Gloabl Bio-Based Packaging Market Size, Share, Growth Analysis By Material Type (Bioplastics, [Polylactic Acid (PLA), Polyhydroxyalkanoates (PHA), Starch Blends, Bio-Polyethylene (Bio-PE), Bio-Polyethylene Terephthalate (Bio-PET), Polybutylene Adipate Terephthalate (PBAT), Other], Paper & Paperboard, Wood Fiber-Based Materials, Other), By Material (Flexible, Rigid), By Application (Food & Beverages, Consumer Goods, Cosmetic & Personal Care, Pharmaceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171588

- Number of Pages: 225

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

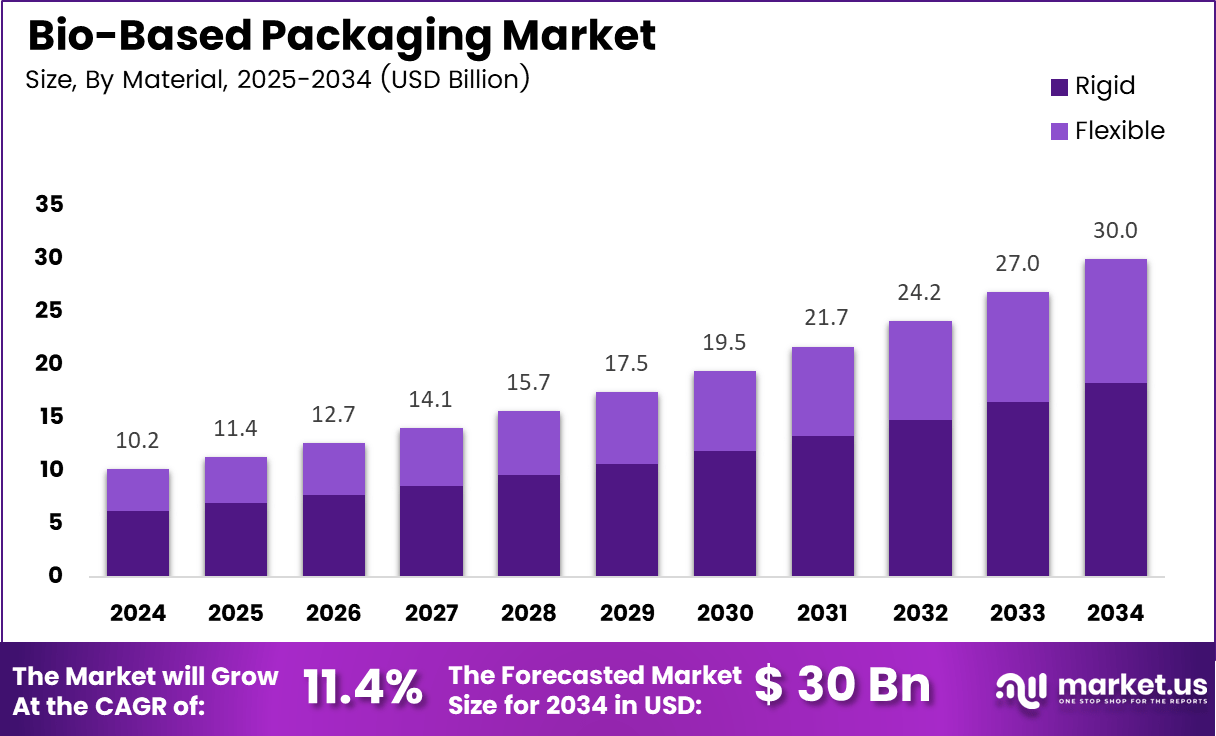

The Global Bio-Based Packaging Market size is expected to be worth around USD 30.0 billion by 2034, from USD 10.2 billion in 2024, growing at a CAGR of 11.4% during the forecast period from 2025 to 2034.

The Bio-Based Packaging Market refers to packaging solutions manufactured from renewable biological resources, including plant-based polymers and natural fibers. In simple business terms, it replaces fossil-based plastics while supporting sustainability goals. Moreover, this market aligns with circular economy principles, reduced carbon footprints, and long-term regulatory compliance across global packaging value chains.

