Global Biometric In-store Payments Market By Component (Hardware, Software), By Biometric Mode (Fingerprint Recognition, Facial Recognition, Iris Recognition, Voice Recognition), By Technology (Contact, Contactless), By Application (BFSI, Retail & E-commerce, Healthcare, Travel & Hospitality, Government, Others (Transportation, etc.)), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 175509

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Global Adoption and Usage Overview

- Drivers Impact Analysis

- Restraint Impact Analysis

- Investor Type Impact Matrix

- Component Analysis

- Biometric Mode Analysis

- Technology Analysis

- Application Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

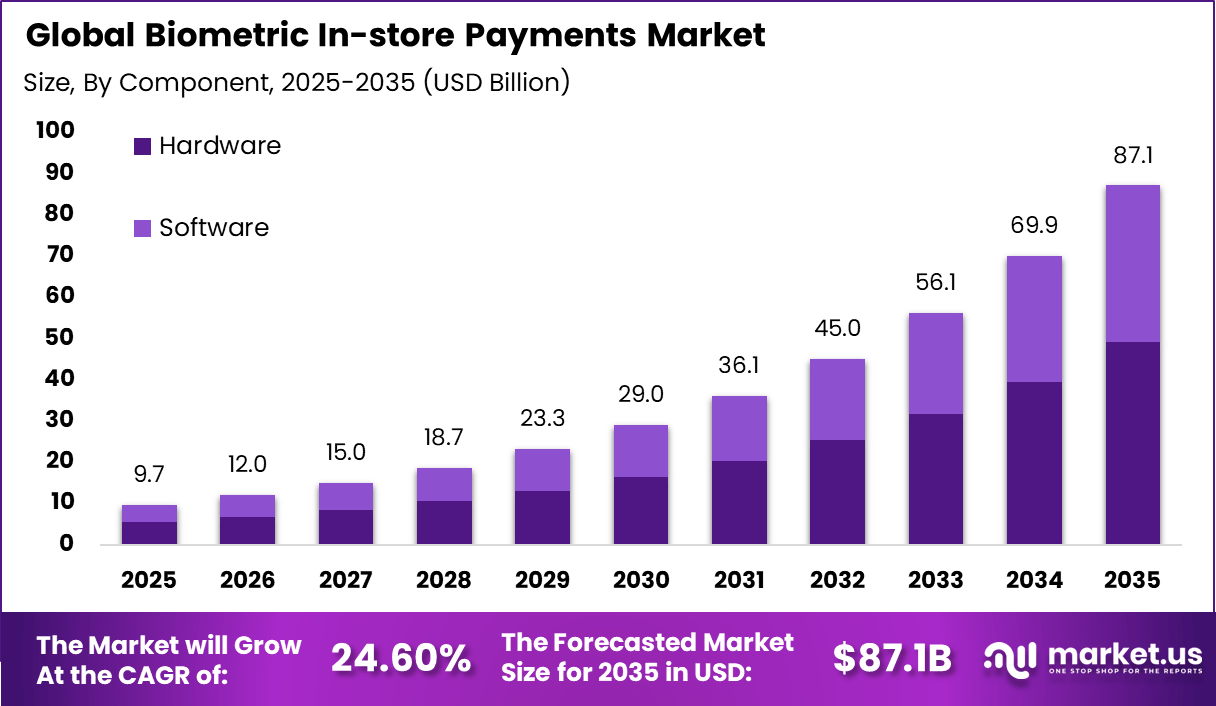

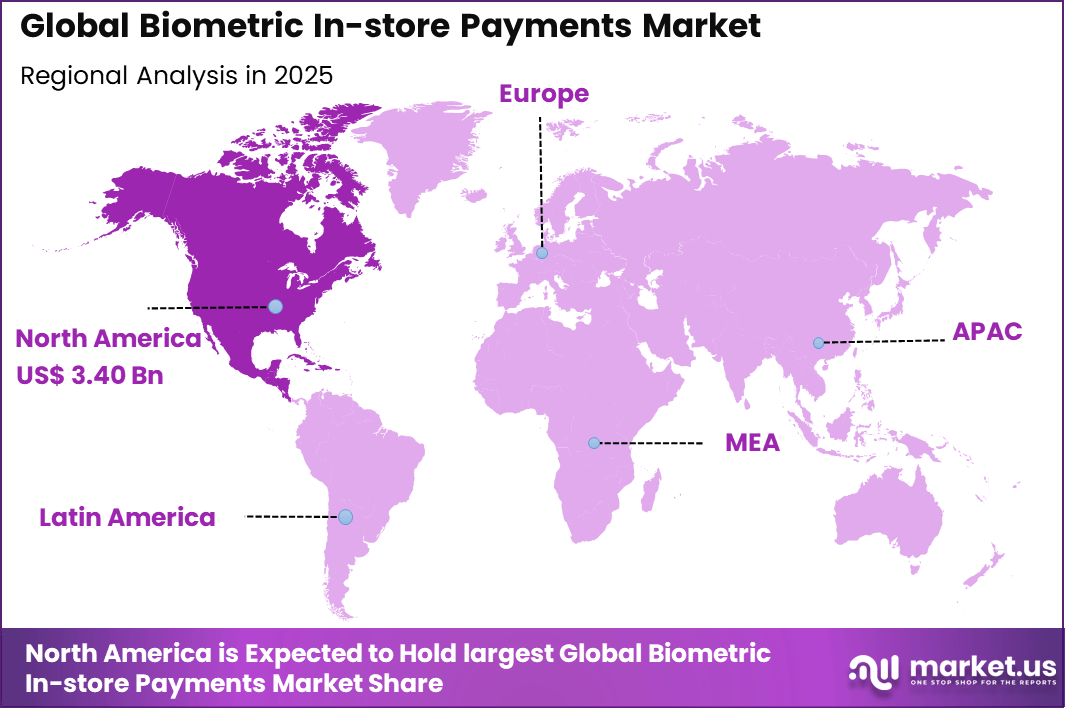

The Global Biometric In-store Payments Market generated USD 9.7 billion in 2025 and is predicted to register growth from USD 12 billion in 2026 to about USD 87.1 billion by 2035, recording a CAGR of 24.60% throughout the forecast span. In 2025, North America held a dominant market position, capturing more than a 35.3% share, holding USD 3.40 Billion revenue.

The Biometric In-store Payments Market covers payment systems that authenticate customers using biological characteristics such as fingerprints, facial features, or iris patterns at physical retail locations. These systems allow customers to authorize transactions without cards, cash, or mobile devices. Biometric authentication is integrated with point of sale infrastructure to enable secure and fast payments.

