Global Biobased Acrylonitrile Market Size, Share Analysis Report By Type (Upto 99%, Above 99%), By Product Type (Bio-Based Acrylonitrile Butadiene Styrene, Bio-Based Styrene Acrylonitrile, Bio-Based Acrylonitrile Styrene Acrylate, Others), By Application (Automotive, Electronics, Construction, Packaging, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160941

- Number of Pages: 380

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

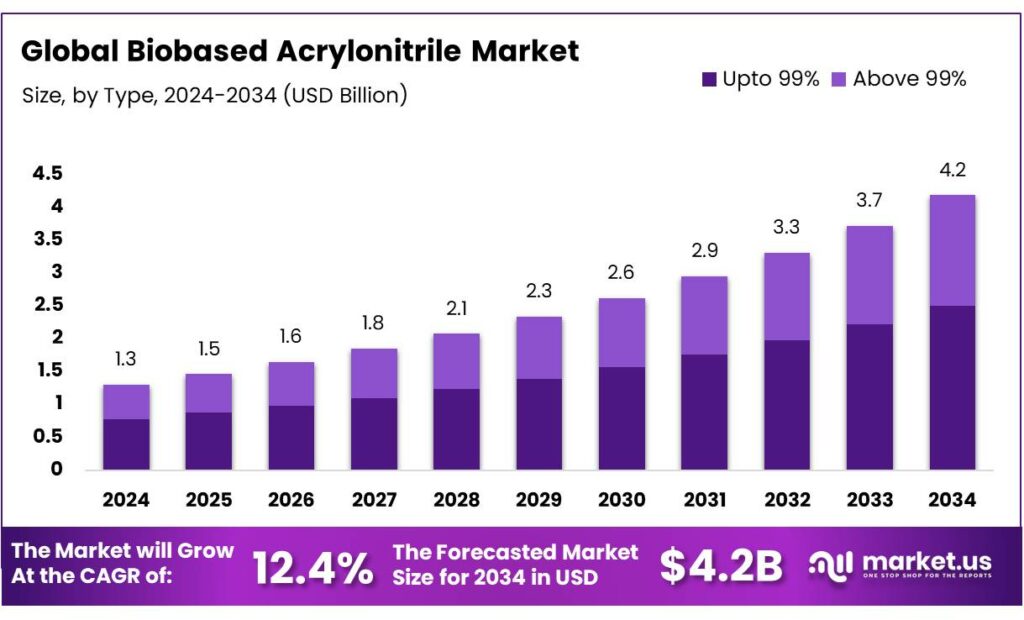

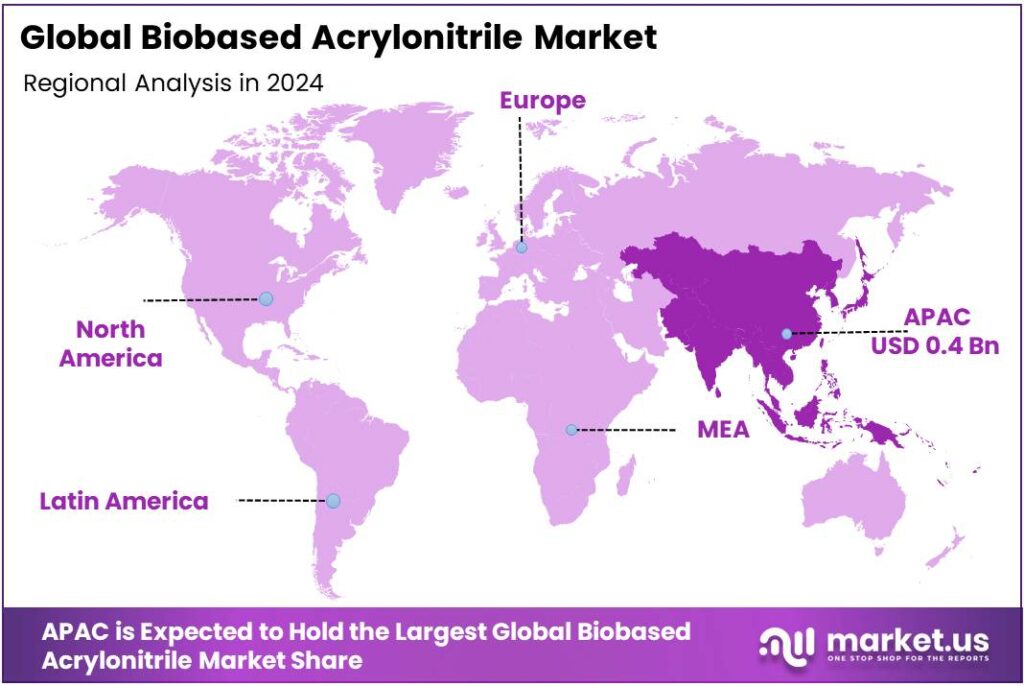

The Global Biobased Acrylonitrile Market size is expected to be worth around USD 4.2 Billion by 2034, from USD 1.3 Billion in 2024, growing at a CAGR of 12.4% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 35.8% share, holding USD 0.4 Billion in revenue.

Bio-based acrylonitrile (bio-ACN) refers to acrylonitrile produced from renewable biomass or bio-feedstocks (e.g. glycerol, sugars, agricultural residues) rather than conventional petrochemical routes (e.g. propylene ammoxidation). Conventional acrylonitrile is a key intermediate used in ABS, SAN, polyacrylonitrile, knitrile rubber, carbon fiber precursors, and other specialty chemicals.

This growth is underpinned by the rising need for eco-friendly chemicals in various industries, including automotive, electronics, and packaging. Companies like Ascend Performance Materials are leading the way by producing bio-circular performance chemicals, such as acrylonitrile derived from used cooking oil, which results in a 25% lower carbon footprint compared to traditional methods.

