Global Bio-LNG Plant Insurance Market Size, Share and Analysis Report By Coverage Type (Property Insurance, Liability Insurance, Business Interruption Insurance, Environmental Liability Insurance, Others), By Plant Type (Small-Scale Bio-LNG Plants, Large-Scale Bio-LNG Plants), By End-User (Energy Companies, Transportation, Industrial, Utilities, Others), By Distribution Channel (Direct, Brokers, Others) , By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 176353

- Number of Pages: 361

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Drivers Impact Analysis

- Restraint Impact Analysis

- Investor Type Impact Matrix

- By Coverage Type

- By Plant Type

- By End User

- By Distribution Channel

- Regional Perspective

- United States Market Overview

- Technology Enablement Analysis

- Emerging trends

- Growth Factors

- Risk Exposure Analysis

- Regulatory Impact Assessment

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

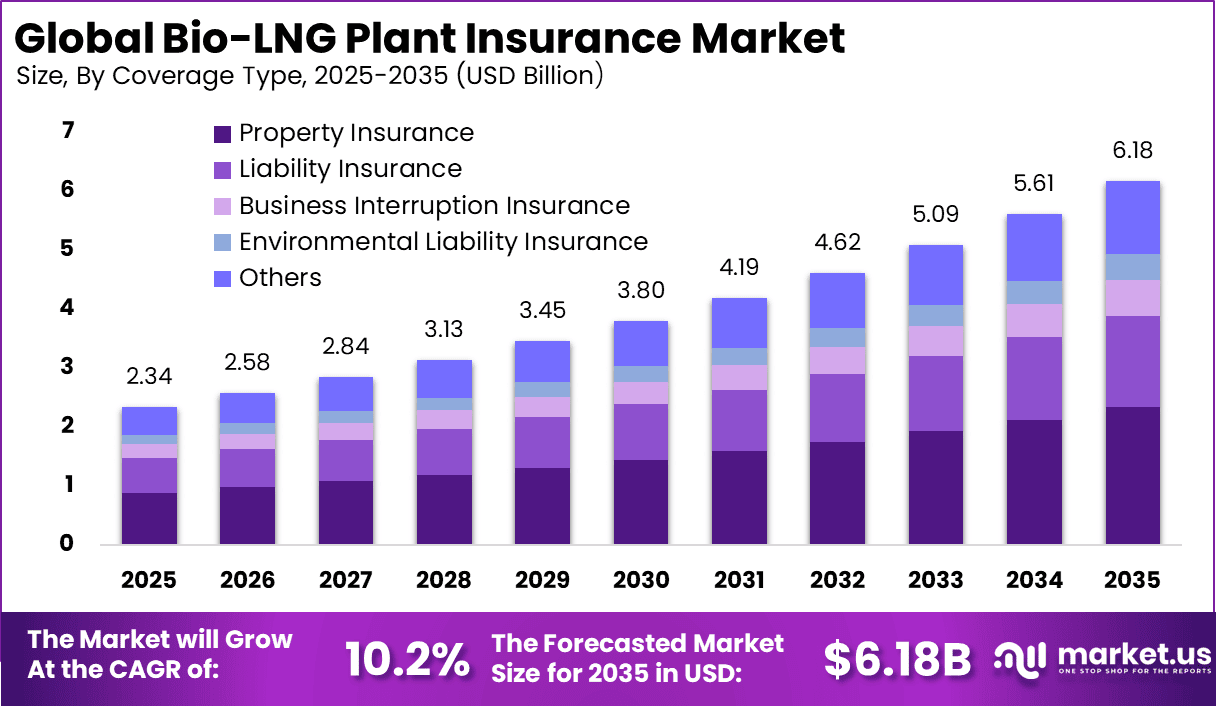

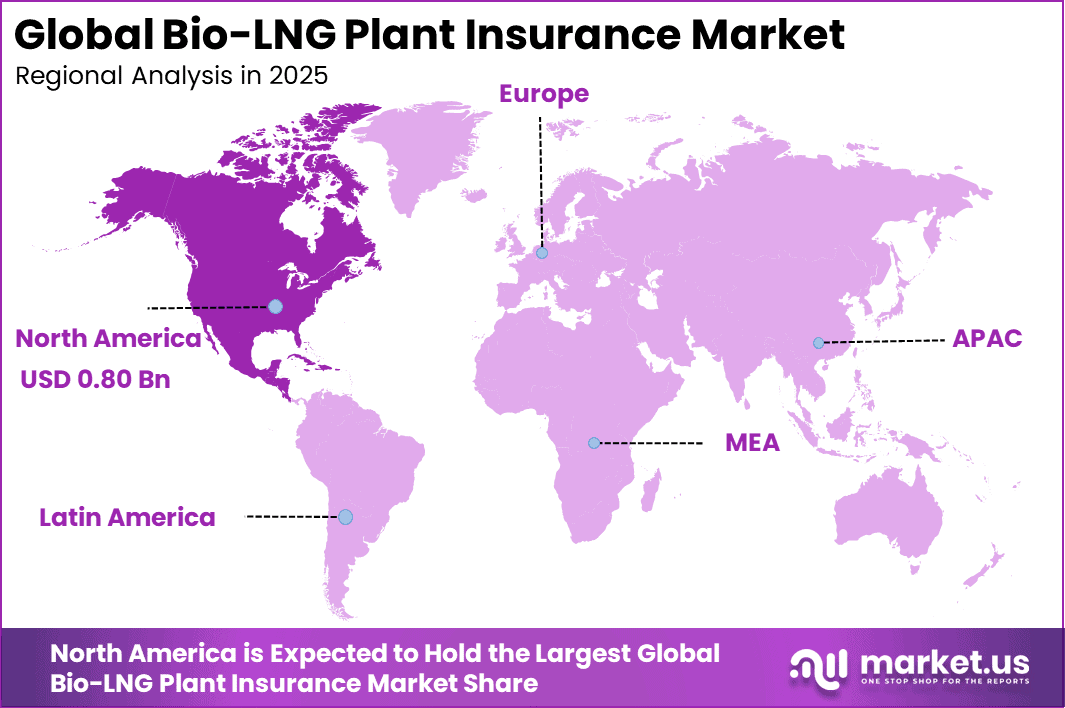

The Global Bio-LNG Plant Insurance Market is gaining steady momentum, projected to expand from USD 2.34 billion in 2025 to approximately USD 6.18 billion by 2035, registering a CAGR of 10.2% over the forecast period. North America led the market, capturing more than 34.3% share and generating USD 0.80 billion in revenue, reflecting rising insurance demand tied to bio-energy infrastructure expansion and risk mitigation in renewable gas production.

The Bio-LNG Plant Insurance Market covers insurance solutions designed to protect bio-liquefied natural gas production facilities across construction, commissioning, and operational phases. These facilities face a mix of industrial, environmental, and operational risks due to gas handling, cryogenic storage, and complex processing systems. Insurance coverage is therefore structured to address property damage, operational interruptions, third-party liability, and environmental exposure.

The growing role of bio-LNG in renewable energy transition has increased the importance of structured risk protection. Bio-LNG plants often operate within regulated energy and waste-to-fuel frameworks, which adds compliance-related exposure to their risk profile. As plants scale in size and integrate advanced automation, insurance policies are being aligned more closely with plant design and operational models.

One of the main drivers is the expansion of bio-LNG infrastructure as governments promote low-carbon fuels derived from organic waste and biogas. Bio-LNG production involves high-value assets and continuous processing, which increases exposure to fire, explosion, and mechanical failure risks. Insurance is therefore required to protect capital investment and secure lending arrangements.

For instance, in June 2025, Berkshire Hathaway Specialty Insurance introduced enhanced energy risk solutions, expanding coverage for Bio-LNG production risks like feedstock volatility and tech failures. From Omaha, this development aids North American plant developers in securing capital for expansion, showcasing the firm’s deep expertise in emerging green energy insurance.

Key Takeaway

- By coverage type, property insurance led with 37.8%, reflecting the need to protect high-value processing equipment, storage infrastructure, and plant facilities.

- By plant type, large-scale Bio-LNG plants accounted for 58.7%, driven by higher asset concentration and greater insurance requirements for industrial-scale operations.

