Global Bank Connectivity Platform Market By Component (Software, Services), By Deployment Mode (On-Premises, Cloud-Based), By Organization Size (Large Enterprises, Small and Medium Enterprises), By Application (Cash Management, Payment Processing, Treasury Management, Compliance & Reporting, Others), By End-User (Banks, Corporates, Financial Institutions, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 169643

- Number of Pages: 255

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- By Component

- By Deployment Mode

- By Organization Size

- By Application

- By End-User

- Reasons for Adoption

- Key Benefits

- Usage

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

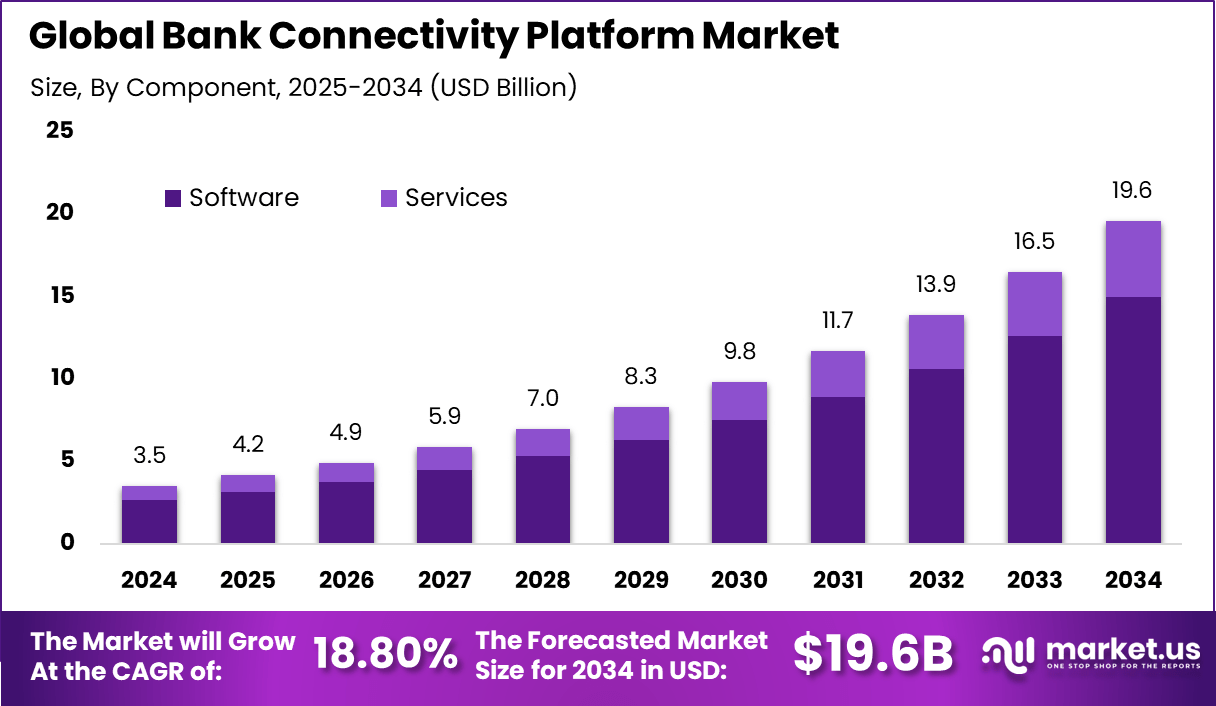

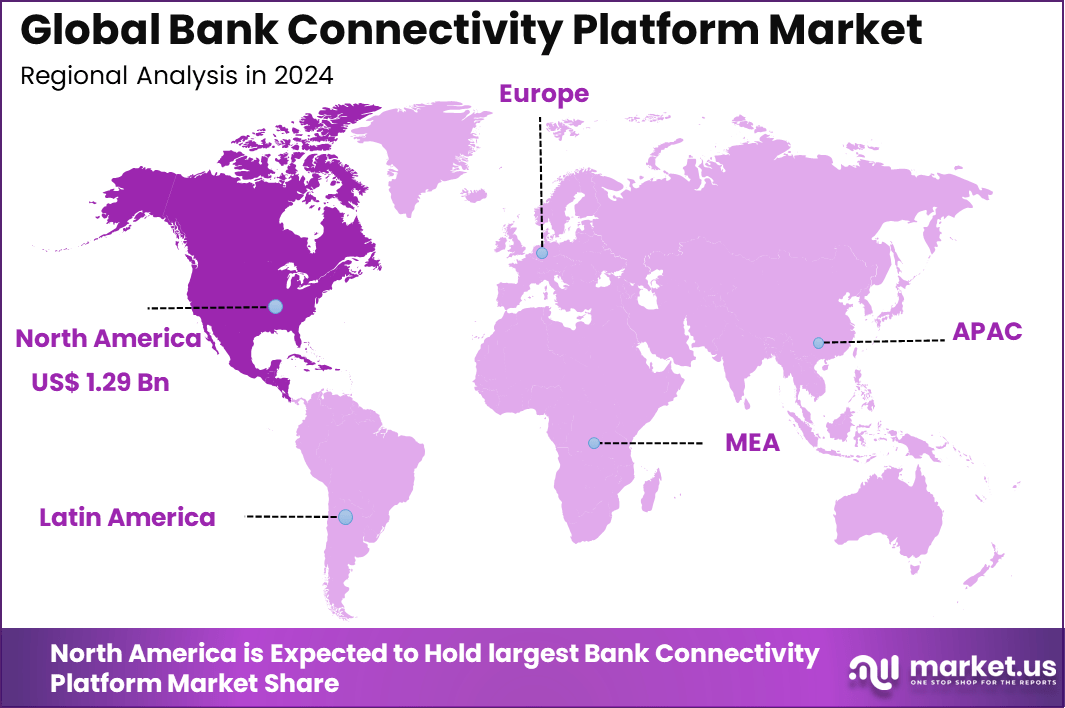

The Global Bank Connectivity Platform Market generated USD 3.5 billion in 2024 and is predicted to register growth from USD 4.2 billion in 2025 to about USD 19.6 billion by 2034, recording a CAGR of 18.80% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 37% share, holding USD 1.29 Billion revenue.

The bank connectivity platform market has grown as financial institutions seek secure and reliable ways to connect internal banking systems with external partners, payment networks and financial service providers. Growth is linked to rising digital transactions, multi bank operations and the need for real time data exchange across systems. These platforms act as a central connection layer that allows banks to send and receive financial messages in a controlled manner.

The growth of the market can be attributed to rising demand for instant payments, increasing use of digital banking channels and growing integration between banks and third party service providers. Banks must support faster settlement, account verification and transaction status updates. Regulatory pressure for transparency and reporting also drives the need for stable and auditable connectivity systems.

In 2025, more than 81% of banks had adopted open banking APIs, with the US leading at 97% of financial institutions. Global API usage reached 137 billion calls, marking a sharp year on year increase. On average, banks offered 16 APIs, with account information services accounting for 63% of total API traffic.

Demand is rising across retail banks, commercial banks, digital banks, payment service providers and financial service intermediaries. Banks handling large payment volumes rely on connectivity platforms to link with clearing systems, corporate clients and partner networks. Demand is strongest in markets with high digital payment usage and cross border transaction activity.

Key technologies supporting adoption include API integration frameworks, secure message routing systems, encryption tools, real time transaction monitoring, cloud based connectivity infrastructure and automated error handling systems. These technologies allow banks to connect multiple systems through a single platform while maintaining data security and process control.

Top Market Takeaways

- By component, software accounted for 76.4% of the bank connectivity platform market, driven by increasing automation and integration of treasury operations.