Bio-based packaging is increasingly viewed as a strategic growth lever rather than a compliance cost. Consequently, demand is expanding across food packaging, consumer goods packaging, and sustainable flexible packaging formats. In addition, lifecycle benefits and brand differentiation are accelerating procurement adoption among manufacturers seeking environmentally responsible packaging alternatives.

Growth momentum remains strong as governments gradually tighten restrictions on conventional plastics and encourage renewable materials. Therefore, policy support, eco-labeling programs, and waste reduction mandates continue shaping procurement decisions. Simultaneously, public-private investment in bio-packaging infrastructure is improving scalability, cost optimization, and industrial composting readiness across developed and emerging economies.

Opportunities are emerging through technological upgrades, especially in biodegradable packaging films and bio-polymer blending innovations. As a result, material performance, barrier properties, and shelf stability continue improving. Furthermore, agriculture-linked feedstock utilization and regional bio-refinery investments support supply security while creating local value chains and employment opportunities.

From a regional production perspective, community-driven manufacturing highlights strong institutional adoption. According to study, central Bangladesh produces approximately 1,500 metric tons of finished flexible packaging annually, supplying nearly 80% of internal demand. Moreover, under BRAC Printing Pack, monthly capacity reaches approximately 100 metric tons using biodegradable technologies.

Material evolution further explains market progression and commercialization maturity. According to Robertson 2008, first-generation bio-based packaging materials commonly served shopping bags, combining low-density polyethylene with approximately 5–15% starch fillers and oxidative additives. These materials represented early-stage sustainability attempts rather than fully biodegradable solutions.

Subsequently, second-generation bio-based materials marked significant advancement in formulation science. According to Robertson 2008, these materials contain approximately 40–75% gelatinized starch blended with polyethylene and compatibility agents like polyvinyl alcohol. Consequently, flexibility, biodegradability, and functional performance improved considerably.

Overall, the Bio-Based Packaging Market is transitioning from experimental adoption toward mainstream commercialization. Therefore, supported by regulatory clarity, scalable production, and material innovation, the market is projected to expand steadily. In conclusion, sustainable packaging solutions now represent both an environmental necessity and a long-term revenue opportunity for packaging ecosystems.

Key Takeaways

- The Bio-Based Packaging Market is projected to reach USD 30.0 billion by 2034, growing from USD 10.2 billion in 2024 at a CAGR of 11.4% during 2025–2034.

- By material type, Bioplastics dominated the market in 2024, accounting for a share of 49.5%.

- By material format, Flexible packaging led with a market share of 61.2% in 2024.

