Global Banking Data Lake Platform Market By Component (Software, Services), By Deployment Mode (On-Premises, Cloud), By Application (Risk Management, Customer Insights, Regulatory Compliance, Fraud Detection, Others), By Organization Size (Large Enterprises, Small and Medium Enterprises), By End-User (Retail Banking, Corporate Banking, Investment Banking, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 169594

- Number of Pages: 362

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- By Component: Software 80.3%

- By Deployment Mode: On Premises 66.6%

- By Application: Risk Management 40.2%

- By Organization Size: Large Enterprises 75.5%

- By End User: Retail Banking 45.3%

- Reasons for Adoption

- Key Benefits

- Usage

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

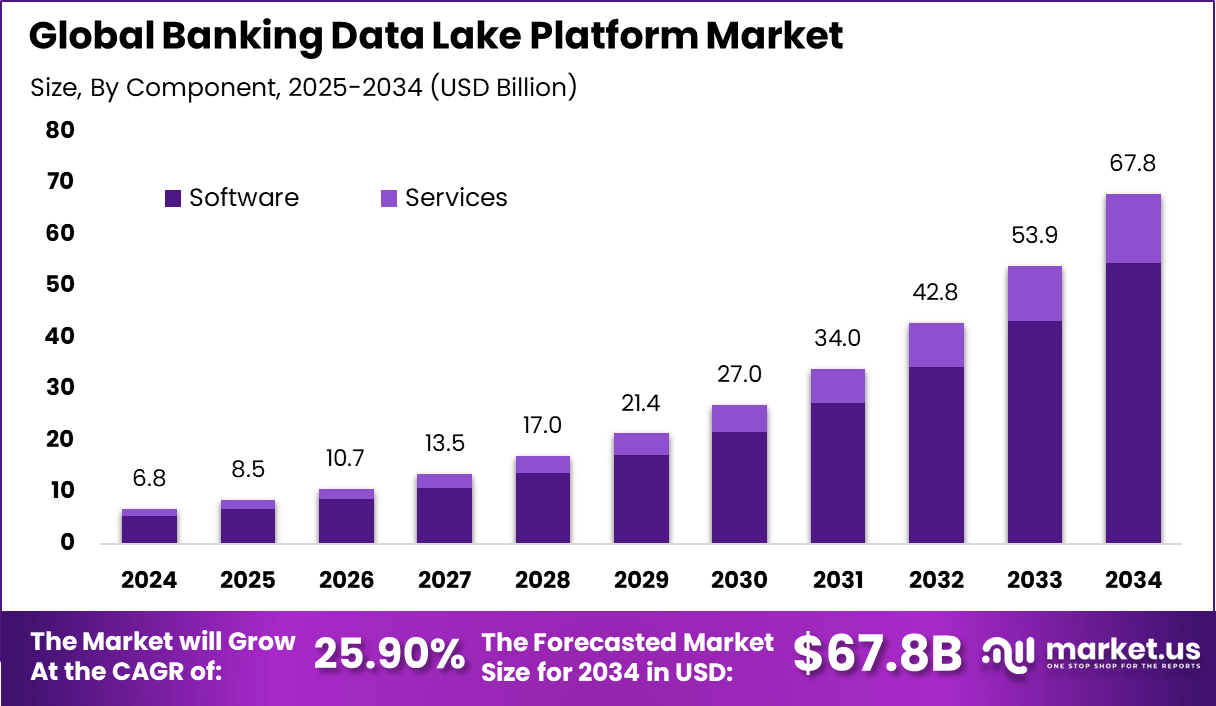

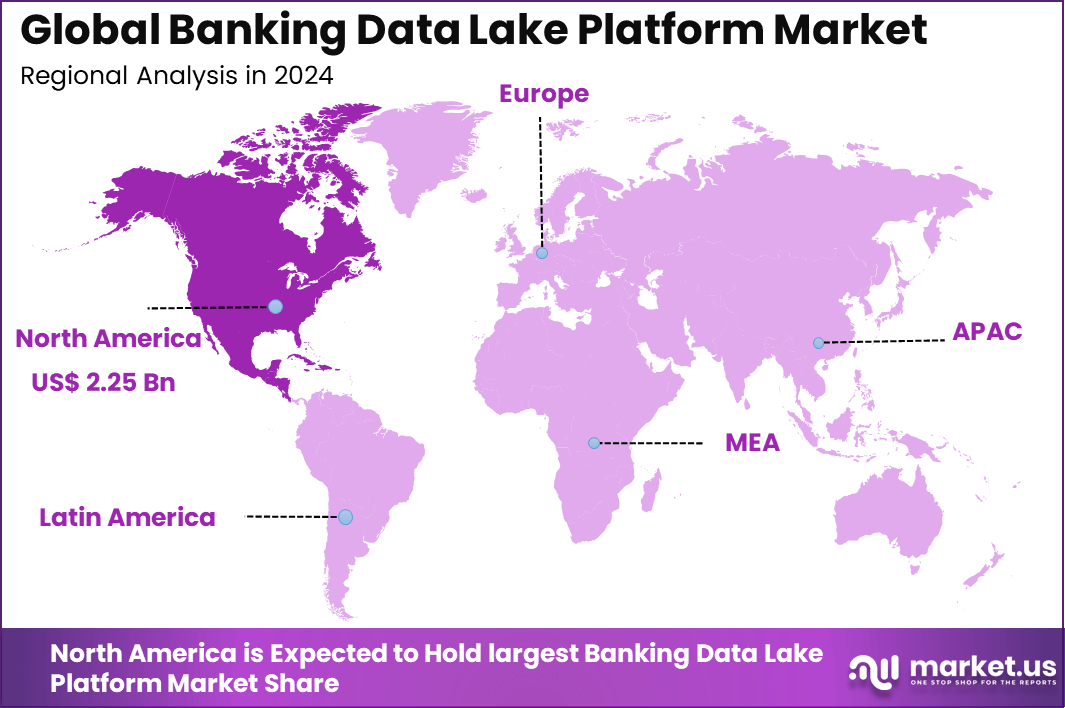

The Global Banking Data Lake Platform Market generated USD 6.8 billion in 2024 and is predicted to register growth from USD 8.5 billion in 2025 to about USD 67.8 billion by 2034, recording a CAGR of 25.90% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 33.2% share, holding USD 2.25 Billion revenue.

The banking data lake platform market has grown as banks manage rising volumes of structured and unstructured data from digital channels, transactions, customer interactions and risk systems. Growth is linked to the need for a central storage environment that can hold large data sets at low cost while supporting fast access for reporting and analysis. Data lake platforms now support core banking operations, customer insight programs and regulatory reporting across large financial institutions.

The growth of the market can be attributed to rapid growth in digital payments, mobile banking activity and online customer engagement. Banks generate large volumes of transaction data that must be stored for analysis, fraud checks and compliance use. Pressure to improve decision speed, reduce data silos and strengthen risk oversight further drives adoption of centralized data lake platforms.

Demand is rising across retail banks, commercial banks, digital only banks, credit institutions and financial service groups with multi channel operations. Banks use data lakes to store payment data, loan information, customer profiles and audit records in one environment. Markets with strong digital banking usage show higher demand due to fast growth in daily transaction volumes and customer data flow.

Key technologies supporting adoption include cloud storage systems, distributed file processing, real time data ingestion engines, batch processing frameworks, data encryption tools, access control systems and data catalog platforms. These technologies allow banks to collect data from many systems and store it in a usable format. Data quality tools help clean and organize large data sets for reporting and analysis.

Top Market Takeaways

- By component, software dominated the banking data lake platform market with an 80.3% share.