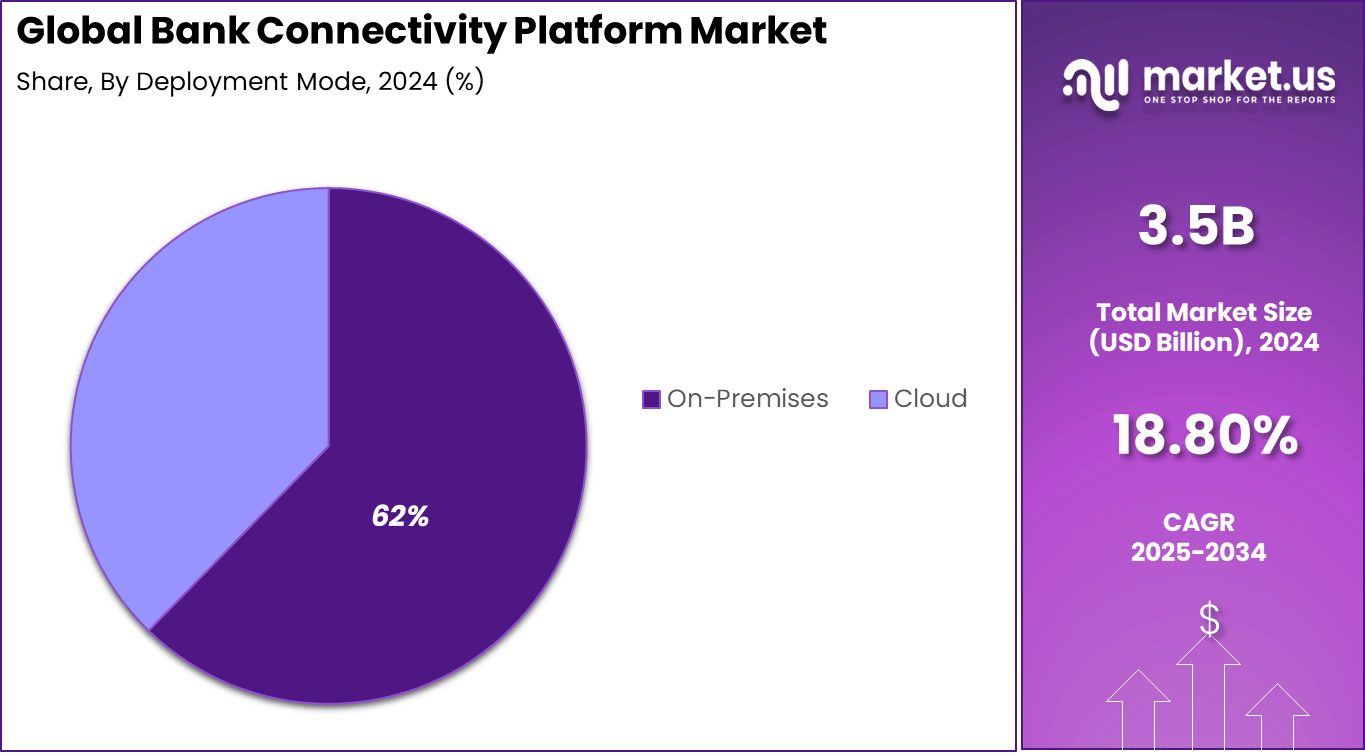

- By deployment mode, on-premises solutions represented 62.3% of the market, reflecting continued preference for secure and controlled banking environments.

- By organization size, large enterprises held a 70.1% share as they invest heavily in robust connectivity frameworks to support global transaction workflows.

- By application, cash management dominated with 38.4% share, supported by the need for real-time liquidity visibility and streamlined treasury processes.

- By end-user, banks accounted for 42.3% of the market, emphasizing their focus on centralized payment connectivity and regulatory compliance.

