Global Biological Wastewater Treatment Market Size, Share Analysis Report By Process (Aerobic Wastewater Treatment, Anaerobic Wastewater Treatment, Anoxic Wastewater Treatment), By Type of Wastewater (Municipal Wastewater, Industrial Wastewater, Agricultural Wastewater, Stormwater and Combined Sewer Overflows) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153417

- Number of Pages: 229

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

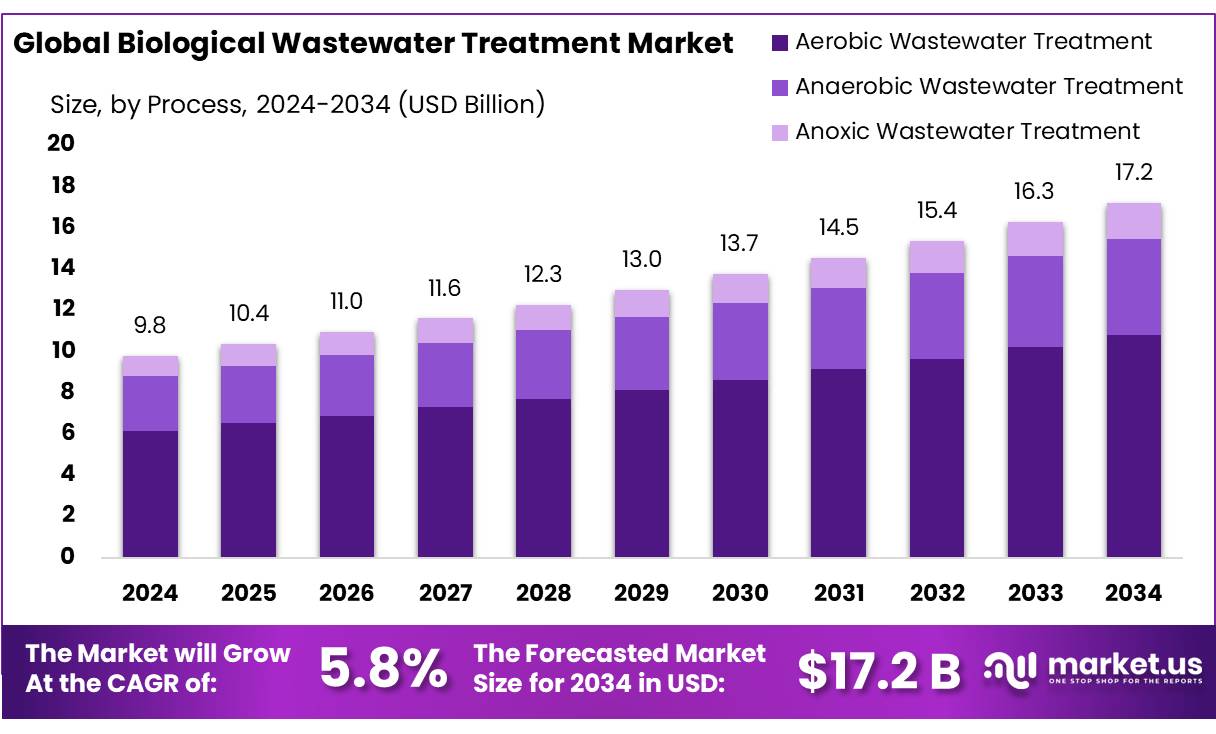

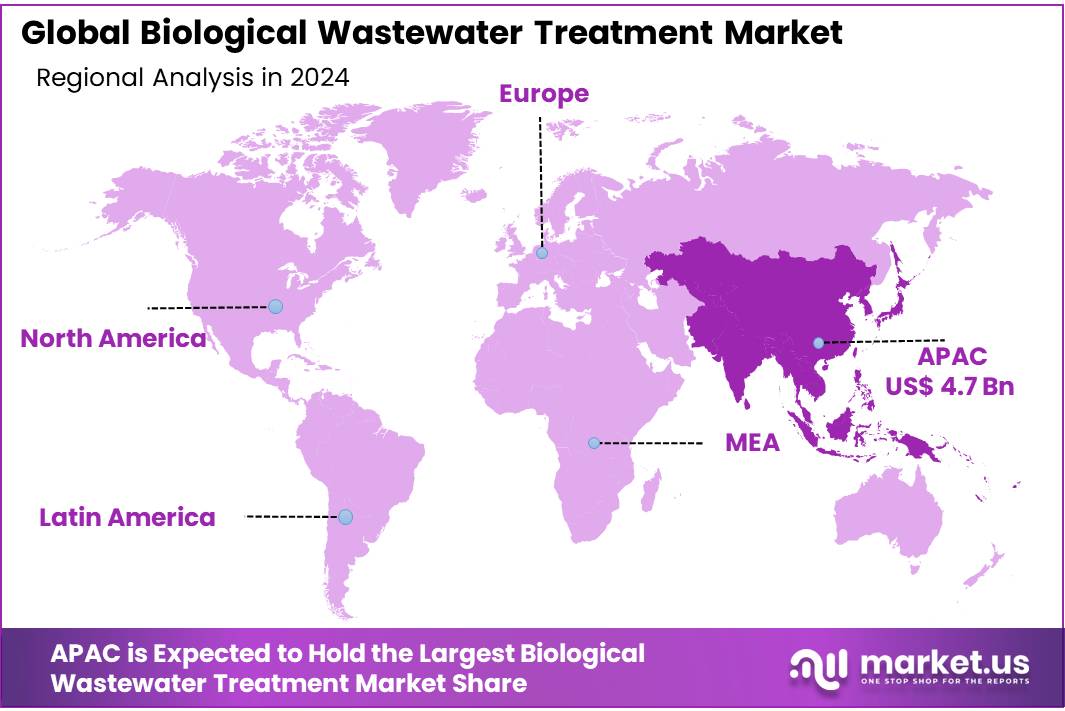

The Global Biological Wastewater Treatment Market size is expected to be worth around USD 17.2 Billion by 2034, from USD 9.8 Billion in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific (APAC) held a dominant market position, capturing more than a 48.2% share, holding USD 4.7 Billion revenue.

Biological wastewater treatment concentrates (BWTC) are a critical component in modern wastewater management, representing the residual byproducts—such as sludge, brine, and biosolids—generated from biological treatment processes. These concentrates often contain high levels of organic matter, nutrients, heavy metals, and pathogens, necessitating advanced treatment and disposal strategies.

The industrial sector, encompassing industries such as chemicals, pharmaceuticals, and food processing, is a major contributor to the generation of BWTCs. These industries often produce wastewater with high organic loads, necessitating advanced treatment solutions. The adoption of technologies like membrane bioreactors (MBRs) has been on the