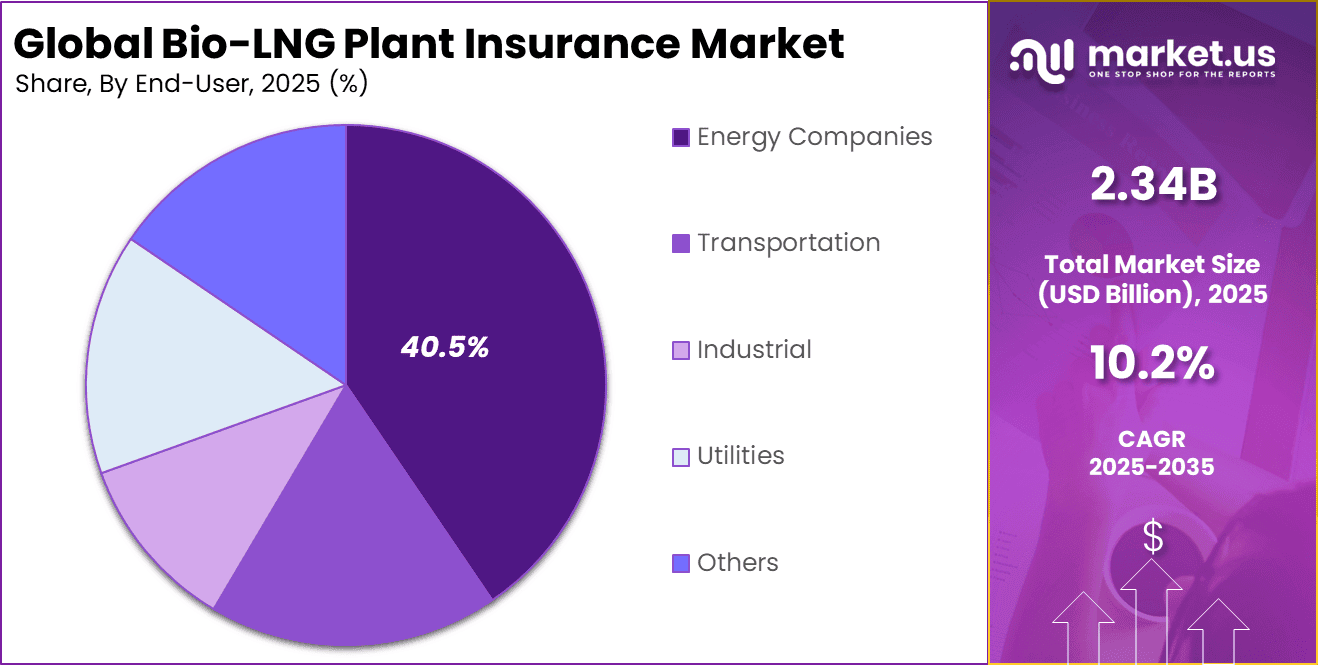

- By end user, energy companies held 40.5%, supported by their expanding investments in renewable gas infrastructure and risk management programs.

- By distribution channel, direct sales captured 54.6%, indicating preference for customized policies, direct underwriting engagement, and faster coverage placement.

- North America represented 34.3% of the global market, supported by advanced bioenergy projects and regulatory backing for renewable fuels.