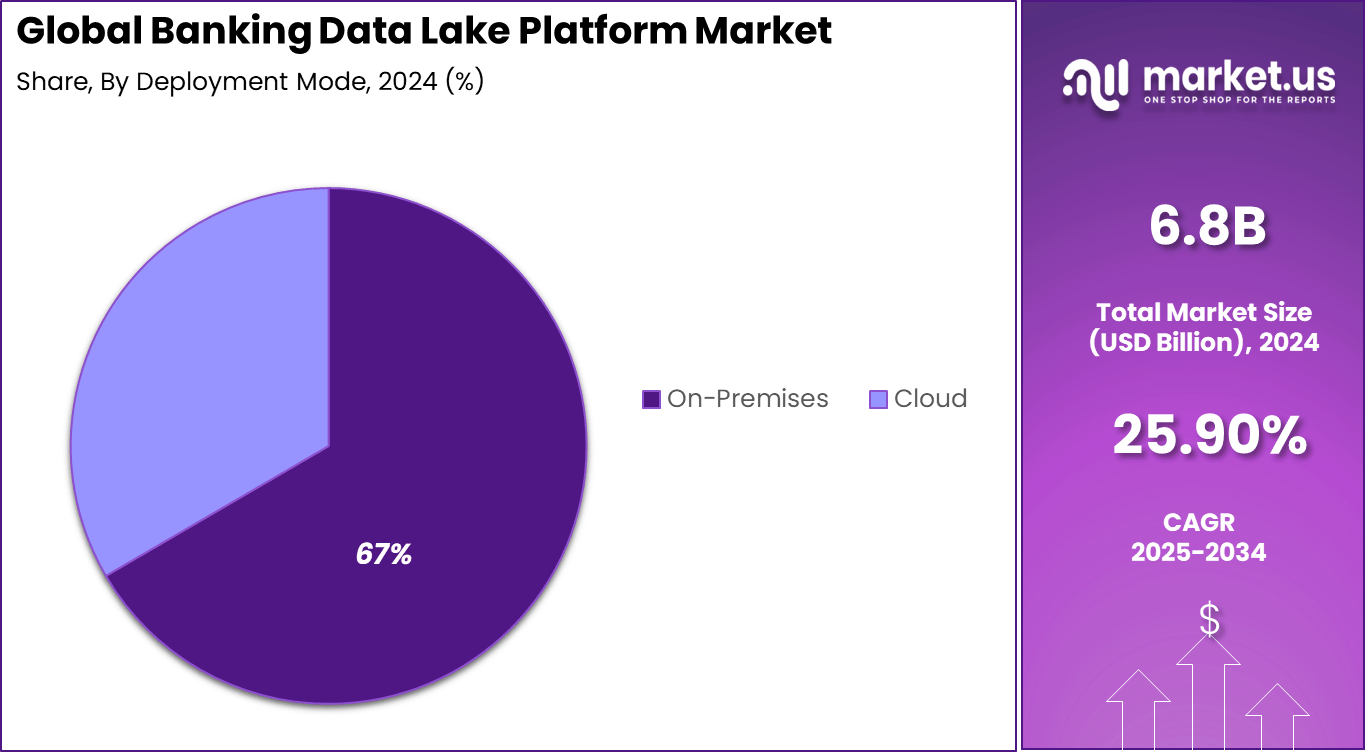

- By deployment mode, on-premises solutions accounted for 66.6% of the market, highlighting strong demand for in-house data control and security.

- By application, risk management led with a 40.2% share, driven by growing regulatory compliance needs and real-time fraud detection capabilities.

- By organization size, large enterprises held a 75.5% share, emphasizing their focus on scalable data infrastructure and advanced analytics integration.

- By end-user, retail banking accounted for 45.3% of the market, supported by rising adoption of data lakes for personalized customer experiences and transaction monitoring.