rise due to their efficiency in treating wastewater and reducing the volume of concentrates. The MBR market was valued at approximately USD 838.2 million in 2011 and is expected to continue growing, driven by the increasing demand for water reuse and resource recovery.

The global emphasis on sustainable water management has intensified the focus on BWTC. For instance, the European Union’s Urban Waste Water Treatment Directive aims to achieve energy neutrality in wastewater treatment plants serving over 10,000 population equivalents by 2040, highlighting the need for efficient BWTC management. Similarly, the U.S. Environmental Protection Agency’s National Water Reuse Action Plan outlines actions to enhance water reuse, indirectly influencing BWTC handling practices.

Government initiatives play a pivotal role in addressing the challenges associated with BWTC. For instance, the U.S. Environmental Protection Agency (EPA) has awarded $6.4 million in research grants to Iowa State University and the Water Research Foundation to support national efforts in reducing technological and institutional barriers for expanded water reuse. Similarly, China has mandated raising the proportion of sewage that must be treated to reuse standards to 25% by 2025, as part of its 14th Five-Year Plan.

Key Takeaways

- Biological Wastewater Treatment Market size is expected to be worth around USD 17.2 Billion by 2034, from USD 9.8 Billion in 2024, growing at a CAGR of 5.8%.

- Aerobic Wastewater Treatment held a dominant market position, capturing more than a 62.8% share.

