Global Black Beer Market By Product Type (Dark Lager, Dark Ale, Brown Porter, and Stout), By Packaging (Canned and Bottled), By End-User (Men and Women), By Distribution Channel (On-trade and Off-trade), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 178288

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

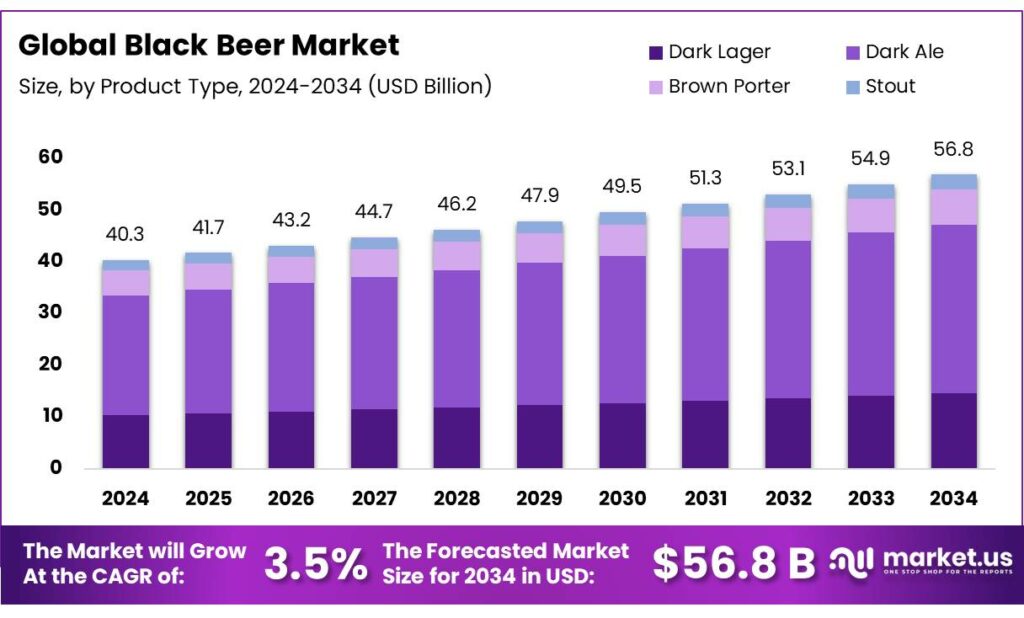

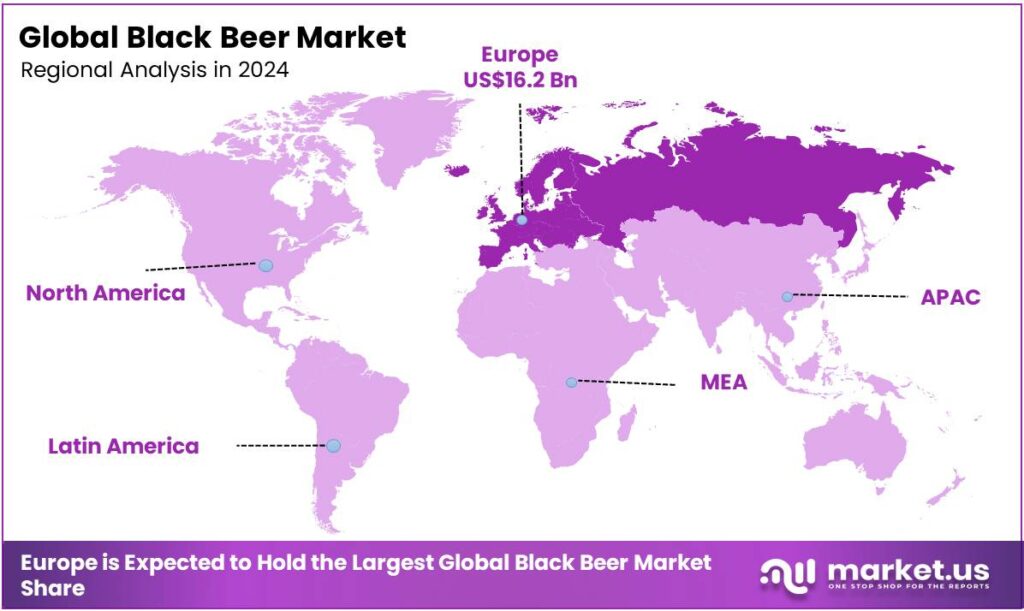

The Global Black Beer Market is expected to be worth around USD 56.8 Billion by 2034, up from USD 40.3 Billion in 2024, and is projected to grow at a CAGR of 3.5%, from 2025 to 2034. Europe accounted for 40.1%, reaching USD 16.2 Bn.