The market is gaining attention as retailers seek frictionless and secure checkout experiences. Biometric in-store payments reduce dependency on physical payment instruments while improving identity assurance at the transaction level. The approach links payment authorization directly to the individual rather than a device or credential. This model aligns with evolving consumer expectations for convenience and speed.

One major driving factor is the growing demand for faster and contactless checkout experiences. Consumers increasingly prefer payment methods that minimize physical interaction and reduce transaction time. Biometric authentication allows instant verification without requiring cards or PIN entry. This improves throughput in high traffic retail environments.

Demand for biometric in-store payments is driven by large retailers and chains seeking to differentiate customer experience. These organizations prioritize technologies that improve speed, security, and loyalty engagement. Biometric payments support seamless repeat purchases without repeated credential input. This makes them attractive in convenience-driven retail formats.

Facial recognition technology is one of the most widely adopted biometric methods in in-store payment environments. It allows hands-free authentication and integrates easily with cameras already present in retail spaces. Advances in accuracy and lighting tolerance have improved reliability. These improvements support growing adoption.

Top Market Takeaways

- By component, hardware dominated the biometric in-store payments market with 56.3% share, supplying scanners and terminals for secure checkout integration.

- By biometric mode, fingerprint recognition captured 45.9%, favored for its speed, accuracy, and widespread consumer familiarity at POS systems.