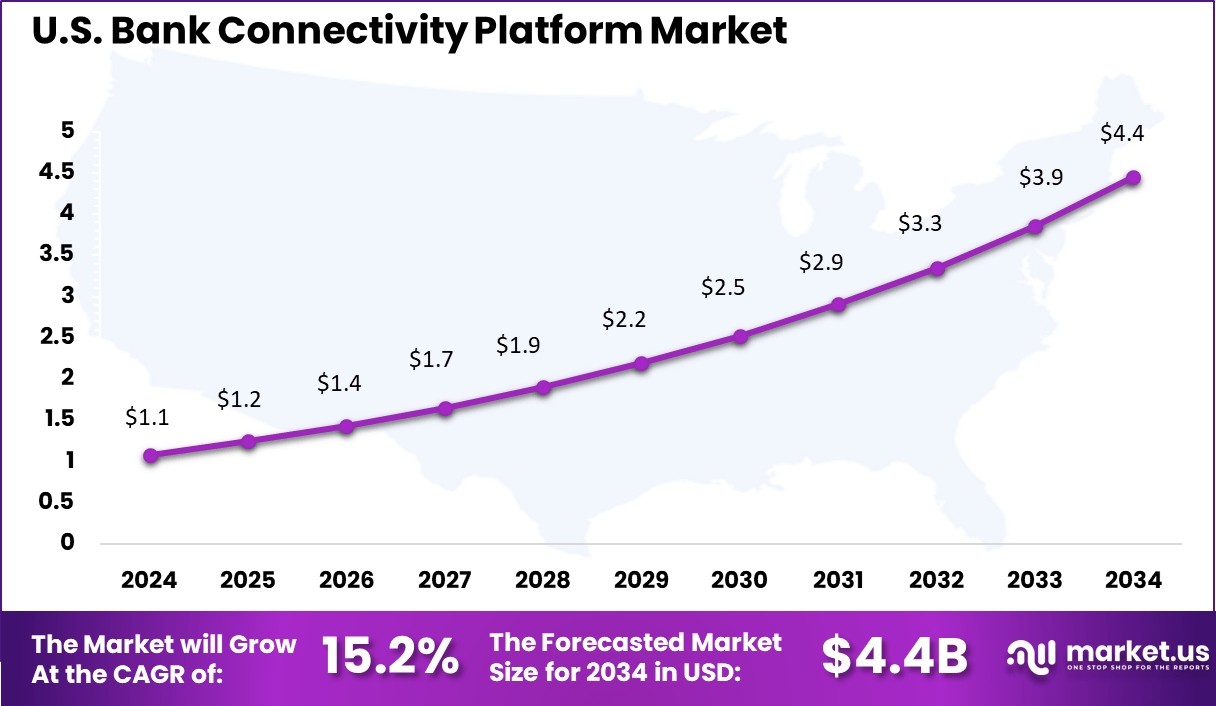

- North America captured 37.0% of the global market, with the U.S. valued at USD 1.08 billion in 2025 and projected to grow at a CAGR of 15.2%.

By Component

The software segment leads with a strong 76.4% share, showing that most bank connectivity platforms are delivered through digital software systems. These platforms enable secure data exchange between banks, corporate systems, treasury platforms, and payment networks.

High adoption of software solutions is driven by the need for real-time transaction visibility, system integration, and automated reporting. Banks and financial institutions rely on software platforms to manage large volumes of payment and account data efficiently.

By Deployment Mode

On premises deployment holds a 62.3% share, reflecting the preference of banks for direct control over sensitive financial data. Financial institutions often maintain strict internal security standards that support on site deployment of connectivity platforms.

On premises systems also provide higher data governance, reduced exposure to external threats, and better compliance with internal audit policies. Many legacy banking systems continue to operate within controlled data center environments.

By Organization Size

Large enterprises account for a dominant 70.1% share, confirming that bank connectivity platforms are mainly adopted by organizations with high transaction volume and large operational footprints. These include multinational banks, payment processors, and large corporate treasury functions.

Their strong presence is linked to complex financial operations, multi country regulatory exposure, and greater integration needs across internal and external banking systems. Large organizations also have the financial capacity to invest in advanced integration platforms.

By Application

Cash management represents 38.4% of total application demand, making it the leading use case for bank connectivity platforms. Enterprises use these platforms to monitor account balances, track real time cash flow, and automate liquidity planning processes.

Rising demand for cash visibility and payment automation continues to strengthen this segment. Organizations depend on real time cash data to optimize working capital and reduce idle funds across bank accounts.

By End-User

Banks account for a leading 42.3% share, confirming their central role in the adoption of bank connectivity platforms. These platforms are used to link core banking systems with payment networks, treasury operations, and corporate client portals. Secure and continuous data exchange is essential for daily transaction processing and account monitoring.

Rising demand for real time payments, digital account services, and automated reconciliation is strengthening platform usage across banks. Financial institutions are also expanding digital partnerships with fintech firms, which increases the need for reliable system integration and data connectivity.

Reasons for Adoption

- Banks adopt these platforms to link core systems with multiple banks through one secure channel, skipping the hassle of separate logins and setups.

- Open banking rules force institutions to share data safely, and platforms handle API connections to meet those standards without heavy custom work.

- Real-time payment demands grow fast, so platforms pull live balances and transactions to keep treasuries on top of cash flows.

- Corporate clients push for quicker ERP ties, and banks use platforms to speed onboarding while cutting their own integration costs.

- Handling varied protocols like SWIFT or EBICS across borders gets simpler, letting banks serve global firms without building everything in-house.

Key Benefits

- Finance teams get a single dashboard for balances and flows from all banks, sharpening cash forecasts and liquidity calls.

- Manual data pulls drop away, freeing staff for strategy over spreadsheets and portal hopping.

- Security layers meet compliance needs with encryption and logs, lowering fraud risks on multi-bank links.

- Costs fall as platforms scale connections without big IT spends, using bank-shared infrastructure.

- Payment runs smooth across currencies and methods, with auto-reconciliation to spot issues early.