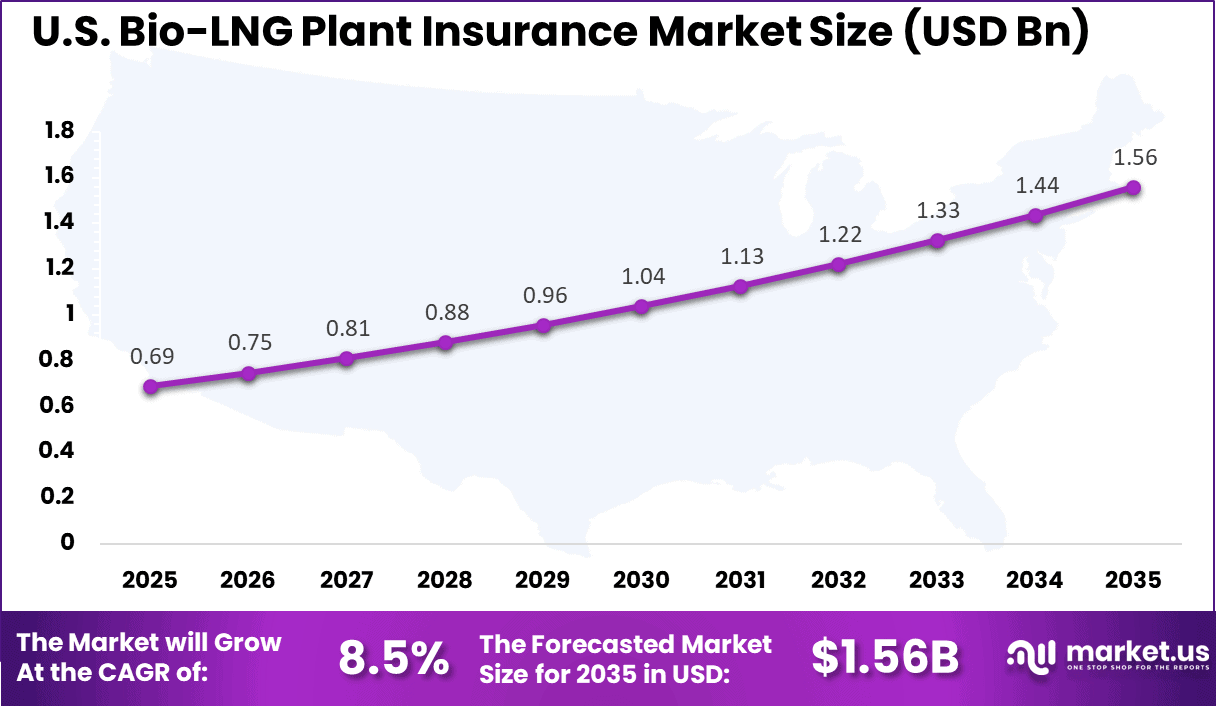

- The US market was valued at USD 0.69 billion and is growing at a 8.5% CAGR, driven by rising Bio-LNG production capacity and increased focus on asset protection.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~)% Geographic Relevance Impact Timeline Expansion of bio-LNG production to support energy transition goals +3.1% Europe, North America Medium term Increasing insurance requirements for renewable energy infrastructure +2.6% Europe, North America Short to medium term Rising investment in biogas upgrading and liquefaction plants +2.2% Europe, Asia Pacific Medium term Higher operational and safety risk profile of bio-LNG facilities +1.5% Global Short term Growth in long-term offtake agreements requiring risk coverage +0.8% Europe, North America Long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline High premium costs for complex energy infrastructure -2.1% Global Short to medium term Limited underwriting expertise in bio-LNG specific risks -1.8% Emerging Markets Medium term Variability in feedstock supply affecting risk profiles -1.4% Global Medium term Regulatory uncertainty in emerging renewable gas markets -1.2% Asia Pacific, Latin America Medium to long term Long project development and commissioning timelines -0.9% Global Long term Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Energy and renewable infrastructure insurers High Medium Europe, North America Stable long-term premium growth Large commercial insurers Medium Low to Medium Global Portfolio diversification opportunity Reinsurance providers High Medium to High Global Attractive for risk pooling and scale Private equity infrastructure funds Medium Medium Europe Linked to renewable asset expansion Venture capital investors Low High Europe Limited to technology-linked insurance models By Coverage Type

Property insurance represents the leading coverage category in the Bio-LNG Plant Insurance Market, accounting for 37.8% of total adoption. This dominance is driven by the high capital intensity of Bio-LNG facilities, where physical assets such as liquefaction units, storage tanks, and processing infrastructure face exposure to fire, mechanical failure, and environmental hazards. Protection of fixed assets remains a primary risk management priority for plant operators.

The importance of property insurance is further reinforced by financing and regulatory requirements. Lenders and regulatory authorities often mandate asset coverage as a condition for project approval and operation. As Bio-LNG infrastructure expands, property insurance continues to serve as the foundation of insurance portfolios for plant owners.