Black beer is defined by its deep brown to jet-black color, resulting from the use of roasted malts or grains, which impart rich, complex flavors of coffee, chocolate, caramel, and nuts. They are not necessarily higher in alcohol content or calories compared to light beers. It often ranges between 4% and 12% ABV. The market is shaped by diverse consumer preferences, with demand primarily driven by the growing interest in unique, premium, and craft beer offerings.

- In 2024, global beer consumption reached approximately 194.12 million kiloliters, up 0.5% year-on-year.

Europe remains the largest market, with countries such as Belgium, Germany, and the UK at the forefront of dark beer consumption, supported by long-standing brewing traditions and evolving taste preferences. The market is marked by an increasing shift towards innovative black beer styles, such as non-alcoholic and low-calorie variants, catering to health-conscious young consumers.

- According to the Brewers Association of the United States, beer production and imports in the US alone were down 1% in 2024, while craft brewer volume sales declined by 4%.

Furthermore, canned black beers are gaining popularity due to better preservation qualities, portability, and sustainability. On-trade channels, including pubs and restaurants, dominate sales as consumers seek a social and experiential beer-drinking environment. While male consumers are more prevalent in black beer purchases, there is a gradual shift toward broader appeal.

Key Takeaways:

- The global black beer market was valued at USD 40.3 billion in 2024.

- The global black beer market is projected to grow at a CAGR of 3.5% and is estimated to reach USD 56.8 billion by 2034.

- Based on types of beer, dark ale dominated the black beer market, constituting 57.5% of the total market share.

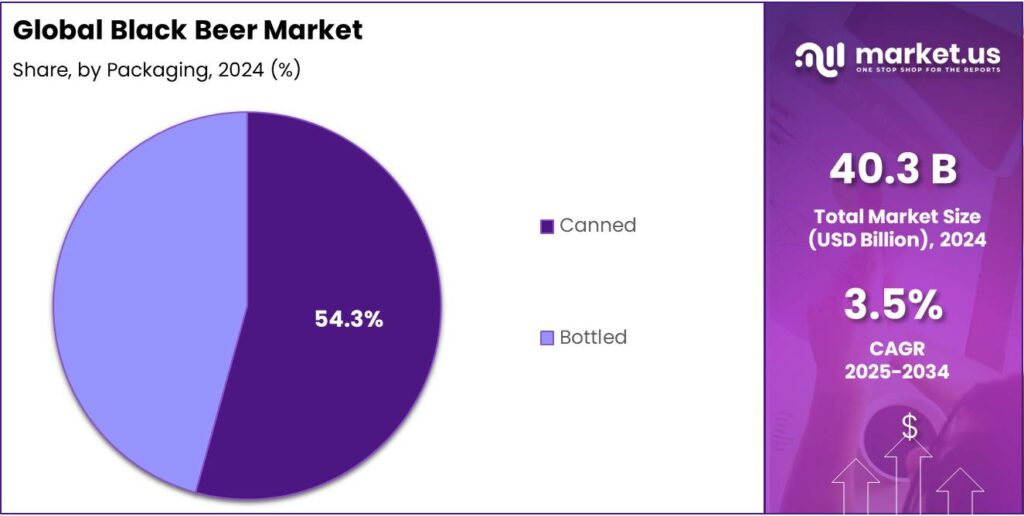

- Based on the packaging, canned black beer dominated the market, with a market share of around 54.3%.

- Based on the end-users, men led the black beer market, comprising 60.9% of the total market.

- Among the distribution channels, on-trade channels held a major share in the black beer market, 62.5% of the market share.

- In 2024, Europe was the most dominant region in the black beer market, accounting for 40.1% of the total global consumption.

Product Type Analysis

Dark Ale Black Beer is a Prominent Segment in the Market.