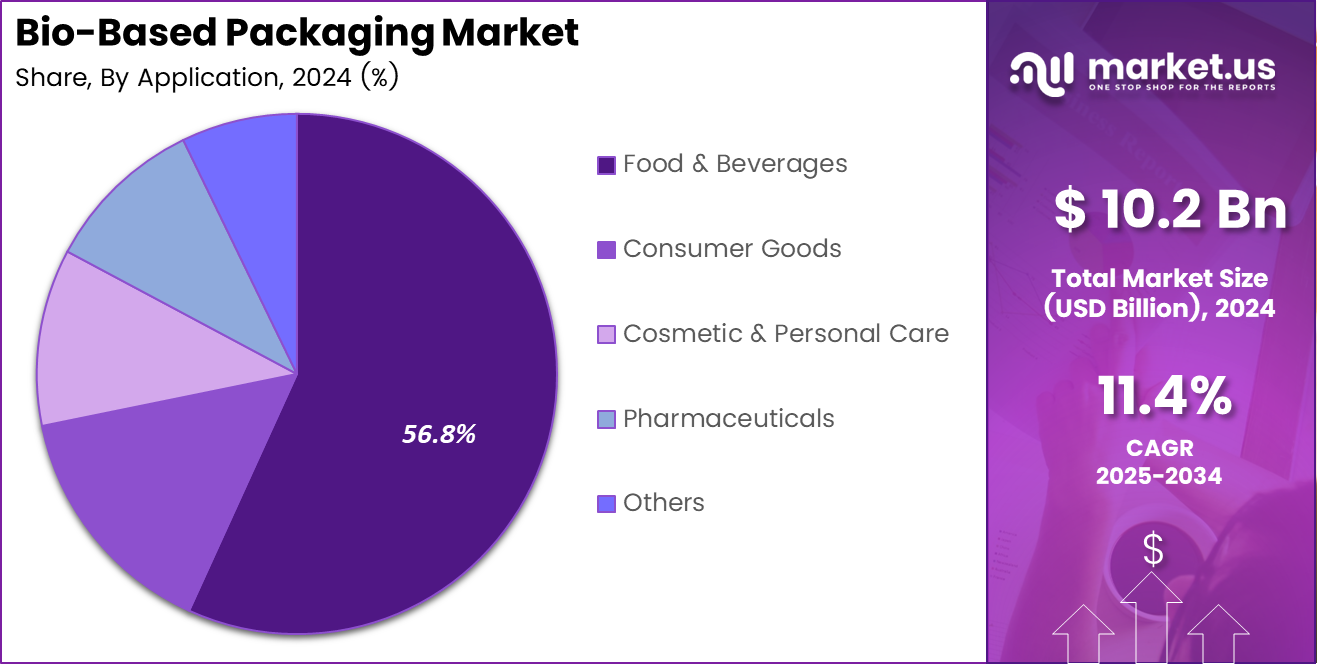

- By application, Food & Beverages held the largest share of 56.8% in 2024, driven by sustainable food packaging demand.

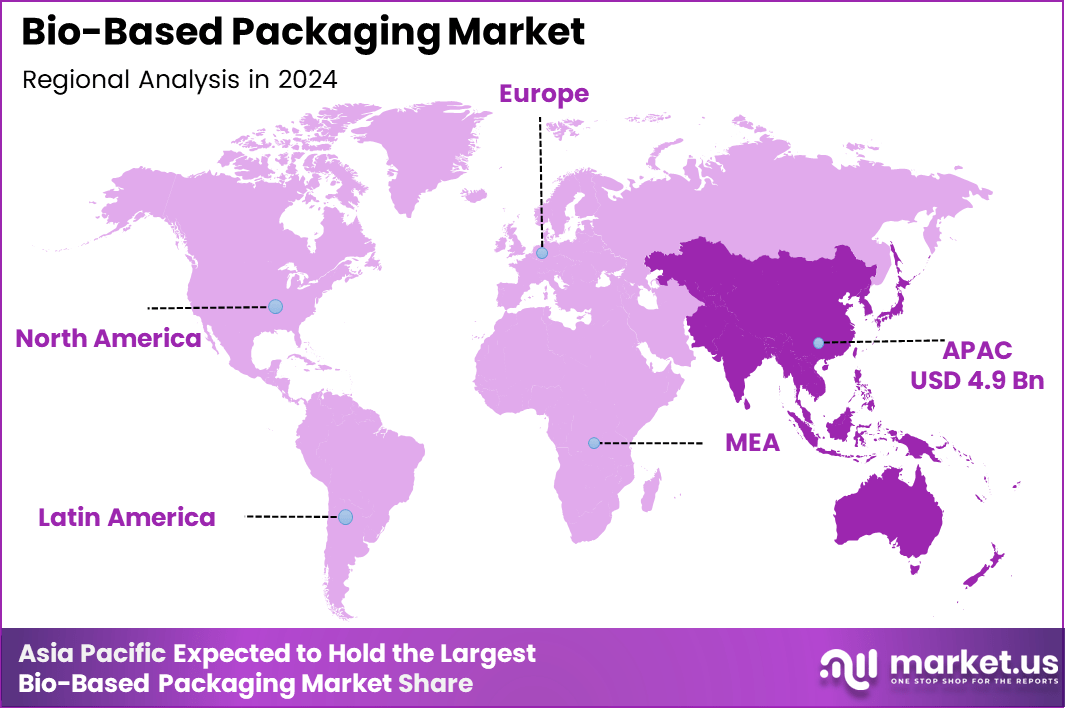

- Regionally, Asia Pacific dominated with a market share of 48.1%, valued at USD 4.9 billion in 2024.

By Material Type Analysis

Bioplastics dominates with 49.5% due to its wide applicability across flexible and rigid sustainable packaging formats.

In 2024, Bioplastics held a dominant market position in the By Material Type Analysis segment of the Bio-Based Packaging Market, with a 49.5% share. This dominance is driven by rising adoption of renewable polymer-based packaging across food, retail, and logistics. Moreover, bioplastics support compostability, lightweight design, and improved processability.