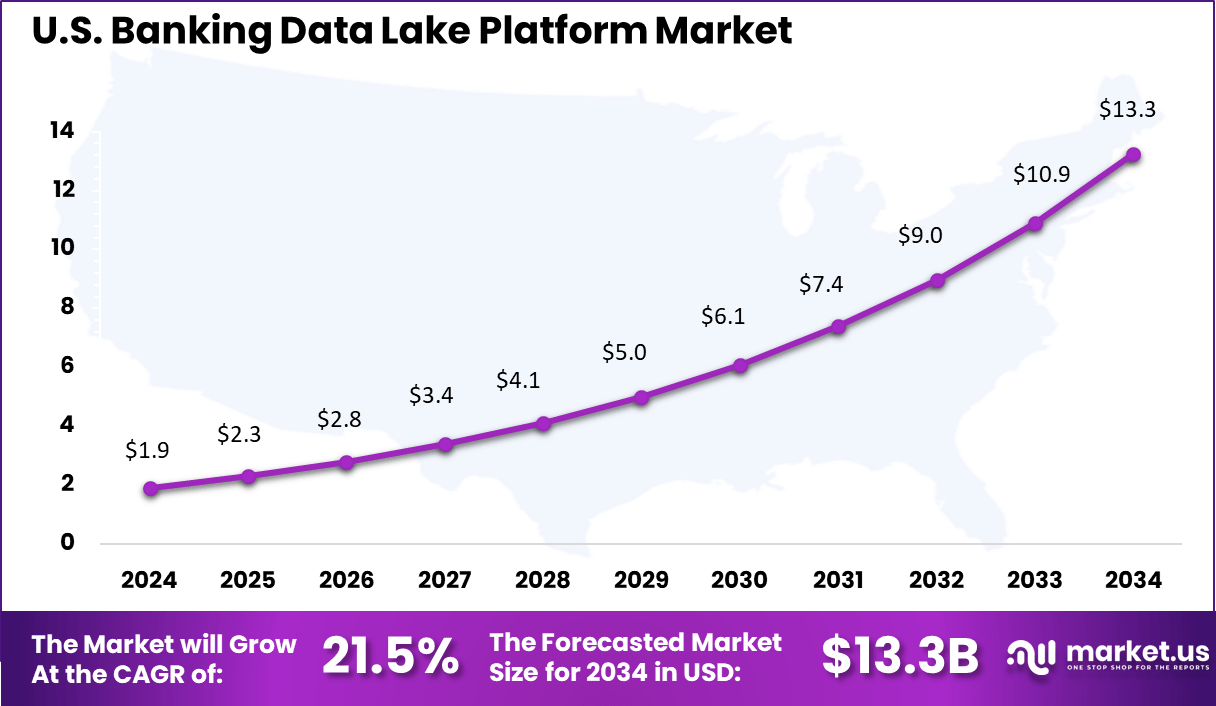

- North America captured 33.2% of the global market, with the U.S. valued at USD 1.89 billion in 2025 and projected to grow at a CAGR of 21.5%.

By Component: Software 80.3%

The software segment leads with a strong share of 80.3% in the banking data lake platform market. This dominance is driven by the rising need for centralized data storage, analytics integration, and real time reporting across banking systems. Software platforms allow banks to manage large volumes of structured and unstructured data efficiently.

These solutions support fraud monitoring, customer analytics, and regulatory tracking within a single environment. The growing use of automation and machine based insights continues to strengthen software adoption across banking institutions.

By Deployment Mode: On Premises 66.6%

On premises deployment accounts for 66.6% of total market adoption. Banks prefer internal infrastructure to maintain full control over sensitive financial and customer data. Data security and regulatory compliance remain the main reasons for this preference.

Internal deployment models also allow direct integration with legacy banking systems. Many large banks continue to rely on in house infrastructure to support high transaction volumes and internal audit requirements.

By Application: Risk Management 40.2%

Risk management represents 40.2% of total application demand. Data lake platforms help consolidate credit, market, and operational risk data into unified monitoring systems. This improves visibility across lending and investment activities.