Usage

- Treasury pulls real-time balances from various accounts to manage daily liquidity and avoid shortfalls.

- Bulk payments like payroll or supplier wires go out through one hub, hitting multiple banks at once.

- Reconciliation matches bank statements to ERP records automatically, cutting errors in AR or AP.

- Fraud checks scan transactions live across linked banks for odd patterns or blocks.

- Reporting grabs data from all sources for audits or board views on cash positions and risks.

Emerging Trends

Key Trend Description Open Banking API Expansion Standardized APIs enable secure data sharing between banks and third-party providers, supporting innovative financial services and digital ecosystems. Embedded Finance Integration Non-financial platforms integrate banking services such as payments and lending through API connectivity, creating seamless user experiences. Real-Time Payment Connectivity APIs support instant transactions and account-to-account payments, improving speed and reducing transfer costs. AI-Powered API Management Artificial intelligence is applied to dynamic API security, fraud detection, and personalized service orchestration within banking systems. Cloud and Serverless APIs Scalable cloud and serverless architectures manage high transaction volumes while improving system agility and cost efficiency. Growth Factors

Key Factors Description Regulatory Mandates for Open Access Frameworks such as PSD2 encourage secure data sharing and API adoption to promote competition and transparency. Rising Demand for Seamless Experiences Customers seek frictionless, real-time banking across devices and applications, driving demand for unified API connectivity. Fintech and Bank Partnerships Collaborations between banks and fintech firms integrate third-party innovation and expand digital service offerings. Digital Transformation Investments Banks invest heavily in connectivity platforms to break data silos, enable analytics, and support mobile-first financial services. Cost Reduction and Efficiency Gains Automation and scalable cloud platforms lower operational costs while supporting rising transaction volumes. Key Market Segments

By Deployment Mode

- On-Premises

- Cloud-Based

By Organization Size

- Large Enterprises

- Small and Medium Enterprises

By Application

- Cash Management

- Payment Processing

- Treasury Management

- Compliance & Reporting

- Others

By End-User

- Banks

- Corporates

- Financial Institutions

- Others

Regional Analysis

North America holds a 37.0% share of the global Bank Connectivity Platform market, leading due to advanced banking infrastructure, early adoption of digital technologies, and a competitive financial services landscape. Major U.S. and Canadian banks alongside corporates invest heavily in these platforms to enable open banking, real-time payments, and regulatory compliance across cash management, payment processing, and treasury functions.

The mature fintech ecosystem and presence of key providers like Finastra and Kyriba further solidify the region’s dominance in seamless multi-bank integrations. Cloud-based deployments capture the majority share at around 59%, offering scalability and cost efficiency that appeal to both large enterprises and SMEs handling high transaction volumes.

Regulatory support for API-driven architectures and open banking initiatives drives innovation, with platforms automating reconciliation and providing real-time visibility into global cash positions. This environment positions North America to maintain its lead amid rising demand for secure, interoperable solutions.

The U.S. Bank Connectivity Platform market reaches USD 1.08 billion, expanding at a CAGR of 15.2%, fueled by stringent compliance needs and the push for instant payments in a highly digitized economy. Large banks and multinational corporates prioritize platforms for treasury management and fraud detection, integrating with ERP systems to streamline cross-border transactions and liquidity oversight. High smartphone penetration and tech-savvy enterprises accelerate adoption, particularly in cloud-native solutions from leaders like FIS Global.

Within North America, the U.S. drives the bulk of growth through investments in AI-enhanced analytics and multi-bank connectivity for compliance reporting under frameworks like Dodd-Frank. Corporates benefit from centralized platforms that reduce manual processes, enhancing operational agility amid complex banking relationships. This focus on innovation and security cements the U.S. as the core hub for platform deployment and market expansion.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

A primary driver is rising adoption of digital treasury and finance systems. As organizations modernize their treasury functions, they require automated links between ERP systems and banks. Connectivity platforms serve as the bridge that enables automated payments, instant balance updates and consistent reporting. This greatly improves efficiency and reduces manual reconciliation work.

Another driver is the rapid growth of cross border transactions. Global operations demand consistent payment formats and secure channels to interact with banks in different countries. Platforms that translate varied banking standards into unified formats help reduce delays and errors, making them essential for multinational companies.