For Instance, in January 2026, Zurich Insurance Group rolled out updated property coverage for renewable energy sites, focusing on bioenergy plants. They boosted limits for physical damage from fires and storms, helping bio-LNG operators protect costly liquefaction gear. This move supports growing facilities amid climate risks, with quick claims handling to minimize downtime.

By Plant Type

Large scale Bio-LNG plants dominate the plant type segment with a share of 58.7%. These facilities typically handle higher feedstock volumes and operate complex liquefaction systems, which increases operational risk and insurance demand. The scale of investment involved makes comprehensive insurance coverage essential to protect against production disruptions and asset damage.

The dominance of large scale plants is also linked to their role in supplying industrial users and regional energy networks. Higher output capacity results in greater exposure to financial loss in the event of downtime. As a result, insurance adoption is more concentrated among large scale Bio-LNG facilities.

For instance, in December 2025, Swiss Re Corporate Solutions launched tailored insurance for large renewable projects, including bio-LNG setups. Offering up to USD 125 million in all-risks property damage and business interruption cover, it targets big-scale operations with high deductibles for quality risks. This helps fund massive plants tied to energy grids, easing investor worries over breakdowns.

By End User

Energy companies account for 40.5% of insurance demand in the Bio-LNG Plant Insurance Market. These organizations often operate diversified energy portfolios and integrate Bio-LNG plants within broader renewable and low carbon strategies. Their exposure spans construction, operation, and distribution, increasing the need for structured insurance coverage.

Insurance adoption among energy companies is driven by corporate risk governance frameworks and shareholder expectations. Comprehensive coverage supports business continuity and regulatory compliance. This reinforces the strong presence of energy companies within the end user segment.

For Instance, in December 2025, Chubb expanded renewable energy insurance in Latin America for energy firms building bio-LNG and similar plants. The new offerings cover civil liability, natural disasters, and operational continuity up to large limits, aiding transition projects. Energy companies gain tools to attract financing and handle weather threats, boosting regional green power growth.

By Distribution Channel

Direct distribution represents 54.6% of policy placement across the market. This channel is preferred due to the technical complexity of Bio-LNG operations, which requires detailed risk assessment and customized policy structures. Direct engagement allows insurers and insured parties to align coverage with plant specific risk profiles.

The growth of direct distribution is also supported by long term insurer relationships and negotiated contracts. Large plant operators often seek consistent coverage terms across multiple facilities. This strengthens the role of direct channels in the insurance procurement process.

For Instance, in November 2025, Tokio Marine HCC strengthened direct renewable energy underwriting via its GCube unit for bio-LNG clients. Acquired earlier, it provides streamlined property and liability policies worldwide without brokers, speeding placements for operators. This direct approach cuts costs and fits custom needs, driving faster coverage for expanding sustainable plants.

Regional Perspective

North America holds a leading regional position in the Bio-LNG Plant Insurance Market, accounting for 34.3% of total activity. This position is supported by strong renewable energy policies, increasing investment in biofuels, and well developed insurance frameworks for energy infrastructure. Risk transfer through insurance is widely embedded within project planning and operational management.

The region also benefits from established regulatory standards governing plant safety and environmental protection. These requirements drive consistent insurance adoption across Bio-LNG projects. As a result, North America maintains a structurally strong position in the market.

For instance, in September 2025, Tokio Marine HCC launched TMGX, offering comprehensive green transition insurance, including coverage for renewable energy projects like Bio-LNG plants. The platform provides specialist solutions for decarbonization risks, reinforcing North America’s position in supporting the shift to sustainable energy infrastructure through innovative insurance products.

United States Market Overview

The United States represents the largest contributor within North America, with a market value of USD 0.69 Bn and a growth rate of 8.5% CAGR. Expansion is supported by increased deployment of renewable gas projects and growing interest in low carbon fuel alternatives. Bio-LNG plants are increasingly integrated into industrial and transportation fuel supply chains.

Insurance adoption in the U.S. is influenced by strict compliance standards and exposure to operational and environmental risk. Energy companies and plant operators prioritize coverage to protect long term investments and meet regulatory obligations. These factors collectively support steady growth in the U.S. segment.