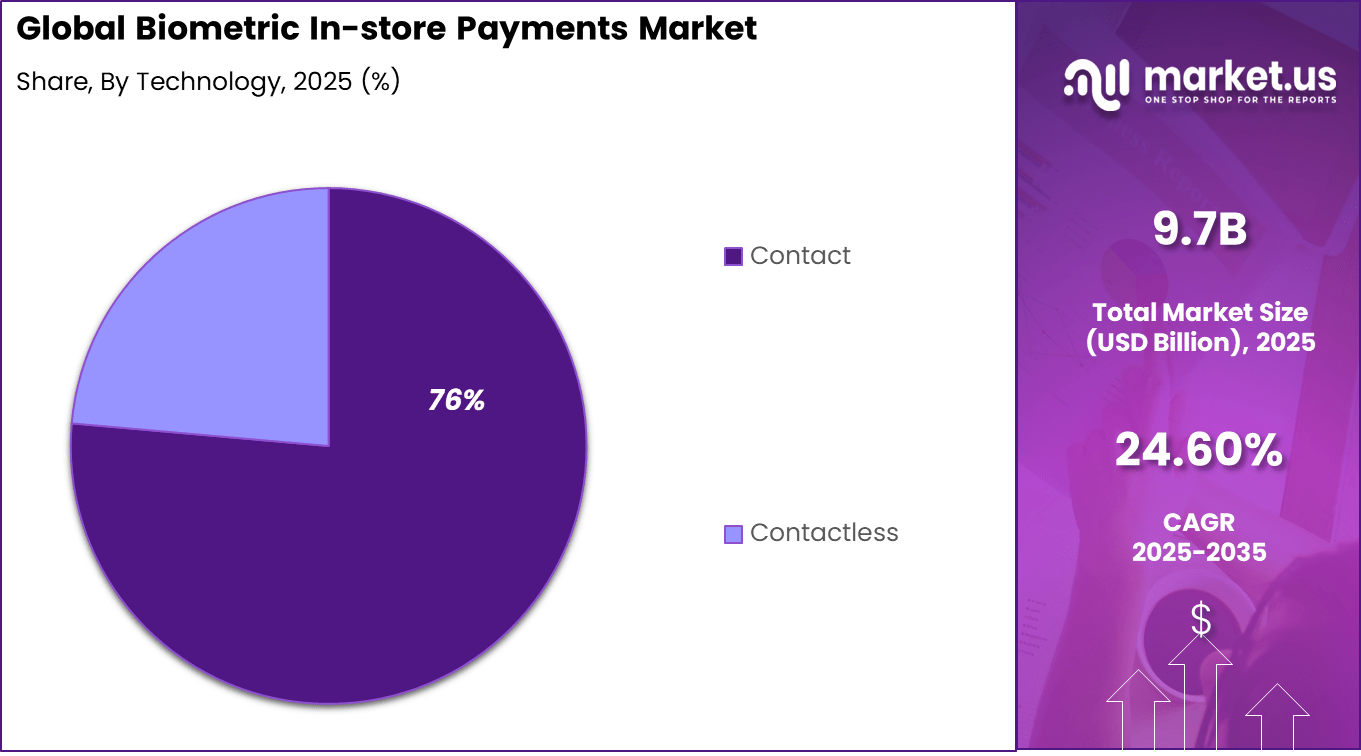

- By technology, contact-based solutions led at 76.4%, providing reliable authentication through direct physical interaction in retail environments.

- By application, BFSI held 36.7%, deploying biometrics to streamline transactions and enhance fraud prevention in banking-linked payments.