Restraint Analysis

A key restraint is the high cost and effort required for system integration. Connecting legacy ERP systems, custom workflows and older banking channels can be challenging. Smaller firms may not have the internal expertise to manage a complex integration project, which slows adoption despite clear benefits.

Another restraint arises from differences in banking standards across regions. Not all banks support the same file formats or API structures. Ensuring compatibility across a wide range of institutions requires ongoing maintenance, which increases operational burden for platform providers and users.

Opportunity Analysis

There is strong opportunity in offering connectivity solutions for mid sized organizations that are beginning to expand internationally. These firms often lack dedicated treasury infrastructure and rely on manual payment processes. Modular and affordable connectivity platforms can help them modernize without large initial investment.

Another opportunity lies in combining bank connectivity with advanced analytics and cash forecasting. Once financial data flows through a single platform, companies can gain insights into liquidity trends, risk exposure and payment patterns. Providers that add these analytical capabilities can differentiate their services and attract a broader customer base.

Competitive Analysis

Finastra, FIS, and ACI Worldwide lead the bank connectivity platform market with core infrastructures that enable real-time payment routing, message transformation, and secure interbank communication. Their platforms support high transaction volumes across SWIFT, ACH, RTGS, and instant payment networks. These companies focus on reliability, regulatory compliance, and end-to-end transaction visibility.

Bottomline Technologies, SAP, Oracle, Tata Consultancy Services, Infosys, and Temenos strengthen the market with API-driven banking connectivity, treasury integrations, and ISO 20022-ready payment hubs. Their solutions support corporate-to-bank connectivity, liquidity visibility, and automated reconciliation. These providers help banks modernize legacy infrastructure and improve straight-through processing.

Intellect Design Arena, Volante Technologies, Kyriba, Serrala, Cashfac, Nexi, and Sopra Banking Software broaden the landscape with specialized connectivity platforms for payments, cash management, and treasury automation. Their systems focus on rapid onboarding, secure APIs, and real-time reporting. These players serve banks and corporates seeking flexible, scalable connectivity.

Top Key Players in the Market

- Finastra

- FIS (Fidelity National Information Services)

- ACI Worldwide

- Bottomline Technologies

- SAP

- Oracle

- Tata Consultancy Services (TCS)

- Infosys

- Temenos

- Intellect Design Arena

- Volante Technologies

- Kyriba

- Serrala

- Cashfac

- Nexi

- Sopra Banking Software

- FISERV

- EBICS (Deutsche Bank, Société Générale, BNP Paribas)

- SWIFT

- Banking Circle

- Others

Recent Developments

- September, 2025 – Finastra launched an Intelligent Routing Module for its Global PAYplus platform at Sibos, using microservices and open APIs to steer payments across multiple rails, targeting upwards of 95% straight‑through processing while lowering cross‑border routing costs for connected banks.

- November, 2024 – Volante introduced Volante Payments Intelligence, a cloud‑ready analytics layer that taps real‑time and historical payment data to help banks streamline operations, manage ISO 20022 reporting, and improve performance without replacing existing connectivity stacks.

Report Scope

Report Features Description Market Value (2024) USD 3.5 Bn Forecast Revenue (2034) USD 19.6 Bn CAGR(2025-2034) 18.80% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software, Services), By Deployment Mode (On-Premises, Cloud-Based), By Organization Size (Large Enterprises, Small and Medium Enterprises), By Application (Cash Management, Payment Processing, Treasury Management, Compliance & Reporting, Others), By End-User (Banks, Corporates, Financial Institutions, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Finastra, FIS (Fidelity National Information Services), ACI Worldwide, Bottomline Technologies, SAP, Oracle, Tata Consultancy Services (TCS), Infosys, Temenos, Intellect Design Arena, Volante Technologies, Kyriba, Serrala, Cashfac, Nexi, Sopra Banking Software, FISERV, EBICS (Deutsche Bank, Société Générale, BNP Paribas), SWIFT, Banking Circle, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Bank Connectivity Platform MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Bank Connectivity Platform MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Finastra

- FIS (Fidelity National Information Services)

- ACI Worldwide

- Bottomline Technologies

- SAP

- Oracle

- Tata Consultancy Services (TCS)

- Infosys

- Temenos

- Intellect Design Arena

- Volante Technologies

- Kyriba

- Serrala

- Cashfac

- Nexi

- Sopra Banking Software

- FISERV

- EBICS (Deutsche Bank, Société Générale, BNP Paribas)

- SWIFT

- Banking Circle

- Others