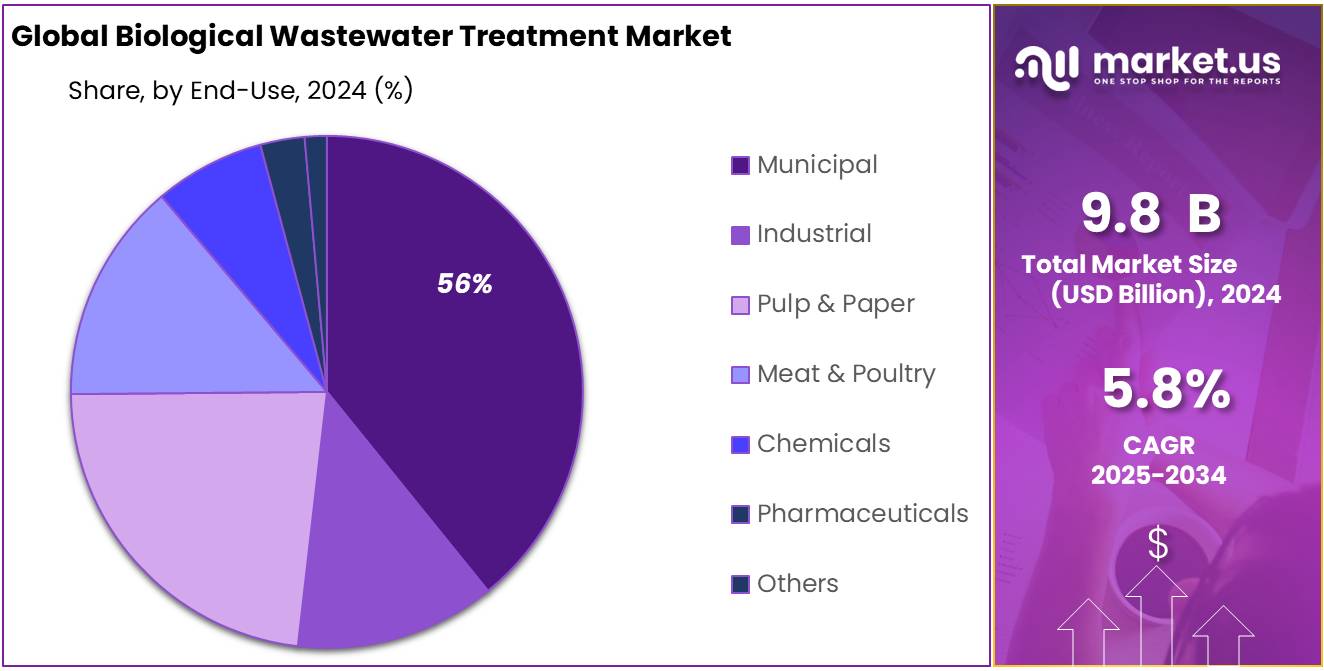

- Municipal Wastewater held a dominant market position, capturing more than a 56.9% share.

- Asia-Pacific (APAC) region emerged as the dominant force in the Biological Wastewater Treatment Market, holding a substantial 48.2% share—equivalent to approximately USD 4.7 billion.

By Process Analysis

Aerobic Wastewater Treatment dominates with 62.8% in 2024 due to its efficiency and widespread adoption.

In 2024, Aerobic Wastewater Treatment held a dominant market position, capturing more than a 62.8% share. This segment’s leadership is largely attributed to its high efficiency and the increasing need for cost-effective solutions in wastewater treatment across various industries. Aerobic processes are highly favored for their ability to break down organic contaminants in water, making them a reliable choice for municipalities and industries that prioritize water quality and reuse. Additionally, advancements in aerobic treatment technologies have made them more sustainable, contributing to their growth in the market.

The widespread adoption of aerobic treatment systems can also be linked to regulatory pressures aimed at improving wastewater quality standards, particularly in regions where water scarcity is a growing concern. As urbanization continues to accelerate, and industries expand globally, the demand for robust, energy-efficient wastewater treatment technologies, such as aerobic systems, is expected to keep rising. The market share for aerobic wastewater treatment is anticipated to remain significant in the coming years as the technology continues to evolve and adapt to modern water management challenges.