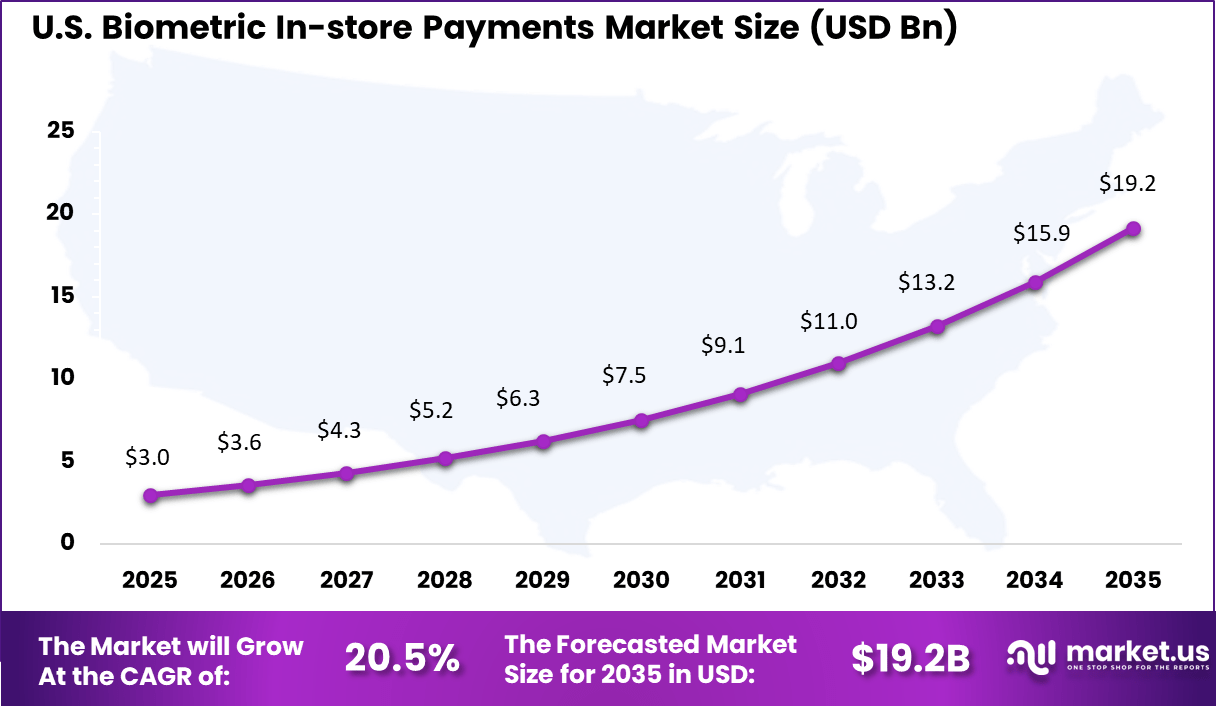

- North America accounted for 35.3% of the global market, with the U.S. valued at USD 2.97 billion and growing at a CAGR of 20.5%.

Global Adoption and Usage Overview

- Widespread integration of fingerprint and facial recognition into smartphones and point of sale systems continues to accelerate biometric payment adoption.

- An estimated 1.4 billion people worldwide are expected to use facial biometrics for payments by 2025-2026, more than double the 671 million users in 2020.

- Around 84% of global consumers had used at least one form of biometric authentication for transactions by early 2026.

- Biometric authentication is projected to secure over USD 3 trillion in global mobile payment transactions by 2025–2026.

- About 60% of users report using biometric authentication daily for financial access or secure digital processes.

- Adoption in retail ranges between 30% and 40%, with use cases including facial recognition at self checkout kiosks and palm based payments linked to loyalty programs.

- Globally, 42% of retailers had implemented some form of biometric payment capability by late 2025.

- Banks and financial institutions show the highest adoption at 60% to 75%, driven by replacement of PINs with biometric authentication in mobile banking apps and ATMs.

- Around 81% use digital wallets globally, with 64% of US Gen Z users actively using biometric authentication such as facial or fingerprint recognition.

- About 75% of Millennials use digital wallets, and 57% in the US are either using or willing to use biometric payments.