These platforms support real time alerts, stress testing, and predictive risk analysis. The ability to process both historical and live data strengthens overall financial risk control.

By Organization Size: Large Enterprises 75.5%

Large enterprises hold a dominant 75.5% share of total adoption. These organizations manage complex operations across multiple regions and business units, which increases the need for centralized data platforms.

High regulatory scrutiny and large transaction volumes push large banks to invest in advanced analytics infrastructure. Data lakes support regulatory reporting, audit readiness, and enterprise wide performance tracking.

By End User: Retail Banking 45.3%

Retail banking contributes 45.3% of total end user demand. This growth is supported by rising digital transactions, mobile banking adoption, and customer behavior analysis needs.

Data lake platforms help retail banks improve fraud detection, customer profiling, and personalized service delivery. These systems also support faster decision making across loan approvals and account monitoring.

Reasons for Adoption

- Banks face massive data growth from transactions and customer channels, so data lakes store everything raw without upfront costs or limits.

- Regulatory rules demand quick access to full records, and data lakes centralize data for easy compliance pulls and audits.

- Real-time needs like payment processing push banks to adopt lakes that handle streaming data alongside batch loads.

- Flexibility for AI and machine learning draws institutions, as lakes support varied formats for model training on risk or fraud.

- Cost savings over traditional warehouses make lakes appealing, with cheap cloud storage scaling as volumes rise.

Key Benefits

- Unified customer views emerge by merging transaction, behavior, and external data for better service tailoring.

- Lower storage costs come from scalable cloud setups that avoid expensive preprocessing steps.

- Faster analytics happen since teams query raw data on demand, cutting time for loan or investment decisions.

- Fraud detection improves with real-time scans across vast datasets spotting odd patterns early.

- Cross-team collaboration strengthens as siloed data flows into one shared hub for operations and insights.

Usage

- Fraud monitoring runs constant checks on transactions against stored patterns to flag risks instantly.

- Customer personalization builds targeted offers by linking profiles, history, and preferences in the lake.

- Risk modeling uses historical trends and market feeds to predict defaults or portfolio shifts.

- Compliance reporting grabs records fast from the central store to file reports on time.

- Product innovation draws from usage trends and feedback to shape new accounts or features.

Emerging Trends

Key Trends Description Lakehouse Architecture Adoption Combines data lakes and data warehouses for unified handling of structured and unstructured data with ACID transactions, improving reliability in banking operations. AI and ML Integration Enables predictive analytics, fraud detection, and personalized services by processing diverse datasets in real time. Real-Time Data Processing Supports streaming via tools like Kafka for instant fraud monitoring and customer insights using transactional data. Cloud-Native Solutions Provides scalability and cost efficiency as banks migrate to flexible cloud data platforms. Enhanced Governance Frameworks Improves compliance and data quality through strong metadata management aligned with regulatory standards. Growth Factors

Key Factors Description Rising Data Volumes Rapid growth of transactional, IoT, and customer data from digital payments increases demand for scalable storage. Digital Transformation Banks centralize data silos to enable 360-degree customer views, boosting engagement and operational efficiency. Regulatory Compliance Needs Stricter compliance rules require real-time reporting and aggregated risk management through unified data platforms. Cost-Effective Storage Lower infrastructure expenses compared with traditional warehouses for handling large volumes of unstructured data. Advanced Analytics Demand Rising need for AI-driven risk assessment, predictive modeling, and personalized banking services supports adoption. Key Market Segments

By Component

- Software

- Services

By Deployment Mode

- On-Premises

- Cloud

By Application

- Risk Management

- Customer Insights

- Regulatory Compliance

- Fraud Detection

- Others

By Organization Size

- Large Enterprises

- Small and Medium Enterprises

By End-User

- Retail Banking

- Corporate Banking

- Investment Banking

- Others

Regional Analysis

North America commands a 33.2% share of the global Banking Data Lake Platform market, driven by widespread cloud adoption, advanced analytics demand, and a mature technology infrastructure in sectors like finance and banking.