By Type of Wastewater Analysis

Municipal Wastewater dominates with 56.9% in 2024 due to increasing urbanization and stringent water quality regulations.

In 2024, Municipal Wastewater held a dominant market position, capturing more than a 56.9% share. This segment’s growth is primarily driven by the rising urban population and the need for efficient wastewater treatment systems in cities worldwide. As urbanization continues to expand, municipalities are under increasing pressure to upgrade their water treatment infrastructure to meet stricter environmental regulations and ensure sustainable water management.

The demand for municipal wastewater treatment solutions has been amplified by the growing awareness of water scarcity and pollution. Governments and regulatory bodies are imposing stringent standards on wastewater discharge, driving the adoption of advanced biological treatment technologies. The growing trend of water reuse and recycling further supports the growth of this market, as municipalities look for ways to treat and recycle wastewater for non-potable uses, such as irrigation and industrial processes. As these trends continue, the market for municipal wastewater treatment is expected to maintain its dominant share in the coming years.

Key Market Segments

By Process

- Aerobic Wastewater Treatment

- Activated Sludge

- Fixed-Bed Bioreactor (FBBR)

- Moving Bed Bioreactor (MBBR)

- Membrane Bioreactor (MBR)

- Biological Trickling Filters

- Anaerobic Wastewater Treatment

- Upflow Anaerobic Sludge Blankets (UASBs)

- Anaerobic Digesters

- Anoxic Wastewater Treatment

By Type of Wastewater

- Municipal Wastewater

- Industrial Wastewater

- Agricultural Wastewater

- Stormwater and Combined Sewer Overflows

- Chemicals

- Pharmaceuticals

- Others

Emerging Trends

Circular Resource Recovery in Food Sector Wastewater

In recent years, a compelling trend has emerged in the biological treatment of food‑industry wastewater: the shift towards circular resource recovery—especially nutrient and energy reclamation. Food processing effluents often contain organic matter at concentrations 10 to 100 times higher than municipal wastewater. This presents both a challenge and an opportunity: rather than simply treating and discarding these streams, leading organizations are embracing technologies that extract value—turning “waste” into resources.

Biological processes are playing a central role in this transformation. For example, anaerobic digestion of slaughterhouse and food processing wastewater has shown promising energy outcomes. Pilot studies indicate that two 8,500 m³ reactors jointly produced approximately 8,300 m³ of biogas per day. This scale of energy recovery not only offers carbon mitigation but also moves facilities closer to energy self-sufficiency.

Another trend involves nutrient extraction—especially ammonium and phosphate—from food and dairy effluent. Innovative systems are producing struvite, recovering about 72% phosphorus by precipitation in collaboration with sewage sludge ash. This nutrient can be reused as fertilizer in agriculture, supporting both farm productivity and circular economy goals.

Government support and guidelines are critical to advancing this trend. The WHO, FAO, and UNEP jointly recommend that food industry wastewater be treated, and biological treatment is recognized as essential for reducing BOD5 and COD before reuse. Additionally, EU regulations such as Directive 2020/741 mandate resource-efficient sewage processing, setting frameworks that incentivize nutrient and energy recovery through biological means.

On the ground, food producers are taking note. Algal treatment systems have been piloted in dairy and meat processing, not only for wastewater purification but also for producing biofuels—suggesting dual financial and environmental returns. Likewise, microbial fuel cells have demonstrated BOD₅ removal of over 95% and generated up to 27 W/m³ of electricity in dairy wastewater treatment.

Drivers

Increasing Demand for Water Reuse and Recycling

One of the major driving factors behind the growth of biological wastewater treatment is the rising demand for water reuse and recycling across various industries. The agricultural, food, and beverage industries, which are some of the largest consumers of water, are under increasing pressure to adopt sustainable water management practices.

- According to the Food and Agriculture Organization (FAO), around 70% of global freshwater is used for irrigation, making the agricultural sector a key player in the quest for water efficiency. The food industry alone is responsible for a significant portion of water usage due to the high volumes required for production and processing.