The industrial scenario for bio-ACN is still largely at pilot or demonstration scale. For example, the U.S. Department of Energy is backing a project to convert glycerol to bio-ACN through a pilot/demonstration route, including design, operation, purification, lifecycle assessment and technoeconomic studies. In December 2022, Trillium Renewable Chemicals received USD 2.5 million in DOE funding to support design and construction of a demonstration plant for bio-ACN.

The key driving factors for bio-based acrylonitrile adoption include intensifying global pressure to decarbonize chemical value chains, regulatory mandates, sustainability targets from end users, and innovation in biotechnology and catalysis. For example, INEOS Nitriles has launched a bio-based acrylonitrile “INVIREO™” that reportedly provides up to 90% reduction in carbon footprint relative to fossil-based acrylonitrile under mass balance certification.

Key Takeaways

- Biobased Acrylonitrile Market size is expected to be worth around USD 4.2 Billion by 2034, from USD 1.3 Billion in 2024, growing at a CAGR of 12.4%.

- Upto 99% held a dominant market position, capturing more than a 59.7% share of the global biobased acrylonitrile market.

- Bio-Based Acrylonitrile Butadiene Styrene held a dominant market position, capturing more than a 46.9% share of the global biobased acrylonitrile market.

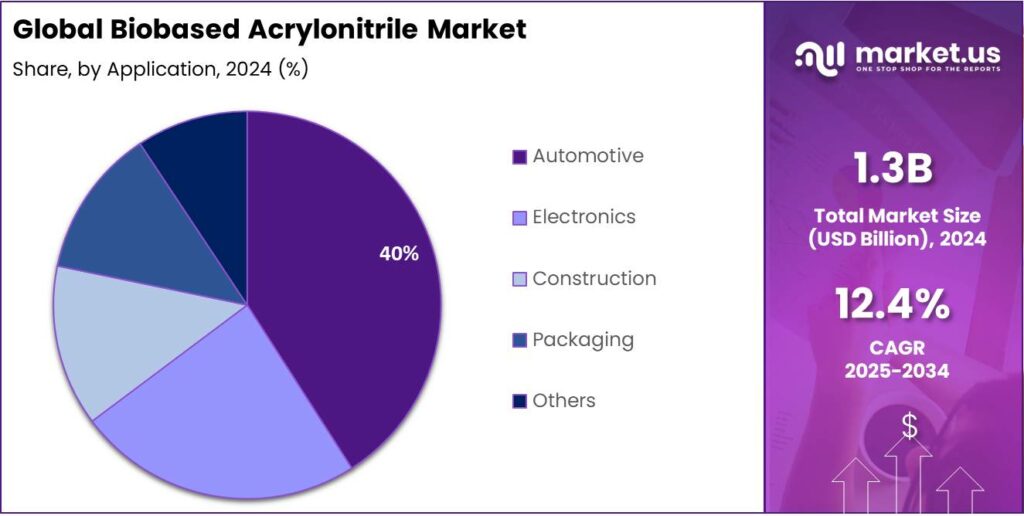

- Automotive held a dominant market position, capturing more than a 39.5% share of the global biobased acrylonitrile market.