The black beer market is segmented based on product type into dark lager, dark ale, brown porter, and stout. The dark ale black beer led the market, comprising 57.5% of the market share, primarily due to its versatile flavor profile and broader appeal. Dark ales, particularly Belgian dubbel or English brown ale styles, offer a balanced mix of malt sweetness, caramel, and sometimes fruitiness, making them accessible to a wider range of beer drinkers.

Additionally, they are often less intense than stouts or porters, which may be perceived as too heavy or bitter for some consumers. Moreover, dark ales are often brewed at warmer temperatures, which allows for more yeast-driven flavors, appealing to drinkers seeking complexity without the overwhelming heaviness of darker lagers or stouts. Their adaptability in pairing with food and their smoother finish further contribute to their popularity, making them more common in casual and premium beer markets.

Packaging Analysis

Canned Black Beer Dominated the Market.

On the basis of the packaging, the black beer market is segmented into canned and bottled. The canned black beer dominated the market, comprising 54.3% of the market share, primarily due to its superior preservation qualities and convenience. Cans provide a more effective barrier to light and air, which helps protect the beer from oxidation and light damage, preserving its flavor profile.

Additionally, cans are more portable and easier to store, making them appealing for outdoor events, travel, and easy distribution. Moreover, the modern perception of cans has shifted, with many consumers now associating them with freshness and quality. Similarly, cans are lighter, more durable, and recyclable, making them an environmentally favorable choice.

End-User Analysis

Black Beer Industry is Mostly Purchased by Male Consumers.

Based on the end-users, the black beer market is divided into men and women. Male consumers dominated the black beer market, with a notable market share of 60.9%. The higher purchase of black beer by men can be attributed to several cultural and behavioral factors. Traditionally, darker beers such as stouts and porters have been marketed with masculine imagery and associated with bold, strong flavors, which may resonate more with male consumers.

Additionally, the taste profile of black beer, which often features robust, malty, and sometimes bitter flavors, tends to align with preferences historically observed in male beer drinkers, who are more likely to seek out intense and complex tastes.

Similarly, social factors play a role, with beer drinking, especially dark beer, often embedded in male-centric cultural activities such as sports events or pub gatherings. This demographic skew is gradually changing as more women explore craft beer options.

Distribution Channel Analysis

On-Trade Channels Held a Major Share of the Black Beer Market.

Among the distribution channels, 62.5% of the total global consumption of black beer is through on-trade channels, such as pubs, bars, cafes, hotels, and restaurants. Most black beer is purchased through on-trade channels as these venues offer an experiential aspect to beer consumption. Consumers often seek out black beer in social settings where they can enjoy the atmosphere, pair it with food, and engage in conversation, which enhances the overall experience.

Additionally, on-trade venues provide an opportunity for consumers to explore a diverse range of beer styles, including specialty options, in a curated environment with expert recommendations. Furthermore, on-trade establishments often offer a broader selection of premium or craft beers, including black beer, which may not be as readily available in supermarkets or online. The social and communal nature of on-trade consumption makes it a preferred channel for those seeking to savor unique or artisanal brews in a setting that encourages discovery and shared enjoyment.

Key Market Segments:

By Product Type

- Dark Lager

- Dark Ale

- Brown Porter

- Stout

By Packaging

- Canned

- Bottled

By End-User

- Men

- Women

By Distribution Channel

- On-trade

- Pubs, Bars & Cafes

- Hotels & Restaurants

- Others

- Off-trade

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Stores

Drivers

Demand for Unique and Premium Flavors Drives the Black Beer Market.

The demand for unique and premium flavors is a key driver of the black beer market, reflecting a broader trend in consumer preferences for distinct and higher-quality products. In recent years, several global breweries have reported the growing popularity of black beers, particularly driven by consumer demand for complex flavor profiles characterized by roasted malt, coffee, and chocolate.

For instance, several breweries are introducing specialty dark beers with added spices, fruits, and exotic botanicals, targeting discerning consumers. The Brewers Association of the United States notes that flavored and specialty beers now account for an increasing share of craft beer production, with dark beers being a prominent segment.

Similarly, the UK’s Department for Environment, Food & Rural Affairs (DEFRA) highlights a shift toward premium beer choices, with higher consumer spending on craft beer, including black variants. This preference aligns with broader trends in the alcoholic beverage industry toward innovation and quality, driven by consumer demand for novel experiences.

Restraints

Decreasing Consumption of Alcohol Products Poses a Significant Challenge to the Black Beer Market.