Polylactic Acid (PLA) continues gaining traction due to its bio-based origin and compatibility with thermoforming and extrusion. Consequently, PLA-based packaging remains preferred for disposable food containers and transparent packaging, supporting sustainability goals while maintaining functional performance in short shelf-life applications.

Polyhydroxyalkanoates (PHA) are increasingly recognized for full biodegradability in marine and soil environments. As a result, PHA-based materials attract interest for high-value applications requiring advanced environmental compliance, despite relatively higher production costs and limited large-scale availability.

Starch Blends remain relevant due to cost efficiency and abundant raw material availability. Therefore, these blends support shopping bags and secondary packaging where partial biodegradability and affordability remain key decision factors.

Bio-Polyethylene (Bio-PE) and Bio-Polyethylene Terephthalate (Bio-PET) benefit from drop-in compatibility with existing plastic recycling systems. Meanwhile, PBAT supports flexibility and compostability in film applications. Paper & Paperboard, Wood Fiber-Based Materials, and Other materials collectively strengthen fiber-based sustainable packaging alternatives.

By Material Analysis

Flexible dominates with 61.2% due to its extensive use in food, retail, and e-commerce packaging applications.

In 2024, Flexible held a dominant market position in the By Material Analysis segment of the Bio-Based Packaging Market, with a 61.2% share. This leadership is attributed to lightweight structure, lower material consumption, and superior adaptability across pouches, wraps, and sachets.

Flexible bio-based packaging supports improved shelf efficiency and reduced transportation emissions. Consequently, manufacturers increasingly adopt bio-based films and laminates for high-volume applications requiring durability, printability, and sealing performance.

Rigid bio-based packaging maintains relevance in containers, trays, and bottles requiring structural integrity. Therefore, rigid formats remain essential for beverages, personal care, and pharmaceutical products where protection and shape retention are critical.

By Application Analysis

Food & Beverages dominates with 56.8% due to strong regulatory and consumer-driven demand for sustainable food packaging.

In 2024, Food & Beverages held a dominant market position in the By Application Analysis segment of the Bio-Based Packaging Market, with a 56.8% share. This dominance reflects growing restrictions on plastic food packaging and increased preference for compostable and renewable materials.

Consumer Goods packaging increasingly integrates bio-based materials to enhance brand sustainability positioning. As a result, bio-based packaging supports differentiation across household, retail, and lifestyle product categories.

Cosmetic & Personal Care applications adopt bio-based packaging to align with clean-label and eco-conscious branding. Meanwhile, bio-based solutions enhance visual appeal and regulatory compliance for premium product lines.

Pharmaceutical applications focus on safety, compliance, and traceability. Therefore, bio-based packaging adoption remains selective but expanding. Other applications, including industrial and agricultural packaging, contribute incremental demand supporting overall market diversification.

Key Market Segments

By Material Type

- Bioplastics

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- Starch Blends

- Bio-Polyethylene (Bio-PE)

- Bio-Polyethylene Terephthalate (Bio-PET)

- Polybutylene Adipate Terephthalate (PBAT)

- Other

- Paper & Paperboard

- Wood Fiber-Based Materials

- Other

By Material

- Flexible

- Rigid

By Application

- Food & Beverages

- Consumer Goods

- Cosmetic & Personal Care

- Pharmaceuticals

- Others

Drivers

Escalating Regulatory Restrictions on Single Use Plastics Drives Bio-Based Packaging Market Growth

Tightening regulations on single use plastic packaging across food, beverage, and consumer goods industries are a major driver for the bio-based packaging market. Governments in multiple regions are restricting plastic usage through bans, taxes, and extended producer responsibility rules, pushing companies to shift toward sustainable alternatives. Bio-based packaging is increasingly viewed as a practical compliance solution.

At the same time, brand owners are committing to carbon neutrality and lower lifecycle emissions across their packaging supply chains. Large FMCG and retail brands are actively replacing fossil-based plastics with renewable materials to meet internal sustainability targets and public ESG commitments. This is accelerating demand for bio-based films, trays, and containers.

Consumer behavior is also supporting market growth. Buyers are showing higher acceptance of compostable, recyclable, and renewable packaging formats, especially for food and daily-use products. This willingness to pay a small premium improves adoption across retail shelves.

In addition, bio polymers are gaining traction in food service, e commerce, and ready to eat packaging applications. These sectors value lightweight, sustainable materials that align with environmental expectations and regulatory pressure.