- Asia Pacific region held a dominant position in the global bio-based acrylonitrile market, capturing more than a 35.8% share, valued at approximately USD 0.4 billion.

By Type Analysis

Upto 99% Biobased Acrylonitrile dominates with 59.7% share in 2024 due to high purity demand across industries.

In 2024, Upto 99% held a dominant market position, capturing more than a 59.7% share of the global biobased acrylonitrile market. This high-purity segment is increasingly preferred across applications in automotive, electronics, and packaging industries, where product performance and stability are critical. The strong adoption can be attributed to the ability of Upto 99% acrylonitrile to deliver consistent chemical reactivity and lower impurities, which enhances its suitability for advanced polymer production and specialty chemical manufacturing.

As industries shift towards more sustainable and eco-friendly alternatives, the demand for high-purity bio-based acrylonitrile has seen notable growth in 2024, setting the stage for further expansion in 2025. Emerging applications, particularly in high-performance plastics and resins, are expected to reinforce the dominance of the Upto 99% segment, making it the preferred choice for manufacturers seeking reliable and environmentally responsible feedstocks.

By Product Type Analysis

Bio-Based Acrylonitrile Butadiene Styrene leads with 46.9% share in 2024 driven by versatile industrial applications.

In 2024, Bio-Based Acrylonitrile Butadiene Styrene held a dominant market position, capturing more than a 46.9% share of the global biobased acrylonitrile market. This product type is widely adopted due to its excellent balance of strength, flexibility, and chemical resistance, making it suitable for applications in automotive components, electronics housings, and consumer goods. The growing emphasis on sustainable materials has further accelerated the shift towards bio-based ABS, as manufacturers aim to reduce reliance on fossil-based feedstocks.

In 2024, the increasing use of bio-based ABS in high-performance plastics contributed significantly to its market share, and this trend is expected to continue into 2025, driven by rising industrial demand and regulatory support for greener alternatives. Its versatility and eco-friendly profile make it a preferred choice for industries looking to combine performance with sustainability.

By Application Analysis

Automotive leads with 39.5% share in 2024 driven by demand for lightweight and durable components.

In 2024, Automotive held a dominant market position, capturing more than a 39.5% share of the global biobased acrylonitrile market. The strong adoption in this sector is attributed to the increasing demand for lightweight, high-strength, and chemically resistant materials used in vehicle components such as fuel lines, under-the-hood parts, and interior fittings. Manufacturers are progressively shifting towards bio-based acrylonitrile to meet sustainability targets and reduce carbon footprints while maintaining performance standards.

The integration of bio-based materials in electric vehicles and hybrid models further fueled market growth, reflecting the industry’s focus on eco-friendly and efficient solutions. This trend is expected to continue into 2025, reinforcing automotive as a key driver for biobased acrylonitrile adoption across the industrial landscape.

Key Market Segments

By Type

- Upto 99%

- Above 99%

By Product Type

- Bio-Based Acrylonitrile Butadiene Styrene

- Bio-Based Styrene Acrylonitrile

- Bio-Based Acrylonitrile Styrene Acrylate

- Others

By Application

- Automotive

- Electronics

- Construction

- Packaging

- Others

Emerging Trends

Emergence of Smart & Active Bio-based Packaging

In the food packaging world, there is growing interest in packaging that does more than just contain. Smart packaging systems can monitor gas levels, humidity, or spoilage markers; active packaging can release antimicrobial agents or antioxidants to prolong shelf life. In one recent innovation, a battery-free stretchable smart packaging film was able to monitor fish freshness and trigger release of protective compounds, extending shelf life by up to 14 days compared to conventional packaging.