- Women aged 25 to 34 represent the fastest growing demographic, recording a 41% year over year increase in biometric adoption during 2025.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~) % Geographic Relevance Impact Timeline Rising demand for secure and frictionless in-store payments +6.8% Global Short term Increasing adoption of contactless and cashless payment methods +5.9% Europe, Asia Pacific, North America Short to medium term Growth in payment fraud driving stronger authentication needs +4.7% Global Medium term Expansion of biometric-enabled POS infrastructure +3.9% Europe, North America Medium term Consumer acceptance of fingerprint and facial recognition +3.2% Asia Pacific, North America Medium to long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~) % Geographic Relevance Impact Timeline High deployment cost of biometric POS systems -4.1% Emerging Markets Short to medium term Data privacy and biometric data protection concerns -3.6% Europe, North America Medium term Limited interoperability with legacy payment systems -2.9% Global Medium term Consumer hesitation in sharing biometric information -2.4% Global Short term Regulatory uncertainty around biometric usage -1.9% Europe Medium to long term Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Payment technology providers Very High Medium Global Strong transaction volume growth Biometric hardware and sensor companies High Medium Asia Pacific, Europe Expansion through retail deployments Banks and payment service providers High Low to Medium Global Strategic fraud reduction investment Private equity firms Medium Medium Europe, North America Platform scaling and consolidation Venture capital investors High High North America Innovation-led growth opportunities Component Analysis

Hardware accounts for 56.3% of overall adoption in the Biometric In store Payments Market. This dominance is driven by the need for physical devices such as biometric scanners, sensors, and payment terminals that support secure authentication at the point of sale. Retailers and financial service providers prioritize reliable hardware to ensure transaction accuracy and system stability.

The continued importance of hardware is also linked to infrastructure upgrades across physical retail locations. Existing payment terminals are being replaced or enhanced to support biometric functionality. This sustains strong demand for hardware components within the market.

Biometric Mode Analysis

Fingerprint recognition represents 45.9% of biometric mode adoption. This leadership reflects its familiarity, ease of use, and high accuracy in identity verification. Fingerprint systems offer fast authentication, which is essential for in store payment environments where transaction speed matters.

The preference for fingerprint recognition is further supported by its cost effectiveness compared to other biometric methods. Integration with payment terminals is relatively straightforward. These advantages reinforce its dominant position within the biometric mode segment.

Technology Analysis

Contact-based biometric technology holds 76.4% of the market, indicating that direct physical interaction remains common in biometric payments. Contact systems require users to touch a scanner to authenticate transactions. These systems are widely deployed due to their proven accuracy and lower implementation cost.

From a deployment standpoint, contact-based solutions are easier to integrate with existing POS systems. They also provide reliable performance in controlled retail environments. The strong dominance of this segment reflects continued reliance on established biometric technologies for secure in-store payments.

Application Analysis

The BFSI sector accounts for 36.7% of application demand, making it the largest use case for biometric in-store payments. Financial institutions use biometric authentication to enhance transaction security and reduce fraud. In-store biometric payments help banks offer secure alternatives to traditional card-based payments.

BFSI organizations also focus on improving customer experience while maintaining compliance. Biometric systems support faster transactions and reduce authentication errors. The strong share of this segment reflects the sector’s emphasis on secure, convenient, and innovative payment solutions.

Key Reasons for Adoption

- Demand is rising for faster and frictionless payment experiences inside retail stores

- Payment security concerns are increasing with higher card and cash fraud risks

- Consumers are becoming more comfortable with biometric authentication methods

- Retailers are seeking checkout solutions that reduce queues and manual effort

- Contactless payment preferences are strengthening after digital payment expansion

Benefits

- Payment security is improved through unique biometric identification

- Checkout speed is increased by removing the need for cards or PIN entry

- Fraud risk is reduced by linking payments directly to the user identity

- Customer convenience is enhanced with seamless and touch-free payments

- Operational efficiency is improved by reducing cash and card handling

Usage

- Used in retail stores for biometric-based checkout payments

- Applied in supermarkets to support fast self-checkout experiences

- Deployed in convenience stores for quick and secure transactions

- Utilized in premium retail environments for personalized payment services

- Integrated with point-of-sale systems for real-time biometric verification

Emerging Trends

Key Trend Description Cloud-native architectures Microservices enable scalable, real-time banking operations. AI-driven personalization Machine learning delivers tailored products and services. Open banking integration APIs connect core systems with fintech ecosystems. Real-time payment processing Instant settlements across domestic and international rails. Embedded insurance capabilities Seamless integration of non-banking financial products. Growth Factors