Decreasing alcohol consumption presents a significant challenge for the black beer market. According to the World Health Organization (WHO), global alcohol consumption has been declining in several key regions, particularly among younger demographics. The UK Office for National Statistics (ONS) reveals that the percentage of individuals reporting regular alcohol consumption dropped from 64% in 2005 to 57% in 2021. This trend is particularly evident in younger age groups, with a marked decline in alcohol consumption among 16-24-year-olds, citing health consciousness as a key factor.

- Germany’s beer sales fell to about 7.8 billion liters in 2025, down 6.0 percent compared with the previous year.

The trend reflects broader health and wellness movements that challenge traditional alcohol markets, including black beer. These developments suggest that while some craft beer segments, including darker varieties, are innovating with flavors, the overall decline in alcohol consumption poses long-term challenges for maintaining growth in the black beer market.

- Participation in Dry January reached 30% of U.S. adults in 2025, marking a 36% increase from 2024 and highlighting a strong sober curious movement.

Opportunity

Growth of Microbreweries Creates Opportunities in the Black Beer Market.

The growth of microbreweries, coupled with increased disposable income, presents a notable opportunity for the black beer market. According to the Brewers Association, the number of microbreweries in the U.S. has risen from 1,500 in 2005 to over 9,788 in 2025, indicating a strong trend towards smaller, independent craft beer producers. These breweries often experiment with innovative styles, including dark beers, aligning with consumer demand for unique and premium flavors.

The household disposable income in the EU has grown steadily over the past decade, with a 3.5% increase in 2020 alone, which corresponds to a greater willingness to spend on premium, craft alcoholic beverages. The rising consumer interest in local, small-batch brews has enhanced the appeal of microbreweries. This trend supports the potential for black beer producers to capitalize on innovations in product offerings and growing consumer purchasing power.

Trends

Shift Towards Non-Alcoholic & Low-Calorie Black Beers.

The shift toward non-alcoholic and low-calorie black beers is an emerging trend within the broader beer market. According to the Alcohol and Tobacco Tax and Trade Bureau (TTB), the production of non-alcoholic beers in the United States has been growing steadily, with a notable increase in consumer demand for lower-calorie options.

Similarly, the UK’s Department for Environment, Food & Rural Affairs (DEFRA) reports that sales of low-alcohol and alcohol-free beer rose in the region, reflecting changing consumer preferences toward healthier lifestyle choices. Several craft brewers have introduced non-alcoholic and lower-calorie versions of dark beers, catering to health-conscious consumers seeking alternatives to traditional alcoholic beverages.

For instance, Diageo’s Guinness 0.0 is brewed traditionally, followed by a cold-filtration process that removes alcohol without thermal stress, which helps maintain the traditional nitrogenated mouthfeel, flavor, and color. This shift suggests significant opportunities for black beer producers to diversify their offerings in response to evolving market demands.

Geopolitical Impact Analysis

Geopolitical Uncertainties Have Affected the Global Black Beer Market.

The geopolitical tensions have introduced significant challenges and uncertainties to the black beer market, particularly through supply chain disruptions, trade barriers, and shifting consumer behavior. According to the European Commission’s 2022 Annual Economic Report, the ongoing war in Ukraine has severely impacted global supply chains, particularly for raw materials such as barley and hops, essential ingredients for brewing.

Similarly, the United Nations Food and Agriculture Organization (FAO) notes that the disruption of agricultural production in Ukraine, a major grain exporter, has contributed to price volatility and scarcity, affecting brewers’ operational costs.

Additionally, political instability has led to tariffs and trade restrictions in certain regions. For instance, the U.S. Department of Commerce reported retaliatory tariffs on European Union beer exports, which have impacted cross-border sales of specialty dark beers. Similarly, geopolitical tensions influence consumer sentiment. This shift is evident as consumers in some regions opt for lower-cost or domestic alternatives, adjusting their purchasing behavior in response to economic instability caused by geopolitical factors.

Regional Analysis

Europe Held the Largest Share of the Global Black Beer Market.

In 2024, Europe dominated the global black beer market, led by Germany, the UK, Ireland, and Belgium, holding about 40.1% of the total global consumption, driven by longstanding beer traditions and an increasing interest in craft and specialty beers. The region’s market dominance is sustained by high per capita consumption and a dense concentration of specialized brewing facilities.