Major banks leverage data lakes for managing diverse datasets from transactions, customer interactions, and regulatory compliance, supported by a robust vendor ecosystem and innovation hubs. The region’s growth aligns with a CAGR of around 21.5%, fueled by IoT integration and digital transformation initiatives.

Hybrid architectures combining on-premises and cloud solutions dominate, addressing data security needs in regulated banking environments while enabling scalable AI-driven insights. Financial institutions extend data retention for stress-testing and build multimodal graphs for risk analytics, with venture capital boosting governance startups. This positions North America as the benchmark for data lake maturity in banking.

The U.S. banking data lake platform market stands at USD 1.89 billion, growing at a CAGR of 21.5%, propelled by stringent regulations like Dodd-Frank and CCAR that mandate advanced risk analytics and fraud detection.

Leading multinational banks adopt cloud-based platforms for real-time processing of massive transaction volumes, enhancing competitiveness through machine learning and sophisticated analytics in financial services. Early technology adoption and high digital penetration further accelerate market expansion.

Focus on data governance, compliance, and enterprise-wide risk management drives U.S. dominance within North America, with platforms integrating heterogeneous data for breakthrough insights. Healthcare and banking sectors prioritize scalable solutions amid rising data volumes, supported by investments in AI and edge computing. This growth reflects the U.S.’s role as a hub for banking innovation in data lake technologies.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

A major driver in the banking data lake platform market is the rapid growth of data produced by banks. Financial institutions collect information from transactions, online banking, mobile apps, branch activity, customer service interactions, and external data sources. A data lake platform allows banks to store all of this information in one place without forcing it into a fixed structure. This helps banks unify their data and prepare for future analysis.

Another driver is rising pressure from regulatory and compliance requirements. Banks must maintain accurate records, produce regular reports, and show clear traceability of data used in decisions. A centralized data lake supports these needs by keeping information accessible, organized, and available for audits. As regulations become more detailed, banks depend more on systems that simplify compliance tasks.

Restraint Analysis

A key restraint is the challenge of managing and organizing very large data repositories. Without strong data governance, a data lake can become disorganized, leading to duplication, poor quality, or incomplete information. Banks must invest in policies and tools to keep data usable, which increases operational effort.

Another restraint is the cost and skill requirement associated with building and maintaining a data lake. Smaller banks and institutions with older systems may struggle to integrate multiple data sources or hire staff with the needed technical expertise. This slows adoption in organizations that lack resources or experience.

Opportunity Analysis

There is strong opportunity in the use of advanced analytics. A well-managed data lake gives banks access to detailed customer behavior, transaction patterns, and risk indicators. This helps improve fraud detection, credit assessment, and customer service. Institutions can use this insight to make faster and more informed decisions.

Another opportunity comes from cloud based data lake solutions. These platforms reduce the need for large internal infrastructure and allow smaller banks to adopt modern data practices at lower cost. This widens the market, as more financial institutions can use data lakes to improve operations and compliance.

Challenge Analysis

A major challenge lies in securing sensitive financial and personal data. Data lakes often store large amounts of unprocessed information, which increases exposure if access controls are weak. Banks must maintain strong encryption, steady monitoring, and strict access rules to protect information.

Another challenge is maintaining performance as data volume and data sources grow. Banks generate constant streams of information that require fast ingestion and reliable storage. Ensuring that the platform remains stable while supporting analytics and reporting requires careful planning and ongoing technical support.

Competitive Analysis

Microsoft, Oracle, IBM, Amazon Web Services, and Google lead the banking data lake platform market with large-scale cloud infrastructure, advanced analytics, and AI-ready storage frameworks. Their platforms enable banks to centralize structured and unstructured data for risk, compliance, and customer analytics. These providers focus on security, scalability, and real-time data ingestion. Rising demand for data-driven banking decisions continues to reinforce their leadership.