Key Factors Description Digital banking transformation Customer shift from branches to mobile-first experiences. Regulatory open banking mandates PSD2-style laws force legacy modernization. Fintech competition pressure Neobanks demand agile core platform capabilities. Real-time payment infrastructure RTP networks require responsive back-end systems. Cost efficiency imperatives Cloud migration reduces total ownership costs. Key Market Segments

By Component

- Hardware

- Software

By Biometric Mode

- Fingerprint Recognition

- Facial Recognition

- Iris Recognition

- Voice Recognition

By Technology

- Contact

- Contactless

By Application

- BFSI

- Retail & E-commerce

- Healthcare

- Travel & Hospitality

- Government

- Others (Transportation, etc.)

Regional Analysis

North America accounted for 35.3% share, supported by strong adoption of contactless and secure payment technologies across retail, hospitality, and transportation sectors. Biometric in store payments have been adopted to enhance transaction security and improve checkout speed by using fingerprint, facial recognition, or palm based authentication.

Demand has been driven by rising concerns around payment fraud, need for frictionless customer experiences, and growing acceptance of biometric technologies among consumers. The region’s advanced payment infrastructure has enabled smooth integration of biometric systems with existing point of sale environments.

The U.S. market reached USD 2.97 Bn and is projected to grow at a 20.5% CAGR, reflecting strong demand from large retailers and technology driven payment ecosystems. Adoption has been driven by the need to reduce checkout friction and improve identity verification during in store transactions. Biometric payment systems have helped U.S. merchants improve throughput, reduce fraud, and enhance customer convenience.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

A primary driver of the biometric in-store payments market is the growing emphasis on transaction security. Traditional payment methods can be vulnerable to fraud through stolen cards, lost credentials, or unauthorized use. Biometric authentication provides a direct link between the individual and their payment method, significantly reducing the possibility of fraudulent transactions. This heightened security appeals both to consumers seeking safe payment experiences and to retailers that aim to minimise fraud-related losses.

Another important driver is consumer demand for faster and more seamless checkout processes. In-store environments face pressure to reduce queue times and improve customer flow, especially in high-volume retail settings. Biometric payment options accelerate the authentication step by eliminating the need to enter PINs or sign receipts, thereby reducing friction at the point of sale.

Restraint Analysis

A significant restraint for the biometric in-store payments market is consumer concern over privacy and data protection. Biometric identifiers are inherently personal, and mishandling of biometric data can lead to severe privacy risks. Consumers may hesitate to adopt systems that store or transmit their biometric templates, particularly if there is uncertainty about how data is secured or used. These concerns are heightened in regions with strict data protection laws that require clear consent and rigorous safeguards.

Another restraint is the infrastructure investment required for adoption. Retailers and payment terminals must be equipped with compatible biometric sensors and secure processing capabilities. This upgrade involves hardware costs and integration complexity, which can be prohibitive for small or independent merchants with limited technology budgets.

Opportunity Analysis

A notable opportunity in the biometric in-store payments market lies in integrating biometrics with mobile and wearable devices. Smartphones and smart watches already include advanced biometric sensors, enabling payment authentication without additional hardware at point of sale. Retailers and payment networks that leverage consumer devices for biometric verification can extend secure payment options to more environments with minimal investment in new infrastructure.

Another opportunity is growing customer trust and familiarity with biometric authentication through other use cases. Consumers increasingly use biometrics for unlocking devices, authorising mobile payments, and accessing secure applications. As comfort with biometric interactions rises, willingness to adopt in-store biometric payments is likely to increase, supporting broader market penetration.