Restraints

Higher Cost Structure of Bio-Based Materials Limits Wider Market Penetration

High production and raw material costs remain a key restraint for the bio-based packaging market. Bio-based polymers often rely on agricultural inputs or complex processing methods, making them more expensive than conventional petrochemical plastics. This cost gap restricts adoption, particularly in price-sensitive markets.

Limited composting and bio waste management infrastructure further challenges market growth. In many emerging economies, industrial composting facilities and organized bio waste collection systems are still underdeveloped. As a result, the environmental benefits of bio-based packaging are not fully realized.

Performance limitations also act as restraints. Some bio-based materials show weaker moisture resistance, barrier protection, and shelf life stability compared to traditional plastics. These limitations reduce suitability for certain food and beverage applications.

Together, higher costs, infrastructure gaps, and performance concerns slow large-scale replacement of conventional packaging, especially in mass-market consumer goods.

Growth Factors

Expansion of Bio-Based Flexible Packaging Creates New Growth Opportunities

The expansion of bio-based flexible packaging presents strong growth opportunities. Packaged food, personal care, and homecare brands are increasingly adopting flexible formats made from renewable materials to reduce plastic usage while maintaining convenience and branding appeal.

Technological improvements in bio polymer blends are further supporting growth. New material formulations are enhancing durability, heat resistance, and barrier performance, making bio-based packaging suitable for a wider range of applications previously dominated by plastics.

Another key opportunity lies in the use of agricultural waste and non food biomass as feedstock. Utilizing crop residues and organic waste reduces reliance on food-based resources and improves sustainability credentials, attracting both regulators and brand owners.

The pharmaceutical and medical packaging sectors are also emerging demand centers. These industries are exploring bio-based materials that meet safety, compliance, and sustainability requirements, opening new high-value application areas.

Emerging Trends

Shift Toward Mono Material Designs Is Shaping Bio-Based Packaging Trends

A major trend in the bio-based packaging market is the shift toward mono material designs. These designs simplify recycling and waste sorting, helping improve end-of-life outcomes and align with circular economy goals. Brands prefer packaging structures that are easier to process in existing recycling systems.

Bio-based coatings and laminates are also gaining rapid adoption. These solutions are replacing plastic-based barrier layers while maintaining protection against moisture, grease, and oxygen. This trend supports wider use in food and beverage packaging.

Another important trend is the integration of life cycle assessment in product development. Packaging manufacturers are increasingly evaluating environmental impact from raw material sourcing to disposal.

Carbon labeling is becoming part of this process. Clear environmental information on packaging helps brands communicate sustainability efforts and supports informed purchasing decisions.

Regional Analysis

Asia Pacific Dominates the Bio-Based Packaging Market with a Market Share of 48.1%, Valued at USD 4.9 Billion

Asia Pacific held the leading position in the Bio-Based Packaging Market, accounting for 48.1% of total demand and reaching a valuation of USD 4.9 billion. This dominance is supported by rapid urbanization, expanding food and beverage consumption, and strong government-led sustainability policies across major economies. Increasing restrictions on single-use plastics and rising adoption of compostable packaging in food service and e-commerce channels further strengthen regional demand. Large-scale manufacturing capabilities and improving access to bio-based raw materials also contribute to market expansion.

North America Bio-Based Packaging Market Trends

North America represents a mature and innovation-driven market for bio-based packaging, supported by strong environmental regulations and high consumer awareness. The region shows steady adoption across food, personal care, and retail packaging applications. Brand-level commitments toward carbon neutrality and circular packaging models continue to influence material shifts. Demand is also supported by well-developed recycling and industrial composting infrastructure.

Europe Bio-Based Packaging Market Trends

Europe remains a key region due to strict environmental directives and early adoption of sustainable packaging standards. Regulatory frameworks encouraging renewable and biodegradable materials support consistent market growth. High penetration of eco-labeled consumer goods and strong retailer sustainability mandates drive usage. The region also benefits from advanced bio-polymer research and favorable policy alignment.

U.S. Bio-Based Packaging Market Trends

The U.S. market is characterized by rising adoption of bio-based packaging in food, beverage, and e-commerce segments. Corporate sustainability targets and state-level plastic bans accelerate material substitution. Growing consumer preference for recyclable and compostable packaging supports demand. Ongoing investments in bio-material innovation further enhance market potential.