In the face of rising water scarcity, especially in water-stressed regions, the need for cost-effective water treatment solutions is more pressing than ever. Biological wastewater treatment, which uses natural processes involving microorganisms to break down pollutants, offers an eco-friendly and sustainable way to treat wastewater. The global food and beverage industry, as per the FAO, is expected to increase its investment in wastewater treatment technologies, including biological systems, by nearly 10% annually over the next decade.

Moreover, governments worldwide are encouraging such initiatives through stricter regulations and incentives for adopting water-saving technologies. For example, in the European Union, the Water Framework Directive mandates member states to take measures that prevent water pollution and promote the reuse of treated wastewater. In the U.S., the EPA’s Clean Water State Revolving Fund (CWSRF) has been instrumental in supporting the upgrade of wastewater infrastructure, with billions allocated to improving water treatment facilities in the coming years.

Restraints

High Operational and Maintenance Costs

One of the primary restraining factors in the widespread adoption of biological wastewater treatment technologies is the high operational and maintenance costs associated with these systems. Although biological processes are environmentally friendly, they require a significant investment in terms of energy, chemicals, and skilled labor for operation and maintenance. The food and beverage industry, which is one of the largest consumers of water globally, faces considerable challenges in managing the costs of wastewater treatment.

- According to the World Bank, the food processing industry alone accounts for 3-5% of total industrial water use, which translates into substantial treatment costs.

For example, the dairy industry, a major sector within the food industry, often requires large-scale treatment plants due to the high volume of wastewater produced during milk processing. These plants are energy-intensive and demand constant monitoring to ensure they meet regulatory standards. The average cost of operating and maintaining such facilities can range from US$50,000 to US$150,000 annually, depending on the size and complexity of the plant. This can place a significant financial burden on smaller operators who may not have the capital to invest in state-of-the-art treatment technologies.

Governments have recognized the importance of addressing these financial challenges. In the European Union, for instance, the European Investment Bank has been providing funding to help food processing companies upgrade their wastewater treatment plants, reducing the financial strain. Similarly, in the U.S., the EPA has allocated billions in grants through the Clean Water State Revolving Fund to support infrastructure upgrades, but the gap in financial assistance remains significant. Despite these efforts, the operational and maintenance costs of biological treatment systems still pose a barrier to many businesses, particularly smaller food producers who struggle to meet these high costs.

Opportunity

Adoption of Circular Economy Practices

One of the significant growth opportunities for biological wastewater treatment is the increasing adoption of circular economy practices, particularly in water-scarce regions. As industries, especially in the food and beverage sector, face rising water stress, there is a growing trend towards reusing and recycling wastewater. Circular economy principles encourage the reduction of waste and the continual use of resources, aligning perfectly with biological wastewater treatment’s capabilities. For the food and beverage industry, which accounts for a substantial share of global water consumption, adopting circular water usage can dramatically reduce operational costs and environmental impact.

In fact, according to the Food and Agriculture Organization (FAO), approximately 30% of the water used in food production is wasted, highlighting a significant opportunity to reduce water consumption through effective wastewater treatment and reuse. By implementing biological wastewater treatment systems, companies can recycle water for non-potable purposes, such as cleaning or irrigation, reducing their reliance on freshwater sources.

Governments are also actively encouraging the shift towards circular economy practices. In 2020, the European Union launched its Circular Economy Action Plan, which includes initiatives to promote water reuse and sustainable wastewater treatment across various industries. The plan outlines funding opportunities and regulatory measures to support businesses in adopting water-efficient technologies. In the U.S., the EPA’s WaterSense program encourages water efficiency and promotes the use of sustainable water management practices within industries, including food and beverage processing.

Regional Insights

In 2024, the Asia-Pacific (APAC) region emerged as the dominant force in the Biological Wastewater Treatment Market, holding a substantial 48.2% share—equivalent to approximately USD 4.7 billion of the global market. This commanding position reflects a regional ecosystem marked by rapid industrialization, urban expansion, and tightening environmental regulations, which together have driven significant investment in biological treatment solutions such as aerobic activated sludge systems, anaerobic digesters, and moving bed biofilm reactors (MBBRs).