Challenge Analysis

A core challenge for the biometric in-store payments market is achieving consistent performance across diverse consumer populations and physical environments. Variability in lighting, sensor quality, and physical characteristics can affect the accuracy of some biometric methods. If systems fail to recognise legitimate users consistently, consumer frustration can undermine confidence and slow adoption. Providers must invest in robust algorithms and quality hardware to ensure reliability.

Another challenge involves aligning biometric solutions with regulatory frameworks that govern biometric data use. Diverse legal standards across regions can complicate deployment, as businesses must navigate consent requirements, storage limitations, and cross-border data transfer rules. Compliance demands add operational complexity and require careful policy and system design.

Competitive Analysis

Technology and biometric solution providers such as IDEMIA, Thales, and NEC Corporation lead biometric in-store payments through secure authentication platforms. Their solutions combine fingerprint, facial, and multimodal biometrics with payment terminals. Strong compliance with payment security standards supports large-scale retail adoption. These players benefit from deep experience in identity systems and secure transactions.

Biometric hardware and sensing specialists such as Fingerprint Cards AB, Aratek, and Aware, Inc. focus on accuracy and reliability at the point of sale. Fujitsu strengthens the segment with palm vein and contactless biometric innovations. These providers support merchants seeking low-friction checkout and reduced card dependency. Adoption is supported by improving sensor performance and declining hardware costs.

Payment networks and platform providers such as Visa, Inc. and Mastercard enable biometric payments through tokenisation and network-level authentication standards. Google LLC integrates biometric identity with digital wallets and in-store acceptance. These players ensure interoperability across terminals and merchants. Other vendors expand regional deployments and pilot programs. This ecosystem supports scalable rollout of biometric in-store payments across retail and transit environments.

Top Key Players in the Market

- Aratek

- Fujitsu

- NEC Corporation

- IDEMIA

- Thales

- Fingerprint Cards AB

- Google LLC (Alphabet Inc.)

- Visa, Inc.

- Mastercard

- Aware, Inc.

- Others

Future Outlook

Growth in the Biometric In-store Payments market is expected to continue as retailers and payment providers focus on speed, security, and convenience at checkout. Biometric methods such as fingerprint and facial recognition reduce dependence on cards, PINs, and cash, which helps simplify in store transactions.

Rising consumer familiarity with biometrics on smartphones is supporting acceptance in retail environments. Over time, stronger privacy safeguards, better system accuracy, and smoother integration with payment infrastructure are likely to support wider daily usage.

Recent Developments

- January 2025 – IDEMIA launched smartphone enrollment for F.CODE biometric cards using a USB-C dongle and bank app. Users scan fingerprints at home for in-store contactless payments with no limits or PINs. Data stays secure on the card chip.

- November 2025 – NEC partnered with Stripe to integrate face recognition payments on Stripe Reader S700 for in-store use. Pilots at Expo 2025 Osaka tested face biometrics for quick retail buys. NEC’s liveness detection stops spoofing in busy stores.

Report Scope

Report Features Description Market Value (2025) USD 9.7 Billion Forecast Revenue (2035) USD 87.1 Billion CAGR(2025-2035) 24.60% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Hardware, Software), By Biometric Mode (Fingerprint Recognition, Facial Recognition, Iris Recognition, Voice Recognition), By Technology (Contact, Contactless), By Application (BFSI, Retail & E-commerce, Healthcare, Travel & Hospitality, Government, Others (Transportation, etc.)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Aratek, Fujitsu, NEC Corporation, IDEMIA, Thales, Fingerprint Cards AB, Google LLC (Alphabet Inc.), Visa, Inc., Mastercard, Aware, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Biometric In-store Payments MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Biometric In-store Payments MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Aratek

- Fujitsu

- NEC Corporation

- IDEMIA

- Thales

- Fingerprint Cards AB

- Google LLC (Alphabet Inc.)

- Visa, Inc.

- Mastercard

- Aware, Inc.

- Others