership is mainly linked to its growing use as a sustainable alternative to fishmeal and soybean meal in aquaculture, poultry, and livestock feed. Black Soldier Fly Larvae protein meal is valued for its balanced amino acid profile and high digestibility, making it suitable for feed formulators looking to improve feed efficiency while lowering environmental impact.

During 2024, feed manufacturers increasingly integrated insect protein into commercial feed blends as pressure mounted to reduce reliance on conventional protein sources. Rising volatility in global fishmeal supply further strengthened the case for insect-based protein meal.

By Application Analysis

Animal Feed leads with 53.9% as livestock producers shift toward sustainable protein sources

In 2024, Animal Feed held a dominant market position, capturing more than a 53.9% share. The segment’s strength came from the rising demand for alternative protein ingredients across aquaculture, poultry, and swine farming. Black Soldier Fly Larvae are increasingly used as a replacement for traditional fishmeal and soybean meal, mainly because of their strong nutritional value and better sustainability profile.

Feed manufacturers in 2024 focused on improving feed efficiency while reducing exposure to volatile raw material prices, which supported the steady inclusion of insect-based protein in commercial feed formulas. Aquaculture, in particular, remained a key consumption area as fish farmers searched for high-protein inputs that do not depend heavily on marine resources.

Key Market Segments

By Product Type

- Protein Meal

- Biofertilizers (Frass)

- Whole Dried Larvae

- Larvae Oil

- Others

By Application

- Animal Feed

- Agriculture

- Pet Food

- Others

Emerging Trends

BSFL is moving into Smart Factories with automation, real-time monitoring, and tighter traceability

One clear latest trend in the Black Soldier Fly Larvae (BSFL) industry is the shift from small, manual rearing sites to highly automated, factory-style production designed for consistent output and audit-ready traceability. Producers are investing in controlled environments, automated feeding and harvesting, and data systems that track batches from incoming substrate to finished protein meal and oil.

This matters because the biggest buyers—feed manufacturers and pet food brands—want steady quality, predictable volumes, and documentation that can stand up to safety checks. The industrial model also helps producers lower labor intensity and reduce biological variability, which has historically been a pain point when scaling insects beyond pilot plants.

The scale of this shift is visible in how large “industrial farms” are being described in mainstream reporting. One example from 2025 highlights a facility raising around 10 billion black soldier fly larvae as part of an ultra-mechanized operation where robots handle large parts of the process, from egg distribution to monitoring and harvesting.

In Europe, the same trend is being reinforced by sector-level planning and policy alignment. IPIFF’s sector outlook also forecasts European insect producers could reach over 120,000 tonnes of insect feed products in 2025, reflecting the expectation that industrial capacity continues to come online and move beyond early-stage supply.

Drivers

Sustainable animal feed demand is rising as food waste and fishmeal volatility push the industry toward circular, local proteins

A major force moving the Black Soldier Fly Larvae (BSFL) industry forward is the pressure to secure reliable, sustainable protein for animal feed—especially for aquaculture and poultry—without increasing dependence on fragile supply chains. This is not just a “green” preference; it is becoming a practical sourcing decision for feed buyers who need stable inputs at scale.

The timing matters because global seafood farming continues to expand: in 2022, global aquaculture production reached 130.9 million tonnes, including 94.4 million tonnes of farmed aquatic animals, and aquaculture surpassed capture fisheries as the main producer of aquatic animals.

- At the same time, the world is wasting an enormous amount of edible material that could be redirected into circular feed systems. The UNEP Food Waste Index Report 2024 estimates that in 2022, 1.052 billion tonnes of food were wasted across retail, food service, and households; households alone accounted for 631 million tonnes.

For the BSFL value chain, this matters because larvae can convert many organic side streams into high-value biomass and frass, turning a disposal challenge into a feed and soil input opportunity. In practical terms, the scale of food waste gives BSFL producers a large potential “input pool,” while giving municipalities and food businesses an incentive to explore waste diversion solutions that reduce landfill burden and improve sustainability reporting.

Another reason this driving factor is strengthening is that traditional marine-based ingredients remain exposed to production swings. For example, FAO notes that global fishmeal production fell by 23% in 2023, largely linked to poor Peruvian anchoveta catches. When fishmeal tightens, prices typically become more uncertain for feed formulators, and buyers look harder at alternatives that can be produced closer to demand centers.

Restraints

Strict substrate rules and food-safety controls limit low-cost feedstock, slowing large-scale BSFL economics

One major restraint for the Black Soldier Fly Larvae (BSFL) industry is that the biggest “available” organic waste streams are not automatically usable as insect feed, because regulators and buyers demand tight food-safety and biosecurity control. On paper, the world has plenty of food waste that could feed insects. In reality, a large share of that waste sits in places that are hard to collect safely, hard to trace, and often restricted for feed use.

- The UNEP Food Waste Index 2024 estimates that in 2022, 1.052 billion tonnes of food were wasted across retail, food service, and households, equal to 132 kg per person and about 19% of food available to consumers. But the same UNEP data shows households alone accounted for 631 million tonnes (60%), while food service generated 290 million tonnes (28%) and retail 131 million tonnes (12%).

The limitation is not minor—there is evidence that only a portion of food waste is realistically suitable under current frameworks. A sector presentation linked to European feed and insect industry discussions notes that about 30% of food waste generated in the EU could be suitable for insect farming activities, and it frames substrate authorisation as a key lever for reducing the footprint of insect farming.