Government-led initiatives across APAC—addressing water scarcity, urban sanitation, and alignment with sustainable development goals—further underpin market growth. As wastewater volumes continue to rise, biological treatment systems offer an essential, scalable, and environmentally friendly solution. Overall, APAC’s near half-share in the global market underscores its strategic role in steering innovation and capacity expansion in biological wastewater treatment.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Aquatech International delivers cutting edge industrial and municipal wastewater treatment solutions—including MBBR, MBR, and anaerobic membrane bioreactors—with published energy consumption performance as low as 1.75 kWh/m³ for MBBR systems processing up to 1800 m³/day. The firm emphasizes modular, zero liquid discharge designs, supporting water reuse initiatives. AnMBR units by Aquatech deliver ultrahigh flux (30–35 LMH) and 40% lower sludge production, reflecting the company’s commitment to operational efficiency and sustainable resource use.

Calgon Carbon specializes in adsorption-based treatment using activated carbon for removing organic contaminants and odors in industrial and municipal effluents. The company operates fifteen production/reactivation facilities globally—spanning the US, Europe, and Asia—and achieved sales of roughly 50 million pounds of granular activated carbon in 2014 for drinking water treatment. With a leadership focus on mercury control in power plants and municipal systems, Calgon Carbon continues to deploy high-performance filtration media in key water-treatment applications.

Condorchem Envitech—a Spanish water technology provider—applies biological, physico-chemical, and advanced oxidation processes for industrial and municipal wastewater systems. A notable presence in Asia (via Condorchem Envitech Guangzhou Co. Ltd.) and Europe, the firm is recognized among market leaders alongside companies such as Aquatech and 3M. Its solutions are tailored to food & beverage, chemical, and petrochemical sectors, integrating customized biological treatment with advanced process control to meet stringent effluent standards.

Top Key Players Outlook

- 3M

- Aquatech International

- Calgon Carbon Corporation

- Condorchem Envitech SL

- DAS Environment Expert GmbH

- Dryden Aqua Ltd.

- Ecolab Inc.

- Entex Technologies

- Envirocare

- Huber SE

- Samco Technologies Inc.

- Suez Water Technologies & Solutions

- United Utilities Group plc

- Veolia Environment SA

- Xylem Inc

Recent Industry Developments

In 2024, Calgon Carbon expanded its virgin granular activated carbon (GAC) production to over 200 million pounds per year in the United States following the completion of a plant expansion in Mississippi.

In 2024, Aquatech International continued to elevate its role in the biological wastewater treatment market through technological innovation and global reach. The company reported 2,000+ system installations worldwide, collectively treating over 1.6 billion gallons (approximately 6 billion litres) of water per day through its membrane bioreactor (MBR), moving bed biofilm reactor (MBBR), and ultrafiltration platforms.

Report Scope

Report Features Description Market Value (2024) USD 9.8 Bn Forecast Revenue (2034) USD 17.2 Bn CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Process (Aerobic Wastewater Treatment, Anaerobic Wastewater Treatment, Anoxic Wastewater Treatment), By Type of Wastewater (Municipal Wastewater, Industrial Wastewater, Agricultural Wastewater, Stormwater and Combined Sewer Overflows) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape 3M, Aquatech International, Calgon Carbon Corporation, Condorchem Envitech SL, DAS Environment Expert GmbH, Dryden Aqua Ltd., Ecolab Inc., Entex Technologies, Envirocare, Huber SE, Samco Technologies Inc., Suez Water Technologies & Solutions, United Utilities Group plc, Veolia Environment SA, Xylem Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Biological Wastewater Treatment MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Biological Wastewater Treatment MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M

- Aquatech International

- Calgon Carbon Corporation

- Condorchem Envitech SL

- DAS Environment Expert GmbH

- Dryden Aqua Ltd.

- Ecolab Inc.

- Entex Technologies

- Envirocare

- Huber SE

- Samco Technologies Inc.

- Suez Water Technologies & Solutions

- United Utilities Group plc

- Veolia Environment SA

- Xylem Inc