Cloudera, Teradata, SAP, Snowflake, and Hewlett Packard Enterprise strengthen the competitive landscape with hybrid data lake architectures and high-performance analytics engines. Their solutions support fraud detection, regulatory reporting, and real-time customer insights. These companies emphasize interoperability, governance, and cost-efficient scaling. Growing adoption of hybrid cloud and real-time analytics expands their market relevance.

Informatica, SAS Institute, Dell Technologies, Hitachi Vantara, Talend, Atos, Capgemini, Tata Consultancy Services, Infosys, and Accenture broaden the market with data integration, governance, and managed analytics services for banks. Their offerings focus on end-to-end data pipeline automation and regulatory-ready architectures. Increasing focus on open banking, AI adoption, and compliance modernization continues to drive demand for banking data lake platforms worldwide.

Top Key Players in the Market

- Microsoft Corporation

- Oracle Corporation

- IBM Corporation

- Amazon Web Services (AWS)

- Google LLC

- Cloudera Inc.

- Teradata Corporation

- SAP SE

- Snowflake Inc.

- Hewlett Packard Enterprise (HPE)

- Informatica LLC

- SAS Institute Inc.

- Dell Technologies Inc.

- Hitachi Vantara

- Talend S.A.

- Atos SE

- Capgemini SE

- Tata Consultancy Services (TCS)

- Infosys Limited

- Accenture plc

- Others

Future Outlook

The Banking Data Lake Platform market looks set for steady evolution as banks face rising data volumes from digital transactions, customer channels, and external sources. Platforms will shift toward unified lakehouse designs that blend storage flexibility with warehouse reliability, supporting real-time analytics and AI tools for fraud detection and personalized services. Regulatory pressures and open banking rules will drive adoption of secure, scalable solutions, while cloud options help smaller institutions consolidate silos for better decision-making and operational agility.

Opportunities lie in

- AI-driven analytics to enable predictive risk modeling and customer insights from diverse data streams.

- Cloud-native deployments for cost-effective scaling in emerging markets with growing digital banking.

- Integration with real-time payment systems and compliance tools to streamline regulatory reporting.

Recent Developments

- September, 2025, Made Microsoft Sentinel data lake generally available, enhancing SIEM with AI-powered analytics for banking security.

- July, 2025, Launched Sentinel data lake features for unified signals and cost reduction in financial data management.

Report Scope

Report Features Description Market Value (2024) USD 6.8 Bn Forecast Revenue (2034) USD 67.8 Bn CAGR(2025-2034) 25.90% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Deployment Mode (On-Premises, Cloud), By Application (Risk Management, Customer Insights, Regulatory Compliance, Fraud Detection, Others), By Organization Size (Large Enterprises, Small and Medium Enterprises), By End-User (Retail Banking, Corporate Banking, Investment Banking, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft Corporation, Oracle Corporation, IBM Corporation, Amazon Web Services (AWS), Google LLC, Cloudera Inc., Teradata Corporation, SAP SE, Snowflake Inc., Hewlett Packard Enterprise (HPE), Informatica LLC, SAS Institute Inc., Dell Technologies Inc., Hitachi Vantara, Talend S.A., Atos SE, Capgemini SE, Tata Consultancy Services (TCS), Infosys Limited, Accenture plc, Others. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Banking Data Lake Platform MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Banking Data Lake Platform MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft Corporation

- Oracle Corporation

- IBM Corporation

- Amazon Web Services (AWS)

- Google LLC

- Cloudera Inc.

- Teradata Corporation

- SAP SE

- Snowflake Inc.

- Hewlett Packard Enterprise (HPE)

- Informatica LLC

- SAS Institute Inc.

- Dell Technologies Inc.

- Hitachi Vantara

- Talend S.A.

- Atos SE

- Capgemini SE

- Tata Consultancy Services (TCS)

- Infosys Limited

- Accenture plc

- Others