The practical implication is that BSFL scale-up can stall when “available waste” is not “approved, consistent, and contractable waste.” That gap drives up procurement costs, increases compliance burden, and forces producers to invest more in testing, segregation, traceability, and process controls—steps that are essential for market trust, but which can slow margins and delay break-even for new facilities.

Opportunity

Expanding approvals for insect protein in mainstream animal feed can unlock much larger demand for BSFL

A major growth opportunity for Black Soldier Fly Larvae (BSFL) is the shift from “niche ingredient” to “mainstream feed input” as regulators and large feed users open the door for insect-derived proteins in more animal diets—especially poultry and pigs. The logic is simple: the demand for compound feed keeps rising, while traditional protein inputs face supply shocks and sustainability pressure. Aquaculture is a clear signal of where global feed demand is heading.

In the EU, the European Commission announced measures that allow broader use of high-quality protein derived from pigs, poultry and insects for certain categories of pigs and poultry, supporting more local and sustainable feed sourcing. Industry-aligned explainers also note that EU Member States voted positively on authorising insect processed animal proteins (PAPs) in poultry and pig feed in 2021, marking an important step in widening the legal market for insect proteins beyond aquaculture.

- This growth path is supported by another hard reality: traditional marine inputs can be unstable. FAO’s GLOBEFISH analysis reports that global fishmeal production fell by 23% in 2023, with fish oil output down 21%, largely due to poor Peruvian anchoveta catches. For feed producers, this kind of disruption increases interest in alternatives that can be scaled closer to demand and sourced more predictably.

In 2024, the opportunity is strongest where BSFL suppliers can prove consistency, safety, and traceability at industrial scale. The push toward circular supply chains also helps: UNEP estimates 1.052 billion tonnes of food waste were generated in 2022 across retail, food service and households, including 631 million tonnes from households alone. While not all waste streams are suitable for insect rearing, the overall volume shows why governments and cities keep looking for better organic diversion models—an environment where BSFL facilities can become part of local waste-to-protein infrastructure.

Regional Insights

Europe dominates with 37.1% share valued at USD 126.8 Mn driven by strong regulatory backing and circular economy focus

Europe emerged as the dominating region in the Black Soldier Fly Larvae market, accounting for 37.1% of the total market share, valued at USD 126.8 Mn. The region’s leadership is largely supported by progressive sustainability policies, structured waste management systems, and clear regulatory approvals for insect-based proteins in animal feed.

The European Union has actively promoted alternative protein development under its Farm to Fork Strategy and circular economy framework, encouraging the use of insects as a sustainable feed ingredient. Regulatory clarity allowing insect processed animal proteins in aquaculture, poultry, and pig feed has provided commercial confidence to producers and feed manufacturers across member states.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Bioflytech is a Spain-based BSFL producer focused on insect ingredients for feed and soil nutrition. Its Fuente Álamo site produces 4,000 tonnes/year of fresh larvae and runs a large hatchery making 180 kg of eggs per month. In output terms, that fresh-larvae volume is often referenced as roughly ~1,300 tonnes/year of insect meal and ~400 tonnes/year of insect fat, showing how the company is already operating at meaningful industrial scale while expanding capacity.

Entofood is a Malaysia-based BSFL player positioned around bioconversion know-how and insect biotechnology. Public industry listings describe Entofood as founded in 2012, producing multiple insect-derived products such as whole insect meal, defatted meal, and insect oil. Earlier capacity disclosures (from the same industry compilation) referenced ~20 metric tons/year at pilot stage with an ambition to scale, highlighting a company that has operated through the sector’s early commercialization phase and built technical credibility over time.

Entobel Holding (Singapore-based) is one of the more industrialized BSFL names in Asia. An IFC disclosure notes the company was incorporated in 2016, and Entobel has since pushed large-scale production in Vietnam. The company states its Vung Tau, Vietnam facility has 50 levels of vertical rearing and an annual capacity of 10,000 metric tons of insect protein, supported by automation (robotics, sensors, and data analytics). This scale positions Entobel as a volume supplier for aquafeed and pet food channels.

Top Key Players Outlook

- Bioflytech

- Entofood

- Entobel Holding

- EnviroFlight

- F4F

- Hexafly

- InnovaFeed

- nextProtein

- Nutrition Technologies Group

- Protenga

- Protix B.V.

- Sfly

Recent Industry Developments

In 2024, Bioflytech began producing flours and fats from dried BSFL larvae and outlined a €2.8 million hatchery upgrade plan to lift egg capacity from 180 kg/month to 350 kg/month, supporting faster scaling across sites.

In 2024, Entofood (Malaysia) industrial backbone is strongly linked to the Veolia Bioconversion Malaysia site (developed with Entofood), which is described as having the capacity to produce 3,000 tonnes of insect meal per year and supplying insect ingredients to multiple animal nutrition markets.

Report Scope

Report Features Description Market Value (2024) USD 341.8 Mn Forecast Revenue (2034) USD 5010.1 Mn CAGR (2025-2034) 30.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Protein Meal, Biofertilizers (Frass), Whole Dried Larvae, Larvae Oil, Others), By Application (Animal Feed, Agriculture, Pet Food, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Bioflytech, Entofood, Entobel Holding, EnviroFlight, F4F, Hexafly, InnovaFeed, nextProtein, Nutrition Technologies Group, Protenga, Protix B.V., Sfly Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Black Soldier Fly Larvae MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Black Soldier Fly Larvae MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Bioflytech

- Entofood

- Entobel Holding

- EnviroFlight

- F4F

- Hexafly

- InnovaFeed

- nextProtein

- Nutrition Technologies Group

- Protenga

- Protix B.V.

- Sfly