Additionally, Germany serves as the global center for Schwarzbier. Despite a 6.0% contraction in total beer sales in 2025, falling to 7.8 billion liters, the region remains the largest domestic market for dark lagers. In countries such as Belgium, the Netherlands, and Ireland, dark beers, including stouts and porters, are well-established and increasingly popular among consumers seeking premium and unique flavors.

Additionally, DEFRA reports that the UK has seen a significant rise in craft beer consumption, with dark variants, including black beer, being central to the trend. This strong regional demand positions Europe as a critical market for the black beer sector.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Manufacturers of black beer focus on product innovation, where breweries experiment with unique ingredients, such as exotic fruits, spices, and specialty malts, to differentiate their dark beer offerings. Additionally, they emphasize quality and authenticity by adopting traditional brewing techniques or offering limited-edition brews. Similarly, expanding distribution channels, such as direct-to-consumer sales and partnerships with bars and restaurants, are focused on to increase market reach. Furthermore, brewers often emphasize regional identity and heritage, aligning their products with local tastes and cultural preferences to strengthen customer loyalty.

The following are some of the major players in the industry

- Diageo plc

- Heineken Holding N.V.

- Anheuser-Busch InBev SA/NV

- Allagash Brewing Co.

- Kirin Holdings Company, Limited

- Carlsberg A/S

- The Asahi Group Holdings, Ltd.

- Molson Coors Beverage Company

- Sapporo Holdings Ltd.

- Constellation Brands Inc.

- BrewDog plc

- Sierra Nevada Brewing Co.

- Phillips Brewing & Malting Co.

- Bitburger Holding GmbH (Köstritzer Schwarzbier)

- Boston Beer Company

- Hill Farmstead Brewery

- Bent Paddle Brewing Co.

- The Alchemist Brewery

- J. Taylor Companies, Inc.

- Dark Horse Brewing Co.

- Other Key Players

Key Development

- In January 2023, Allagash Brewing Company, based in Portland, Maine, and Crowns & Hops Brewing Co., based in Inglewood, California, announced the launch of Cur-8, a collaborative beer with all proceeds benefiting the 8 Trill Initiative. It is a unique blend of Crowns & Hops’ 8 Trill Pils pilsner and Allagash’s Curieux bourbon barrel-aged golden ale.

- In December 2025, Diageo announced the sale of its 65% stake in East African Breweries (EABL) to Asahi Group Holdings for US$2.3 billion, marking a major strategic shift in its African beer operations.

Report Scope

Report Features Description Market Value (2024) US$40.3 Bn Forecast Revenue (2034) US$56.8 Bn CAGR (2025-2034) 3.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Dark Lager, Dark Ale, Brown Porter, and Stout), By Packaging (Canned and Bottled), By End-User (Men and Women), By Distribution Channel (On-trade and Off-trade) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Diageo plc, Heineken Holding N.V., Anheuser-Busch InBev SA/NV, Allagash Brewing Co., Kirin Holdings Company, Limited, Carlsberg A/S, The Asahi Group Holdings, Ltd., Molson Coors Beverage Company, Sapporo Holdings Ltd., Constellation Brands Inc., BrewDog plc, Sierra Nevada Brewing Co., Phillips Brewing & Malting Co., Bitburger Holding GmbH (Köstritzer Schwarzbier), Boston Beer Company, Hill Farmstead Brewery, Bent Paddle Brewing Co., The Alchemist Brewery, J.J. Taylor Companies, Inc., Dark Horse Brewing Co., and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Diageo plc

- Heineken Holding N.V.

- Anheuser-Busch InBev SA/NV

- Allagash Brewing Co.

- Kirin Holdings Company, Limited

- Carlsberg A/S

- The Asahi Group Holdings, Ltd.

- Molson Coors Beverage Company

- Sapporo Holdings Ltd.

- Constellation Brands Inc.

- BrewDog plc

- Sierra Nevada Brewing Co.

- Phillips Brewing & Malting Co.

- Bitburger Holding GmbH (Köstritzer Schwarzbier)

- Boston Beer Company

- Hill Farmstead Brewery

- Bent Paddle Brewing Co.

- The Alchemist Brewery

- J. Taylor Companies, Inc.

- Dark Horse Brewing Co.

- Other Key Players