Although most smart/active packaging has been built on existing biopolymers (PLA, PHA, cellulose derivatives), combining such capabilities with bio-based acrylonitrile (or its co-polymers) could be an attractive route. Acrylonitrile’s strength and barrier properties are well known; if a bio-derived acrylonitrile backbone can carry embedded sensors, antimicrobial microcapsules, or responsive additives, the resulting material may justify higher value and faster adoption—especially in food systems that demand freshness assurance.

From a demand perspective, the food packaging sector is large and growing. In India, for example, the food and beverage packaging industry is expanding at ~14.8 % annual growth and is projected to reach USD 86 billion by 2029, driven by rising consumption, retail modernization, and demand for convenience foods. This creates an opening for high-performance packaging materials that can command premium usage in high-turnover or high-value food products.

Meanwhile, government and regulatory forces push toward smarter packaging solutions. In India, efforts to curb single-use plastics have triggered policies and funding support for biodegradable and intelligent packaging alternatives. The government has committed over INR 500 crore (≈ USD 67 million) to support biodegradable alternatives and eco-friendly packaging development.

Drivers

Growing Demand for Sustainable Plastics as a Driver

One of the strongest driving factors for bio-based acrylonitrile is the rapidly growing demand within the food and beverage industry for more environmentally friendly, sustainable packaging materials. As consumers, governments, and global organizations tighten their focus on plastic waste, carbon footprints, and food safety, food producers and packagers are under pressure to shift toward greener alternatives. Bio-based acrylonitrile, when used as a feedstock for polymers or barrier layers, offers one potential solution (or component) in that transition.

In recent years, the food packaging segment has accounted for a large share of bioplastic demand. According to the European Bioplastics / nova-Institute data, packaging represents about 45% of the total bioplastics market share in 2024. This shows clearly that food packaging is central to the business case for biobased polymers. As the push for sustainable packaging intensifies, the opportunity for intermediates like bio-based acrylonitrile becomes more relevant.

Another numerical anchor: globally, plastic packaging waste is a mounting challenge. One study noted that 50% of food packaging is flexible plastic packaging, and demand for that segment grew by 56% between 2010 and 2014 . Such growth in flexible packaging intensifies the need for sustainable materials in that domain. Since acrylonitrile-based materials are broadly used in packaging, the trend toward more sustainable flexible packaging helps create a pull for bio-based routes.

Restraints

High Production Cost and Feedstock Constraints as a Restraining Factor

One of the biggest challenges holding back bio-based acrylonitrile is simply the high cost and limited availability of suitable renewable feedstocks. Even if markets want greener plastics, economics still matter — and right now, the cost gap with fossil routes is steep.

In processes to make bio-based chemicals (including acrylonitrile), feedstock cost often represents a large share of total cost. In fact, in some advanced biofuel/biochemical routes, feedstock can account for up to 35 % or more of the overall production cost. That means any volatility in biomass, agricultural residues, sugars or other biological intermediates directly hurts competitiveness.

Governments have recognized this hurdle, but addressing it is nontrivial. For example, integrated strategies recommended by energy or bioeconomy agencies highlight that reducing feedstock cost involves diversifying feedstock types, optimizing supply chains, minimizing harvest-to-plant losses, co-locating biomass sources and plants, and using integrated landscape management. Some national bioeconomy initiatives also subsidize feedstock logistics or build infrastructure to support biorefineries, but such interventions are costly and slow to scale.

Opportunity

Integration into Sustainable Food and Packaging Ecosystem

One of the most compelling growth paths for bio-based acrylonitrile lies in serving the sustainable food packaging sector, where there is increasing pressure to reduce plastic waste, improve recyclability, and incorporate biobased materials. Because a large share of plastics is used for food packaging, offering a “greener” version of acrylonitrile-based polymers can unlock real demand.

Packaging is also a big contributor to waste: packaging accounts for about 40% of plastic waste globally (and even higher in certain countries) according to Our World in Data. This awareness and the policy push to reduce single-use plastics create a favorable context for materials that can deliver the same performance but with lower carbon or better end-of-life credentials.

Governments also support this direction. In India, the BioE3 policy (Biotechnology for Economy, Environment and Employment) is explicitly meant to promote biomanufacturing, bio-based chemicals, and biofoundries. The Indian government sees the bioeconomy expanding from about USD 165.7 billion in 2024 toward USD 300 billion by 2030. Under this policy, infrastructure, R&D funding, tax incentives, and scale-up support can help lower costs and risks in biobased chemical ventures.