For instance, in October 2025, AXA XL, from Stamford, Connecticut, committed to €6 billion in energy transition premiums (2024-26), supporting Bio-LNG and renewables with specialized coverage for regulatory, financial, and construction risks. AXA XL’s focus on low-carbon projects underscores U.S. insurers’ pivotal role in scaling sustainable LNG infrastructure.

Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~)% Primary Function Geographic Relevance Adoption Timeline Digital risk modeling for bio-LNG plant operations +2.4% Improved underwriting accuracy Europe, North America Medium term IoT-based monitoring of pressure, temperature, and safety systems +2.0% Loss prevention Global Medium term Predictive maintenance analytics for plant equipment +1.7% Reduced claim frequency Europe Medium to long term Automated compliance and inspection reporting tools +1.3% Regulatory alignment Europe, North America Long term Data-driven catastrophe and outage risk assessment +1.0% Portfolio risk optimization Global Long term Emerging trends

Bio-LNG plant insurance activity has been increasingly shaped by the expanding bio-LNG sector, where renewable liquefied biomethane serves as a low-carbon fuel alternative in transport and industrial uses. This shift has increased the need for insurance products that address complex operational and environmental exposures presented by large-scale bio-LNG facilities.

Market participants have begun integrating new risk evaluation techniques that account for operational variability and environmental liabilities in plant operations. The insurance ecosystem is also adapting to the broader energy transition by refining policies that support continuity of coverage while responding to evolving risk profiles.

Insurers are placing greater emphasis on understanding site-specific risk drivers, including feedstock variability, equipment reliability, and methane emissions management. Digital tools and data analytics have been referenced in industry discussions as methods to enhance underwriting precision and loss prevention insight, although comprehensive data for plant-specific loss histories remains limited.

Growth Factors

The growth of the bio-LNG industry has been driven by strong expansion in bio-LNG production capacity, underpinned by renewable fuel mandates and rising global emphasis on methane-neutral energy solutions. As bio-LNG facilities increase in number and scale, the corresponding demand for specialised insurance has risen to manage property, operational, and liability risks associated with plant construction and daily operations.

Bio-LNG’s compatibility with existing liquefied natural gas infrastructure further accelerates facility deployment in heavy transportation and industrial sectors. Another important factor is the increasing regulatory focus on decarbonisation and environmental compliance.

Operators are seeking coverage that not only protects physical assets but also addresses environmental liabilities and business continuity risks. Pressure to comply with stringent emission standards and renewable fuel requirements has resulted in heightened risk awareness and proactive insurance procurement among bio-LNG plant developers and operators.

Risk Exposure Analysis

Bio-LNG plant operations are exposed to multiple risk categories. Property risk arises from potential damage to critical equipment, storage tanks, and liquefaction systems. Operational disruptions, including feedstock supply variability or mechanical failures, can result in significant financial losses and business interruption claims. Environmental exposure remains a central concern, as unplanned methane releases or contamination-related incidents can trigger regulatory penalties and extensive remediation costs.

In addition, the relative novelty of large-scale bio-LNG production means that historical loss data are limited, making actuarial risk assessment more challenging for insurers. This can result in cautious underwriting approaches or conservative premium structures. Climate-related threats, such as extreme weather events amplified by broader climate change impacts, further compound risk exposure for plants situated in vulnerable geographies.

Regulatory Impact Assessment

Regulatory frameworks that mandate emission reductions and renewable energy adoption directly influence insurance needs for bio-LNG facilities. Compliance obligations heighten the importance of environmental liability coverage, as operators must demonstrate adherence to strict reporting, safety, and pollution control standards. Failure to meet these requirements can result in substantial fines, loss of operating licences, or costly remediation efforts.

Regulators also shape risk management expectations by enforcing standards for plant design, safety systems, and emergency response planning. These standards influence how insurers evaluate risk controls and underwriting criteria. Facilities with robust compliance practices and documented safety protocols may benefit from more favourable underwriting terms and reduced exposure to liability claims.