Latin America Bio-Based Packaging Market Trends

Latin America shows gradual growth, driven by increasing environmental awareness and regulatory progress in key economies. The food and beverage sector remains the primary application area for bio-based materials. Expansion of organized retail and export-oriented packaging needs support adoption. Cost sensitivity remains a moderating factor across the region.

Middle East and Africa Bio-Based Packaging Market Trends

The Middle East and Africa region is at an early adoption stage, with growth supported by sustainability initiatives and waste reduction goals. Demand is emerging across food packaging and hospitality sectors. Government-led environmental programs and rising urban consumption contribute to gradual market development. Limited composting infrastructure continues to influence adoption rates.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Bio-Based Packaging Company Insights

In 2024, NatureWorks LLC continues to advance its leadership in the bio-based packaging market through a strong focus on polylactic acid (PLA) innovations that enhance performance and sustainability. The company’s investments in scalable production technologies and strategic collaborations are projected to further solidify its presence in high-growth segments such as food and consumer goods packaging. NatureWorks’ commitment to reducing carbon footprint and improving end-of-life options is expected to resonate with increasingly eco-conscious manufacturers.

BASF SE is anticipated to leverage its extensive chemical expertise and global footprint to expand its bio-based packaging portfolio, particularly through renewable polymer development and additive solutions that improve material properties. The company’s integrated approach to sustainability, combining bio-based content with recyclability enhancements, positions it as a key supplier for major packaging converters. BASF’s research pipeline is expected to drive incremental adoption among industries seeking performance parity with conventional plastics.

Novamont S.p.A. remains a significant player in compostable materials, with its Mater-Bi range gaining traction across Europe and beyond. The company’s vertically integrated model, encompassing raw material production to finished products, enables cost-effective supply and quality control. Novamont’s focus on full lifecycle sustainability and compliance with evolving regulatory frameworks is likely to support steady market share growth.

TotalEnergies Corbion PLA is projected to strengthen its competitive edge with advanced PLA resins tailored for packaging applications requiring clarity, barrier properties, and heat resistance. The joint venture’s emphasis on circular economy principles and scalable renewable feedstocks is expected to appeal to brands targeting reduced environmental impact. TotalEnergies Corbion’s strategic capacity expansions align with rising demand for bio-based polymers in global supply chains.

Top Key Players in the Market

- NatureWorks LLC

- BASF SE

- Novamont S.p.A.

- TotalEnergies Corbion PLA

- Braskem S.A.

- Stora Enso Oyj

- Huhtamaki Oyj

- Amcor Plc

- Tetra Pak International S.A.

- Mondi Group

Recent Developments

- In February 2024, BASF SE launched a new bio based polymer solution under its sustainable materials portfolio, aimed at enhancing barrier performance while incorporating over 50% renewable content. This launch supports brand owners transitioning from conventional plastics.

- In February 2025, Novamont S.p.A. introduced a next generation Mater-Bi formulation optimized for flexible packaging, improving mechanical strength and shelf life performance by approximately 12%.

Report Scope

Report Features Description Market Value (2024) USD 10.2 billion Forecast Revenue (2034) USD 30.0 billion CAGR (2025-2034) 11.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Bioplastics, [Polylactic Acid (PLA), Polyhydroxyalkanoates (PHA), Starch Blends, Bio-Polyethylene (Bio-PE), Bio-Polyethylene Terephthalate (Bio-PET), Polybutylene Adipate Terephthalate (PBAT)], Other, Paper & Paperboard, Wood Fiber-Based Materials, Other), By Material (Flexible, Rigid), By Application (Food & Beverages, Consumer Goods, Cosmetic & Personal Care, Pharmaceuticals, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape NatureWorks LLC, BASF SE, Novamont S.p.A., TotalEnergies Corbion PLA, Braskem S.A., Stora Enso Oyj, Huhtamaki Oyj, Amcor Plc, Tetra Pak International S.A., Mondi Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- NatureWorks LLC

- BASF SE

- Novamont S.p.A.

- TotalEnergies Corbion PLA

- Braskem S.A.

- Stora Enso Oyj

- Huhtamaki Oyj

- Amcor Plc

- Tetra Pak International S.A.

- Mondi Group