Regional Insights

Asia Pacific leads with 35.8% share in 2024, valued at $0.4 billion, driven by industrialization and sustainability initiatives.

In 2024, the Asia Pacific region held a dominant position in the global bio-based acrylonitrile market, capturing more than a 35.8% share, valued at approximately USD 0.4 billion. This regional leadership is attributed to rapid industrialization, a substantial presence of manufacturing hubs, and a growing emphasis on sustainable practices across various industries. Countries such as China, Japan, South Korea, and India are at the forefront, leveraging advanced technologies and favorable government policies to promote the adoption of bio-based materials.

The automotive sector in Asia Pacific is a significant contributor to the demand for bio-based acrylonitrile, driven by the increasing use of lightweight and durable materials in vehicle manufacturing. Additionally, the electronics industry is witnessing a shift towards sustainable components, further propelling market growth. Government initiatives aimed at reducing carbon footprints and promoting the use of renewable resources are also playing a crucial role in accelerating the adoption of bio-based acrylonitrile in the region.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

INEOS Group Limited is a global leader in petrochemicals, specializing in the production of acrylonitrile through its subsidiary, INEOS Nitriles. In 2023, INEOS launched Invireo™, a bio-attributed acrylonitrile produced using sustainable feedstocks at its facilities in Cologne, Germany, and Green Lake, Texas. This product offers up to a 90% reduction in carbon footprint compared to traditional fossil-based acrylonitrile, aligning with the company’s sustainability objectives.

AnQore, a subsidiary of the Netherlands-based OCI Nitrogen, produces Econitrile, the world’s first mass-produced sustainable acrylonitrile. Manufactured using bio- and circular feedstocks, Econitrile is ISCC PLUS certified and offers a 60% lower carbon footprint compared to conventional acrylonitrile. It serves as a sustainable alternative in various applications, including ABS, nitrile rubber, and carbon fiber production.

Ascend Performance Materials LLC, a U.S.-based chemical manufacturer, has expanded its Bioserve portfolio to include bio-circular performance chemicals. In December 2024, the company announced the successful production of acrylonitrile, hexamethylene diamine, adipic acid, and nylon 6,6 from feedstocks derived from used cooking oil. The resulting nylon 6,6 exhibits a 25% lower product carbon footprint compared to its fossil-fuel derived counterpart, demonstrating Ascend’s commitment to sustainable manufacturing practices.

Top Key Players Outlook

- INEOS Group Limited

- Asahi Kasei Corporation

- ECONITRILE

- SABIC

- Ascend Performance Materials LLC

- Sinopec Group

- Mitsubishi Chemical Corporation

- LG Chem Ltd.

- Toray Industries Inc.

Recent Industry Developments

As of 2024, INEOS is already a giant in the conventional acrylonitrile industry: over 90 % of global acrylonitrile plants use INEOS’s technology licenses.

In 2023, Asahi Kasei continued its sustainability efforts by acquiring ISCC PLUS certification for several additional products, including methyl methacrylate (MMA), polymethyl methacrylate (PMMA), styrene-butadiene rubber (SBR), and butadiene rubber (BR), among others.

Report Scope

Report Features Description Market Value (2024) USD 1.3 Bn Forecast Revenue (2034) USD 4.2 Bn CAGR (2025-2034) 12.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Upto 99%, Above 99%), By Product Type (Bio-Based Acrylonitrile Butadiene Styrene, Bio-Based Styrene Acrylonitrile, Bio-Based Acrylonitrile Styrene Acrylate, Others), By Application (Automotive, Electronics, Construction, Packaging, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape INEOS Group Limited, Asahi Kasei Corporation, ECONITRILE, SABIC, Ascend Performance Materials LLC, Sinopec Group, Mitsubishi Chemical Corporation, LG Chem Ltd., Toray Industries Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Biobased Acrylonitrile MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Biobased Acrylonitrile MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- INEOS Group Limited

- Asahi Kasei Corporation

- ECONITRILE

- SABIC

- Ascend Performance Materials LLC

- Sinopec Group

- Mitsubishi Chemical Corporation

- LG Chem Ltd.

- Toray Industries Inc.