Key Market Segments

By Coverage Type

- Property Insurance

- Liability Insurance

- Business Interruption Insurance

- Environmental Liability Insurance

- Others

By Plant Type

- Small-Scale Bio-LNG Plants

- Large-Scale Bio-LNG Plants

By End-User

- Energy Companies

- Transportation

- Industrial

- Utilities

- Others

By Distribution Channel

- Direct

- Brokers

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Global insurers such as Zurich Insurance Group, Allianz SE, and AXA XL lead coverage for Bio-LNG plants. Their policies address construction all risks, property damage, operational interruption, and environmental liability. Strong engineering risk assessment and energy-sector underwriting support complex plant profiles. Chubb Limited and AIG add capacity for large-scale projects. Demand is driven by stricter safety standards and capital-intensive infrastructure.

Reinsurance and risk-sharing providers such as Munich Re and Swiss Re play a critical role in absorbing high-severity risks. Their involvement improves underwriting stability for insurers covering Bio-LNG facilities. Tokio Marine HCC, Berkshire Hathaway Specialty Insurance, and Sompo International focus on tailored coverage for energy transition assets. These players emphasize loss prevention, safety audits, and long-term risk management.

Brokerage and advisory firms such as Willis Towers Watson and Marsh & McLennan Companies support policy structuring and placement. HDI Global SE, QBE Insurance Group, and CNA Financial Corporation expand industrial energy coverage. Generali Group and Sampo Group strengthen regional access. Other insurers increase competition and customization across Bio-LNG projects.

Top Key Players in the Market

- Zurich Insurance Group

- Allianz SE

- AXA XL

- Munich Re

- Swiss Re

- Chubb Limited

- AIG (American International Group)

- Liberty Mutual Insurance

- Tokio Marine HCC

- Berkshire Hathaway Specialty Insurance

- Mapfre S.A.

- Sompo International

- Willis Towers Watson

- Marsh & McLennan Companies

- HDI Global SE

- QBE Insurance Group

- RSA Insurance Group

- CNA Financial Corporation

- Generali Group

- Sampo Group

- Others

Recent Developments

- In September 2025, Tokio Marine HCC launched TMGX, the most comprehensive green transformation insurance suite in the U.S. markets for decarbonization projects like Bio-LNG plants. This Houston-based product covers regulatory risks, tax credits, and financing gaps, making it easier for developers to secure funding and build sustainable infrastructure.

- In February June 2025, Zurich Insurance Group released a report urging protection for Europe’s clean energy infrastructure, including Bio-LNG plants, against climate risks. This aligns with North American trends where Zurich’s U.S. operations expand coverage for renewable gas facilities.

Report Scope

Report Features Description Market Value (2025) USD 2.3 Bn Forecast Revenue (2035) USD 6.1 Bn CAGR(2026-2035) 10.2% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Coverage Type (Property Insurance, Liability Insurance, Business Interruption Insurance, Environmental Liability Insurance, Others), By Plant Type (Small-Scale Bio-LNG Plants, Large-Scale Bio-LNG Plants), By End-User (Energy Companies, Transportation, Industrial, Utilities, Others), By Distribution Channel (Direct, Brokers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zurich Insurance Group, Allianz SE, AXA XL, Munich Re, Swiss Re, Chubb Limited, AIG (American International Group), Liberty Mutual Insurance, Tokio Marine HCC, Berkshire Hathaway Specialty Insurance, Mapfre S.A., Sompo International, Willis Towers Watson, Marsh & McLennan Companies, HDI Global SE, QBE Insurance Group, RSA Insurance Group, CNA Financial Corporation, Generali Group, Sampo Group, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Bio-LNG Plant Insurance MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Bio-LNG Plant Insurance MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Zurich Insurance Group

- Allianz SE

- AXA XL

- Munich Re

- Swiss Re

- Chubb Limited

- AIG (American International Group)

- Liberty Mutual Insurance

- Tokio Marine HCC

- Berkshire Hathaway Specialty Insurance

- Mapfre S.A.

- Sompo International

- Willis Towers Watson

- Marsh & McLennan Companies

- HDI Global SE

- QBE Insurance Group

- RSA Insurance Group

- CNA Financial Corporation

- Generali Group

- Sampo Group

- Others